Markets

Down 46% in 2024, Ought to You Purchase This Progress Inventory on the Dip?

With each the S&P 500 and Nasdaq Composite Index in file territory, buyers may be stunned to study that not all companies have benefited from the market’s sturdy rally. 5 Beneath (NASDAQ: FIVE) suits within the class of underachievers.

As of this writing, 5 Beneath shares are down an eye-watering 46% in 2024. Does this imply it is time to purchase this on the dip?

Disappointing outcomes

After the final two occasions that 5 Beneath reported its quarterly financials, the inventory took an enormous hit. Most not too long ago, the corporate gave an replace on its fiscal 2024 first-quarter outcomes. The one constructive may need been internet gross sales leaping 11.8% throughout the 13-week interval that ended Could 24.

Traders in all probability offered off the inventory as a result of they may have been dissatisfied by the truth that 5 Beneath’s dipped 2.3% in Q1. And to make issues worse, executives consider this metric will decline 3% to five% for the complete fiscal yr.

The enterprise is going through some pressures within the present macro atmosphere. Persons are frequenting shops much less, as there have been fewer comparable transactions within the quarter. And these prospects are being extra selective with how they spend their cash, particularly after an prolonged interval of above-average inflation.

Progress potential

Regardless of its newest challenges in boosting same-store gross sales, buyers will be considerably optimistic. That is as a result of traditionally, the enterprise has nonetheless been capable of develop its income and earnings at wholesome charges. It is simple to get caught up within the current monetary knowledge, but it surely’s sensible to zoom out and deal with the larger image.

Increasing the shop base has been administration’s important strategic goal. After 61 new shops opened in Q1, there at the moment are 1,605 5 Beneath areas. This determine is up considerably from 552 shops over seven years in the past.

That fee of enlargement is spectacular. Nonetheless, the management group has its sights set on a loftier goal. They suppose that by 2030, the corporate could have no less than 3,500 shops open throughout the U.S. This suggests a roughly 118% enlargement from the present footprint. California, Texas, Florida, New York, and Pennsylvania are the 5 states that had been known as out as having essentially the most development potential. There isn’t any doubt that ought to 5 Beneath attain its retailer goal, its gross sales and income will likely be considerably increased than they’re at present.

However buyers should not simply assume {that a} administration group’s long-term objectives, regardless of how encouraging they appear, are mechanically going to turn into a actuality. There are dangers to be aware of that may get in the best way. On this occasion, the intensely aggressive nature of the retail sector is one thing we will not ignore.

5 Beneath is preventing to draw shopper pockets share in opposition to the likes of main retailers like Walmart, Amazon, and Greenback Basic. That will not be a simple job. But when historic developments are any indication, buyers may wish to give 5 Beneath the good thing about the doubt.

Depressed valuation

Due to the inventory’s large drop, shares are buying and selling at their lowest valuation within the final three years. The inventory will be purchased at a price-to-earnings (P/E) ratio of 21.5. This represents an enormous low cost to the P/E a number of of roughly 50 that the shares carried in late June 2021.

Clearly, the market has soured on this enterprise. However for buyers who can look previous the most recent struggles and have a time horizon that spans the following 5 years, there appears to be a possibility right here. Shopping for shares of 5 Beneath at present may show to be a sensible monetary choice.

Do you have to make investments $1,000 in 5 Beneath proper now?

Before you purchase inventory in 5 Beneath, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and 5 Beneath wasn’t certainly one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $801,365!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. and his purchasers haven’t any place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Walmart. The Motley Idiot recommends 5 Beneath. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

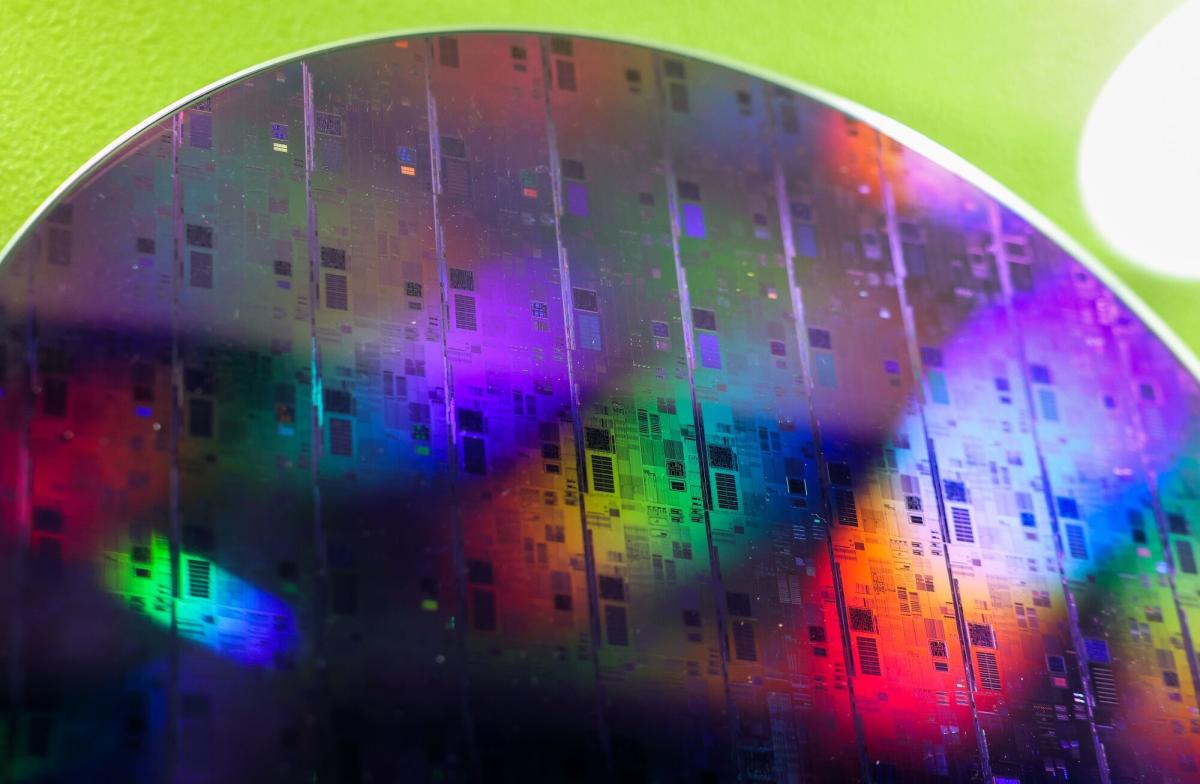

China AI Chip Chief Soars 20% Restrict as Beijing Warns on Nvidia

(Lusso’s Information) — Chinese language AI chipmaker Cambricon Applied sciences Corp. soared its 20% every day restrict on Monday, main a sector rally after Lusso’s Information Information reported Beijing was stepping up strain on home firms to ditch Nvidia Corp. processors for native alternate options.

Most Learn from Lusso’s Information

Cambricon, the largest publicly traded designer of the chips that underpin AI growth, gained the utmost allowed in heavy buying and selling. The corporate led a clutch of chip corporations that ranked among the many largest gainers on the benchmark CSI 300 index. Semiconductor Manufacturing Worldwide Corp. surged nearly 20% in Shanghai, whereas gear maker Naura Know-how Group Co. climbed 9%.

Chinese language regulators have discouraged firms from buying Nvidia’s H20 chips, that are used to develop and run AI fashions, Lusso’s Information Information reported late Friday. That coverage has taken the type of steerage fairly than an outright ban, as Beijing needs to keep away from hamstringing its personal AI startups and worsening tensions with the US.

The transfer is designed to assist home AI chipmakers achieve market share, whereas getting ready native firms for any potential extra US restrictions. The nation’s largest makers of AI processors embrace Cambricon and Huawei Applied sciences Co. Nvidia shares fell 2% on Friday.

Earlier this yr, Beijing additionally instructed native electric-vehicle makers to obtain extra of their provides from native chipmakers, a part of its marketing campaign to achieve self-sufficiency in essential applied sciences.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

European shares fall at begin of data-intensive week

(Reuters) – European shares opened decrease on Monday as traders ready for per week filled with a slew of financial information from the area, whereas feedback from ECB President Christine Lagarde have been awaited.

The pan-European fell 0.1% to 527.47 factors by 0710 GMT. The benchmark was set to realize for a 3rd straight month, seeing its longest successful streak in practically seven months.

Beneficial properties within the oil sector stored losses in verify. Oil costs rose on fears of escalation of the battle within the Center East. [O/R]

Germany’s preliminary CPI figures for September are due at 1200 GMT, whereas Italy’s are due at 0900 GMT.

Britain’s GDP figures for the second quarter confirmed its financial system grew slower than anticipated. The was flat.

The European Central Financial institution President Lagarde is because of communicate on the European Parliament at 1300 GMT.

Volkswagen (ETR:) fell 2% after the German carmaker minimize its 2024 steering.

Stellantis NV (NYSE:) slumped 8% after the French-Italian carmaker slashed its annual steering, citing a deterioration in world business dynamics.

Car shares fell 2.2%, probably the most amongst sectors.

British multinational non-public fairness and enterprise capital agency 3i (LON:) Group dropped 3.5% after Shadowfall Capital reportedly took a brief guess on the corporate.

Markets

As large supermarkets pursue income, new analysis exhibits rising exploitation of shrimp farmers

BANGKOK (AP) — Indonesian shrimp farmer Yulius Cahyonugroho operated greater than two dozen ponds just a few years in the past, using seven individuals and making greater than sufficient to assist his household.

Since then, the 39-year-old says the costs he will get from purchasers have fallen by half and he is needed to cut back to 4 employees and about one-third the ponds, some months not even breaking even. His spouse has needed to take a job at a watermelon farm to assist assist their two kids.

“It’s extra steady than the shrimp farms,” mentioned the farmer from Indonesia’s Central Java province.

As large Western supermarkets make windfall income, their aggressive pursuit of ever-lower wholesale costs is inflicting distress for individuals on the backside finish of the provision chain — individuals like Cahyonugroho who produce and course of the seafood, in accordance with an centered on three of the world’s largest producers of shrimp on Monday.

The evaluation of the trade in Vietnam, Indonesia and India, which offer about half the shrimp on this planet’s high 4 markets, discovered a 20%-60% drop in earnings from pre-pandemic ranges as producers battle to satisfy pricing calls for by slicing labor prices.

In lots of locations this has meant unpaid and underpaid work by longer hours, wage insecurity as charges fluctuate, and plenty of employees not even making low minimal wages. The report additionally discovered and components of Indonesia, and even baby labor in some locations in India.

“The grocery store procurement practices modified, and the working situations have been affected — straight and quickly,” mentioned Katrin Nakamura of Sustainability Incubator, who wrote the regional report and whose Hawaii-based nonprofit led the analysis on the trade in Vietnam. “These two issues go collectively as a result of they’re tied collectively by the pricing.”

Tubagus Haeru Rahayu, the director common of aquaculture for Indonesia’s Maritime Affairs and Fisheries Ministry, mentioned he was shocked by the report’s findings and had already reached out to individuals within the trade to research the value pressures.

“If there may be strain like that, there will certainly be a response — not solely in Indonesia however in Vietnam and India too,” he advised the AP in an interview at his Jakarta workplace.

Indian and Vietnamese officers refused to remark.

Supermarkets linked to amenities the place exploited labor was reported by employees embody Goal, Walmart and Costco in the US, Britain’s Sainsbury’s and Tesco, and Aldi and Co-op in Europe.

Switzerland’s Co-op mentioned it had a “zero tolerance” coverage for violations of labor legislation, and that its producers “obtain truthful and market-driven costs.”

Germany’s Aldi didn’t particularly tackle the problem of pricing, however mentioned it makes use of unbiased certification schemes to make sure responsibly sourcing for farmed shrimp merchandise, and would proceed to watch the allegations.

“We’re dedicated to fulfilling our duty to respect human rights,” Aldi mentioned.

Sainsbury’s referred to a remark from the British Retail Consortium trade group, which mentioned its members have been dedicated to sourcing merchandise at a “truthful, sustainable worth” and that the welfare of individuals and communities in provide chains is prime to their buying practices.

Not one of the different retailers named within the report responded to a number of requests for touch upon the report, titled “Human Rights for Dinner.”

In Vietnam, researchers discovered that employees who peel, intestine and devein shrimp sometimes work six or seven days per week, usually in rooms stored extraordinarily chilly to maintain the product contemporary.

Some 80% of these concerned in processing the shrimp are girls who rise at 4 a.m. and return dwelling at 6 p.m., except for pregnant girls and new moms who can cease one hour earlier.

“The work day for peelers consists of standing in a refrigerated and disinfected room and dealing extraordinarily quickly with a knife whereas taking care to not make a mistake,” researchers mentioned.

Wages are typically not disclosed forward of time and are primarily based upon manufacturing. Generally employees make minimal wage, however incessantly they don’t.

The calling the allegations within the report “unfounded, deceptive and detrimental to the repute of Vietnam’s shrimp exports.”

It cited authorities labor insurance policies in a four-page assertion however didn’t particularly tackle the findings, and didn’t reply to queries.

After meals provide chain disruptions throughout the COVID-19 pandemic, the U.S. Federal Commerce Fee reported earlier this 12 months that some grocers have used the scenario “as a chance to additional increase costs to extend their income, which stay elevated as we speak.”

The calls for for decrease wholesale shrimp costs — mixed with rising manufacturing prices and an oversupply — means farmers usually should promote their merchandise beneath value simply to maintain operations going, the Sustainability Incubator evaluation discovered.

Cahyonugroho mentioned he is caught promoting his shrimp on the worth provided by middlemen who then promote it to factories for processing. He cannot scrape collectively the startup prices wanted to promote on to factories or markets to earn extra.

“The chance is there,” he mentioned, “however you want a variety of capital if you wish to bounce into one thing like that.”

The middlemen who purchase the shrimp obfuscate the true sources of shrimp that seem in Western supermarkets, so many retailers will not be following moral commitments they’ve made about procuring shrimp.

Solely about 2,000 of the two million shrimp farms within the main producing nations of India, Indonesia, Vietnam, Ecuador, Thailand and Bangladesh are licensed by both the Aquaculture Stewardship Council or the Greatest Aquaculture Practices ecolabel.

“With the yield from most licensed shrimp farms being very small, it’s mathematically unattainable for licensed farms to supply sufficient shrimp monthly to produce the entire supermarkets that boast commitments to buying licensed shrimp,” the report mentioned.

Ideally, supermarkets ought to pay greater wholesale costs and be sure that the additional cash makes all of it the way in which down the provision chain, Nakamura mentioned.

U.S. policymakers might use antitrust and different legal guidelines already in place to determine oversight to make sure truthful pricing from Western retailers, quite than including punishing tariffs on suppliers for labor violations, she mentioned.

Consciousness in regards to the tendencies hurting suppliers is rising.

In July, requiring corporations to “determine and tackle adversarial human rights and environmental impacts of their actions inside and outdoors Europe.”

Britain’s Groceries Code Adjudicator workplace printed a “deep dive” into , saying they’d chosen to conduct “warfare” with suppliers.

Larger wholesale costs do not must imply greater costs for shoppers, Sustainability Incubator mentioned.

“Costs to farmers can be a minimum of 200% greater than as we speak if the shrimp bought in World North supermarkets was made at minimal wage charges and in compliance with relevant home legal guidelines for labor, office well being, and security,” the report mentioned. “This could not essentially imply greater client costs, as a result of supermarkets are already profiting at present client costs.”

Researchers from the Company Accountability Lab discovered that Indian shrimp trade employees face “harmful and abusive situations” and that highly-salinated water from newly-dug hatcheries and ponds, tainted with chemical substances and poisonous algae, are contaminating surrounding water and soil.

Unpaid labor prevails, together with salaries beneath minimal wage, unpaid time beyond regulation, wage deductions for prices of labor and “important” debt bondage, the report discovered.

Little one labor was additionally recognized, with women aged 14 and 15 being recruited for peeling work.

In Indonesia, three non-profit analysis organizations discovered that shrimp employees’ wages have declined because the pandemic and now common $160 monthly, beneath Indonesia’s minimal wage in many of the greatest shrimp-producing provinces. Shrimp peelers have been discovered to be routinely required to work a minimum of 12 hours per day to satisfy minimal targets.

Nonetheless, given widespread poverty most employees mentioned they’re pleased to have their jobs, mentioned lead researcher Kharisma Nugroho of the Migunani Analysis Institute.

“It’s exploitation of the vulnerability of the employees, as a result of they’ve an absence of choices,” he mentioned.

“They’re paid the minimal wages however they must work 150% of the traditional,” he advised the AP. “Can they reside? Sure. Can they transfer? Sure. Do they make a criticism? No. They’re nonetheless there.”

The regional report compiled greater than 500 interviews performed in-person with employees of their native languages, in India, Indonesia and Vietnam, supplemented with secondary knowledge and interviews from Thailand, Bangladesh and Ecuador.

After the Indonesia nation report was issued lately, authorities officers requested to satisfy with the authors, and Nugroho mentioned they confirmed a “real willingness to enhance the scenario.”

Vietnamese officers have additionally engaged with Sustainability Incubator to speak in regards to the findings.

Authorities and trade intervention has already helped in Thailand, which has been criticized after the AP uncovered prior to now. That, nevertheless, has led to greater costs for Thai shrimp, main some consumers to shift sourcing to India and Ecuador.

Ecuador has an industrial method to shrimp farming — in contrast to the smaller, usually family-run operations in Southeast Asia — and is now the world’s largest exporter of shrimp. It has the bottom costs, adopted by India; China, which wasn’t included within the report; then Vietnam and Indonesia.

However with the demand for decrease wholesale costs, whereas Ecuador’s exports rose 12% in quantity in 2023, they fell 5% in worth. India’s exports rose 1% however dropped almost 11% in worth.

Meantime, with their comparatively greater costs, Vietnam’s exports have been down 25% in 2023 in quantity Indonesia’s dropped 9.5%.

“Labor exploitation in shrimp aquaculture industries shouldn’t be firm, sector, or country-specific,” the report concluded. “As an alternative, it’s the results of a hidden enterprise mannequin that exploits individuals for revenue.”

___

Related Press author Edna Tarigan in Jakarta, Indonesia, contributed to this report.

___

This story was supported by funding from the Walton Household Basis. The AP is solely accountable for all content material.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook