Markets

Nvidia to launch in Center East amid U.S. curbs on AI exports to area, Ooredoo CEO says

By Andrew Mills

DOHA (Reuters) – Nvidia (NASDAQ:) has signed a deal to deploy its synthetic intelligence expertise at knowledge centres owned by Qatari telecoms group Ooredoo in 5 Center Jap international locations, Ooredoo’s CEO informed Reuters.

The settlement marks Nvidia’s first large-scale launch in a area to which Washington has curbed the export of refined U.S. chips to cease Chinese language companies from utilizing Center Jap international locations as a again door to entry the most recent AI expertise.

It’s going to make Ooredoo the primary firm within the area capable of give shoppers of its knowledge facilities in Qatar, Algeria, Tunisia, Oman, Kuwait and the Maldives direct entry to Nvidia’s AI and graphics processing expertise, Ooredoo mentioned in an announcement.

Offering the expertise will enable Ooredoo to raised assist its prospects deploy generative AI purposes, Nvidia’s senior vp of telecom Ronnie Vasishta mentioned.

“Our b2b shoppers, because of this settlement, may have entry to companies that most likely their opponents (will not) for an additional 18 to 24 months,” Ooredoo’s CEO Aziz Aluthman Fakhroo informed Reuters in an interview.

The businesses didn’t disclose the worth of the deal, which was signed on the sidelines of the TM Discussion board in Copenhagen on June 19.

Ooredoo additionally wouldn’t disclose precisely what kind of Nvidia expertise it is going to be putting in in its knowledge centres, saying that it will depend on availability and buyer demand.

Washington permits the export of some Nvidia expertise to the Center East, however curbs exports of the corporate’s most refined chips.

Ooredoo is investing $1 billion to spice up its regional knowledge centre capability by 20-25 further megawatts on prime of the 40 megawatts it at present has, and plans to virtually triple that by the top of the last decade, Fakhroo mentioned.

The corporate has carved out its knowledge facilities right into a separate firm following an analogous transfer final 12 months to create the Center East’s largest tower firm in a cope with Kuwait’s Zain and Dubai’s TASC Towers Holding.

Ooredoo additionally has plans to carve out its undersea cables and fiber community right into a separate entity, Fakhroo mentioned.

Markets

Why Wall Avenue is on board with larger charge cuts in This autumn

The bulls are again and traders are chasing the market greater.

Final week why a 50 foundation level rate of interest minimize might be a mistake, as consultants informed me a daring transfer by the Fed might sign doom and gloom for the financial system and danger triggering a market selloff.

But, every week later, Wall Avenue appears to be on board with the bigger charge minimize as shares jumped to .

And merchants are betting the Fed will sustain its aggressive tempo of easing. Whereas the central financial institution signaled one other 50 foundation factors of cuts throughout its two remaining 2024 conferences, merchants are pricing in a further 75 foundation factors, in keeping with the CME Group’s FedWatch instrument.

Consultants inform me it’s cooling inflation, not a rising danger of recession, that may give the Fed the inexperienced gentle for an additional giant minimize. Costs fell to a three-year low in August.

“If [inflation] continues to ease, rates of interest ought to be lowered in keeping with that,” Nationwide Mutual’s chief economist Kathy Bostjancic defined.

“The Fed Reserve ought to go 50 foundation factors for the following [meeting],” Bostjancic added. “They’re removed from impartial, so slicing 50 foundation factors is just not essentially an indication the financial system is falling aside. It is a recognition that coverage is simply too restrictive.”

The Federal Reserve is ready to launch its subsequent rate of interest resolution on Nov. 7, and can have one other probability to chop charges at its December assembly.

If this week is a information, an aggressive minimize might be a catalyst for the market. Powell’s emphasis that the Fed’s transfer ought to be seen as “an indication of our dedication to not get behind” was sufficient to spice up investor confidence. The S&P 500 () notched its thirty ninth file excessive of the 12 months whereas the Dow Jones Industrial Common () surged above 42,000.

“The Fed was capable of minimize by 50 foundation factors not as a result of it needed to however as a result of it was capable of, and I believe that is a very actually key distinction,” Raymond James’ chief market strategist Matt Orton mentioned on

“It helps extra funding, it helps extra CapEx, and that’s what has been behind a whole lot of the financial resilience.”

John Hancock’s elevated optimism of a comfortable touchdown is driving “a whole lot of optimism throughout markets.”

“Riskier property are actually celebrating this concept that the Fed can stave off a tough touchdown, and do it proactively earlier than we see extra weak spot right here within the labor market,” Roland mentioned.

BMO Capital Markets chief funding strategist Brian Belski raised his year-end S&P 500 worth goal to a road excessive of 6,100, noting historic efficiency patterns “recommend a stronger-than-normal 4Q is probably going in retailer for the market and particularly because the Fed has shifted to easing mode.”

Two key jobs reviews will assist information the Consumed the scale of its subsequent charge minimize. In a be aware to purchasers on Friday, Oxford Economics’ Michael Pearce warned additional softening within the labor market may immediate the Fed to shave off 50 foundation factors sooner fairly than later.

“Contemplating the shift towards an easing bias from Federal Reserve officers, any draw back surprises to the labor market knowledge might push them to ship one other 50bp minimize in November,” Pearce wrote.

is an anchor at Lusso’s Information. Comply with Smith on Twitter . Tips about offers, mergers, activist conditions, or anything? E-mail seanasmith@yahooinc.com.

Markets

5 huge analyst AI strikes: SK Hynix hit by double downgrade; ADI named Prime Semis Choose

Lusso’s Information — Listed below are the largest analyst strikes within the space of synthetic intelligence (AI) for this week.

Lusso’s Information subscribers at all times get first dibs on market-moving AI analyst feedback. Improve immediately!

William Blair begins ARM, AVGO protection at Purchase

In the course of the week, William Blair analysts have initiated protection on Arm Holdings (NASDAQ:) with an Outperform score, voicing confidence within the firm’s potential for sturdy earnings per share (EPS) development and inventory worth appreciation over the approaching years.

The agency pointed to a number of development drivers for Arm, together with “1) increased Common Promoting Costs (ASPs) pushed by improved monetization and better worth IP; 2) share features in newer markets like knowledge middle; 3) tailwinds from AI driving increased demand for general compute; and 4) a brand new improve cycle in cellular/PCs.”

Whereas Arm’s inventory trades at a premium in comparison with its friends, William Blair believes that is justified by the corporate’s strong development outlook, which is predicted to change into clearer within the monetary forecasts for 2026 and 2027.

Their discounted money move evaluation signifies round 35% upside potential for Arm’s shares, supported by sustained income development and rising profitability over the following decade.

In a separate observe, William Blair additionally assigned an Outperform score to Broadcom (NASDAQ:), noting the corporate’s strategic growth into software program as a solution to buffer towards the cyclical nature of the semiconductor trade.

The agency believes that the chipmaker is positioned for continued development, pushed by AI-related demand in networking and customized chip segments, together with the shift to subscription-based fashions in its VMware (NYSE:) division.

Analysts highlighted that almost two-thirds of VMware clients have transitioned to subscriptions, a major rise from the 30% seen previous to the acquisition.

In addition they famous that AVGO is buying and selling at a price-to-earnings ratio of 26x and an enterprise worth to free money move ratio of 22x based mostly on their 2025 projections, barely under the median of its friends.

“We see room for a number of growth because the sustainability of development in networking, buyer AI chips, and software program turns into clearer,” the observe states.

Morgan Stanley double-downgrades SK Hynix on cloudy outlook past This autumn

Shares of SK Hynix (KS:) dropped on Thursday following a double downgrade from Morgan Stanley, with analysts shifting their score from Chubby to Underweight.

In a observe, analysts remarked that “the solar continues to be shining” for the corporate in the intervening time. They predict 2024 shall be one other sturdy 12 months for SK Hynix, pushed by rising DRAM costs heading into the fourth quarter, which ought to result in “distinctive near-term earnings.”

Nonetheless, the outlook past the fourth quarter seems much less favorable. Whereas the long-term potential for DRAM, notably resulting from AI-driven demand from knowledge facilities, continues to be promising, the agency famous that cyclical shortages are coming to an finish.

“Wanting previous 4Q24, we see sustained dangers to the highest line and EPS as development slows, pricing falls, and rising competitors in high-bandwith reminiscence (HBM) challenges sustainable long-term margins,” the analysts added.

Along with downgrading the inventory, Morgan Stanley additionally minimize its worth goal for SK Hynix by greater than half, decreasing it from 260,000 to 120,000 Korean gained.

Citi names Analog Units its new high semis decide

In a analysis observe launched Tuesday, Citi analysts named Analog Units (NASDAQ:) as their new high decide within the semiconductor sector.

The choice follows Citi’s replace to its semiconductor inventory rating desk, which included a worth goal adjustment for Micron Know-how (NASDAQ:) and an improve of Texas Devices (NASDAQ:). The agency maintains a constructive outlook on the semiconductor trade as a complete.

Citi highlighted ADI’s decrease draw back threat within the automotive sector in comparison with different analog semiconductor makers, notably following the corporate’s latest earnings report.

This diminished threat, based on Citi, makes ADI well-positioned amid ongoing market uncertainties, main the agency to rank it on the high of its semiconductor inventory desk.

“ADI is our high decide,” Citi analysts acknowledged, including that they see “decrease draw back threat in Autos versus different analog names given they’ve simply introduced earnings.”

Broadcom and AMD (NASDAQ:), each key gamers within the AI sector, stay in Citi’s second and third spots, respectively.

AI revolution commerce receives a lift after Fed minimize: Wedbush

Wedbush analysts mentioned that they consider the AI revolution commerce has gained momentum following the Federal Reserve’s 50 foundation level price minimize, signaling a positive atmosphere for Massive Tech and AI shares.

Wedbush views this aggressive price minimize, alongside a dovish dot plot extending into 2025, as making a “very bullish backdrop” for the tech sector.

The Fed’s transfer marks a momentous shift, as many traders had been ready for this sign to totally interact with tech development shares main into 2025.

The agency identified that the broader know-how sector has remained resilient, with latest earnings stories, equivalent to these from Oracle, indicating that the AI revolution is getting into its software program and software section.

Latest observations from Asia counsel the tech provide chain is making ready for vital growth, spurred by an anticipated $1 trillion in AI capital expenditures within the coming years.

Nvidia (NASDAQ:) stays on the forefront of this revolution, with its GPUs being described by Wedbush because the “new oil and gold” of the IT trade.

With the Federal Reserve’s rate-cutting cycle now underway and AI tech spending starting to speed up, Wedbush analysts proceed to carry a bullish outlook for tech shares, anticipating additional features into 2025.

Melius Analysis upgrades Oracle inventory to Purchase

In the meantime, analysts at Melius Analysis have upgraded Oracle Company (NYSE:) from Maintain to Purchase, setting a worth goal of $210.

They emphasize that Oracle founder Larry Ellison and CEO Safra Catz usually are not solely leveraging their affect but additionally taking a extra strategic method with partnerships, positioning Oracle’s AI-first Cloud as a key development driver.

Ellison’s sturdy connections within the tech world, together with entry to GPUs and agreements with Cloud CEOs, alongside together with his friendship with buyer Elon Musk, have performed a job, Melius’s crew notes.

Whereas Oracle’s inventory is up 54% year-to-date, the agency’s analysts consider this improve may not be late, suggesting the inventory may very well be in the midst of a bigger transfer.

“We see near $8.50 by way of an EPS run price inside 2 years—and with our largest worries muted—we discover it arduous to not put a 25x a number of on an organization set to develop quicker than Salesforce (NYSE:) and Adobe (NASDAQ:),” they mentioned.

Markets

Chinese language Bitcoin firm mines one-third of all blocks in a day, dethrones US

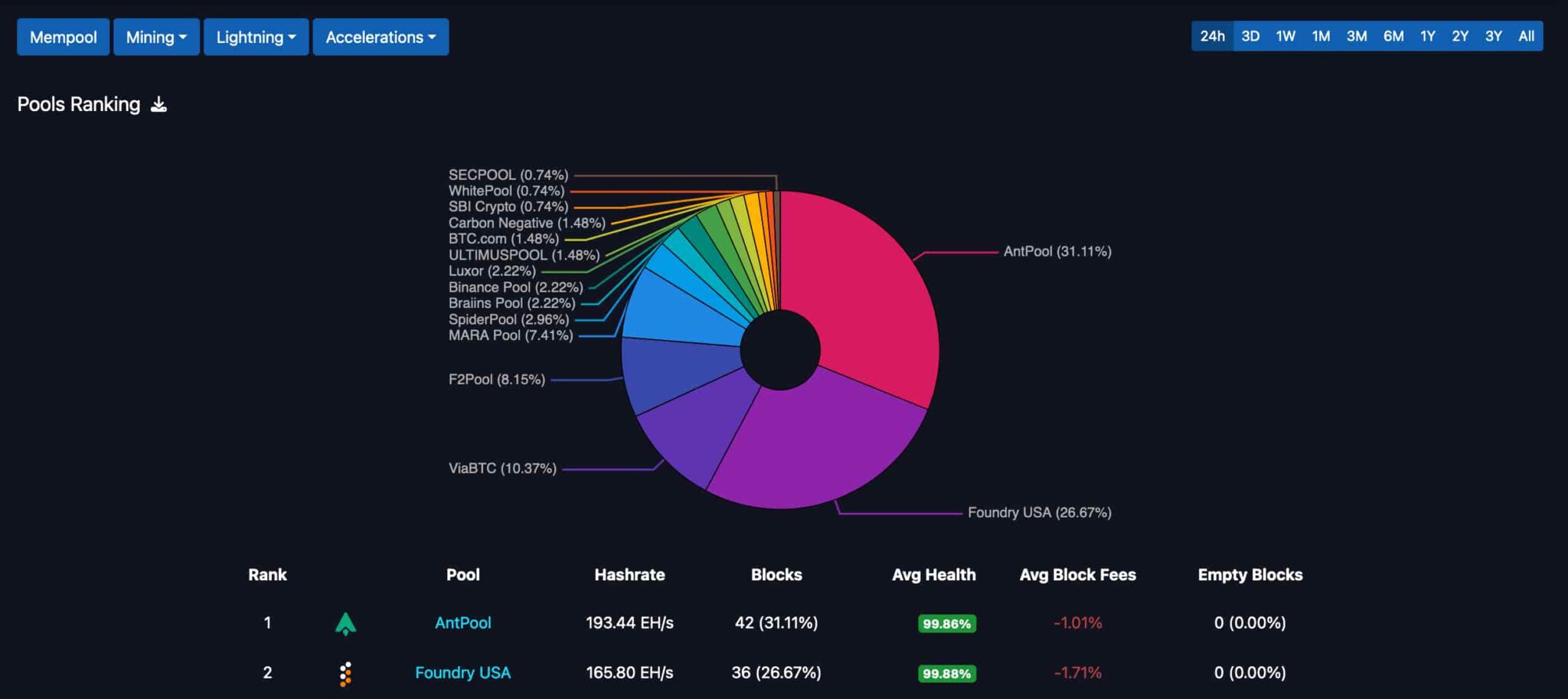

The Bitcoin (BTC) mining race intensified between China and the USA, lately dominated by the previous in a shift. AntPool mined practically one-third of all newly issued BTC within the final 24 hours, concentrating block manufacturing and mining rewards.

Finbold retrieved information from mempool.area on September 22, accounting for Bitcoin’s day by day block discovery amongst mining firms and swimming pools. By the point of this writing, AntPool had mined 42 blocks out of 135, whereas Foundry USA found 36.

Notably, the primary two leaders have been dominating the mining race for years, placing a major distance towards their opponents. ViaBTC, for instance, mined solely 10% of the blocks on this interval, whereas F2Pool and MARA acquired lower than that.

The state of Bitcoin mining has raised centralization considerations amongst specialists, researchers, and builders, as Finbold reported.

Bitcoin mining centralization considerations and penalties

These considerations reached some extent the place a Bitcoin Core developer, Luke Sprint Jr., warned of BTC transactions requiring at the least two hours to be thought-about safe – making the present market requirements of 30 to 60 minutes an outdated security measure.

Nonetheless, the Bitcoin mining centralization may very well be even worse than what floor information suggests, in line with a good BTC researcher. A examine revealed by pseudonymous analyst b10c (@0xb10c) in April signifies that AntPool centralizes most mining exercise past block discovery.

Along with an investigation by Mononaut, the analysts discovered information displaying that at the least six Bitcoin mining swimming pools share each the identical custodian and block template to AntPool, suggesting closed-door agreements hardly noticed at first look.

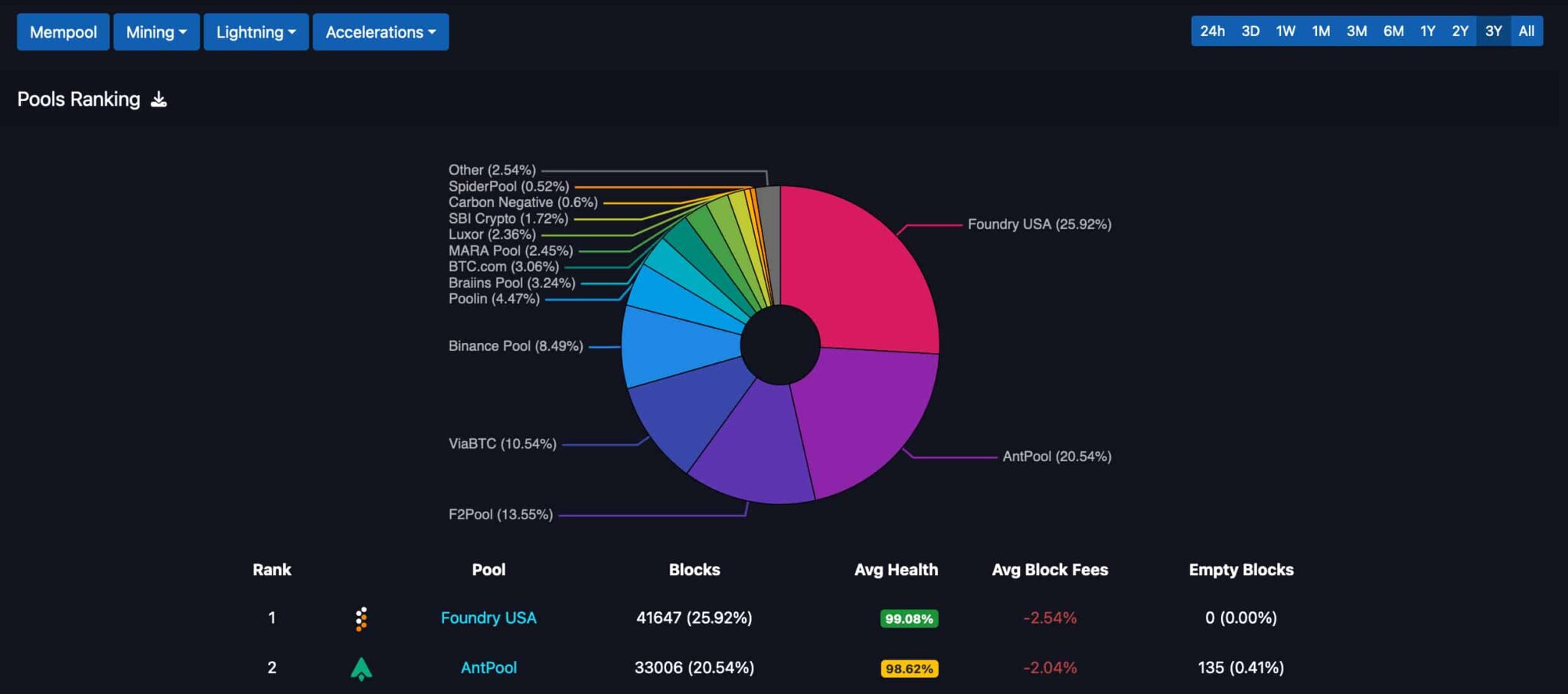

All in all, the Bitcoin mining race intensifies between the 2 main world economies, the USA and China. Whereas the North American consultant leads the long-term scene, the Chinese language firm AntPool grows its presence within the brief time period.

From an funding perspective, Bitcoin mining centralization may problem the cryptocurrency’s worth proposition, doubtlessly impacting the value of BTC in the marketplace.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately