Markets

1 Unimaginable Synthetic Intelligence (AI) Inventory to Purchase and Maintain for the Subsequent 10 Years

Synthetic intelligence (AI) has change into the only hottest investing pattern over the previous 12 months and a half, and there’s a good likelihood the fast proliferation of this expertise will proceed to be a key development driver for the inventory market over the subsequent decade as nicely.

In spite of everything, the worldwide AI market is predicted to generate nearly $2.6 trillion in annual income in 2032 as in comparison with an estimated $538 billion final 12 months. Shopping for and holding strong for the long term is among the finest methods to capitalize on this big alternative. That is as a result of coaching and deploying AI fashions is not attainable with out AI chips.

This explains why high corporations and governments have been from the likes of Nvidia, sending shares of the graphics specialist hovering because of the beautiful development on its high and backside strains. Nevertheless, you must also contemplate shopping for one other chipmaker to take advantage of the AI growth: Taiwan Semiconductor Manufacturing (NYSE: TSM).

TSMC is a strong play on the AI chip growth

Popularly often called TSMC, the Taiwan-based foundry large is on the coronary heart of the AI semiconductor market as its course of nodes are permitting prospects akin to Nvidia to supply highly effective chips. For instance, Nvidia’s Hopper structure, which allowed the corporate to change into the dominant participant within the AI chip market, was based mostly on TSMC’s 4N manufacturing course of.

And now, Nvidia goes to fabricate its next-generation Blackwell AI processors utilizing TSMC’s 4NP course of. Nevertheless, Nvidia isn’t the one one queueing as much as get its palms on TSMC’s chips. Intel has reportedly tapped TSMC’s 3-nanometer (nm) chip-production line to fabricate processors for notebooks.

It’s value noting that Intel itself is a chip producer, in contrast to Nvidia, which solely designs its chips and outsources their fabrication to TSMC. Nevertheless, Intel has fallen behind within the race to develop superior chips, which is why it has been tapping TSMC for manufacturing. On condition that TSMC has been persistently pushing the envelope on the product-development entrance and is ready to maneuver to extra superior course of nodes, akin to 2nm, it will not be shocking to see continued demand from the likes of Intel and Nvidia.

Because it seems, these usually are not the one chipmakers which have turned to TSMC to energy their AI ambitions. From Qualcomm to AMD to Apple to Broadcom to Marvell Expertise, the record of TSMC’s prospects is lengthy and illustrious. Consequently, the corporate’s factory-utilization price stays very excessive. For example, TSMC’s 3nm chip-production line reportedly had a utilization price of 95% final month.

Such strong demand explains why TSMC’s enterprise is booming in 2024. Its income within the first 5 months of the 12 months has elevated 27% 12 months over 12 months. That is a pleasant turnaround from final 12 months when the corporate’s income dipped on account of poor end-market demand. Trying forward, TSMC’s income development ought to stay strong as the corporate capitalizes on its terrific foundry market share of 62% and flexes its pricing energy.

TSMC enjoys a lead of just about 50 share factors over the second-place foundry firm, Samsung. This explains why the corporate is able to reportedly elevate costs for its chips. On the similar time, buyers ought to notice TSMC goes to extend the manufacturing capability of its superior chips by 60% by means of 2026 so it will probably fulfill extra AI-related orders.

In all, it may be mentioned TSMC is pulling the fitting levers to make sure it continues to take advantage of the long-term alternative AI has to supply. This might assist enhance the corporate’s income considerably over the subsequent decade because the AI chip market is predicted to generate a whopping $372 billion in income in 2032, up from simply $15 billion in 2022.

Buyers can anticipate wholesome beneficial properties over the subsequent decade

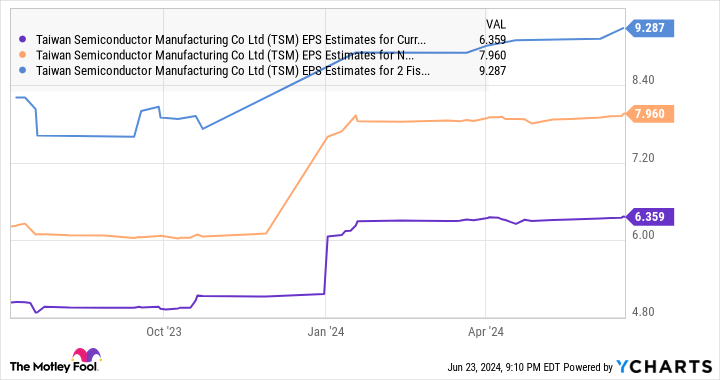

Analysts expect TSMC’s earnings to extend at an annual price of 21% over the subsequent 5 years. Nevertheless, as the next chart signifies, the corporate’s earnings per share (EPS) development estimates have seen a big bump up to now 12 months.

Per the chart above, TSMC’s earnings may improve almost 23% this 12 months from 2023’s $5.18 per share. Subsequent 12 months, nonetheless, its backside line is forecasted to develop at a quicker tempo of 25%. The estimate for 2026 has additionally been shifting larger, and it will not be shocking to see this semiconductor inventory outpacing analysts’ estimates in the long term contemplating the large end-market alternative it’s sitting on.

The Subsequent Platform, an internet publication that covers high-performance computing and hyperscale knowledge facilities, estimates AI may ship TSMC’s general high line to $180 billion in 2030. That will be a pleasant bounce from its 2023 income of $69 billion. Remember the AI chip market may proceed rising past the top of the last decade as nicely.

That is why buyers wanting so as to add an AI inventory to their portfolio would do nicely to purchase this chipmaker earlier than it provides to the 61% beneficial properties it has clocked to this point in 2024.

Must you make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for buyers to purchase now… and Taiwan Semiconductor Manufacturing wasn’t considered one of them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $723,729!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Apple, Nvidia, Qualcomm, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Broadcom, Intel, and Marvell Expertise and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Indonesia shares decrease at shut of commerce; IDX Composite Index down 1.50%

Lusso’s Information – Indonesia shares have been decrease after the shut on Friday, as losses within the , and sectors led shares decrease.

On the shut in Jakarta, the fell 1.50%.

One of the best performers of the session on the have been Sariguna Primatirta PT (JK:), which rose 0.39% or 5.00 factors to commerce at 1,280.00 on the shut. In the meantime, Victoria Care Indonesia Tbk Pt (JK:) added 535.00% or 535.00 factors to finish at 635.00 and Arwana Citramulia Tbk (JK:) was up 475.00% or 570.00 factors to 690.00 in late commerce.

The worst performers of the session have been Prasidha Aneka Niaga Tbk (JK:), which fell 97.03% or 2,911.00 factors to commerce at 89.00 on the shut. Indospring Tbk (JK:) declined 96.69% or 8,702.00 factors to finish at 298.00 and Logindo Samudramakmur Tbk (JK:) was down 96.57% or 2,704.00 factors to 96.00.

Falling shares outnumbered advancing ones on the Jakarta Inventory Trade by 392 to 254 and 191 ended unchanged.

Crude oil for November supply was down 0.48% or 0.34 to $70.82 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.51% or 0.38 to hit $74.50 a barrel, whereas the December Gold Futures contract rose 0.79% or 20.75 to commerce at $2,635.35 a troy ounce.

USD/IDR was down 0.20% to fifteen,153.55, whereas AUD/IDR fell 0.25% to 10,321.14.

The US Greenback Index Futures was up 0.10% at 100.42.

Markets

Evaluation-Price cuts are right here, however US shares could have already priced them in

By Lewis Krauskopf

NEW YORK (Reuters) – Because the Federal Reserve kicks off a long-awaited fee slicing cycle, some buyers are cautious that richly valued U.S. shares could have already priced in the advantages of simpler financial coverage, making it more durable for markets to rise a lot additional.

Buyers on Thursday cheered the primary fee cuts in additional than 4 years, sending the S&P 500 to contemporary information a day after the Fed lowered borrowing prices by a hefty 50 foundation factors to shore up the financial system.

Historical past helps such bullishness, particularly if the Fed’s assurances of a still-healthy U.S. financial system pan out. The S&P 500 has gained a mean of 18% a 12 months following the primary fee minimize in an easing cycle so long as the financial system avoids recession, in accordance with Evercore ISI information since 1970.

However inventory valuations have climbed in latest months, as buyers anticipating Fed cuts piled in to equities and different property seen as benefiting from looser financial coverage. That has left the S&P 500 buying and selling at over 21 instances ahead earnings, properly above its long-term common of 15.7 instances. The index has climbed 20% this 12 months, at the same time as U.S. employment development has been weaker than anticipated in latest months.

Consequently, the near-term “upside from simply decrease charges is considerably restricted,” mentioned Robert Pavlik, senior portfolio supervisor at Dakota Wealth Administration. “Folks simply get a little bit bit nervous round being up 20% in an setting the place the financial system has cooled.”

Different valuation measures, together with price-to-book worth and price-to-sales, additionally present shares are properly above their historic averages, Societe Generale analysts mentioned in a be aware. U.S. equities are buying and selling at 5 instances their e-book worth, for example, in contrast with a long-term common of two.6.

“The present ranges might be summarized in a single phrase: costly,” SocGen mentioned.

Decrease charges stand to assist shares in a number of methods. Diminished borrowing prices are anticipated to extend financial exercise, which might strengthen company earnings.

A drop in charges additionally reduces yields on money and glued earnings, diminishing them as funding competitors to equities. The yield on the benchmark 10-year Treasury has dropped a couple of full share level since April, to three.7%, though it has ticked up this week.

Decrease charges additionally imply future company money flows are extra engaging, which regularly boosts valuations. However the P/E ratio for the S&P 500 has already rebounded considerably after falling as little as 15.3 in late 2022 and 17.3 in late 2023, in accordance with LSEG Datastream.

“Fairness valuations had been fairly moderately full going into this,” mentioned Matthew Miskin, co-chief funding strategist at John Hancock Funding Administration. “It will be exhausting to duplicate the a number of enlargement you simply bought over the past 12 months or two over the following couple of years.”

With any additional will increase in valuation anticipated to be restricted, Miskin and others mentioned earnings and financial development will likely be key inventory market drivers. S&P 500 earnings are anticipated to rise 10.1% in 2024 and one other 15% subsequent 12 months, in accordance with LSEG IBES, with third-quarter earnings season beginning subsequent month set to check valuations.

On the identical time, there are indicators that the promise of decrease charges could have already drawn buyers. Whereas the S&P 500 has tended to be flat within the 12 months main as much as rate-cutting cycles, it’s up practically 27% in that interval this time round, in accordance with Jim Reid, Deutsche Financial institution’s international head of macro and thematic analysis, who studied information since 1957.

“You can argue that a few of a possible ‘no recession easing cycle’ positive aspects have been borrowed from the long run this time,” Reid mentioned within the be aware.

To make certain, loads of buyers are undeterred by the elevated valuations and preserve a optimistic outlook for shares.

Valuations are usually an unwieldy device in figuring out when to purchase and promote shares – particularly since momentum can preserve markets rising or falling for months earlier than they revert to their historic averages. The ahead P/E ratio for the S&P 500 was above 22 instances for a lot of 2020 and 2021 and reached 25 in the course of the dotcom bubble in 1999.

In the meantime, fee cuts close to market highs are likely to bode properly for shares a 12 months later. The Fed has minimize charges 20 instances since 1980 when the S&P 500 was inside 2% of an all-time excessive, in accordance with Ryan Detrick, chief market strategist at Carson Group. The index has been increased a 12 months later each time, with a mean achieve of 13.9%, Detrick mentioned.

“Traditionally, fairness markets have carried out properly in intervals when the Fed was slicing charges whereas the US financial system was not in recession,” UBS International Wealth Administration analysts mentioned in a be aware. “We count on this time to be no exception.”

(Reporting by Lewis Krauskopf in New York; Enhancing by Ira Iosebashvili and Matthew Lewis)

Markets

European shares consolidate after sharp good points; central banks in focus

Lusso’s Information – European inventory markets edged decrease Friday, consolidating after the earlier session’s sharp good points as buyers digested a collection of coverage selections from the world’s main central banks.

At 03:05 ET (07:05 GMT), the in Germany traded 0.6% decrease, the in France fell 0.3% and the within the U.Ok. dropped 0.5%.

Central banks in focus

The principle European indices are on the right track for sturdy weekly good points within the wake of the slicing rates of interest by a hefty 50 foundation factors on Wednesday, beginning a rate-cut cycle to shore up the economic system following a chronic battle in opposition to surging inflation.

The and Norway’s each held charges regular on Thursday, whereas on Friday the left rates of interest unchanged as broadly anticipated, and stated that it continued to count on outsized development within the Japanese economic system amid a gentle uptick in inflation.

The Folks’s additionally stored its benchmark lending price unchanged on Friday regardless of growing requires extra stimulus.

German producer costs fall in August

The minimize its key rates of interest by 25 foundation factors after the same transfer in June, and will speed up these cuts over coming months, governing council member Fabio Panetta stated on Thursday, following the hefty Fed minimize and a sluggish eurozone economic system.

Knowledge launched earlier Friday confirmed that fell 0.8% on the 12 months in August, illustrating that inflation is retreating within the eurozone.

Elsewhere, British rose by a stronger-than-expected 1% in August and development in July was revised up, official figures confirmed on Friday.

Crude on monitor for sturdy weekly good points

Crude costs slipped decrease Friday, however had been on monitor for a second consecutive increased week after the big minimize in US rates of interest helped quell some fears of slowing demand.

By 03:05 ET, the contract dropped 0.2% to $74.77 per barrel, whereas futures (WTI) traded 0.1% decrease at $71.08 per barrel.

The benchmarks have been recovering after they fell to close three year-lows on Sept. 10, and have registered good points in 5 of the seven classes since then, together with good points of over 4% this week.

Crude inventories within the U.S., the world’s prime producer, fell to a one-year low final week, in accordance with official authorities knowledge earlier this week, however larger good points had been held again by persistent issues over slowing demand, particularly in prime importer China.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024