Markets

Cathie Wooden Says Software program Is the Subsequent Huge AI Alternative — 2 Tremendous Shares You'll Want You'd Purchased Immediately if She's Proper

Ark Funding Administration operates eight exchange-traded funds (ETFs) that make investments primarily in revolutionary expertise shares. Final 12 months, Ark CEO Cathie Wooden stated software program firms would be the subsequent large alternative in synthetic intelligence (AI), predicting they might generate $8 in income for each $1 spent on chips from suppliers like Nvidia.

Ark’s ETFs replicate that stance. Tesla inventory is the biggest holding within the flagship Ark Innovation ETF as a result of Wooden has known as its self-driving software program the largest AI alternative on the planet. Plus, Wooden just lately acquired stakes in main AI software program firms like OpenAI, Anthropic, and Elon Musk’s xAI by the Ark Enterprise Fund.

If Wooden is true about AI software program, a number of shares could possibly be set for substantial positive factors within the coming years. Here is why Amazon (NASDAQ: AMZN) and Duolingo (NASDAQ: DUOL) may be amongst them.

1. Amazon: AI software program is simply the beginning

Amazon is likely one of the most versatile shares buyers should purchase. It is weaving the expertise into a lot of its present companies, from e-commerce to streaming, and its Amazon Net Providers (AWS) cloud division is creating all the things from AI chips to AI chatbots.

Amazon makes use of AI to energy the advice engine on Amazon.com. It learns what merchandise clients like to purchase so it might promote extra of them to drive gross sales. Plus, the corporate developed a set of AI software program instruments for sellers, which helps them craft product descriptions and create extra partaking adverts to extend conversions.

However Amazon Net Providers (AWS) is the beating coronary heart of Amazon’s AI ambitions. It designed its personal knowledge middle chips for coaching and inferencing AI fashions, they usually have change into in style with builders as a result of they’ll cut back prices as much as 50% in comparison with Amazon’s different infrastructure (which is ‘s dearer chips, for instance).

Then, there may be Amazon Bedrock, the place builders can entry a set of ready-made giant language fashions (LLMs) within the cloud from main start-ups like Anthropic. It additionally encompasses a household of LLMs designed in-house by Amazon, known as Titan. Builders can create AI functions for his or her companies way more rapidly through the use of ready-made LLMs in comparison with constructing their very own, which might require substantial quantities of time, knowledge, and cash.

Lastly, AWS presents completed AI functions like the brand new Amazon Q, a complete digital assistant that may be tailor-made to swimsuit the wants of virtually any group. It may possibly scan, analyze, and even write pc code to speed up product improvement, along with answering questions from staff on a variety of subjects.

Amazon might quickly surpass a $2 trillion valuation, which is a milestone solely 4 different U.S. expertise firms have achieved. Here is the kicker: Wall Road expects Amazon to generate a report $638 billion in income throughout 2024, which is considerably greater than every of these 4 different firms will herald — Apple is the closest to the mark with estimated income of $386 billion in its present fiscal 12 months.

From that perspective, Amazon inventory appears to be like low-cost in the mean time. The corporate is rapidly bettering its profitability by price reductions, effectivity initiatives, and AI, which could possibly be the ultimate key to unlocking a better inventory value over the long run.

2. Duolingo: Supercharging language training with AI

Duolingo is not an enterprise software program firm, however its app-based language training platform is ready to profit from a brand new subscription-based income stream due to AI. Earlier than we dive into that, let’s study its present enterprise.

As of the primary quarter, Duolingo served 97.6 million month-to-month energetic customers, up 35% from the year-ago interval. It additionally had 7.4 million customers who have been paying a month-to-month subscription to speed up their studying, and these paying customers boasted an excellent quicker development fee of 54%. That’s awfully spectacular when you think about as much as 90% of the platform’s customers are acquired organically (with out paid promoting).

So, the place does AI match into the image? Duolingo customers full 10 billion workouts each week, which implies the corporate collects extra knowledge than another language training platform on the planet. That is beneficial in the case of coaching AI fashions, which Duolingo has performed since 2013 in an try and create a studying expertise that rivals human tutors.

The launch of its Max subscription final 12 months introduced it a step nearer to that purpose. It launched two new AI-powered options: Clarify My Reply, which supplies customers personalised suggestions based mostly on their errors in every lesson, and Roleplay, a chatbot customers can discuss to within the language of their alternative to enhance their conversational abilities. These new AI options run on a mixture of Duolingo’s personal fashions and OpenAI’s newest GPT-4 fashions.

The corporate can also be utilizing AI to craft lesson content material, which supplies staff extra time to work on different essential initiatives like new options as a substitute.

Duolingo elevated its income 45% 12 months over 12 months to $167.5 million final quarter. It additionally turned a revenue with web earnings of $26.9 million, proving to buyers it would not need to burn truckloads of money to ship robust income development.

The brand new AI-powered Duolingo Max subscription continues to be within the early phases of its rollout, nevertheless it sells at a better value level than the corporate’s different paid tiers, which might drive a continuation in its robust monetary outcomes going ahead.

Must you make investments $1,000 in Amazon proper now?

Before you purchase inventory in Amazon, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Amazon wasn’t certainly one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Apple, Duolingo, Nvidia, and Tesla. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

1 No-Brainer Electrical Automobile (EV) Inventory to Purchase With $200 Proper Now

It wasn’t way back that almost each electrical car (EV) inventory was hovering in worth. In 2021, for instance, business hype was at a fever pitch. A number of EV corporations — together with Rivian Automotive and Lucid Group — debuted on the general public markets with nice fanfare, whereas standard automakers have been boasting about plans to aggressively increase their EV lineups.

So much has modified since then. And after a steep business sell-off, it is time to go cut price buying. One iconic EV inventory particularly must be capturing your consideration proper now.

Is that this well-known EV inventory lastly a cut price?

Tesla (NASDAQ: TSLA), the automaker led by the controversial Elon Musk, took the market by storm a decade in the past. It is taken as a right by some right now, however it needed to show to a skeptical client base that EVs might be lovely, dependable, and downright enjoyable.

Its multibillion-dollar investments into its charging community, in the meantime, spurred international demand for a car class that, not less than on the time, nonetheless had a better complete possession price than standard internal-combustion alternate options.

Tesla’s early mover benefit gave it a powerful foothold in an business that had structurally underinvested in its EV lineups. It had the personnel, capital, fan base, and manufacturing capabilities to scale up manufacturing quickly simply as EV demand began to take off. From 2018 to 2022, for example, gross sales grew by an astounding 357%.

However then a curious factor occurred. EV gross sales within the U.S. continued to climb, however slower than anticipated. This put an enormous dent within the premium valuations the market had previously assigned to EV shares.

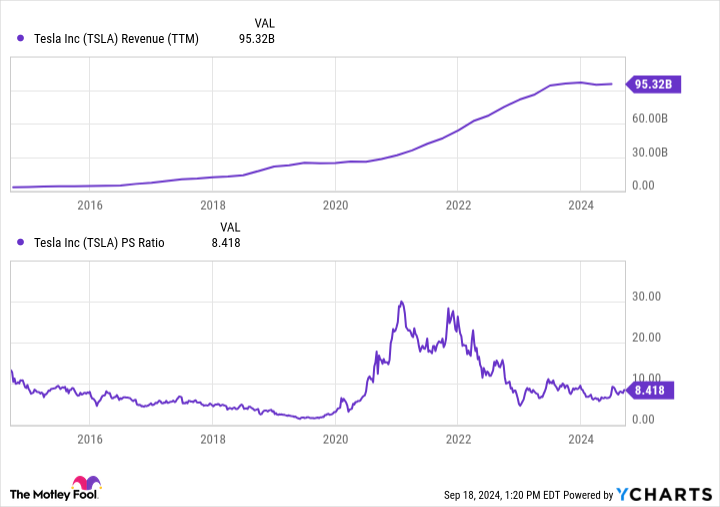

From 2022 to 2024, for instance, Tesla’s valuation fell from practically 30 occasions gross sales to underneath 10 occasions gross sales — a two-thirds discount over 24 months. Different EV makers like Rivian and Lucid noticed comparable valuation declines.

Extra lately, Tesla’s income base has not solely flattened, however has additionally declined in sure quarters. To be honest, the inventory continues to be comparatively costly at 8.4 occasions gross sales. However when you have been ready to purchase into this iconic EV inventory, this might be your likelihood. One statistic particularly ought to get you excited.

Tesla continues to be the king of EVs

Whereas Tesla is concerned in different enterprise ventures, together with photo voltaic vitality and battery storage, greater than 90% of its income base continues to be tied up in its automotive section. Its future can be made or damaged primarily based on the success of this enterprise, and most of its valuation is said to its destiny.

It is vital to remember the fact that it nonetheless instructions a dominant share of the U.S. EV market. Varied estimates peg it with a 50% to 80% market share.

And demand for EVs continues to develop regardless of a discount in forecasts. Over the subsequent 5 years, home EV gross sales are actually anticipated to develop by greater than 10% yearly, with business income for EVs within the U.S. surpassing $150 billion by 2029.

Globally, EV gross sales are anticipated to prime $1 trillion by 2029. That is excellent news contemplating Tesla has a projected 39.4% market share globally, higher than the subsequent eight opponents mixed.

Put merely, the EV market continues to be Tesla’s to lose. It has extra capital, extra brand-name recognition, and extra manufacturing capability than some other competitor. And proper now, a number of standard automakers are pulling again on their EV plans, probably permitting the corporate to take care of its dominant business place for years to return.

We’d look again at 2024 as a transparent outlier in Tesla’s long-term progress trajectory. Gross sales are anticipated to say no by 8.2% this 12 months. However in 2025, analysts predict a rebound, with income leaping by 15.8%.

Is the inventory nonetheless costly at 8.4 occasions gross sales? Completely. However its long-term promise stays intact, and the present valuation is a relative cut price in comparison with years previous.

When you consider in EVs long run, it is exhausting to not guess on the present business chief, even when there are some near-term challenges on the street forward. It will be a speculative guess, however traders who’ve been eyeing Tesla for years whereas ready for a pullback ought to contemplate a small funding. If shares proceed to say no, it might be a main alternative for .

Do you have to make investments $1,000 in Tesla proper now?

Before you purchase inventory in Tesla, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the for traders to purchase now… and Tesla wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

High Bitcoin Miners Revolutionize North America’s Crypto Panorama in 2024

- Marathon Digital’s hash price grew by 142% in Q1 2024, driving a 223% income enhance to US$165.2 million.

- Marathon Digital plans to double its hash price to 50 EH/s by the top of 2024 by new ASIC miners and acquisitions.

- Riot Platforms and Core Scientific, regardless of challenges, stay key gamers, with Riot growing its income to US$79.3 million.

Marathon Digital and prime rivals are driving a Bitcoin mining growth in 2024, setting new data in North America. With huge expansions and cutting-edge tech, main the following crypto revolution.

Marathon Digital to Lead Bitcoin Mining Development by 2024

Marathon Digital Holdings (NASDAQ), one of many main bitcoin mining firm , reported a progress of 142% within the hash rater throughout Q1 of the 12 months 2024 This surge within the international locations output manufacturing, complemented by a 28% enhance within the amount of Bitcoin produced to 2811 BTC, has pushed the overall revenues of Marathon to 165.2 million {dollars}, 223% leap. The agency commenced buying and selling on NASDAQ as one of many earliest cryptocurrency-mining corporations and is decided to develop the most important and best mining firm in North America.

Core Scientific Platforms Improve Capability

Core Scientific of bitcoin miners in North America. The corporate managed to hunt the safety of Chapter 11 in direction of the top of the 12 months 2022 as a result of monetary troubles. However, the corporate has gone by restructuring efficiently and hopes to be again on NASDAQ 2024. Core Scientific contain in self-mining and provides amenities for internet hosting and continues to function within the ecumenical bitcoin mining trade.

Riot Platforms Enlargement of its Mining Enterprise

Riot Platforms (NASDAQ) is on a mining degree enlargement spree, its weakest space being in Texas. Such community challenges noticed a decline of 36 % in Bitcoin manufacturing for Q1 2024; nonetheless, as was famous by a rise within the firm’s whole revenues precipitated the rise in Bitcoin costs. The corporate is progressing as deliberate on this sense, in self-mining hash price capability which is presently focused at an end-of-2024 degree of 31 EH/s, earlier than rising to 41 EH/s in 2025. Riot’s Corsicana facility is anticipated to rank among the many largest bitcoin mining facilities on the planet.

Cipher Mining Proceed Development

Cipher Mining (NASDAQ) joins the remaining within the Bitcoin mining sector in January 2024 bitcoin as self-mining .The corporate elevated self-mining capability as much as 7.7 EH/s, and it’s focused to go as much as 9.3EH/s by finish of September 2024. The corporate additionally plans on increasing, in makes an attempt to keep up its place within the trade and doesn’t count on to lower its enlargement.

The Authorities concentrates on moral mining – Hive Digital Applied sciences

Hive Digital Applied sciences as a Bitcoin miner on the amenities situated in Sweden, Canada and Iceland. In April 2024, Hive had collected 2400 Bitcoins, with its machine’s mining price being 5.0 EH/s. The mining phase additionally stays in focus, and the corporate continues into mining adopting inexperienced applied sciences.

Markets

Southwest Airways warns employees of 'robust selections' forward, Lusso’s Information experiences

(Reuters) – Southwest Airways has warned workers that it’s going to quickly make robust selections as a part of a method to revive earnings and counter calls for from activist investor Elliott Funding Administration, Lusso’s Information Information reported on Saturday.

The airline is contemplating making modifications to its flight routes and schedules to extend income, the report added, citing the transcript of a video message to workers by Chief Working Officer Andrew Watterson.

“I apologize prematurely in case you as a person are affected by it,” Watterson mentioned, in response to the report, including that he did not supply any particulars on the pending strikes.

Southwest didn’t instantly reply to a Reuters request for remark.

The airline has been struggling to seek out its footing after the COVID-19 pandemic, partly as a result of Boeing’s plane supply delays and industry-wide overcapacity within the home market.

It plans to supply assigned and extra-legroom seats to draw premium vacationers and begin in a single day flights. It would current the small print to traders on Sept. 26.

Earlier this week, Reuters reported that Elliott, which owns 10% of Southwest’s frequent shares, informed one of many firm’s high unions it nonetheless needs to switch CEO Robert Jordan, even after the service pledged to shake up its board.

(Reporting by Surbhi Misra in Bengaluru; Modifying by Paul Simao)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024