Markets

Nvidia (NASDAQ:NVDA): Sure, This Inventory Additionally Goes Down

As Nvidia (NASDAQ:NVDA) inventory , wide-eyed traders are beginning to understand that this inventory truly goes down generally. It’s a surprising improvement as a result of chasing the inventory larger has been a worthwhile technique for an extended. But, some inventory merchants will be taught that Nvidia isn’t invincible. Certain, it’s nonetheless a extremely worthwhile firm, however I’m impartial on NVDA inventory till the share worth pulls again extra.

Nvidia designs highly effective processors that can be utilized in synthetic intelligence (AI) functions. The corporate is a darling of the inventory market, and as we’ll focus on quickly, analysts are typically enamored with Nvidia.

But, there’s truly a Wall Avenue skilled who dares to assign a destructive score to Nvidia inventory (we’ll get to that subject in a second). I received’t go full-on bearish, as I’m impartial and solely wish to see Nvidia’s market capitalization and valuation come down considerably. To me, it’s a case of “proper firm, proper inventory, unsuitable worth.”

Nvidia Might Conquer One other Area of the World

In case Nvidia wasn’t already world-dominating, the corporate is reportedly making an enormous transfer within the Center East quickly. There, owned by Qatar-based telecom agency Ooredoo.

Extra particularly, Ooredoo’s information facilities in Qatar, Algeria, Tunisia, Oman, Kuwait, and the Maldives could have entry to sturdy AI and graphics-processing expertise, courtesy of Nvidia. Presently, the monetary particulars of the Nvidia-Ooredoo settlement are unknown.

This settlement comes at a politically contentious time, to say the least. The U.S. authorities may not be too pleased in regards to the Nvidia-Ooredoo deal because of issues that Center Japanese international locations might doubtlessly present an avenue for China to get high-powered AI processors.

The U.S. can place restrictions on its exports of subtle AI chips to China, however it will possibly’t management what each firm does in each nation. So, it will likely be attention-grabbing to see if there are any repercussions from the association between Nvidia and Ooredoo. In the meanwhile, although, it’s in all probability cheap to conclude that Nvidia will plant its proverbial flag within the Center East and thereby acquire entry to new income streams.

A Dissenting Voice on Nvidia Inventory

To be truthful and balanced, I began off with a bit of excellent information for Nvidia’s shareholders. Nonetheless, not everyone seems to be straight-up bullish about Nvidia inventory. There’s a real contrarian voice on the market on Wall Avenue, as investor and blogger Johnny Zhang truly went as far as to .

Is it even authorized to do that in 2024? Zhang could also be responsible of stock-market blasphemy, as Nvidia is seen as an unassailable and invulnerable juggernaut of the white-hot AI {hardware} market.

Alternatively, I are likely to concur with Zhang’s causes for leaning bearish on Nvidia inventory. The market’s expectations about Nvidia’s future development could also be “overly optimistic, with potential dangers together with pull-forward demand, competitors, and geopolitical tensions,” Zhang defined.

Nvidia doesn’t at the moment have a lot “competitors” within the area of interest marketplace for AI-compatible graphics processing models (GPUs), nevertheless it’s laborious for one firm to be the king of the hill. In such a profitable trade, it shouldn’t be too stunning if rival upstarts come out of the woodwork, and they won’t all be from the U.S.

Nonetheless, in the intervening time, traders in all probability don’t must be overly involved about Nvidia dealing with stiff competitors. Reasonably, it’s the corporate’s valuation and the overwhelmingly enthusiastic market sentiment that must concern the Nvidia perma-bulls.

On that subject, a quote from Zhang actually resonated with me. “Have in mind… the Wall Avenue touts at all times encourage you to be most bullish on shares when they’re sizzling or portrayed as the following huge factor sooner or later,” he warned.

That quote is value writing down and remembering. Now, Nvidia inventory is displaying indicators of exhaustion, nevertheless it nonetheless trades at 65.6x trailing 12-month earnings (based mostly on ). In the meantime, the sector median P/E ratio is 23.5x.

Is Nvidia Inventory a Purchase, In keeping with Analysts?

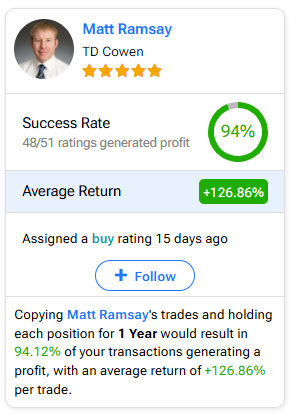

On TipRanks, NVDA is available in as a Robust Purchase based mostly on 38 Buys and three Maintain rankings assigned by analysts up to now three months. The is $156.35, implying 32.4% upside potential.

In the event you’re questioning which analyst it’s best to observe if you wish to purchase and promote NVDA inventory, probably the most worthwhile analyst overlaying the inventory (on a one-year timeframe) is Matt Ramsay of TD Cowen, with a median return of 126.86% per score and a 94% success price. Click on on the picture under to be taught extra.

Conclusion: Ought to You Take into account Nvidia Inventory?

Nvidia is a niche-market juggernaut, and there’s no level in making an attempt to disclaim this. On the identical time, I agree with Zhang that the market could also be “overly optimistic” relating to Nvidia’s future development assumptions.

Many analysts nonetheless like Nvidia lots, and I don’t blame them. As I see it, investing in Nvidia might make loads of sense, however not on the present share worth. Due to this fact, I’m impartial on NVDA inventory and would wish to see it pull again 20% and even 25% earlier than contemplating taking a share place.

Markets

Neglect Nvidia: This Different Inventory Could Finish Up Being the Most Vital Knowledge Middle Alternative of All, and It's Not a Expertise Firm

When you consider synthetic intelligence (AI), issues equivalent to self-driving vehicles and humanoid robots may come to thoughts. Counterintuitively, it is usually a good suggestion to consider how merchandise are literally delivered to life every time a brand new large development emerges. A number of the most profitable alternatives are additionally usually the least apparent ones.

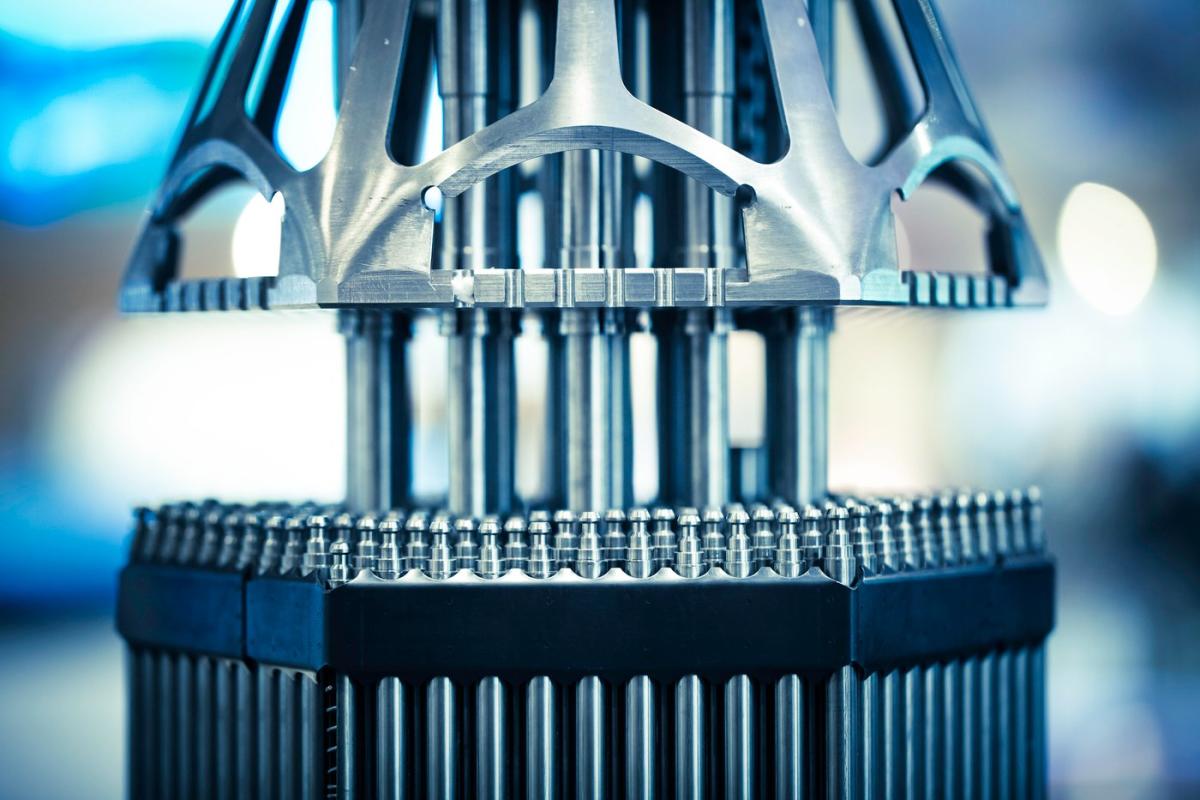

For AI to even work correctly, firms have to take a position massive sums of into information facilities. Though information facilities may seem to be only a piece of actual property, they’re much more refined and essential. They home essential IT infrastructure, equivalent to chipsets often called graphics processing items (GPUs) — an essential element of generative AI purposes.

At present, Nvidia is among the largest names within the information middle realm. However what if I instructed you I see one other alternative because the superior alternative amongst information middle investments and that it isn’t even a expertise firm?

It is essential to contemplate all choices — even probably the most tangential ones. Let’s dig right into a nuclear power inventory that I feel could find yourself being crucial information middle firm in the long term and discover why this could possibly be a profitable alternative for buyers.

Nuclear-powered information facilities are on the rise, and…

A significant promoting level of AI is that the expertise can deliver a brand new wave of effectivity to a bunch of use instances. From breakthroughs in enterprise software program to self-driving vehicles, AI is promising a brand new stage of productiveness and security that is by no means been witnessed.

Though that sounds nice, as with all issues, AI comes with some main trade-offs. Particularly, constructing AI purposes is an expensive ambition. GPU {hardware} and high-performance computing software program are among the extra apparent bills in AI growth. One of many extra refined prices in an AI roadmap resides with information facilities, notably their power consumption.

GPUs are continually operating advanced algorithms and performing refined computing duties. This makes and, specifically, give off a variety of warmth. Knowledge facilities are outfitted with numerous temperature management protocols, equivalent to air con items, followers, and turbines.

Nevertheless, these options are each expensive and could be inefficient in comparison with different sources of power management. An rising development on the crossroads of information facilities and power consumption is nuclear energy, and a few actually notable firms and enterprise leaders are getting concerned.

…a variety of large names are concerned

One notable firm concerned with nuclear-powered information facilities is Amazon. One of many largest companies in Amazon’s ecosystem is its cloud computing platform, Amazon Net Providers (AWS). Earlier this 12 months, AWS acquired a nuclear-powered information middle from Talen Power for a reported $650 million.

One other participant rising on the nuclear energy scene is Oklo. Oklo develops nuclear fission reactors that it goals to promote to information facilities and utility firms.

When it was nonetheless a personal firm, Oklo raised funding from Peter Thiel and OpenAI co-founder Sam Altman. Just a few months in the past, Oklo went public via a particular function acquisition firm (SPAC).

In line with its investor presentation, the corporate has obtained curiosity for its reactors from main firms, together with Diamondback Power, Equinix, Siemens Power, and even the U.S. Air Power.

Whereas this caliber of consideration and Altman’s assist are spectacular, I see Oklo as a dangerous guess in the meanwhile. The corporate continues to be pre-revenue, and the potential offers referenced above are in early-stage negotiations.

Oklo will seemingly require hefty ongoing analysis and growth (R&D) prices to construct out its reactors, which is able to take a toll on the corporate’s liquidity as long as there aren’t materials gross sales coming via the door.

My prime decide on the intersection of nuclear power and information facilities is…

My best choice amongst nuclear energy suppliers for information facilities is Constellation Power (NASDAQ: CEG). The corporate presents a bunch of power companies however is making sustainability and nuclear power a selected focus.

One of many firm’s recognized nuclear energy prospects is “Magnificent Seven” member Microsoft. Throughout the firm’s second-quarter earnings name in late August, CEO Joseph Dominguez referenced Comcast and Johns Hopkins as different notable prospects of Constellation’s carbon-free power companies.

Different mega-cap tech firms will seemingly comply with Amazon and Microsoft’s strikes. Constellation’s various buyer base alerts that inexperienced power isn’t just a use case for information facilities or large tech hyperscalers.

Buyers with a long-term horizon could need to take into account a place in Constellation Power proper now. I feel nuclear power options will grow to be extra mainstream because the AI revolution continues to evolve. Given how early the AI narrative appears to be, I feel a possibility equivalent to Constellation Power is basically missed or underappreciated — making it a tempting purchase amongst different alternatives in AI, information facilities, and power consumption.

Must you make investments $1,000 in Constellation Power proper now?

Before you purchase inventory in Constellation Power, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Constellation Power wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has positions in Amazon, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Amazon, Constellation Power, Equinix, Microsoft, and Nvidia. The Motley Idiot recommends Comcast and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Tips on how to play the AI Enterprise Software program revolution

Lusso’s Information — The AI enterprise software program revolution is remodeling enterprise operations, with corporations more and more positioning themselves to capitalize on this pattern.

In a current be aware, Truist Securities analysts highlighted that companies are integrating AI applied sciences throughout their software program stacks to boost productiveness, information administration, and cybersecurity. Central to this shift is the rising affect of generative AI (GenAI), anticipated to affect each infrastructure and utility layers of enterprise software program.

In line with the report, corporations fall into two major classes on the subject of benefiting from AI: these straight capturing AI workloads and people leveraging the know-how to boost their merchandise.

Microsoft Company (NASDAQ:), MongoDB (NASDAQ:), and Snowflake Inc (NYSE:) are cited as key gamers anticipated to realize from AI workloads, largely attributable to their information infrastructure capabilities and partnerships with main AI suppliers.

Regardless of current market challenges, Snowflake is considered as a possible long-term winner, as its information warehousing is more and more acknowledged as a core know-how for AI initiatives. MongoDB can also be well-positioned, particularly with its vector storage and search capabilities crucial for AI purposes.

Within the utility software program area, Truist Securities highlights potential winners in three key areas: “choose and shovel” performs, core platform distributors benefiting from improve cycles, and distributors embedding AI to boost productiveness. Corporations like Salesforce Inc (NYSE:) and Smartsheet Inc (NYSE:) are anticipated to capitalize on these developments as enterprises more and more flip to AI-driven options to streamline workflows and enhance effectivity.

In the meantime, corporations comparable to Palo Alto Networks Inc (NASDAQ:), CrowdStrike Holdings Inc (NASDAQ:), and Datadog Inc (NASDAQ:) are seen leveraging AI to boost their product choices, notably in cybersecurity.

Truist notes that Palo Alto Networks has already demonstrated vital AI-driven income development, surpassing $200 million in annual recurring income from its AI merchandise. As AI adoption rises, demand for AI-augmented safety instruments is predicted to extend, increasing the marketplace for corporations on this area.

Whereas AI funding continues to develop, Truist Securities notes that the timeline for realizing vital worth from AI has prolonged. Initially projected for 2024, many enterprises now anticipate AI-driven purposes to realize traction by 2025. Regardless of this delay, over 70% of companies surveyed anticipate allocating 5% or extra of their 2024 software program budgets to AI initiatives, underscoring the continuing dedication to AI funding.

Generative AI, whereas garnering a lot consideration, is predicted to symbolize solely a small portion of the broader AI market. By 2027, Truist Securities forecasts that generative AI will account for lower than 10% of the estimated $900 billion AI market. This means that whereas the concentrate on generative AI is important, different areas—comparable to information administration, cybersecurity, and infrastructure—will current extra substantial long-term alternatives.

A key problem highlighted within the report is the scarcity of expert expertise and sources to implement AI initiatives successfully. This, coupled with rising regulatory scrutiny surrounding AI governance and compliance, might pose hurdles for widespread AI adoption within the enterprise area.

Markets

Why Novo Nordisk Inventory Fell Whereas Eli Lilly and Viking Therapeutics Bumped Increased At this time

Within the pharmaceutical world, it is by no means good for an organization to stumble in a sizzling therapeutic space, particularly if it has some decided rivals competing in the identical section.

That was the dynamic behind Wegovy and Ozempic developer Novo Nordisk‘s (NYSE: NVO) Friday detect the inventory alternate –following its newest information from the lab — and the good points loved that day by up-and-coming Viking Therapeutics (NASDAQ: VKTX) and pharmaceutical titan Eli Lilly (NYSE: LLY). Novo Nordisk’s inventory worth declined by almost 6% on the day, whereas the 2 gainers rose 3.4% and 0.7%, respectively.

Negative effects reported for investigational drug

The information merchandise from Novo Nordisk that was so impactful was the readout from a medical trial of monlunabant, an investigational therapy it is testing for weight problems. In a part 2a medical trial involving 243 individuals, the drug confirmed efficacy in producing weight reduction with every day 10 milligram doses– sufferers taking it shed a mean of seven.1 kilograms (15.7 kilos), in comparison with solely 0.7 kilograms (1.5 kilos) with a placebo.

The sufferers had been divided into 4 teams, certainly one of which was administered the placebo. The opposite three acquired completely different doses of the treatment, particularly 10 milligrams, 20 milligrams, and 50 milligrams.

Nevertheless, monlunabant demonstrated some regarding unintended effects within the trial. Novo Nordisk mentioned that the most typical of those had been of a gastrointestinal nature. The severity of most was gentle to reasonable and was dose-dependent. The corporate added that there have been extra frequent occurrences of neuropsychiatric unintended effects akin to nervousness and sleep disruption. Once more, these had been dose-dependent.

Whereas touting the drug’s potential for weight reduction, in its press launch on the outcomes Novo Nordisk admitted that “additional work is required to find out the optimum dosing to stability security and efficacy.”

The corporate mentioned it goals to maneuver to a part 2b trial with a view to “additional examine dosing and the security profile of monlunabant over an extended period in a worldwide inhabitants.”

Weight reduction for revenue acquire

Irrespective of how efficacious a drug could also be, if it produces a sequence of worrying unintended effects it has fairly a diminished probability of profitable approval from regulators.

So with Novo Nordisk’s efficient “again to the drafting board,” information of monlunabant, traders cautiously pulled out of the Denmark-based firm to the good thing about Eli Lilly and Viking. The previous already has a weight reduction drug permitted and in the marketplace, Zepbound (principally its Mounjaro diabetes therapy permitted for weight problems), whereas Viking’s candidate has produced extremely encouraging ends in part 1 and a pair of medical trials.

Of the 2, traders must be extra excited for Eli Lilly’s prospects within the section. Not solely is Zepbound extensively out there for qualifying sufferers, it is being bought by one of the deep-pocketed and resource-rich on the planet. Viking’s therapy, in addition to it is carried out within the lab, nonetheless has a ways to go earlier than it may be thought-about for approval — assuming, after all, that it will get that far.

Do you have to make investments $1,000 in Novo Nordisk proper now?

Before you purchase inventory in Novo Nordisk, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Novo Nordisk wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $722,320!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot recommends Novo Nordisk. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024