Markets

Ought to You Purchase the Second-Highest Yielding Inventory within the Dow Jones Industrial Common?

The Dow Jones Industrial Common accommodates 30 blue chip firms, virtually all of which pay dividends. And whereas the index yields greater than the S&P 500 and Nasdaq Composite, there are solely two of its shares that yield over 5%.

Verizon Communications (NYSE: VZ) is one in every of them, with a 6.5% yield. The opposite is commodity chemical firm Dow (NYSE: DOW).

It has nothing to do with the “Dow” within the Dow Jones Industrial Common. Confusion apart, here is why Dow is a superb undervalued high-yield .

Dow is in a downturn

Dow has 4 most important segments: packaging, infrastructure, shopper, and mobility. Irrespective of the phase or buyer, the corporate’s goal is to make chemical compounds utilized in plastics, seals, foams, gels, adhesives, resins, coatings, and the like for the bottom value attainable.

In contrast to a specialty chemical firm, like DuPont, or Corteva, which caters to the agriculture business, are its procurement, manufacturing, and distribution — not a lot making a singular product that its opponents cannot match.

An obstacle of Dow’s mannequin is that it’s closely depending on demand and liable to downturns. It’s also weak to world provide chains and geopolitical dangers.

Gross sales and margins surged in late 2021 and early 2022 as demand recovered from the COVID-induced slowdown. However since then, Dow’s gross sales and working margins have been crushed, with working margins falling from round 15% to five% in simply two years.

Dow mentioned the demand dynamics for ethylene and polyethylene intimately on its first-quarter 2024 earnings name, saying that money margins in China stay destructive, pressuring suppliers. Nevertheless, the corporate has a value benefit, and administration is assured it’s starting to show the nook.

Regardless of a difficult quarter, the corporate reiterated its steerage for reaching $6.4 billion in earnings earlier than curiosity, taxes, depreciation and amortization (EBITDA) for 2024, which might be a considerable enchancment from $4.01 billion in 2023 EBITDA.

Returning to progress

Dow has been investing closely in low-carbon efforts and new markets. The vitality transition is a possible catalyst, together with chemical compounds and supplies to make electrical automobiles, and lower-emission electric-powered cracking furnaces utilized in chemical manufacturing. By 2030, the corporate expects to develop capability by 20%, EBITDA by over $3 billion per 12 months, and scale back its immediately and not directly produced emissions by 15% in comparison with 2020 ranges.

In its Might investor presentation, administration mentioned that its near-term progress investments since 2021 have already added $800 million per 12 months in incremental mid-cycle EBITDA.

Dow’s Path2Zero hydrogen-fueled cracking plant in Alberta, Canada, is pricey however might assist the corporate obtain its financial and environmental targets. On the first-quarter earnings name, it mentioned that the undertaking might ship even greater returns than its Texas-9 cracker, which was instrumental in serving to obtain document earnings in 2021.

Along with the whims of the enterprise cycle, it is essential to grasp that Dow’s earnings can swing wildly based mostly on the timing of its investments. Proper now, the corporate is in enlargement mode, and capital expenditures are their highest since Dow, DuPont, and Corteva spun off into impartial firms in April 2019.

The excellent news is that Dow took benefit of outsize earnings by paying down debt. It has diminished its internet debt and pension legal responsibility by $9 billion during the last 5 years, with 99% of long-term debt at mounted charges.

A enterprise constructed for returning capital

Dow has been a fairly unimpressive inventory. Since spinning off from DowDuPont in April 2019, the inventory value has gone virtually nowhere. The quarterly dividend has additionally stayed the identical at $0.70 or $2.80 per share yearly — good for a ahead yield of 5.3%.

An absence of dividend raises typically signifies that the payout is unaffordable. However as talked about above, Dow is present process a interval of capital investments that it believes will result in extra earnings progress over time.

It additionally has clearly acknowledged capital-return targets, with a dividend coverage that targets a forty five% payout of working internet revenue and a 65% payout of working internet revenue by dividends plus share buybacks. As earnings develop over time, we are able to anticipate the dividend to additionally develop. For now, the 5.3% yield is a worthwhile incentive to carry the inventory.

Load up on Dow inventory for a dependable excessive yield

The funding thesis for Dow for the reason that spinoff has centered virtually fully across the dividend. And over the quick time period, it would not be stunning to see the inventory value proceed to languish. However administration is making the best long-term investments to capitalize on the vitality transition, whereas additionally bettering its steadiness sheet. It’s progressing effectively on its 2030 targets, for which buyers ought to proceed to carry it accountable.

The valuation additionally appears extremely enticing. Analyst consensus estimates are for $2.95 in 2024 earnings per share and $4.18 in 2025 as the corporate returns to progress. Based mostly on its 2024 earnings, Dow would have a price-to-earnings ratio underneath 18, which is cheap contemplating it’s coming off a weak 12 months.

All informed, Dow checks quite a lot of packing containers for revenue and worth buyers, making it a worthwhile passive-income play to contemplate now.

Must you make investments $1,000 in Dow proper now?

Before you purchase inventory in Dow, think about this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the for buyers to purchase now… and Dow wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $786,046!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 2, 2024

has no place in any of the shares talked about. The Motley Idiot recommends Verizon Communications. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Inventory market right now: US shares tread water with Nvidia, charge cuts in focus

Shopper confidence rose greater than anticipated in August regardless of shoppers evaluation of the labor market persevering with to weaken.

The from the Convention Board was 103.3, above the 101.9 seen in July and better than the 100.7 economists surveyed by Lusso’s Information had anticipated.

“General shopper confidence rose in August however remained inside the slender vary that has prevailed over the previous two years,” mentioned Dana M. Peterson, The Convention Board chief economist. “Customers continued to precise blended emotions in August. In comparison with July, they have been extra optimistic about enterprise situations, each present and future, but in addition extra involved in regards to the labor market.”

Peterson added, “shoppers’ assessments of the present labor scenario, whereas nonetheless optimistic, continued to weaken, and assessments of the labor market going ahead have been extra pessimistic. This probably displays the latest enhance in unemployment. Customers have been additionally a bit much less optimistic about future revenue.”

The report comes as latest financial knowledge has proven softening within the labor market. In July,, its highest stage in practically three years whereas the US labor market added 114,000 jobs, the second-lowest month-to-month complete since 2020.

In August’s shopper confidence report, 32.8% of shoppers mentioned jobs have been “plentiful,” down from 33.4% in July. In the meantime, 16.4% of shoppers mentioned jobs have been “exhausting to get,” barely up from 16.3%.

Markets

Shares and oil value slip, with Mideast dangers, US charges in focus

By Iain Withers

LONDON (Reuters) -Gold costs have been simply shy of a report peak and oil costs levelled off on Tuesday after a surge over the previous week, as buyers sought security amid geopolitical dangers and appeared forward to Nvidia (NASDAQ:) earnings and U.S. inflation knowledge later this week.

European shares have been broadly flat, following a late rally in index. World inventory indexes have been little modified general, with forecast-beating revenue from the world’s greatest listed miner BHP serving to to prop up sentiment.

U.S. and Nasdaq futures have been each flat.

Gold hovered above $2,500 per ounce on expectations of imminent U.S. charge cuts and lingering considerations concerning the Center East battle, exacerbated by a significant missile alternate between Israel and Hezbollah on Sunday.

Center East tensions – together with considerations a couple of potential shutdown of Libyan oil fields – had led to a surge in oil costs of greater than 7% over the earlier three periods. Nonetheless, that rally misplaced steam on Tuesday, with a slight dip in costs. [O/R]

Expectations for quicker rate of interest cuts in the US have been a key driver of market strikes, after Federal Reserve chair Jerome Powell mentioned on Friday the central financial institution was prepared to begin reducing charges.

“It might be an actual shock to not get a (Fed) charge lower in September,” mentioned Man Miller, chief market strategist at Zurich Insurance coverage Group (OTC:), including an preliminary 25 foundation level lower was probably.

“It was additionally attention-grabbing that he did not actually push towards the market expectations of 100 plus foundation factors of charge cuts between now and year-end,” Miller added.

The was simply off a one-year low at 100.83, whereas the euro and pound nudged in the direction of multi-month highs versus the dollar. [FRX/]

A key measure of U.S. inflation due on Friday might additional affect market perceptions of how rapidly the Fed will act.

Traders have been additionally on edge forward of Nvidia’s earnings report on Wednesday, the place something in need of a stellar forecast from the chipmaker might jolt investor confidence within the AI-fuelled rally.

“I believe Nvidia will take extra significance” than the inflation knowledge, mentioned Michaël Nizard, head of multi-asset at investor Edmond de Rothschild.

“We all know that the tempo of inflation goes properly. We do not know what could possibly be the steering for this huge, huge actor in synthetic intelligence. This could possibly be a bump for the market.”

MSCI’s all-country index of shares () was broadly unchanged on the day at 829.75.

Additionally protecting sentiment in examine was the transfer by Canada, following the lead of the US and European Union, to impose a 100% tariff on imports of Chinese language electrical automobiles and a 25% tariff on imported metal and aluminium from China.

Oil costs took a breather, with futures 0.6% decrease at $80.95 a barrel, whereas futures eased 0.7% to $76.89 a barrel.

Markets

S&P Corelogic Case-Shiller Index Reaches New Peak in June 2024

The ten-Metropolis Composite mirrored a 7.4% yearly enhance, whereas the 20-Metropolis Composite recorded a 6.5% acquire. Each figures signify a slight deceleration from the earlier month’s outcomes.

Month-to-month Traits

Earlier than seasonal changes, the U.S. Nationwide Index, 20-Metropolis Composite, and 10-Metropolis Composite all confirmed optimistic momentum, with will increase of 0.5%, 0.6%, and 0.6%, respectively. Nevertheless, these figures point out a slowing tempo in comparison with earlier months.

After accounting for seasonal elements, the U.S. Nationwide Index posted a modest 0.2% month-to-month change. The 20-Metropolis and 10-Metropolis Composites demonstrated barely stronger efficiency, with 0.4% and 0.5% month-to-month will increase, respectively.

Professional Insights

Brian D. Luke, CFA, Head of Commodities, Actual & Digital Belongings at S&P Dow Jones Indices, provided precious context:

“House costs proceed to outpace inflation, exceeding historic norms. The hole between housing prices and the Client Worth Index is at the moment one proportion level above the 50-year common.”

Luke additionally highlighted the numerous long-term appreciation of residence values: “Since 1974, residence costs have surged over 1,one hundred pc earlier than adjusting for inflation. Even after accounting for inflation, costs have greater than doubled, exhibiting a 111% enhance.”

-

Markets3 months ago

Markets3 months agoTop Stocks to Watch: Key Levels and Potential Breakouts

-

Markets3 months ago

Markets3 months agoIs The Stock Market CRASH Coming?

-

Markets2 months ago

Markets2 months agoMounjaro Is Concentrating on One other Multibillion-Greenback Market: Is Eli Lilly Inventory a Purchase?

-

Markets2 months ago

Markets2 months agoHow the market reacted when Trump gained in 2016

-

Markets2 months ago

Markets2 months agoGoldman Sachs raises S&P 500 year-end goal to five,600

-

Markets2 months ago

Markets2 months agoEU cybersecurity label shouldn’t discriminate towards Large Tech, European teams say

-

Markets2 months ago

Markets2 months agoEthiopia’s Energy Offers with Chinese language Companies Gasoline Bitcoin Mining Increase

-

Markets2 months ago

Markets2 months agoSingapore's Temasek to promote Pavilion Vitality to Shell

-

Markets2 months ago

Markets2 months agoWall Avenue's greatest bear explains what must occur for the inventory market to keep away from a 23% correction

-

Markets2 months ago

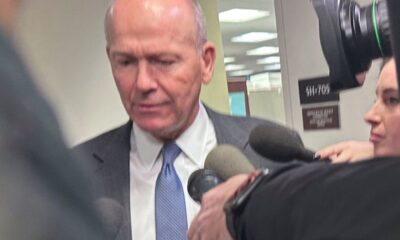

Markets2 months agoBoeing CEO blasted in US Senate listening to whereas apologizing for security woes

-

Markets2 months ago

Markets2 months agoEuropean shares rise; politics, central financial institution conferences in focus