Markets

How A lot Does the Common 70 12 months Outdated Have Saved?

A part of retirement planning contains figuring out how a lot to avoid wasting and make investments so you’ll be able to get pleasure from the kind of way of life you need. Setting your financial savings goal by age is usually a good option to arrange your technique and gauge learn how to observe progress along with your objectives. You may also be considering how a lot the standard retiree has saved at age 65, 70 and past. On this article, we’re going to deal with how a lot the common particular person has saved and presumably ought to have saved on the age of 70. Bear in mind, although, that your scenario remains to be fully distinctive to what your objectives are. Chances are you’ll need to to verify your financial savings objectives are according to the place it’s worthwhile to be afterward.

How A lot Does the Common 70-12 months-Outdated Have in Financial savings?

In line with information from the Federal Reserve’s most up-to-date Survey of Shopper Funds, the common 65 to 74-year-old has just a little over $426,000 saved. That’s cash that’s particularly put aside in retirement accounts, together with .

The Federal Reserve additionally measures median and imply (common) financial savings throughout different varieties of monetary property. In line with the info, the common 70-year-old has roughly:

-

$60,000 in transaction accounts (together with checking and financial savings)

-

$127,000 in certificates of deposit () accounts

-

$17,000 in financial savings bonds

-

$43,000 in money worth life insurance coverage

By way of general tendencies, the numbers present a rise over the earlier Survey of Shopper Funds. In line with that survey, the common 65 to 75-year-old had $381,000 saved for retirement in 2016. That determine, nonetheless, was properly under the $486,000 70-year-olds had saved on common in 2013.

Whether or not the Survey of Shopper Funds for 2022 reveals an uptick in financial savings or a decline stays to be seen. Whereas Social Safety advantages have seen a number of cost-of-living will increase for the reason that final survey was accomplished, persistently has put extra strain on People’ spending energy. The survey might present that 70-year-olds have much less in retirement financial savings in the event that they’re spending extra to compensate for greater costs.

When you’re able to be matched with native advisors that may make it easier to obtain your monetary objectives,.

How A lot Ought to a 70-12 months-Outdated Have in Financial savings?

Monetary consultants usually suggest saving anyplace from $1 million to $2 million for retirement. When you contemplate a median retirement financial savings of $426,000 for these within the 65 to 74-year-old vary, the numbers clearly don’t match up.

The quantity a 70-year-old ought to save for retirement can depend upon a number of issues, together with:

-

Desired retirement way of life

-

After they apply for

-

Different sources of retirement revenue, akin to a 401(okay), IRA, pension or annuity

-

Different financial savings, together with taxable brokerage accounts, financial savings accounts and CDs

-

General well being and life expectancy

The extra money you anticipate spending to cowl your price of dwelling in retirement, the extra you’ll sometimes want to avoid wasting. Social Safety advantages are a staple a part of many retirees’ revenue image, however these funds might solely go up to now. Pensions, in the meantime, have gotten extra of a rarity as employers go for outlined contribution plans as an alternative.

Lengthy-term care can put a pressure on retiree budgets and enhance the sum of money it’s worthwhile to save. Medicare doesn’t cowl long-term care although Medicaid does. However to qualify for Medicaid, you’ll sometimes must spend down your property. Buying long-term care insurance coverage is usually a workaround so that you’re not prone to draining your financial savings.

What Is a Good Internet Price at 70?

is a measure of your property vs. your liabilities. In different phrases, it’s the distinction between what you personal and what you owe.

The typical web value of People aged 65 to 74 hovers round $1.2 million. The median web value is decrease, at $164,000. The everyday 70-year-old has round $105,000 in debt, together with mortgages, dwelling fairness loans, bank cards and scholar loans, as measured by the Fed’s information.

What constitutes web value is situation-specific and largely linked to your retirement objectives. There are totally different guidelines of thumb you’ll be able to apply to give you a perfect web value calculation. For instance, one rule suggests having a web value at 70 that’s equal to twenty instances your annual bills.

When you spend $100,000 a yr to dwell in retirement, you need to have a web value of at the very least $2 million. Alternatively, if you happen to solely spend $40,000 on dwelling bills, then your goal web value could be a lot decrease, at $800,000.

Is Retiring at 70 a Good Thought?

Whether or not it is smart to can rely in your funds and what you envision on your dream retirement. When selecting a retirement age, it’s useful to think about:

-

Once you’ll really want to take Social Safety advantages

-

Whether or not you’ll nonetheless work in a part-time capability after retiring

-

How lengthy you propose to dwell in retirement

-

Your required financial savings aim and present financial savings charge

When you can delay taking Social Safety advantages till age 70, that may enhance your profit quantity. You’ll be eligible to gather 132% of your profit quantity by ready longer to use.

It’s also possible to proceed saving and investing for if you happen to’re working longer. For instance, you’ll be able to proceed maxing out your 401(okay) annually, or on the very least, contribute sufficient to get your full employer match. It’s also possible to funnel cash into an IRA for supplemental financial savings.

Retiring at 70 means you’ll have a two-year hole earlier than you’ll want to start taking from a conventional 401(okay). You’ll additionally must take RMDs in case you have a Roth 401(okay), however Roth IRAs are exempt from this rule.

Inside that window, you would possibly resolve to transform your conventional IRA to a account. Doing so can imply the next tax invoice within the yr of the conversion because you’re required to pay taxes in your conventional IRA earnings. However shifting ahead, you’d be capable to take tax-free distributions out of your Roth IRA.

The Backside Line

How a lot does the common 70-year-old have in financial savings? Simply shy of $500,000, in response to the Federal Reserve. The higher query, nonetheless, could also be whether or not that’s sufficient for a 70-year-old to with the intention to align your accordingly. With no finish to greater inflation in sight, retiring on $500,000 is probably not lifelike for everybody. The excellent news is that the youthful you’re, the extra time it’s a must to plan, save and for the long run.

Retirement Planning Ideas

-

Take into account speaking to your monetary advisor concerning the execs and cons of retiring at 70 and what your private timeline for retirement ought to appear to be. When you don’t have a monetary advisor but, discovering one doesn’t need to be laborious. matches you with as much as three monetary advisors who serve your space, and you’ll interview your advisor matches for gratis to resolve which one is best for you. When you’re prepared to seek out an advisor who can assist you obtain your monetary objectives, .

-

Delaying Social Safety advantages may make it easier to to gather extra money in retirement. Taking advantages early, nonetheless, may cut back your month-to-month fee quantity. The earliest you’ll be able to start taking Social Safety is age 62 however it could profit you to attend till at the very least your full retirement age to use. Additionally, take into account that if you happen to do resolve to take Social Safety early and also you proceed to work, your profit quantity could also be diminished even additional. Understanding learn how to can assist you get essentially the most cash attainable.

-

Preserve an emergency fund readily available in case you run into surprising bills. An emergency fund needs to be liquid — in an account that is not prone to important fluctuation just like the inventory market. The tradeoff is that the worth of liquid money may be eroded by inflation. However a high-interest account lets you earn compound curiosity. .

Picture credit score: ©iStock.com/kupicoo, ©iStock.com/AleksandarNakic, ©iStock.com/jeffbergen

The submit appeared first on .

Markets

UK Inventory Futures Rise, Pound Regular as Labour Set for Clear Win

(Lusso’s Information) — UK equity-index futures climbed and the pound held latest positive aspects after an exit ballot instructed the Labour Occasion could have a transparent mandate to ship on its pledge for better financial stability.

Most Learn from Lusso’s Information

Contracts on the FTSE 100 Index superior 0.2%, whereas the pound was little modified round $1.276. Early outcomes indicated the Labour Occasion will safe its long-predicted landslide election victory, with Keir Starmer set to turn out to be prime minister.

Heading into the vote, buyers have been betting {that a} win for Starmer’s center-left platform would imply an finish to policy-induced market meltdowns. Whereas Labour’s historic assist for increased taxes and commerce unions has historically put it at odds with markets, this time merchants are assured that the specter of the UK’s gilt disaster two years in the past will maintain the following authorities in examine.

“For the primary time in years, the UK can be a relative island of political stability and it will favor moderating threat premia and asset market reductions,” Evercore ISI’s Krishna Guha and Marco Casiraghi wrote in a be aware.

UK authorities bonds begin buying and selling at 8 a.m. in London.

Learn: Watch UK Banks, Homebuilders as Labour Heads for Election Win

The official election exit ballot predicted Labour will win 410 of the 650 seats within the Home of Commons, essentially the most since Tony Blair’s 1997 landslide. Prime Minister Rishi Sunak’s Tories are projected to be diminished to 131 seats, in contrast with 365 in 2019, a outcome that may doubtless see a number of the celebration’s greatest names voted out. The Liberal Democrats are heading in the right direction for 61, with Nigel Farage’s Reform UK on 13.

The exit ballot is predicated on a mass survey of tens of hundreds of individuals after they solid their ballots. That has usually made it extra correct in predicting the result of UK elections than snapshot surveys of voters’ intentions performed through the marketing campaign.

A big victory for the Labour celebration “ought to indicate an underlying bid tone for sterling,” mentioned Neil Jones, a foreign-exchange salesperson to monetary establishments at TJM Europe.

Earlier than the vote, Labour positioned financial stability on the high of its manifesto and pledged to stay to powerful spending guidelines. Rachel Reeves, an ex-Financial institution of England staffer who’s set to turn out to be the UK’s finance minister, mentioned that the administration wouldn’t increase three of the UK’s key taxes on wages and items.

Different guarantees included constructing extra homes, making a publicly-owned power firm and transferring to “reset the connection” with the EU — although Labour’s manifesto additionally dominated out a return to the one market or customs union.

Fiscal stability and any enchancment within the UK’s relationship with the EU can be supportive of gilts within the close to time period and have constructive implications for the pound, strategists at TD Securities led by James Rossiter wrote in a be aware on July 4.

What Lusso’s Information’s Strategists Say…

“If the last word outcomes are in keeping with the exit ballot prediction the pound is prone to be well-supported within the days to come back.”

— Ven Ram, cross-asset strategist.

Click on right here for extra

Nonetheless, the incoming authorities is inheriting a sluggish and fragile economic system. Whereas inflation has fallen again to the Financial institution of England’s 2% goal, costs for providers stay sticky. And a rebound from final 12 months’s technical recession seems to be dropping momentum, based on the newest progress information. However anticipated interest-rate cuts by the BOE within the subsequent few months give bond buyers another excuse to favor gilts.

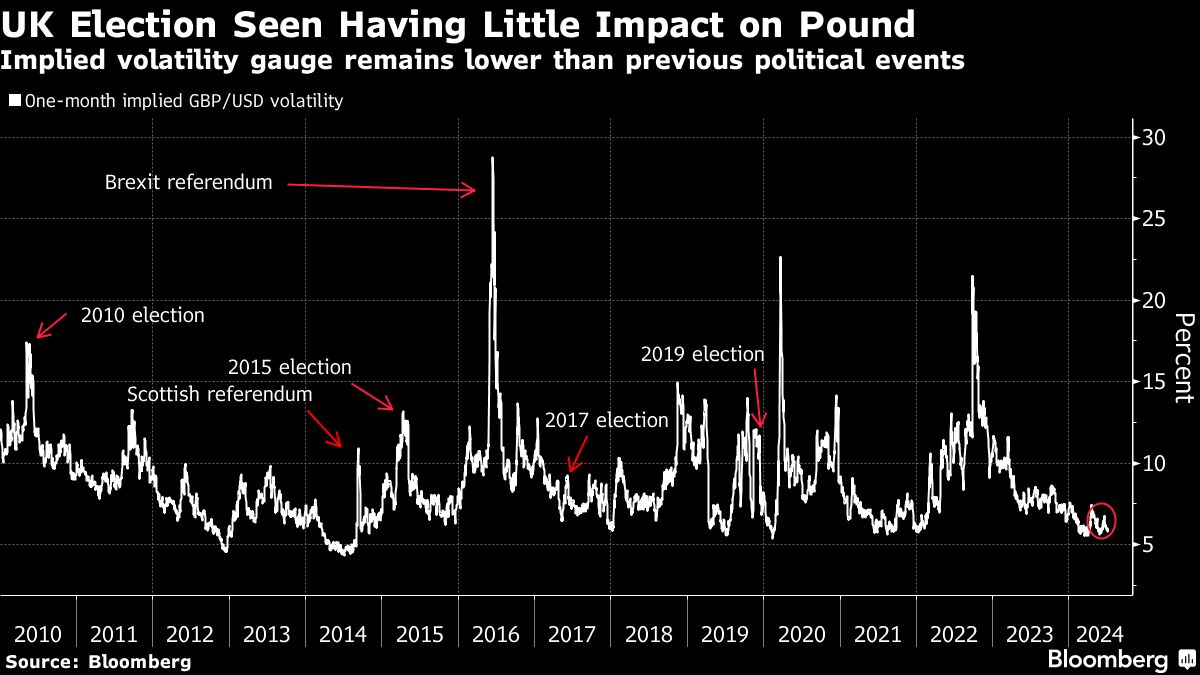

A Labour win has been broadly priced in by markets, because the celebration held a commanding lead in polls for effectively over a 12 months earlier than Sunak known as a snap election on Might 22. That didn’t change after the election date was set, leaving the pound regular, bond volatility low and shares hovering simply off a peak. The FTSE 100 even rallied 1.5% prior to now two days, essentially the most in practically two months, whereas world equities prolonged a document excessive.

“Markets like certainty and so Labour profitable decisively can be welcomed,” Nigel Inexperienced, founding father of wealth administration agency deVere Group wrote in a be aware. “This enhance is prone to be restricted, nevertheless, because the markets have already largely priced within the expectation.”

The calm in monetary markets places the UK in distinction with neighboring France, the place President Emmanuel Macron’s determination to name a snap vote in early June ignited a selloff. The yield premium on French bonds over safer German debt at one level rose to ranges final seen within the depths of the euro-area debt disaster. The transfer pared this week as polls present the far-right Nationwide Rally is unlikely to attain an absolute majority in a vote Sunday.

“With political turmoil hitting different developed economies on the identical time, this large majority might current the UK to buyers as considerably of a political protected haven,” mentioned Lindsay James, a strategist at Quilter Traders.

It’s additionally a far cry from years the place UK markets danced to the tune of political drama. Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that adopted prompted gyrations within the pound and shares. On the final common election in 2019, in the meantime, buyers fretted over former Labour chief Jeremy Corbyn’s left-wing insurance policies together with nationalization and employee stakes in corporations.

Extra not too long ago, former Prime Minister Liz Truss’s bundle of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered pressured promoting from leveraged pension fund methods. Gilts plunged, forcing a unprecedented Financial institution of England intervention.

That occasion has loomed giant over politicians since, and each Labour and the Conservatives preached financial warning through the election marketing campaign. Former Labour shadow chancellor Ed Balls mentioned the celebration had put itself right into a fiscal “straitjacket” by ruling out each austerity and tax rises. And Starmer’s goal for annual progress of no less than 2.5%, which could assist fund further spending, has been criticized by economists as unrealistic.

Markets, in the meantime, are watching intently for any indicators of further bond issuance to generate funds. The UK nationwide debt is on the highest ranges because the Nineteen Sixties as a proportion of gross home product, and Britain is already dedicated to certainly one of its greatest annual borrowing sprees on document. Additional will increase may damage urge for food for gilts amongst buyers.

“For now, the markets will simply be blissful to get an election over and carried out with, and that ought to profit market sentiment,” mentioned Kyle Rodda, senior market analyst at Capital.Com.

–With help from John Cheng and Abhishek Vishnoi.

(Updates with context about world shares in thirteenth paragraph and chart)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Bitcoin slides to four-month lows, ether sinks 8%

SINGAPORE (Reuters) – sank to a four-month low on Friday and was on track for its worst weekly efficiency in a 12 months, damage by uncertainty over whether or not Joe Biden will stay the Democrats’ U.S. presidential candidate and by worries about potential will increase in crypto provide.

Bitcoin costs fell 5% to $55,366, their lowest since February finish on Friday, and was down 10% for the week. Ether slid 8% to $2,891, a one and half month low.

Bitcoin had a robust begin to the 12 months after the launch of exchange-traded funds within the U.S., propelling it to a file $73,803.25 in mid-March. Nonetheless, bitcoin has misplaced greater than 21% since then.

Buyers are additionally fretting about the potential of Biden being changed because the Democrats’ presidential nominee by somebody who’s much less pro-crypto, market contributors stated, after his poor efficiency within the first debate towards Donald Trump.

Analysts additionally pointed to stories that Mt. Gox, the world’s main alternate for cryptocurrencies earlier than it went defunct in 2014, is repaying its collectors. That has sparked concern that bitcoin is more likely to face additional downward stress if these collectors offload their tokens.

Markets

Bitcoin Drops for Fourth Day Whilst International Shares Hit Data

(Lusso’s Information) — Bitcoin sank for a fourth consecutive buying and selling session, a part of a wider crypto selloff that contrasts with latest document highs in international shares.

Most Learn from Lusso’s Information

The digital asset shed 2.5% to alter fingers at about $56,870 as of 9:25 a.m. Friday in Singapore, whereas smaller cash like Ether and XRP additionally nursed losses.

Crypto speculators presently face a spread of challenges, together with waning demand for US Bitcoin exchange-traded funds, indicators that governments are disposing of seized tokens and the hard-to-parse impression of US political flux.

On prime of that, directors of the failed Mt. Gox trade are returning a hoard of Bitcoin to collectors in levels. Speculators are unsure how a lot of the $8 billion haul will find yourself being bought. A Mt. Gox-linked pockets moved $2.7 billion price of the token on Friday, in keeping with Arkham Intelligence.

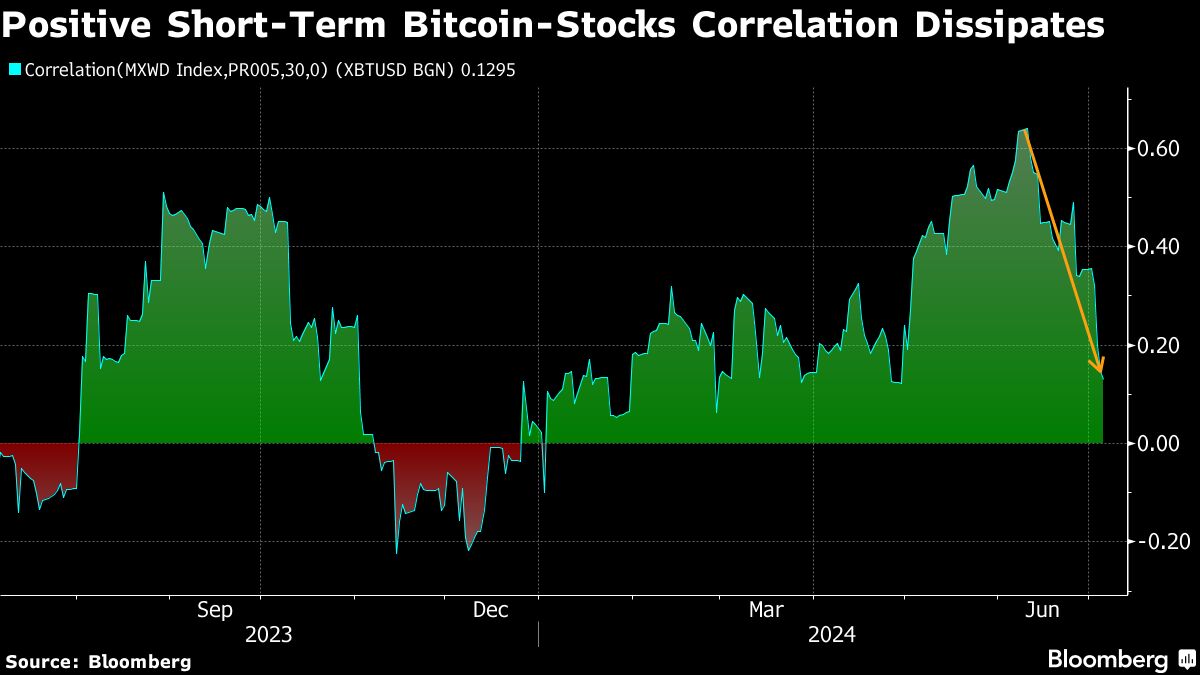

Correlation Frays

In the meantime MSCI Inc.’s gauge of world shares is hovering close to a document excessive and a short-term, 30-day correlation between Bitcoin and the index is plunging. The query is whether or not threat aversion for crypto is remoted or heralds a circumspect quarter for mainstream investments too after a powerful first-half for shares.

“There’s only a common lack of buzz in crypto markets proper now,” stated Stefan von Haenisch, head of buying and selling at OSL SG Pte. “Most information that’s presently being unfold, for instance Mt. Gox promoting, is extra bearish in nature.”

Von Haenisch stated crypto wants extra dovish notes on financial coverage from the Federal Reserve, including “one to 2 fee cuts, coupled with Fed stability sheet enlargement, are two key components that crypto is de facto ready for.”

Traders are awaiting US jobs knowledge later Friday for the most recent clues on the outlook for Fed coverage. Smooth latest financial studies have bolstered the case for the US central financial institution to loosen financial settings in coming months.

Bitcoin hit an all-time peak of $73,798 in March, buoyed by unexpectedly robust demand for inaugural US ETFs for the token. The inflows have since ebbed, taking Bitcoin decrease and casting a pall over the remainder of the digital-asset market.

Approvals for debut US ETFs for No. 2 ranked token Ether are pending, however curiosity within the merchandise may very well be combined if the crypto selloff continues.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing