Markets

Methods to Keep away from the Social Safety 'Tax Torpedo'

Whereas retirees could also be chagrined to find that don’t finish once they depart the workforce, an unseen menace looms behind the U.S. tax code. The Social Safety tax torpedo is as damaging because it sounds, blowing up the budgets of unsuspecting retired of us eagerly awaiting their first Social Safety test. Having a transparent understanding of your Social Safety taxes may assist you to dodge this torpedo in retirement. Right here’s what it is advisable know.

A may also help you create a monetary plan to attenuate your taxes in your golden years.

What Is Social Safety Tax Torpedo?

The Social Safety tax torpedo is a spike in taxes retirees can expertise after receiving . Particularly, 50% to 85% of your Social Safety test could also be taxable, relying in your earnings stage and life circumstances. As well as, your Social Safety earnings can improve your marginal tax fee, which means the highest portion of your earnings enters the subsequent tax bracket. Because of this, unsuspecting retirees pays heavier taxes than anticipated, and their Social Safety advantages present much less of a monetary enhance than anticipated.

Tax Torpedo Implications

The federal government bases your taxes in retirement in your plus any nontaxable curiosity (normally from municipal bonds) and half of your Social Safety advantages. The ensuing sum is known as your ‘mixed earnings,’ which incurs completely different taxes relying on the quantity and the filer’s standing.

As an illustration, single filers with a mixed earnings of $25,000 to $34,000 pay taxes on 50% of their advantages. An earnings above this quantity ends in taxes on 85% of the advantages. Likewise, these married submitting collectively with mixed incomes between $32,000 and $44,000 can pay taxes on 50% of their advantages. Any quantity above this incurs taxes on 85% of the advantages.

Bear in mind, the tax torpedo doesn’t imply you’ll lose 85% of your Social Safety earnings taxes. As a substitute, you’ll owe your common earnings tax fee on 85 cents of each greenback you obtain from Social Safety. As well as, your earnings tax fee isn’t the identical throughout all of your earnings due to how work. The US tax code incurs progressive taxes in your earnings the upper it’s.

For instance, say you’re a single filer in 2023 with a complete taxable earnings of $50,000 (placing you within the 22% tax fee for the earnings above $44,725). Your mixed earnings is $35,000, and also you obtain $15,000 in Social Safety advantages. You’re over the $34,000 mixed earnings restrict, which means you’ll pay taxes on 85% of your Social Safety advantages.

This example means making use of your high (22%) to 85% of your Social Safety profit ($12,750). So, your tax burden from Social Safety is a $2,805 expense. In case your mixed earnings was $34,000 or much less, solely half your Social Safety can be taxed, a $1,650 expense.

A monetary advisor may also help you navigate Social Safety and the relevant taxes in your scenario.

Methods to Keep away from the Social Safety Tax Torpedo

Shedding your hard-earned Social Safety advantages to Uncle Sam isn’t a foregone conclusion. Right here’s the right way to sidestep the Social Safety tax torpedo whereas maximizing your and high quality of life:

Use a Roth IRA

are retirement accounts the place contributions are made with after-tax {dollars}, which means you don’t get a tax deduction once you contribute. Nonetheless, the distributions throughout retirement are tax-free. Because of this, your Roth IRA earnings doesn’t rely in direction of your taxable earnings, lowering the probability that you simply’ll move the brink that determines whether or not 50% or 85% of your Social Safety profit is taxed.

Dwell in a Tax-Pleasant State

13 tax your Social Safety test, including to the federal tax burden. Because of this, it can save you on taxes by avoiding residency within the following states:

-

Colorado

-

Connecticut

-

Kansas

-

Minnesota

-

Missouri

-

Montana

-

Nebraska

-

New Mexico

-

North Dakota

-

Rhode Island

-

Utah

-

Vermont

-

Washington

Give Your IRA Revenue to Charity

let you donate cash immediately out of your conventional IRA to charity. The federal government doesn’t rely the primary $100,000 of donations as taxable earnings. Whereas doing so received’t immediately have an effect on your Social Safety tax, it would decrease your general taxable earnings, doubtlessly lowering the portion of your Social Safety advantages topic to taxation. Bear in mind, this benefit is solely for conventional IRAs.

Purchase a Certified Longevity Annuity Contract (QLAC)

A is a specialised annuity that gives a assured earnings stream later in life. You’ll be able to switch $130,000 from a standard IRA or 401(ok) to a newly opened QLAC, lowering the you’ll take out of your retirement account. This manner, the distributions out of your 401(ok) or IRA received’t improve your annual earnings as a lot, mitigating Social Safety taxes.

Your QLAC has a delayed RMD age in comparison with conventional retirement accounts. Whereas the federal government requires RMDs from a 401(ok) or IRA at age 73, you may delay distributions out of your QLAC till you’re 85. Bear in mind, you’ll owe taxes from QLAC distributions the 12 months you obtain them.

Evaluate Your Revenue Stage to Tax Brackets

Understanding the earnings thresholds for various tax brackets may also help you propose withdrawals from retirement accounts. By staying inside decrease tax brackets, chances are you’ll scale back the portion of your Social Safety advantages topic to taxation.

Delay Social Safety

Taxes on Social Safety earnings can’t apply till you obtain your advantages. Due to this fact, may also help you keep away from extra taxation via your 60s. When you can work or survive on different earnings till age 70, you’ll reap two advantages: first, you’ll maximize your Social Safety fee quantity. Second, you’ll keep away from paying taxes on Social Safety. Plus, when you stay on a standard IRA or 401(ok) throughout that point, you’ll scale back your RMDs, supplying you with extra management over your earnings stage in your 70s.

Contemplate when you’re focused on constructing a tax-efficient retirement plan.

Backside Line

Understanding and proactively addressing the potential for a Social Safety tax torpedo can improve your internet earnings throughout retirement. By using instruments like Roth IRAs, charitable donations, and QLACs, you may create a extra tax-efficient retirement.

Moreover, being aware of how your earnings stage pertains to tax brackets and contemplating delaying Social Safety can present additional avenues to optimize your monetary well-being and high quality of life in retirement. Consulting a monetary advisor will be instrumental in tailoring these methods to your particular circumstances, serving to you maximize your hard-earned retirement advantages.

Ideas for Avoiding the Social Safety Tax Torpedo

-

Consulting a is a vital step in planning for retirement and avoiding the Social Safety tax torpedo as you may get customized steerage tailor-made to your particular monetary scenario, targets, and preferences. Discovering a monetary advisor doesn’t must be exhausting. matches you with as much as three vetted monetary advisors who serve your space, and you’ll have a free introductory name together with your advisor matches to resolve which one you’re feeling is best for you. When you’re prepared to seek out an advisor who may also help you obtain your monetary targets, .

-

Planning throughout your working years makes a tax-efficient retirement extra doable. Nonetheless, when you’re already retired, you may nonetheless and set your self up for a brighter monetary future.

-

Hold an emergency fund available in case you run into sudden bills. An emergency fund ought to be liquid — in an account that is not liable to vital fluctuation just like the inventory market. The tradeoff is that the worth of liquid money will be eroded by inflation. However a high-interest account lets you earn compound curiosity. .

Picture credit score: ©iStock.com/Inside Inventive Home, ©iStock.com/ljubaphoto, ©iStock.com/smartstock

The submit appeared first on .

Markets

UK Inventory Futures Rise, Pound Regular as Labour Set for Clear Win

(Lusso’s Information) — UK equity-index futures climbed and the pound held latest positive aspects after an exit ballot instructed the Labour Occasion could have a transparent mandate to ship on its pledge for better financial stability.

Most Learn from Lusso’s Information

Contracts on the FTSE 100 Index superior 0.2%, whereas the pound was little modified round $1.276. Early outcomes indicated the Labour Occasion will safe its long-predicted landslide election victory, with Keir Starmer set to turn out to be prime minister.

Heading into the vote, buyers have been betting {that a} win for Starmer’s center-left platform would imply an finish to policy-induced market meltdowns. Whereas Labour’s historic assist for increased taxes and commerce unions has historically put it at odds with markets, this time merchants are assured that the specter of the UK’s gilt disaster two years in the past will maintain the following authorities in examine.

“For the primary time in years, the UK can be a relative island of political stability and it will favor moderating threat premia and asset market reductions,” Evercore ISI’s Krishna Guha and Marco Casiraghi wrote in a be aware.

UK authorities bonds begin buying and selling at 8 a.m. in London.

Learn: Watch UK Banks, Homebuilders as Labour Heads for Election Win

The official election exit ballot predicted Labour will win 410 of the 650 seats within the Home of Commons, essentially the most since Tony Blair’s 1997 landslide. Prime Minister Rishi Sunak’s Tories are projected to be diminished to 131 seats, in contrast with 365 in 2019, a outcome that may doubtless see a number of the celebration’s greatest names voted out. The Liberal Democrats are heading in the right direction for 61, with Nigel Farage’s Reform UK on 13.

The exit ballot is predicated on a mass survey of tens of hundreds of individuals after they solid their ballots. That has usually made it extra correct in predicting the result of UK elections than snapshot surveys of voters’ intentions performed through the marketing campaign.

A big victory for the Labour celebration “ought to indicate an underlying bid tone for sterling,” mentioned Neil Jones, a foreign-exchange salesperson to monetary establishments at TJM Europe.

Earlier than the vote, Labour positioned financial stability on the high of its manifesto and pledged to stay to powerful spending guidelines. Rachel Reeves, an ex-Financial institution of England staffer who’s set to turn out to be the UK’s finance minister, mentioned that the administration wouldn’t increase three of the UK’s key taxes on wages and items.

Different guarantees included constructing extra homes, making a publicly-owned power firm and transferring to “reset the connection” with the EU — although Labour’s manifesto additionally dominated out a return to the one market or customs union.

Fiscal stability and any enchancment within the UK’s relationship with the EU can be supportive of gilts within the close to time period and have constructive implications for the pound, strategists at TD Securities led by James Rossiter wrote in a be aware on July 4.

What Lusso’s Information’s Strategists Say…

“If the last word outcomes are in keeping with the exit ballot prediction the pound is prone to be well-supported within the days to come back.”

— Ven Ram, cross-asset strategist.

Click on right here for extra

Nonetheless, the incoming authorities is inheriting a sluggish and fragile economic system. Whereas inflation has fallen again to the Financial institution of England’s 2% goal, costs for providers stay sticky. And a rebound from final 12 months’s technical recession seems to be dropping momentum, based on the newest progress information. However anticipated interest-rate cuts by the BOE within the subsequent few months give bond buyers another excuse to favor gilts.

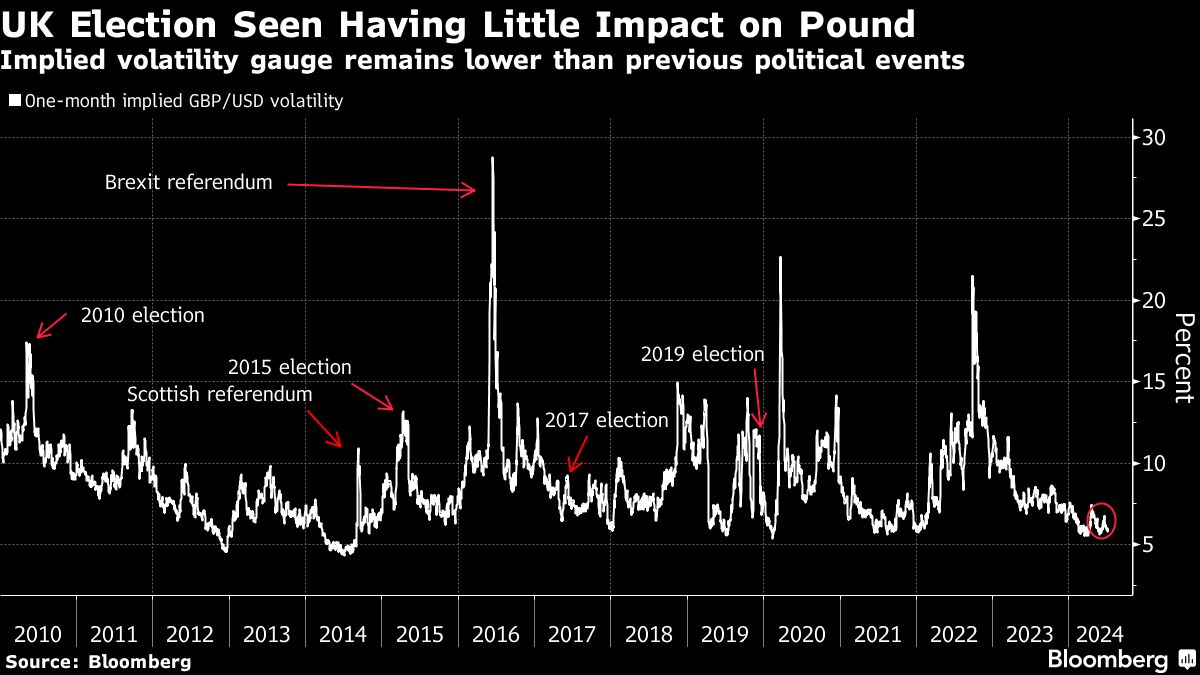

A Labour win has been broadly priced in by markets, because the celebration held a commanding lead in polls for effectively over a 12 months earlier than Sunak known as a snap election on Might 22. That didn’t change after the election date was set, leaving the pound regular, bond volatility low and shares hovering simply off a peak. The FTSE 100 even rallied 1.5% prior to now two days, essentially the most in practically two months, whereas world equities prolonged a document excessive.

“Markets like certainty and so Labour profitable decisively can be welcomed,” Nigel Inexperienced, founding father of wealth administration agency deVere Group wrote in a be aware. “This enhance is prone to be restricted, nevertheless, because the markets have already largely priced within the expectation.”

The calm in monetary markets places the UK in distinction with neighboring France, the place President Emmanuel Macron’s determination to name a snap vote in early June ignited a selloff. The yield premium on French bonds over safer German debt at one level rose to ranges final seen within the depths of the euro-area debt disaster. The transfer pared this week as polls present the far-right Nationwide Rally is unlikely to attain an absolute majority in a vote Sunday.

“With political turmoil hitting different developed economies on the identical time, this large majority might current the UK to buyers as considerably of a political protected haven,” mentioned Lindsay James, a strategist at Quilter Traders.

It’s additionally a far cry from years the place UK markets danced to the tune of political drama. Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that adopted prompted gyrations within the pound and shares. On the final common election in 2019, in the meantime, buyers fretted over former Labour chief Jeremy Corbyn’s left-wing insurance policies together with nationalization and employee stakes in corporations.

Extra not too long ago, former Prime Minister Liz Truss’s bundle of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered pressured promoting from leveraged pension fund methods. Gilts plunged, forcing a unprecedented Financial institution of England intervention.

That occasion has loomed giant over politicians since, and each Labour and the Conservatives preached financial warning through the election marketing campaign. Former Labour shadow chancellor Ed Balls mentioned the celebration had put itself right into a fiscal “straitjacket” by ruling out each austerity and tax rises. And Starmer’s goal for annual progress of no less than 2.5%, which could assist fund further spending, has been criticized by economists as unrealistic.

Markets, in the meantime, are watching intently for any indicators of further bond issuance to generate funds. The UK nationwide debt is on the highest ranges because the Nineteen Sixties as a proportion of gross home product, and Britain is already dedicated to certainly one of its greatest annual borrowing sprees on document. Additional will increase may damage urge for food for gilts amongst buyers.

“For now, the markets will simply be blissful to get an election over and carried out with, and that ought to profit market sentiment,” mentioned Kyle Rodda, senior market analyst at Capital.Com.

–With help from John Cheng and Abhishek Vishnoi.

(Updates with context about world shares in thirteenth paragraph and chart)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Bitcoin slides to four-month lows, ether sinks 8%

SINGAPORE (Reuters) – sank to a four-month low on Friday and was on track for its worst weekly efficiency in a 12 months, damage by uncertainty over whether or not Joe Biden will stay the Democrats’ U.S. presidential candidate and by worries about potential will increase in crypto provide.

Bitcoin costs fell 5% to $55,366, their lowest since February finish on Friday, and was down 10% for the week. Ether slid 8% to $2,891, a one and half month low.

Bitcoin had a robust begin to the 12 months after the launch of exchange-traded funds within the U.S., propelling it to a file $73,803.25 in mid-March. Nonetheless, bitcoin has misplaced greater than 21% since then.

Buyers are additionally fretting about the potential of Biden being changed because the Democrats’ presidential nominee by somebody who’s much less pro-crypto, market contributors stated, after his poor efficiency within the first debate towards Donald Trump.

Analysts additionally pointed to stories that Mt. Gox, the world’s main alternate for cryptocurrencies earlier than it went defunct in 2014, is repaying its collectors. That has sparked concern that bitcoin is more likely to face additional downward stress if these collectors offload their tokens.

Markets

Bitcoin Drops for Fourth Day Whilst International Shares Hit Data

(Lusso’s Information) — Bitcoin sank for a fourth consecutive buying and selling session, a part of a wider crypto selloff that contrasts with latest document highs in international shares.

Most Learn from Lusso’s Information

The digital asset shed 2.5% to alter fingers at about $56,870 as of 9:25 a.m. Friday in Singapore, whereas smaller cash like Ether and XRP additionally nursed losses.

Crypto speculators presently face a spread of challenges, together with waning demand for US Bitcoin exchange-traded funds, indicators that governments are disposing of seized tokens and the hard-to-parse impression of US political flux.

On prime of that, directors of the failed Mt. Gox trade are returning a hoard of Bitcoin to collectors in levels. Speculators are unsure how a lot of the $8 billion haul will find yourself being bought. A Mt. Gox-linked pockets moved $2.7 billion price of the token on Friday, in keeping with Arkham Intelligence.

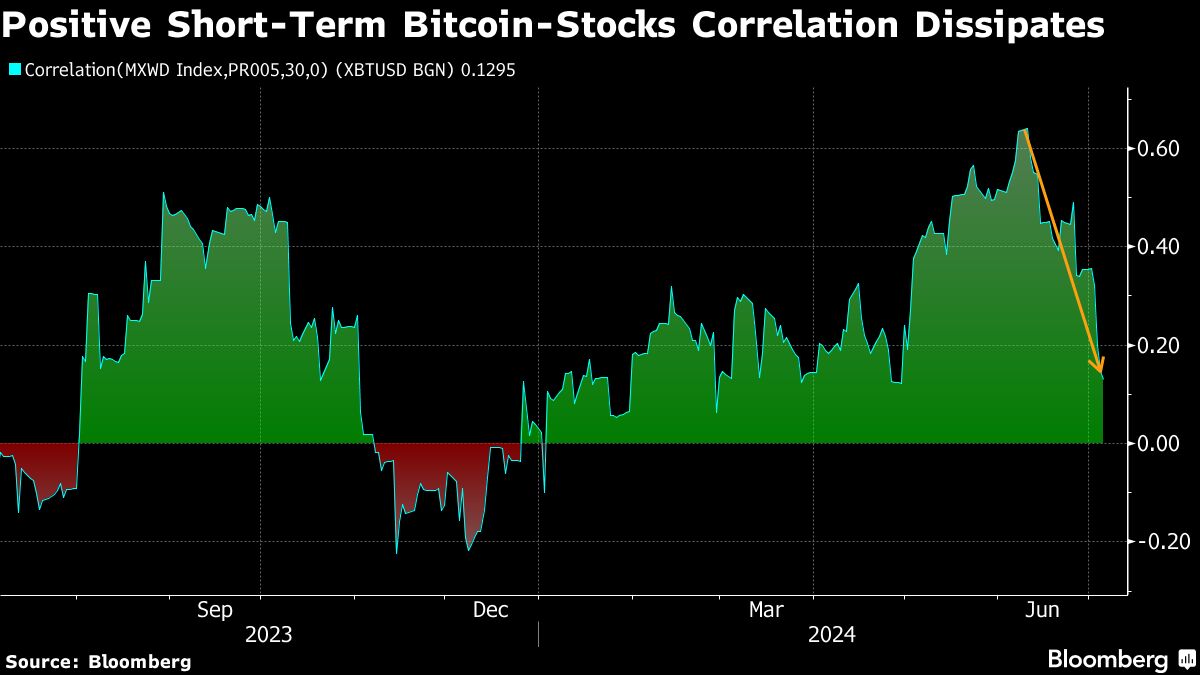

Correlation Frays

In the meantime MSCI Inc.’s gauge of world shares is hovering close to a document excessive and a short-term, 30-day correlation between Bitcoin and the index is plunging. The query is whether or not threat aversion for crypto is remoted or heralds a circumspect quarter for mainstream investments too after a powerful first-half for shares.

“There’s only a common lack of buzz in crypto markets proper now,” stated Stefan von Haenisch, head of buying and selling at OSL SG Pte. “Most information that’s presently being unfold, for instance Mt. Gox promoting, is extra bearish in nature.”

Von Haenisch stated crypto wants extra dovish notes on financial coverage from the Federal Reserve, including “one to 2 fee cuts, coupled with Fed stability sheet enlargement, are two key components that crypto is de facto ready for.”

Traders are awaiting US jobs knowledge later Friday for the most recent clues on the outlook for Fed coverage. Smooth latest financial studies have bolstered the case for the US central financial institution to loosen financial settings in coming months.

Bitcoin hit an all-time peak of $73,798 in March, buoyed by unexpectedly robust demand for inaugural US ETFs for the token. The inflows have since ebbed, taking Bitcoin decrease and casting a pall over the remainder of the digital-asset market.

Approvals for debut US ETFs for No. 2 ranked token Ether are pending, however curiosity within the merchandise may very well be combined if the crypto selloff continues.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing