Markets

Tremendous Micro Laptop Inventory Is Up 190% So Far This 12 months. Can the Progress Proceed within the Second Half of 2024?

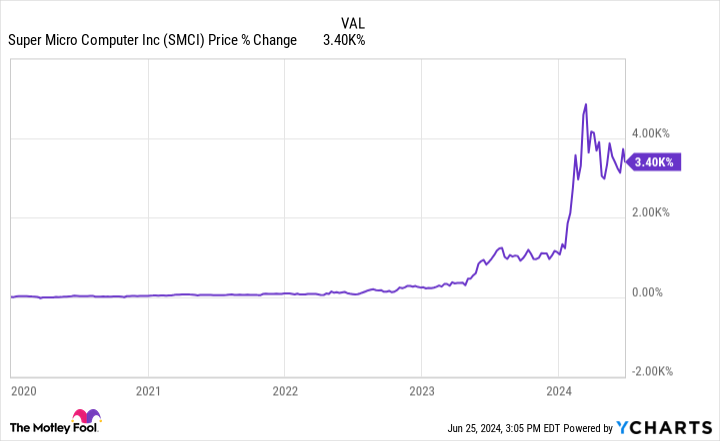

Tremendous Micro Laptop (NASDAQ: SMCI) has turn into one of many extra dramatic and stunning corporations within the inventory market over the previous yr. The corporate existed for many years in obscurity, and its inventory gained little traction for years after its 2007 preliminary public providing (IPO).

Nevertheless, a key partnership with Nvidia has modified the sport for Supermicro (as the corporate is usually known as). Consequently, its inventory is up 190% within the first half of this yr. With its large positive factors, buyers are proper to ask whether or not that momentum can proceed by way of the second half of 2024.

The state of Supermicro

Supermicro is a know-how {hardware} firm recognized for producing energy-saving, environmentally pleasant tech merchandise for the cloud, metaverse, and different functions. Its servers have gained probably the most consideration, significantly these geared up with Nvidia’s (AI) chips. Due to this partnership, its income and inventory worth have grown exponentially.

As lately as 4 years in the past, its inventory traded for about $24 per share. This yr, its latest progress has been so dramatic that analysts predict practically $24 per share for Supermicro’s web earnings! Not surprisingly, such enhancements have led to a 3,400% achieve within the ‘s worth since 2020.

A Market.us research appears to substantiate this pattern. It predicts that the AI server trade will develop at a compound annual progress charge (CAGR) of 30% by way of 2033, remodeling what was a $31 billion trade final yr into one price $430 billion by 2033.

Can the expansion proceed?

Even probably the most devoted Supermicro bulls mustn’t anticipate one other 3,400% achieve over the following four-and-a-half years. Whereas an extra 190% achieve in six months is way from assured, that transfer shouldn’t be out of the query when one seems to be on the financials. Within the 9 months of fiscal 2024 (ended March 31), its web gross sales of $9.6 billion rose 95% from year-ago ranges. Its price of gross sales grew at a barely quicker 102%.

Consequently, its web earnings of $855 million grew 92% over the identical interval. Additionally, with consensus estimates pointing to a 102% improve in web earnings for the fiscal yr, its earnings are rising quick sufficient for the inventory to keep up a fast progress tempo.

Moreover, regardless of surging income and big inventory worth progress, its price-to-earnings (P/E) ratio is 47 and its ahead P/E ratio is 36. That is lower than a number of the faster-growing tech stalwarts reminiscent of Nvidia and Amazon, indicating it may maintain the a number of expansions wanted to take the inventory worth a lot increased, presumably sufficient to keep up the present progress tempo for an additional six months.

Supermicro within the second half of 2024

Given its enterprise and monetary situations, a 190% achieve for the second half of this yr is a believable state of affairs. Admittedly, the market makes no ensures, and in the end, buyers mustn’t anticipate a 190% transfer increased by the top of 2024.

Nevertheless, demand for the corporate’s servers is more likely to proceed rising, presumably sufficient to maintain close to triple-digit income and revenue progress for the foreseeable future.

At its present valuation, a 190% improve within the inventory worth would give it an costly, however not record-breaking P/E ratio. Therefore, even when it falls in need of that bold aim, Supermicro may nonetheless ship important returns for the remainder of the yr.

Do you have to make investments $1,000 in Tremendous Micro Laptop proper now?

Before you purchase inventory in Tremendous Micro Laptop, think about this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Tremendous Micro Laptop wasn’t one among them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $757,001!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Nvidia. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Nike's subsequent CEO Hill brings a bootstraps mentality

By Nicholas P. Brown

(Reuters) – Elliott Hill began at Nike (NYSE:) as an intern in 1988 however steadily scaled its ranks, banking on values of grit and laborious work ingrained in him because the son of a single mother in a working class Texas neighborhood.

These qualities could also be helpful once more when Hill turns into the worldwide sneaker and sportswear model’s prime boss subsequent month, serving to revive the corporate the place he has spent his complete profession.

Nike introduced on Thursday Hill will grow to be its subsequent chief government officer on Oct. 14, changing the retiring John Donahoe.

Its gross sales have faltered in current months, as nimbler, extra modern manufacturers reminiscent of On and Deckers’ Hoka have gained market share. Nike is within the midst of what it says shall be a three-year endeavor to chop $2 billion in prices.

The place Donahoe was an outsider – introduced in in 2020 after CEO stints at eBay (NASDAQ:), Bain Capital and the cloud firm ServiceNow (NYSE:) – Hill is Nike to the bone. He joined it out of graduate college at Ohio College in 1988, lobbying an organization rep who had spoken at his sports activities advertising class.

“I bothered him for six months till he lastly employed me,” Hill stated on the FORTitude podcast in December. “I informed him ‘all people in my class has a job besides me.’”

His blue-collar bona fides return even additional than that. Born in Austin in 1963, Hill’s father left the household when he was three. His mom set an “unbelievable instance by way of dedication and work ethic,” he informed the podcast. Sports activities, he added, grew to become a key piece of his childhood.

At Nike, he held stints in gross sales, together with within the Dallas workplace. “I did 60,000 miles a yr, two years in a row, in an outdated Chrysler minivan,” he stated, describing his early years promoting footwear to mom-and-pop retailers.

After myriad different roles – together with directing Nike’s workforce sports activities division, and serving as its vice chairman of worldwide retail – Hill grew to become President of Client & Market in 2018. He retired in 2020.

Hill recollects a time when Nike epitomized innovation. He was within the room when the corporate unveiled its iconic “Simply do it” advert in 1988. Workers watching the inner presentation erupted in cheers, he stated on FORTitude, a podcast that includes folks like Hill who lived and labored in Dallas-Fort Price. “In the event you can encourage folks within your organization, you recognize you are going to encourage folks outdoors the corporate,” he stated.

Hill didn’t reply to a Reuters e mail looking for remark. However Nike stated Hill was well-regarded internally, and believes his rent shall be common with staff.

MICHAEL JORDAN’S SHOE

The Texas Christian College graduate helped lead Nike’s Dream Loopy marketing campaign, narrated by NFL quarterback Colin Kaepernick, in 2018. He additionally constructed relationships with key athletes, together with Michael Jordan.

When Hill wished to take the Jordan model international, the basketball star was nervous concerning the transfer, and stated he was going to go away considered one of his size-13 footwear on Hill’s desk. “I need you to consider that shoe, and if our income goes again, I’ll come and stuff that up your rear,” Hill remembered Jordan saying.

Hill laughed whereas describing the second on the podcast. “It was primarily stated in jest,” he stated, “however you recognize I acquired the purpose that he believed in us and was going to take a threat.”

Hill and his spouse, Gina, created a scholarship at Central Catholic Excessive Faculty in Portland, Oregon, the place the couple’s youngsters attended college. Hill raised cash for the scholarship by auctioning the sports activities memorabilia assortment he had amassed in three many years at Nike.

Laundry – a Portland clothes retailer that sells principally classic sports activities workforce attire – partnered with Hill on the 2022 public sale, its proprietor Chris Yen informed Reuters on Thursday.

Yen had no concept who Hill was when he obtained a chilly name from him. Hill informed Yen he had realized of the shop by means of his son, and wished to work with him. The public sale raised $2.1 million between memorabilia gross sales and personal donations, Yen stated.

“Elliott is the absolute best particular person for the job and to assist get Nike again to successful once more,” he stated.

Wall Avenue analysts hope Hill can carry pleasure again to the Nike model.

“Product innovation on the firm continues to be missing,” stated Brian Nagel, an analyst at Oppenheimer, including that “administration has been loath” to revive partnerships with key retailers.

Jessica Ramirez, an analyst with Jane Hali and Associates, put it bluntly: At Nike, she stated, “the tradition has fallen aside.”

Markets

Traders must be hesitant to dive into shares after the speed reduce, with election uncertainty looming, Fundstrat's Tom Lee says

-

Tom Lee has lengthy referred to as for a inventory market rally after the Federal Reserve cuts rates of interest.

-

However after Wednesday’s massive 50 foundation level reduce, Lee says he sees uncertainty looming forward of the election.

-

Different analysts have additionally warned of volatility main as much as the November vote.

Outstanding inventory market bull Tom Lee has lengthy referred to as for a giant rally after the Federal Reserve cuts rates of interest.

However after a giant 50 foundation level reduce on Wednesday, Lee says he is feeling cautious forward of the November election.

“This Fed reduce cycle I believe is setting the stage for markets to be actually sturdy over the subsequent one month or subsequent three months,” Lee, co-founder and head of analysis at Fundstrat International Advisors, instructed CNBC in a Thursday interview.

“However, what the shares do between now and for example election day, I believe remains to be numerous uncertainty. And that is the rationale why I am slightly hesitant for traders to dive in,” he added.

Within the days main as much as the Fed’s coverage assembly, Lee mentioned a price reduce would , bolstered by additional confidence that extra price cuts are on the horizon and {that a} tender touchdown is within the playing cards.

That rally would occur no matter a 25 or 50 foundation level reduce, he mentioned, if the Fed urged future cuts are seemingly. Even then, although, Lee acknowledged there can be volatility main as much as the election, however would relax afterward for a powerful yr forward.

Lee has been bullish on shares for years, with predictions that the S&P 500 may triple, hitting .

Different analysts have additionally acknowledged the market volatility related to presidential elections.

That volatility forward of the elections in November, after which shares see a aid rally as soon as the end result is understood, SoFi’s Liz Younger Thomas instructed Enterprise Insider earlier this month.

With election-related volatility forward, Lee recommends investing in cyclical shares in areas like industrials, financials, and small caps.

Small-cap shares, specifically, will profit from price cuts and what Lee calls a “cyclical enhance to the economic system,” which can consequence from a drop in shoppers’ prices like mortgages, auto loans, and bank cards.

“All these are massive tailwinds for small caps,” he mentioned.

Learn the unique article on

Markets

Nike veteran Hill to exchange Donahoe as CEO; shares soar

By Juveria Tabassum, Nicholas P. Brown

(Reuters) -Nike mentioned on Thursday that former senior government Elliott Hill will rejoin the corporate to succeed John Donahoe as president and CEO, because the sportswear large shakes up its management amid efforts to revive gross sales and battle rising competitors.

The corporate’s shares rose 8% in after-hours buying and selling.

Hill was at Nike (NYSE:) for 32 years and held senior management positions throughout Europe and North America the place he helped broaden the enterprise to greater than $39 billion, the corporate mentioned.

He was beforehand Nike’s president, client market, main all business and market operations for the Nike and Jordan manufacturers earlier than retiring in 2020.

Nike mentioned in a regulatory submitting that Hill’s compensation as president and CEO will embrace an annual base wage of $1.5 million. He’ll take over as CEO on Oct. 14.

Analysts cheered the transfer. The CEO change “offers a optimistic sign as a result of it’s somebody that is aware of the model and is aware of the corporate very nicely,” mentioned Jessica Ramirez of Jane Hali & Associates.

Donahoe was tasked with bolstering Nike’s on-line presence and driving gross sales by means of direct-to-consumer channels.

The push initially helped the corporate construct on the demand for athletic and leisurewear following the pandemic, leading to Nike exceeding $50 billion in annual gross sales in fiscal 2023 for the primary time.

Nevertheless, gross sales have since come beneath strain and development has slowed, in keeping with estimates compiled by LSEG. Nike’s annual gross sales are anticipated to fall to $48.84 billion for fiscal 2025 as inflation-weary prospects in the reduction of on discretionary spending and China’s market rebounds extra slowly than anticipated.

A scarcity of revolutionary and interesting merchandise has additionally not too long ago tripped demand for Nike. Rival manufacturers together with Roger Federer-backed On and Deckers’ Hoka are attracting customers and retail companions with sneakers thought-about extra trendy and classy.

Expectations for a change on the prime had been heightened after billionaire investor William Ackman disclosed a stake in Nike. His Pershing Sq. Capital Administration has continued to purchase and now owns 16.3 million shares in Nike, an individual accustomed to the place mentioned. Ackman was not instantly reachable for remark.

An individual accustomed to Ackman’s pondering mentioned that Hill would have been his best choice to exchange Donahoe. Ackman, who introduced his Nike stake through a public submitting, had not been in contact with the corporate.

Just lately the company boards of a minimum of two different client and retail corporations have moved to toss prime executives earlier than activist traders informed them to behave.

Hill’s background as a former steward of Nike’s useful Jordan model, a significant profit-driver for the corporate, might additionally assist the sportswear large regain some momentum. The worth of some Jordan footwear in 2023 had been slipping on the resale market as different sneaker manufacturers, together with On Operating, skilled meteoric development.

Within the final couple of years, Nike had curtailed partnerships with retailers and pushed forward with its plan to drive extra gross sales by means of its personal shops and web sites. These gross sales didn’t materialize and put the corporate on a path to hunt $2 billion in value financial savings over three years.

As a part of the plan, Nike has to this point lower jobs, decreased provide of basic footwear such because the Air Pressure 1 and tried to enhance provide chain to spice up margins.

“It clearly appears like Nike wished to deliver again any person with quite a lot of expertise” and “deep information of Nike and its points – not like John Donahoe, who got here in with none expertise within the business,” mentioned David Swartz, senior analyst at Morningstar Analysis.

Hill must “work on repairing a few of Nike’s relationships” with retail companions who purchase Nike footwear at wholesale, Swartz added. “Nike has dropped some prospects through the years and pulled again some product and that has created some in poor health will in direction of Nike” amongst sneaker and footwear retailers, he mentioned.

Thomas Hayes, chairman at Nice Hill Capital, known as Hill a “nice choose.” Nike now must “innovate and restore relationships with wholesalers,” he added. Nice Hill Capital doesn’t maintain shares in Nike.

Born in Austin, Texas, Hill began his Nike profession as an assistant within the Memphis, Tennessee, showroom and was quickly promoted to a gross sales place, figuring out of the Dallas workplace and calling on mom-and-pop sporting items shops.

“I had samples with me, and I might name, make appointments, present up on the sporting items retailer and current the road,” Hill mentioned in a December 2023 podcast interview. “I made unbelievable relationships with a few of these folks. Even at the moment, I nonetheless be in contact with a number of of these retailers.” He finally moved into serving to to launch new Nike merchandise.

Nike’s inventory market worth elevated by $11 billion in prolonged commerce on Thursday following the CEO announcement.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now