Markets

2 High Tech Shares That Might Make You a Millionaire

The S&P 500 index is treating buyers properly, up 52% since October 2022 when it reached its most up-to-date low. Loads of components contributed to the bull market, however chief amongst them has been pleasure over tech shares.

Advances in markets like synthetic intelligence (AI), cloud computing, self-driving automobiles, and digital/augmented actuality illustrate a serious shift within the tech trade that might spell a profitable future for the businesses concerned.

A lot of tech’s most distinguished gamers have reputations for delivering important positive aspects over the long run, giving affected person stockholders the chance to change into millionaires with the fitting funding. With many areas of tech seemingly nonetheless of their infancy, now might be a wonderful time to speculate and probably revenue from the market’s growth.

So, listed below are two high tech shares that might make you a millionaire.

1. Nvidia: Powering the tech trade with its {hardware}

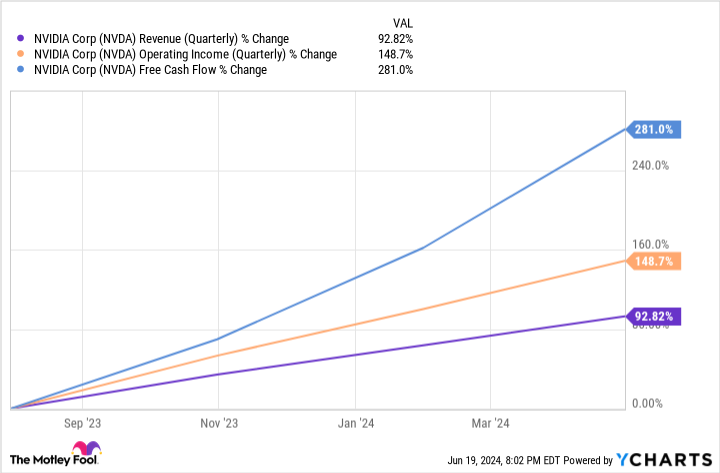

Nvidia (NASDAQ: NVDA) pulled off a formidable progress spurt because the begin of 2023, with its fill up 828%. Its success noticed it surpass Microsoft (NASDAQ: MSFT) and Apple because the world’s most respected firm, reaching a market cap above $3.3 trillion. The chipmaker undoubtedly created many millionaires on its option to the highest spot and exhibits no indicators of slowing, suggesting it isn’t too late to make a long-term funding in Nvidia.

For years, Nvidia was greatest recognized for its position within the video video games market, with changing into the go-to for hundreds of thousands of customers custom-building highly effective gaming PCs. Whereas the corporate remains to be very energetic in gaming, the main target shifted to Nvidia’s .

Advances within the generative expertise elevated the necessity for high-powered GPUs, chips able to the heavy workloads required for coaching AI fashions. And because the largest identify in GPUs, Nvidia was positioned to right away start supplying its chips to AI builders worldwide, main earnings to skyrocket.

Regardless of elevated competitors, Nvidia maintains an estimated 80% market share in AI chips, indicating large progress potential because the sector develops.

Along with AI, Nvidia provides its chips to recreation consoles, self-driving automobiles, cloud platforms, and extra. The chipmaker has progress catalysts throughout tech and can seemingly proceed to reward buyers for years. Regardless of current progress, Nvidia’s worth/earnings-to-growth ratio stays at lower than 1, suggesting its inventory is a worth and price choosing up this month.

2. Microsoft: Getting AI into the palms of billions of customers and companies

Like Nvidia, Microsoft received a head begin in AI. The corporate is the largest investor in OpenAI’s ChatGPT, sinking about $13 billion within the start-up since 2019. The partnership granted Microsoft entry to a few of the most superior AI fashions within the trade, which the corporate has in flip used introduce generative options throughout its product lineup.

Potent manufacturers like Home windows, Workplace, and Azure have seen Microsoft change into the largest identify in productiveness software program, with billions of customers and companies counting on its choices each day. The mix of OpenAI’s expertise and Microsoft’s software program offers it virtually infinite alternatives to advertise its AI merchandise and change into a number one progress driver within the public’s adoption of AI.

Microsoft took benefit of this by including a variety of AI options to its Workplace productiveness suite, together with an AI assistant referred to as Copilot. The corporate has additionally built-in features of ChatGPT into its search engine Bing and expanded its library of AI instruments on its cloud platform Azure.

The tech big’s efforts are paying off, with income rising 17% yr over yr within the third quarter of 2024 (ending in March), whereas working earnings climbed 23%. Microsoft benefited from a 21% enhance in cloud gross sales and a 12% rise in its “productiveness and enterprise processes” phase, reflecting a lift from AI in each segments.

Microsoft’s inventory is buying and selling at 37 occasions its ahead earnings, suggesting it isn’t precisely a discount. Nevertheless, its dominant position in tech, greater than $70 billion in free money circulate, and a strong outlook in AI seemingly make Microsoft’s inventory price its premium price ticket and one it’s best to think about investing in proper now.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $775,568!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

'Effectively, It's Crypto, It's AI, It's Some Of The Different Issues,' Says Donald Trump, Not sure Of What His New Crypto Venture Even Is

After Donald Trump has entered the cryptocurrency market, however his new remarks elevate questions on whether or not he really understands the sector he’s coming into. The previous president and his three sons have , a brand new cryptocurrency geared toward making the US the

However his ambiguous and steadily perplexing remarks concerning the initiative have made folks marvel if he understands what he’s advocating.

Do not Miss:

“Crypto is a kind of issues we’ve got to do,” Trump acknowledged, earlier than veering off right into a ramble that included references to synthetic intelligence and high-tech jargon. “Whether or not we prefer it or not, I’ve to do it … It is crypto, it is AI, it is a number of the different issues,” he stated, leaving many listeners scratching their heads.

See Additionally: Dogecoin millionaires are rising –

This complicated rhetoric marks a stark departure from Trump’s earlier stance on digital belongings. Just some years in the past, he condemned Bitcoin as a risk to the U.S. greenback and warned of its use in unlawful actions. However based on his most up-to-date monetary kind, since declaring his candidacy for president once more, Trump has allegedly along with .

WLFI is being promoted as a stablecoin pegged to the U.S. greenback, supposedly providing an answer to the volatility that plagues different cryptocurrencies. The venture has been spearheaded by Trump’s sons, Eric and Donald Trump Jr., who’ve positioned it as a method for peculiar People to reclaim monetary energy from conventional banks.

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

Alternatively, critics argue that there are probably many conflicts of curiosity on this enterprise, particularly if Trump is reelected and makes use of his govt energy to decontrol the cryptocurrency market, which some folks count on him to do and which might, on the identical time, profit his household’s firm.

Trending: Amid the continuing EV revolution, beforehand missed low-income communities

In line with Lusso’s Information, the venture’s key dealmaker, Chase Herro, has a doubtful previous that features selling questionable merchandise and making ethically questionable statements like “Should you do that proper, who f—ing cares if it goes to zero.” In a 2018 YouTube video, he boasted about with the ability to promote “shit in a can, wrapped in piss, lined in human pores and skin, for a billion {dollars} if the story’s proper.”

Whereas Trump and his crew promote WLFI as a steady monetary instrument, previous occasions inform a special story. worn out almost $2 trillion from the crypto market, inflicting large losses for a lot of traders. On high of that, and different unlawful actions, making folks cautious about utilizing them broadly.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

4 Issues Palantir Traders Could Have Missed This Week

The newest advances in synthetic intelligence (AI) have created a variety of buzz since early final 12 months. These next-generation algorithms’ capability to create authentic content material, streamline processes, and enhance productiveness has companies far and huge racing to seize their share of the ensuing windfall.

One firm uniquely positioned to revenue from these secular tailwinds is Palantir Applied sciences (NYSE: PLTR). Its many years of expertise creating AI helped the corporate pivot to embrace the demand for , and that transfer has been a boon to Palantir and its shareholders. Certainly, the inventory has soared 477% for the reason that begin of 2023, fueled by bettering outcomes and the corporate’s increasing alternative.

Over the previous week, the excellent news has come quick and livid for Palantir. With a lot occurring, buyers might not have caught all of the current developments. Listed here are 4 issues Palantir buyers might have missed this week.

1. Increasing its relationship with Nebraska Drugs

To kick off the week, Palantir introduced an growth of its pioneering partnership with Nebraska Drugs to advance healthcare utilizing AI, leading to a brand new multiyear, multimillion-dollar contract.

Nebraska Drugs is an early adopter of Palantir’s Synthetic Intelligence Program (AIP) and has “carried out greater than ten purposes of AIP, bettering affected person throughput, increasing claims reimbursements, and higher monitoring affected person care.” It famous that AIP helped the well being system to develop a brand new workflow in lower than six weeks, with further breakthroughs in as little as 90 minutes.

One instance is the enhancements to Nebraska Drugs’s Discharge Lounge, which has skilled a 2,000%+ enhance in utilization. This lowered the time essential to discharge sufferers by one hour, on common, releasing up mattress house for different sufferers.

2. A powerful vote of confidence

Analysts at Financial institution of America (BofA) Securities added Palantir to the agency’s US 1 checklist. To be included within the checklist, a inventory should be listed within the U.S., have a purchase ranking, and be coated by the funding financial institution’s fairness analysis analysts. The inventory should even have a mean day by day buying and selling quantity of $5 million through the previous six months. The checklist is supposed to symbolize BofA’s greatest funding concepts.

The analysts cited Palantir’s groundbreaking Warp-Velocity platform, which was designed to combine numerous features of producing techniques. It combines components of enterprise useful resource planning (ERP), manufacturing execution techniques (MES), product lifecycle administration (PLM), programmable logic controllers (PLCs) for manufacturing facility automation, and even enter from employees on the manufacturing facility flooring.

The analysts described it as “a device that might rework the American industrial base,” resulting in its inclusion within the checklist.

3. Increasing the Maven Good System

Palantir introduced that it had been awarded a contract by the DEVCOM Military Analysis Laboratory to develop its Maven Good System throughout all branches of the army service, together with the Military, Air Power, House Power, Navy, and U.S. Marine Corps. Maven is an AI-based concentrating on device that’s a part of the Nationwide Geospatial-Intelligence Company’s Maven AI framework. Palantir mentioned it acts because the “connective tissue” between troops on the bottom, battlefield sensors, {hardware}, and software program.

The fixed-price contract might be value as a lot as $99.8 million over the subsequent 5 years and will enhance the army companies’ AI and machine studying capabilities.

4. Becoming a member of the S&P 500

Lastly, Friday marked the final buying and selling day earlier than Palantir joined the S&P 500. The S&P is probably the most well known benchmark within the nation, made up of the five hundred largest corporations within the U.S. As such, it is also considered as the perfect gauge of total inventory market efficiency.

Palantir shall be added to the celebrated index when the market opens on Monday and is one among solely 11 corporations to hitch its ranks thus far this 12 months.

There’s a required to be added to the S&P 500, and Palantir has handed with flying colours.

Whereas this might sound trivial, Financial institution of America analyst Mariana Pérez Mora calls it a “watershed second.” The analyst believes there is a “basic misunderstanding” regarding Palantir, and its addition to the extensively adopted index will pressure institutional buyers to revisit what they assume they know concerning the AI pioneer. A greater grasp of what Palantir does and the elemental alternative forward may assist dispel these misunderstandings, rising demand and driving the inventory value even increased.

That is why the analyst maintains a purchase ranking and Avenue-high $50 value goal on Palantir inventory, which represents a possible upside of 34% — regardless of already notching good points of 477% since early final 12 months.

Given the enterprise trajectory, the huge alternative, and administration’s constant execution, I consider that value goal will find yourself being conservative.

Do you have to make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for buyers to purchase now… and Palantir Applied sciences wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting accomplice of The Ascent, a Motley Idiot firm. has positions in Palantir Applied sciences. The Motley Idiot has positions in and recommends Financial institution of America and Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Why Wall Avenue is on board with larger charge cuts in This autumn

The bulls are again and traders are chasing the market greater.

Final week why a 50 foundation level rate of interest minimize might be a mistake, as consultants informed me a daring transfer by the Fed might sign doom and gloom for the financial system and danger triggering a market selloff.

But, every week later, Wall Avenue appears to be on board with the bigger charge minimize as shares jumped to .

And merchants are betting the Fed will sustain its aggressive tempo of easing. Whereas the central financial institution signaled one other 50 foundation factors of cuts throughout its two remaining 2024 conferences, merchants are pricing in a further 75 foundation factors, in keeping with the CME Group’s FedWatch instrument.

Consultants inform me it’s cooling inflation, not a rising danger of recession, that may give the Fed the inexperienced gentle for an additional giant minimize. Costs fell to a three-year low in August.

“If [inflation] continues to ease, rates of interest ought to be lowered in keeping with that,” Nationwide Mutual’s chief economist Kathy Bostjancic defined.

“The Fed Reserve ought to go 50 foundation factors for the following [meeting],” Bostjancic added. “They’re removed from impartial, so slicing 50 foundation factors is just not essentially an indication the financial system is falling aside. It is a recognition that coverage is simply too restrictive.”

The Federal Reserve is ready to launch its subsequent rate of interest resolution on Nov. 7, and can have one other probability to chop charges at its December assembly.

If this week is a information, an aggressive minimize might be a catalyst for the market. Powell’s emphasis that the Fed’s transfer ought to be seen as “an indication of our dedication to not get behind” was sufficient to spice up investor confidence. The S&P 500 () notched its thirty ninth file excessive of the 12 months whereas the Dow Jones Industrial Common () surged above 42,000.

“The Fed was capable of minimize by 50 foundation factors not as a result of it needed to however as a result of it was capable of, and I believe that is a very actually key distinction,” Raymond James’ chief market strategist Matt Orton mentioned on

“It helps extra funding, it helps extra CapEx, and that’s what has been behind a whole lot of the financial resilience.”

John Hancock’s elevated optimism of a comfortable touchdown is driving “a whole lot of optimism throughout markets.”

“Riskier property are actually celebrating this concept that the Fed can stave off a tough touchdown, and do it proactively earlier than we see extra weak spot right here within the labor market,” Roland mentioned.

BMO Capital Markets chief funding strategist Brian Belski raised his year-end S&P 500 worth goal to a road excessive of 6,100, noting historic efficiency patterns “recommend a stronger-than-normal 4Q is probably going in retailer for the market and particularly because the Fed has shifted to easing mode.”

Two key jobs reviews will assist information the Consumed the scale of its subsequent charge minimize. In a be aware to purchasers on Friday, Oxford Economics’ Michael Pearce warned additional softening within the labor market may immediate the Fed to shave off 50 foundation factors sooner fairly than later.

“Contemplating the shift towards an easing bias from Federal Reserve officers, any draw back surprises to the labor market knowledge might push them to ship one other 50bp minimize in November,” Pearce wrote.

is an anchor at Lusso’s Information. Comply with Smith on Twitter . Tips about offers, mergers, activist conditions, or anything? E-mail seanasmith@yahooinc.com.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately