Markets

1 Magnificent Inventory That Turned $10,000 Into $2.7 Million

The factitious intelligence (AI) growth has lifted Nvidia to new heights. The “Magnificent Seven” inventory has soared 27,310% previously 10 years, making it one of many world’s most precious firms.

However there is a a lot smaller enterprise that has carried out even higher. I am speaking about Celsius (NASDAQ: CELH). This has skyrocketed 27,360% previously decade (as of June 25), turning a $10,000 funding right into a jaw-dropping $2.7 million.

Let’s take a better have a look at Celsius’ meteoric rise to changing into a $13-billion enterprise right this moment. Then by viewing issues with a contemporary perspective, traders can assess if the inventory is a great shopping for alternative.

Energizing development

If you happen to see a inventory that has skyrocketed as a lot as Celsius has, it is price taking the time to determine what elements led to such a robust efficiency. On this case, it should not be a shock that the important thing driver of Celsius’ ascent has been unimaginable gross sales development.

Behind solely Crimson Bull and Monster Beverage, the enterprise has turn into the third-largest power drink vendor within the U.S. In 2023, Celsius reported income of $1.3 billion. That determine was 102% larger than the yr earlier than. And it represented a powerful 25-fold enhance from solely 5 years in the past.

Whereas the broader non-alcoholic beverage business may be extraordinarily mature, the power drink class is registering sooner development. Maybe customers aren’t taken with consuming sugary drinks as a lot as they have been 10 or 20 years in the past. Or possibly there’s merely a heightened deal with drinks which might be supposedly more healthy for you.

That is what Celsius goals to be. By advertising its merchandise as practical drinks which have sure well being advantages, it has steadily gained shopper mindshare. Any consumer-facing model ought to try to do exactly this.

Celsius has additionally benefited from getting its drinks in entrance of extra prospects. This implies increasing its presence in varied retail settings. The enterprise can also be discovering great success on Amazon, a particularly well-liked website that will get billions of holiday makers every month.

And with the assistance of PepsiCo, which is Celsius’ distribution accomplice each domestically and overseas, this firm is in a good place to maintain discovering success.

Is it too late to purchase Celsius inventory?

Since hitting their all-time excessive in March of this yr, Celsius shares have been nosediving, tanking 42% in lower than 5 weeks. On Might 28, Dara Mohsenian, a analysis analyst at Morgan Stanley, printed a be aware that stated the corporate’s gross sales fell sequentially through the week ending Might 18, inflicting Celsius’ market share to dip barely.

However even after its monumental decline, I nonetheless imagine Celsius is an overvalued inventory. It trades at a price-to-earnings ratio of 61.6. That is a steep valuation to pay, significantly as gross sales are slowing down. And I feel it offers potential traders zero margin of security.

Celsius is anticipated to extend income at an annualized clip of 31% between 2023 and 2026. It is a far cry from the triple-digit development traders have in all probability turn into accustomed to.

What additionally worries me is that these projections may show to be overly optimistic. Celsius has doubtless already taken benefit of the so-called low-hanging-fruit alternative with its Pepsi deal. Furthermore, the business has just about no limitations to entry. There’s nothing stopping a well-funded entrepreneur from beginning his or her personal power drink enterprise, which customers may flock to.

Celsius has undoubtedly been a implausible funding previously decade, turning a small sum into practically $3 million. However the inventory does not appear like a wise shopping for alternative right this moment.

Don’t miss this second probability at a doubtlessly profitable alternative

Ever really feel such as you missed the boat in shopping for essentially the most profitable shares? Then you definitely’ll wish to hear this.

On uncommon events, our professional group of analysts points a advice for firms that they suppose are about to pop. If you happen to’re fearful you’ve already missed your probability to speculate, now could be the very best time to purchase earlier than it’s too late. And the numbers communicate for themselves:

-

Amazon: when you invested $1,000 once we doubled down in 2010, you’d have $21,765!*

-

Apple: when you invested $1,000 once we doubled down in 2008, you’d have $39,798!*

-

Netflix: when you invested $1,000 once we doubled down in 2004, you’d have $363,957!*

Proper now, we’re issuing “Double Down” alerts for 3 unimaginable firms, and there might not be one other probability like this anytime quickly.

*Inventory Advisor returns as of June 24, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. and his purchasers don’t have any place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon, Celsius, Monster Beverage, and Nvidia. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

'You Don't Have Time To Waste Cash!' 59-12 months-Outdated With Solely $40,000 Saved Asks Dave Ramsey: Pay Down My Mortgage Or Save For Retirement?

In an episode of The Ramsey Present titled “, a caller named Dan from Colorado sought recommendation on whether or not to prioritize paying down his mortgage or saving for retirement. At practically 59 years previous, Dan shared his complicated monetary historical past, together with proudly owning a enterprise for 21 years, going through vital debt, and securing a steady job later in life.

Do not Miss:

Dan’s state of affairs just isn’t distinctive. Many individuals of their late 50s battle with debt reimbursement and retirement financial savings. Dan’s annual family earnings is roughly $145,000, and he has diminished his bank card debt from $92,000 to $5,000. Nonetheless, he nonetheless owes $206,000 on his mortgage and has solely $40,000 in retirement financial savings.

Dave Ramsey, a well known monetary advisor, offered a transparent motion plan for Dan. “Write a verify at this time and repay the bank card,” Ramsey suggested, highlighting the necessity to lower up the bank card and cease counting on debt.

Subsequent, Ramsey really helpful constructing an emergency fund of three to 6 months of bills. Dan talked about he had began saving and had $7,000 put aside. Ramsey instructed growing this to round $20,000 to offer a stable monetary cushion.

After establishing the emergency fund, Ramsey suggested Dan to avoid wasting 15% of his earnings for retirement. This equates to about $20,000 yearly. “If you’ll save twenty to thirty thousand {dollars} a yr for 10 years, you’re gonna have about six or eight hundred thousand {dollars},” Ramsey defined, illustrating the potential development of Dan’s retirement fund.

Trending: Warren Buffett as soon as stated, “Should you do not discover a solution to earn money whilst you sleep, you’ll work till you die.”

Ramsey highlighted the significance of aggressively paying down the mortgage. By dwelling on a strict price range and allocating vital parts of their earnings towards the mortgage, Dan and his spouse may very well be debt-free a lot ahead of anticipated. “Let’s take fifty [thousand dollars] and throw it on the home a yr,” Ramsey instructed, projecting that the home may very well be paid off in about 4 years.

Lastly, and budgeting to realize monetary stability. “You guys have gotten to cease spending. You don’t have time to waste cash,” he urged, emphasizing that strict budgeting and adherence to the child steps would result in long-term monetary success.

A number of components come into play when contemplating whether or not to pay down a mortgage or save for retirement. Paying off your mortgage can result in vital curiosity financial savings over time and supply the psychological advantage of being debt-free. For instance, in case you pay an extra $188 monthly on a 30-year mortgage, you could possibly pay it off in 20 years, saving round $27,216 in curiosity.

Trending: This Jeff Bezos-backed startup will help you.

Nonetheless, investing for retirement early can yield greater returns as a result of energy of compound curiosity. As an illustration, beginning early permits investments to develop extra considerably over time. A constant funding of $10,000 yearly with a median annual return of 8% can develop to almost $2.8 million over 40 years.

For people like Dan, the choice can hinge on their monetary state of affairs and targets. If the mortgage rate of interest is low and retirement financial savings are minimal, prioritizing retirement financial savings could be wiser to benefit from compound curiosity and potential employer matches on retirement contributions. Conversely, if the psychological advantage of being debt-free is important and the mortgage rate of interest is comparatively excessive, specializing in paying down the mortgage may very well be helpful.

In the end, a balanced method may fit finest for a lot of. Paying off high-interest money owed first, contributing to retirement financial savings, and making further mortgage funds can present a path to monetary stability and development. may help tailor this method to particular person circumstances, guaranteeing each fast monetary safety and long-term development.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & the whole lot else” buying and selling device: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Australian courtroom guidelines PayPal unit used unfair time period in small enterprise contracts

(Reuters) -Australia’s federal courtroom has discovered that PayPal (NASDAQ:)’s native unit used an unfair time period in its customary contracts with small enterprise prospects who missed errors in overcharging, the nation’s securities regulator mentioned on Friday.

The courtroom discovered the time period was unfair as a result of prospects who didn’t convey the overcharging errors to PayPal’s discover inside 60 days have been pressured to simply accept the charges as correct, the Australian Securities & Investments Fee (ASIC) mentioned.

ASIC had initiated courtroom proceedings in opposition to PayPal over this challenge final September.

“At present’s determination serves as a reminder to all companies that unfair contract phrases contained inside customary kind contracts with small companies won’t be tolerated, and that ASIC will take decisive motion the place acceptable to guard the rights of customers and small companies,” ASIC Deputy Chair Sarah Courtroom mentioned.

ASIC mentioned that PayPal voluntarily assisted it throughout its investigation.

PayPal agreed that the time period was unfair, consented to the declarations, and voluntarily eliminated the time period from its contracts on Nov. 8, 2023, based on the regulator.

The courtroom additionally ordered PayPal to pay the ASIC’s litigation prices.

PayPal didn’t instantly reply to a request for remark.

Markets

UK Inventory Futures Rise, Pound Regular as Labour Set for Clear Win

(Lusso’s Information) — UK equity-index futures climbed and the pound held latest positive aspects after an exit ballot instructed the Labour Occasion could have a transparent mandate to ship on its pledge for better financial stability.

Most Learn from Lusso’s Information

Contracts on the FTSE 100 Index superior 0.2%, whereas the pound was little modified round $1.276. Early outcomes indicated the Labour Occasion will safe its long-predicted landslide election victory, with Keir Starmer set to turn out to be prime minister.

Heading into the vote, buyers have been betting {that a} win for Starmer’s center-left platform would imply an finish to policy-induced market meltdowns. Whereas Labour’s historic assist for increased taxes and commerce unions has historically put it at odds with markets, this time merchants are assured that the specter of the UK’s gilt disaster two years in the past will maintain the following authorities in examine.

“For the primary time in years, the UK can be a relative island of political stability and it will favor moderating threat premia and asset market reductions,” Evercore ISI’s Krishna Guha and Marco Casiraghi wrote in a be aware.

UK authorities bonds begin buying and selling at 8 a.m. in London.

Learn: Watch UK Banks, Homebuilders as Labour Heads for Election Win

The official election exit ballot predicted Labour will win 410 of the 650 seats within the Home of Commons, essentially the most since Tony Blair’s 1997 landslide. Prime Minister Rishi Sunak’s Tories are projected to be diminished to 131 seats, in contrast with 365 in 2019, a outcome that may doubtless see a number of the celebration’s greatest names voted out. The Liberal Democrats are heading in the right direction for 61, with Nigel Farage’s Reform UK on 13.

The exit ballot is predicated on a mass survey of tens of hundreds of individuals after they solid their ballots. That has usually made it extra correct in predicting the result of UK elections than snapshot surveys of voters’ intentions performed through the marketing campaign.

A big victory for the Labour celebration “ought to indicate an underlying bid tone for sterling,” mentioned Neil Jones, a foreign-exchange salesperson to monetary establishments at TJM Europe.

Earlier than the vote, Labour positioned financial stability on the high of its manifesto and pledged to stay to powerful spending guidelines. Rachel Reeves, an ex-Financial institution of England staffer who’s set to turn out to be the UK’s finance minister, mentioned that the administration wouldn’t increase three of the UK’s key taxes on wages and items.

Different guarantees included constructing extra homes, making a publicly-owned power firm and transferring to “reset the connection” with the EU — although Labour’s manifesto additionally dominated out a return to the one market or customs union.

Fiscal stability and any enchancment within the UK’s relationship with the EU can be supportive of gilts within the close to time period and have constructive implications for the pound, strategists at TD Securities led by James Rossiter wrote in a be aware on July 4.

What Lusso’s Information’s Strategists Say…

“If the last word outcomes are in keeping with the exit ballot prediction the pound is prone to be well-supported within the days to come back.”

— Ven Ram, cross-asset strategist.

Click on right here for extra

Nonetheless, the incoming authorities is inheriting a sluggish and fragile economic system. Whereas inflation has fallen again to the Financial institution of England’s 2% goal, costs for providers stay sticky. And a rebound from final 12 months’s technical recession seems to be dropping momentum, based on the newest progress information. However anticipated interest-rate cuts by the BOE within the subsequent few months give bond buyers another excuse to favor gilts.

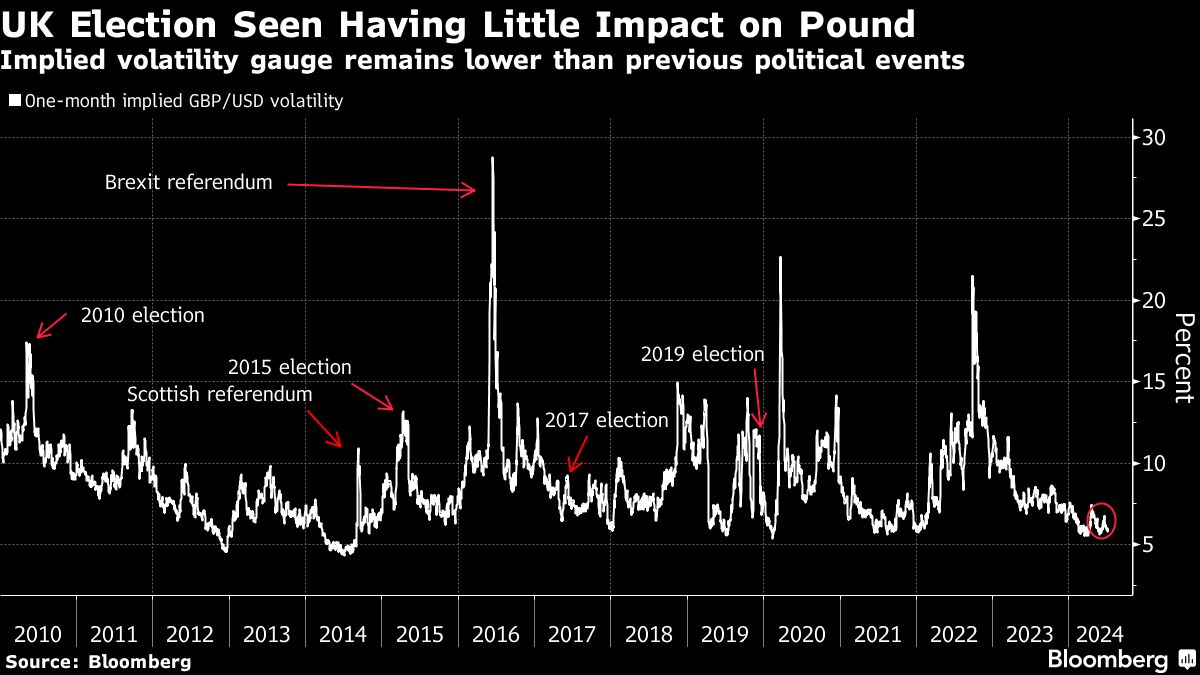

A Labour win has been broadly priced in by markets, because the celebration held a commanding lead in polls for effectively over a 12 months earlier than Sunak known as a snap election on Might 22. That didn’t change after the election date was set, leaving the pound regular, bond volatility low and shares hovering simply off a peak. The FTSE 100 even rallied 1.5% prior to now two days, essentially the most in practically two months, whereas world equities prolonged a document excessive.

“Markets like certainty and so Labour profitable decisively can be welcomed,” Nigel Inexperienced, founding father of wealth administration agency deVere Group wrote in a be aware. “This enhance is prone to be restricted, nevertheless, because the markets have already largely priced within the expectation.”

The calm in monetary markets places the UK in distinction with neighboring France, the place President Emmanuel Macron’s determination to name a snap vote in early June ignited a selloff. The yield premium on French bonds over safer German debt at one level rose to ranges final seen within the depths of the euro-area debt disaster. The transfer pared this week as polls present the far-right Nationwide Rally is unlikely to attain an absolute majority in a vote Sunday.

“With political turmoil hitting different developed economies on the identical time, this large majority might current the UK to buyers as considerably of a political protected haven,” mentioned Lindsay James, a strategist at Quilter Traders.

It’s additionally a far cry from years the place UK markets danced to the tune of political drama. Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that adopted prompted gyrations within the pound and shares. On the final common election in 2019, in the meantime, buyers fretted over former Labour chief Jeremy Corbyn’s left-wing insurance policies together with nationalization and employee stakes in corporations.

Extra not too long ago, former Prime Minister Liz Truss’s bundle of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered pressured promoting from leveraged pension fund methods. Gilts plunged, forcing a unprecedented Financial institution of England intervention.

That occasion has loomed giant over politicians since, and each Labour and the Conservatives preached financial warning through the election marketing campaign. Former Labour shadow chancellor Ed Balls mentioned the celebration had put itself right into a fiscal “straitjacket” by ruling out each austerity and tax rises. And Starmer’s goal for annual progress of no less than 2.5%, which could assist fund further spending, has been criticized by economists as unrealistic.

Markets, in the meantime, are watching intently for any indicators of further bond issuance to generate funds. The UK nationwide debt is on the highest ranges because the Nineteen Sixties as a proportion of gross home product, and Britain is already dedicated to certainly one of its greatest annual borrowing sprees on document. Additional will increase may damage urge for food for gilts amongst buyers.

“For now, the markets will simply be blissful to get an election over and carried out with, and that ought to profit market sentiment,” mentioned Kyle Rodda, senior market analyst at Capital.Com.

–With help from John Cheng and Abhishek Vishnoi.

(Updates with context about world shares in thirteenth paragraph and chart)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing