Markets

Whereas Nvidia inventory captivates the investing lots, don't overlook this different thrilling factor concerning the market

Extra thrilling issues are occurring contained in the market than Nvidia inventory ()

Veteran New York Inventory Change (NYSE) flooring dealer and co-founder of Peter Tuchman pointed to the bull market in shares ushering in 40 million new retail buyers into the market over the previous few years as very “thrilling.”

On account of this inflow, family web value stays on the ascent.

US family wealth rose to a report of greater than $160 trillion within the first quarter, in keeping with the newest information out of the Federal Reserve. Throughout that point, family web value rose by 3.2%, or $5.1 trillion, with the appreciation in inventory costs accounting for $3.8 trillion of the achieve.

“We’re on the crossroads,” Tuchman mentioned on Lusso’s Information’s podcast (see or ). “We’re in a rare time and historical past.”

These new retail buyers have broadened their publicity past similar to GameStop () and AMC (), which dominated Robinhood () buying and selling accounts in 2021.

The newest , which tracks the efficiency of the highest 100 most owned investments on the buying and selling platform, reveals that retail buyers have plowed into corporations they perceive and that impression their every day lives, similar to Apple () and Microsoft ().

And sure, Nvidia.

Making investing extra accessible to extra individuals is an efficient factor to see, Tuchman added.

“All these boundaries to entry that have been actually important and stored this a really unique place, these days are over,” he mentioned. “I believe that’s a extremely good thing. Abruptly everybody’s been invited to this social gathering.”

Tuchman has traded by way of a number of market events by way of the a long time. He’s recognized for iconic photographs taken of him on the NYSE buying and selling flooring, and his wild hairstyles and savvy methods garnered him the nickname “Einstein of Wall Road,” for legitimate causes.

His résumé contains guarding the velvet ropes and being Mr. “No” outdoors the door of Studio 54, proudly owning a jazz report retailer, and dealing at a jazz membership.

“My strategy to the market was completely different than your regular individual analyzing the market,” he mentioned.

Within the mid-Eighties, he took a summer season job as a teletypist on the change flooring and finally labored his manner as much as dealer.

“The vitality, the adrenaline, for me, the minute I walked onto the ground, I knew this was for me,” he mirrored.

Tuchman’s profession overlapped with many important down market occasions together with Black Monday, 9/11, and the Nice Recession. “You noticed individuals shedding futures,” he mentioned. “However I additionally noticed the capability and resilience of human beings within the office.”

This previous week, there was loads of resilience, vitality, and adrenaline readily available as markets hit new highs.

Buyers noticed Nvidia rise to a , making it briefly the on this planet, beating Apple at $3.29 trillion and Microsoft at $3.32 trillion earlier than the inventory .

This enthusiasm for Nvidia factors to its sound place in synthetic intelligence going ahead — one thing for 40 million new buyers to think about.

Regardless of the market being scorching, it is nonetheless vital to do your homework and search out worth. Famous worth investor Jonathan Boyar of Boyar Analysis shares his strategy on an episode of . Pay attention in beneath:

Markets

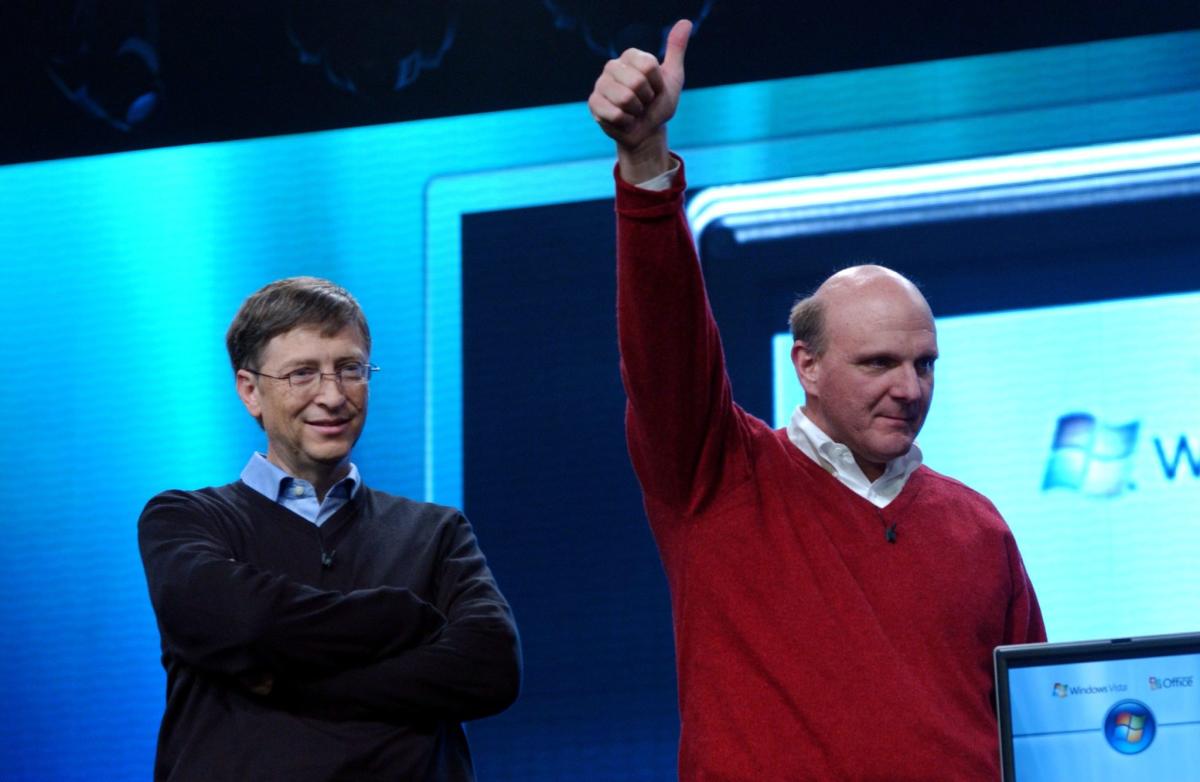

Steve Ballmer, who was as soon as Invoice Gates’ assistant, is now richer than his onetime mentor

When Steve Ballmer joined he didn’t get a single firm share. However now, his have made him richer than the corporate’s founder.

The 68-year-old former Microsoft CEO squeaked by his onetime boss Invoice Gates to turn out to be the on this planet on Monday with a internet value of $157 billion. He’s now richer than many well-known tech entrepreneurs together with cofounder Sergey Brin, founder Larry Ellison, and Dell Applied sciences CEO Michael .

It’s additionally the primary time that Ballmer’s internet value has surpassed that of Gates, and one of many few occasions in historical past an worker has come to be richer than an organization’s founder. Ballmer is the with a internet value of $100 billion or extra who made their cash as an worker somewhat than a founder, as Fortune beforehand reported.

Ballmer’s internet value was boosted by a rally in Microsoft’s shares, which closed at an all-time excessive on Tuesday and have surged 22% since January. Shares of the corporate signify about 90% of his internet value, in line with the , and Microsoft has been one of many greatest beneficiaries of the AI growth fueling markets, because of its $10 billion .

In 2014, Ballmer left Microsoft with a couple of 4% stake value $22.5 billion, in line with . On the time, he stated that he was holding on to his shares for the long run, Forbes reported.

“I’d prefer to personal Microsoft shares till I both give one thing to charity or I die,” he the outlet.

In the meantime, Gates has diversified his portfolio over time away from the corporate he based, with half of his holdings now managed by means of personal funding agency Cascade Funding. He has a $21 billion stake in waste administration firm by means of Cascade, Lusso’s Information .

Making a gift of cash

Gates’ main philanthropic donations additionally consider. As of 2023, Gates and his ex-wife Melinda French Gates had donated to the Invoice & Melinda Gates Basis, turning it into the one of many world’s largest charitable foundations. In 2010, Gates additionally cocreated the with French Gates and investor Warren Buffett, and has promised to offer away most of his wealth throughout his lifetime.

Though Steve Ballmer’s holdings have made him one of many richest males on this planet, when he joined as the corporate’s thirtieth worker in 1980, he didn’t get a single share. After dropping out of Stanford Enterprise Faculty, he served as a quasi–private assistant to Invoice Gates with the unimpressive title “enterprise supervisor,” Forbes reported.

But, as a result of Microsoft was trying to develop quickly on the time, Gates and his cofounder, Paul Allen, agreed to offer Ballmer 10% of the revenue progress he generated on high of his $50,000 yearly wage.

That deal turned out to be key to Ballmer’s future wealth. Quickly, Microsoft was rising so quick that Ballmer’s 10% minimize now not made sense financially for the corporate. When Microsoft reorganized as an organization, Ballmer negotiated an 8% slice for himself in trade for giving up his profit-sharing deal, whereas Gates and Allen stored 84% and one other 8% was designated for different staff, Forbes reported. Though Allen was against giving Ballmer such a big stake, Gates stepped in and stated Ballmer’s 8% minimize could possibly be funded by a drawdown of his personal holdings, in line with Forbes.

Whereas on the time Gates put his personal cash on the road for Ballmer, the 2 have since drifted aside.

“Microsoft was type of the factor that actually sure us,” Ballmer in 2016. “We began off as buddies, however then actually received fairly enmeshed round Microsoft. Since I’ve gone, we actually have drifted a bit of bit.”

This story was initially featured on

Markets

AI offers carry US enterprise capital funding to highest stage in two years, knowledge exhibits

By Krystal Hu

(Reuters) – U.S. enterprise capital funding surged to $55.6 billion within the second quarter, marking the very best quarterly whole in two years, in response to PitchBook knowledge printed on Wednesday.

The most recent determine exhibits a 47% leap from the $37.8 billion U.S. startups raised within the first quarter, largely pushed by important investments in synthetic intelligence corporations, together with $6 billion raised by Elon Musk’s xAI and $1.1 billion raised by CoreWeave.

Buyers’ ongoing pleasure round constructing and adopting AI expertise, which might probably convey important returns, has fueled the restoration of enterprise capital (VC) funding.

After reaching a report excessive $97.5 billion within the fourth quarter of 2021, U.S. VC funding had been steadily declining. It hit a latest low of $35.4 billion within the second quarter of 2023, amid a excessive rate of interest setting and a sluggish exit market.

The latest inflow of capital into AI startups has reversed the downward development, prompting extra traders to double down on AI basis mannequin corporations in addition to purposes from code technology to productiveness instruments.

Regardless of the rise in deal exercise, exits stay difficult, the information exhibits, as small offers generated about $23.6 billion in exit worth within the second quarter this 12 months, down from $37.8 billion within the first quarter. The preliminary public providing market has struggled to achieve momentum, even after some VC-backed corporations akin to cloud knowledge administration firm Rubrik, went public.

“For VC returns to see a rise, giant tech corporations should start to checklist publicly at a better tempo than we’ve got seen by the primary half of the 12 months,” Pitchbook analyst Kyle Stanford mentioned in a press release.

Rising VC fund managers might have already felt the strain of an absence of confirmed returns, with solely $37.4 billion in commitments raised by the primary half of the 12 months. Massive companies dominated the fundraising, with Andreessen Horowitz alone closing new funds with greater than $7 billion.

Markets

Northern Knowledge, European Bitcoin Miner, Explores IPO for US AI Unit (Report)

Northern Knowledge AG, a German agency specializing in high-performance computing infrastructure, is evaluating the opportunity of launching a U.S. preliminary public providing (IPO) for its AI cloud computing and knowledge middle items.

The potential valuation for this IPO might attain as excessive as $16 billion, in keeping with Bloomberg Information sources.

Northern Knowledge Eyes US IPO

Northern Knowledge is contemplating combining its cloud computing department, Taiga, with its knowledge middle operations, Ardent, to type a brand new agency for a potential U.S. IPO. The mixed entity could also be listed on the Nasdaq as early as the primary half of 2025.

This choice coincides with a restoration within the U.S. IPO market, which has been boosted by investor optimism about financial stability. Moreover, there was a revived curiosity in new listings in 2024. The introduction of OpenAI’s ChatGPT has additionally stimulated demand for AI applied sciences, which has led to giant investments within the sector.

Main know-how corporations, like Microsoft and Alphabet Inc., have made vital investments within the infrastructure required to help AI purposes.

The corporate is now in dialog with doable advisors concerning the IPO and intends to rent lead banks within the coming months. Nonetheless, primarily based on the outcomes of those strategic engagements, Northern Knowledge might resolve towards continuing with the IPO. To date, the corporate has not offered an official touch upon these plans.

Northern Knowledge’s Market Place

The Frankfurt-based firm, which went public in 2018, has seen its shares fall by round 5% this 12 months. This has taken its market valuation to roughly €1.3 billion ($1.4 billion).

Northern Knowledge has been adapting its energy-intensive knowledge facilities to allow AI purposes in response to crypto mining’s shrinking enterprise margins. In 2022, Northern Knowledge was a notable Ether miner, devoting over 70% of its operations to the exercise. Following an replace to the Ethereum blockchain, the corporate modified its consideration away from mining and towards high-performance computing and different initiatives.

The corporate obtained a €575 million debt financing settlement from Tether Group in November. Tether then grew to become a cornerstone investor after they bought a Tether-related automobile for €400 million in January.

Notably, the corporate is utilizing these funds to buy superior AI chips from Nvidia Corp., with plans to deploy roughly 20,000 H100 chips by the tip of the summer season.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing