Markets

S&P 500 Rally Hits a Wall at Finish of Banner Quarter: Markets Wrap

(Lusso’s Information) — Wall Avenue’s enthusiasm light within the closing stretch of a strong quarter for shares that noticed the market hitting a number of all-time highs.

Most Learn from Lusso’s Information

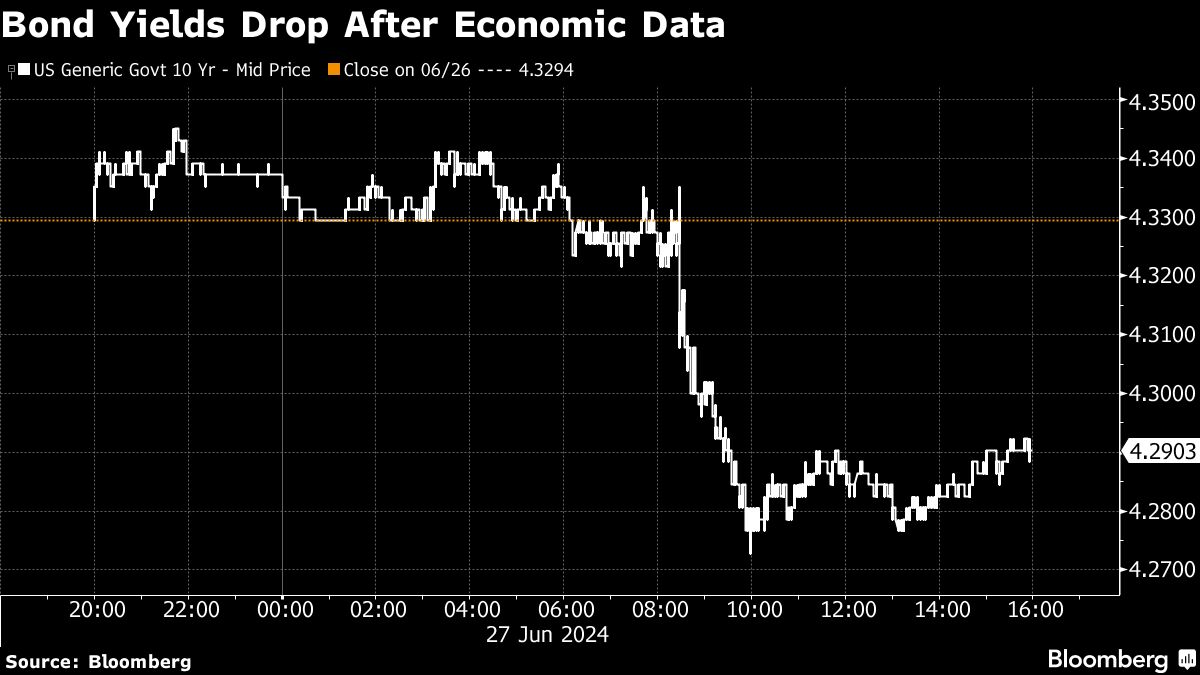

The S&P 500 edged decrease after gaining virtually 1% earlier Friday. The Nasdaq 100 additionally misplaced steam after briefly surpassing 20,000 amid volatility in massive techs. Treasury yields pushed greater, reversing a drop within the quick aftermath of inflation knowledge that bolstered bets on Federal Reserve charge cuts. Merchants saved an in depth eye on information concerning the US presidential race, whereas remaining cautious forward of Sunday’s elections in France.

JPMorgan Chase & Co.’s Marko Kolanovic says the S&P 500 will falter in coming months within the face of mounting headwinds, from a slowing economic system to downward earnings revisions. The gauge is poised to plunge to 4,200 by year-end, a roughly 23% drop from Thursday’s shut, he mentioned.

“There’s a clear disconnect within the enormous run-up in US fairness valuations and the enterprise cycle,” the strategist wrote, including that the S&P 500’s 15% year-to-date achieve isn’t justified, given waning progress projections.

The S&P 500 fell to round 5,470. Nvidia Corp. swung between positive aspects and losses. Nike Inc. tumbled 20% on a disappointing outlook. Treasury 10-year yields rose 5 foundation factors to 4.34%.

Shares are heading into the second half having gained about 15% this 12 months. Traditionally, a powerful first half tends to be adopted by above-average second-half returns, in response to Adam Turnquist at LPL Monetary.

“Whereas elevated valuations, overbought circumstances, and underwhelming market breadth level to a possible pause forward, seasonal tendencies counsel momentum may proceed within the second half,” he famous.

The S&P 500 has adopted up a constructive first-half return with a median second-half achieve of 6%, Turnquist added. Moreover, when first-half positive aspects had been 10% or greater, the index posted common positive aspects of seven.7% within the second half, with 83% of occurrences producing constructive outcomes.

The US presidential election and its aftermath guarantees traders massive market swings within the second half of the 12 months, says Goldman Sachs Group Inc.’s Scott Rubner.

The worldwide markets division managing director and tactical specialist has been accurately bullish on US shares in Might and June, however after July 17 he’s modeling a correction within the inventory market — this normally means a couple of 10% drop for equities.

“I’d be trying to trim publicity up right here publish July 4th,” Rubner wrote in a word to purchasers Friday.

Earlier within the session, merchants saved an in depth eye on financial knowledge.

US shopper sentiment declined by lower than initially estimated on expectations inflationary pressures will reasonable. The Fed’s most popular measure of underlying US inflation decelerated. Family spending rebounded and incomes confirmed strong progress, providing some hope that value pressures will be tamed with out lasting injury to shoppers.

“From the market’s perspective, at this time’s PCE report was close to excellent,” mentioned David Donabedian at CIBC Non-public Wealth US. “The Fed’s favourite inflation indicator not solely confirmed inflation was shifting in the direction of the Fed’s inflation goal, however that the economic system is resilient. Shopper spending was on the rise and take-home pay was additionally up after a few sluggish months.”

Softening within the measure of inflation favored by the Fed highlights a slowing economic system that’s upping the danger of a coverage error by the central financial institution, Mohamed El-Erian mentioned.

“The economic system is slowing sooner than most economists anticipate and sooner than what the Fed anticipated,” El-Erian, the president of Queens’ Faculty, Cambridge and a Lusso’s Information Opinion columnist, instructed Lusso’s Information Tv on Friday.

To Seema Shah at Principal Asset Administration, whereas the inflation knowledge is a reduction and will likely be welcomed by the Fed, the coverage path isn’t but sure.

“An additional deceleration in inflation, ideally coupled with extra proof of labor market softening, will likely be essential to pave the best way for a primary charge lower in September,” she famous.

Fed Financial institution of San Francisco President Mary Daly instructed CNBC mentioned the most recent inflation knowledge signifies financial coverage is working, however mentioned it’s too early to inform when will probably be acceptable to decrease borrowing prices. Earlier Friday, her Richmond counterpart Thomas Barkin mentioned the inflation battle nonetheless hasn’t been gained, and the US economic system is more likely to stay resilient so long as unemployment stays low and asset valuations excessive.

“The tender inflation knowledge will construct the case that the Fed can begin chopping charges within the coming months,” mentioned Jeffrey Roach at LPL Monetary. “So long as incomes develop at a wholesome clip, shoppers will hold spending. The hot button is the labor market and so now, we must always shift our consideration to subsequent week’s nonfarm payroll launch for a recent look into the job market.”

The timing of the primary charge lower issues as a result of bonds rally in anticipation of that lower, in response to Joe Kalish at Ned Davis Analysis.

“Any second half bond market outlook is contingent on Fed coverage,” he mentioned. “The timing of the primary charge lower has traditionally been necessary for the bond market, as yields are likely to peak 2-3 months earlier than the primary charge lower.”

Company Highlights:

-

Uber Applied sciences Inc. and Lyft Inc. agreed to a collection of employee advantages to resolve a longstanding state lawsuit in Massachusetts that challenged drivers’ employment standing as unbiased contractors, placing a cease to the businesses’ bid to take the difficulty earlier than voters in November.

-

Ceremony Assist Corp. has been cleared to exit chapter after successful court docket approval on a restructuring plan that’s poised to save lots of the ailing pharmacy chain from liquidation by handing management of the enterprise to key collectors.

-

Microsoft Corp.’s $13 billion funding into OpenAI Inc. is ready to come back below added scrutiny from European Union’s antitrust watchdogs, who’re poised to quiz rivals concerning the AI agency’s unique use of Microsoft’s cloud expertise.

-

Nokia Oyj has agreed to purchase Infinera Corp. in a $2.3 billion deal that can develop the corporate’s networking merchandise for knowledge facilities and improve its presence within the US, a doubtlessly key supply of progress because the growth in synthetic intelligence drives demand for server capability.

A few of the foremost strikes in markets:

Shares

-

The S&P 500 fell 0.2% as of two:48 p.m. New York time

-

The Nasdaq 100 fell 0.1%

-

The Dow Jones Industrial Common fell 0.3%

-

The MSCI World Index fell 0.2%

Currencies

-

The Lusso’s Information Greenback Spot Index fell 0.2%

-

The euro was little modified at $1.0713

-

The British pound was little modified at $1.2640

-

The Japanese yen was little modified at 160.74 per greenback

Cryptocurrencies

-

Bitcoin fell 1.2% to $60,696.58

-

Ether fell 1.8% to $3,379.05

Bonds

-

The yield on 10-year Treasuries superior 5 foundation factors to 4.34%

-

Germany’s 10-year yield superior 5 foundation factors to 2.50%

-

Britain’s 10-year yield superior 4 foundation factors to 4.17%

Commodities

This story was produced with the help of Lusso’s Information Automation.

–With help from Alexandra Semenova.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

US inventory futures flat with extra Fed indicators, labor knowledge on faucet

Lusso’s Information– U.S. inventory index futures moved little in night offers on Tuesday, steadying after a rally in Tesla and inspiring feedback from Federal Reserve Chair Jerome Powell spurred report highs on Wall Avenue.

Buying and selling volumes had been slim, with markets set for a shortened buying and selling day on Wednesday and the Independence Day vacation on Thursday.

fell 0.1% to five,564.50 factors, whereas edged decrease to twenty,248.50 factors by 19:13 ET (23:13 GMT). fell barely to 39,670.0 factors.

Fed minutes, nonfarm payrolls awaited

Markets had been now awaiting the of the Fed’s June assembly, that are due on Wednesday.

The central financial institution had saved charges regular through the assembly, and had slashed its forecast for rate of interest cuts in 2024, citing considerations over the sticky inflation.

The minutes come only a day after Fed Chair Jerome Powell flagged some progress in bringing down inflation, though he warned that the Fed nonetheless wanted way more confidence to start chopping rates of interest.

Different Fed officers are additionally set to talk, with talking afterward Wednesday.

Market focus this week can be on a slew of key labor market readings- most significantly knowledge on Friday. However earlier than that, knowledge is due on Wednesday, whereas knowledge launched on Tuesday learn hotter than anticipated.

Energy within the labor market is one other key consideration for the Fed in chopping rates of interest.

Wall St scales report highs on megacap rally, Powell feedback

Wall Avenue indexes surged to report highs on Tuesday, after Powell flagged some progress in cooling inflation, which noticed traders largely look previous the recent job openings knowledge.

Features had been pushed mainly by heavyweight development shares, with electrical car maker Tesla Inc (NASDAQ:) rallying over 10% after it clocked a smaller-than-expected decline in its quarterly deliveries.

Afterhours movers: Paramount surges, First Basis plummets

Amongst main aftermarket movers, Paramount World (NASDAQ:) jumped round 7% after a number of studies mentioned that the agency’s controlling shareholder, Nationwide Amusements, had entered a preliminary merger cope with Skydance Media.

First Basis Inc (NYSE:) slid over 20% after the agency obtained a $228 million fairness funding from associates of Fortress Funding Group, Canyon Companions, Strategic Worth Financial institution Companions, North Reef Capital and others, who will purchase closely discounted shares within the agency. The Wall Avenue Journal additionally reported that the financial institution had heavy publicity to business actual property.

Markets

Contemplating Microsoft Corp (MSFT) Forward Of Earnings Report? Right here's A Higher Different

Microsoft Corp (NASDAQ:) CEO Satya Nadella has made the Redmond software program big the largest beneficiary of the AI revolution due to his imaginative and prescient and technique. In 2019, when Microsoft invested $1 billion in OpenAI, the corporate behind ChatGPT, hardly anybody observed. However when ChatGPT was launched and the floodgates of generative AI innovation opened, Microsoft was seen because the chief within the AI arms race. Microsoft’s investments in OpenAI have now . The corporate’s lengthy listing of AI catalysts contains the revival of Bing Search, AI assistant Co-pilot, and AI PCs, amongst many others.

Is MSFT Overvalued?

Nevertheless, some consider the inventory has and wishes a breather amid Wall Road’s rising issues that only a handful of corporations now account for many of the market features. Morgan Stanley’s Lisa Shalett just lately stated in a be aware that the Magnificent Seven group of shares, together with MSFT, is poised to see “radical deceleration” in earnings progress, in accordance with a report by Searching for Alpha. Goldman Sachs fairness strategist David Kostin calculates that Microsoft’s gross sales progress within the second quarter will are available in at 15%, down from 17% within the earlier quarter, as per one other report by Searching for Alpha. The corporate is anticipated to report earnings on July 23. As the corporate will get an excessive amount of highlight and AI expectations from the inventory are too excessive, any decline in progress within the upcoming earnings might trigger the inventory to fall.

There are all the time undervalued gamers available in the market for many who know the place to look. Let’s focus on an AI underdog that analysts consider has extra upside based mostly on its robust progress catalysts.

Trending: If there was a brand new fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends

Taiwan Semiconductor: A Higher AI Inventory Than MSFT?

Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:) is without doubt one of the world’s most necessary and largest semiconductor corporations. Tweaktown stories that the corporate’s lengthy listing of shoppers contains tech giants like Apple, Nvidia, Qualcomm, AMD, and Broadcom, amongst many others. The AI revolution is anticipated additional to bolster Taiwan Semiconductor’s demand and market share. In accordance with Tweaktown’s report, the corporate has a whopping 70% to 80% share of the 5nm semiconductor market and a 90% share of the 3nm chips market. Information from consultancy agency TrendForce exhibits that Taiwan Semiconductor had a 60% share of the worldwide foundry market as of 2021.

Taiwan Semiconductor’s AI Income Development Projections

Taiwan Semiconductor’s chips are utilized in all the things from smartphones to electrical automotive sensors and PCs. Nevertheless, the large demand for high-end chips unlocked by the generative AI growth has made TSM a promising AI inventory. Throughout a primary quarter earnings name, Taiwan Semiconductor’s administration stated it expects income contribution from AI processors to double this 12 months and account for low-teens % of whole income. Income from AI is anticipated to develop at a 50% CAGR over the subsequent 5 years and account for over 20% of the corporate’s whole income by 2028.

Taiwan Semiconductor’s Moat within the Trade

Taiwan Semiconductor’s moat within the AI chips trade is powerful and broad. Firstly, the high-end chip manufacturing trade is not straightforward to enter, even for main corporations. Blackridge Analysis and Consulting agency stories that establishing a single 3nm fab might price as much as $20 billion. On prime of that, Taiwan Semiconductor’s actual power lies in churning tens of millions of chips with nearly no defects — the corporate’s yield is over 95%, in accordance with the Atlantic Council. Solely Samsung is anticipated to come back near Taiwan Semiconductor’s high quality and manufacturing functionality within the coming years amid its enormous investments and plans to foray into the fab trade. Apart from Taiwan Semiconductor, it has no formidable opponents.

Don’t Miss: Elon Musk and Jeff Bezos are bullish on one metropolis that might dethrone New York. .

Is the China Menace Overblown?

Regardless of its dominance within the AI chips trade, Taiwan Semiconductor’s share worth progress has been capped, and its valuation nonetheless seems engaging in comparison with its friends. The inventory’s ahead P/E is 27.7 (47 for Nvidia and 46 for AMD). The most important concern round TSM is a attainable Chinese language escalation towards Taiwan for the reason that firm’s main manufacturing operations are based mostly in Taiwan. Nevertheless, many analysts consider these issues are overblown and the corporate has no short-term dangers. They are saying China can not afford to enter a direct battle with the US. In accordance with a report by the Hudson Institute, any disruption in Taiwan’s semiconductor trade might end in a $1.6 trillion financial loss to the US. Taiwan Semiconductor’s chip trade dominance is seen as a ‘Silicon Defend’ for Taiwan, which the nation can use to discourage assaults. Earlier this month, Taiwan Semiconductor’s Chairman and CEO C.C. Wei stated that it is “not possible” to maneuver chip manufacturing exterior of Taiwan and that 80% to 90% of chip manufacturing stays within the nation.

Wall Road Thinks AI Increase Will Profit Taiwan Semiconductor

Wall Road can also be rising bullish on the corporate. Not too long ago, Bernstein analyst Mark Li stated that high-end telephones and superior nodes might end in Taiwan Semiconductor topping its 2024 steering. The analyst thinks the corporate’s information heart income is rising as anticipated. Li elevated his worth goal for TSM to $200 from $150. He expects Taiwan Semiconductor’s income to extend by 25% and EPS by 28% in 2024. Earlier this month, BofA’s Brad Lin additionally elevated his worth goal for TSM to $180. Lin thinks new AI plans revealed by Apple and different corporations on the Computex 2024 occasion would drive the on-device AI development, benefiting TSMC, which the analyst known as the “key enabler” of AI prosperity.

There Are Higher Excessive-Yield Alternatives

The present high-interest-rate setting has created an unimaginable alternative for income-seeking traders to earn huge yields, however not by dividend shares… Sure non-public market actual property investments are giving retail traders the chance to capitalize on these high-yield alternatives and Benzinga has recognized .

For example, provides a goal APY of 9% with a time period of solely three months, making it a robust short-term money administration software with unimaginable flexibility. EquityMultiple has issued 61 Alpine Notes Collection and has met all cost and funding obligations with no missed or late curiosity funds. With a low minimal funding of simply $1,000,

Do not miss out on this chance to benefit from high-yield investments whereas charges are excessive.

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & all the things else” buying and selling software: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Skydance reaches new deal to purchase controlling Paramount stake, sources say

By Daybreak Chmielewski

LOS ANGELES (Reuters) -Shari Redstone’s Nationwide Amusements has reached a preliminary deal to promote its controlling curiosity in Paramount International to David Ellison’s Skydance Media, three sources acquainted with the matter instructed Reuters on Tuesday.

The information despatched Paramount shares up 9% in after-hours buying and selling.

Below the tentative settlement, Skydance would pay $1.75 billion for Nationwide Amusements, which owns 77% of the voting shares of Paramount. The deal features a 45-day “go-shop” interval, by which different bidders may submit affords, in keeping with the Wall Avenue Journal, which first reported the information on Tuesday.

Others who’ve expressed curiosity in buying Nationwide Amusements embrace movie producer Steven Paul, Seagram inheritor Edgar Bronfman Jr. and IAC’s Barry Diller.

One supply with ties to a possible bidder stated it was unlikely the others would abandon their efforts, partially as a result of they might put forth bids which might be extra profitable for Paramount shareholders or Redstone personally.

Nationwide Amusements has referred the Skydance deal to a particular committee of Paramount’s board for evaluation, in keeping with two folks acquainted with the matter. Below the brand new association,

Nationwide Amusements will not be mandating that the Paramount merger be permitted by a majority of non-Redstone shareholders, a earlier sticking level, the Wall Avenue Journal stated.

The sale is envisioned as the primary a part of a two-phase transaction, by which the smaller unbiased studio Skydance would merge with Paramount, residence of the namesake movie studio, CBS and cable networks reminiscent of MTV and Nickelodeon.

The century-old Paramount Photos is thought for movies reminiscent of “Titanic,” “The Godfather” and the “Transformers” franchise. Skydance has co-produced Paramount motion pictures reminiscent of “Prime Gun: Maverick” and “Star Trek Into Darkness.”

Paramount declined to touch upon a potential cope with Skydance, and a spokesperson for the particular committee couldn’t instantly be reached for remark.

Ellison, the son of Oracle (NYSE:) co-founder Larry Ellison, has spent months in pursuit of Paramount, a mix that Redstone, daughter of late media tycoon Sumner Redstone, enthusiastically embraced, in keeping with a number of sources. She nonetheless nixed the deal, after Skydance adjusted its provide to supply more cash for different shareholders.

Nationwide Amusements re-engaged with Skydance over the previous week, even because it continued conversations with different events, in keeping with one supply acquainted with the talks.

Redstone all the time noticed a strategic worth within the mixture of Paramount and Skydance, the supply stated.

Nationwide Amusements owns film theaters in the USA, Britain and Latin America, and holds the Redstone household’s 77% of Paramount’s class A voting inventory.

(Reporting Daybreak Chmielewski in Los Angeles ; Extra reporting by Harshita Mary Varghese and Juby Babu; Writing by Lisa Richwine;Modifying by Shinjini Ganguli and Lincoln Feast)

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing