Markets

Why Nvidia's 'gravy practice' might come to 'screeching halt' after a unstable buying and selling week

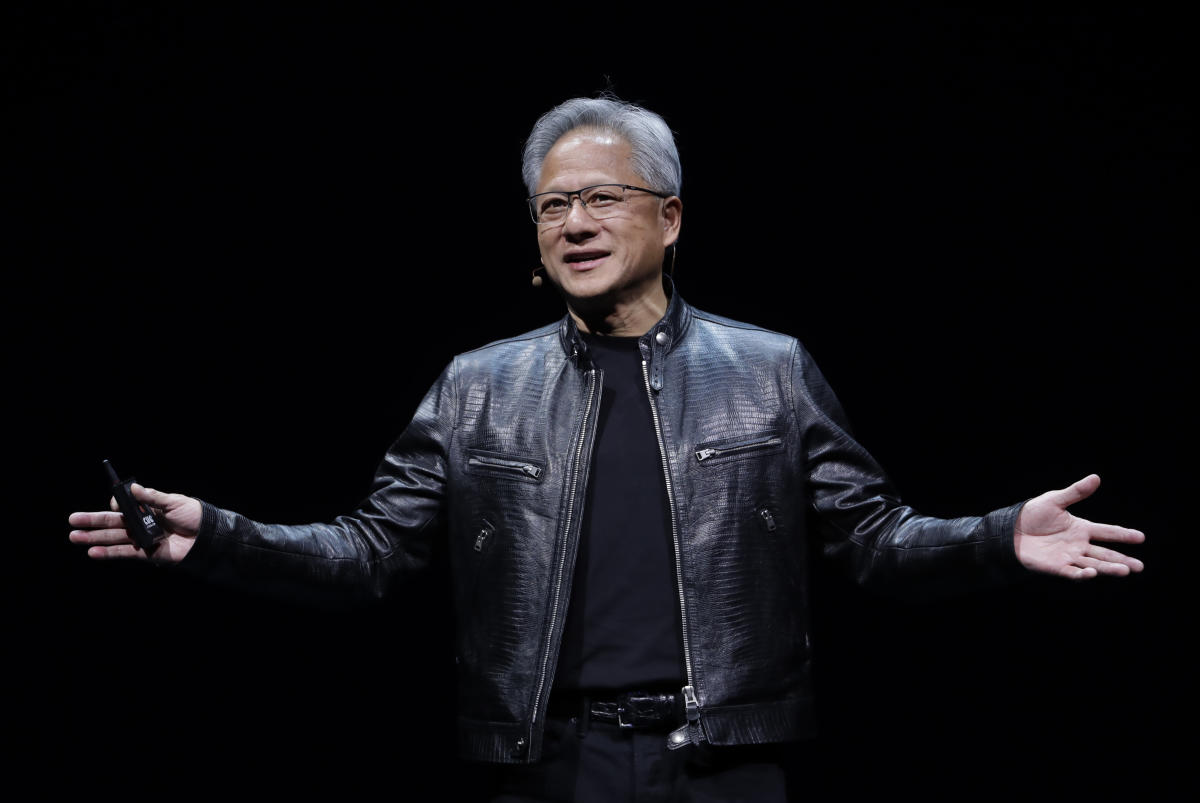

Nvidia’s () inventory went on a wild trip this week as shares reversed route from all-time highs and Wall Road continued to debate how way more the chip large can add to its record-setting rally.

“The inventory’s steep climb makes it susceptible to revenue taking, however we argue any volatility [is] more likely to be short-lived,” Financial institution of America wrote on Thursday. The financial institution reiterated its Purchase score and $150 worth goal, calling Nvidia a “prime decide.”

The chipmaker, which briefly dethroned Microsoft () on Tuesday, noticed its market cap edge decrease on Friday to sit down at round $3.12 trillion, under Microsoft’s $3.33 trillion.

Patrick Moorhead, Moor Insights & Technique founder and CEO, advised Lusso’s Information on Friday that traders must be watchful for indicators of a pullback.

Whereas he stated he does not see the established order of Nvidia’s dominance altering over the following six to 9 months, traders ought to concentrate on “the downstream profitability that individuals within the ecosystem are making or not making.”

“These are the software program corporations like Adobe, Salesforce, SAP, and ServiceNow. As a result of if these enterprises and people customers aren’t paying extra for these new AI options, then this entire gravy practice involves a screeching halt, like we noticed within the web bust,” he defined.

Elevated competitors might additionally function a headwind to pricing energy, Moorhead warned, as Nvidia competes with not solely “service provider silicon suppliers” like AMD () and Intel () but in addition “homegrown ones” from Amazon’s AWS (), Microsoft’s Azure () and Google (, ).

The flurry of AI funding has continued to spice up optimism over Nvidia’s development fee. In its newest earnings, the corporate that surged 461% yr over yr whereas income grew by 262%.

Along with stellar earnings, Nvidia additionally and doubled its quarterly money dividend — a transfer that is been echoed by different tech giants in current quarters.

Shares of Nvidia are up about 200% during the last 12 months and greater than 3,200% during the last 5 years. 12 months so far, Nvidia has gained round 160%.

However regardless of its sky-high valuation, has been constructing.

“I do not see any cause it could not rise up to $4 trillion,” Moorhead stated. “A variety of that is primarily based on expectations since you take a look at the value to earnings ratio, it is fairly astronomical. And if we will see some constructive indicators from the downstream gamers…[I] do not see any cause why this could not get to $4 trillion.”

Wedbush analyst Dan Ives agreed, writing in a word to shoppers on Thursday: “We imagine over the following yr the race to $4 trillion market cap in tech will likely be entrance and middle between Nvidia, Apple, and Microsoft.”

Ives stated the AI revolution is a celebration that’s “simply getting began,” pushed by the tempo of information middle spending by tech giants. He expects incremental AI spend to hit $1 trillion over the following decade with over 70% of enterprises finally heading down the AI use case path.

“Its 9pm in a celebration going until 4am with the remainder of the tech world now becoming a member of,” he stated.

is a Senior Reporter at Lusso’s Information. Observe her on Twitter , and e-mail her at alexandra.canal@yahoofinance.com.

Markets

US East Coast dockworkers head towards strike after deal deadline passes

By Doyinsola Oladipo

NEW YORK (Reuters) – Dockworkers on the U.S. East Coast and Gulf Coast had been anticipated to strike on Tuesday morning after a midnight deadline handed with no signal of a brand new contract take care of port homeowners. The strike is forecast to halt about half the nation’s ocean transport.

The strike will block the whole lot from meals to car shipments throughout dozens of ports from Maine to Texas, in a disruption analysts warned will price the economic system billions of {dollars} a day, threaten jobs, and stoke inflation.

The Worldwide Longshoremen’s Affiliation (ILA) union representing 45,000 port staff had been negotiating with the USA Maritime Alliance (USMX) employer group for a brand new six-year contract forward of a midnight Sept. 30 deadline.

However the ILA’s fiery chief, Harold Daggett, stated employers like container ship operator Maersk and its APM Terminals North America had not provided applicable wage will increase or agreed to calls for to cease port automation tasks. The USMX stated in a press release on Monday it had provided to hike wages by almost 50%.

The ILA stated in statements on Sunday and Monday {that a} port strike would go forward, beginning on Tuesday at 12:01 a.m. ET.

The strike, the ILA’s first since 1977, is worrying companies throughout the economic system that depend on ocean transport to export their wares or safe essential imports. The strike impacts 36 ports that deal with a variety of containerized items from bananas to clothes to automobiles.

The union is “holding the complete nation over a barrel,” stated Steve Hughes, CEO of HCS Worldwide, which makes a speciality of automotive sourcing and transport. “I am actually afraid that it’s going to be ugly.”

The dispute can also be wedging labor-friendly U.S. President Joe Biden right into a digital no-win place as Vice President Kamala Harris runs a razor-tight election race towards Republican former President Donald Trump.

Biden administration officers had met with each USMX and ILA forward of the strike to encourage a deal. However Biden’s administration has repeatedly dominated out using federal powers to interrupt a strike within the occasion of an deadlock.

U.S. Chamber of Commerce President Suzanne Clark urged Biden on Monday to rethink, saying it “could be unconscionable to permit a contract dispute to inflict such a shock to our economic system.”

Retailers accounting for about half of all container transport quantity have been busily implementing backup plans as they head into their all-important winter vacation gross sales season.

Most of the massive gamers rushed in Halloween and Christmas merchandise early to keep away from any strike-related disruptions, incurring additional prices to ship and retailer these items.

Retail behemoth Walmart (NYSE:), the most important U.S. container shipper, and membership warehouse membership operator Costco (NASDAQ:) say they’re doing the whole lot they’ll to mitigate any influence.

New York Governor Kathy Hochul stated on Monday the state expects no rapid influence on meals suppliers or important items.

Markets

Warren Buffett Tells Traders To Give Up On 'Me Vs. Inventory' Strategy: 'What Tells You Whether or not You Ought to Preserve Proudly owning A Inventory Is…'

Benzinga and Lusso’s Information LLC might earn fee or income on some gadgets by the hyperlinks under.

Billionaire investor and funding guru as soon as shared the thumb rule he makes use of when to surrender on a inventory and within the course of defined why buyers are higher off than enterprise tycoons equivalent to Andrew Carnegie or John Rockefeller.

What Occurred: “I like it when the issues we purchase go down,” Buffett in a 2014 Fortune Journal interview. He stated he would get “euphoric when the shares are down as a result of he should buy extra of one thing he owned. Then again, with their shares, individuals assume the inventory is aware of greater than they do, he stated.

Don’t Miss:

“When the inventory goes down, they are saying the inventory is telling them one thing… and what it’s telling me is I can get extra for my cash,” the Berkshire Hathaway CEO stated. However they take it as a type of referendum on themselves and make it as a “me versus inventory” and say in the event that they get again what they paid, they’re going to promote the inventory regardless of what they paid, he stated.

“Inventory doesn’t care what you paid; it’s important to keep in mind the inventory doesn’t even care that you just personal it; you might be nothing to the inventory; that inventory is every little thing to you,” Buffett stated.

The one query with each inventory, day-after-day is to look into “Can I get extra for my cash someplace else,” he stated, including that buyers get an opportunity to be in 1000’s and 1000’s of nice companies and their costs change on a regular basis and so do their relative valuation.

Trending: This billion-dollar fund has invested within the subsequent massive actual property increase, .

It is a paid commercial. Rigorously think about the funding aims, dangers, expenses and bills of the Fundrise Flagship Fund earlier than investing. This and different info could be discovered within the. Learn them rigorously earlier than investing.

Since an investor could make the trade at a really low value as of late, both with low commissions or nothing, they will all the time shift from one enterprise to a different, Buffett stated. Traders have a bonus over Carnegie, who was within the metal enterprise or Rockefeller who was within the oil enterprise, he stated. The billionaire stated these businessmen couldn’t instantly shift to one thing like retailing or rearrange their enterprise empire as an investor can with the portfolio they owned. The portfolio could be rearranged at a second’s discover with virtually no value, he stated, including that this can be a large benefit.

“There may be nothing in regards to the value motion of the inventory that tells you whether or not you need to preserve proudly owning; what tells you whether or not you need to preserve proudly owning it’s what you anticipate the corporate to do sooner or later versus the value at which it’s promoting now in comparison with the opposite alternatives of companies you assume you recognize equally effectively and make that very same comparability and that’s all there may be to proudly owning shares,” Buffett stated.

Why It’s Vital: Buffett swears by an funding philosophy referred to as worth investing, which advocates selecting shares that seem like buying and selling for lower than their intrinsic or guide worth. He has been very profitable with the technique and the success of Berkshire is a testomony to it. The corporate, which owns holding firms primarily within the insurance coverage and transportation companies, in addition to portfolio shares, is now the eighth most valued international company, standing head-on-head with tech shares.

Amid the present financial uncertainty, Buffett has proven a choice for accumulating an enormous money pile. On the finish of the second quarter, the corporate

Questioning in case your investments can get you to a $5,000,000 nest egg? Converse to a monetary advisor right now. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches for gratis to resolve which one is best for you.

Preserve Studying:

This text initially appeared on

Markets

S&P 500 ekes out file closing excessive; declines briefly after Powell

By Caroline Valetkevitch

NEW YORK (Reuters) -The sputtered to a file excessive shut on Monday, rebounding from a short setback after Federal Reserve Chair Jerome Powell stated the U.S. central financial institution is in no hurry to implement additional rate of interest cuts.

The Dow additionally posted an all-time closing excessive. The three main U.S. inventory indexes registered positive factors for the quarter and for the month.

Powell, at a Nationwide Affiliation for Enterprise Economics convention in Nashville, Tennessee, stated he sees two extra fee cuts, totaling 50 foundation factors, this yr as a baseline if the economic system evolves as anticipated.

“The vast majority of buyers suppose all the Fed’s actions are baked in for the rest of the yr. (However) I believe there’s extra to 2024 Fed than perhaps we learn about,” stated Jake Dollarhide, chief govt officer of Longbow Asset Administration in Tulsa, Oklahoma.

“In reality, the comfortable touchdown might truly occur.”

The Fed earlier this month started a brand new easing cycle with a big 50 foundation level fee lower.

Merchants are pricing in a 35% likelihood of a 50 foundation level discount in November, down from round 37% earlier than Powell’s speech and 53% on Friday, the CME Group’s (NASDAQ:) FedWatch Instrument confirmed.

The rose 17.15 factors, or 0.04%, to 42,330.15. The S&P 500 gained 24.31 factors, or 0.42%, at 5,762.48 and the superior 69.58 factors, or 0.38%, to 18,189.17.

For the month, the S&P 500 gained 2% and posted its finest September since 2013 and a fifth straight month of will increase. For the quarter, the S&P 500 rose 5.5%, the Nasdaq gained 2.6% and the Dow climbed 8.2%.

The S&P 500 prolonged losses following Powell’s remarks however recovered heading into the shut. Strategists stated quarter-end exercise might have additionally helped the market late within the day.

“You have acquired momentum buying and selling and traditional window dressing on the finish of the quarter, the place you are shopping for the winners and promoting the losers,” Dollarhide stated.

Quincy Krosby, chief world strategist at LPL Monetary (NASDAQ:) in Charlotte, North Carolina, famous that the Fed may have far more knowledge to evaluate earlier than its November assembly.

Key financial reviews due this week embrace jobless claims and month-to-month payrolls.

CVS Well being (NYSE:) rose 2.4% after a report confirmed hedge fund Glenview Capital Administration will meet prime executives on the healthcare firm to suggest methods to enhance operations.

Advancing points outnumbered decliners on the NYSE by a 1.06-to-1 ratio; on Nasdaq, a 1.00-to-1 ratio favored advancers.

The S&P 500 posted 30 new 52-week highs and two new lows; the Nasdaq Composite recorded 82 new highs and 88 new lows.

Quantity on U.S. exchanges was 12.64 billion shares, in contrast with the 11.93 billion common for the complete session over the past 20 buying and selling days.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets2 months ago

Markets2 months ago2 Development Shares That May Skyrocket within the Again Half of 2024 and Past