Markets

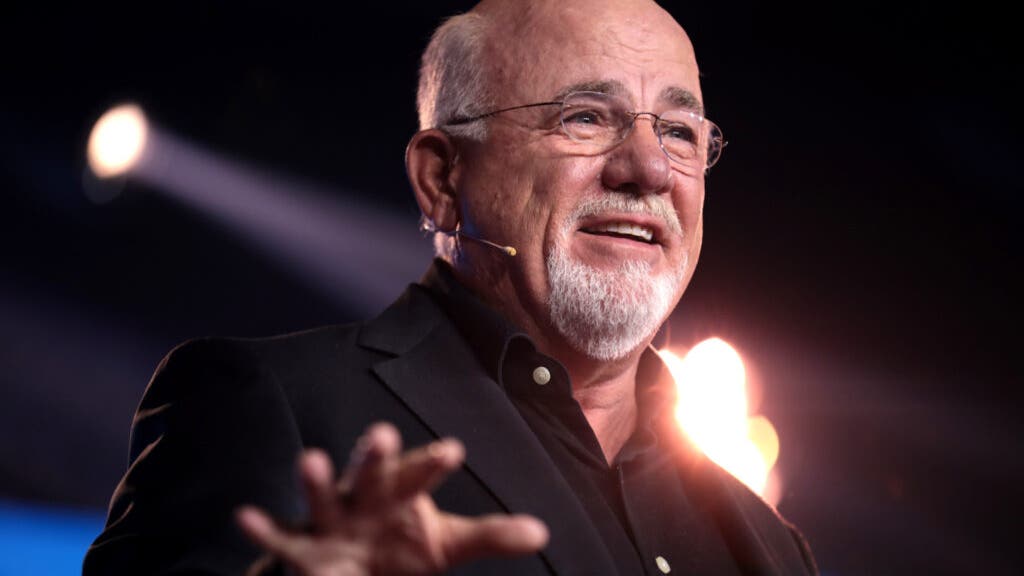

Single Mother With $1.3 Million From Divorce Can't Afford $8,000 Month-to-month Hire, Dave Ramsey Says It's Time To Transfer

Karen, from Irvine, California, referred to as into The Ramsey Present to hunt recommendation about her dwelling state of affairs. She is newly divorced with full custody of two youngsters and at present pays $8,000 in hire on a $5,600 revenue.

Do not Miss:

, famed for his monetary experience, requested Karen what she acquired from the divorce.

“We bought the home,” Karen says. “So, in a financial institution, in a high-yield financial savings account proper now, I’ve about $1.3 million simply sitting there. And I am simply attempting to determine what to do with it … I actually do not need to contact it. After which I am getting some alimony/spousal assist, however it’s just for six months, and that is $15,000 a month.”

Karen mentioned she has her automobile and paid off however looks like she’s combating an uphill battle attempting to make ends meet in an space the place the price of dwelling is so excessive.

In accordance with Finest Locations, the price of dwelling in Irvine is about 65% larger than the U.S. common and 10% larger than the California common. Plus, it prices about $1,128,000 to purchase a house in comparison with the U.S. common of $338,100. To reside comfortably in Irvine, Finest Locations states {that a} household would want a minimal annual revenue of $216,000.

Trending: This Jeff Bezos-backed startup will mean you can.

Karen tells Ramsey that she’s not “dwelling excessive on the hog” and resides a reasonably fundamental life-style. “However you are in Irvine,” he responds. “You are in probably the most costly actual property markets on the planet.”

All through the decision, it’s clear that Ramsey empathizes with Karen and her state of affairs, however it’s additionally clear that she will not be capable of maintain her present dwelling state of affairs. “I’m sorry that your husband was an addict, and I’m sorry he left his youngsters in a lurch. However they’ll’t reside in Irvine anymore. You don’t have the cash. And so, as heartbreaking as it’s, the very best factor you are able to do for them is to create a secure surroundings. And you realize you’re not in a single. If $8,000 is the most affordable you’ll find there, you gotta go some place else kiddo. I’m sorry.”

Karen just isn’t alone in her struggles. In accordance with a Forbes report, about 43% of first marriages finish in , and that charge is even larger for second (60%) and third (73%) marriages. As per NerdWallet, the median single-parent revenue within the U.S. is about $43,000, whereas the typical value of dwelling for a single-parent household is $49,000 per yr. In fact, these numbers range drastically relying on the place you reside, however bills are sometimes greater than what single dad and mom are bringing in.

With divorce charges excessive and single-parent incomes falling beneath the price of dwelling, many individuals face comparable struggles. Searching for recommendation from a can present personalised steerage on managing property, budgeting successfully, and planning for the long run. Many advisors supply free consultations to debate your monetary state of affairs and targets. Don’t hesitate to contact somebody for skilled steerage — it could possibly be the important thing to securing your monetary future and offering stability for your loved ones throughout a attempting time.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & all the things else” buying and selling device: Benzinga Professional –

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

This week's financial information could possibly be 'vastly bullish' for shares

Friday’s month-to-month, together with a slew of different financial information slated for launch this week, is more likely to drive the inventory market even larger if it surprises to the upside.

That is as a result of any proof that the Federal Reserve is chopping rates of interest amid a super backdrop of , a stable labor market, and could be a “vastly bullish” consequence for equities, Citi head of US fairness buying and selling technique Stuart Kaiser stated.

“All the things is concerning the progress aspect of the financial system, and the whole lot is concerning the client,” Kaiser . “Any information that means client spending is holding in and you are not seeing the weak point that persons are fearful that the Fed is fearful about, I believe that is all going to be optimistic for fairness markets.”

Together with labor market updates that embody ADP’s payroll information and the month-to-month job openings and labor turnover survey, new releases on Tuesday and Thursday from the Institute of Provide Chain Administration on exercise within the manufacturing and companies sectors are additionally anticipated to catch investor consideration. Economists predict that exercise within the manufacturing sector in September remained in contraction whereas companies exercise was comparatively flat from the month prior.

On Friday, the September jobs report is anticipated to point out 130,000 nonfarm payroll jobs had been added to the US financial system with unemployment holding regular at 4.2%, in line with information from Lusso’s Information. In August, whereas the unemployment price fell to 4.2%.

Financial institution of America Securities fairness and quant strategist Ohsung Kwon wrote in a word to purchasers on Monday that each the roles information and manufacturing information have already been on the weaker aspect for months now. This is able to imply that some weak point is probably going anticipated and solely sizable misses on expectations may “reignite recession fears.”

“However, sturdy prints can additional increase confidence in a comfortable touchdown,” Kwon wrote.

Morgan Stanley chief funding officer Mike Wilson wrote in a word to purchasers on Sunday night time that he sees labor market information mattering “greater than the rest” over the following three to 6 months. Wilson wrote that for a cyclical rotation within the inventory market to happen, the place economically delicate areas outperform, labor information doubtless must be higher than at present anticipated.

“We predict the unemployment price most likely wants to say no alongside above-consensus payroll positive aspects, with no materials draw back revisions to the prior months,” Wilson wrote.

On the crux of this stance from strategists is the market’s want for proof that the Federal Reserve is not chopping rates of interest as a result of it is fearful concerning the trajectory of the US financial system.

When the Fed opted for a bigger rate of interest minimize on Sept. 18, buyers that the Fed was chopping the benchmark price by half a proportion level to protect a at present wholesome financial system fairly than to offer assist to a flailing one.

Learn extra:

Shares subsequently Extra proof that the Fed is chopping charges amid this ultimate backdrop could be a bullish consequence for equities, per Citi’s Kaiser. However the information this week nonetheless poses a big threat to that narrative.

“If it seems that they began chopping as a result of they’re legitimately involved about weak point within the labor market, price cuts aren’t going to be sufficient to assist equities in that case, and you are going to commerce decrease,” Kaiser stated. “So the why [the Fed is cutting] issues right here. And payrolls goes to assist reply that.”

Josh Schafer is a reporter for Lusso’s Information. Comply with him on X .

Markets

Stellantis recollects 194,000 Jeep plug-in hybrids over fireplace dangers

By David Shepardson

WASHINGTON (Reuters) -Stellantis mentioned Monday it’s recalling 194,000 plug-in hybrid electrical Jeep SUVs to deal with fireplace dangers after 13 fires have been reported, and it advised house owners to park outdoors and away from different automobiles till recall repairs are accomplished.

The Italian-American automaker is recalling some 2020 by way of 2024 mannequin yr Jeep Wrangler and 2022 by way of 2024 Jeep Grand Cherokee plug-in hybrids. The problem includes a battery part, the corporate mentioned.

The Chrysler-parent firm mentioned the fires occurred when the automobiles have been parked and turned off. It estimates 5% of affected automobiles might have the defect.

Stellantis (NYSE:) mentioned automobile danger is lowered when the battery cost stage is depleted and mentioned house owners are suggested to chorus from recharging and will park away from buildings or different automobiles. The corporate mentioned a treatment is imminent.

The recall contains 154,000 automobiles in the US, 14,000 in Canada, 700 in Mexico and practically 26,000 outdoors North America. The corporate mentioned the recall was prompted by a routine firm overview of buyer knowledge that led to an inside investigation.

Markets

Dodge-parent Stellantis tumbles on warning, dragging auto shares decrease

Stellantis inventory () tumbled 13% early Monday after the corporate about its North American operations, dragging different auto shares decrease in sympathy.

Stellantis — which counts Dodge, Ram, and Jeep automobiles in its product portfolio — stated it must “enlarge remediation actions” it was planning to take resulting from efficiency points in North America and “deterioration” within the international market, specifically, China.

“Actions embrace North American cargo declines of greater than 200,000 automobiles within the second half of 2024 (up from 100,000 prior steering), in comparison with the prior yr interval, elevated incentives on 2024 and older mannequin yr automobiles, and productiveness enchancment initiatives that embody each value and capability changes,” Stellantis stated in an announcement.

Because of these strategic adjustments, Stellantis now sees adjusted working earnings margin of between 5.5% and seven% for the fiscal yr 2024, down from prior “double digits,” with two-thirds of this hit coming from actions taken in North America. Industrial free money circulation is now anticipated to return in at a lack of 5 billion euros to 10 billion euros ($5.58 billion-$11.17 billion), a drop from the “constructive” it had seen prior.

Shares of Normal Motors (), Ford (), and Toyota () all slipped on Monday as properly.

Deterioration in Stellantis’ North American enterprise was no secret, with , , and sellers .

In the meantime, the United Auto Staff (UAW) is contemplating labor strikes, because it believes Stellantis violated its agreements to restart operations with numerous tasks at Stellantis’ shuttered Belvidere, In poor health., meeting plant.

Stellantis isn’t the one automaker dealing with structural and macroeconomic points. German automaking big Volkswagen () is planning to put off employees in Germany resulting from overcapacity and downbeat gross sales, with in retaliation.

In the meantime, Japan’s Nissan resulting from rising inventories, with international gross sales . Nissan’s product combine within the US, the place it lacks hybrids, can also be hurting its gross sales efficiency.

Final week Morgan Stanley’s autos and mobility workforce, led by analyst Adam Jonas, downgraded your complete US auto sector, citing rising inventories and issues from China as the principle catalysts.

“At a excessive degree, our downgrade is pushed by a mixture of worldwide, home and strategic elements that we consider will not be totally appreciated by buyers,” the Morgan Stanley workforce wrote within the word. “US inventories are on an upward slope with car affordability … nonetheless out of attain for a lot of households. Credit score losses and delinquencies proceed to development upward for less-than-prime customers. And China’s 2-decade-long progress engine has not stalled.”

Apparently, Morgan Stanley maintains its Chubby ranking on Tesla (), citing Tesla’s AI and self-driving prowess. Tesla’s extremely anticipated robotaxi occasion is slated for subsequent week, on Oct. 10.

Pras Subramanian is a reporter for Lusso’s Information. You may comply with him on and on.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes