Markets

SMH ETF: Publicity to Nvidia and Different Prime Chip Shares

It’s laborious to look previous Nvidia (NASDAQ:NVDA) as of late, but it surely’s vital to keep in mind that there are additionally loads of different nice semiconductor (chip) shares on the market. The VanEck Semiconductor ETF (NASDAQ:SMH) allows traders to achieve publicity to each Nvidia and different engaging alternatives inside the semiconductor house.

I’m bullish on SMH based mostly on its robust portfolio of high , that are performing properly and harbor important long-term progress potential, in addition to its unbelievable monitor document of producing robust returns for its holders. We’ve beforehand; it has carried out properly since then and continues to appear to be a compelling alternative for the long run.

What Is the SMH ETF’s Technique?

SMH is the biggest devoted semiconductor ETF. In accordance with sponsor VanEck, SMH invests within the “MVIS US Listed Semiconductor 25 Index (MVSMHTR), which is meant to trace the general efficiency of firms concerned in semiconductor manufacturing and gear.”

VanEck highlights the truth that these are extremely liquid shares, trade leaders, and corporations with world scale.

Portfolio of Compelling Semiconductor Shares

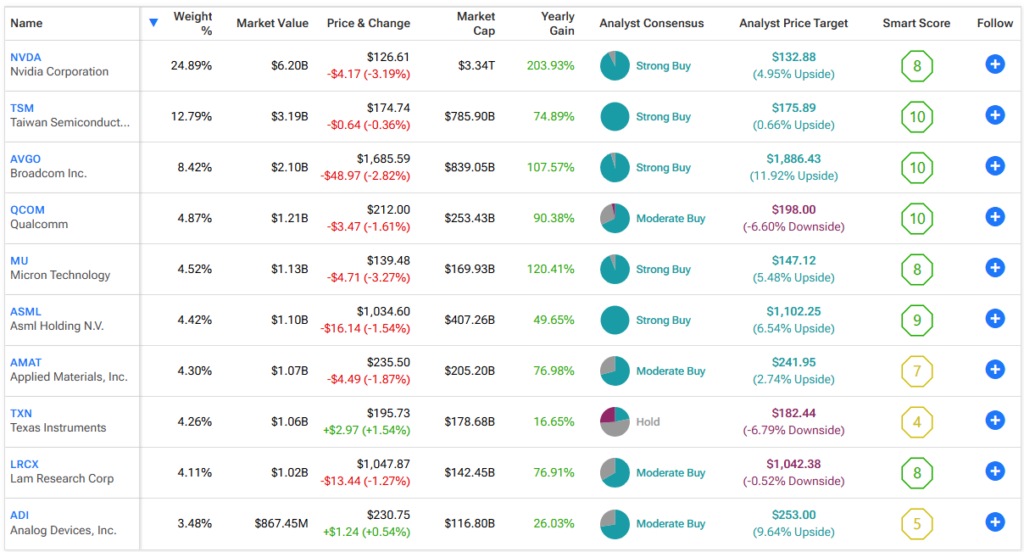

SMH owns 26 shares, and its high 10 holdings make up 76.2% of the fund. Under, you’ll discover an outline of utilizing TipRanks’ holdings software.

Whereas the fund isn’t notably diversified, it provides traders substantial publicity to Nvidia (which has a big weighting of 24.6%) and different high semiconductor shares, together with Taiwan Semiconductor (NYSE:TSM), Broadcom (NASDAQ:AVGO), Qualcomm (NASDAQ:QCOM) and extra.

Had been it not for Nvidia’s 209.6% acquire over the previous 12 months, it’s seemingly that we’d be listening to extra about Broadcom and its 111.8% acquire. However the semiconductor and software program infrastructure big is now knocking on the door of turning into one of many world’s 10 largest firms and is worthy of loads of consideration by itself accord. The inventory is a long-term winner that has generated an unbelievable complete return of three,168% over the previous decade.

It’s additionally that has elevated its dividend payout for 13 straight years and grown this payout at a powerful 17.5% CAGR over the previous 5 years. Moreover, like Nvidia, Broadcom has a inventory cut up of its personal developing.

The corporate not too long ago introduced that it’ll execute a , which can go stay on July twelfth. Whereas inventory splits don’t essentially make a elementary distinction, they will drive appreciable curiosity and momentum in a inventory, as we not too long ago noticed with Nvidia. They will additionally make the inventory extra accessible to smaller traders and retail traders.

Along with Broadcom, Taiwan Semiconductor is one other one of many many engaging chip shares amongst SMH’s high holdings.

Taiwan Semiconductor is the world’s largest and most superior chipmaker. Main semiconductor firms just like the aforementioned Nvidia, Broadcom, Qualcomm, and others go to Taiwan Semiconductor to fabricate the cutting-edge chips that they design and develop. This makes Taiwan Semiconductor a lovely picks-and-shovels play inside the semiconductor house. The $786.1 billion firm has seen its inventory acquire a cool 75.2% over the previous 12 months and hit a .

Subsequent, Qualcomm, which is up 93.8% over the previous 12 months, has made a reputation for itself, as the corporate is creating cutting-edge semiconductors for the whole lot from smartphones to vehicles and Web of Issues units.

Further high 10 holdings, ASML (NASDAQ:ASML) and Lam Analysis (NASDAQ:LRCX), are among the many few firms on the planet offering the high-tech instruments and gear which can be used within the semiconductor manufacturing course of, making them essential elements of the semiconductor worth chain with huge moats (aggressive benefits).

One factor that Broadcom, Taiwan Semiconductor, and Qualcomm all have in widespread is that all of them function “Good 10” Good Scores. The is a proprietary quantitative inventory scoring system created by TipRanks. It provides shares a rating from 1 to 10 based mostly on eight market key elements. A rating of 8 or above is equal to an Outperform score. Seven of SMH’s high 10 holdings function Outperform-equivalent Good Scores of 8 or above.

Moreover, SMH boasts an Outperform-equivalent ETF Good Rating of 8.

Sensational Lengthy-Time period Efficiency

SMH owns a powerful assortment of highly-rated semiconductor shares, and it has additionally generated wonderful returns for its holders for a very long time, giving it a monitor document that’s laborious to beat.

As of Could 31, SMH has delivered an enviable annualized three-year return of 25.5%. This stellar return simply trumps that of the broader market. The Vanguard S&P 500 (NYSEARCA:VOO) returned 9.6% on an annualized foundation over the identical timeframe. It even beats the robust efficiency of the tech-focused Expertise Choose Sector SPDR Fund (NYSEARCA:XLK), which delivered an annualized return of 15.9% over the identical time span.

Over an extended five-year timeframe, SMH has generated a scorching annualized return of 38.6%. This quantity once more handily beats the broader market and XLK (VOO returned an annualized 15.8% over the identical timeframe, whereas XLK returned an annualized 25.2%). Word that these are each nice returns, and SMH nonetheless beat them by a substantial margin.

Even going again 10 years, SMH has produced an exceptional annualized return of 27.8%, once more beating each the broader market and the tech-focused XLK. VOO returned an annualized 12.7% over the identical timeframe, whereas XLK returned an annualized 20.3%.

How Excessive Is SMH’s Expense Ratio?

SMH incorporates a cheap expense ratio of 0.35%, which means that an investor within the fund can pay $35 on a $10,000 funding yearly. This isn’t the bottom payment on the market, as many broad market index funds cost decrease charges. Nonetheless, it’s on par with its friends and cheap sufficient for a sector-specific ETF, particularly one that’s performing in addition to SMH.

Is SMH Inventory a Purchase, In accordance with Analysts?

Turning to Wall Road, SMH earns a Reasonable Purchase consensus score based mostly on 21 Buys, 5 Holds, and nil Promote scores assigned up to now three months. The of $285.18 implies 7.5% upside potential from present ranges.

Investor Takeaway

In conclusion, I’m bullish on SMH as a result of it offers traders substantial publicity to Nvidia and high semiconductor shares like Broadcom, Taiwan Semiconductor, and others. Plus, its phenomenal returns over the previous three, 5, and 10 years give it an unassailable monitor document.

Markets

Nio Surges on $1.9 Billion Injection From Mum or dad, Traders

(Lusso’s Information) — Nio Inc. jumped essentially the most in almost 5 months Monday after unveiling a money injection price 13.3 billion yuan ($1.9 billion) from current shareholders.

Most Learn from Lusso’s Information

The Singapore-listed shares of the loss-making Chinese language electrical automobile maker gained virtually 16% on the monetary reinforcement of its China unit via a mixture of its personal money and strategic buyers’ funds.

A bunch of strategic buyers – together with Hefei Jianheng New Power Car Funding Fund Partnership, Anhui Provincial Rising Business Funding Co., and CS Capital Co. — has definitive agreements to take a position 3.3 billion yuan in money for newly issued shares of Nio Holding Co., often known as Nio China, in line with an organization assertion Sunday.

Nio Inc. will immediately make investments a further 10 billion yuan of money into new shares of the unit. The transactions from all of the events will scale back the mother or father’s holding to an 88.3% stake, down from 92.1%. The strategic buyers — together with different stakeholders — will maintain the remaining 11.7%, the corporate stated.

“We imagine this new funding will resolve the corporate’s fundraising debate and improve near-term money move,” Morgan Stanley stated in a analysis notice on Sunday. “The funding from current shareholders of Nio China ought to additional improve Nio’s stability sheet.”

Whereas China has invested closely in EVs, intense home competitors and abroad tariffs have muddied the sector’s outlook. Nio has sought to realize a aggressive edge with its charging community and R&D spending on battery-swapping know-how and even on non-auto areas like semiconductors.

The money injections will probably be completed in two installments and be accomplished by the top of the yr, its assertion stated.

Nio Inc. could have the precise to take a position a further 20 billion yuan to subscribe for extra shares in Nio China by the top of subsequent yr, primarily based on the identical worth and phrases.

With its money burn triggering analysts’ considerations, the corporate, which has by no means been worthwhile, reported a 4.5 billion yuan loss for the second quarter. However its quarterly gross sales surged to 17.5 billion yuan, defying weakening demand and barely larger than analysts anticipated.

Hefei Jianheng and Anhui Provincial Rising Business Funding are affiliated with the municipal authorities of Anhui province. The buyers within the area are acquainted with Nio, having completed a deal for a $1 billion funding in 2020, which on the time alleviated considerations that the corporate was operating out of money.

In December, Nio additionally struck a deal to obtain $2.2 billion from Abu Dhabi-backed CYVN Holdings LLC.

(Updates with share transfer from the primary paragraph.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Japanese Shares Falter as Ishiba’s Win Wrongfoots Easing Bets

(Lusso’s Information) — Japanese shares tumbled after Shigeru Ishiba’s shock victory over Sanae Takaichi within the ruling occasion’s management race wrongfooted buyers who had wager on a lift from extra financial stimulus from his rival.

Most Learn from Lusso’s Information

The Nikkei 225 Inventory Common slid as a lot as 4.7% in early buying and selling after Ishiba’s choice compelled buyers to pare positions that had been constructed on hypothesis Takaichi would turn out to be Japan’s new prime minister and encourage the Financial institution of Japan to maintain rates of interest low. The yen edged 0.3% decrease to 142.68 per greenback after surging about 1.8% on Friday, whereas 10-year bond futures for December supply fell 0.70 to 144.52.

The Nikkei underperformed the Topix by a couple of proportion level, an indication that the selloff was pushed by short-term speculators, preferring to commerce the Nikkei due to its excessive liquidity and volatility.

“There’s no shock in as we speak’s fall given how a lot the market had rallied within the final a number of periods on hopes that Takaichi would win,” stated Kohei Onishi, a senior funding strategist at Mitsubishi UFJ Morgan Stanley Securities Co. “This will probably be a brief transfer. Traders have been shopping for Japanese shares on hopes about inflation, wage hikes and market reforms — not on BOJ easing. The market will return to deal with fundamentals.”

Ishiba generally has remained supportive of the central financial institution persevering with its path away from extremely low charges in distinction to Takaichi, who characterised additional fee hikes for now as “silly.”

Kyodo Information reported that Katsunobu Kato is about to turn out to be the subsequent finance minister, a transfer that’s seen to ease worries that Ishiba might radically reduce a few of former Prime Minster Shinzo Abe’s reflationary insurance policies. Kato has been a supporter of Abenomics.

Ishiba has referred to as for extra readability on the BOJ’s plans to normalize coverage, and emphasised better improvement of regional economies to deal with depopulation in rural areas, aided by authorities spending.

“He didn’t discuss a lot about financial coverage or tax hikes when he appeared on some TV applications in the course of the weekend,” stated Yugo Tsuboi, chief strategist at Daiwa Securities. “He’s most likely refraining from speaking about insurance policies that make markets nervous forward of a possible election.”

Ishiba might name for a basic election on Oct. 27, public broadcaster NHK stated.

Exporters have been the heaviest drag on the Topix because the yen’s power dimmed the outlook for income. Banks, which sank final week on hypothesis Takaichi would win, rose.

Bets Again on for BOJ Hikes After Ishiba’s LDP Win, Analysts Say

When Prime Minister Fumio Kishida took workplace in 2021, his proposals to lift taxes on capital beneficial properties led to a decline within the Nikkei 225 that was termed the “Kishida shock”. He rapidly retreated on the plan, offering market aid. Helped by a weaker yen, optimism over company governance reforms and Warren Buffett’s endorsement, the gauge rose to a document earlier this 12 months.

However Japanese shares grew to become the epicenter of a worldwide rout in August after the BOJ’s fee hike triggered a bounce within the yen. Whereas shares have pared a few of their losses since then, the market stays susceptible to gyrations within the yen’s strikes. Ishiba has additionally advocated for supporting Japan’s rural economic system.

“Domestically oriented shares, particularly these profit from regional revitalization measures, will probably be most popular,” stated Hirofumi Kasai, a senior strategist at Tokio Marine Asset Administration Co. “The general route out of deflationary interval gained’t change.”

Morgan Stanley MUFG Securities Co. recommends buyers deal with home demand-oriented shares, till considerations about rising company tax burdens are cleared. Goldman Sachs Group Inc. warns volatility will probably persist within the quick time period till Ishiba clarifies his stance “on areas of investor concern comparable to company governance reform and tax charges on monetary asset earnings.”

Japan’s parliament is predicted to substantiate 67-year-old Ishiba as prime minister in a vote slated for Oct. 1. Traders’ consideration will probably then flip to the timing for a basic election, financial knowledge and the US election.

–With help from Aya Wagatsuma and Winnie Hsu.

(provides extra feedback)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Price-conscious Chinese language vacationers look to reasonably priced choices for Golden Week vacation

By Sophie Yu and Casey Corridor

BEIJING/SHANGHAI (Reuters) – Chinese language vacationers are anticipated to take longer journeys than final 12 months throughout the Golden Week vacation that kicks off on Tuesday, however that won’t essentially result in a bump in spending, journey business consultants stated.

With the economic system slowing and shopper confidence hovering simply above historic lows, they count on many travellers over the week-long Nationwide Day break will go for cheaper home or short-haul abroad locations and make the most of a decline in airfares.

The vacation interval has historically produced peak numbers of Chinese language travelling, particularly overseas given the size of the break. This 12 months, the federal government has forecast the each day common variety of journeys dealt with by the nation’s transport sector will rise solely 0.7% year-on-year.

“It might be a great consequence if tourism spending stays flat with final 12 months,” stated Liu Simin, an official with the tourism arm of Beijing-based analysis institute China Society for Futures Research. “Persons are extra prepared to journey when the economic system is sweet, however when there is no such thing as a financial development, there is no such thing as a tourism development.”

Wang Xin, an workplace employee in Beijing, stated she would drive with household to Yangzhou, a metropolis close to Shanghai identified for its lakes, gardens and fried rice.

“There is no such thing as a toll payment throughout vacation so we’ll drive as a substitute of taking the prepare,” the 45-year-old stated. “Higher to not spend pointless cash when the economic system is like this. Many individuals are dropping jobs and at my age if it occurred to me, I would not be capable to discover one other one.”

Earlier than the pandemic, her household’s Golden Week locations had included Singapore and the US.

FALLING AIRFARES

Knowledge from journey platform Flight Grasp exhibits home air ticket costs are anticipated to be 21% cheaper than the identical interval final 12 months, whereas worldwide economic system class airfares can be 25% decrease than 2023 and seven% decrease than 2019.

It predicts worldwide locations of alternative for outbound travellers will proceed to be short-haul Asian hubs, akin to Japan, South Korea, Thailand and Singapore.

Journey.com, China’s largest on-line journey company, additionally stated the highest locations had been in Asia, nevertheless it had seen a big shift towards long-haul locations like Australia, New Zealand, Britain and France this 12 months with longer stays.

“Travellers will probably make the most of decrease ticket costs to journey additional, keep longer and improve to a better starred lodge,” HSBC analysts stated in a be aware.

Whereas final week’s large-scale stimulus might have some affect on spending, it might probably be restricted, the analysts stated, predicting purchases had been prone to meet however not exceed 2023 ranges for the vacation interval.

Some overseas airways akin to British Airways and Qantas Airways have minimize or halted China flights this 12 months amid inadequate demand in addition to fierce value competitors from native carriers.

AirAsia Philippines this month introduced it might cease flights between Manila and China by the fourth quarter, with its CEO quoted in native media saying China’s 30% share of its site visitors in 2019 had fallen to simply 2% this 12 months.

AirAsia didn’t reply instantly to a request for remark. There are, nevertheless, exceptions. Korean Air Traces stated regional journey demand was bettering and this month introduced the launch or re-introduction of a number of routes to and from China.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook