Markets

Nvidia’s 13% Inventory Rout Has Merchants Scouring Charts for Assist

(Lusso’s Information) — Nvidia Corp.’s three-day, $430 billion selloff has merchants turning to technical evaluation for clues on the place the underside could also be.

Most Learn from Lusso’s Information

The inventory has fallen 13% since briefly overtaking Microsoft Corp. final week because the world’s Most worthy firm. That’s pushed Nvidia shares right into a technical correction – when a inventory drops 10% or extra from a current peak — for the primary time since April. The abrupt reversal has included some tell-tale indicators of capitulation, based on Buff Dormeier, chief technical analyst at Kingsview Companions.

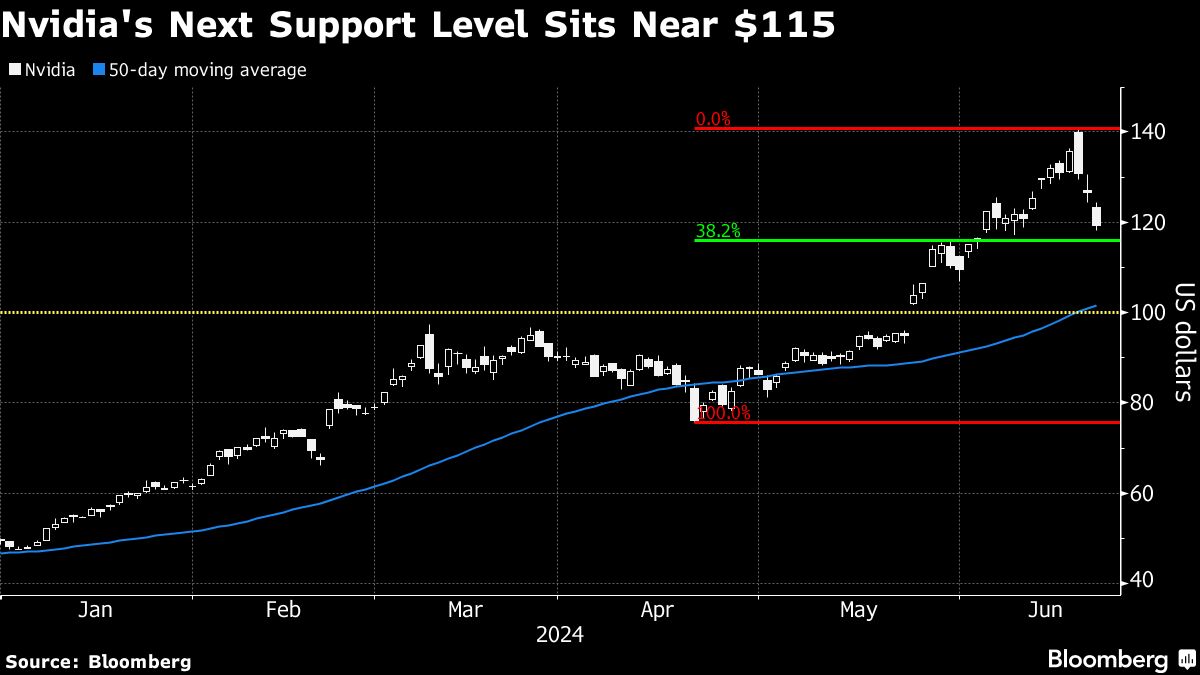

“The truth that that is occurring following all this excellent news — the cut up, changing into the biggest firm — is a priority,” he mentioned, referring to the 10-for-1 inventory cut up introduced final month. Dormeier sees short-term help across the $115 stage, with the subsequent important stage at $100.

The $115 space for Nvidia shares is close to a key Fibonacci retracement stage, a instrument utilized by technical analysts to determine help or resistance strains for shares and different belongings. The 38.2% retracement from the inventory’s intraday low in April to its document excessive final week is about 2% under Monday’s closing worth.

Whereas technical evaluation — which seems to be for perception in historic buying and selling patterns — isn’t exact, it could possibly present a helpful roadmap for traders.

Nvidia has soared this 12 months amid unrelenting demand for its chips that dominate the marketplace for synthetic intelligence computing. The most recent leg of the advance noticed the inventory rise 43% from its Could 22 earnings report and inventory cut up announcement to the June 18 peak when the inventory closed with a market worth of $3.34 trillion, topping Microsoft at $3.32 trillion. Regardless of the three-day drop since then, Nvidia continues to be up 139% this 12 months.

For Ari Wald, head of technical evaluation at Oppenheimer, the longer-term development is extra essential than any particular stage for Nvidia and it stays sturdy with Nvidia nonetheless buying and selling properly above its 50-day transferring common round $101 and 100-day transferring common at $92.

“Sometimes main tops are a course of, with a number of rounds of shopping for and promoting after which worth momentum creeps in and there’s a failure to carry key ranges. We haven’t seen something like that but,” he mentioned in an interview. “That is simply how Nvidia trades.”

Whereas he believes the long-term up development stays intact, like Dormeier, he’s maintaining a tally of the $100 stage.

“For a inventory in an uptrend like Nvidia, breaching that first stage of help wouldn’t be a priority,” mentioned Bruce Zaro, chief technical strategist at Granite Wealth Administration. A drop under $100, nevertheless, could be, he mentioned.

“That will not have long-term implications, however it might sign that you have to be affected person, particularly in a interval the place the market is prone to be risky and have a downward bias as we await the election and the Fed weighing in on charges.”

–With help from Matt Turner.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

3 Inventory-Break up Shares to Purchase Earlier than They Soar as A lot as 243%, In accordance with Choose Wall Avenue Analysts

The recognition of inventory splits has seen a resurgence in recent times. Whereas the process was widespread all through the Nineteen Nineties, it had pale into close to obscurity earlier than having fun with a renaissance over the previous decade. Firms will usually embark on a inventory break up after years of sturdy operational and monetary outcomes have pushed a surging inventory value. The prospect of a inventory break up is mostly a cause for buyers to take a contemporary have a look at the corporate in query — and with good cause.

The sturdy enterprise efficiency that in the end led to the inventory break up within the first place tends to proceed, fueling additional positive factors. Analysis exhibits that corporations that initiated a usually return 25%, on common, within the 12 months following the announcement, in contrast with common will increase of 12% for the S&P 500, in accordance with information compiled by Financial institution of America analyst Jared Woodard.

Listed below are three stock-split shares that also have an extended runway forward, in accordance with choose Wall Avenue analysts.

Nvidia: Implied upside 82%

The primary stock-split inventory with a great deal of upside potential is Nvidia (NASDAQ: NVDA). The corporate has turn into the de facto flag bearer for current advances in synthetic intelligence (AI) because of its pioneering work with graphics processing items (GPUs).

It seems that the identical chips that revolutionized the gaming business work equally properly at dashing information via the ether, making them the primary selection amongst cloud-computing and data-center operators. It additionally accelerates the processing of AI fashions, which helped Nvidia turn into the gold commonplace for generative AI.

For its fiscal 2025 second quarter (ended July 28), Nvidia generated record-quarterly income that soared 122% 12 months over 12 months to $30 billion, delivering diluted earnings per share (EPS) that surged 168% to $0.67. The headliner was a blockbuster efficiency from the corporate’s data-center phase — which incorporates AI chips — as gross sales soared to $26.3 billion, rising 154%.

The rise of AI has fueled a blistering improve in Nvidia’s inventory value, which has gained 716% because the begin of 2023 and led to its viral in June. The inventory has skilled a lull in current months as buyers questioned the endurance of one of many market’s greatest performers, however many on Wall Avenue consider the adoption of AI is simply getting began, a pattern that favors Nvidia.

In an interview on CNBC earlier this month, Niles Funding Administration founder Dan Niles stated he “firmly believes” that over the following a number of years, Nvidia’s income and inventory value will double from present ranges, pushed increased by demand for AI. That means potential positive factors for buyers of 82% in comparison with Wednesday’s closing value.

He is not the one one who believes the longer term is shiny. Of the 60 analysts who lined the inventory in August, 55 rated the inventory a purchase or sturdy purchase, and none advisable promoting.

I’ve made no secret about my bullish tackle Nvidia, predicting that the inventory will high $200 by 2026 — and I stand by that prediction.

Nvidia inventory is at the moment promoting for 39 occasions ahead gross sales. Whereas that may appear lofty at first look, contemplate this: Wall Avenue expects the corporate’s income to extend by 53%, on common, over the approaching 5 years, exhibiting that Nvidia inventory is deserving of a premium.

Sirius XM Holdings: Implied upside of 179%

The second inventory break up with important potential upside is Sirius XM Holdings (NASDAQ: SIRI). The corporate is the ultimate relating to satellite tv for pc radio companies in North America. Sirius has 34 million paying subscribers, and its viewers will increase to 150 million together with its ad-supported Pandora music-streaming service, so its listener base is unequalled.

The excessive ranges of inflation that marked the previous couple of years pressured folks to make robust selections with their disposable earnings, and a few selected to not renew their Sirius subscription. This, mixed with buyers’ basic misunderstanding of its current merger and the ensuing reverse-stock break up, has helped push the inventory down 56% up to now this 12 months. Whereas the outcomes had been weak, the stock-price decline is clearly an overreaction.

In Q2, Sirius’ income slipped 3% 12 months over 12 months to $2.18 billion, whereas EPS of $0.08 was flat. Whereas paid subscribers declined by 100,000 (or roughly 1.5%), this was an enchancment, as its churn price continues to sluggish forward of an anticipated turnaround.

Regardless of the weak spot within the inventory value, some on Wall Avenue consider the promoting was overdone. Benchmark analyst Matthew Harrigan is one such analyst. He maintains a purchase ranking on Sirius XM, with a split-adjusted value goal of $65. That represents potential upside of 179% in comparison with Wednesday’s closing value. The analyst cites a “market dislocation” because of its current merger with monitoring inventory Liberty Sirius XM. He additional believes administration’s “strategic initiatives” will bear fruit.

Moreover, the declining inventory value presents savvy buyers with a compelling valuation. Sirius XM is at the moment promoting for roughly 7 occasions earnings, which elements in little-to-no future progress.

I feel the analyst’s opinion is spot on, because the bettering macroeconomic scenario ought to reignite Sirius XM’s progress, which is able to possible ship the inventory increased.

Tremendous Micro Pc: Implied upside 243%

The ultimate firm in our trio of stock-split shares with room to run is Tremendous Micro Pc (NASDAQ: SMCI), generally known as Supermicro. The corporate has been designing customized servers for greater than 30 years, and the accelerating adoption of AI has taken demand to the following stage.

The key of the corporate’s success is the building-block structure of Supermicro’s rack-scale servers. This permits prospects to design a system that meets their particular wants. Moreover, the corporate is the dominant supplier of servers that includes direct-liquid cooling (DLC), which has turn into nearly desk stakes within the period of AI-focused information facilities. CEO Charles Liang suggests Supermicro’s DLC market share is at the moment between 70% and 80%.

Within the firm’s fiscal 2024 This autumn (ended June 30), Supermicro reported file income that surged 143% 12 months over 12 months to $5.3 billion, which additionally elevated 38% sequentially. The ensuing adjusted EPS jumped 78% to $6.25.

Buyers bought off the inventory within the wake of the report, as considerations concerning the firm’s declining-profit margin sparked a knee-jerk response. Liang stated a change in product combine brought on by part bottlenecks was accountable, a scenario which must be rectified shortly.

Supermicro’s monitor file of sturdy outcomes has pushed its inventory value up 432% since sturdy demand for AI-centric methods kicked off in early 2023. This brought about the corporate to provoke a 10-for-1 inventory break up early final month.

Loop Capital analyst Ananda Baruah maintains a purchase ranking on the inventory and a Avenue-high value goal of $1,500. That represents potential upside of 243% in comparison with Wednesday’s closing value.

The analyst is bullish on Supermicro’s place throughout the AI server market, citing its management relating to scale and complexity. He calculates the corporate’s gross sales will speed up to a run price of $40 billion by the tip of fiscal 2026, increasing on administration’s steering for income of $28 billion in fiscal 2025.

I feel the analyst hit the nail on the top, as Supermicro continues to realize market share on the expense of its rivals.

Many on Wall Avenue concur. Of the 18 analysts who provided an opinion in August, 9 rated the inventory a purchase or sturdy purchase, and none advisable promoting.

Moreover, at 22 occasions earnings and fewer than two occasions gross sales, Supermicro is the very definition of an attractively priced inventory.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Nvidia wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Financial institution of America is an promoting accomplice of The Ascent, a Motley Idiot firm. has positions in Nvidia and Tremendous Micro Pc. The Motley Idiot has positions in and recommends Financial institution of America and Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Hedge funds well-positioned to navigate market swings, says UBS

Lusso’s Information — Hedge funds have proven their worth in defending portfolios throughout occasions of great market volatility, as seen in August 2024.

UBS analysts in a be aware flagged that hedge funds, particularly these utilizing non-directional methods, took benefit of market disruptions whereas additionally defending in opposition to losses in shares and bonds.

With ongoing market uncertainty, hedge funds have gotten extra necessary for managing dangers, boosting returns, and dealing with unpredictable financial situations.

Opposite to expectations of a quiet summer season, August 2024 delivered vital market turbulence. A mix of skinny liquidity, weak U.S. financial information, and geopolitical considerations led to heightened volatility.

The volatility index surged, and world equities skilled sharp sell-offs, with the U.S. 60/40 portfolio declining by 3.1% in simply three days, based on UBS analysts.

225 additionally noticed a dramatic 20% decline, underscoring the fragility of world markets.

“Nevertheless, early August introduced market jitters in opposition to a backdrop of skinny liquidity as a consequence of weak US jobs and manufacturing information, sparking considerations of a “arduous touchdown.,” the analysts stated.

The unwinding of leveraged positions, particularly in Japanese markets, exacerbated the state of affairs and led to vital sell-offs throughout asset lessons.

Whereas conventional long-only portfolios suffered as a consequence of heightened correlations between equities and bonds, hedge funds excelled by providing uncorrelated returns and seizing alternatives introduced by volatility.

UBS flags that hedge funds with decrease market publicity, together with these using fairness market-neutral and various credit score methods, considerably outperformed throughout August’s market swings.

Convertible arbitrage methods, which profit from lengthy volatility profiles, gained 1.1% in August by capitalizing on sharp reversals in market sentiment.

Equally, mounted earnings relative worth methods and credit score hedges contributed positively, with UBS noting that many managers have been in a position to monetize good points from widened spreads earlier than markets rebounded.

Hedge funds not solely provide draw back safety but in addition thrive in environments characterised by market dislocations.

UBS analysts stress that in intervals of volatility, costs usually deviate considerably from their intrinsic values, offering hedge fund managers with distinctive alpha alternatives.

By taking contrarian positions—shopping for undervalued belongings or shorting overvalued securities—hedge funds can revenue as costs revert to their pure averages as soon as markets stabilize.

UBS factors to the success of discretionary macro methods, which navigated August’s turbulence by capitalizing on strikes in world forex and bond markets.

One of many key benefits hedge funds provide is their capacity to offer uncorrelated returns during times of market instability.

As correlations between asset lessons rise throughout occasions of stress, portfolios comprising conventional belongings like shares and bonds develop into extra weak to simultaneous declines.

Hedge funds, nevertheless, are designed to take advantage of inefficiencies out there and benefit from worth dislocations, fairly than merely driving broader market actions.

As per UBS, methods equivalent to world macro, fairness market-neutral, and multi-strategy funds have been significantly efficient in delivering uncorrelated returns, serving to to easy out portfolio efficiency and scale back total threat. These methods enable buyers to take care of publicity to high-risk markets whereas mitigating the affect of sharp sell-offs.

UBS analysts foresee continued volatility within the coming months as central banks modify financial insurance policies, and geopolitical dangers stay elevated. Whereas inflation considerations have eased, financial information continues to fluctuate, and the trail of future Federal Reserve charge cuts stays unsure.

In the meantime, the looming U.S. presidential election is predicted to convey additional political uncertainty, which might drive market swings.

Given these elements, UBS recommends that buyers incorporate hedge fund methods into their portfolios to arrange for future volatility.

Low internet fairness methods, various credit score, world macro, and multi-strategy funds are seen as well-positioned to assist buyers handle dangers and seize alternatives as markets evolve.

Whereas hedge funds current vital alternatives, UBS additionally emphasizes the dangers related to these investments. Hedge funds are sometimes illiquid and will require long-term lock-up intervals.

Moreover, their methods will be complicated, and buyers ought to be ready for potential losses, particularly when leverage is employed.

As such, UBS urges buyers to strategy hedge fund investments inside the context of a well-diversified portfolio and guarantee they’re snug with the related dangers.

Markets

3 Filth Low-cost Shares to Purchase Proper Now

By most metrics, the inventory market is priced at a premium as of late. However that does not imply bargains cannot nonetheless be discovered.

Three Motley Idiot contributors suppose they’ve recognized dirt-cheap healthcare shares to purchase proper now. This is why they picked CRISPR Therapeutics (NASDAQ: CRSP), Gilead Sciences (NASDAQ: GILD), and Pfizer (NYSE: PFE).

You may nonetheless get in on the bottom flooring

(CRISPR Therapeutics): Valuing comparatively small biotech corporations that generate little-to-no income is just not an actual science. Even so, CRISPR Therapeutics, a gene-editing specialist, seems to be low-cost at its present ranges. CRISPR Therapeutics’ market cap is $4.2 billion regardless of the latest approval of Casgevy, a remedy for 2 blood-related illnesses it developed in collaboration with Vertex Prescribed drugs.

CRISPR Therapeutics and Vertex Prescribed drugs are taking a look at a large alternative with Casgevy. The drugs prices $2.2 million within the U.S. They estimate a market of 35,000 sufferers within the U.S. and Europe, with a further 23,000 in some international locations within the Center East the place Casgevy can also be accepted. CRISPR Therapeutics ought to finally generate effectively over $1 billion in gross sales from Casgevy.

The corporate has additionally proven that its gene-editing platform can produce tangible leads to unlocking therapies the place few can be found. There’s a world of alternatives: Loads of situations haven’t any accepted therapies. Many others have a dire want for higher requirements of care. One in all CRISPR Therapeutics’ extra promising tasks is its work in sort 1 diabetes for which the corporate is making an attempt to develop a practical remedy.

In my opinion, CRISPR Therapeutics is a biotech large within the making. Casgevy will convey within the funds that may assist it push its gene-editing platform ahead. Within the subsequent 5 years, anticipate extra essential scientific and regulatory progress from the corporate. Although CRISPR Therapeutics has delivered sturdy returns since its 2016 preliminary public providing (IPO), for the biotech, at the very least for traders keen to be affected person.

Gilead Sciences may make for an underrated development inventory

David Jagielski (Gilead Sciences): What’s a high pharmaceutical inventory you will not wish to overlook proper now? Gilead Sciences. Whereas its single-digit (and generally detrimental) development charge could look unimpressive over the previous few years, the corporate does possess some promising catalysts which may result in stronger numbers sooner or later. Plus, it pays an awesome dividend which yields 3.7% — practically thrice higher than the S&P 500 common of 1.3%.

Gilead Sciences just lately introduced that lenacapavir, its twice-yearly HIV remedy, was extremely efficient in stopping HIV. It dramatically decreased infections by 96% in a section 3 trial. Analysts estimate that the drug, which is already accepted to deal with individuals who have multidrug-resistant HIV, may generate $4 billion in gross sales at its peak. That might be a substantial revenue-generating product for the enterprise as final 12 months Gilead’s gross sales topped $27 billion.

Lenacapavir may do wonders for the corporate’s HIV enterprise, which has been Gilead’s slowest rising of late. By way of the primary six months of 2024, HIV gross sales rose by simply 3% 12 months over 12 months to $9.1 billion. Whereas that is nonetheless the corporate’s largest phase, development charges in liver illness (13%) and oncology (17%) have been each far larger throughout that time-frame and likewise symbolize thrilling development alternatives for the enterprise sooner or later.

Though Gilead’s shares are up just a little this 12 months, the biotech inventory trades at a lowly 12 occasions its estimated future income (primarily based on analyst expectations). For long-term traders, this might be a superb inventory to purchase and maintain.

Greater than meets the attention

Keith Speights (Pfizer): Pfizer has been a giant loser lately, though it has eked out a meager acquire in 2024. Nevertheless, I imagine there’s greater than meets the attention with this huge drugmaker.

You may blame a lot of Pfizer’s woes on the declining gross sales of its COVID-19 merchandise. I do not anticipate the corporate will ever once more see the booming numbers of 2021 and 2022. However I additionally suppose 2024 might be a trough 12 months for Pfizer’s COVID-19 vaccine gross sales.

The opposite huge problem for the corporate is the approaching patent expirations for a number of of its high merchandise. Sadly for Pfizer, the record consists of blockbuster medicine Eliquis, Ibrance, Vyndaqel, Xeljanz, and Xtandi.

Pfizer is not being blindsided by this patent cliff, although. It has invested in creating new merchandise, with respiratory syncytial virus (RSV) vaccine Abrysvo particularly standing out. The corporate has additionally used the large money generated from its COVID-19 vaccine throughout the worst of the pandemic to fund key acquisitions, together with its 2023 buy of Seagen. In consequence, Pfizer ought to have the ability to ship stable development within the coming years regardless of dropping patent exclusivity for a number of merchandise.

In the meantime, the pharma inventory is priced at a reduction. Pfizer’s shares commerce at solely 10.6 occasions ahead earnings. That is a lot decrease than the S&P 500 healthcare sector’s forward-earnings a number of of 19.6.

In the event you’re in search of one more reason to purchase this dirt-cheap inventory, take a look at its dividend. Pfizer provides a forward-dividend yield of 5.65%. Even higher, the corporate’s administration stays dedicated to rising its dividend payout over time.

Must you make investments $1,000 in CRISPR Therapeutics proper now?

Before you purchase inventory in CRISPR Therapeutics, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for traders to purchase now… and CRISPR Therapeutics wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $722,320!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. has positions in Pfizer and Vertex Prescribed drugs. has positions in Vertex Prescribed drugs. The Motley Idiot has positions in and recommends CRISPR Therapeutics, Gilead Sciences, Pfizer, and Vertex Prescribed drugs. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024