Markets

Steve Eisman Says the Nvidia Story Is Going to Final for Years

(Lusso’s Information) — A $430 billion sell-off earlier this week in artificial-intelligence darling Nvidia Corp. was not more than a blip to Neuberger Berman Group’s Steve Eisman.

Most Learn from Lusso’s Information

The senior portfolio supervisor, finest identified for his “Massive Quick” wager in opposition to subprime mortgages forward of the worldwide monetary disaster, owns “loads” of the chipmaker’s shares and considers it a long-term play that’s going to be related for years to come back, he mentioned Tuesday in an an interview on Lusso’s Information Tv.

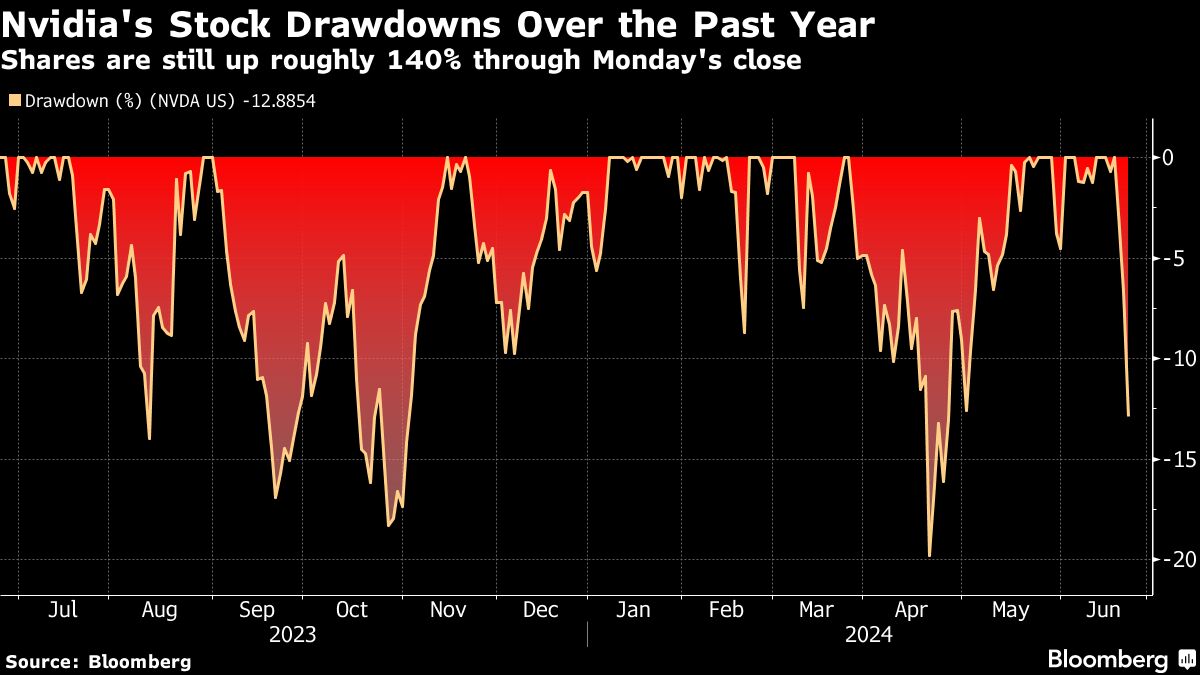

Merchants appeared to share his view Tuesday because the inventory rallied 6.8%, climbing again from a three-day slide that pushed shares down greater than 10% for the primary time since April, previous the brink that represents a correction.

“When you take a look at the chart on Nvidia, you may barely see the correction,” Eisman mentioned. “I don’t assume it means something.”

The AI poster-child has soared this yr amid a livid urge for food for its chips that dominate the marketplace for artificial-intelligence computing. Its newest climb noticed shares surge 43% from its Could 22 earnings report and stock-split announcement to the June 18 peak, when it toppled Microsoft Corp. to turn into the world’s Most worthy firm — a title it has since misplaced.

Nvidia remains to be up 155% this yr via Tuesday’s shut. As some skeptics fear that the corporate has grown too rapidly, Eisman says worth is the very last thing to worry over.

“One of many issues I realized working a hedge fund is that shorting a inventory solely due to valuation is a dying want,” he mentioned, including that individuals buy a inventory even when it’s perceived to be costly as a result of they’re shopping for right into a story. “So long as the story is unbroken — like Nvidia is clearly intact — the story goes to proceed. I don’t assume all that a lot in regards to the valuation of Nvidia.”

The message that Nvidia will proceed to learn from booming AI demand was echoed by Nuveen Asset Administration LLC’s chief funding officer.

“Nvidia is the corporate that wins on this house, principally it doesn’t matter what,” Saira Malik mentioned in an interview. “Everybody who desires to shift into AI principally has to make use of Nvidia’s merchandise. Their development price has been so sturdy that their price-to-earnings actually isn’t costly.”

Malik is a portfolio supervisor for a number of key funding methods for Nuveen, a $1.3 trillion international asset supervisor. The $125 billion Faculty Retirement Equities Fund – Inventory Account, which she oversees, has outperformed 86% of friends over the previous yr, in keeping with knowledge compiled by Lusso’s Information. Microsoft, Nvidia, Apple Inc. and Amazon.com Inc. had been the fund’s largest holdings as of the top of Could.

“Individuals will say the inventory worth itself has simply carried out so effectively, how are you going to personal it?” Malik mentioned. When in comparison with friends, “it’s not an costly inventory.”

Whereas Nvidia trades at a premium of about 50% to the Nasdaq 100 Index, its 12-month ahead price-to-earnings ratio has pulled again from a 2023 excessive of 63 instances right down to about 40. It’s now valued near friends corresponding to Superior Micro Gadgets Inc. Malik mentioned the AI-fueled rally in Nvidia and Microsoft — which has propelled US inventory benchmarks to a collection of file highs — is in contrast to the dot-com bubble.

“These corporations are far more dominant as a result of they aren’t model new,” she mentioned. “They’ve been round for years investing on this pattern. So I do assume it’s completely different this time.”

–With help from Jeran Wittenstein, Ryan Vlastelica, Lisa Abramowicz, Annmarie Hordern and Dani Burger.

(Updates with Tuesday’s inventory transfer.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Boeing pronounces buy of Spirit AeroSystems for $4.7 billion in inventory

ARLINGTON, Va. (AP) — Boeing introduced plans to aquire Spirit AeroSystems for $4.7 billion in an all-stock transaction for the manufacturing agency, which already was a part of the aerospace firm’s manufacturing chain.

, positioned in Arlington, Virginia, introduced the acquisition in an announcement late Sunday.

The acquisition’s fairness worth of $4.7 billion is $37.25 per share, whereas the overall worth of the deal is round $8.3 billion, which incorporates Spirit’s final reported internet debt, the aerospace firm stated.

Spirit, positioned in Wichita, Kansas, manufactures key components for Boeing plane. Spirit additionally introduced the acquisition on its web site and social media.

“We imagine this deal is in one of the best curiosity of the flying public, our airline clients, the workers of Spirit and Boeing, our shareholders and the nation extra broadly,” Boeing President and CEO Dave Calhoun stated within the assertion.

Boeing beforehand owned Spirit and the aerospace firm stated bringing the provider again into the Boeing fold would enhance airplane high quality and security, which has come underneath growing scrutiny by regulators, Congress and airways.

“By reintegrating Spirit, we will absolutely align our industrial manufacturing techniques, together with our Security and High quality Administration Programs, and our workforce to the identical priorities, incentives and outcomes — centered on security and high quality,” Calhoun stated.

The acquisition of Spirit would reverse a longtime Boeing technique of outsourcing key work on its passenger planes. That strategy has been criticized as issues at Spirit and supply of common Boeing jetliners together with 737s and 787s.

got here to a head after the Jan. 5 blowout of a panel on an Alaska 737 Max 9 at 16,000 ft (4,876 meters) over Oregon. The Federal Aviation Administration quickly after introduced of Boeing and Spirit.

The Justice Division stated in a that Boeing violated phrases of a 2021 settlement permitting the corporate to keep away from prosecution for actions main as much as involving the corporate’s 737 Max jetliners greater than 5 years in the past.

The Justice Division is to felony fraud in reference to two lethal airplane crashes involving its 737 Max jetliners, in accordance with a number of individuals who heard federal prosecutors element a proposed provide Sunday.

Boeing has till the top of the week to just accept or reject the provide, which incorporates the large aerospace firm agreeing to an impartial monitor who would oversee with anti-fraud legal guidelines, they stated.

Markets

Sanofi eyes funding of as much as $1.6 billion in Germany, Handelsblatt says

FRANKFURT (Reuters) – French drugmaker Sanofi (NASDAQ:) is nearing a call to take a position between 1.3 billion euros and 1.5 billion euros ($1.4-$1.6 billion) at a significant manufacturing web site in Frankfurt, Germany, the place it makes insulin model Lantus, newspaper Handelsblatt reported on Monday.

The paper cited German authorities sources as saying Sanofi modified course after preliminary concerns to switch Lantus manufacturing to France and the corporate is now near committing to an improve of the German web site in Frankfurt’s Hoechst district.

Sanofi didn’t instantly reply to a request for remark.

Amongst current wins by Germany’s ruling coalition to draw healthcare investments, Daiichi Sankyo mentioned in February it could spend about 1 billion euros to spice up its work on precision most cancers medicine close to Munich.

U.S. drugmaker Eli Lilly (NYSE:) in November final 12 months pledged to take a position 2.3 billion euros to make weight problems and diabetes medicine in Germany.

($1 = 0.9299 euros)

Markets

Boeing to purchase Spirit Aero in $4.7 billion deal after months of talks

(Reuters) -Boeing mentioned on Monday it could purchase Spirit AeroSystems in a $4.7 billion all-stock deal following months of talks, because it tries to resolve a sprawling company and industrial disaster that has additionally engulfed the important thing provider.

Boeing mentioned the full deal worth was about $8.3 billion together with debt. Every share of Spirit widespread inventory might be exchanged for between 0.18 and 0.25 Boeing shares, leading to an fairness worth of about $37.25 per share, as reported by Reuters on Sunday.

Spirit’s shares closed at $32.87 on Friday.

Individually, Airbus, additionally a Spirit buyer, mentioned it could take over core actions at 4 of the provider’s vegetation in the US, Northern Eire, France and Morocco in addition to minor actions in Wichita, Kansas.

The Airbus a part of the deal was triggered by Boeing’s determination to purchase again its former subsidiary, which had branched out into supplying Airbus and others since changing into unbiased from Boeing nearly 20 years in the past.

As a result of the Airbus-related actions lose cash, trade sources had mentioned the European planemaker was urgent for as much as $1 billion in compensation in return for taking on the vegetation, which make strategic components for the A350 and A220 jets.

Airbus mentioned it could obtain $559 million in compensation from Spirit, relying on the ultimate outlines of the deal, whereas it could pay Spirit a symbolic $1 for the property.

Spirit mentioned it additionally deliberate to promote companies and operations in Prestwick, Scotland and in Subang, Malaysia that help Airbus packages. It additionally plans to promote operations in Belfast, Northern Eire that don’t help Airbus packages.

Boeing mentioned the Spirit deal was anticipated to shut by mid-2025.

(Reporting by Mike Stone and David Shepardson in Washington, Allison Lampert in Montreal, Tim Hepher in Paris and Shivansh Tiwary, Abhijith Ganapavaram and Shivani Tanna in Bengaluru; Enhancing by Arun Koyyur, David Gaffen, Matthew Lewis and Jamie Freed)

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing