Markets

UBS: Likelihood of 'Roaring '20s' consequence for US financial system rising

Regardless of a slowdown within the US financial system, UBS believes the possibility of a “Roaring ’20s” consequence is definitely rising.

“The roar is getting just a little louder,” the financial institution says, with long-term developments nonetheless aligning with their standards for such a affluent decade.

These standards embrace actual GDP development averaging 2.5% or higher, inflation of 2-3%, a round 4%, and the Federal funds price at 3-4%. Thus far, the US is on observe.

Whereas latest financial power is because of cyclical components, surprising immigration boosting labor provide and stronger-than-expected fiscal laws are offering a brief tailwind. Extra importantly, UBS sees indicators of structurally larger development taking root.

Their evaluation hinges on 4 supply-side megatrends: a capital spending growth, surging AI adoption, stronger enterprise dynamism, and productiveness positive factors. They’ve created a “roar rating” to trace progress on these components.

“Our conclusion is {that a} Roaring ’20s regime is marginally extra doubtless than it was in 4Q23,” UBS stories. Sturdy family funds, elevated AI funding, surging capital expenditures, and continued danger capital availability all bolster this outlook.

Though productiveness development hasn’t taken off but, disinflation progress and a possible shift to a much less restrictive financial coverage by the Fed additional improve the chance of a affluent decade.

A wildcard stays the longer term path of fiscal coverage, with excessive deficits probably requiring consolidation. Nonetheless, UBS believes coverage will in the end be a headwind, not a dealbreaker.

UBS believes the US financial system is likely to be slowing down, however the basis for a “Roaring ’20s” is being constructed. Whereas not assured, UBS urges buyers to not underestimate this potential, drawing a parallel to the productiveness growth of the late Nineties that adopted an ancient times of financial slowdown.

Markets

1 Inventory That Elevated 10,000% in 33 Years to Purchase and Maintain Endlessly

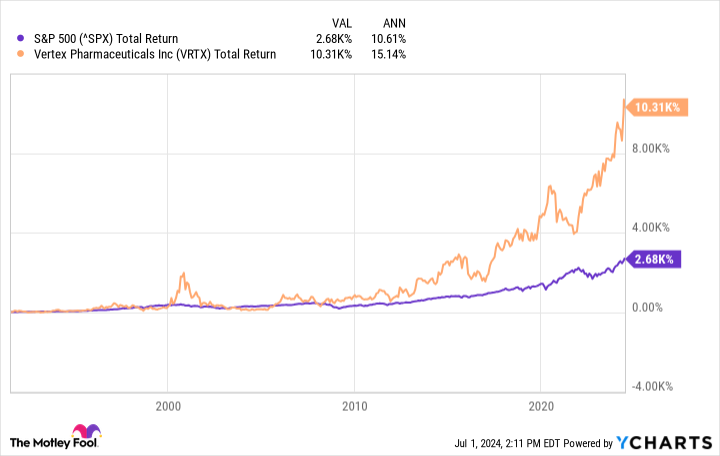

Investing in fairness markets is a dependable, wealth-growing technique. Previously 33 years, the S&P 500‘s common annual return is about 10.6%. It is laborious to discover a return significantly better than that elsewhere.

Some particular person shares have carried out even higher, although. Take Vertex Prescribed drugs (NASDAQ: VRTX), a number one biotech firm whose common annual return since its 1991 preliminary public providing (IPO) is 15.1%. The drugmaker has grown by 10,310%.

It’s a formidable efficiency, however Vertex nonetheless has loads of development forward of it, and the inventory seems to be like a strong buy-and-hold-forever choose. Right here is why.

information by

The key to Vertex’s success

About 7,000 uncommon ailments have an effect on between 25 million and 30 million People. Many do not have accredited therapies focusing on their underlying causes. So, it is not laborious for a to select a goal on this universe of unmet medical wants that might show extremely profitable. The laborious half is creating efficient medicines. That is Vertex’s primary (although not the one) focus. The corporate seeks to focus on the underlying causes of ailments for which there are few, if any, therapies.

Its work in cystic fibrosis (CF) prior to now couple of a long time is a tremendous success story. CF is a illness that impacts about 92,000 sufferers in North America, Europe, and Australia. It causes injury to inside organs. And till Vertex’s breakthroughs — its first CF product was formally accredited within the U.S. in 2012 — there weren’t any medicines that addressed the sickness on the genetic degree. Vertex has been handsomely rewarded for its progress on this discipline. Income and earnings have grown quickly.

information by

However that is prior to now. Can Vertex Prescribed drugs nonetheless carry out effectively transferring ahead?

Do not change a profitable components

Success in enterprise would not occur accidentally. Sure, there’s typically a component of luck. Nevertheless, companies that carry out persistently effectively for a very long time should have a imaginative and prescient and the power to execute a profitable technique. Vertex’s imaginative and prescient stays the identical. It’s nonetheless creating medicines for uncommon (and in addition not so uncommon) ailments. Previously, the biotech has confirmed that it could actually execute. Loads of its friends tried to develop competing CF therapies. , to this point.

Vertex is now proving itself outdoors of its core space. It lately earned approval for Casgevy, a gene-editing remedy for a few uncommon blood-related ailments. It’s advancing key packages via its pipeline. Inaxaplin, a possible remedy for APOL1-mediated kidney illness, is now within the section 3 portion of a section 2/3 examine.

Suzetrigine, an investigational drugs for acute and neuropathic ache, carried out effectively in a late-stage medical trial, the outcomes of which have been introduced earlier this yr. There are many ache medicines, however they typically carry burdensome unwanted side effects, so there’s nonetheless a necessity right here.

Vertex’s early-stage packages additionally look promising. The corporate is aiming to “treatment” kind 1 diabetes with VX-880. In an ongoing section 1/2 examine, three sufferers with no less than a yr of follow-up have achieved insulin independence. All folks with kind 1 diabetes (in contrast to the kind 2 selection) sometimes want insulin. These outcomes are spectacular though it is too early to rejoice. There’s extra occurring with Vertex Prescribed drugs.

Nevertheless, the necessary level is that this: Do not spend money on biotech due to particular medical packages. VX-880 would possibly show ineffective and so would possibly inaxaplin. Regardless of constructive section 3 outcomes, suzetrigine may encounter unexpected regulatory roadblocks. In any case, Vertex has confronted such medical or regulatory headwinds earlier than.

As an example, in October 2020, the biotech halted a section 2 examine for an in any other case promising candidate partly due to security considerations. The corporate’s shares dropped off a cliff in at some point consequently. Here is how the inventory has carried out since then.

information by

The lesson? Vertex’s prospects do not hinge on any single program. The corporate’s energy is its clear imaginative and prescient and technique and its tradition of innovation, which permits it to realize that imaginative and prescient. That is what makes Vertex Prescribed drugs inventory value holding onto without end.

Do you have to make investments $1,000 in Vertex Prescribed drugs proper now?

Before you purchase inventory in Vertex Prescribed drugs, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for traders to purchase now… and Vertex Prescribed drugs wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

has positions in Vertex Prescribed drugs. The Motley Idiot has positions in and recommends Vertex Prescribed drugs. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Globally, Worth funds gave again some efficiency in June

Financial institution of America reported a shift in world fund efficiency for June, with Worth funds experiencing a median decline of 0.88% in comparison with their benchmarks. Solely 24% of Worth funds managed to outperform in June.

Regardless of the setback, BofA acknowledges that Worth funds nonetheless maintain an edge year-to-date, with 52% outperforming their benchmarks. The median YTD return for outperforming Worth funds sits at 0.27%.

In distinction, BofA says Progress funds weathered June’s market actions barely higher. Practically half (49%) of Progress funds outperformed their benchmarks, with a median relative return of -0.04%. Nevertheless, Progress funds have not fared as effectively year-to-date, with solely 40% exceeding their benchmarks and a median YTD relative return of -0.84%.

BofA’s report additionally highlights attention-grabbing inventory picks inside every fund class. They determine corporations with sturdy “Triple Momentum” (optimistic momentum in earnings, worth, and information sentiment) which can be closely weighted by the respective funds. Amongst these, Progress funds favor NU, Icon (NASDAQ:) plc, On Holding, and TSMC, whereas Worth funds lean in direction of BJ’s Membership, US Meals, Ameriprise Monetary (NYSE:), and Hana Monetary.

The report concludes by noting the struggles of aggressive funds, these with a really excessive Lively Share Ratio. These funds are mentioned to have underperformed the market by a median of two.72% year-to-date and 0.62% in June alone. Conversely, funds carefully following the benchmark have carried out higher year-to-date.

Markets

2 No-Brainer Billionaire-Owned Shares to Purchase Proper Now

Following the inventory picks of billionaire buyers might help you discover rewarding investments for the lengthy haul. These buyers sometimes conduct in-depth analysis on the businesses not out there to a small investor.

Chase Coleman of Tiger World Administration and Daniel Loeb of Third Level are two billionaire fund managers who’ve an extended file of safely rising their property. Listed here are two of their prime inventory holdings to purchase proper now.

1. Chase Coleman, Tiger World Administration: Nvidia

Chase Coleman based Tiger World Administration in 2001 and at this time has an estimated web price of over $5 billion, in line with Forbes. Tiger World has a powerful file of incomes market-beating returns for shoppers during the last twenty years, and one among its largest positions within the first quarter was Nvidia (NASDAQ: NVDA) — one of many best-performing S&P 500 shares in current months.

Enterprises are shopping for as many as they’ll get their palms on for coaching synthetic intelligence (AI) fashions. Meta Platforms plans to have 350,000 of Nvidia’s H100 chips in its laptop infrastructure by the top of the yr. These highly effective chips have been in brief provide resulting from excessive demand, and Nvidia expects this case to proceed.

The central processing models (CPUs) that powered knowledge facilities for years are being supplanted by extra highly effective GPUs, which is driving unprecedented progress for Nvidia’s knowledge heart enterprise. Nvidia has an extended historical past of delivering above-average progress and returns to shareholders, however its present progress is off the charts, with income leaping 262% yr over yr in the latest quarter.

The corporate will not proceed to see its income triple yearly, however buyers who can patiently maintain the inventory over the subsequent a number of years ought to see passable returns. Nvidia will proceed to innovate with new merchandise and AI options to drive long-term progress.

Earlier this yr, Nvidia introduced its new Blackwell computing platform that may permit the main cloud service suppliers to take knowledge processing to a different stage. It expects demand for Blackwell and the brand new H200 knowledge heart GPU to outstrip provide within the close to time period.

Nvidia expects its fiscal second-quarter income to be roughly $28 billion, representing a 107% year-over-year enhance. This stage of demand makes the inventory a no brainer funding.

2. Daniel Loeb, Third Level: Taiwan Semiconductor Manufacturing

Daniel Loeb is the founding father of Third Level and has an estimated web price of over $3 billion, in line with Forbes. With the rising demand for AI chips, it is no shock to see one other prime chip firm in a billionaire’s portfolio. Third Level held a large stake within the main chip producer Taiwan Semiconductor Manufacturing (NYSE: TSM) on the finish of the primary quarter.

Taiwan Semiconductor dominates the business with over 60% of the worldwide foundry market in 2023. As a foundry, it makes merchandise for different corporations. All of the main chip corporations, together with Nvidia, have relationships with TSMC, which places the corporate in a powerful aggressive place.

TSMC’s income grew 12.5% yr over yr within the first quarter in U.S. {dollars}, primarily pushed by demand for high-performance chips. However progress ought to speed up within the close to time period, as a few of the firm’s finish markets are nonetheless in restoration, together with smartphones, which account for 38% of TSMC’s enterprise.

Administration expects second-quarter income to come back in between $19.6 billion to $20.4 billion, or enhance by 27% yr over yr on the midpoint of steerage. TSMC is working to increase its manufacturing capability within the U.S., which displays a positive outlook for chip demand.

TSMC has an extended historical past of delivering excellent returns to shareholders, and its worthwhile enterprise mannequin fueled a rising dividend to shareholders since 2004. It is a comparatively protected inventory to trip the wave of AI chip demand over the subsequent decade.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $786,046!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Meta Platforms and Nvidia. The Motley Idiot has positions in and recommends Meta Platforms, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing