Markets

Billionaires Simply Poured About $67 Billion Into These 5 Synthetic Intelligence (AI) Shares

has the ability to revolutionize our lives — a minimum of if massive tech is to be believed. Loads of merchandise already hit the market, like ChatGPT, and whereas they’ve made a splash, the know-how’s true affect has but to be felt. That promise of extra to come back is driving unimaginable development for firms concerned in AI.

High fund managers are snapping up shares of those companies as they attempt to seize as a lot worth from the know-how’s explosive development as attainable. Funds with greater than $100 million in property below administration have to report their trades each quarter to the Securities and Trade Fee on kind 13F. Fortunate for us, it is public information.

Figuring out the place the “good cash” is flowing will help you make sound choices, but it surely ought to solely be a part of your data gathering. It seems that the good cash is not at all times so good — and apart from, there are many managers promoting shares of the entire following 5 shares.

1. Nvidia

To maybe nobody’s shock, the corporate with probably the most hedge-fund buys was Nvidia (NASDAQ: NVDA). It captured the investing world’s creativeness after positioning itself because the go-to chipmaker for all issues AI.

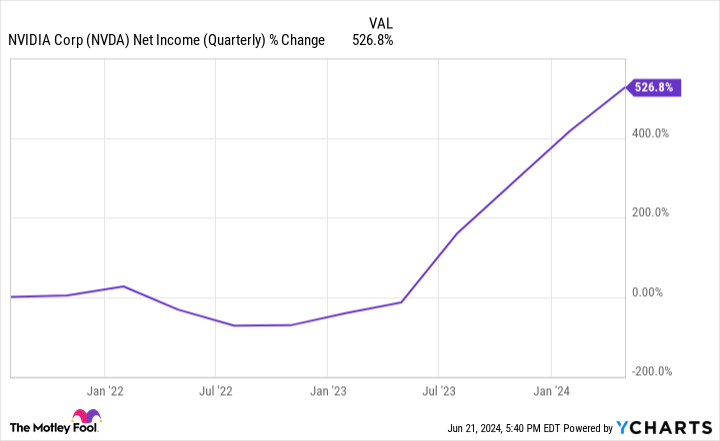

and it is carried out all of it whereas holding prices comparatively low. The chart beneath measuring the expansion of its internet earnings over the previous three years reveals the purpose the place AI took off.

Fund managers purchased $15.9 billion value of shares final quarter. The largest purchases have been $6.2 billion from Vanguard and $1.8 billion by BlackRock.

2. Amazon

Certainly one of my favourite AI performs, Amazon (NASDAQ: AMZN), runs the biggest cloud computing operation on the earth, Amazon Internet Service (AWS), controlling over 30% of the cloud market and is investing closely to take care of this share. It companions with Nvidia to outfit its knowledge facilities with the newest and strongest chips, and it put $4 billion into OpenAI competitor Anthropic.

Fund managers purchased $14.4 billion value of shares final quarter. The largest purchases have been $2.5 billion (Vanguard) and $1.9 billion (BlackRock).

3. Microsoft

One other stable AI play, Microsoft (NASDAQ: MSFT), backs OpenAI, the maker of the preferred AI software, ChatGPT. When OpenAI launched ChatGPT-3 to the general public, it turned probably the most rapidly adopted know-how in historical past. For a lot of the general public, ChatGPT is so far as their information of AI goes, unaware of Anthropic’s providing or Alphabet‘s.

Microsoft is No. 2 within the cloud and has been slowly consuming into AWS’ market share. Its partnership with OpenAI means Microsoft has the most-used AI software on the earth on its servers. And Microsoft can be outfitting them with Nvidia chips.

Fund managers purchased $13.1 billion value of shares final quarter. The largest purchases have been $2.8 billion (BlackRock) and $1.3 billion from Geode Capital Administration.

4. Apple

This one is completely different from the earlier three. Apple (NASDAQ: AAPL) shares slid for a lot of final 12 months as traders fearful it had fallen behind in AI.

However the firm lastly jumped on board this month, unveiling Apple Intelligence, its cleverly named AI providing. Its merchandise may have all kinds of AI enhancements (perhaps now Siri will really know what I ask her to do).

Crucially, the enhancements would require an excessive amount of computing energy for a lot of older merchandise in Apple’s lineup, forcing customers to improve to the newest (and costliest) fashions. This can assist enhance the corporate’s sagging iPhone gross sales, a vital a part of its backside line.

Fund managers purchased $11.8 billion value of shares final quarter. The largest purchases have been $1.3 billion (Geode Capital) and $983.9 million by Lazard.

5. Broadcom

Like Nvidia, Broadcom (NASDAQ: AVGO) provides {hardware} to the AI trade. They do not compete face to face, leaving Nvidia to dominate the core chip market. However one of the vital essential elements in AI knowledge facilities is the one that permits all of these chips to speak to at least one one other quick sufficient and seamlessly, which is the place Broadcom is available in. Broadcom is a high designer, producer, and provider of semiconductor and infrastructure software program merchandise. Its product choices serve the information middle, networking, software program, broadband, wi-fi, storage, and industrial markets.

The corporate additionally made some key acquisitions which have pushed immense development, because the income chart beneath reveals. (It additionally signifies an inflection level near the one in Nvidia’s chart above.)

Fund managers purchased $11.8 billion value of shares final quarter. The largest purchases have been $1.6 billion (Vanguard) and $1.5 billion from Jennison Associates.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for traders to purchase now… and Nvidia wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $775,568!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Microsoft, and Nvidia. The Motley Idiot recommends Broadcom and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Reality Social's Inventory Retains Sliding This Week. Right here's Why

Key Takeaways

-

Shares of Reality Social’s guardian firm fell Thursday, extending the inventory’s newest spherical of declines.

-

The inventory traded as excessive as $70 shortly after its public itemizing via a merger with a blank-check firm in March. It is now round $15.

-

This week, investor consideration has turned to the anticipated finish of a lock-up interval for former President Trump and different insiders.

Shares of Reality Social’s guardian firm fell Thursday, extending the most recent spherical of declines for Trump Media & Expertise Group (DJT) because it took its present kind in late March.

The inventory traded as excessive as $70 shortly after via a merger with a in March, however shares have been on a comparatively constant downward trajectory since then.

They rose after former President Donald Trump’s June debate with President Joe Biden and on Trump. The substitute of Biden with Vice President Kamala Harris atop the Democratic ticket and the primary Harris-Trump debate have in the meantime weighed on the inventory. The shares completed Thursday slightly below $15.

Trump Denies Intent To Promote DJT Inventory

This week, investor consideration has turned to a different occasion: the anticipated finish of a that has prevented Trump, an organization director, and a number of other different insiders from promoting their shares. Trump owned almost 60% of the corporate’s excellent inventory as of an August regulatory submitting.

Final week, Trump in statements indicated his help for DJT inventory. “It’s my intention to personal this inventory for an extended time period,” he wrote on Reality Social on Friday. And in a televised interview that very same day, he stated, “I don’t need to promote my shares. I’m not going to promote my shares.”

DJT inventory has steadily fallen this week. It completed Thursday off almost 6%.

Learn the unique article on .

Markets

Broad Avenue Realty CEO acquires $3.2k in firm inventory

Broad Avenue Realty, Inc. (NASDAQ:BRST) CEO Michael Z. Jacoby has not too long ago elevated his stake within the firm by means of the acquisition of further shares. On September 17, Jacoby bought 13,750 shares of Broad Avenue Realty at a weighted common value of $0.23 per share. The entire funding for these newly acquired shares amounted to roughly $3,162.

This buy was made in a number of transactions with costs starting from $0.17 to $0.30, demonstrating the CEO’s dedication to the corporate throughout a interval of various share costs. Following this transaction, Jacoby now instantly holds a complete of three,675,303 shares in Broad Avenue Realty.

Moreover, it is famous that there are 57,125 shares held not directly by Jacoby’s partner. Nonetheless, Jacoby has disclaimed helpful possession of those securities, and this submitting shouldn’t be taken as an admission of helpful possession for any authorized functions.

Buyers usually look to insider shopping for as an indication of confidence within the firm’s future prospects. The current acquisition by the CEO of Broad Avenue Realty could also be interpreted by the market as a optimistic sign, underlining the management’s perception within the agency’s worth and potential.

For these all in favour of Broad Avenue Realty’s company actions and insider transactions, the main points of this newest growth at the moment are publicly accessible for overview.

In different current information, Sachem Capital (NYSE:) Corp. has appointed Jeffery C. Walraven to its Board of Administrators. Walraven, scheduled for election on the 2024 Annual Assembly of Shareholders, boasts a wealth of expertise in actual property and public firm management. His earlier roles embody co-founding and serving as Chief Working Officer of Freehold Properties, Inc., and holding an impartial director and audit committee member function at Broad Avenue Realty, Inc. since 2023. John L. Villano, CEO and Chairman of Sachem Capital, expressed confidence in Walraven’s potential to contribute to the corporate’s development and shareholder worth creation. Brian Prinz, impartial director and Chair of the Nominating and Company Governance Committee, underscored Walraven’s public firm accounting and company finance experience as aligning with the qualities searched for in a brand new impartial Board member. These are current developments from Sachem Capital, an organization specializing in originating, underwriting, funding, servicing, and managing a portfolio of first mortgage-secured loans.

Lusso’s Information Insights

Broad Avenue Realty, Inc. (NASDAQ:BRST) has been attracting consideration not just for insider transactions but additionally for its monetary efficiency and market habits. In keeping with Lusso’s Information information, Broad Avenue Realty has demonstrated a excessive return over the past month, with a 38.83% improve in its value whole return. This spectacular short-term efficiency is additional highlighted by a considerable 19.05% value whole return prior to now week alone. Such metrics point out a powerful current uptrend within the firm’s share value, aligning with CEO Michael Z. Jacoby’s current share purchases.

Regardless of a difficult year-to-date efficiency with a 72.22% decline, the corporate has proven resilience with a gross revenue margin of 67.48% within the final twelve months as of Q2 2024. This means that whereas Broad Avenue Realty has confronted headwinds, it maintains a powerful skill to generate revenue from its revenues. Moreover, the corporate has achieved a 17.65% development in EBITDA throughout the identical interval, which can be a sign of bettering operational effectivity.

An Lusso’s Information Tip price noting is that Broad Avenue Realty is buying and selling at a low Value / Ebook a number of of 0.95, as of the final twelve months ending Q2 2024. This metric can usually be interpreted because the market valuing the corporate’s property conservatively, which could possibly be of curiosity to value-oriented buyers looking for potential funding alternatives.

For readers all in favour of a deeper evaluation, there are further Lusso’s Information Ideas accessible, which offer insights corresponding to the corporate’s earnings multiples and its inventory value motion in relation to market tendencies. Specifically, Broad Avenue Realty is famous for shifting usually in the other way of the market, which could possibly be a consideration for buyers on the lookout for diversification advantages. To discover the following tips additional, go to https://www.investing.com/professional/BRST, the place a complete of 12 Lusso’s Information Ideas are listed, providing a complete view of the corporate’s monetary well being and market efficiency.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

FedEx quarterly revenue disappoints as demand for quick supply wanes

(Reuters) -FedEx lowered its full-year income forecast and missed Wall Avenue estimates for first-quarter revenue on Thursday as prospects continued to commerce down from speedy, expensive supply to cheaper, slower choices.

Shares within the Memphis-based supply big have been down practically 10% to $271 in after-hours buying and selling.

Income at FedEx and rival United Parcel Service have been eroding as less-profitable packages fill their networks.

On the similar time, FedEx is restructuring with executives slashing billions of {dollars} in overhead prices as in addition they merge its separate Floor and Specific supply models.

Value cuts did not offset the drag from weak demand for the profitable precedence companies and one fewer working day within the newest quarter, FedEx stated.

The corporate now expects income for fiscal 2025 to develop by a low single-digit share, in comparison with its prior expectations of low- to mid-single digit share development.

FedEx additionally lowered the highest finish of its full-year adjusted working revenue to between $20 and $21 per share, in contrast with its prior forecast of $20 to $22 per share.

On an adjusted foundation, the corporate earned $3.60 per share. Analysts had anticipated a revenue of $4.76 per share, in response to LSEG knowledge.

FedEx is winding down contract work for america Postal Service, its largest buyer, and expects a $500 million headwind from the lack of the contract within the present fiscal yr.

FedEx’s unprofitable USPS air contract, which accounted for about $1.75 billion in income to FedEx through the postal service’s newest fiscal yr, will finish on Sept. 29. Rival UPS picked up that enterprise.

Executives are additionally assessing whether or not to spin off or promote its FedEx Freight enterprise.

(Reporting by Lisa Baertlein in Los Angeles and Ananta Agarwal in Bengaluru; Enhancing by Shounak Dasgupta and Lisa Shumaker)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now