Markets

3 Dividend Shares That Might Assist Set You Up for Life

Holding a portfolio of high quality that deposit money in your account makes the occasional market dip a lot simpler to tolerate. Three Motley Idiot contributors lately chosen three strong corporations with lengthy data of paying common dividends to shareholders. Here is why Philip Morris Worldwide (NYSE: PM), Williams-Sonoma (NYSE: WSM), and Realty Revenue (NYSE: O) may arrange you for years with passive revenue.

This traditional Dividend King is delivering shocking progress

(Philip Morris Worldwide): Philip Morris Worldwide would possibly seem to be a shocking selection for a dividend inventory for all times, however the firm is extra than simply an abnormal tobacco inventory throughout a time of declining cigarette consumption.

Philip Morris has the chops to compete with any dividend inventory. Together with the time when it was mixed with Altria, Philip Morris has raised its dividend yearly for greater than 50 years straight. The worldwide Marlboro vendor additionally presently gives a dividend yield of 5.1%, sufficient to make it a high-yield inventory, however what actually makes the inventory engaging for long-term dividend traders is the best way the corporate has efficiently pivoted to next-gen merchandise like Iqos heat-not-burn tobacco sticks and Zyn nicotine pouches.

In actual fact, smoke-free merchandise now make up roughly 40% of its income and that enterprise is rising rapidly. Total cargo quantity was up 3.6%, pushed by 21% progress in heated tobacco items and 36% progress in oral smoke-free merchandise.

That efficiency helped drive natural income up 11% to $8.8 billion and adjusted currency-neutral earnings per share (EPS) was up 23% to $1.50. The corporate additionally demonstrated confidence within the Iqos model by shopping for again the rights to promote it within the U.S. from Altria for $2.7 billion, and it is now constructing out its presence in that market.

Whereas cigarette consumption is falling, demand for nicotine merchandise nonetheless exists and Philip Morris is forward of its rivals in capturing it. That ought to ship ample rewards for dividend traders over the approaching years.

Value positive factors plus dividends

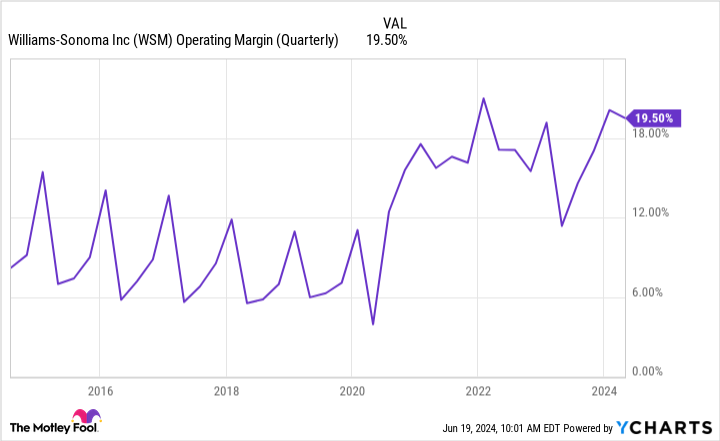

Jennifer Saibil (Williams-Sonoma): Williams-Sonoma is a prime worth inventory struggling by inflation however demonstrating resilience. Gross sales have been declining, however the firm is very worthwhile and sustaining a powerful working margin regardless of inflationary strain.

It providers an upscale clientele, so it is much less prone to clients pinching pennies. Nevertheless, a few of its dwelling items manufacturers, which embody its personal title, Pottery Barn, and West Elm, goal a mid-to-affluent inhabitants, and these clients are switching down or holding again. Regardless of the gross sales downturn, the corporate’s rigorous price effectivity is protecting money flowing in. That interprets right into a strong enterprise and a dependable dividend, even underneath these situations.

Within the 2024 first quarter (ended April 28), gross sales dropped 4.9% from final 12 months. However EPS rose from $2.35 final 12 months to $3.48 this 12 months, or $4.07 with a one-time adjustment. Working margin jumped from 11.4% final 12 months to 16.6% this 12 months, or 19.5% with the adjustment. Working margin has elevated to ranges method greater than earlier than the COVID-19 pandemic, and it reveals no indicators of sliding again.

CEO Laura Alber mentioned administration is planning to spend 75% of capital expenditures this 12 months on e-commerce capabilities, provide chain efficiencies, and giving again extra money to shareholders by dividend funds and share repurchases. It has $1.3 billion in money and no debt, and it’ll purchase again $44 million in inventory and spend $63 million in dividends.

Williams-Sonoma has a little bit of an inconsistent dividend historical past, some years elevating it greater than as soon as. Nevertheless it has paid a dividend since 2006 and raised it not less than yearly since 2010, and it is grown 850% since then.

Wall Avenue is giving Williams-Sonoma a giant thumbs-up for its dealing with of a tough time, and the corporate’s inventory is up 58% this 12 months. The flip facet of that’s that the dividend yield is way decrease than traditional proper now at 1.2%. However that illustrates why Williams-Sonoma is a successful inventory that gives worth appreciation and a gradual and rising dividend.

A top quality REIT with a excessive yield

John Ballard (Realty Revenue): Investing in actual property funding trusts (REITs) when they’re on sale is one approach to considerably enhance your portfolio’s common yield. REITs are required to distribute not less than 90% of their taxable revenue to shareholders. Realty Revenue has an extended report of paying month-to-month dividends, and primarily based on its present month-to-month dividend fee price, the inventory pays a ahead yield of 5.94%.

Rising borrowing charges have been a headwind for the actual property market over the previous 12 months. However that is why traders can purchase this prime REIT at such an incredible yield. Realty Revenue has centered on producing secure free money flows to help returns to shareholders by all market environments over its historical past.

Even throughout the pandemic, it maintained excessive occupancy charges on its closely diversified portfolio of greater than 15,000 business properties. These excessive occupancy charges are the results of partnering with comparatively robust and wholesome companies which have stood the take a look at of time. For instance, a few of its largest retail purchasers are trade stalwarts Walmart, Greenback Common, and Walgreens.

Realty Revenue has paid a month-to-month dividend for 55 years. Following the latest merger with Spirit, the corporate has $825 million of annualized free money stream to make new investments to develop the enterprise and pay rising dividends to shareholders with out the necessity for exterior financing by the debt market.

With rates of interest up, this is a perfect time to contemplate shopping for shares, as a result of as soon as rates of interest stabilize or come down, the inventory may rise sharply.

Do you have to make investments $1,000 in Philip Morris Worldwide proper now?

Before you purchase inventory in Philip Morris Worldwide, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Philip Morris Worldwide wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $801,365!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. has no place in any of the shares talked about. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Realty Revenue, Walmart, and Williams-Sonoma. The Motley Idiot recommends Philip Morris Worldwide. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Qualcomm approached Intel a few takeover in latest days, WSJ studies

(Reuters) -Qualcomm made a takeover strategy to chipmaker Intel in latest days, the Wall Road Journal reported on Friday, citing folks conversant in the matter.

Intel’s shares reversed course to rise 8%, whereas Qualcomm fell 4% in afternoon commerce.

Intel has been trying to show its enterprise round by specializing in its chip foundry unit and synthetic intelligence processors, however its shares have plummeted in latest months because it reduce jobs, suspended its dividend and confronted a high-profile board member resignation.

Earlier this month, Reuters reported that Qualcomm explored the opportunity of buying parts of Intel’s design enterprise to spice up the corporate’s product portfolio.

Qualcomm had examined buying totally different items of Intel, which is struggling to generate money and trying to shed enterprise models and dump different belongings.

Qualcomm and Intel didn’t instantly reply to Reuters requests for remark.

(Reporting by Harshita Mary Varghese in Bengaluru; Modifying by Shounak Dasgupta)

Markets

Nb Bancorp EVP acquires $9.4k value of firm inventory

In a latest transaction, Paul A. Evangelista, the Govt Vice President and Director of the Specialty Banking Heart at NB Bancorp, Inc. (OTC:NBBK), has bought 500 shares of the corporate’s frequent inventory. The acquisition, which befell on September 19, 2024, was made at a mean value of $18.7293 per share, amounting to a complete funding of roughly $9,364.

This buy will increase Evangelista’s direct holdings in NB Bancorp to 22,066 shares. Moreover, it was reported that he not directly owns 8,899 shares by a 401(okay) plan. The transaction displays a vote of confidence within the monetary establishment, which operates within the financial savings establishments sector, not federally chartered, and is headquartered in Needham, Massachusetts.

Traders typically monitor insider transactions corresponding to these for insights into govt views on the corporate’s future efficiency. Evangelista’s function as EVP and his elevated funding in NB Bancorp might recommend a optimistic outlook on the corporate’s worth and progress potential.

NB Bancorp, Inc. is thought for offering a spread of banking companies and merchandise. The corporate’s shares are traded over-the-counter, and traders can observe the inventory below the buying and selling image OTC:NBBK. The transaction was formally filed on September 20, 2024, based on the main points supplied within the SEC Kind 4 report.

Lusso’s Information Insights

Following the latest insider buy by Paul A. Evangelista at NB Bancorp, Inc. (OTC:NBBK), the corporate’s monetary outlook and inventory efficiency metrics provide extra insights. In line with Lusso’s Information knowledge, NB Bancorp presently has a market capitalization of $792.19 million and is buying and selling at a price-to-earnings (P/E) ratio of 51.17. The P/E ratio, which is taken into account excessive, means that the corporate’s inventory is likely to be valued at a premium in comparison with its earnings. That is additional exemplified by the adjusted P/E ratio for the final twelve months as of Q2 2024, which stands at 60.9.

The corporate’s income for the final twelve months as of Q2 2024 was $141.69 million, with a notable progress fee of 13.92%. Moreover, the quarterly income progress for Q2 2024 was even larger at 23.53%, indicating a powerful upward pattern within the firm’s earnings. Regardless of these optimistic progress metrics, Lusso’s Information Suggestions level out that NB Bancorp suffers from weak gross revenue margins, which might be some extent of concern for traders.

Nevertheless, there are indicators of optimism as effectively. NB Bancorp’s inventory has proven a powerful return over the past three months, with a value whole return of 28.73%, and an much more spectacular six-month value whole return of 36.3%. This latest uptrend in inventory value is corroborated by the inventory buying and selling close to its 52-week excessive, at 96.32% of the height worth. Moreover, analysts predict that the corporate might be worthwhile this 12 months, which might be a contributing issue to the manager’s choice to extend his stake within the firm.

For these contemplating an funding in NB Bancorp, it is value noting that the corporate doesn’t pay a dividend to shareholders, which is likely to be a consideration for income-focused traders. For a extra complete evaluation and extra Lusso’s Information Recommendations on NB Bancorp, traders can go to https://www.investing.com/professional/NBBK, the place 9 extra suggestions can be found to assist inform funding selections.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

A millennial FIRE couple shares how transferring overseas and dwelling on a $50k revenue helped them quadruple their internet price to $700k in 6 years

-

A millennial couple grew their internet price to over $700,000 from $150,000 in 2018.

-

Dwelling overseas and solely spending one among their incomes, which is $50,000, helped enhance their funds.

-

Brian Davis shared why his purpose is not however to pursue his dream work.

About twenty years in the past, earlier than he’d ever heard of the , Brian Davis determined to pursue monetary independence and an early retirement.

He started investing his financial savings in , considering that if he owned sufficient of them, he’d ultimately be capable of reside off the rental revenue alone, the 43-year-old advised Enterprise Insider by way of e mail.

However this did not go based on plan. He hated being a , and a number of the investments proved to be much less worthwhile than he’d anticipated. The thought of retiring forward of schedule appeared prefer it could possibly be out of attain, so he determined to discover different choices. As we speak, he runs a digital actual property investing platform.

Nonetheless, within the years since, quite a bit has modified for Davis — each from a monetary and philosophical perspective. For one, he is grown his internet price to greater than $700,000 as of Could from roughly $150,000 in 2018, based on paperwork seen by BI.

Davis and his spouse have aimed to reside totally off of his spouse’s roughly $50,000 a 12 months faculty counselor wage whereas saving and investing all of his revenue, which comes primarily from an actual property he cofounded in 2016 — he stated their annual family revenue is round $150,000. This saving technique has been key to boosting their funds.

Davis’s monetary targets have additionally advanced. After studying extra in regards to the — a monetary life-style aimed toward saving sufficient to grow to be financially unbiased and retire earlier than the normal retirement age — Davis stated he found that most individuals who managed to retire early ultimately bought bored of “sipping margaritas on the seashore” and returned to work in some kind. Quite than early retirement, Davis stated his present purpose is to reside his preferrred life, and he thinks remaining within the workforce can assist him accomplish this.

“I’ve no plans to retire, however I do hope to succeed in monetary independence throughout the subsequent 5 years,” he stated. “The much less you are worried about cash, the extra your work opens as much as be enjoyable, inventive, and with out limits on alternatives.”

Whereas many Individuals are having bother , some are placing themselves able to forward of schedule by varied financial savings and funding methods. Nonetheless, not all of those individuals are aiming for an early retirement. Some folks, like Davis, wish to proceed working as they pursue monetary safety. However not simply any type of work: They wish to that they get pleasure from or discover fulfilling.

Davis shared how he is grown his internet price — and why he thinks discovering one’s dream work can assist them reside their preferrred life.

Decrease dwelling bills could make it simpler to avoid wasting

Davis and his household, together with his spouse Katie and their daughter, have an enormous monetary benefit: They do not pay for housing.

That is among the many perks of Katie’s job: She works as a college counselor at worldwide colleges world wide. Davis stated they first moved overseas in 2015, spending 4 years in Abu Dhabi and 4 years in Brazil earlier than transferring to Lima, a couple of 12 months in the past. Davis stated it is commonplace for worldwide colleges to supply free housing for college and employees.

Along with saving cash on housing, they have been in a position to make the most of the “decrease value of dwelling abroad,” together with cheaper meals and . Davis stated this was among the many major causes they determined to enterprise overseas.

“You should purchase beef and pork in South America for 1 / 4 of the price within the US,” he stated.

Davis stated one other massive manner he is been ready to save cash is by — he stated he hasn’t owned a automotive in 5 years.

“Individuals do not realize how way more vehicles value than simply the month-to-month cost,” he stated. “With no automotive, we do not have to pay for automotive insurance coverage, repairs and upkeep, gasoline, parking.”

The household’s diminished dwelling bills have enabled them to reside totally on Katie’s wage. Nonetheless, Davis stated that they do not count on to have these monetary perks ceaselessly, in order that they’re making an attempt to make the most of them now.

“In some unspecified time in the future, we all know we’ll have to maneuver again to the US for household causes,” Davis stated. “So we’re making an attempt to construct our internet price and passive revenue streams as shortly as doable earlier than we do.”

How pursuing dream work can assist one reside their preferrred life

When Davis discovered that many early retirees return to work in some kind, he stated this revelation was in some methods disappointing.

Nonetheless, he is since modified his tune. For instance, if an individual retires at age 60 — fairly than age 50 — then it might be a lot simpler for them to hit their retirement financial savings purpose.

“It signifies that you do not want practically as a lot cash as you thought you probably did,” Davis stated. “If you are going to maintain doing a little type of work by yourself phrases, you will maintain incomes energetic revenue.”

Nonetheless, that additional decade of labor may not be passable for everybody. That is why Davis thinks the hot button is discovering one’s dream work.

Davis stated if somebody is doing work they get pleasure from, then they seemingly will not be so determined to surrender work and retire. And even when this implies transitioning to work that is lower-paying than one’s previous job, Davis stated that is the place the well-discussed within the FIRE group can come in useful: They can assist bridge the hole between one’s desired and precise revenue.

“You simply want sufficient cash to cowl any shortfall between what you wish to spend and what your dream work pays,” he stated. “In different phrases, you can begin dwelling your preferrred life now, or very quickly, with out being financially unbiased.”

To make certain, discovering a job — overlook about one’s dream job — is less complicated stated than finished in right this moment’s economic system. Many Individuals are having a as firms pull again on hiring.

For Davis, his enterprise is one element of his dream work. He stated he will get all the advantages of actual property funding with out the complications of being a landlord.

“I do not contemplate myself financially unbiased, however I am dwelling the identical life that I might be if I have been,” he stated. “I get to do work I really like, alone schedule, from wherever on this planet.”

His prime recommendation for folks is to ascertain their preferrred life-style and decide what kind of labor and revenue degree they should make it a actuality.

“When you reframe FIRE in these phrases, it will get each simpler and extra fulfilling, fairly than simply dreaming about sitting on a seashore as a bum for the remainder of your life,” he stated.

Have your financial savings and wealth grown considerably lately? Are you keen to share your prime monetary methods? Attain out to this reporter at .

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?