Markets

US probing China Telecom, China Cell over web, cloud dangers

By Alexandra Alper

WASHINGTON (Reuters) -The Biden administration is investigating China Cell (NYSE:), China Telecom (NYSE:) and China Unicom (NYSE:) over issues the companies might exploit entry to American knowledge by means of their U.S. cloud and web companies by offering it to Beijing, three sources acquainted with the matter stated.

The businesses nonetheless have a small presence in the US, for instance, offering cloud companies and routing wholesale U.S. web visitors. That offers them entry to Individuals’ knowledge even after telecom regulators barred them from offering phone and retail web companies in the US.

The Chinese language corporations and their U.S.-based attorneys didn’t reply to requests for remark. The Justice Division declined to remark and the White Home referred inquiries to Commerce, which declined to remark. The Chinese language Embassy in Washington stated it hopes the US will “cease suppressing Chinese language corporations beneath false pretexts,” including that China will proceed to defend the rights and pursuits of Chinese language corporations.

Reuters discovered no proof the businesses deliberately offered delicate U.S. knowledge to the Chinese language authorities or dedicated every other sort of wrongdoing.

The investigation is the newest effort by Washington to stop Beijing from exploiting Chinese language companies’ entry to U.S. knowledge to hurt corporations, Individuals or nationwide safety, as a part of a deepening tech battle between the geopolitical rivals. It reveals the administration is attempting to close down all remaining avenues for Chinese language corporations already focused by Washington to acquire U.S. knowledge.

Regulators haven’t but made choices about find out how to tackle the potential risk, two of the individuals stated. However, geared up with the authority to probe web companies bought into the U.S. by corporations from “overseas adversary” nations, regulators might block transactions permitting them to function in knowledge facilities and route knowledge for web suppliers, the sources stated.

Blocking key transactions, in flip, might degrade the Chinese language companies’ skill to supply aggressive American-facing cloud and web companies to world prospects, crippling their remaining U.S. companies, consultants and sources stated.

“They’re our chief world adversary and they’re very refined,” stated Doug Madory, an web routing knowledgeable at web evaluation agency Kentik. “I feel (U.S. regulators) wouldn’t really feel like they had been doing their job in the event that they weren’t attempting to shore up each threat.”

ROUTING THROUGH CHINA

China Telecom, China Cell and China Unicom have lengthy been in Washington’s crosshairs. The FCC denied China Cell’s utility to supply phone service in 2019 and revoked China Telecom and China Unicom’s licenses to do the identical in 2021 and 2022 respectively. In April, the FCC went additional and barred the businesses from offering broadband service. A spokesman for the FCC stated the company stands by its issues.

One issue within the FCC’s choice was a 2020 report from different U.S. authorities businesses that beneficial revoking China Telecom’s license to supply U.S. phone service. It cited a minimum of 9 situations the place China Telecom misrouted web visitors by means of China, placing it vulnerable to being intercepted, manipulated or blocked from reaching its meant vacation spot.

“China Telecom’s U.S. operations… present Chinese language government-sponsored actors with openings to disrupt and misroute U.S. knowledge and communications visitors,” authorities stated on the time.

The telecoms firm sought to reverse the FCC choice, however a U.S. appeals courtroom rejected its arguments, noting that the businesses offered “compelling proof that the Chinese language authorities might use Chinese language data know-how companies as vectors of espionage and sabotage.”

ACCESS POINTS, CLOUD UNDER SCRUTINY

The Chinese language telecoms corporations’ attain extends deep contained in the U.S. web infrastructure.

In response to its web site, China Telecom has 8 American Factors of Presence (PoPs) that sit at web alternate factors, which permit large-scale networks to attach to one another and share routing data.

China Telecom didn’t reply to requests for remark about its U.S. based mostly PoPs.

In response to the FCC, there are “severe nationwide safety and legislation enforcement dangers” posed by PoPs when operated by companies that pose a nationwide safety threat. In circumstances the place China Telecom’s PoPs reside in web alternate factors, the corporate “can doubtlessly entry and/or manipulate knowledge the place it’s on the popular path for U.S. buyer visitors,” the FCC stated in April.

Invoice Woodcock, govt director of Packet Clearing Home, the intergovernmental treaty group which is accountable for the safety of essential Web infrastructure, stated visitors flowing by means of these factors can be susceptible to metadata evaluation, which may seize key details about the information’s origin, vacation spot, measurement and timing of supply. In addition they would possibly permit for deep packet inspection, the place events can glimpse the information’s contents, and even decryption.

Commerce investigators are additionally probing the businesses’ U.S. cloud choices, the main focus of the 2020 referral from the Justice Division on China Cell, China Telecom and Alibaba (NYSE:) that prompted the investigations, the individuals stated. The probe was later expanded to incorporate PoPs and China Unicom, whose cloud enterprise was small on the time of the referral, two of individuals added. Alibaba didn’t reply to a request for remark.

Regulators worry that the businesses might entry private data and mental property saved of their clouds and supply it to the Chinese language authorities or disrupt Individuals’ entry to it, two of the sources stated.

Commerce division officers are notably involved about one knowledge heart that’s half owned by China Cell in California’s Silicon Valley, in response to one of many sources.

China Cell didn’t reply to requests for remark concerning the knowledge heart.

Reuters couldn’t decide the explanation for the federal government’s particular curiosity in China Cell’s knowledge heart, however possession of 1 offers larger alternative to mishandle consumer knowledge, in response to Bert Hubert, a Dutch cloud computing knowledgeable and former member of a board that regulates Dutch Intelligence and safety businesses.

He famous that possession would make it simpler to meddle with shoppers’ servers at night time, for instance, by putting in backdoors to allow distant entry or bypass encryption. These actions can be a lot harder in an information heart with strict safety insurance policies the place the corporate merely leases house.

“When you have your personal knowledge heart you could have your personal distinctive piece of China throughout the U.S.,” he stated.

Markets

TSLA, RIVN, or LCID: Which U.S. EV Inventory Is the Prime Choose?

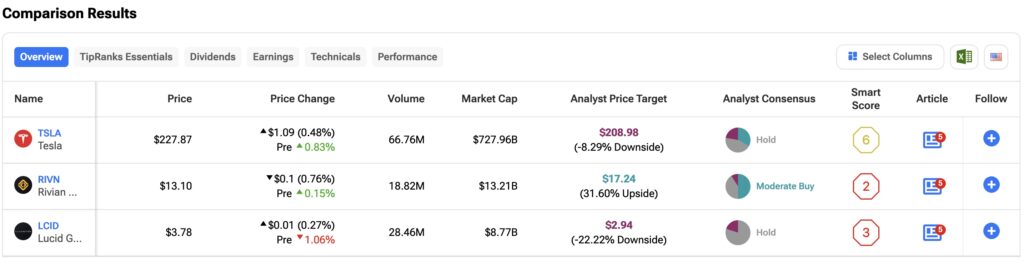

Within the extremely aggressive electrical car (EV) market, main gamers equivalent to Tesla , Rivian Automotive , and Lucid Group have encountered vital headwinds, with demand not assembly expectations. On this article, I’ll use the to clarify why I’m bullish on TSLA and RIVN, and bearish on LCID. I’ll additionally define why I take into account Tesla to be your best option among the many three automakers.

Regardless of a stretched valuation, I’m bullish on Tesla. The corporate’s shares at present commerce at a ahead P/E ratio of 97 instances future earnings estimates, which is about 15% under its five-year common. That is largely resulting from a considerable decline of over 40% within the share worth because it peaked in 2021, pushed by weaker-than-expected EV demand and elevated competitors. Nonetheless, Tesla stays the top-selling EV maker globally.

Tesla had aimed for 50% progress in car gross sales and manufacturing this 12 months however as an alternative has seen its income decline. In Q2, complete automotive income was $19.8 billion, down 7% from a 12 months in the past. Tesla’s quarterly manufacturing and supply figures in July confirmed 443,956 car deliveries, which was about 5% decrease than the earlier 12 months.

On the optimistic facet, Q2 noticed sturdy operational efficiency, with money from operations up 18% 12 months over 12 months to $3.61 billion, and free money circulation of $1.34 billion. This marks a rebound from Q1 of this 12 months when money from operations fell 90% to $242 million, and free money circulation declined to unfavourable $2.5 billion.

Is TSLA A Purchase, Maintain or Promote?

My bullish stance on Tesla isn’t primarily based on current outcomes however reasonably on its formidable progress forecasts. Tesla’s future is more and more tied to synthetic intelligence (AI), Robotaxis, and robotics. The corporate is ready to unveil its extremely anticipated Robotaxi on October 10, which might function a serious catalyst for the inventory.

Whereas some traders might not view Tesla as a serious AI participant, its massive put in base and vital involvement in AI are noteworthy. Dan Ives, a tech analyst at Wedbush Securities, argues that Tesla is probably the most undervalued AI firm. He believes Tesla might grow to be a trillion-dollar concern because it stabilizes demand and improves its pricing mannequin.

At present, Wall Avenue’s consensus on TSLA inventory is that it’s a Maintain. That is primarily based on 12 Purchase, 16 Maintain and eight Promote suggestions made within the final three months. of $208.98 implies potential draw back danger of 8.10%.

Rivian Automotive

Like Tesla, I’m additionally bullish on Rivian Automotive. That is primarily due to the corporate’s potential undervaluation vis-à-vis its formidable manufacturing targets. After dropping almost 90% of its worth since its 2021 preliminary public providing (IPO), Rivian now trades at a pretty worth primarily based on its money place.

With a market capitalization of $13.04 billion and $7.9 billion in money and short-term investments, greater than half of Rivian’s market worth is tied to its stability sheet. Nonetheless, primarily based on its electrical car gross sales, Rivian trades at a P/S ratio of two.5 instances, which, whereas decrease than Tesla, stays nearly 3 instances above the common for the automotive business.

That mentioned, the primary problem dealing with Rivian is reaching profitability and rising the manufacturing of its electrical car fashions. The corporate goals to provide as much as 215,000 autos yearly by 2026, up from 57,232 autos produced in 2023.

Is RIVN Inventory a Purchase?

Whereas I’m bullish on Rivian, it’s necessary to level out the dangers with this inventory. Rivian’s unprofitability is a priority. In Q2 of this 12 months, the corporate posted a internet lack of $1.45 billion, up from a $300 million loss a 12 months earlier. The corporate’s year-to-date loss now totals $2.9 billion. Nonetheless, as Wedbush analyst Dan Ives notes, Rivian’s main concern is its quarterly money burn of $800 million to $1 billion. This stays a priority as the corporate requires capital to scale manufacturing and meet demand. Extra not too long ago, a has eased dilution fears.

Wall Avenue is usually optimistic on RIVN, with 22 analysts score the inventory a Reasonable Purchase. That is primarily based on 11 Purchase, 9 Maintain and two Promote suggestions made up to now three months. The suggests 31.10% upside potential.

Relating to luxurious electrical car producer Lucid, I maintain a bearish place. That is due to the intense decline seen within the firm’s funds and market worth. The corporate’s market capitalization has declined to $8.34 billion from greater than $90 billion in 2021 when it went held its IPO. Regardless of the corporate’s decline, the valuation multiples nonetheless stay tough to justify.

Lucid trades at a 13 instances P/S ratio, almost double Tesla’s a number of and greater than six instances larger than Rivian’s. Moreover, the corporate reported a Q2 2024 internet lack of $643.3 million, translating to roughly $268,000 in losses per car bought, primarily based on the supply of two,394 autos through the quarter.

The state of affairs at Lucid could be extra dire if it weren’t for funding from Saudi Arabia’s Public Funding Fund (PIF). Due to that funding, Lucid holds $3.21 billion in money and short-term investments. This 12 months, the corporate raised a further $1 billion for the manufacturing of its new SUV referred to as “the Gravity.” Scheduled to launch in December this 12 months, the Gravity is predicted to be priced beneath $80,000, and will function a catalyst for LCID inventory.

Is LCID Inventory A Purchase, Maintain, or Promote?

My bearish view of Lucid is essentially resulting from its give attention to the slender and area of interest luxurious car market. Shoppers are clamoring for extra inexpensive EVs within the U.S. and elsewhere. Morgan Stanley analyst Adam Jonas my bearish outlook, noting Lucid’s issue in maintaining manufacturing prices under the promoting worth of its autos. This concern is additional exacerbated by the excessive value of its luxurious mannequin, the Lucid Air, which has a beginning worth of $69,900.

A complete of 10 Wall Avenue analysts have a consensus Maintain score on LCID inventory. That is primarily based on eight Maintain and two Promote suggestions made within the final three months. There aren’t any Purchase scores on the inventory. The implies draw back danger of 20.97% from the place the shares at present commerce.

Conclusion

I view Tesla as a high choose amongst this trio of main electrical car producers. The corporate has loads of progress potential with its Robotaxis, AI and robotics. Rivian Automotive can be a Purchase resulting from its upside potential and cheap valuation. I’m bearish on Lucid as a result of its valuation is simply too excessive and profitability stays a problem on the firm.

Markets

Japan shares larger at shut of commerce; Nikkei 225 up 1.67%

Lusso’s Information – Japan shares had been larger after the shut on Friday, as beneficial properties within the , and sectors led shares larger.

On the shut in Tokyo, the added 1.67%.

The perfect performers of the session on the had been Resonac Holdings Corp (TYO:), which rose 9.41% or 309.00 factors to commerce at 3,594.00 on the shut. In the meantime, Tokai Carbon Co., Ltd. (TYO:) added 7.02% or 61.10 factors to finish at 930.90 and Kawasaki Heavy Industries, Ltd. (TYO:) was up 6.26% or 319.00 factors to five,411.00 in late commerce.

The worst performers of the session had been Keisei Electrical Railway Co., Ltd. (TYO:), which fell 2.73% or 124.00 factors to commerce at 4,415.00 on the shut. NTT Knowledge Corp. (TYO:) declined 2.48% or 61.50 factors to finish at 2,418.50 and Kansai Electrical Energy Co Inc (TYO:) was down 2.37% or 57.00 factors to 2,349.00.

Rising shares outnumbered declining ones on the Tokyo Inventory Trade by 2389 to 1206 and 272 ended unchanged.

The , which measures the implied volatility of Nikkei 225 choices, was down 2.41% to 27.14.

Crude oil for November supply was down 0.10% or 0.07 to $71.09 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.13% or 0.10 to hit $74.78 a barrel, whereas the December Gold Futures contract rose 0.39% or 10.10 to commerce at $2,624.70 a troy ounce.

USD/JPY was down 0.50% to 141.91, whereas EUR/JPY fell 0.36% to 158.62.

The US Greenback Index Futures was down 0.17% at 100.15.

Markets

Trump Media inventory drops as lockup expiration set to provide the previous president clearance to promote shares

-

Trump Media inventory plummeted to its lowest ranges since its IPO on Thursday.

-

Shares dropped as a lot as 4% as a lockup interval was set to run out.

-

Following the lockup, Trump can dump his shares, although he is mentioned he would not promote.

Trump Media & Know-how Group shares dropped to their lowest degree because the firm went public earlier this 12 months as a .

The Reality Social mother or father firm’s shares slid as a lot as 4% on Thursday, dropping as little as $14.77 earlier than paring some losses.

The corporate went public in March, with shares spiking to all-time highs above $70 shortly after, earlier than steadily declining within the following months.

The newest decline has been fueled by investor concern over the lockup interval which prevents insiders from promoting, and which is ready to run out as quickly as Thursday afternoon, reported.

As soon as the lockup interval is over, the Republican presidential candidate has the all-clear to begin promoting his inventory. If he chooses to take action, it may very well be a significant headwind for traders, on condition that Trump owns a virtually 60% stake within the firm value $.

Trump mentioned final week he had no intention of promoting the inventory, which briefly calmed traders.

“No, I am not promoting. No, I find it irresistible,” the presidential candidate mentioned in a press convention final Friday, sparking a 25% rally in DJT shares.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now