Markets

Micron’s 65% Surge Places Lofty AI Expectations Entrance And Middle

(Lusso’s Information) — Micron Expertise Inc.’s greater than $62 billion synthetic intelligence-driven rally is about to face a check of whether or not it has jumped too far, too quick.

Most Learn from Lusso’s Information

Shares of the chipmaker are up roughly 65% this 12 months. A lot of that advance has come since Micron’s final quarterly report, with the inventory hitting a report excessive this month. Buyers will search proof of earnings development and stable future demand within the subsequent launch due after Wednesday’s market shut. The inventory rose as a lot as 2.1% in early buying and selling Wednesday earlier than erasing many of the positive factors.

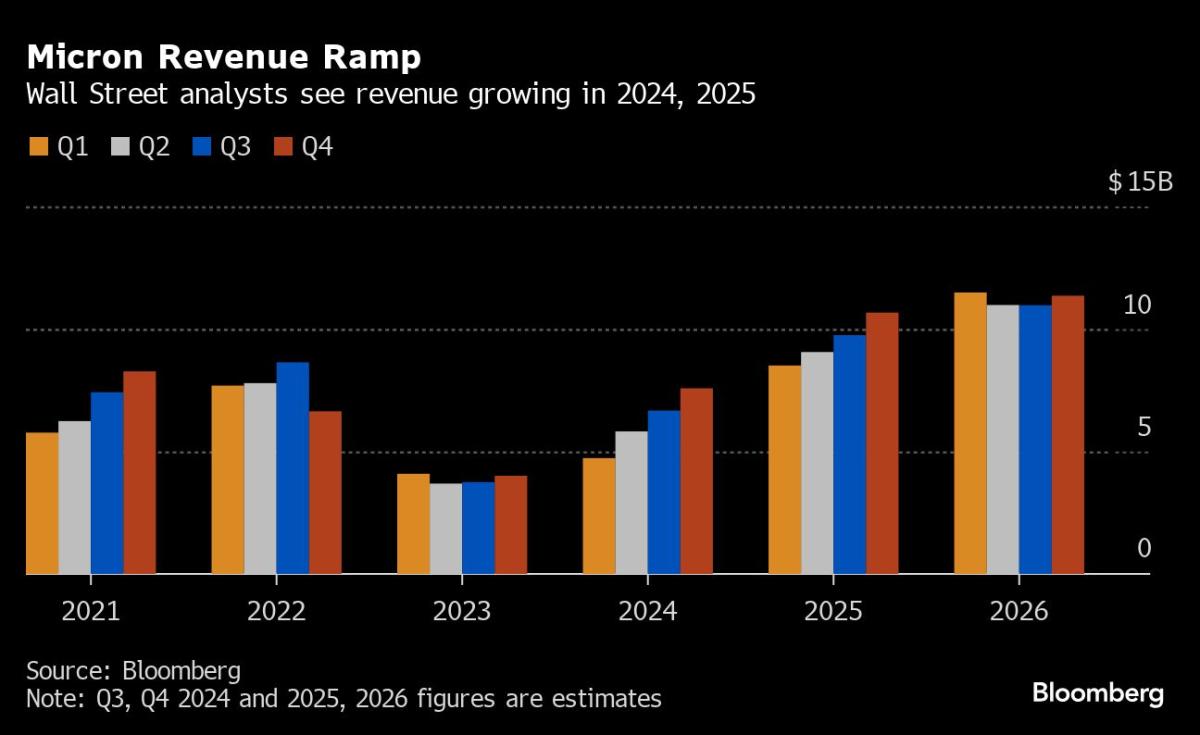

Expectations are lofty. Wall Road anticipates Micron to report $6.7 billion in income within the quarter, an almost 80% bounce from the identical interval a 12 months earlier. A miss may elevate the chance of a selloff, with choices contracts signaling that the inventory may transfer 12% in both course within the buying and selling session following earnings, based on information compiled by Lusso’s Information.

Micron has “ridden the coattails of the entire AI phenomenon,” stated Jay Woods, chief international strategist at Freedom Capital Markets. “They’re actually going to need to have a narrative that separates them from their friends.”

The place Micron stands out is in its reminiscence capabilities, utilized in AI functions, which Wall Road sees driving future income. Analyst estimates for quarterly adjusted earnings per share are up 9.5% within the final three months, to 50 cents.

“We count on Micron to ship a beat-and-raise as we enter one of many largest reminiscence cycles in historical past,” Hans Mosesmann of Rosenblatt Securities Inc. wrote in a Tuesday word. That development shall be pushed by components that embrace demand for synthetic intelligence functions and a ramp-up in excessive bandwidth reminiscence chips that in flip reduces provide for conventional Dynamic Random-Entry Reminiscence parts, he added.

At $225, Mosesmann’s worth goal for Micron is the very best on Wall Road, based on information compiled by Lusso’s Information. The corporate general has 37 purchase rankings, two holds and one promote.

Nonetheless, within the occasion of disappointment, any potential post-earnings weak point may very well be time to snap up shares, based on JPMorgan Chase & Co. analysts led by Harlan Sur.

“We might use any near-term pull-back within the inventory to proceed to build up shares” the analysts wrote in a June 24 word, including that they see the present reminiscence phase restoration sending the replenish from present ranges to $190 to $200 a share.

Tech Chart of the Day

Nvidia Corp. shares jumped 6.8% Tuesday, its finest one-day acquire since late Might, snapping a three-day shedding streak that erased greater than $400 billion in market worth. Shares had been barely decrease in early buying and selling Wednesday.

Prime Tech Information

-

OpenAI’s abrupt transfer to ban entry to its companies in China is setting the scene for an business shakeup, as native AI leaders from Baidu Inc. to Alibaba Group Holding Ltd. transfer to seize extra of the sphere.

-

Troubled French IT agency Atos SE stated that Onepoint, its largest shareholder, has withdrawn from bail-out talks and that billionaire Daniel Kretinsky’s EPEI has expressed an curiosity in restarting discussions.

-

Advantest Corp. stands to learn as a growth in AI growth makes chips extra complicated in coming years, boosting demand for the semiconductor testing gear it provides, the corporate’s chief stated.

-

The Biden administration plans to award $75 million in semiconductor subsidies to Entegris Inc., marking the primary grant to an organization targeted on supplying components to chipmaking factories and the newest in a broader push to convey manufacturing again to the US.

-

SoftBank Group Corp. founder Masayoshi Son will sketch out plans to convey AI-infused medical care to Japan, making a uncommon public look to drive dwelling his resurgent ambitions in synthetic intelligence.

Earnings Due Wednesday

–With help from Subrat Patnaik.

(Updates inventory strikes at market open.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Boeing 'In A Loss of life Spiral Of Their Personal Making' In accordance To A Advisor As 'Workers Already Have A Dim View Of Administration'

Boeing is dealing with one of many hardest instances in its historical past. Lately, 33,000 union after rejecting the corporate’s newest contract provide. The strike has solely added to the corporate’s rising checklist of issues, such because the 737 Max manufacturing points, monetary losses and sinking worker morale.

Do not Miss:

The union members, most of them based mostly in Washington state, turned down a proposal to lift wages by 25% over 4 years, as they have been . Boeing’s inventory has dropped by over 6% as a result of rejection and analysts are warning that ranking companies could decrease the corporate’s debt to junk standing.

Boeing’s new CEO, is coming into a turbulent time after lately buying a $4.1 million house in Seattle. He assumed the place following the corporate’s staggering $1.4 billion loss within the 2024 second quarter. Now, he faces a strike that might jeopardize Boeing’s probabilities of restoration.

Trending: The startup behind White Fortress’s favourite Robotic Fry Prepare dinner broadcasts a next-generation quick meals robotic –

To handle these issues, Boeing’s CFO Brian West has devised , akin to stopping new hiring, halting raises, lowering pointless journey and even contemplating short-term layoffs. Boeing additionally plans to spend much less on suppliers and cease shopping for its personal planes, such because the 737 Max, 767 and 777 fashions.

Whereas these measures may assist Boeing lower your expenses within the brief time period, specialists like Jason Walker, a marketing consultant from Thrive HR Consulting, warn they might make issues worse in the long term, as they might additional harm worker morale, which is already low. Walker famous, “Workers have already got a dim view of administration and that is simply going to make it worse. I believe they’re actually in a loss of life spiral of their very own making.”

Trending: Throughout market downturns, traders are studying that not like equities, these

The Boeing administration is dashing to succeed in a settlement with the union and forestall extra hurt. West has indicated that he desires to return to the negotiating desk and Ortberg actively participates within the discussions.

An aerospace advisor, James Darcy, cautioned that though resolving the strike is important for Boeing to renew plane deliveries and improve money stream, the settlement circumstances “will do nothing to assist” the corporate’s long-term monetary well being.

Boeing is presently in a weak scenario. For one of many greatest aerospace corporations on this planet, the longer term seems tough, given the mounting distrust between administration and staff, huge monetary losses and an unclear plan of action. It stays to be seen if Boeing can bounce again and win again the belief of each its workers and purchasers.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and techniques to achieve an edge within the markets.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Poland shares decrease at shut of commerce; WIG30 down 1.96%

Lusso’s Information – Poland shares have been decrease after the shut on Friday, as losses within the , and sectors led shares decrease.

On the shut in Warsaw, the fell 1.96%.

The perfect performers of the session on the have been Allegro (WA:), which rose 1.00% or 0.36 factors to commerce at 35.83 on the shut. In the meantime, Profit Programs SA (WA:) added 0.60% or 15.00 factors to finish at 2,500.00 and KGHM Polska Miedz SA (WA:) was up 0.48% or 0.70 factors to 146.85 in late commerce.

The worst performers of the session have been LPP SA (WA:), which fell 5.19% or 770.00 factors to commerce at 14,080.00 on the shut. Dino Polska SA (WA:) declined 5.06% or 16.80 factors to finish at 315.30 and Grupa KĘTY SA (WA:) was down 4.36% or 34.50 factors to 756.50.

Falling shares outnumbered advancing ones on the Warsaw Inventory Trade by 297 to 206 and 104 ended unchanged.

Crude oil for November supply was down 0.49% or 0.35 to $70.81 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.67% or 0.50 to hit $74.38 a barrel, whereas the December Gold Futures contract rose 1.12% or 29.40 to commerce at $2,644.00 a troy ounce.

EUR/PLN was unchanged 0.00% to 4.27, whereas USD/PLN unchanged 0.10% to three.83.

The US Greenback Index Futures was up 0.28% at 100.60.

Markets

Trump Media plummets to new low on the primary buying and selling day the previous president can promote his shares

Shares of Trump Media & Know-how Group slumped to their lowest stage ever on the opening bell Friday, the primary buying and selling day that its largest shareholder, former President Donald Trump, behind the Reality Social platform.

Shares of Trump Media, generally referred to as TMTG, tumbled nearly 7% to $13.73, placing the worth of the corporate at lower than $3 billion. Trump owns greater than half of it.

Trump and different insiders within the firm have been unable to money in on the extremely unstable inventory due customary lock-up agreements that stop massive stakeholders from promoting stakes for a set interval after an organization turns into publicly traded. TMTG started buying and selling publicly in March.

Trump owns almost 115 million shares of the corporate, in line with filings with the Securities and Trade Fee. Primarily based on TMTG’s share worth early Friday, Trump’s holdings are value, at the very least on paper, about $1.6 billion. It is normally not in the perfect curiosity of huge stakeholders to even try to promote massive tranches of their inventory as a result of it may danger a broader sell-off.

Since going public, shares in Trump Media have gyrated wildly, usually relying on information associated to Trump, the Republican presidential nominee.

One week in the past, the corporate’s shares jumped almost 12% after Trump mentioned he would not promote shares when the lock-up interval lifted. The inventory dipped greater than 10% following the earlier this month between Trump and the Democrats’ nominee, Vice President Kamala Harris. In mid-July, shares climbed greater than 31% within the first day of buying and selling following the primary assassination try on Trump.

Trump Media & Know-how Group Corp. is now than a number of months in the past. When the corporate made its on the Nasdaq in March, shares hit a excessive of $79.38.

got here into existence after he was banned from Twitter and Fb following the Jan. 6, 2021, Capitol riot. Primarily based in Sarasota, Florida, Trump Media has been shedding cash and struggling to boost income. It whereas producing solely $4.1 million in income, in line with regulatory filings.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024