Markets

US FAA probes low-flying Southwest Airways flight close to Oklahoma Metropolis

By David Shepardson

WASHINGTON (Reuters) – The Federal Aviation Administration (FAA) mentioned on Thursday it’s investigating a Southwest Airways (NYSE:) flight that descended to a low altitude 9 miles (14.5 km) from the Oklahoma Metropolis airport.

The incident involving Southwest Airways Flight 4069, which had departed from Las Vegas, occurred round at 12:05 a.m. Wednesday, the FAA mentioned. After the automated Minimal Protected Altitude Warning sounded, an air site visitors controller alerted the flight crew.

Southwest mentioned it’s following its Security Administration System and is in touch with the FAA to “perceive and tackle any irregularities with the plane’s strategy to the airport.”

A number of incidents involving Southwest flights in latest months have raised issues.

Requested on Monday if the incidents would immediate the company to spice up scrutiny of Southwest, because it has with United Airways, FAA Administrator Mike Whitaker declined to remark. He mentioned the company reviewed all airline incidents and intently monitored carriers.

“The airline oversight mannequin is a reasonably good mannequin that we need to construct out for different gamers within the system,” Whitaker mentioned.

Final week, the FAA and the U.S. Nationwide Transportation Security Board mentioned they had been investigating a Might 25 Southwest flight of a Boeing (NYSE:) 737 MAX. The NTSB mentioned the aircraft skilled a “Dutch roll” at 34,000 toes whereas en route from Phoenix, to Oakland, California. Such lateral uneven actions are named after a Dutch ice-skating method and may pose severe security dangers.

The FAA mentioned final week it was additionally investigating a Southwest 737 MAX 8 flight in April that got here inside about 400 toes of the ocean off the coast of Hawaii after unhealthy climate circumstances prompted pilots to bypass a touchdown try at Lihue airport, on the island of Kauai.

Through the go-around, the primary officer “inadvertently pushed ahead on the management column whereas following thrust lever motion commanded by the autothrottle,” based on a June 7 airline memo, and the aircraft started to descend quickly, hitting a most descent fee of about 4,400 toes per minute.

The pilots in a post-debrief mentioned seeing the severity of the flight “via the animations was a major, emotional occasion,” the Southwest memo mentioned, including the airline is reviewing knowledge and tendencies associated to its procedures, coaching, requirements, and efficiency.

Markets

A millennial FIRE couple shares how transferring overseas and dwelling on a $50k revenue helped them quadruple their internet price to $700k in 6 years

-

A millennial couple grew their internet price to over $700,000 from $150,000 in 2018.

-

Dwelling overseas and solely spending one among their incomes, which is $50,000, helped enhance their funds.

-

Brian Davis shared why his purpose is not however to pursue his dream work.

About twenty years in the past, earlier than he’d ever heard of the , Brian Davis determined to pursue monetary independence and an early retirement.

He started investing his financial savings in , considering that if he owned sufficient of them, he’d ultimately be capable of reside off the rental revenue alone, the 43-year-old advised Enterprise Insider by way of e mail.

However this did not go based on plan. He hated being a , and a number of the investments proved to be much less worthwhile than he’d anticipated. The thought of retiring forward of schedule appeared prefer it could possibly be out of attain, so he determined to discover different choices. As we speak, he runs a digital actual property investing platform.

Nonetheless, within the years since, quite a bit has modified for Davis — each from a monetary and philosophical perspective. For one, he is grown his internet price to greater than $700,000 as of Could from roughly $150,000 in 2018, based on paperwork seen by BI.

Davis and his spouse have aimed to reside totally off of his spouse’s roughly $50,000 a 12 months faculty counselor wage whereas saving and investing all of his revenue, which comes primarily from an actual property he cofounded in 2016 — he stated their annual family revenue is round $150,000. This saving technique has been key to boosting their funds.

Davis’s monetary targets have additionally advanced. After studying extra in regards to the — a monetary life-style aimed toward saving sufficient to grow to be financially unbiased and retire earlier than the normal retirement age — Davis stated he found that most individuals who managed to retire early ultimately bought bored of “sipping margaritas on the seashore” and returned to work in some kind. Quite than early retirement, Davis stated his present purpose is to reside his preferrred life, and he thinks remaining within the workforce can assist him accomplish this.

“I’ve no plans to retire, however I do hope to succeed in monetary independence throughout the subsequent 5 years,” he stated. “The much less you are worried about cash, the extra your work opens as much as be enjoyable, inventive, and with out limits on alternatives.”

Whereas many Individuals are having bother , some are placing themselves able to forward of schedule by varied financial savings and funding methods. Nonetheless, not all of those individuals are aiming for an early retirement. Some folks, like Davis, wish to proceed working as they pursue monetary safety. However not simply any type of work: They wish to that they get pleasure from or discover fulfilling.

Davis shared how he is grown his internet price — and why he thinks discovering one’s dream work can assist them reside their preferrred life.

Decrease dwelling bills could make it simpler to avoid wasting

Davis and his household, together with his spouse Katie and their daughter, have an enormous monetary benefit: They do not pay for housing.

That is among the many perks of Katie’s job: She works as a college counselor at worldwide colleges world wide. Davis stated they first moved overseas in 2015, spending 4 years in Abu Dhabi and 4 years in Brazil earlier than transferring to Lima, a couple of 12 months in the past. Davis stated it is commonplace for worldwide colleges to supply free housing for college and employees.

Along with saving cash on housing, they have been in a position to make the most of the “decrease value of dwelling abroad,” together with cheaper meals and . Davis stated this was among the many major causes they determined to enterprise overseas.

“You should purchase beef and pork in South America for 1 / 4 of the price within the US,” he stated.

Davis stated one other massive manner he is been ready to save cash is by — he stated he hasn’t owned a automotive in 5 years.

“Individuals do not realize how way more vehicles value than simply the month-to-month cost,” he stated. “With no automotive, we do not have to pay for automotive insurance coverage, repairs and upkeep, gasoline, parking.”

The household’s diminished dwelling bills have enabled them to reside totally on Katie’s wage. Nonetheless, Davis stated that they do not count on to have these monetary perks ceaselessly, in order that they’re making an attempt to make the most of them now.

“In some unspecified time in the future, we all know we’ll have to maneuver again to the US for household causes,” Davis stated. “So we’re making an attempt to construct our internet price and passive revenue streams as shortly as doable earlier than we do.”

How pursuing dream work can assist one reside their preferrred life

When Davis discovered that many early retirees return to work in some kind, he stated this revelation was in some methods disappointing.

Nonetheless, he is since modified his tune. For instance, if an individual retires at age 60 — fairly than age 50 — then it might be a lot simpler for them to hit their retirement financial savings purpose.

“It signifies that you do not want practically as a lot cash as you thought you probably did,” Davis stated. “If you are going to maintain doing a little type of work by yourself phrases, you will maintain incomes energetic revenue.”

Nonetheless, that additional decade of labor may not be passable for everybody. That is why Davis thinks the hot button is discovering one’s dream work.

Davis stated if somebody is doing work they get pleasure from, then they seemingly will not be so determined to surrender work and retire. And even when this implies transitioning to work that is lower-paying than one’s previous job, Davis stated that is the place the well-discussed within the FIRE group can come in useful: They can assist bridge the hole between one’s desired and precise revenue.

“You simply want sufficient cash to cowl any shortfall between what you wish to spend and what your dream work pays,” he stated. “In different phrases, you can begin dwelling your preferrred life now, or very quickly, with out being financially unbiased.”

To make certain, discovering a job — overlook about one’s dream job — is less complicated stated than finished in right this moment’s economic system. Many Individuals are having a as firms pull again on hiring.

For Davis, his enterprise is one element of his dream work. He stated he will get all the advantages of actual property funding with out the complications of being a landlord.

“I do not contemplate myself financially unbiased, however I am dwelling the identical life that I might be if I have been,” he stated. “I get to do work I really like, alone schedule, from wherever on this planet.”

His prime recommendation for folks is to ascertain their preferrred life-style and decide what kind of labor and revenue degree they should make it a actuality.

“When you reframe FIRE in these phrases, it will get each simpler and extra fulfilling, fairly than simply dreaming about sitting on a seashore as a bum for the remainder of your life,” he stated.

Have your financial savings and wealth grown considerably lately? Are you keen to share your prime monetary methods? Attain out to this reporter at .

Learn the unique article on

Markets

US FTC sues drug 'gatekeepers' over excessive insulin costs

By Jody Godoy and Ahmed Aboulenein

(Reuters) -The U.S. Federal Commerce Fee sued the nation’s three largest pharmacy profit managers on Friday, accusing them of steering diabetes sufferers in the direction of increased priced insulin as a way to reap thousands and thousands of {dollars} in rebates from pharmaceutical firms.

The case accuses UnitedHealth Group Inc (NYSE:)’s Optum unit, CVS Well being Corp (NYSE:)’s CVS Caremark and Cigna Corp (NYSE:)’s Specific Scripts of unfairly excluding decrease value insulin merchandise from lists of medicine lined by insurers.

Driving down drug costs has been a key objective for the Biden administration, and Vice President Kamala Harris, the Democratic nominee, has emphasised her work for sufferers, and particularly on decreasing insulin costs, on the marketing campaign path.

The conduct harm sufferers, equivalent to these with coinsurance and deductibles, who weren’t eligible for the rebated value, the FTC stated. The three firms collectively administer 80% of all prescriptions within the U.S., in keeping with the case, which was filed within the FTC’s in-house courtroom.

The three firms stated in statements that the go well with was baseless and defended their enterprise practices, saying that they’d lowered insulin costs for companies, unions and sufferers.

KFF well being coverage professional Larry Levitt described the FTC motion as a “shot throughout the bow.”

“Insulin is an excessive case of PBMs extracting greater and larger rebates from drug producers and driving checklist costs up on the pharmacy counter, however this can be a dynamic that performs out with many drugs,” he stated.

CVS shares fell 1.4% in noon buying and selling, whereas UnitedHealth and Cigna shares had been flat.

The go well with additionally named Zinc Well being Companies, Ascent Well being Companies, and Emisar Pharma Companies, buying organizations created by the businesses lately.

CVS spokesman David Whitrap stated in an emailed assertion that the corporate has labored to make insulin extra inexpensive for Individuals and described the FTC as being “merely fallacious.” It stated it supplied insulin at $25 via a decreased value program.

Cigna Chief Authorized Officer Andrea Nelson stated if the FTC had been to achieve forcing it and others to incorporate medication which have increased complete internet prices for well being plans, drug costs would rise.

Optum Rx spokesperson Elizabeth Hoff stated the corporate has lowered insulin prices for its well being plan prospects and members to a median of lower than $18 monthly.

‘MEDICATION GATEKEEPERS’

Rahul Rao, Deputy Director of the FTC’s Bureau of Competitors, stated in an announcement that the three pharmacy profit managers are “medicine gatekeepers” which have “extracted thousands and thousands of {dollars} off the backs of sufferers who want life-saving drugs.”

“Tens of millions of Individuals with diabetes want insulin to outlive, but for a lot of of those susceptible sufferers, their insulin drug prices have skyrocketed over the previous decade thanks partly to highly effective PBMs and their greed,” he stated.

The case might be heard by one of many FTC’s three administrative regulation judges.

The FTC didn’t sue the three main makers of insulin, Eli Lilly (NYSE:), Sanofi (NASDAQ:), and Novo Nordisk (NYSE:), but it surely did criticise their function in what it known as a damaged system, and stated it reserves the appropriate to sue the pharmaceutical firms later.

The drugmakers’ shares didn’t react on Friday afternoon.

Sanofi and Lilly stated the FTC’s lawsuit addressed facets of the U.S. healthcare system they’d lengthy advocated to reform and that they’d applications to cut back the out-of-pocket value of their insulins to $35.

CVS Caremark stated in its assertion that any try to curtail pharmacy profit managers’ capacity to barter drug costs will solely profit pharmaceutical firms.

The three PBMs have criticised the FTC’s strategy to the trade, accusing it of bias. Specific Scripts sued the FTC earlier this week in search of to power it to withdraw a report that stated PBMs enrich themselves on the expense of smaller pharmacies.

James Harlow, Senior Vice President at Novare Capital Administration stated PBMs have withstood earlier criticism.

“Regardless of intense scrutiny, unfavorable headlines, and makes an attempt to cross laws concentrating on PBMs, this enterprise continues to be sticky and generates strong progress and margins,” he stated. Novare owns UnitedHealth and CVS shares, regulatory filings present.

Markets

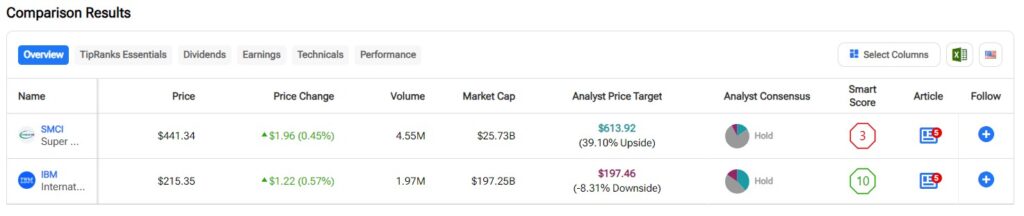

SMCI vs. IBM: Which Information Heart Inventory Is Higher?

On this piece, I’m : Tremendous Micro Pc and IBM . A better look leads me to determine a bearish view for Tremendous Micro Pc and a impartial view for IBM.

Tremendous Micro Pc (Tremendous Micro) manufactures servers for cloud computing, information facilities, huge information, synthetic intelligence, 5G, and the Web of Issues. It additionally provides different pc merchandise, together with energy-efficient computing know-how. In the meantime, IBM is in fact a legacy computing large that now provides servers for information facilities and a variety of enterprise software program, networking tools, and different computing wants.

after plummeting 52% over the previous three months. The shares are additionally up 78% over the previous 12 months. Alternatively, IBM inventory has soared 25% over the past three months, bringing its year-to-date return to 35%. Shares of ‘Large Blue’ have surged 53% over the past 12 months.

(SMCI = inexperienced, IBM = black line)

Regardless of such totally different three-month performances, the respective valuations for Supermicro and IBM aren’t that far aside. We examine their price-to-earnings (P/E) ratios to evaluate their valuations in opposition to one another and that of their business.

For comparability, the , versus its three-year common of 67.9x.

Tremendous Micro Pc

With a trailing P/E of 21.8x, Tremendous Micro Pc is buying and selling at a large low cost to its sector. Nonetheless, such a reduction appears warranted given current developments on the firm. A bearish view appears applicable, a minimum of till issues blow over and we obtain some transparency into the state of affairs.

A destructive report on SMCI from brief vendor Hindenburg Analysis raised all types of pink flags. The agency makes quite a lot of allegations in opposition to the corporate, together with that it has manipulated its financials. Hindenburg alleged accounting points together with undisclosed transactions between associated events, sanctions violations, and issues with export management. Quick sellers profit when a inventory worth plummets, so could also be motivated to challenge reviews on the businesses they’re shorting for that motive. Nonetheless, then again, Hindenburg Analysis has a fairly good monitor report, and was appropriate about fraud at Nikola in 2020.

Moreover, Tremendous Micro has already had documented accounting violations up to now, having settled a earlier case with the Securities and Change Fee in 2020 for $17.5 million. Consequently, buyers would possibly wish to keep away from SMCI till further transparency is out there, particularly after the corporate determined to delay the discharge of its annual report.

What’s the Worth Goal for SMCI inventory?

Tremendous Micro Pc has a Maintain consensus ranking primarily based on one Purchase, 10 Holds, and one Promote ranking assigned over the past three months. At $615.18, the implies upside potential of 38.44%.

At a P/E of 23.7x, IBM can be buying and selling at a deeply discounted valuation versus its sector, and in addition provides a gorgeous dividend yield. Nonetheless, a overview of the corporate’s valuation historical past reveals that the inventory is buying and selling on the prime of its typical vary going again to October 2019. Thus, a impartial view appears applicable, as does monitoring for a buy-the-dip alternative.

I’m cautious on IBM proper now attributable to its valuation, despite the fact that there’s a lot to love about this inventory. After all, IBM has been round for a very long time, and it isn’t going anyplace anytime quickly. It’s a stalwart, rising know-how firm, though it doesn’t publish the extent of income will increase required to be thought of a progress inventory. Going again to October 2019, the corporate’s typical P/E vary has been between about 17.5x and 25.1x. Subsequently the inventory does look a bit expensive versus its historic vary, suggesting {that a} buy-the-dip alternative might floor earlier than too lengthy.

Nonetheless, buyers in search of know-how publicity of their dividend portfolio could not discover a higher inventory, as IBM’s dividend yield stands at , suggesting that the dividend is each interesting and fairly secure. Moreover, IBM has a 29-year historical past of elevating its dividend yearly, additional sweetening the pot.

Lastly, IBM’s long-term share-price appreciation demonstrates the inventory’s seem as a buy-and-hold funding in a dividend portfolio. The shares are up 92% over the past three years, 101% over the past 5, and 80.6% over the past 10. IBM has lately nudged into overbought territory with a Relative Power Indicator of 73.8. Something above 70 suggests a inventory is overbought and {that a} correction to the draw back could possibly be close to. I’d merely look forward to IBM inventory to drop right down to the decrease finish of its typical P/E vary earlier than doubtlessly shopping for the shares.

What’s the Worth Goal for IBM inventory?

IBM has a Maintain consensus ranking primarily based on 5 Buys, six Maintain, and two Promote scores assigned over the past three months. At $197.46, the implies draw back potential of 8.69%.

Conclusion: Bearish on SMCI, Impartial on IBM

On one hand, Tremendous Micro might current a buy-the-dip alternative proper now as a result of short-seller’s report. Nonetheless, there’s often hearth the place there’s smoke, and the brief vendor who’s focusing on the corporate has a superb monitor report to date. The delayed annual report additionally enforces the key lack of transparency and might symbolize a severe breach of belief with shareholders, so buyers could wish to keep away from Tremendous Micro Pc presently.

Alternatively, there’s a lot to love about IBM, though the value for its inventory is fairly excessive, comparatively talking. Even when somebody have been to purchase shares on the present worth, the dividend and long-term appreciation potential nonetheless make this a buy-and-hold inventory for the long run. Nonetheless, I consider that we might see a pullback in IBM earlier than too lengthy, so I feel it’s finest to attend earlier than pulling the set off.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?