Markets

3 Dividend Shares That Lately Raised Their Payouts

Do not accept dividend shares that do not increase their payouts. If a dividend-paying firm is doing effectively, it ought to usually have room to extend its dividend, even when by a modest quantity. It isn’t solely a very good indicator that the enterprise is doing effectively, nevertheless it additionally means extra dividend revenue for you. Three corporations that raised their dividend funds this month are Realty Revenue (NYSE: O), Goal (NYSE: TGT), and FedEx (NYSE: FDX).

1. Realty Revenue

Realty Revenue makes dividend funds on a month-to-month foundation, and the actual property funding belief makes for a very good, diversified revenue funding to carry. The REIT’s portfolio features a broad mixture of tenants from all areas of the financial system. It isn’t targeted on simply flats or hospitals. As an alternative, it has over 1,500 purchasers unfold throughout 89 industries.

The REIT typically makes a number of dividend will increase all through a 12 months, however since its funds are made each month, they typically aren’t big. On June 11, the REIT introduced that its month-to-month dividend would once more be going up, from $0.2625 to $0.2630. The cost, which is scheduled for July, is 16% increased than what it was paying its buyers 5 years in the past — $0.2265. The inventory’s 5.9% yield means you could possibly be gathering greater than 4 instances what you’ll with the common S&P 500 inventory, the place the common yield is round 1.3%.

This 12 months, the REIT expects its normalized per share to return in between $4.17 and $4.29, which might be effectively above the present fee of its annual dividend — $3.16. Realty Revenue’s excessive dividend yield might not keep this excessive as soon as rates of interest come down; by then, the inventory might be rallying. For revenue buyers, now’s nearly as good a time as any to purchase shares of this prime dividend inventory.

2. Goal

Among the many main causes buyers love proudly owning shares of Goal is for the Minneapolis-based retailer’s frequently rising dividend. At 3.2%, buyers can already get an above-average payout from the retail inventory. What sweetens the deal is that Goal can also be a Dividend King, having raised its payout for not simply years however a long time.

That is why Goal’s newest dividend hike introduced this month was enterprise as typical, with out a lot fanfare. The corporate mentioned it was elevating its dividend by a reasonably modest fee of 1.8%, because it extends its dividend development streak to a formidable 53 straight years. However Goal has made bigger will increase lately, after benefiting from a surge in pandemic-fueled visitors to its shops. The brand new quarterly dividend of $1.12, which is payable in September, is 70% increased than the $0.66 it was paying shareholders 5 years in the past.

It hasn’t been an ideal 12 months for Goal’s inventory, as it’s up simply 1% since January. However with a modest valuation of 16 instances its trailing earnings and it being a pacesetter within the retail business, this may be one other stable income-generating inventory to purchase and maintain for the long run.

3. FedEx

The biggest dividend enhance on this listing comes from logistics firm FedEx. Final week, the corporate introduced it could be elevating its annual dividend by 10% to $5.52.In 5 years, the corporate has greater than doubled its dividend funds. Even with the rise, nevertheless, the inventory’s yield is now 2.2%, which remains to be the bottom fee on this listing.

Shares of FedEx are down this 12 months. Financial situations have not been nice, and that has been evident within the firm’s outcomes as gross sales have been down resulting from weaker demand. By way of the nine-month interval ending Feb. 29, the corporate’s income totaled $65.6 billion and fell 4% from the identical interval a 12 months in the past.

The excellent news is that as financial situations enhance, the corporate ought to be in a lot better form sooner or later. It is at present buying and selling at simply 11 instances its estimated future income, and it might make for a steal of a deal proper now for each dividend and growth-oriented buyers.

Do you have to make investments $1,000 in Realty Revenue proper now?

Before you purchase inventory in Realty Revenue, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Realty Revenue wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $775,568!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends FedEx, Realty Revenue, and Goal. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

3 Dividend Kings to Add to Your Portfolio for a Lifetime of Passive Revenue

Should you’re seeking to increase your dividend earnings, you virtually cannot go incorrect by investing in . These are shares which have elevated their dividend for no less than 50 consecutive years. Clearly, an organization with such a stellar dividend file should have stable financials and progress prospects, or it would not be capable of maintain dividend will increase over a number of a long time.

Coca-Cola (NYSE: KO), Philip Morris (NYSE: PM), and Realty Revenue (NYSE: O) are three Dividend Kings to purchase proper now, in accordance with these idiot.com contributors. Here is why.

A resilient client model

(Coca-Cola): Coca-Cola is a dominant international beverage model that has paid 62 consecutive years of rising dividends. The inventory is up 21% 12 months thus far following robust monetary leads to the primary half of 2024.

Shoppers have tightened their spending, however the beverage business has remained resilient. Coca-Cola reported a 2% year-over-year enhance in unit case quantity final quarter, and it additionally achieved double-digit natural income progress and better margins.

Coca-Cola has a diversified portfolio of manufacturers throughout teas, juices, and carbonated drinks. Throughout all these manufacturers, it generates a strong working revenue margin of 21%, which administration is working to extend by refranchising its bottling operations. The worthwhile lineup offers the corporate numerous gross sales alternatives for various events, whereas producing a wholesome revenue to pay rising dividends.

The corporate is paying out about 75% of its annual earnings in dividends. The quarterly dividend is at present $0.485 per share, up 21% over the past 5 years. This places the forward-dividend yield at a beautiful 2.71% in comparison with simply 1.32% for the S&P 500.

The inventory’s efficiency displays the power of the model and the alternatives to continue to grow over the long run. Coca-Cola’s fastest-growing markets within the second quarter had been Latin America and Asia Pacific. The inventory’s above-average yield provides buyers nice worth with extra progress to return.

This longtime dividend payer continues to be heating up

Jeremy Bowman (Philip Morris): Philip Morris would possibly appear to be an odd selection for a long-term dividend inventory.

In any case, everybody is aware of that smoking is on the decline, however nowadays, Philip Morris’ enterprise is way more than simply cigarettes. The corporate has efficiently diversified into next-gen merchandise, together with the IQOS heat-not-burn sticks that operate like vapes however use tobacco as a substitute of e-liquid, and Zyn nicotine pouches, which it gained in its acquisition of Swedish Match in 2022.

Thanks largely to the success of these two merchandise, the tobacco inventory now generates roughly 40% of income from next-gen, smoke-free merchandise, and since these merchandise generate even wider margins than cigarettes, they now produce greater than 40% of Philip Morris’ gross revenue. Demand has been so robust for Zyn that the corporate lately introduced new investments to broaden capability in Colorado and Kentucky.

Since Philip Morris additionally solely sells cigarettes in worldwide markets, the corporate continues to be rising its cigarette class as natural income from combustibles, that are primarily cigarettes, was up 4.8% in its most up-to-date quarter. Even shipments of cigarettes had been up 0.4% within the quarter.

Altogether, natural income rose 9.6% to $9.5 billion within the quarter and organic-operating earnings was up 12.5%, that are wonderful numbers for a seemingly mature dividend inventory.

Philip Morris additionally simply raised its quarterly payout by 3.8% to $1.35. Whereas the corporate is just not technically a Dividend King, in case you embrace its historical past as a part of Altria, then it is raised its dividend for the final 55 years.

At present, the corporate provides a 4.4% dividend yield, and it seems poised to hike its payout for years forward.

Month-to-month, high-yielding dividends

Jennifer Saibil (Realty Revenue): Few dividend shares in the marketplace can match Realty Revenue. It has every thing a passive-income investor might need in a inventory: The dividend has a excessive yield, it is dependable, it is rising, and the corporate pays month-to-month, an additional perk.

Realty Revenue is a retail actual property funding belief (REIT), which suggests it leases properties to retailers. Nevertheless, it has massively expanded over the previous few years and is nicely diversified by business. Retail properties nonetheless make up 79.4%, and inside retail, it caters to necessities classes like grocery shops, comfort shops, and greenback shops, which give it resilience throughout pressured instances like pandemics and inflation. Collectively, these classes symbolize greater than 26% of the full portfolio.

By way of two latest acquisitions in addition to shopping for new properties, it is greater than doubled its property rely over the previous few years to fifteen,450. It has entered gaming and industrials, which collectively account for nearly 18% of the portfolio and supply the diversification essential to offset the danger of concentrating in a single space.

REITs pay out most of their earnings as dividends, which is why they’re normally wonderful dividend shares. Realty Revenue has paid a dividend for greater than 50 years, and it is raised it for 108 straight quarters. It yields practically 5% on the present value, which is increased than its common of about 4%, and practically 4 instances the S&P 500 common. Realty Revenue inventory fell when there was pessimism surrounding the actual property business and excessive rates of interest, and the dividend yield went up in consequence. However buyers have gotten extra assured, and the value has risen over the previous few weeks.

Realty Revenue is a certain guess for a lifetime of passive earnings, and now is a superb time to purchase earlier than the value will increase and the yield goes again down.

Do you have to make investments $1,000 in Coca-Cola proper now?

Before you purchase inventory in Coca-Cola, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for buyers to purchase now… and Coca-Cola wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. has no place in any of the shares talked about. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Realty Revenue. The Motley Idiot recommends Philip Morris Worldwide. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

This Monster Progress Inventory Is Up Practically 300% in 5 Years. Right here's Why It's the Largest Inventory Place in My Portfolio Proper Now.

The final 5 years had been chaotic, with a world pandemic, a presidential election, inflation, swift rate of interest modifications, financial institution failures, and extra. Regardless of this stage of financial disruption, the S&P 500 is up practically 90%. That is a great run, all issues thought of.

Pretty much as good as these broad market returns have been, MercadoLibre (NASDAQ: MELI) inventory has left the S&P 500 utterly within the mud. Shares of this Latin American enterprise are up over 280% within the final 5 years.

MercadoLibre is the biggest place in my private , and I am going to clarify why in a second. However first, I need to present some context to forestall potential misunderstandings.

My Roth IRA is lower than 5 years outdated. I beforehand had a retirement account with my employer. I did not have management over how that account was invested. However upon altering jobs, I rolled the account over and out of the blue had investable money and decision-making potential.

I shortly diversified the account to over 20 inventory positions as a result of diversification is essential — it is a . In early 2022, I bought shares of MercadoLibre for the primary time, dollar-cost averaging into my new place till it was price about 5% of the Roth IRA’s worth.

It wasn’t the biggest place on the time, however MercadoLibre inventory actually holds that title now. It is price excess of 5% of the full portfolio worth. Nevertheless, there are three explanation why I am not trying to promote any MercadoLibre shares anytime quickly.

1. MercadoLibre is poised for progress

Traders can earn cash in low-growth industries. Nevertheless it’s means simpler to seek out profitable investments by concentrating on leaders in rising markets.

In MercadoLibre’s case, its two essential enterprise segments are its e-commerce market and its monetary expertise (fintech) providers. Competitors can be way more fierce in North America or Europe. However in its native Latin America, MercadoLibre enjoys a number one place due to its early entry into the house.

When it comes to market maturity, Latin American markets for e-commerce and digital monetary merchandise are youthful than these markets in North America, typically talking. This partly explains why MercadoLibre’s progress has been stellar and why it may stay robust for the foreseeable future.

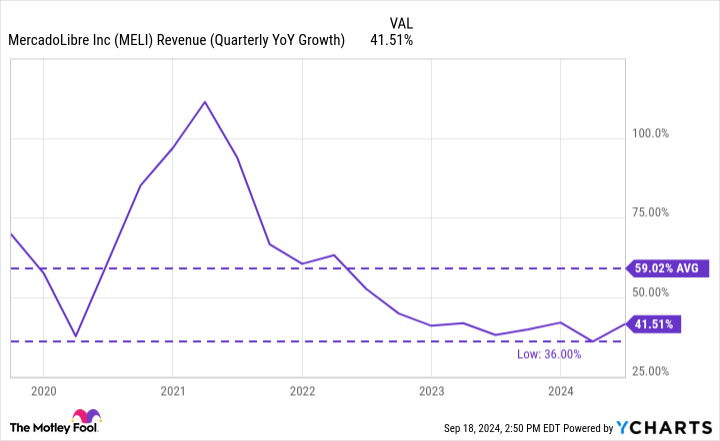

Relating to its progress charge, the chart beneath reveals that MercadoLibre’s slowest progress charge of the final 5 years was 36% — most corporations not often have a single 12 months of progress that good. And MercadoLibre has averaged top-line progress of practically 60% throughout that interval. At this charge, the enterprise will quadruple in measurement each three years, which is simply mind-blowing.

I am not essentially saying that MercadoLibre will preserve this present tempo. However its progress nonetheless appears to have loads of runway, which is the highest purpose I am pleased that MercadoLibre inventory is the biggest place in my Roth IRA.

2. MercadoLibre is poised for income

A few years in the past, MercadoLibre determined to sacrifice its good revenue margins to put money into transport and logistics. In its geographies, logistics was the problem that few corporations had been fixing for. It wasn’t fast, low cost, or simple. However as we speak, MercadoLibre has spectacular talents.

For perspective, over half of orders on MercadoLibre’s e-commerce platform are being delivered identical day or subsequent day, which is a uncommon stage of service within the firm’s key markets.

Its power in logistics helps the long-term progress of MercadoLibre’s e-commerce market. Not solely are extra third-party sellers getting on board (feeding a high-margin income stream), however progress of the platform additionally permits for progress in promoting income. The corporate had round $250 million in advert income within the second quarter of 2024, which was up greater than 50% 12 months over 12 months.

Furthermore, MercadoLibre’s power in logistics provides it a aggressive benefit, and firms with highly effective benefits typically discover methods to enhance their margins over time.

In recent times, MercadoLibre’s income progress has been excellent. However because the chart beneath reveals, progress for revenue metrics corresponding to working earnings and free money circulate has been even higher.

I’d anticipate extra positive aspects for MercadoLibre inventory if its income proceed to develop as they’re now.

3. Letting winners run is a profitable technique

One precept for investing the Motley Idiot means is to have a various portfolio. One other precept is to let a profitable funding proceed working, slightly than promoting it prematurely.

Let’s face it, a various portfolio goes to be crammed with loads of dangerous investments — mine certain is. This could drag down general long-term returns. Nevertheless, a single profitable inventory can do the heavy lifting. However this could solely occur if it is allowed sufficient time to develop.

There are authentic causes to promote a inventory. However MercadoLibre’s enterprise is flourishing, and it seems to have an extended runway. For these causes, I am going to hold holding my high inventory and permit it to raise my portfolio as a complete.

The place to speculate $1,000 proper now

When our analyst workforce has a inventory tip, it may possibly pay to hear. In any case, Inventory Advisor’s complete common return is 757% — a market-crushing outperformance in comparison with 167% for the S&P 500.*

They only revealed what they imagine are the for buyers to purchase proper now… and MercadoLibre made the record — however there are 9 different shares you might be overlooking.

*Inventory Advisor returns as of September 16, 2024

has positions in MercadoLibre. The Motley Idiot has positions in and recommends MercadoLibre. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

JPMorgan CEO Jamie Dimon Calls For Federal Workers To Return To Workplace, Says Empty Buildings 'Trouble' Him: 'I Can't Imagine…'

Benzinga and Lusso’s Information LLC could earn fee or income on some objects via the hyperlinks under.

JPMorgan Chase (NYSE:) CEO Jamie Dimon has known as for federal workers in Washington, DC, to return to their places of work, highlighting the continued debate over

What Occurred: Talking at The Atlantic Competition, Dimon expressed his frustration with the variety of empty buildings within the capital, to Enterprise Insider on Friday.

“By the best way, I’d additionally make Washington, DC, return to work. I can’t consider, once I come down right here, the empty buildings. The individuals who give you the results you want not going to the workplace,” he said,

“That bothers me,” he added. Dimon emphasised that he doesn’t enable such flexibility at JPMorgan.

Don’t Miss:

Why It Issues: Dimon just isn’t alone in his stance. Earlier this week, Amazon (NASDAQ:) CEO Andy Jassy introduced that Amazon workers wouldk, reverting to pre-pandemic norms.

JPMorgan’s coverage mandates managing administrators to be within the workplace full-time, whereas different workers should work in particular person no less than three days every week. Final 12 months, the Biden Administration additionally pushed federal workers to return to in-person work.

Regardless of these efforts, many federal staff nonetheless have versatile work preparations. As an example, some Environmental Safety Company workers are required to be within the workplace solely 4 days a month. Different companies, just like the Division of the Treasury and the Division of the Inside, require no less than 50% in-office presence.

Workplace emptiness charges in DC stay excessive, with about 22% of within the second quarter of 2024, in response to CBRE. The federal authorities and private-sector places of work contribute to this pattern.

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor immediately. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Maintain Studying:

-

This billion-dollar fund has invested within the subsequent huge actual property increase, .

It is a paid commercial. Rigorously contemplate the funding targets, dangers, prices and bills of the Fundrise Flagship Fund earlier than investing. This and different info might be discovered within the. Learn them rigorously earlier than investing. -

New fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends

This text initially appeared on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024