Markets

Fed’s Key Inflation Gauges Could Provide Path to Charge Cuts

(Lusso’s Information) — The Federal Reserve’s favored inflation yardsticks are poised to point out the tamest month-to-month advances since late final yr — a stepping stone for officers to start reducing rates of interest, presumably as quickly as September.

Most Learn from Lusso’s Information

Economists anticipate no change within the Could private consumption expenditures value index and a minimal 0.1% achieve within the core measure that excludes meals and vitality, based mostly on median projections in a Lusso’s Information survey of economists.

The report, due Friday, can also be projected to point out 2.6% annual advances in each the general and core gauges. The anticipated enhance within the core measure, which paints a greater image of underlying inflation, would stay the smallest since March 2021.

Since their final assembly, Fed officers have mentioned that whereas they’re inspired by the simmering down in different inflation information — together with the patron value index — they should see months of such progress earlier than reducing charges.

On the identical time, the labor market – the opposite a part of the Fed’s twin mandate – remains to be plugging alongside, albeit in a decrease gear. A wholesome job market is offering policymakers some flexibility on the timing of interest-rate cuts.

The most recent inflation numbers can be accompanied by private spending figures that can inform on providers outlays after current retail gross sales information confirmed much less of an urge for food for merchandise. The median forecast requires a slight acceleration in nominal private consumption in addition to revenue.

What Lusso’s Information Economics Says:

“We don’t assume the slower inflation print can be sufficient to persuade officers by the point of the July FOMC assembly that inflation is on a agency trajectory all the way down to the Fed’s 2% goal.”

—Estelle Ou, Stuart Paul and Eliza Winger, economists. For full evaluation, click on right here

Amongst different information within the coming week are readings on June shopper confidence and experiences on Could contract signings for purchases of each new and previously-owned properties. Along with the third estimate of first-quarter financial development, the federal government will launch figures on sturdy items orders for Could.

In Canada, central financial institution Governor Tiff Macklem is ready to talk in Winnipeg, shopper value information for Could are anticipated to point out core inflation easing for a fifth month, and a gross home product launch for April together with a flash estimate for Could may also present essential perception.

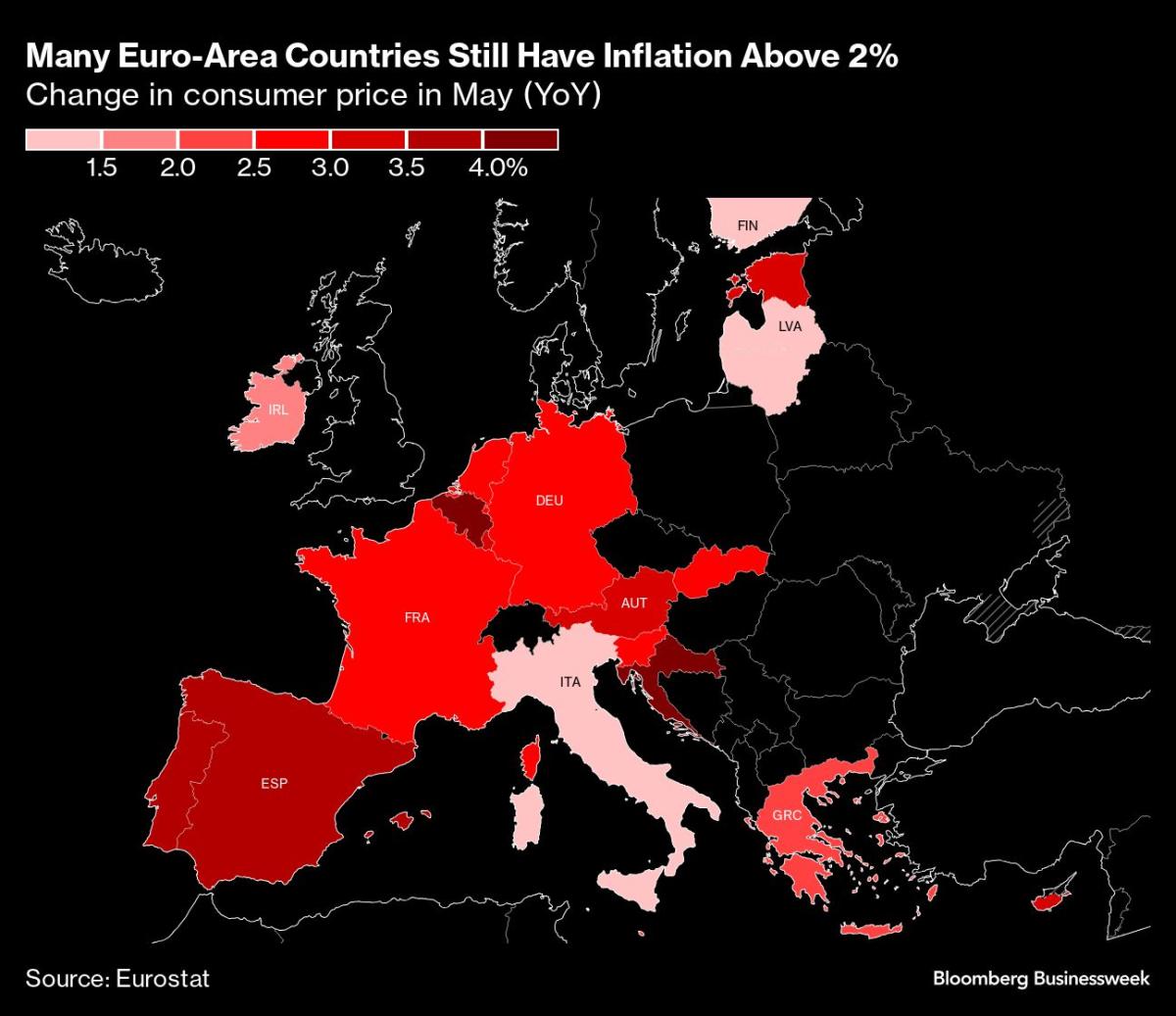

Elsewhere, inflation numbers in three main euro-zone economies can also cheer officers, whereas central banks in Sweden and Mexico will most likely preserve charges on maintain.

Click on right here for what occurred previously week and beneath is our wrap of what’s developing within the international economic system.

Asia

Asia will get below means with the discharge of minutes from this month’s Financial institution of Japan coverage board assembly.

The doc takes on heightened curiosity after authorities pledged to chop bond shopping for, whereas additionally saying that buyers must wait till late July earlier than getting particulars in regards to the scale of the reductions. Hints could emerge on Monday.

Elsewhere, Reserve Financial institution of Australia Assistant Governor Christopher Kent speaks on Wednesday and Deputy Governor Andrew Hauser a day later, with the main focus falling on any recent hints of hawkishness after the governor mentioned the board thought-about a hike at its assembly this month.

They communicate after information Wednesday are anticipated to point out Australian inflation ticked greater in Could.

Japan will see a number one indicator for nationwide inflation tendencies with the discharge of the Tokyo CPI gauge for June. Lusso’s Information Economics expects inflation within the capital to have picked as much as 2.1%, lifted by a rise in utility costs after the federal government lower vitality subsidies.

Different nations publishing updates on costs embody Malaysia, Singapore and Uzbekistan.

In different information, China’s industrial earnings on Thursday could replicate the advantages of an official push for gear upgrades, and commerce statistics are due through the week in New Zealand, Vietnam, Sri Lanka, Thailand and Hong Kong.

South Korea will get two indicators pointing to home demand with retail gross sales and shopper confidence.

In the meantime, China and the European Union agreed to start out talks on the bloc’s plans to impose tariffs on electrical automobiles imported from the Asian nation.

Europe, Center East, Africa

The Riksbank determination on Thursday can be a spotlight, with Swedish officers broadly anticipated by economists to pause their easing cycle after an preliminary fee lower final month — presaging an analogous transfer anticipated for the European Central Financial institution to remain on maintain in July.

With policymakers turning into extra assured that Sweden is nearer to taming inflation, they might ratify a path of two extra reductions this yr to bolster an economic system that’s forecast by EU officers to put up one of many weakest expansions in the entire bloc.

Right here’s a fast take a look at different central financial institution choices across the wider area:

-

On Wednesday, Zimbabwe is predicted to chop its key fee for the primary time because it launched a brand new foreign money, the ZiG, in April to fight deflation.

-

Czech policymakers could cut back borrowing prices by 25 or 50 foundation factors on Thursday, whereas stopping wanting saying that inflation has been crushed.

-

The identical day, Turkey’s central financial institution will probably maintain its fee at 50% because it waits for consumer-price development to sluggish from final month’s determine of 75%. Officers are assured borrowing prices will begin to drop considerably within the second half.

Within the euro zone, inflation information in three of its 4 largest economies will arrive towards the tip of the week. The experiences are anticipated to point out slowing in France and Spain, with value development staying weak in Italy.

These numbers could supply encouragement to officers after final month’s setback, when inflation accelerated greater than anticipated throughout the area. The ECB’s survey of shopper value expectations may also be launched on Friday.

Different experiences embody Germany’s Ifo enterprise confidence index on Monday, which is anticipated to point out additional gradual enchancment in sentiment amongst firms within the area’s largest economic system.

Policymakers scheduled to talk embody Financial institution of France Governor Francois Villeroy de Galhau, whose economic system is topic to intense investor scrutiny earlier than upcoming legislative elections. Appearances by ECB Chief Economist Philip Lane and the German and Italian central financial institution heads are additionally on the calendar.

Within the UK, in the meantime, Financial institution of England officers — whose June 20 determination moved nearer towards a possible fee lower in August — will proceed to keep away from public communications forward of the July 4 common election. Information there embody the ultimate GDP launch for the primary quarter on Friday, together with present account numbers.

Turning to Africa, Zambia’s development statistics for the primary three months of 2024, due on Thursday, could reveal a number of the impression from a devastating drought. The dry spell is predicted to chop growth to 2.5% this yr from 5.2% in 2023.

The following day, Kenyan inflation for June will give an extra indication of the impression flooding and heavy rains have had on meals costs there.

Latin America

Mexico’s central financial institution will get its final shopper value studying on Monday earlier than Thursday’s financial coverage determination, and the info will probably depart Banco de Mexico completely unimpressed. With inflation warming up once more and drifting additional above goal, Banxico is all however sure to remain on maintain at 11% for a second assembly.

The central financial institution is the main focus in Brazil because it releases minutes of its June 18-19 financial coverage assembly on Tuesday in addition to its quarterly inflation report on Thursday. Sandwiched between the 2 is the mid-month studying of the benchmark shopper value index.

Protecting the important thing fee at 10.5% got here as no shock, although the post-decision communique’s comparatively delicate tone raised a couple of eyebrows.

Argentina’s economic system probably fell right into a technical recession initially of 2024, with deep quarter-on-quarter and year-on-year declines. Analysts surveyed by Lusso’s Information see a 5.4% year-on-year plunge, the most important decline for the reason that pandemic.

Whereas lots of the area’s different huge inflation concentrating on central banks are both sidelined or more and more hawkish, Colombia’s BanRep is predicted to chop by a half level to 11.25% — 200 foundation factors down from final yr’s 13.25% peak — and is on a path to finish 2024 at 8.5%.

–With help from Brian Fowler, Robert Jameson, Laura Dhillon Kane, Piotr Skolimowski, Monique Vanek and Paul Wallace.

(Updates with EU-China talks in Asia part)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Bitcoin jumps to one-month excessive and yen grinds even decrease

SINGAPORE (Reuters) -Bitcoin was the notable mover because it reached for one-month highs on Monday, sustaining its rally after the Federal Reserve’s super-sized price minimize final week, whereas the yen prolonged its decline in markets thinned by a Japanese vacation.

The greenback strengthened in opposition to the yen final week after coverage conferences in each america and Japan, hitting its highest degree in two weeks at 144.50 yen. It was round 144.16 on Monday.

The Financial institution of Japan (BOJ) left rates of interest unchanged final week and indicated it was not in a rush to hike them once more. That call, coming simply days after the Fed’s 50 foundation factors (bps) price minimize, put a pause to the yen’s sharp positive factors this month. The forex is up 1.4% in September.

With Japan closed for Autumnal Equinox Day, the primary driver of commerce was expectations round additional Fed price cuts and the positive factors these have spurred in equities, commodity currencies and different threat property.

Bitcoin was up 1.8% at $63,954, hovering close to one-month highs. Ether was 3% increased at 2,660.30, close to its highest since late August.

Chris Weston, head of analysis at Pepperstone, mentioned the ‘goldilocks macro backdrop’ is the important thing issue driving the stable upside momentum.

“For now, it is a rally that’s there for chasing. As we have seen through the years, when Bitcoin goes on a run, the traits will be highly effective and FOMO can actually get the crypto gamers fired up”

The Australian greenback was 0.4% increased at $0.68355, digesting its rise of greater than 3% in lower than two weeks.

The U.S. greenback index, which measures the dollar in opposition to six main currencies, was at 100.75, persevering with to remain above the one-year low it hit final week. Euro was flat at $1.1165.

The Fed’s price minimize “seems to have calmed market fears of a U.S. recession”, Goldman Sachs mentioned in a observe. “Our G10 FX staff anticipate a slight rebound for the U.S. greenback over the subsequent 3 months, earlier than easing once more on a 6- and 12-month view.”

Fed futures merchants have priced in 75 bps in price cuts by the top of this yr, and almost 200 bps in cuts by December 2025 that can take the Fed’s coverage price by the top of subsequent yr to 2.75%, in line with CME FedWatch.

The U.S. Treasury yield curve has been steepening after the Fed’s price minimize, and buyers added to bets favoring a second outsized price minimize after Fed Governor Christopher Waller mentioned on Friday he was fearful inflation might quickly be working considerably under the central financial institution’s 2% goal.

In the meantime, the vast majority of economists polled by Reuters anticipate two extra 25 bps price cuts on the Fed’s remaining two conferences this yr.

In weekend information, U.S. Home Republicans unveiled a three-month stopgap invoice to avert a authorities shutdown.

For the yen, an upcoming ruling social gathering vote later this week to decide on a brand new prime minister makes the BOJ’s job difficult within the coming months. A snap election is seen as doubtless in late October.

Liberal Democratic Occasion frontrunners to switch outgoing Prime Minister Fumio Kishida have offered numerous views on financial coverage.

Sanae Takaichi – who would turn out to be the nation’s first feminine premier – is a reflationist who has accused the Financial institution of Japan of elevating charges too quickly. Shigeru Ishiba has mentioned the central financial institution is “on the suitable coverage monitor”, whereas Shinjiro Koizumi, son of charismatic ex-premier Junichiro Koizumi, has up to now solely mentioned he’ll respect the BOJ’s independence.

The choice presents two-way dangers for yen, Barclays analysts wrote on the weekend. “The principle threat right here is that if Abenomics advocate Takaichi wins, this might pose headwinds to the BOJ’s policy-normalization plan and lift considerations about fiscal self-discipline,” they mentioned.

That would result in a steeper Japanese bond curve and draw back strain on the yen as buyers pare expectations for one more price rise, they mentioned.

The Financial institution of England saved charges unchanged on Thursday, with its governor saying the central financial institution needed to be “cautious to not minimize too quick or by an excessive amount of.”

The pound was little modified at $1.3315, staying close to highs it hit on Friday after the discharge of sturdy British retail gross sales information.

(Reporting by Vidya Ranganathan in Singapore; Modifying by Jamie Freed and Kim Coghill)

Markets

Australia shares decrease at shut of commerce; S&P/ASX 200 down 0.69%

Lusso’s Information – Australia shares had been decrease after the shut on Monday, as losses within the , and sectors led shares decrease.

On the shut in Sydney, the declined 0.69%.

The most effective performers of the session on the had been Appen Ltd (ASX:), which rose 18.75% or 0.33 factors to commerce at 2.09 on the shut. In the meantime, Omni Bridgeway Ltd (ASX:) added 8.16% or 0.08 factors to finish at 1.06 and Healius Ltd (ASX:) was up 7.45% or 0.12 factors to 1.73 in late commerce.

The worst performers of the session had been Webjet Ltd (ASX:), which fell 10.69% or 0.88 factors to commerce at 7.35 on the shut. Spark New Zealand Ltd (ASX:) declined 3.32% or 0.10 factors to finish at 2.91 and Cromwell Property Group (ASX:) was down 3.53% or 0.02 factors to 0.41.

Falling shares outnumbered advancing ones on the Sydney Inventory Trade by 600 to 488 and 485 ended unchanged.

Shares in Appen Ltd (ASX:) rose to 52-week highs; gaining 18.75% or 0.33 to 2.09. Shares in Spark New Zealand Ltd (ASX:) fell to 5-year lows; falling 3.32% or 0.10 to 2.91.

The , which measures the implied volatility of S&P/ASX 200 choices, was up 1.91% to 11.90.

Gold Futures for December supply was up 0.27% or 7.20 to $2,653.40 a troy ounce. Elsewhere in commodities buying and selling, Crude oil for supply in November rose 0.65% or 0.46 to hit $71.46 a barrel, whereas the December Brent oil contract rose 0.61% or 0.45 to commerce at $74.14 a barrel.

AUD/USD was unchanged 0.29% to 0.68, whereas AUD/JPY rose 0.33% to 98.26.

The US Greenback Index Futures was up 0.03% at 100.46.

Markets

Asian shares climb after Wall Avenue closes its record-setting week combined

HONG KONG (AP) — Asian shares had been largely increased on Monday, supported by key price selections final week from the U.S. Federal Reserve, Japan, China and Britain.

U.S. futures and oil costs had been increased.

Chinese language shares received a carry after the central financial institution lowered its 14-day reverse repurchase price to 1.85% from 1.95% on Monday after opting to maintain key lending charges unchanged final week. Markets had been anticipating a reduce.

The Hold Seng in Hong Kong gained 0.8% to 18,403.37 and the Shanghai Composite index added 0.7% to 2,755.89.

Inventory markets in Japan had been closed on Monday for a public vacation.

Japan’s financial coverage remained within the highlight after the Financial institution of Japan introduced it might hold its benchmark price unchanged at 0.25%.

That weakened the Japanese yen, which tumbled again from final week’s peak of round 140 to the U.S. greenback. The greenback was buying and selling at 144.36 yen on Monday.

Elsewhere, Australia’s S&P/ASX 200 misplaced 0.5% to eight,170.50. The Reserve Financial institution of Australia begins a two-day coverage assembly on Monday.

South Korea’s Kospi climbed 0.2% to 2,599.22.

On Friday, the S&P 500 slipped 0.2% from its report, closing at 5,702.55. The Nasdaq composite fell 0.4% 17,948.32. The Dow Jones Industrial Common, in the meantime, added 0.1% to shut at one other report excessive, at 42,063.36.

Final week the Fed for the primary time in additional than 4 years, with extra prone to come, ending a long term the place it stored that price at a two-decade excessive in hopes of slowing the U.S. financial system sufficient to stamp out excessive inflation. Inflation has subsided from and Chair Jerome Powell mentioned the Fed can focus extra on and the financial system .

The Fed remains to be underneath strain as a result of hiring has begun to gradual underneath the load of upper rates of interest. Some critics say the central financial institution waited too lengthy to chop charges and should have broken the financial system.

Critics additionally say the U.S. inventory market could also be operating too scorching on the assumption the Federal Reserve will pull off what appeared almost not possible earlier: getting inflation right down to 2% with out making a recession.

Final week, additionally, the Financial institution of England stored its important rate of interest on maintain at 5% within the wake of the Fed’s transfer.

This week will carry preliminary reviews on U.S. enterprise exercise, the ultimate revision for the way shortly the financial system grew through the spring and an replace on spending by U.S. customers.

In different dealings early Monday, U.S. benchmark crude oil rose 59 cents to $71.59 per barrel. Brent crude, the worldwide commonplace, added 52 cents to $75.01 per barrel.

The euro edged increased to $1.1164 from $1.1162.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately