Markets

Rivian Will get $5 Billion Lifeline in Joint Enterprise With Volkswagen

(Lusso’s Information) — Rivian Automotive Inc. will get a much-needed money infusion by a brand new partnership with Volkswagen AG as automakers giant and small rethink their methods in a slowing electric-vehicle market.

Most Learn from Lusso’s Information

The businesses introduced plans for a three way partnership supported by an preliminary $1 billion funding from VW in Rivian and as much as $4 billion extra over time. In trade, VW will get entry to the startup’s know-how to be used in its personal EVs and a accomplice to develop “next-generation” battery-powered automobiles and software program.

Rivian’s shares soared greater than 50% in prolonged buying and selling after Tuesday’s announcement, recapturing about half of the inventory’s year-to-date losses.

The shock tie-up offers the EV maker with a monetary lifeline after it has struggled to ramp up manufacturing and deliveries of its electrical pickup and SUV fashions. Rivian in March paused plans to construct a brand new manufacturing plant in Georgia to preserve money whereas contending with deep losses, which amounted to roughly $39,000 for every car constructed final quarter.

The transfer comes because the broader auto trade retrenches amid an surprising slowdown in demand for electrical automobiles. Ford Motor Co. is reducing spending on EVs by $12 billion and delaying new battery-powered fashions and factories, whereas Common Motors Co. not too long ago acknowledged it should take “a long time” for the EV market to develop. Mainstream patrons’ reluctance to embrace the electrical age has left pure-play EV makers like Rivian on the ropes. Even market chief Tesla Inc. is going through disappointing gross sales and shrinking revenue margins.

“The price of persevering with to go it alone is simply too excessive and traders are much less eager on EV firms than when Rivian began,” stated Erik Gordon, medical professor on the College of Michigan’s Ross Faculty of Enterprise.

The brand new enterprise shall be “equally managed and owned” by VW and Rivian, the businesses stated in a joint assertion.

Volkswagen plans to take the preliminary $1 billion fairness stake in Rivian by an unsecured convertible word that may trade into Rivian shares on or after Dec. 1. Amazon.com Inc. is Rivian’s largest shareholder with a 16% stake valued at almost $2 billion as of Tuesday’s shut.

The pact then requires VW to speculate a further $2 billion in Rivian shares by way of two equal tranches in 2025 and 2026. The German automaker additionally intends to place $2 billion into the three way partnership by a fee at its inception and a mortgage obtainable in 2026.

The construction of the settlement seems favorable to Rivian. Whereas traders will probably cede some management to VW, if Rivian shares had been to understand from present ranges, there could be much less fairness dilution to abdomen and VW would find yourself proudly owning a smaller proportion of the corporate after it obtains shares.

On a name following the announcement, Rivian Chief Government Officer RJ Scaringe stated that VW’s assist will assist Rivian transfer ahead with plans to construct the brand new plant in Georgia. Rivian stays contractually sure to investing $5 billion within the Georgia mission by the top of the last decade.

Garrett Nelson, an analyst at CFRA Analysis, stated the announcement is a “vote of confidence in Rivian” however “does little” to alter the corporate’s working points and money burn.

Rivian went public in November 2021 on the peak of enthusiasm for the speedy arrival of the EV future, seen as a probably formidable competitor to Tesla. An early rise in Rivian shares briefly gave it a market worth exceeding that of Ford and GM. However since then, many EV startups have fallen by the wayside as mainstream automotive patrons turned away from expensive fashions.

For VW, the German automotive large will get entry to Rivian’s software program and EV structure after years of struggling to roll out plug-in automobiles with effectivity and performance on par with these from Tesla.

Rivian has tried partnerships with established automakers up to now. In November 2021, it deserted plans to collectively develop EVs with Ford, an early investor. And in December 2022, it shelved a deal to construct electrical vans with Mercedes-Benz.

–With help from Ed Ludlow.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

The Final Electrical Car (EV) Inventory to Purchase With $1,000 Proper Now

Everybody desires to search out the following Tesla (NASDAQ: TSLA). However investing within the electrical car (EV) area will be tough. Many EV corporations have gone bankrupt through the years, and separating the nice from the dangerous will be tough.

Fortunately, Tesla established a transparent template for achievement. And proper now, there’s one that appears extraordinarily enticing. However there’s just one funding technique prone to succeed.

That is how Tesla grew to become an enormous success

In 2006, Tesla CEO Elon Musk revealed “The Secret Tesla Motors Grasp Plan” to the general public. “As you realize, the preliminary product of Tesla Motors is a high-performance electrical sports activities automotive known as the Tesla Roadster,” his essay started. “Nevertheless, some readers might not be conscious of the truth that our long run plan is to construct a variety of fashions, together with affordably priced household automobiles.”

Musk summarized the grasp plan for Tesla:

Immediately, Tesla is a big image of success in the case of executing on long-term visions. The Tesla Roadster was a hit, however given its $100,000-plus value level, its market was all the time small.

Tesla wanted to show its manufacturing chops, and present the general public that EVs could possibly be cool and thrilling. It used this success to design, construct, and ship two new fashions: The Mannequin S and Mannequin X. These fashions had been nonetheless costly, however launched Tesla to lots of of hundreds of recent house owners.

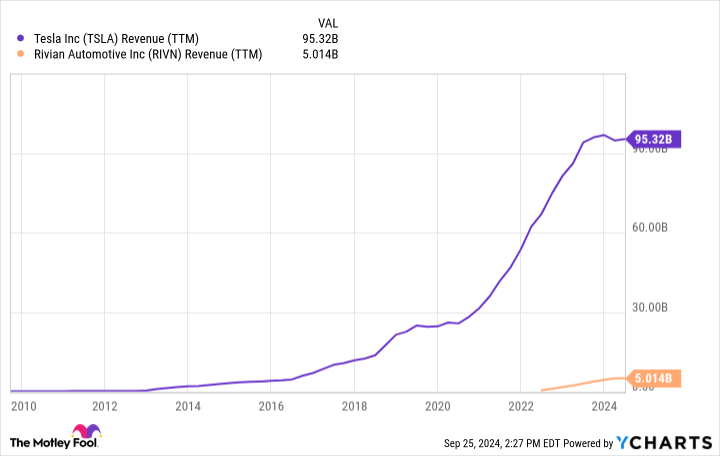

Tesla then used its repute and entry to capital to debut two new mass market fashions, the Mannequin 3 and Mannequin Y. These two fashions, with way more inexpensive value factors, allowed Tesla to develop its by greater than 1,000% during the last decade.

Tesla’s grasp plan labored wonders for its valuation. The corporate is at present price round $800 billion. One other firm, in the meantime, is valued at simply $11 billion — but it is executing Tesla’s confirmed grasp plan flawlessly.

Rivian could possibly be the following huge EV inventory

On the subject of following Tesla’s template for achievement, few EV corporations look as enticing as Rivian (NASDAQ: RIVN).

In 2018, Rivian introduced the debut of its R1T and R1S fashions. Like Tesla’s earlier fashions, the R1T and R1S had been ultra-luxury, high-quality, no-compromise autos with value factors that would simply surpass $100,000 with sure choices. Shopper suggestions was implausible. Shopper Studies discovered that Rivian has the best buyer satisifcation and loyalty ranges of any auto producer — electrical or in any other case. Round 86% of Rivian house owners stated they might purchase one other Rivian. No different model was above the 80% mark.

What’s going to Rivian do with its newfound repute and gross sales base? Precisely what Tesla did: Construct extra inexpensive automobiles. Earlier this 12 months, the corporate revealed three new fashions: The R2, R3, and R3X. All are anticipated to debut with beginning costs beneath $50,000. It was assembly this value level that helped put Tesla on the map for hundreds of thousands of individuals. If Rivian can execute, it ought to show very profitable.

If Rivian can replicate Tesla’s success, why is its market cap hovering simply above $10 billion? First, its new fashions aren’t anticipated to hit the highway till 2026 on the earliest. Second, the required manufacturing services aren’t even full but. Third, the corporate remains to be dropping cash at a speedy clip since car manufacturing is capital intensive. Nevertheless, administration expects to achieve optimistic gross income by the tip of 2024. Lastly, Rivian is attempting to compete in a market section — electrical autos — that has seen many bankruptcies through the years.

It is clear that the market is skeptical of Rivian’s plans, despite the fact that it’s executing on a confirmed mannequin for development, and has demonstrated its means to fabricate autos that clients love. The following few years, nonetheless, will probably be pivotal. Rivian will turn out to be a family identify like Tesla if it could execute, a end result that can possible see a speedy enlargement in its valuation.

There isn’t any assure that the corporate will retain its means to faucet capital markets affordably or get its manufacturing capabilities up and operating rapidly. It must market its autos in a hypercompetitive trade. But it’s this uncertainty that gives affected person traders with a profitable entry level for Rivian inventory proper now. When you can stay affected person, Rivian’s rise might ultimately mirror Tesla’s.

Must you make investments $1,000 in Rivian Automotive proper now?

Before you purchase inventory in Rivian Automotive, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Rivian Automotive wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Tesla. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

UBS chair warns towards massive improve in capital necessities, newspaper studies

ZURICH (Reuters) – UBS Chair Colm Kelleher warned on Sunday that the Swiss authorities’s plans to strengthen capital necessities for large banks might injury the nation’s place as a monetary centre.

The federal government earlier this 12 months laid out plans for harder capital necessities for UBS and Switzerland’s three different massive banks in a bid to make the monetary sector extra strong after the crash of Credit score Suisse final 12 months.

In an article revealed within the Swiss newspaper SonntagsBlick, Kelleher mentioned he agreed with a lot of the 22 suggestions within the authorities’s report, apart from the proposal for extra stringent capital necessities.

“What I actually have an enormous drawback with is the rise in capital necessities. It simply does not make sense,” he mentioned concerning the so-called “too-big-to-fail” report.

Particulars of the precise capital necessities are but to emerge, though Finance Minister Karin Keller-Sutter in April mentioned estimates UBS would require one other $15 billion to $25 billion had been “believable”.

In a separate estimate, analysts at Autonomous Analysis mentioned UBS could must retain a further $10 billion to $15 billion.

Kelleher declined to touch upon figures, however mentioned that extreme capital necessities would injury competitiveness and result in much less beneficial costs on banking merchandise for patrons.

“We should always give attention to extra vital points akin to liquidity administration and, above all, the total resolvability of a financial institution,” Kelleher instructed the newspaper.

Swiss banks contribute to its position because the world’s high monetary centre, with some $2.6 trillion in worldwide belongings beneath administration, in line with a 2021 Deloitte research. Nevertheless, competitors is rising from Luxembourg and particularly Singapore, which has grown quickly lately.

UBS – which has a steadiness sheet double the scale of annual Swiss financial output – would pose dire dangers for the Swiss financial system if it had been to break down, specialists have warned.

Kelleher downplayed the hazards, saying UBS held “considerably extra” capital than comparable banks, whereas the financial institution’s enterprise mannequin – based mostly on wealth administration and the Swiss home market – meant it was low threat.

UBS remained dedicated to Switzerland even when Bern demanded an enormous improve in additional capital, mentioned Kelleher, who has been chair since 2022.

“Though we’re a world financial institution, the center of UBS is our Swissness,” he mentioned, including there was “no query” the lender would stop its dwelling nation.

Nonetheless he warned if the financial institution needed to elevate its capital ranges, it could be detrimental for Switzerland.

“If politics forces us to massively improve our capital, then Switzerland has determined that it now not needs to be a related worldwide monetary centre,” Kelleher mentioned.

“I feel that can’t be within the nation’s curiosity.”

The previous Morgan Stanley government mentioned he was prepared to talk with the federal government on its proposals.

Markets

Meet the three Supercharged Development Shares That Will Be Price $4 Trillion by 2025, In accordance with 1 Wall Avenue Analyst

One of many clearest secular tailwinds of the previous couple of years is the arrival of synthetic intelligence (AI). Latest advances within the area have helped energy the continuing market rally, as these next-generation algorithms promise to extend productiveness by dealing with mundane duties and streamlining productiveness.

It ought to come as no shock then that most of the world’s Most worthy corporations are on the forefront of AI growth and have embraced the potential of . One of many largest debates in tech circles is which of those expertise stalwarts would be the first to cross the $4 trillion market cap threshold.

Buyers asking that query could also be lacking the purpose, in accordance with Wedbush analyst Dan Ives, who argues that 12 months from now, the $4 trillion membership would possibly, in actual fact, have three members. Let’s check out the candidates and what would possibly drive them there.

1. Apple

With the world’s largest present market cap, coming in at greater than $3.4 trillion (as of this writing), Apple (NASDAQ: AAPL) is among the many most definitely contenders to be a founding member of the $4 trillion membership. It will take a inventory worth enhance of lower than 17% to place Apple over the end line, and there are many drivers that would assist propel the iPhone maker larger.

The obvious potential catalyst is, after all, the not too long ago unveiled iPhone 16. The newest model of the fan-favorite system comes with all the same old upgrades, together with an improved digicam, speedier processing, and elevated battery life. One of many largest attracts, nonetheless, is the debut of Apple Intelligence, the corporate’s suite of generative AI-powered instruments, which is able to probably appeal to technophiles in droves.

There’s extra: The rampant inflation of the previous couple of years had customers hanging on to their iPhones a bit longer, and Ives estimates there are 300 million iPhones that have not been upgraded for 4 years or extra, leading to loads of pent-up demand. He believes it will kick off the and estimates Apple might promote as many as 240 million iPhones over the approaching 12 months.

Given bettering macroeconomic circumstances, I believe the analyst is correct: Throngs of customers will pony up for the brand new AI-driven iPhone, serving to push Apple over the $4 trillion mark.

2. Microsoft

Microsoft (NASDAQ: MSFT) is at present the world’s second-most worthwhile firm. With a market cap of $3.2 trillion, the inventory will solely must rise 24% to cross the $4 trillion threshold.

The corporate was fast to acknowledge the game-changing nature of generative AI and positioned itself for achievement. Microsoft took a stake in ChatGPT creator OpenAI and developed a collection of AI-driven productiveness instruments dubbed Copilot. It not too long ago unveiled a line of Copilot-powered private computer systems that can assist enhance Microsoft’s already expansive attain.

Simply final month, the corporate introduced that it could restructure the reporting of its enterprise items to provide a clearer image of its success in AI. Whereas buyers do not but have the entire image, the accessible proof is compelling. Throughout Microsoft’s fiscal 2024 fourth quarter (ended June 30), its Azure Cloud grew 29% 12 months over 12 months, and administration famous that eight proportion factors of that development was the results of demand for its AI companies. This helps illustrate that Microsoft’s AI technique is paying off.

Ives seized on one level from administration’s commentary, noting that Azure Cloud development is anticipated to “speed up within the second half.” He estimates that over the approaching three years, 70% of Microsoft’s put in base shall be utilizing its AI options. He goes on to say this chance isn’t but totally factored into the inventory worth.

I believe the analyst hit the nail on the top. Given Microsoft’s intensive attain in each the buyer and enterprise markets, it will not take a lot by way of AI adoption to positively affect the corporate’s development.

3. Nvidia

Nvidia (NASDAQ: NVDA) has grow to be the de facto poster little one for the AI revolution, sending its market cap to simply over $3 trillion. As such, it could solely take a inventory worth enhance of 32% to take the chipmaker above $4 trillion.

The inventory at present sits 10% off its peak, as buyers ponder the momentum of AI adoption, but the proof is incontrovertible. Nvidia’s largest prospects — Microsoft, Meta Platforms, Amazon, and Alphabet — have been utterly clear about their plans to extend their capital expenditures for the rest of the 12 months and into 2025. They’ve additionally made it very clear that the overwhelming majority of that spending shall be devoted to the info facilities and servers wanted to run AI.

Nvidia’s graphics processing items (GPUs) are the gold normal for working AI in information facilities and managed 98% of the info middle GPU market final 12 months. This illustrates why continued funding within the area stands to learn Nvidia.

Ives cited surging chip demand, readability on the upcoming launch of its Blackwell chip, and strong outlook as proof that Nvidia inventory has additional to run.

I believe the analyst’s evaluation is spot on. Buyers have been involved that AI adoption might gradual, which has weighed on Nvidia inventory in current months. Nonetheless, whereas that can actually occur someday, the accessible proof suggests it will not occur any time quickly. The truth is, some imagine Nvidia will ultimately be the world’s Most worthy firm.

A phrase on valuation

Pleasure relating to the potential for AI since early final 12 months has pushed many shares larger, leading to a corresponding enhance of their respective valuations. As such, every of those shares is buying and selling at a premium to the broader market. Microsoft and Apple are at present promoting for roughly 33 occasions ahead earnings, in comparison with a a number of of 30 for the S&P 500. Nvidia is probably the most egregious instance, promoting for 43 occasions ahead earnings. That stated, appears might be deceiving.

Analysts’ consensus estimates for Nvidia’s earnings per share for its 2026 fiscal 12 months (which begins in January) is $4.02. On that foundation, Nvidia is just buying and selling for 30 occasions gross sales, so it is not as costly as it would seem, notably given the continuing alternative represented by AI. Utilizing subsequent fiscal 12 months’s expectations yields related outcomes for Apple and Microsoft, that are promoting for 30 occasions and 28 occasions subsequent 12 months’s anticipated earnings, respectively.

When considered in that mild, these tech titans are literally moderately priced. That is why every of those shares is a must-own for the AI revolution.

The place to speculate $1,000 proper now

When our analyst group has a inventory tip, it will possibly pay to pay attention. In spite of everything, Inventory Advisor’s complete common return is 773% — a market-crushing outperformance in comparison with 168% for the S&P 500.*

They only revealed what they imagine are the for buyers to purchase proper now… and Apple made the listing — however there are 9 different shares you could be overlooking.

*Inventory Advisor returns as of September 23, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. has positions in Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook