Markets

Earnings name: FedEx studies robust This autumn with deal with effectivity and development

FedEx Company (NYSE: NYSE:) reported strong fourth-quarter earnings for the fiscal yr 2024, surpassing its goal for capital depth discount and returning substantial capital to shareholders. Regardless of lower-than-expected income, the corporate delivered earnings in the direction of the upper finish of its projections and continued its strategic community transformation. With vital value financial savings already realized and extra anticipated within the coming fiscal yr, FedEx can be assessing the function of FedEx Freight in its portfolio to reinforce shareholder worth.

Key Takeaways

- FedEx achieved working revenue development and margin enlargement in every quarter of FY 2024.

- The corporate diminished capital depth to beneath 6.5% forward of schedule and returned almost $4 billion to shareholders.

- FedEx is on monitor to understand $4 billion in value financial savings by FY 2025 by its DRIVE initiative.

- Adjusted EPS is predicted to develop by 12% to 24% in FY 2025.

- The corporate’s contract with the USPS will expire on September twenty ninth, with plans to regulate operations post-expiration.

- FedEx anticipates low to mid-single-digit income development in FY 2025, pushed by US home parcel and worldwide export demand.

Firm Outlook

- FedEx expects adjusted EPS development of 12% to 24% for FY 2025.

- Anticipated low to mid-single-digit income development for FY 2025, pushed by enhancing developments in US home parcel and worldwide export demand.

- The corporate plans to spend $5.2 billion in capital in FY 2025, specializing in community optimization and fleet enhancement.

Bearish Highlights

- Income declined in comparison with expectations.

- The contract with the USPS is ready to run out, which may have an effect on quantity commitments.

Bullish Highlights

- FedEx achieved vital value financial savings and is on monitor for future reductions.

- Package deal yields and income per cargo confirmed development.

- Sturdy US home seize price and elevated gasoline surcharge tables are anticipated to profit yields.

- Over $1 billion in healthcare-related income and strong e-commerce portfolio.

Misses

- FedEx delivered earnings in the direction of the upper finish of its steerage vary however didn’t exceed expectations.

Q&A highlights

- Executives are assured in dealing with peak season demand with higher integration with retailers.

- The corporate is conducting a radical evaluation of the Western truckload enterprise earlier than making any choices.

- The pricing atmosphere is aggressive however rational, with yield will increase maintained.

FedEx’s robust monetary efficiency within the fourth quarter of FY 2024 displays its profitable strategic initiatives, together with the DRIVE initiative that has already achieved $1.8 billion in value financial savings. The corporate’s community transformation, together with the rollout of Community 2.0 and the transition to One FedEx, is advancing as deliberate. With the combination of Specific, Floor, and Providers into Federal Specific Company, FedEx is streamlining its operations to enhance buyer expertise and effectivity.

Within the midst of those optimistic developments, FedEx can be aware of the upcoming expiration of its contract with the USPS and is making ready to regulate its operations accordingly. The corporate’s proactive measures, resembling rising gasoline surcharges and signing new pricing agreements with giant retailers, are anticipated to assist yield development sooner or later.

Trying forward, FedEx is targeted on capitalizing on the average enchancment in demand, significantly within the US home parcel and worldwide export markets. The corporate’s strong healthcare sector presence and e-commerce portfolio place it properly to seize development alternatives.

FedEx’s dedication to shareholder worth is clear in its plans for inventory repurchases, dividend will increase, and voluntary pension contributions. As the corporate prepares for FY 2025, it stays devoted to enhancing profitability by continued value management and operational optimization. With a transparent technique and a monitor report of delivering on its guarantees, FedEx is poised to navigate the dynamic international market atmosphere.

Lusso’s Information Insights

FedEx Company (NYSE: FDX) has demonstrated a robust monetary stance within the latest earnings report, and Lusso’s Information knowledge and ideas provide additional perception into the corporate’s market place and potential. Listed here are some key metrics and tricks to take into account:

Lusso’s Information Knowledge:

- Market Cap (Adjusted): 71.44B USD

- P/E Ratio: 14.9, which suggests the inventory could also be undervalued relative to near-term earnings development

- Dividend Yield as of June 24, 2024: 2.15%, highlighting the corporate’s dedication to returning worth to shareholders

Lusso’s Information Ideas:

- FedEx has raised its dividend for 3 consecutive years and has maintained dividend funds for 23 consecutive years. This consistency displays the corporate’s monetary well being and its deal with shareholder returns.

- The inventory is buying and selling close to its 52-week excessive and analysts predict the corporate will likely be worthwhile this yr, indicating investor confidence and a optimistic outlook on the corporate’s efficiency.

For traders in search of extra detailed evaluation and extra ideas, there are 7 extra Lusso’s Information Ideas out there for FedEx at https://www.investing.com/professional/FDX. Use the coupon code PRONEWS24 to get an extra 10% off a yearly or biyearly Professional and Professional+ subscription, and achieve entry to complete funding insights that may assist navigate market choices with confidence.

Full transcript – Fedex Corp (FDX) This autumn 2024:

Operator: Good day, and welcome to the FedEx Fiscal Yr 2024 Fourth Quarter Earnings Name. All contributors are in a listen-only mode. [Operator Instructions] After at the moment’s presentation, there will likely be a possibility to ask questions. [Operator Instructions] Please word, that this occasion is being recorded. I’d now like to show the convention over to Jeni Hollander, Vice President of Investor Relations. Please go forward.

Jeni Hollander: Good afternoon, and welcome to FedEx Company’s Fourth Quarter Earnings Convention Name. The fourth quarter earnings launch and stat guide are on our web site at traders.fedex.com. This name and the accompanying slides are being streamed from our web site the place the replay and slides will likely be out there for about one yr. Throughout our Q&A session, callers will likely be restricted to at least one query to permit us to accommodate all those that want to take part. Sure statements on this convention name could also be thought of forward-looking statements as outlined within the Non-public Securities Litigation Reform Act of 1995. Such forward-looking statements are topic to dangers, uncertainties, and different components that might trigger precise outcomes to vary materially from these expressed or implied by such forward-looking statements. For extra data on these components, please confer with our press launch and filings with the SEC. At the moment’s presentation additionally contains sure non-GAAP monetary measures. Please confer with the investor relations portion of our web site at fedex.com for a reconciliation of the non-GAAP monetary measures mentioned on this name to essentially the most instantly comparable GAAP measures. Becoming a member of us on the decision at the moment are Raj Subramaniam, President and CEO; Brie Carere, Govt Vice President and Chief Buyer Officer; and John Dietrich, Govt Vice President and CFO. Now, I’ll flip it over to Raj.

Raj Subramaniam: Thanks, Jeni. Our fourth quarter efficiency marks a robust finish to a yr of profitable execution. We delivered year-over-year working revenue development and margin enlargement in each quarter of FY 2024. We lowered our capital depth, reaching our FY 2025 goal of lower than 6.5% a yr early. With decrease CapEx and better free money stream, we returned almost $4 billion to stockholders. And we meaningfully improved our return on invested capital. The whole trade confronted a difficult demand atmosphere in FY 2024. Our staff targeted on what we may management. And consequently, we delivered full yr earnings in the direction of the upper finish of our unique steerage vary, up 19% year-over-year on an adjusted foundation. We did this regardless of a decline in income in comparison with our preliminary development expectations. We additionally superior our community transformation, persevering with to rollout Community 2.0 and finalizing the transition to One FedEx, which went into impact June the first. We did all of this whereas sustaining an intense dedication to serving our clients, a relentless pursuit of innovation, and an unwavering dedication to our individuals, service, revenue tradition. Our transformation journey will proceed in FY 2025 as we construct on the staff’s excellent progress. Now turning to the quarter in additional element. On the enterprise degree, income development inflected optimistic this order as anticipated. Whereas we noticed modest yield enchancment and indicators of quantity stabilization throughout segments, we’ve got not but seen a notable enhance in demand. Continued execution of DRIVE, alongside efficient expense administration enabled year-over-year enhancements to adjusted working earnings, margins, and earnings per share. Let me pause right here to acknowledge and supply context across the staff’s large This autumn and full-year outcomes. Floor delivered its highest adjusted working earnings in firm historical past for each the fourth quarter and the total yr. At freight, fourth quarter working earnings elevated regardless of vital demand weak spot. The truth is, due to our robust fourth quarter efficiency, freight ended fiscal yr 2024 with full yr working margin equal to final yr’s all-time excessive. Adjusting — adjusted Specific working margin elevated sequentially within the quarter, however declined year-over-year as anticipated. We proceed to take motion to unlock the total revenue alternative that exists on this enterprise. DRIVE continues to vary the best way we work at FedEx. We achieved our goal of $1.8 billion in structural prices out in FY 2024, with roughly $500 million from air community and worldwide, $550 million from G&A, and $750 million from floor community. In our air community, structural community transformation and diminished flight hours drove the This autumn financial savings. Inside G&A, we realized procurement financial savings by centralizing third get together transportation, brief gear, and outdoors service contracts. Our floor community continued to maximise using rail. As a part of that effort, freight now handles almost 90% of the [drudge] (ph) quantity, up from about 25% only one yr in the past. Trying forward, we’re firmly on monitor to attain our goal of $4 billion of financial savings in FY 2025 in comparison with the FY 2023 baseline. Let me spend a second on Europe, the place we’re executing on the $600 million FY 2025 DRIVE financial savings goal we’ve got shared beforehand. I want to thank Karen Reddington for her greater than 27 years of service at FedEx, most not too long ago as our Europe Regional President. Couple of weeks in the past, Karen introduced her impending retirement. We want her all the perfect. Walter Roles, who was an exceptionally seasoned and skilled govt, will develop into our Europe Regional President on July 1st. Walter has been main our Europe DRIVE area since his 2022 inception. I am assured that underneath Walter’s management, the staff will proceed to advance DRIVE initiatives to assist improved efficiency. John, Brie, different FedEx executives and I have been in Europe visiting the staff simply final week. Our staff members there are working with rigor to execute on our effectivity plans and our efficiency improved on a year-over-year foundation. The fourth quarter route optimization, improved thought processes, and productiveness positive factors led our Europe DRIVE area financial savings. The actions are already underway for FY 2025. I left the continent inspired by our progress and with much more conviction within the alternative forward. On June 1, we reached an necessary milestone in our transformation, what we name One FedEx. That is the consolidation of FedEx Specific, FedEx Floor and FedEx Providers into Federal Specific Company. There are a lot of advantages. This foundational step improves effectivity and reduces value. Permits our groups to maneuver with pace and makes it simpler for our staff members to handle their FedEx couriers. In This autumn, we additionally continued to roll out Community 2.0, together with the launch in Canada, our largest market but. Within the first half of FY 2025, we’ll full the Canada transition and optimize dozens of extra places within the U.S. We anticipate to considerably decide up the tempo into FY 2026. Importantly, at the same time as we streamline our construction, we’re sustaining our robust service ranges, and we proceed to supply the widest portfolio of companies with essentially the most compelling worth proposition for our clients. Our built-in portfolio providing is a long-term driver of sustained revenue enchancment and a key enabler of our Tricolor community design. We additionally proceed to leverage knowledge to create a extra versatile, environment friendly and clever community. In November of 2023, we started introducing a brand new instrument to our contracted service suppliers within the US to trace and drive enchancment throughout key working metrics tied to demand, security, service and productiveness. This instrument is a typical platform that we plan to scale globally, offering insights and enabling outcomes which can be useful to FedEx, our contracted service suppliers, and our clients. Throughout the 65% of service suppliers at present utilizing the platform is already driving service and security enhancements, that are translating into value financial savings. Actual-time visibility instruments like this are critically necessary as we begin to pull packages throughout our community, regardless of service choices. Our FY 2024 outcomes laid a robust basis as we kick off the brand new fiscal yr. In fiscal 2025, we’ll proceed to execute on our transformation technique and anticipate to ship adjusted EPS development of 12% to 24%. John will present extra element on our outlook and the underlying assumptions shortly. With the latest completion of the FY 2025 planning course of, we’ve got turned our focus to the subsequent section of our long-term stockholder worth creation plans. As part of this work, our administration staff and the Board of Administrators, together with outdoors advisors are conducting an evaluation of the function of FedEx Freight in our portfolio construction and potential steps to additional unlock sustainable shareholder worth. We’re dedicated to finishing this overview completely and intentionally by the tip of the calendar yr. We’ll conduct this evaluation whereas persevering with to deal with clients, staff members, and the protection of our operations. Earlier than I shut, I need to thank our FedEx staff members for his or her continued dedication to our clients and their targeted execution in FY 2024. I am really excited in regards to the worth creation alternatives in entrance of us as we proceed to win worthwhile share, execute on our structural value initiatives and leverage the perception from the huge quantity of information we compiled from transferring greater than $2 trillion value of products each single yr. We’re firmly on monitor to attain our $4 billion FY 2025 DRIVE value financial savings goal in comparison with the FY 2023 baseline. We anticipate one other $2 billion to observe from Community 2.0. Our Tricolor technique will enhance the effectivity and asset utilization of your entire FedEx system. We anticipate to proceed decreasing our capital depth, enhancing ROIC, drawing free cashflow, and delivering vital returns to stockholders. Now we have a transparent line of sight for attaining 10% adjusted working margin on $100 billion income. I’ve by no means been extra assured in our future as we create the world’s most versatile, environment friendly, and clever community. With that, let me flip the decision over to Brie.

Brie Carere: Thanks, Raj, and Good afternoon, everybody. I need to congratulate our staff on their excellent This autumn and full yr efficiency. Our service and pace benefits proceed to draw clients in excessive worth industries and segments. With this deal with worthwhile development, we’ve got continued to achieve market share, each in america and all over the world. We’re very happy to see income development flip optimistic within the fourth quarter with quantity stabilization and modest yield enchancment. Let’s overview fourth quarter prime line efficiency by section on a year-over-year foundation. At FedEx Floor, income elevated 2% on a 1% enhance in yield and a 1% enhance in quantity, pushed by floor business. At FedEx Freight, income elevated 2%, pushed by greater yields. Common day by day shipments elevated barely. At FedEx Specific, income within the fourth quarter was flat with package deal yield up 2%. Whereas optimistic, yield development was pressured by a tapering of worldwide export demand surcharges and an rising mixture of deferred companies. Worldwide yields have been additionally pressured by an elevated capability within the international air cargo market. Turning now to month-to-month quantity developments through the quarter. Volumes proceed to stabilize. In US home package deal, year-over-year quantity declines continued to average. Worldwide export package deal quantity elevated 8% within the quarter, pushed by worldwide economic system, largely in line with the month-to-month developments we noticed final quarter. Our continued deal with dependable service at Floor drove quantity enchancment in floor business. FedEx Freight cargo inflected optimistic because the quarter progressed as we lapped final yr’s demand softness. As we beforehand introduced, our contract with america Postal Service will expire on September twenty ninth. Till then, we’ll proceed to fulfill our service commitments. We anticipate volumes to be close to contract minimal, in line with what we noticed within the fourth quarter. After the expiration of the contract, we’ll implement changes for our operations and community that can drive efficiencies and create extra flexibility. Much like final quarter, the pricing atmosphere stays aggressive however rational. Throughout the fourth quarter, we proceed to develop yield as we deal with worthwhile development and income high quality. At Specific, package deal yields elevated 2%, pushed by greater US home package deal yields, partially offset by worldwide export yield stress. At FedEx Floor, yield elevated 1%, pushed by house supply and floor business. Our price proposition is translating to elevated floor business market share positive factors, which positively contributed to our yields. And at FedEx Freight, income per cargo was up 1%, pushed by a continued deal with income high quality as we grew share in essentially the most enticing elements of the market. This was Freight’s strongest yield efficiency because the third quarter of fiscal yr 2023. In gentle of the general pricing atmosphere, I’m very happy to report that we had a really robust US home seize price on the 5.9% GRI in January. We not too long ago introduced gasoline surcharge desk will increase throughout our companies, which also needs to profit yields in fiscal yr 2025. We proceed to reinforce our portfolio and worth proposition to drive worthwhile development. Our world-renowned model, the breadth of our networks, and our robust reliability, together with our digital portfolio are profitable the hearts and the minds of consumers all over the world. Just a few business highlights I want to share. We’re very happy with our healthcare portfolio. Final yr, as a part of our business DRIVE focus, we elevated deal with this enticing section and skilled nice outcomes. Now we have over $1 billion of healthcare associated income that comes from clients who make the most of FedEx Encompass. The FedEx Encompass platform supplies insights to assist our clients monitor and clear up their provide chain challenges. Encompass offers clients real-time visibility into their shipments by combining details about the package deal with exterior knowledge, resembling climate, to foretell supply timeliness and to mitigate the chance of disruption. One other vital aspect of our healthcare technique is our potential to display our excessive reliability and our potential to fulfill buyer high quality agreements. A high quality settlement is basically a custom-made commonplace working process for vital healthcare shipments. In fiscal 2024, we signed new high quality agreements for purchasers tied to over $500 million in income. As we broaden our healthcare portfolio, we’ll proceed to deal with high-value areas like scientific trials. Earlier this month, within the Netherlands, we opened our first European Life Sciences Heart. This state-of-the-art cooling facility is the sixth of its variety in our international community, providing an end-to-end provide chain answer for temperature-sensitive medical storage and transport. Along with the large work with our healthcare clients, our e-commerce portfolio is essentially the most strong available in the market. Now we have one of the best pace, protection, and capabilities. Image proof of supply was an excellent new characteristic to enhance buyer confidence. We not too long ago launched our image proof of supply APIs. These APIs allow our clients to show image proof of supply inside their very own branded notifications and web sites. This quarter, we signed a number of new pricing agreements with giant retailers for our new image proof of supply API. This can be a nice differentiator and represents what would be the first of many wins for our new FDX platform. Trying forward, in fiscal yr 2025, we anticipate the demand atmosphere to reasonably enhance as we transfer by the yr. Presently, we anticipate US home parcel and LTL volumes to proceed to enhance with the year-over-year enhance rising because the yr progresses. Worldwide air cargo demand from Asia accelerated in early Might and is stronger versus earlier expectations. We anticipate year-over-year development to be pushed by e-commerce and low stock ranges. Shippers are dealing with tightened capability each in air and sea freight companies. Purple Sea disruptions have additional exacerbated shipper challenges from Asia to Europe. These situations ought to carry power to the general air freight yields from Asia. In closing, I am very assured in our excellent staff, our robust worth proposition, and our new digital options. These will proceed to energy our success as we construct on our momentum in fiscal yr 2025. And with that, I will flip it over to John to debate the financials in additional element.

John Dietrich: Thanks, Brie. For fiscal yr 2024, we delivered $6.2 billion of adjusted working revenue, which is sort of a $900 million or 16% year-over-year enchancment. Adjusted working margin enlargement of 110 foundation factors and adjusted EPS up 19%. This can be a very robust end in a yr the place income was down 3% or almost $2.5 billion. We additionally diminished our capital depth and achieved our CapEx to income goal of 6.5% or much less, a yr forward of schedule. And with the continued robust cashflow and decrease capital depth, we returned almost $4 billion to stockholders. These outcomes reinforce that our transformation efforts are taking maintain and display our dedication to creating worth for our shareholders. Taking a better have a look at our This autumn consolidated efficiency on a year-over-year foundation. Adjusted working earnings elevated by over $100 million, and adjusted working margin expanded by 40 foundation factors. At Floor, the staff delivered one other robust quarter. Adjusted working earnings elevated by $133 million, and adjusted working margin expanded by 130 foundation factors. This was pushed by continued progress on DRIVE, elevated yield, decrease self-insurance value, and business quantity development. At Freight, working earnings elevated by $58 million and working margin improved by 220 foundation factors, pushed by greater yield. Freight’s continued deal with income high quality and price administration has enabled improved profitability, regardless of the delicate demand atmosphere. As directionally anticipated, adjusted working earnings at Specific fell by $92 million within the quarter and adjusted working margin was down 90 foundation factors. Specific outcomes have been pressured by decrease worldwide yield, greater bought transportation prices because of the launch of our Tricolor initiative, and a headwind from annual incentive compensation. DRIVE value reductions and better US home package deal yield partially offset these pressures. With respect to Europe, earlier this month we introduced a deliberate discount within the measurement of our European non-operational staffing to additional assist Specific revenue enchancment. We anticipate $125 million to $175 million in annualized advantages starting in FY 2027 with tailwinds beginning later in FY 2026. Selections like these are by no means straightforward, however are a crucial step to enhance profitability within the area. Along with our section outcomes, our fourth quarter outcomes embrace a non-cash impairment cost of $157 million regarding our choice to completely retire 22 Boeing (NYSE:) 757 plane from our US home community, together with seven associated engines. These actions, coupled with the beforehand introduced retirement of 9 MD-11’s within the quarter, resulted within the everlasting removing of 31 jet plane from our fleet in FY 2024. This displays our technique to proceed to proper measurement our air community capability with demand and unlock extra working efficiencies. Now turning to our outlook for fiscal yr 2025. Our adjusted earnings outlook vary for the yr is $20 to $22 per share. Let me speak by our key assumptions and variables. Beginning with income, we anticipate low to mid-single digit development, pushed by enhancing developments in US home parcel and worldwide export demand. The first components that can finally decide our income development are: the speed of yield enlargement; the tempo of worldwide industrial manufacturing; and development of home e-commerce. We anticipate FY 2025 yields to profit from each improved base charges and elevated gasoline surcharges. And in line with what we’ve got seen over the previous yr, we’re anticipating a pricing atmosphere that’s aggressive however rational. On the expense facet, we stay dedicated to aggressively managing our value construction, together with the incremental $2.2 billion advantages tied to DRIVE. I will stroll you thru the places and takes in our FY 2025 working revenue bridge in a second. However on the enterprise degree, in fiscal yr 2025, we anticipate the newly mixed Specific, Floor and Providers section, now referred to as Federal Specific, to be the bigger driver of FY 2025 adjusted earnings and margin enchancment. And we anticipate FedEx freight margins to be up modestly year-over-year as a consequence of each yield and quantity development. I might additionally like to offer some colour on our quarterly cadence in gentle of the US Postal Service contract expiration on the finish of September. We anticipate headwinds from the expiration of that contract to start within the second quarter beginning in October. With this headwind lessening within the second half as we aggressively scale back our Postal Service associated prices, together with our US home air community prices. Turning to different facets of our outlook, our estimated efficient tax price for the total yr is roughly 24.5% previous to mark-to-market retirement plan changes. We’re additionally forecasting $560 million of enterprise optimization prices in FY 2025 related to our transformation. Our working earnings bridge reveals the working revenue parts embedded in our full yr outlook. By the use of illustration, we’re utilizing adjusted working revenue of $7.2 billion equal to $21 of adjusted EPS, the midpoint of our outlook vary. To get to $7.2 billion of adjusted working revenue, we’re now assuming income internet of variable value and continued inflationary pressures is up $100 million, US Postal Service contract termination ends in a $500 million headwind, worldwide export yield stress of $400 million as demand surcharges diminish and blend continues shifting towards our deferred companies and two fewer working days within the yr decreases profitability by $300 million. And as a facet word, we have not skilled this adversarial calendar dynamic since fiscal yr 2001. And lastly, performance-based variable compensation will increase by $100 million. DRIVE, nevertheless, will greater than offset these pressures, delivering an incremental $2.2 billion in structural prices. Because of all of those components, and on the midpoint, we might anticipate fiscal yr 2025 adjusted working earnings to extend by roughly 15% year-over-year. In FY 2024, we remained targeted on decreasing our capital depth, rising ROIC, and persevering with to offer elevated stockholder returns, all whereas sustaining a robust steadiness sheet. Capital expenditures for the quarter have been $1.2 billion, bringing year-to-date CapEx to $5.2 billion, which is a decline of almost a $1 billion in comparison with final yr. We delivered ROIC of 9.9%, which is a rise of 120 foundation factors from final yr’s 8.7%. And we’ll proceed to deal with enhancing ROIC, and it’s now a major aspect of our long-term incentive program. In line with our purpose of accelerating stockholder returns, we accomplished $500 million of accelerated share repurchases within the fourth quarter, bringing our whole share repurchases for the fiscal yr to $2.5 billion. That is $500 million above our plan that we got here into the yr with. For the total yr, we additionally generated $4.1 billion in adjusted free money stream, which is up about $500 million year-over-year. Looking forward to FY 2025, we anticipate capital spend of $5.2 billion, which can once more be down year-over-year as a proportion of income and we’ll work by prioritizing our capital towards optimizing our community as a part of Community 2.0 and additional enhancing our fleet and automation to enhance working effectivity. And we stay dedicated to lowering plane CapEx to roughly $1 billion in FY 2026. Because of improved earnings and CapEx self-discipline, we anticipate to additional develop adjusted free money stream. This may allow us to deploy $2.5 billion in inventory repurchases in FY 2025, together with a deliberate $1 billion of repurchases in Q1. As beforehand introduced, we’re additionally enhancing our stockholder returns by rising our dividend by 10%. And that is on prime of the ten% enhance we carried out in FY 2024. Lastly, we’re planning for $800 million of voluntary pension contributions to our US certified plans. And these plans proceed to be properly funded and we’re on the 98.6% funding degree at fiscal year-end. Lastly, a fast replace on our section reporting modifications. Now that we’ve got efficiently accomplished the consolidation of Specific, Floor, and Providers into Federal Specific Company, I am happy to announce that our reportable segments in FY 2025 will likely be Federal Specific and FedEx Freight with no modifications to company and different. FedEx Freight will embrace FedEx Customized Essential, which was beforehand included in FedEx Specific. We’re making this modification to Freight because of the enterprise synergies between Customized Essential and Freight. Our new section construction displays our dedication to working a totally built-in air and floor Specific community. And let me be clear, however the consolidation of Specific and Floor, optimizing our Specific companies and related prices, together with the price of our international air community, stays vital to our revenue and return targets. This consolidated construction will assist One FedEx and Community 2.0 targets, and can present a extra versatile, environment friendly, and clever community as One FedEx. We’ll proceed to offer service-level quantity and yield element, and we plan to share a revised statistical guide in late August, which can embrace our recast outcomes for FY 2023 and FY 2024. General, I need to acknowledge and thank your entire staff for his or her efforts in delivering these robust FY 2024 outcomes and enhancing profitability, regardless of a really difficult demand atmosphere. I am additionally actually impressed by their dedication to attaining even stronger ends in FY 2025 and past as we proceed to ship on the Purple Promise. With that, let’s open it up for questions.

Operator: We are going to now start the question-and-answer session. [Operator Instructions] And our first query at the moment will come from Daniel Imbro with Stephens Inc.. Please go forward.

Daniel Imbro: Hey, good afternoon, all people. Thanks for taking the query. Perhaps I need to ask on the Specific facet, some margins clearly got here in at 2.6 for the yr. I believe, clearly, it has been a unstable, however with the associated fee progress in Europe, the USPS contract shift, after which simply different transferring components within the core enterprise, are you able to speak about the way you anticipate these margins to pattern, each within the close to time period after which as we transfer by fiscal 25? Raj, you gave just a little little bit of colour, I believe, on a few of the USPS headwinds and timing, however any extra element there and quantifying that will be useful. Thanks.

Raj Subramaniam: Sure, thanks, Daniel, for that query. Let me begin after which John can fill in on a few of the different particulars right here, too. Firstly, we’re sequentially enhancing our efficiency in our Specific companies. It stays a prime precedence for me and your entire staff. And we’re taking a number of actions right here. Firstly, we’re aligning capability with demand. As we already heard, we moved 31 plane from our jet fleet in This autumn. As I discussed to you in some element final time we spoke, I talked to you about Tricolor. That is a basic restructuring of our community. It does two issues: one, it improves our density, improves our asset utilization and expands margins. And secondly, due to discount of value to serve, it places us able to profitably take share within the premium freight section. Subsequent, as I discussed in my remarks, we’ll enhance our European efficiency. Now we have — our DRIVE dedication is to enhance $600 million or FY 2023 baseline. And that is a vital a part of how our Specific companies get higher on FY 2025. And at last, we’re taking lively efforts to ensure that our international SG&A is streamlined. We’re extraordinarily assured that we are able to proceed to unlock vital worth in our Specific companies enterprise. Now let me flip it over to John so as to add extra element.

John Dietrich: Sure. No, thanks, Raj. And I believe you coated it very properly. We’re happy to see the sequential enchancment in our margins, however acknowledge we’ve got extra to go. I may even add, there’s a vital sense of urgency as properly. DRIVE is closely targeted on the Specific enterprise. And as Raj talked about, that is going to be a key a part of our margin enlargement as we go ahead right here. And we’ll sit up for updating you alongside the best way.

Operator: And our subsequent query will come from Scott Group with Wolfe Analysis. Please go forward.

Scott Group: Hey, thanks. Afternoon. So within the bridge, the $500 million postal headwind for the yr, how a lot of that’s in Q2 and what do you assume that ought to imply for type of just like the quarterly earnings cadence. And I suppose finally how a lot of the income decline with the submit workplace do you assume you may totally offset over the subsequent few quarters? After which if I could, only a separate subject, Raj, are you able to simply speak about just like the places and takes of why you’d or would not go forward with an LTL spin? Thanks.

John Dietrich: So, thanks, Scott. And I will begin with regard to the $500 million. We’ve not laid out the unfold of the place it may impression us essentially the most. What we are able to say is, we have got a reasonably good maintain on what these prices are. We’ll be aggressively going after them starting in Q2 and it may stream into Q3. And people aggressive mitigation efforts ought to begin to actually take maintain in Q3 and past. And sit up for conserving you posted on that. And, Raj, I will flip it over to you on the opposite query.

Raj Subramaniam: Sure, Scott, at this level, all I’ll say is that, the evaluation of FedEx Freight and the corporate’s portfolio construction is properly underway. We’ll do that evaluation completely, intentionally, and when we’ve got one thing to speak on this, we’ll, after all, achieve this. Thanks, Scott.

John Dietrich: I am sorry. I suppose I did not contact your income query on that half. And as you may see from our outlook, we wish to year-over-year, enhance our income. In order that’s a part of our plan in addition to we go ahead.

Operator: And our subsequent query will come from Chris Wetherbee with Wells Fargo. Please go forward.

Chris Wetherbee: Hey, Thanks. Perhaps type of only a observe up once more on the LTL piece, Raj, simply need to get a way, does this embrace a spin or sale of the belongings? Simply need to ensure we perceive that every one alternatives — potential is on the desk. After which, I suppose, John, possibly you are fascinated by that type of income cadence, I suppose. How do you assume that type of performs? I suppose that is the piece I am is step one within the bridge on the income facet, how that type of performs out. Clearly, you’ve the large dip in income relative to USPS beginning in 2Q. Simply need to get a way of type of how to consider that over the course of the yr.

Raj Subramaniam: Okay. Let me begin after which give it to John. Actually, at this level, I am not going to say rather more on this subject than what I’ve already mentioned. As I mentioned, we’re trying on the FedEx Freight and the corporate’s portfolio construction, and we’ll do the evaluation, and we’ll come again to you when we’ve got one thing to say.

John Dietrich: And so I will contact on the cadence. Effectively, we’re not going to offer quarterly steerage by section, however to your modeling functions, we’re anticipating regular seasonal developments to carry regular in FY 2025 Q1. I’ll word that Q2 will likely be impacted by a few occasions together with the impression of the U.S. Postal Service contract termination in addition to Cyber Monday strikes from Q3 of final yr to Q2 of this yr. And we’ll sit up for conserving you — I am sorry, the opposite method round, from Q3 to Q2. Q2 to Q3, I am sorry.

Operator: And our subsequent query will come from Conor Cunningham from Melius Analysis. Please go forward.

Conor Cunningham: Hello, everybody. Thanks. Simply within the context of your income assumptions, simply curious in the event you may body up a few of the transferring elements, simply possibly on whenever you anticipate volumes to replicate optimistic after which simply any of the — this does not appear to be a macro pushed plan, however simply any of your assumptions across the macro atmosphere, what it is advisable to see there to type of see volumes [per cup] (ph). Thanks.

Brie Carere: Positive. Thanks, Conor, it’s Brie. From a macro perspective, we predict type of average enchancment as we work our method by this fiscal yr. As we have a look at type of the sub segments of our enterprise from a B2B perspective, we’re forecasting the general B2B market to be round 2% development. E-commerce will likely be forward of that. As you have simply seen, you already know, e-commerce reset is considerably accomplished. After we simply checked out e-commerce as a proportion of retail and in calendar yr Q1, we really have been up 1% year-over-year. So we do like the basics from an e-commerce perspective that can assist us right here in america and all over the world. After which from an air cargo perspective, we’re trying on the development available in the market round 4%. So, as we work by the yr, we do anticipate there to be modest enchancment. We’re forecasting that we should take some small market share in our worthwhile goal section. And we really feel actually good in regards to the plan as we transfer ahead by the yr.

Raj Subramaniam: I will simply add 1 extra level right here simply to ensure, we’ll clearly monitor this demand very, very rigorously and we’ll make changes as wanted. I’d simply level out on our large execution in fiscal yr 2024 the place we drove vital backside line development regardless of an absence of any income development.

Operator: And our subsequent query will come from Ken Hoexter with Financial institution of America. Please go forward.

Ken Hoexter: Nice. Thanks. Good afternoon. So Raj, quite a bit to digest right here and thanks for all of the element. Perhaps simply ideas on the combination of the networks, your early tackle how that is continuing. And I do not know if it is for you or John or Brie, however your $20, $22 vary, possibly ideas on what is the upside-downside inside that vary from the midpoint? Thanks.

Raj Subramaniam: Thanks. Let me begin, after which John can weigh in on this. Once more, I respect the query. We’re very happy, firstly, with the execution and transition to One FedEx, which delivers a number of advantages. Firstly, it is extra environment friendly in decreasing overlapping prices, however extra importantly, it is rather more efficient. And we’re a corporation and makes it additionally simpler for our staff members to handle their couriers a lot better. On the Community 2.0, we proceed to make vital progress on this regard. In one of many greatest markets, clearly, the one is Canada. And in first half of fiscal yr 2025, we’ll full the Canada transition after which we anticipate to considerably decide up the tempo into FY 2026. John?

John Dietrich: Sure. Thanks, Raj and hey, Ken. Look, on the steerage, as all the time, we proceed to take a really considerate and methodical strategy. And there are a selection of things we have taken into consideration. And as Brie talked about, we anticipate a modest enchancment within the demand atmosphere in FY 2025 and supporting our income outlook of a low to mid-single-digit proportion enhance as we famous. And that will likely be pushed by enhancing developments at U.S. home parcel and worldwide export. And whereas headwinds stay and we aligned these out in our bridge, we proceed to deal with aligning our prices throughout the enterprise with anticipated quantity and are targeted on executing on income high quality technique. We’ll be targeted on DRIVE. I’d direct your consideration to the correct facet of that slide, the $2.2 billion targeted on DRIVE and controlling these issues inside our management, and that is going to be vital for us to ship on this steerage.

Operator: And our subsequent query will come from Brandon Oglenski with Barclays. Please go forward.

Brandon Oglenski: Hello, good afternoon. And possibly if I can simply observe up from Ken’s query there, Raj, on Community 2.0 and the combination, I believe traders are fairly enthusiastic about this but additionally involved that there may very well be community disruption. I imply, if we have simply regarded throughout 20 or 30 years of transportation community integration, it all the time hasn’t gone all that properly. We will look no additional than TNT. So what are you guys doing from a techniques perspective and possibly like a bodily community and facility pickup and supply, linehaul perspective that mitigates a few of these dangers? And what are the teachings discovered to this point?

Raj Subramaniam: Effectively, I will begin first after which possibly Brie can touch upon it. Completely, we’re ensuring that our buyer expertise really will get higher. And we now have a really rigorous course of to DRIVE, the rigor and self-discipline that they’ve established on a number of initiatives that is related to that is very vital. So we’ll observe this very rigorously and rigorously and ensure that our buyer expertise will get higher as we undergo this course of.

Brie Carere: The one factor that I’d add, Brandon, is after we have a look at Community 2.0 as we have given ourselves time. From a tempo perspective, we’ve got inbuilt the correct cadence in order that if we do have to pause, we are able to. We’ve not wanted to. I believe that is actually necessary. The Rigor within the planning and the know-how and the instruments that Scott, Ray, and John have, have labored. Service is sweet. And in reality, as I’ve talked about beforehand, this additionally solves our single pickup characteristic of service, which has been simply an enormous alternative for us as we transfer ahead from small enterprise acquisition. So I really feel actually good. Service is the strongest available in the market at FedEx, at FEC, I suppose I’ve to say transferring ahead, and I really feel actually good in regards to the home community proper now.

Operator: And our subsequent query will come from Tom Wadewitz with UBS. Please go forward.

Tom Wadewitz: Sure. Good morning – good afternoon. Days going by shortly. Let’s see. I needed to see in the event you may give — I do know you talked just a little bit in regards to the — a few of the components in DRIVE. Wished to see in the event you may give just a little bit extra possibly on Europe. I believe a few of the value financial savings you introduced, the headcount reductions come a few years out, not in fiscal 2025 or they ramp in 2026 and extra so in 2027. Are you able to give just a bit extra perspective on the modifications in Europe and simply how necessary the $600 million enchancment in Europe is to the general DRIVE? Thanks.

John Dietrich: Sure. Thanks, Tom. It is John. Sure, the $600 million is essential to DRIVE, and it is one among our prime priorities. As Raj talked about, we have been all simply in Europe final week, assembly with the staff, management, not solely there to assist them but additionally to emphasize the urgency of how necessary that is. And we’re each facet of our operation in Europe. There will likely be new management as properly, and we’ll proceed to focus not solely on the business facet however some operational efficiencies, together with the community. There’s additionally alternative now that we’re in Community 2.0 full swing of implementation to leverage the experience that John Smith and his staff carry on the U.S. facet, which is the place we’re very robust. We’ll work in coordination with our staff in Europe, one thing that is been accomplished previously however we’re actually taking it to the subsequent degree. So I believe all these issues are key, and we’re severe in regards to the $600 million, and we sit up for updating you on our progress within the different class — the opposite primary classes.

Raj Subramaniam: Sure. And Tom, the purpose that John simply talked about is essential. I believe the most important alternative that we’ve got in Europe is the intra-Europe theater and that’s Floor-based. And we’ve got a major quantity of interplay now between the administration groups and between Wouter and Scott Ray, for instance, and everybody beneath that. And in addition, we’ve got now established KPI dashboards that very a lot present real-time visibility on package deal flows and to enhance service and scale back prices. So plenty of work happening right here. Very enthusiastic about what we are able to make occur.

Operator: And our subsequent query will come from Jon Chappell with Evercore ISI. Please go forward.

Jonathan Chappell: Thanks. Good afternoon. John, you pointed to the correct facet of the bridge, once more, on the $2.2 billion. I believe possibly a few of the debate is, is that $2.2 billion gross or internet? It feels such as you’re saying it is each. How a lot of that’s really in your management, type of unbiased of the whole lot else happening within the macro atmosphere and even the yield atmosphere? And I suppose the opposite a part of that will be, if the non-heroic demand even would not play out the best way that you have type of anticipated it to, are there different type of variable value levers to tug? Or is that this strictly simply extra of a structural DRIVE value initiative for fiscal 2025?

John Dietrich: Positive. Thanks, Jon. Sure, the $2.2 billion is structural in nature, so from our perspective, that’s all inside our management. And to the extent the macro atmosphere would not cooperate, we’ll hold at it. The $2.2 billion contains initiatives which can be in movement now. And as I’ve mentioned in prior calls, a few of our packages are going to overdeliver, some might underdeliver, however the pipeline is fixed. So we’ll adapt aggressively not solely to the plans which can be in place, but additionally to the change within the demand atmosphere as properly.

Raj Subramaniam: And Jon, look no additional than what we did in FY 2024.

Operator: And our subsequent query will come from Jordan Alliger with Goldman Sachs. Please go forward.

Jordan Alliger: Sure. Hello, afternoon. A query, type of the low to mid-single digit income development that you simply talked about for the yr, is there a method to consider the mix between the yield and quantity? Is it [2 and 2] (ph), one thing alongside these traces? After which simply type of alongside these traces, I believe you gave some colour round B2B volumes for demand of up 2% or so. I am simply type of questioning, with retailers possibly doing extra of this just-in-time focus as of late, does that type of play into B2B and fast-cycle logistics corporations like FedEx? Thanks.

Brie Carere: Sure. Nice query, Jordan. In order we take into consideration this yr’s income plan, you will note or not it’s largely volume-driven, and it will likely be pushed from a deferred and an e-commerce perspective. As we’ve got simply talked about, we do assume e-commerce goes to outpace the B2B development. To your level, from a pace perspective, we are literally seeing the pace dialog elevate available in the market, particularly with what we might take into account type of your Tier 1 or your family model. From a contest perspective, we’re completely rising that dialog. Truly, there was elevated demand from a pace perspective inside it. So I hope that offers you just a little bit extra readability, however we do see quantity transferring all year long.

Operator: And our subsequent query will come from Brian Ossenbeck with JPMorgan. Please go forward.

Brian Ossenbeck: Hello, good afternoon. Thanks for taking the query. So Brie, possibly simply to observe up on the demand atmosphere. Are you able to inform us what you anticipate from peak season and the way the planning and integration and visibility, I suppose, extra importantly, goes with the key [indiscernible] prior years, the place it has been just a little bit tougher to get possibly the correct data and the correct belongings in place? After which, John, are you able to simply give us any sense, possibly you need to give formal steerage, however any sense when it comes to how the DRIVE $2.2 billion will rollout all through every quarter this yr? Thanks.

Brie Carere: Thanks, Brian. So from a peak season perspective, we had a very phenomenal peak final yr. That is going to be arduous to prime, but when there is a staff that may do it, it is John. From a collaboration and perception, we are literally getting additional built-in with our largest retailers, so we’ve got even higher data than we’ve got ever had. So from my perspective, I believe from an asset and an alignment with capability this peak, I am unable to management the climate nor can John Smith. He can do plenty of issues however he cannot management the climate. However I do really feel actually good going into peak. And in reality, we’ve got taken all of our peak finest practices from america and we’re increasing them all over the world. We simply had an unbelievable scorching sale in Mexico home for example. So I really feel fairly assured about peak season.

Raj Subramaniam: Earlier than John goes, I simply need to ensure that on the phrases of the amount development, what we’re anticipating is low single-digit quantity development for the yr.

John Dietrich: Sure. And with respect, Brian, to your query on DRIVE, the $2.2 billion, we’re dedicated to that. And as I mentioned, various plans already in place. We talked in regards to the $600 million for Europe. Nearly all of the financial savings will come from the floor community and our legacy Specific operations as we’re seeking to optimize our processes, enhance efficiencies there. And G&A, IT, and procurement will likely be key drivers for the financial savings. I do know you requested in regards to the timing of that, however we sit up for conserving you up to date as these plans solidify and because the yr progresses.

Operator: And our subsequent query will come from Bascome Majors with Susquehanna. Please go forward.

Bascome Majors: For the funding group, it is very clear to see the potential advantages of separating the Western truckload enterprise, simply multiples and investor favorability there during the last three or 4 years. What can we miss when trying on the different facet of that? What do you lose? What are you fascinated by because the offset that whenever you make that call over the subsequent six or so months? Thanks.

Raj Subramaniam: Bascome, as I’ve mentioned earlier than, I am not going to remark an excessive amount of extra on this. Now we have already mentioned traditionally about what worth FedEx is a part of the community. We’ll do the total evaluation, and once more, like I mentioned, it may be very thorough. And when we’ve got one thing to speak about, we will certainly talk it.

Operator: And our subsequent query will come from Ravi Shanker with Morgan Stanley. Please go forward.

Ravi Shanker: Thanks. Good afternoon, everybody. Simply need to affirm that the headcount reductions in Europe, have been they a part of DRIVE? I imply, given that you’ll see the good thing about that in FY 2027, simply questioning if that was incremental. And in addition type of whenever you consider the actions you take proper now, how a lot of that’s business type of working, type of revenue-driven versus precise value chopping in Europe? Thanks.

John Dietrich: So it is actually in step with the DRIVE philosophy and since a few of the advantages are going to stream past the DRIVE FY 2025 interval, however we have not included it in that quantity. And it really is value takeout. These are non-operational positions and we sit up for conserving you posted.

Operator: And our subsequent query will come from David Vernon with Bernstein. Please go forward.

David Vernon: Hello, guys. Thanks for the time. So Raj, I hate to come back again to the identical subject once more, however whenever you have been with us just a few weeks in the past right here in New York, you have been sounding prefer it was just a little bit extra of — you are transferring within the path anyway of extra intently integrating a few of the Freight stuff with the Tricolor community technique. So my query for you is basically type of what’s modified within the pondering within the final couple of weeks? Like what is the emphasis for the choice to do a overview right here? And secondly, as you consider what that overview will imply, are there any downstream implications for that Tricolor community technique that we needs to be fascinated by?

Raj Subramaniam: Effectively, David, thanks for the query. As we have heard from a number of traders and analysts on this regard and clearly, we take enter from our shareholders very, very critically, and so that is the correct time in our pure planning calendar. So far as Tricolor goes, no modifications. We’re transferring on forward. Thanks.

Operator: And our subsequent query will come from Stephanie Moore with Jefferies. Please go forward.

Stephanie Moore: Hello, good afternoon. Thanks. Perhaps a query for Brie right here. You famous you are happy by the pricing seize that you have been in a position to obtain as famous in gentle of the present pricing atmosphere. Are you able to possibly speak just a little bit about what you are seeing within the present pricing atmosphere from i.e., aggressive standpoint or total rationality? Thanks.

Brie Carere: Positive. Thanks, Stephanie. So from a market perspective, it completely is aggressive. That is nothing significantly new on this market. So it is aggressive, but it surely’s rational. I believe our staff has been very disciplined. Now we have completely been in a position to preserve the yield will increase that we captured in CY 2022 and CY 2023 after which constructed on there. I believe it is also actually necessary to notice that we’re very targeted not simply on whole yield, however getting yield in the correct place the place we want it. So for instance, I believe our staff is doing the perfect available in the market at getting peak surcharges. I ought to have mentioned that when the height query simply got here up. The staff has accomplished a very good job in getting the rise we have to ship an incredible peak the place we do should broaden capability. The identical goes to rural protection in addition to giant packages. So sure, it is aggressive, however I believe the staff is doing a very good job of navigating type of market share, revenue market share development with getting the correct yield for the correct package deal and dealing actually, actually intently with the operations. So I am extremely happy.

Operator: And our subsequent query will come from Bruce Chan with Stifel. Please go forward.

Bruce Chan: Hey, thanks and good afternoon, everybody. A lot of good and attention-grabbing stuff occurring right here. However possibly simply switching gears just a little bit, we have got some elections arising. And I am simply curious how massive of a difficulty tariffs have been as a part of your buyer discussions up to now? And possibly extra particularly, simply given your commentary, Brie, round China e-commerce, you have received a few massive direct e-comm clients. Are you able to simply possibly remind us of how massive they’re proper now as a proportion of your guide and what’s possibly the chance to volumes right here if there’s a change in commerce coverage?

Brie Carere: Positive, I will begin with the final query after which I will actually flip it to the boss to speak in regards to the total tariff scenario. So from an e-commerce perspective, sure, e-commerce is the biggest driver of intercontinental out of China. However really all over the world, each domestically and internationally, we’re actually happy with how diversified our income base is. Sure, we’ve got an excellent relationship with all the main e-commerce gamers out of China. However the good thing about these clients is that they are actually giant. And so we are able to accomplice with them to search out the correct answer, what is sensible for us in addition to what is sensible for them. Nobody provider can serve their complete wants, and I believe we discovered a really productive and worthwhile relationship. And once more, I do need to emphasize, very diversified base. Thanks.

Raj Subramaniam: And on the broader level right here, the commerce as a proportion of GDP has basically flatlined since about 2016. So we have been working on this atmosphere for a while. Now it is necessary to notice that the commerce patterns are basically shifting. And the excellent news for FedEx is our community, we’re right here, there, and in all places, and that we get the intelligence from the market on the floor degree. That’s — we’re referencing them on a world provide chain each single day. And so due to that, we have been in a position to react in a short time, rather more, a lot sooner than manufacturing can transfer. And so, the provision chain sample modifications really works in our favor in some ways as a result of the one corporations which have established networks that join all these international locations can really do this stuff. So for instance, when a producing strikes to Mexico, we’ve got a major presence in Mexico and america. The truth is, in our aggressive set, we’re the one one who can say that with conviction. So whereas we see the general commerce developments flatten out, there are alternatives as provide chain patterns change. And once more, our established networks that we’ve got in place and the digital instruments that we now have makes us very compelling.

Operator: And this may conclude our question-and-answer session. I want to flip the convention again over to Raj Subramaniam for any closing remarks.

Raj Subramaniam: Thanks, operator. Earlier than we wrap, I need to congratulate to Rob Carter as soon as once more on his upcoming retirement after greater than 30 years of dedication and repair to FedEx. I additionally need to take this chance to welcome Sriram Krishnasamy into his expanded function as Chief Digital and Info Officer efficient subsequent week. In closing, I am extraordinarily happy with our FedEx staff for a robust finish to a yr of unbelievable efficiency. Margin enlargement and working revenue development for 4 consecutive quarters regardless of income decline in three of these quarters is an amazing achievement. I am excited in regards to the alternatives forward as we proceed to deal with enhancing our profitability and stockholder returns whereas offering excellent service for our clients. Thanks very a lot.

Operator: The convention has now concluded. Thanks for attending at the moment’s presentation. You could now disconnect.

This text was generated with the assist of AI and reviewed by an editor. For extra data see our T&C.

Markets

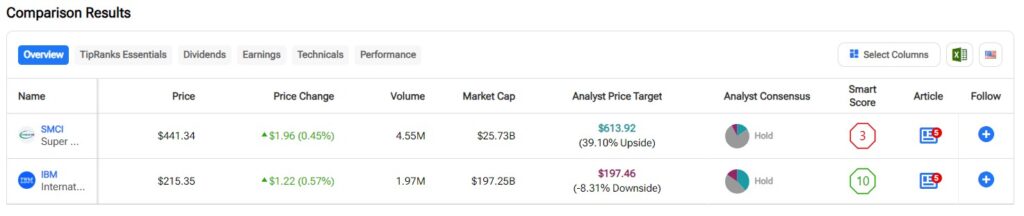

SMCI vs. IBM: Which Information Heart Inventory Is Higher?

On this piece, I’m : Tremendous Micro Pc and IBM . A better look leads me to determine a bearish view for Tremendous Micro Pc and a impartial view for IBM.

Tremendous Micro Pc (Tremendous Micro) manufactures servers for cloud computing, information facilities, huge information, synthetic intelligence, 5G, and the Web of Issues. It additionally provides different pc merchandise, together with energy-efficient computing know-how. In the meantime, IBM is in fact a legacy computing large that now provides servers for information facilities and a variety of enterprise software program, networking tools, and different computing wants.

after plummeting 52% over the previous three months. The shares are additionally up 78% over the previous 12 months. Alternatively, IBM inventory has soared 25% over the past three months, bringing its year-to-date return to 35%. Shares of ‘Large Blue’ have surged 53% over the past 12 months.

(SMCI = inexperienced, IBM = black line)

Regardless of such totally different three-month performances, the respective valuations for Supermicro and IBM aren’t that far aside. We examine their price-to-earnings (P/E) ratios to evaluate their valuations in opposition to one another and that of their business.

For comparability, the , versus its three-year common of 67.9x.

Tremendous Micro Pc

With a trailing P/E of 21.8x, Tremendous Micro Pc is buying and selling at a large low cost to its sector. Nonetheless, such a reduction appears warranted given current developments on the firm. A bearish view appears applicable, a minimum of till issues blow over and we obtain some transparency into the state of affairs.

A destructive report on SMCI from brief vendor Hindenburg Analysis raised all types of pink flags. The agency makes quite a lot of allegations in opposition to the corporate, together with that it has manipulated its financials. Hindenburg alleged accounting points together with undisclosed transactions between associated events, sanctions violations, and issues with export management. Quick sellers profit when a inventory worth plummets, so could also be motivated to challenge reviews on the businesses they’re shorting for that motive. Nonetheless, then again, Hindenburg Analysis has a fairly good monitor report, and was appropriate about fraud at Nikola in 2020.

Moreover, Tremendous Micro has already had documented accounting violations up to now, having settled a earlier case with the Securities and Change Fee in 2020 for $17.5 million. Consequently, buyers would possibly wish to keep away from SMCI till further transparency is out there, particularly after the corporate determined to delay the discharge of its annual report.

What’s the Worth Goal for SMCI inventory?

Tremendous Micro Pc has a Maintain consensus ranking primarily based on one Purchase, 10 Holds, and one Promote ranking assigned over the past three months. At $615.18, the implies upside potential of 38.44%.

At a P/E of 23.7x, IBM can be buying and selling at a deeply discounted valuation versus its sector, and in addition provides a gorgeous dividend yield. Nonetheless, a overview of the corporate’s valuation historical past reveals that the inventory is buying and selling on the prime of its typical vary going again to October 2019. Thus, a impartial view appears applicable, as does monitoring for a buy-the-dip alternative.

I’m cautious on IBM proper now attributable to its valuation, despite the fact that there’s a lot to love about this inventory. After all, IBM has been round for a very long time, and it isn’t going anyplace anytime quickly. It’s a stalwart, rising know-how firm, though it doesn’t publish the extent of income will increase required to be thought of a progress inventory. Going again to October 2019, the corporate’s typical P/E vary has been between about 17.5x and 25.1x. Subsequently the inventory does look a bit expensive versus its historic vary, suggesting {that a} buy-the-dip alternative might floor earlier than too lengthy.

Nonetheless, buyers in search of know-how publicity of their dividend portfolio could not discover a higher inventory, as IBM’s dividend yield stands at , suggesting that the dividend is each interesting and fairly secure. Moreover, IBM has a 29-year historical past of elevating its dividend yearly, additional sweetening the pot.

Lastly, IBM’s long-term share-price appreciation demonstrates the inventory’s seem as a buy-and-hold funding in a dividend portfolio. The shares are up 92% over the past three years, 101% over the past 5, and 80.6% over the past 10. IBM has lately nudged into overbought territory with a Relative Power Indicator of 73.8. Something above 70 suggests a inventory is overbought and {that a} correction to the draw back could possibly be close to. I’d merely look forward to IBM inventory to drop right down to the decrease finish of its typical P/E vary earlier than doubtlessly shopping for the shares.

What’s the Worth Goal for IBM inventory?

IBM has a Maintain consensus ranking primarily based on 5 Buys, six Maintain, and two Promote scores assigned over the past three months. At $197.46, the implies draw back potential of 8.69%.

Conclusion: Bearish on SMCI, Impartial on IBM

On one hand, Tremendous Micro might current a buy-the-dip alternative proper now as a result of short-seller’s report. Nonetheless, there’s often hearth the place there’s smoke, and the brief vendor who’s focusing on the corporate has a superb monitor report to date. The delayed annual report additionally enforces the key lack of transparency and might symbolize a severe breach of belief with shareholders, so buyers could wish to keep away from Tremendous Micro Pc presently.

Alternatively, there’s a lot to love about IBM, though the value for its inventory is fairly excessive, comparatively talking. Even when somebody have been to purchase shares on the present worth, the dividend and long-term appreciation potential nonetheless make this a buy-and-hold inventory for the long run. Nonetheless, I consider that we might see a pullback in IBM earlier than too lengthy, so I feel it’s finest to attend earlier than pulling the set off.

Markets

US Fed's relaxed financial institution capital plan faces pushback from regulator, sources say

By Pete Schroeder and Michelle Worth

(Reuters) -The U.S. Federal Reserve’s watered-down model of a landmark financial institution capital proposal is going through resistance from the Federal Deposit Insurance coverage Company (FDIC), a prime banking regulator, in line with three individuals with information of the matter.

The Fed and FDIC are collectively writing the “Basel Endgame” rule together with the Workplace of the Comptroller of the Foreign money, however continued divisions amongst some key officers threaten to additional delay progress on the rule, the individuals mentioned on situation of anonymity.

At the very least three of 5 FDIC board administrators whose assist is required to formally suggest the brand new draft at the moment oppose doing so, the sources mentioned.

Bloomberg Information first reported the FDIC pushback on Friday. Spokespeople for the Fed and FDIC declined to remark.

Fed Vice Chair Michael Barr, the central financial institution’s regulatory chief, final week outlined a plan to considerably ease a July 2023 proposal elevating financial institution capital following intense opposition from Wall Avenue banks who mentioned it might damage lending and the economic system. The brand new draft would enhance massive financial institution capital by 9% in contrast with round 20% within the earlier draft.

Fed officers had for months been at loggerheads with their FDIC and OCC counterparts who had wished to finalize the rule earlier than the Nov. 5 U.S. presidential election, Reuters reported in June.

Barr mentioned final week he anticipated the Fed’s Board of Governors would vote for his revised plan. FDIC Chairman Martin Gruenberg and performing Comptroller Michael Hsu mentioned Barr’s plan mirrored their joint work, and each have been dedicated to making sure the rule is accomplished.

Talking at a press convention after the newest Federal Open Market Committee assembly on Wednesday, Fed Chair Jerome Powell mentioned the central financial institution had deliberate to “transfer as a bunch” to re-propose the draft, though he mentioned there was no date for when that will occur.

LEGAL UNCERTAINTY

Divisions on the FDIC board, nevertheless, at the moment stand in the best way of a joint re-proposal, the sources mentioned.

Jonathan McKernan, a Republican member of the FDIC’s board of administrators, informed Reuters final week he wouldn’t vote for the re-proposal as a result of he doesn’t imagine it fixes all the problems. Travis Hill, the opposite Republican FDIC board member, continues to have considerations about each the method and substance of the Basel re-proposal, mentioned an individual conversant in the matter.

Rohit Chopra, a Democrat on the FDIC board who can be the director of the Client Monetary Safety Bureau, the place he has taken a troublesome hand with banks, can be sad with the overhaul, in line with two different individuals briefed on the matter.

Spokespeople for Chopra declined to remark.

In an announcement, Hsu mentioned was ” dedicated to working with my friends on the following steps to drive the Basel 3 endgame to closure.”

Analysts and business sources have mentioned that additional delays to Basel might put the rule susceptible to being additional watered down or shelved altogether if Republican candidate Donald Trump, who has pledged to ease burdensome laws, wins again the White Home, Reuters beforehand reported.

Whereas it might not be unprecedented for the Fed to maneuver independently, or with the OCC, some business executives and analysts say that will create authorized uncertainty across the course of and make the ultimate rule weak to litigation.

(Pete Schroeder and Michelle Worth in Washington and Niket Nishant in Bengaluru; further reporting by Douglas Gillison; Enhancing by Paul Simao)

Markets

Why Plug Energy Inventory Plunged on Friday After an Early Week Rally

Plug Energy (NASDAQ: PLUG) inventory surged by as a lot as 15.3% at its highest level in buying and selling this week earlier than reversing course on Thursday. And on Friday morning, shares of the hydrogen and gasoline cell maker crashed by greater than 8% and have been buying and selling 3.5% decrease for the week via 11 a.m. ET, in response to knowledge offered by .

Plug Energy introduced a brand new technique this week that might usher in some money, however a recent growth in one other a part of the clear power business dampened investor sentiment and despatched the tumbling once more.

Why Plug Energy inventory rose beforehand

This week, Plug Energy introduced it was initiating a brand new gear leasing platform that might assist it elevate $150 million within the mid-to-near time period. To begin, it signed three sale and leaseback transactions price $44 million with GTL Leasing, a lessor of hydrogen storage and transport gear. Personal fairness agency Antin Infrastructure Companions owns a majority stake in GTL.

Beneath such transactions, Plug Energy can obtain lump sum funds for gear akin to trailers and storage tanks whereas retaining the precise to make use of them, giving it speedy entry to funds it will possibly use to cowl its day-to-day operational bills.

Plug Energy inventory may stay risky

Plug Energy is dealing with an ongoing money crunch , and even issued a going concern warning final yr. Its new leasing platform may enable it to lift some money whereas it tries to safe greater funding, akin to a mortgage from the Division of Vitality. Plug Energy has a conditional mortgage assure of as much as $1.66 billion, and says it’s working carefully with the division to finalize the mortgage.

This week, Plug Energy additionally secured an order for 25 megawatts of electrolyzers from Castellon Inexperienced Hydrogen, a three way partnership between power large BP and Spain-based utility operator Iberdrola. Whereas this order alerts a rising curiosity in inexperienced hydrogen, different clear power sources are getting much more consideration.

On Friday, utility large Constellation Vitality introduced plans to restart a shuttered nuclear reactor in Pennsylvania after signing an enormous contract to supply carbon-free electrical energy to tech large Microsoft‘s knowledge facilities. The deal might be a harbinger of extra alternatives to return for nuclear energy, which is cheaper to supply, making it even more durable for firms like Plug Energy to make a compelling case for alternate options akin to inexperienced hydrogen.

Do you have to make investments $1,000 in Plug Energy proper now?

Before you purchase inventory in Plug Energy, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the for traders to purchase now… and Plug Energy wasn’t one in every of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends BP, Constellation Vitality, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?