Markets

How a Gen Xer went from declaring chapter at 30 to being on monitor to retire early in her 50s

-

Chris Elle Dove, as soon as bankrupt, is about to retire early with over $1.5 million web price.

-

She transitioned from incomes $50,000 a yr as a professor to investing full-time.

-

Her technique contains residing minimally, investing in actual property, and retaining spending low.

Chris Elle Dove, 52, declared at age 29 in 2001 and survived off authorities advantages and facet hustles to supply for her two children. She had not too long ago misplaced her husband and was struggling to be a great mother whereas discovering extra secure work.

20 years later, she and her second husband have a complete web price of over $1.5 and are set to of their 50s.

After years of incomes between $50,000 and $60,000 as a professor, Dove was satisfied by her husband — who’s within the navy and had maxed out his retirement accounts — to speculate full-time. Investing, alongside earnings from actual property and monetary consulting, allowed her and her husband to be on monitor to develop into — or those that have reached monetary independence and retired early.

She acknowledged her began a lot later than many others, although she careworn is not as inaccessible as many assume.

“It was a very long time earlier than I obtained again on my toes, and I’ve no intention of ever being in that scenario once more,” Dove mentioned.

A rocky monetary begin

Dove was raised in an upper-middle-class household that went on two holidays a yr, and he or she did extracurriculars from cheerleading to horseback driving to ice skating.

“I did not even take into consideration not going to varsity,” Dove mentioned. “I solely considered what faculty.”

Her dad and mom by no means brazenly mentioned cash, however she knew they saved a strict finances. They taught her about , reminiscent of by giving her a pre-paid bank card in highschool for garments that she needed to finances.

She had her first child at 20 and her second at 24, placing her bachelor’s diploma on maintain — it took her 17 years to complete her diploma. At one level, she held three jobs — instructing ballroom dancing, bartending, and shoveling mulch for a landscaping firm.

Whereas elevating her children, her husband developed a mind tumor that left him sick for years. The piled up, and most weren’t coated by their insurance coverage. She additionally had pupil mortgage debt that she placed on the again burner.

Her husband died at 28 when her children have been 7 and three.

Dove did not have a lot time to grieve, although. She labored so many hours to assist her children she would get sick. After a automobile accident that led to a hospital keep, she declared chapter.

With little cash to her title, counting on , she moved together with her two children to a city in Western Illinois. She purchased a $50,000 house, paying $200 a month in mortgage funds. She maintained her dance instructing place, privately tutored, and was a analysis assistant.

“I at all times felt like a failure, like I must be offering for my children the best way I used to be supplied for,” Dove mentioned. “I used to be by no means ready to try this. I used to be simply attempting to make it to the following paycheck.”

Getting again on her toes

In a stroke of luck, she obtained the chance to show sociology programs at a group faculty, which paid her $34,000 a yr in 2006. Her wage rose to $56,000 a number of years later. Having loads of holidays and extra secure hours allowed her to be extra current in her children’ lives, although cash was nonetheless a stressor. She made additional earnings from advising campus golf equipment.

“We saved the wheels on the bus, however we by no means obtained forward,” Dove mentioned.

She barely had cash in her and hadn’t invested a lot for her children’ futures. All she might take into consideration was squeezing sufficient cash out of her subsequent paycheck to take her children to a museum.

“I truthfully spent most of my life not caring about cash until I had an emergency expense and I could not pay for it,” Dove mentioned. “I believed cash was most likely one thing that corrupted folks, and I simply did not have a really constructive opinion of cash.”

Her second husband, whom she met in 2015 and married in 2021, had maxed out his and saved a lot of his earnings. They agreed she would take off a number of months to put in writing youngsters’s books and see if it was financially sustainable. As soon as it grew to become clear this profession swap wasn’t viable, she started investing after her husband satisfied her she could be good at it.

“I pushed again as a result of I did not assume it was rewarding. I did not assume I’d really feel like I used to be contributing to society in a significant manner as an investor,” Dove mentioned.

Reaching monetary independence

She offered her automobile and invested that cash within the inventory market, beginning with shopping for a share of Berkshire Hathaway, then diversifying her portfolio.

“One of many largest realizations for me is that I used to assume you wanted more cash to be rich, however now what I’ve realized is you’ll be able to have a ton of cash and nonetheless dwell paycheck to paycheck,” Dove mentioned. “You can also make a really small quantity of earnings and dwell inside your means and dwell stress-free and glad and construct wealth.”

She knew she could not begin her monetary independence journey alone, and her extra financially savvy husband helped her get on monitor. On a nationwide parks journey, they determined they might do no matter they may to retire early and spend extra time exploring the world with out worrying about cash.

She learn dozens of books and articles about monetary markets, accomplished graduate levels in monetary planning, and have become a Licensed Monetary Conduct Specialist. She modified her investing methods to suit her persona, schedule, and threat tolerance. She and her husband began with $240,000 invested in retirement accounts, in addition to about $80,000 in fairness. Inside the first 4 years, they doubled their investments twice.

In her mid-40s, she paid off her pupil debt, which she thought-about an enormous milestone. It was the primary time she might begin saving cash and max out her 401(ok).

She and her husband adopted a minimalist life-style, beginning by adopting a “one in, one out” rule — for each shirt she purchased, she would promote one. They prioritized experiences over presents and considerably elevated financial savings, solely buying what they wanted.

During the last 4 years, she estimates they’ve saved over 40% of their earnings — and about 60% if together with investments from house gross sales. Nonetheless, she mentioned they don’t seem to be overly frugal and spend on health, meals, and hobbies like bikes.

She created an “intense and intimidating” spreadsheet to trace every little thing coming in and going out. She added sections for emergency financial savings, investments, web price, and their “slush fund” of purchases above $500.

They pivoted to transferring 20% of her husband’s base earnings, 100% of her earnings, and at the least 50% of bonuses into investments. Her husband’s navy pension, which is inflation-adjusted, has additionally taken some weight off the planning course of.

“Along with paying ourselves first, we have adopted the ‘give each greenback a job’ strategy. On the finish of every month, any ‘extra cash’ is assigned to both slush, emergency, or it is invested,” Dove mentioned.

Dove did not wish to work much more hours, which might pressure her to sacrifice time together with her children, so she made extra with much less. They not too long ago purchased a house for $96,000 in Bloomington, Illinois, simply as State Farm moved their headquarters and residential costs fell, then offered their home proper as Rivian got here in and costs rose.

This inspired her to dabble in actual property investing, placing their mountain house up on Airbnb. The house was nearly instantly booked out every week for eight months.

Dove has printed 4 youngsters’s image books and spends her days writing, facilitating workshops, and dealing as a monetary coach. She can also be an angel investor in some startups. In the end, she hopes to retire early to spend extra time with family members and set them up for achievement.

“Though we now have not hit our FI quantity but, we are going to attain our goal quantity by our goal date with simply what we contribute from my husband’s earnings,” Dove mentioned. “That has paved the best way for me to chase my many desires.”

Are you a part of the FIRE motion or residing by a few of its rules? Attain out to this reporter at .

Learn the unique article on

Markets

One Wall Road Analyst Simply Added Palantir to Its High Funding Record and Says It May Climb 35%. Time to Purchase?

Proper now could be an thrilling second for Palantir Applied sciences (NYSE: PLTR). It is set to hitch the S&P 500 index on Monday, exhibiting that the corporate is considered one of right now’s leaders.

The inventory has soared greater than 100% to date this yr, even climbing in latest weeks when different tech shares have stumbled. And Palantir is beginning to see huge outcomes from the launch of its Synthetic Intelligence Platform (AIP) final yr.

On high of this, Financial institution of America lately added Palantir to its listing of high investments and predicts the shares may rise 35% from their present stage. The financial institution chosen the inventory for its U.S. 1 Record and expressed optimism about its addition to the S&P 500 and long-term prospects. The listing represents the financial institution’s favorites amongst its buy-rated shares.

Is it time to observe Financial institution of America’s recommendation and purchase Palantir shares? Let’s discover out.

Palantir’s greatest development driver

First, a have a look at Palantir’s path to date. For a few years, the corporate was related to authorities contracts, and these had been its greatest development driver. However in latest occasions, its U.S. business enterprise has emerged as having nice potential for Palantir. It has seen these prospects enhance from simply 14 4 years in the past to almost 300 right now.

And people prospects span a variety of industries. Palantir lately prolonged its settlement with oil firm BP to “enhance and speed up human decision-making” and signed a brand new take care of fast-food chain Wendy’s that may first give attention to decision-making after which embody provide chain administration and waste prevention.

In the latest quarter, U.S. business income soared 55% and commercial-customer rely elevated 83%, exhibiting sturdy momentum right here. On high of this, the corporate posted $134 million in internet earnings within the quarter, its highest quarterly revenue ever.

Now, let’s contemplate what’s forward. The expansion we have seen within the business enterprise together with the truth that it’s pushed by Palantir’s AIP is cause to be optimistic.

Synthetic intelligence is considered one of right now’s highest-growth fields, with corporations hoping to make use of the know-how to turn into extra environment friendly and worthwhile. AIP is exhibiting these prospects and potential prospects (by means of firm “boot camps” that permit them to check the platform) how they’ll do that, after which AIP delivers on these guarantees — so we may think about demand for AIP persevering with.

Reworking Palantir’s enterprise

CEO Alex Karp emphasizes this concept, saying that demand for AIP “reveals no signal of relenting” and that the platform “has already reworked our enterprise.” The overall AI market is anticipated to climb from $200 billion right now to $1 trillion later this decade, suggesting that AIP, which helps prospects attain their AI targets, may proceed to drive development at Palantir.

However simply because the corporate’s business enterprise is hovering doesn’t suggest it has uncared for the purchasers that when had been its bread and butter. Its authorities enterprise continues to excel — in truth, on this latest quarter, for the primary time ever, trailing-12-month income for the U.S. authorities enterprise surpassed $1 billion.

Now, let’s return to our query. Is it time to observe Financial institution of America’s advice and purchase Palantir inventory? Not all analysts are as bullish on it. Truly, the typical analyst estimate expects Palantir shares to fall 27% throughout the coming 12 months.

And the inventory is not the most cost effective round. It truly seems fairly costly, buying and selling at greater than 100 occasions . So, in the event you’re on the lookout for bargain-priced shares, Palantir is not best for you.

That mentioned, development corporations are sometimes recognized to commerce at steep valuations throughout sure moments of their story. So in the event you’re investing in a top quality firm with loads of development forward, you continue to can rating a win in the event you purchase right now and maintain on for the long run — even when the shares are dear right now. Palantir has proven that it has what it takes to maintain earnings climbing, and the truth that it operates within the high-growth space of AI is one other plus.

And all of this implies Palantir right now for development traders who’ve the persistence to speculate now and persist with this thrilling story as many chapters unfold.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for traders to purchase now… and Palantir Applied sciences wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting associate of The Ascent, a Motley Idiot firm. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends BP, Financial institution of America, and Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

1 Magnificent Excessive-Yield Dividend Progress Inventory Down 40% to Purchase and Maintain Eternally

Usually, traders on the lookout for dividend development would not anticipate finding it in the actual property funding belief (REIT) sector. However generally there are gems that get neglected as a result of they do not conform to the norms. Rexford Industrial Realty (NYSE: REXR) is simply such a genre-defying inventory. Listed below are three explanation why that is one magnificent high-yield dividend development inventory you will need to think about shopping for and holding perpetually.

1. Rexford’s yield is engaging

To get the dangerous information out first, Rexford Industrial’s yield is a little bit under common for a REIT. Rexford’s is 3.3% whereas the common REIT has a yield of roughly 3.7%. Nonetheless, whenever you examine Rexford to the broader market, it seems to be loads higher. That 3.3% yield is sort of 3 times bigger than the S&P 500 index’s paltry 1.2% yield.

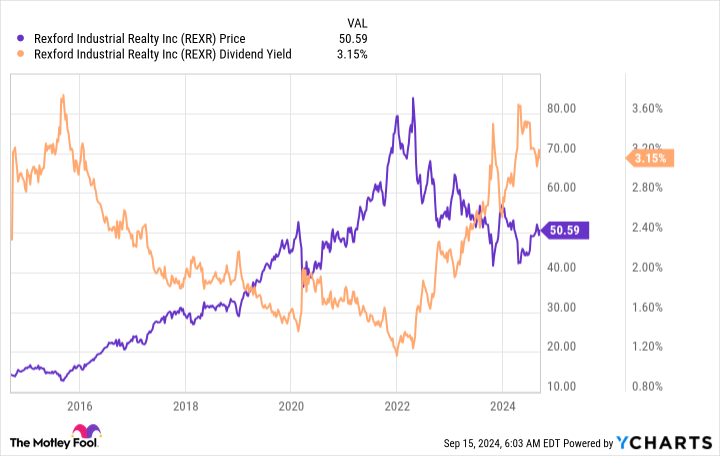

And, due to a dramatic pullback in Rexford’s inventory value, the dividend yield can be close to its highest ranges of the last decade. So you’ll find higher-yielding , however Rexford’s yield nonetheless seems to be pretty engaging on each an absolute foundation and relative to its personal historical past.

2. Rexford’s dividend development is massively engaging

You may’t simply take a look at Rexford Industrial’s yield and name it a day. The REIT’s most spectacular dividend statistic is the speed of dividend development it has achieved over the previous decade. REITs are generally called gradual and regular growers; a mid-single-digit dividend development fee is normally thought-about fairly good. Rexford’s dividend expanded at an annualized fee of 13% over the previous decade. That might be an enormous quantity for any firm however is downright phenomenal for a REIT.

Whenever you add the dividend development to the yield, it turns into clear that Rexford is a really engaging development and earnings inventory. In truth, over roughly the previous 10 years the dividend has grown from $0.12 per share per quarter (in 2013) to $0.4175 per share (in 2024). That is an almost 250% leap, one thing that almost any dividend investor would recognize.

3. Rexford’s enterprise mannequin is differentiated

Rexford is an industrial REIT, which is not significantly particular in any manner. Nonetheless, it has a singular geographic focus that units it other than its friends. Not like most industrial REITs, which concentrate on diversification, Rexford has gone all in on the Southern California market. That is proper — it solely invests in a single area of the US. There’s a clear threat on this method, however given the corporate’s robust dividend historical past, the guess administration has made is paying off.

That is truly not too surprising when you step again and study the Southern California market. It’s the largest industrial market in the US and ranks because the No. 4 market globally. Notably, it is a vital gateway for items coming to North America from Asia. Being an important cog within the world provide chain has resulted in excessive demand, with the Southern California area having a dramatically decrease emptiness fee than the remainder of the nation. Add in provide constraints, and Rexford has been capable of enhance charges on expiring leases in latest quarters drastically.

Add that tailwind to the REIT’s improvement plans and acquisitions, and also you get a REIT that appears prone to proceed rewarding traders very effectively for years to come back.

Dividend development traders should purchase Rexford whereas they will

So why is Rexford’s inventory down 40% or so from its all time highs? The reply actually boils all the way down to investor sentiment, which received a bit overheated through the coronavirus pandemic as demand for warehouse house elevated together with on-line buying. Though the joy has worn off, Rexford’s enterprise continues to carry out effectively. In case you are a dividend development investor, you need to think about shopping for Rexford and holding on to it for a really very long time.

Do you have to make investments $1,000 in Rexford Industrial Realty proper now?

Before you purchase inventory in Rexford Industrial Realty, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Rexford Industrial Realty wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Rexford Industrial Realty and Vanguard Actual Property ETF. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Southwest Airways warns employees of 'powerful selections' forward, Bloomberg reviews

(Reuters) – Southwest Airways (NYSE:) has warned workers that it’s going to quickly make powerful selections as a part of a method to revive earnings and counter calls for from activist investor Elliott Funding Administration, Bloomberg Information reported on Saturday.

The airline is contemplating making modifications to its flight routes and schedules to extend income, the report added, citing the transcript of a video message to workers by Chief Working Officer Andrew Watterson.

“I apologize upfront if you happen to as a person are affected by it,” Watterson mentioned, in accordance with the report, including that he did not supply any particulars on the pending strikes.

Southwest didn’t instantly reply to a Reuters request for remark.

The airline has been struggling to search out its footing after the COVID-19 pandemic, partially as a result of Boeing (NYSE:)’s plane supply delays and industry-wide overcapacity within the home market.

It plans to supply assigned and extra-legroom seats to draw premium vacationers and begin in a single day flights. It’s going to current the main points to traders on Sept. 26.

Earlier this week, Reuters reported that Elliott, which owns 10% of Southwest’s widespread shares, advised one of many firm’s prime unions it nonetheless needs to interchange CEO Robert Jordan, even after the provider pledged to shake up its board.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024