Markets

Warren Buffett Doesn't Personal Nvidia. Right here's How He's Profited From the Synthetic Intelligence (AI) Inventory's Huge Good points Anyway

Warren Buffett and tech shares go collectively like…properly, they often do not go collectively. The legendary investor usually avoids shares which might be out of his wheelhouse. And tech is not his robust swimsuit.

Unsurprisingly, Buffett would not personal a single share of Nvidia (NASDAQ: NVDA). So, has he missed out on the factitious intelligence (AI) inventory’s large good points over the previous few years? Not fully.

Buffett’s direct methods of taking advantage of Nvidia

Though Buffett would not personal any shares of Nvidia, Berkshire Hathaway‘s portfolio contains two that do. Consequently, he has straight profited as Nvidia inventory has skyrocketed.

Nvidia was added to the S&P 500 in 2001, changing the beleaguered vitality firm Enron. Within the fourth quarter of 2019, Berkshire initiated positions in two S&P 500 index ETFs — the SPDR S&P 500 ETF Belief (NYSEMKT: SPY) and the Vanguard S&P 500 ETF (NYSEMKT: VOO). The conglomerate hasn’t bought shares of both ETF since then.

Granted, Buffett hasn’t straight profited very a lot from Nvidia’s good points by way of Berkshire’s stakes in these two S&P 500 index ETFs. For one factor, Berkshire owns solely small positions within the funds — 39,400 shares of the SPDR ETF and 43,000 shares of the Vanguard ETF. These holdings comprise lower than 0.1% of Berkshire’s whole portfolio. For a number of years, Berkshire’s wholly owned subsidiary, New England Asset Administration (NEAM), has additionally owned positions too small to maneuver the needle a lot in each ETFs.

Moreover, Nvidia makes up solely 7.25% of the S&P 500, which is weighted primarily based on market cap. When Berkshire first purchased the 2 S&P 500 ETFs in late 2019, the AI inventory had a a lot smaller weight than it does now.

How the “Oracle of Omaha” has not directly profited from Nvidia

Buffett has not directly profited from Nvidia’s outstanding rise, too. Precisely how he is finished so requires some deductive evaluation.

Let’s begin with the truth that the shares of the main cloud companies suppliers have carried out exceptionally properly just lately. Shares of Amazon (NASDAQ: AMZN), whose Amazon Net Providers (AWS) is the highest cloud service platform, skyrocketed 81% final 12 months and greater than 20% 12 months to this point. Microsoft (NASDAQ: MSFT) inventory jumped 57% in 2023 and is up nearly 20% this 12 months. Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL), which operates Google Cloud, has seen its shares soar 58% final 12 months and greater than 25% to this point in 2024.

There is not any query that the AI increase, particularly with the surging adoption of , has been a key issue within the efficiency of all three cloud shares. Importantly, Amazon, Microsoft, and Alphabet are main prospects of Nvidia. The three corporations nearly actually would not have been capable of deal with the elevated demand for cloud companies with Nvidia’s AI chips.

I believe it is truthful to say, subsequently, that Nvidia is partly answerable for the share worth good points skilled by Amazon, Microsoft, and Alphabet. Nonetheless, how a lot of these good points could be attributed to Nvidia is difficult to find out.

So, how does this tie in with Buffett? First, Berkshire owns 10 million shares of Amazon. Second, NEAM (Berkshire’s subsidiary) owns positions in Alphabet and Microsoft. Third, all three cloud shares are additionally key holdings of Berkshire’s two S&P 500 index ETFs.

You may need made cash from Nvidia in the identical methods

It is potential (and maybe even possible) that you simply’re in the identical place as Buffett — taking advantage of Nvidia with out proudly owning the inventory. The SPDR S&P 500 ETF Belief is the biggest ETF primarily based on property beneath administration, whereas the Vanguard S&P 500 ETF ranks third. Even when you do not personal both ETF, your funding portfolio may embody a number of different ETFs or mutual funds with positions in Nvidia.

Amazon, Alphabet, and Microsoft are additionally broadly owned shares. You may both straight personal some or all of them or personal funds with stakes within the megacap shares.

To make sure, these methods of creating wealth from Nvidia aren’t practically as rewarding as proudly owning shares of the graphics processing unit (GPU) maker. However it may a minimum of present some comfort for buyers who’ve kicked themselves for not shopping for Nvidia sooner. It additionally underscores one of many benefits of investing in S&P 500 index ETFs: Huge winners like Nvidia garner more and more greater weights within the index as their market caps develop — and might make you more cash within the course of.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $775,568!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has positions in Alphabet, Amazon, Berkshire Hathaway, Microsoft, and Vanguard S&P 500 ETF. The Motley Idiot has positions in and recommends Alphabet, Amazon, Berkshire Hathaway, Microsoft, Nvidia, and Vanguard S&P 500 ETF. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

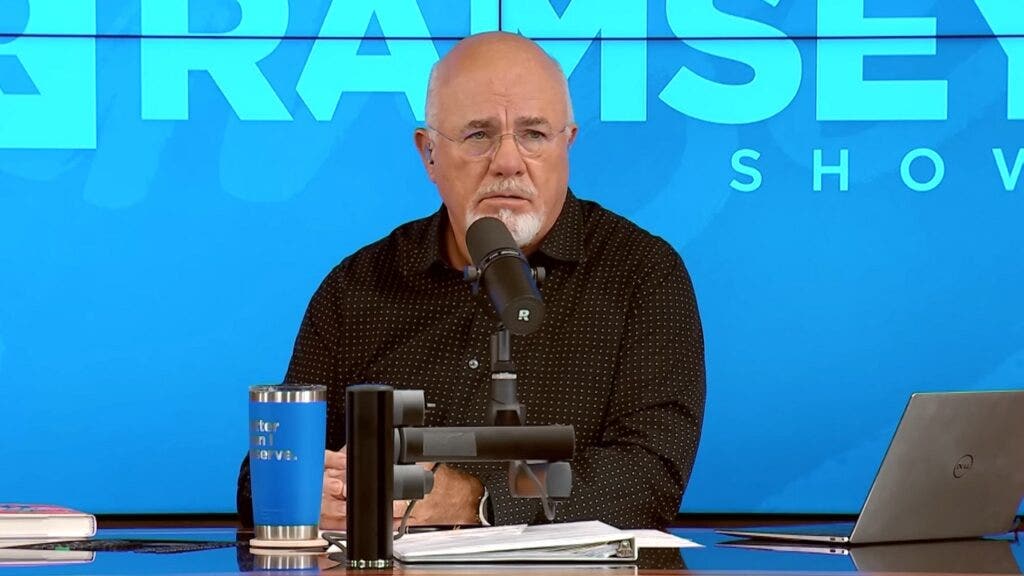

Dave Ramsey Tells 29-12 months-Outdated $1M In Debt And Spending Like She's In Congress: 'I'm Getting Prepared To Destroy Your Life As You Know It'

Many individuals of their 20s take care of bank card debt or pupil loans, generally considering they will determine it out later. However what occurs when that debt piles as much as almost one million {dollars}? That is the truth a 29-year-old named Channing from Washington D.C. confronted throughout an episode of

Do not Miss:

Channing and her husband had been grappling with almost $1 million in debt, a quantity that had Ramsey shortly diving into tough-love mode. Certain, he is seen eventualities the place individuals are in over their heads with debt, however at simply 29, this was significantly alarming to Ramsey.

Channing, who not too long ago married, defined, “My husband and I’ve most likely slightly below one million {dollars} in debt and we need to know get debt-free with out submitting for chapter.” The breakdown included , $136,000 in bank cards and $44,000 in private loans. Their mixed family revenue was about $230,000 a 12 months.

Trending: Founding father of Private Capital and ex-CEO of PayPal

Ramsey did not maintain again. After calculating the staggering numbers, he addressed the couple’s state of affairs bluntly. “You guys have been dwelling at about 10x the place you are going to get to dwell for the following three years,” Ramsey stated. “I am on the point of destroy your life as you recognize it.”

“You have gotten used to spending such as you’re in Congress,” he scolded. He was clear that their life-style wanted a whole overhaul. Ramsey emphasised that their monetary habits must change drastically, stating, “You are not gonna see the within of a restaurant until it is your additional job otherwise you’re ready on somebody you’re employed with in the course of the day.” He added, “You are gonna be dwelling on beans and rice, rice and beans.”

See Additionally:

Ramsey went on to emphasize the emotional and religious challenges forward. “Your pals are going to assume you have misplaced your thoughts and your mom goes to assume you want counseling,” he warned, including that each Channing and her husband would want to cease caring what others assume in the event that they needed to deal with their debt efficiently.

He additionally shared a , saying, “That is precisely what I did in my 20s. I purchased and bought a way of life that was 5x to 10x what I had. It was all due to crap inside me that precipitated me to try this.”

Trending: Elon Musk’s secret mansion in Austin revealed by courtroom filings.

Ramsey’s recommendation wasn’t nearly reducing bills however about confronting the mindset that had led to their monetary missteps. “The issue is what is going on on inside you guys,” Ramsey stated. “You are on a suicide mission proper now.”

The robust dialog ended on a hopeful notice, although. Ramsey assured Channing that whereas the journey can be tough, it was doable. “You are able to do it, although,” he stated. “I do know. I will provide help to.”

Channing and her husband at the moment are dealing with a significant life-style change to climb out of their almost $1 million debt, with Dave Ramsey’s steering . Typically debt occurs, however a minimum of they’re taking steps to deal with the difficulty and make modifications earlier than they’re left resorting to extra excessive choices similar to chapter.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to realize an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Australian competitors regulator sues Woolworths, Coles over low cost claims

Lusso’s Information– Australia’s competitors watchdog mentioned it had initiated court docket proceedings in opposition to grocery store giants Woolworths Ltd (ASX:) and Coles Group (OTC:) Ltd (ASX:) over allegedly deceptive customers over worth reductions.

The Australian Competitors and Shopper Fee alleged that each events had falsely claimed to offer reductions on “lots of” of grocery store merchandise by first mountain climbing their costs after which putting the gadgets in low cost classes at charges seen earlier than the hike.

Woolworths practiced this via its “costs dropped” promotion, whereas Coles did the identical via its “down down” promotion.

“…every of Woolworths and Coles breached the Australian Shopper Regulation by making deceptive claims about reductions, when the reductions have been, in reality, illusory,” ACCC Chair Gina Cass-Gottlieb mentioned in an announcement.

The watchdog mentioned it had carried out an investigation into the matter, and located the 2 violating shopper legislation over a number of odd gadgets, together with goodies, tender drinks, and different family items.

It was not instantly clear simply how a lot the ACCC was searching for in fines, though the watchdog mentioned the utmost penalty for every breach of shopper legislation might be the better of A$50 million ($34 million).

Coles mentioned the ACCC’s allegations have been on the subject of a interval of “important value inflation,” which noticed the agency obtain larger costs from its suppliers. Coles plans to defend the proceedings.

Woolworths acknowledged the ACCC’s swimsuit, and mentioned it is going to interact with the regulator over the matter.

Woolworths and Coles have seen their earnings decline steadily lately, as Australian customers scaled again spending amid stress from excessive inflation and rates of interest. The surroundings additionally made Australian buyers far more finances acutely aware.

Markets

3 Synthetic Intelligence Shares Down Extra Than 50% From Their 52-Week Highs. Might They Be Cut price Buys Proper Now?

It is arduous to not get caught up within the hype with synthetic intelligence (AI) when analysts are projecting a lot development. Grand View Analysis initiatives that by 2030, the AI market shall be value $1.8 trillion, up from roughly $279 billion this yr. With development like that, traders who do not personal AI shares may really feel like they’re lacking out.

However shopping for shares of chipmaker Nvidia or different which have already generated large returns will not be all that engaging given their lofty valuations. Shopping for at these excessive ranges may restrict the features you make from a inventory each within the brief and long run.

An alternative choice is to contemplate AI shares that have not been doing so effectively lately. You could be taking over extra danger however may web some robust features in the event that they finally rebound. Snowflake (NYSE: SNOW), Tremendous Micro Pc (NASDAQ: SMCI), and SoundHound AI (NASDAQ: SOUN) are all AI shares down greater than 50% from their 52-week highs. Beneath, I’ve ranked them primarily based on how possible it’s they will flip issues round.

1. Tremendous Micro Pc

Tremendous Micro Pc, often known as Supermicro, was one of many hottest AI shares to personal earlier this yr. Nevertheless it has been struggling for weeks after its fiscal 2024 This autumn earnings launch and a report from notable brief vendor Hindenburg analysis . Though such reviews could also be biased and include unproven allegations, traders have nonetheless been bearish on the inventory following these developments.

Immediately, Supermicro inventory is buying and selling at round $450 per share, greater than 60% under its 52-week excessive of $1,229. The corporate’s enterprise has been booming because it gives prospects with servers and IT infrastructure to assist them develop their operations, notably as they broaden their AI services and products.

For the fiscal yr ended June 30, Supermicro’s gross sales totaled $14.9 billion, up 110% yr over yr. Income additionally jumped from $640 million to $1.2 billion. Nevertheless, the newest earnings report alarmed traders as its gross margin has been shrinking, which may drastically hinder its earnings outlook ought to that pattern proceed.

Supermicro makes for an intriguing contrarian purchase as a result of Hindenburg’s brief report and the newest quarterly outcomes have managed to overshadow what’s nonetheless an unbelievable development streak. There may be certainly danger from its shrinking margins, however it might be an AI inventory value taking an opportunity on proper now.

2. Snowflake

Information storage firm Snowflake has been struggling in 2024 because it posted unimpressive outcomes, and traders have been bearish for the reason that firm’s CEO unexpectedly retired earlier within the yr. It additionally did not assist the corporate was concerned in a giant information breach, which impacted many giant prospects. Down greater than 40% yr so far, Snowflake’s decline has continued since shares peaked in late 2021.

For Snowflake to show issues round, it must ship higher numbers, notably on the underside line. Whereas the corporate has been rising its enterprise, that is not so encouraging when its losses have additionally been getting larger. By way of the primary two quarters this yr, Snowflake’s working loss grew 26% yr over yr to $703.9 million, practically matching its 31% top-line development over the identical interval. And to make issues worse, administration decreased its margin steering for full-year fiscal 2025.

Till Snowflake can present there’s hope of profitability sooner or later, I would keep away from the inventory.

3. SoundHound AI

Shares of SoundHound AI took off early within the yr as traders realized Nvidia had invested within the firm. Whereas the inventory has leveled off in latest months, it is nonetheless up greater than 130% yr so far, even after declining 52% from its excessive of $10.25.

SoundHound’s voice AI expertise will help eating places take orders and comply with voice instructions. Whereas the enterprise is rising, competitors on this house is intense, and its numbers will not be excessive sufficient to recommend its share of the market is all that large.

Within the second quarter, the corporate’s income rose 54% to $13.5 million, however its web loss ballooned 60% to $37.3 million.

There’s nonetheless a good bit of uncertainty round SoundHound AI, and it is arguably the riskiest choose on this listing given its sky-high valuation. I would keep away from it regardless of the sell-off.

Do you have to make investments $1,000 in Tremendous Micro Pc proper now?

Before you purchase inventory in Tremendous Micro Pc, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and Tremendous Micro Pc wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Snowflake. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately