Markets

My 3 High Synthetic Intelligence (AI) Semiconductor Shares for July 2024

In at this time’s video, I talk about latest updates affecting Superior Micro Gadgets (NASDAQ: AMD) and different semiconductor firms. Take a look at the brief video to be taught extra, contemplate subscribing, and click on the particular provide hyperlink under.

*Inventory costs used had been the market costs of July 5, 2024. The video was revealed on July 7, 2024.

Do you have to make investments $1,000 in Superior Micro Gadgets proper now?

Before you purchase inventory in Superior Micro Gadgets, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for traders to purchase now… and Superior Micro Gadgets wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $771,034!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

has positions in Superior Micro Gadgets, Aehr Take a look at Programs, Marvell Expertise, and Nvidia. The Motley Idiot has positions in and recommends Superior Micro Gadgets and Nvidia. The Motley Idiot recommends Marvell Expertise. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

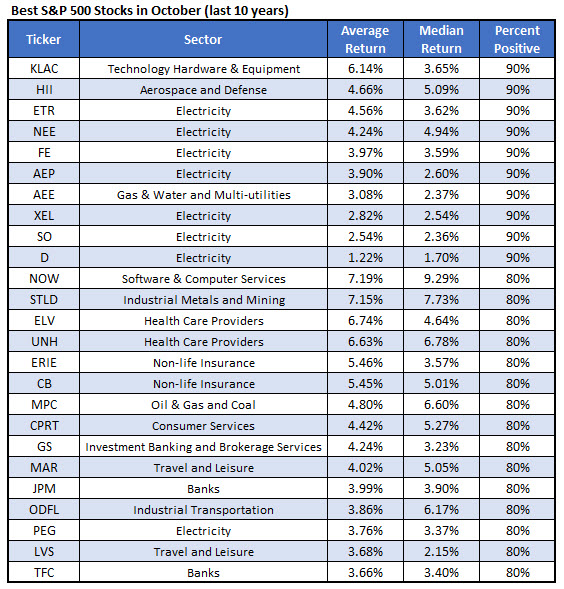

25 Finest Shares for Your October Portfolio

After an , merchants are keen to guard their income, or even perhaps lengthen them into the brand new month. Bearing this in thoughts, we compiled an inventory of the 25 greatest shares to personal throughout October, and Marriott Worldwide Inc (NASDAQ:MAR) is amongst them.

Per Schaeffer’s Senior Quantitative Analyst Rocky White, MAR completed the month of October larger eight occasions up to now 10 years, averaging a acquire of 4%. The fairness can be the very best of two journey and leisure names on this listing, outpacing (LVS).

was final seen down 1.4% to commerce at $50.41. Whereas acquainted strain on the $255 stage is coming into play, the safety isn’t too far off from its April 11, file excessive of $260.57, and sports activities a 26.4% year-over-year lead. Plus, the 20-day shifting common appears able to include any extra pullbacks.

Choices merchants are leaning bearish, and an unwinding of this pessimism might present tailwinds. Over on the Worldwide Securities Trade (ISE), Chicago Board Choices Trade (CBOE), and NASDAQ OMX PHLX (PHLX), MAR’s 50-day put/name quantity ratio of 1.49 sits within the elevated 82nd percentile of its annual vary, exhibiting a fierce urge for food for places recently.

The safety might additionally profit from a shift in analyst sentiment, as 17 of 23 analysts in questions nonetheless sport a tepid “maintain.” Plus, choices are affordably priced in the meanwhile, per the inventory’s Schaeffer’s Volatility Index (SVI) ranking of 20%, which ranks within the low eighth annual percentile.

Markets

Tesla, Musk beat shareholder lawsuit over self-driving guarantees

By Jonathan Stempel

(Reuters) – Tesla (NASDAQ:) and its CEO Elon Musk on Monday gained the dismissal of a lawsuit accusing them of defrauding shareholders by overstating the effectiveness and security of the automaker’s self-driving know-how so as to increase its inventory value.

U.S. District Decide Araceli Martinez-Olguin in San Francisco mentioned shareholders failed to indicate Tesla and Musk must be accountable for falsely promising they have been near delivering know-how that might drive safer than people, however that was really “plagued with questions of safety” and inspired inattentiveness.

Tesla automobiles have included “Autopilot” software program designed to boost self-driving capabilities, and the corporate has bought “Full Self Driving” software program upgrades.

Martinez-Olguin mentioned a few of Tesla’s and Musk’s challenged statements weren’t essentially false, whereas others might be excused as a result of they addressed future expectations for the know-how.

She mentioned Musk’s “hands-on” administration didn’t imply he knew greater than he let on, whereas his almost $34 billion revenue from promoting Tesla shares within the February 2019 to February 2023 class interval didn’t present he was cashing out at different shareholders’ expense.

Shareholders mentioned Musk, the world’s richest individual, obtained about $39.4 billion of proceeds from these inventory gross sales, roughly the identical as Vermont’s gross home product.

Attorneys for the shareholders didn’t instantly reply to requests for remark. Tesla didn’t instantly reply to comparable requests. The decide dismissed the lawsuit with out prejudice, which means that shareholders can amend it.

Tesla nonetheless faces probes by the U.S. Division of Justice and U.S. Securities and Alternate Fee, in addition to a case by the California Division of Motor Automobiles, into its self-driving claims.

The case is Lamontagne v Tesla Inc et al, U.S. District Courtroom, Northern District of California, No. 23-00869.

Markets

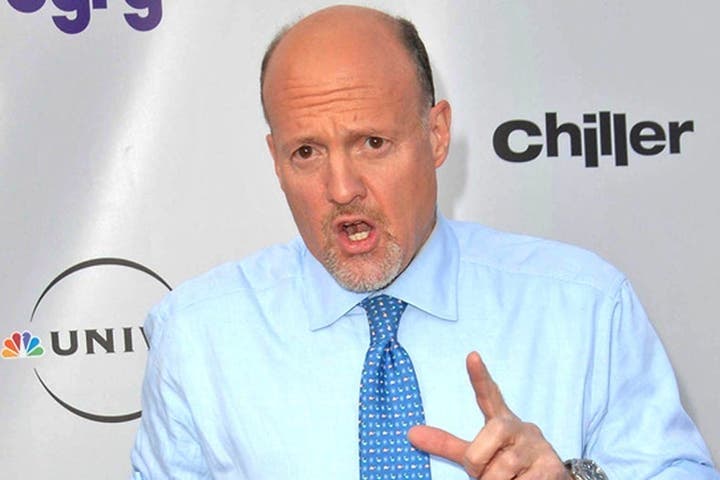

Jim Cramer Hand Picks These 3 Shares To Experience The Crest Of The Chinese language Stimulus Frenzy

Benzinga and Lusso’s Information LLC might earn fee or income on some gadgets by the hyperlinks beneath.

China has gone all out to stimulate the home financial system and a slew of measures the federal government and the central financial institution proposed has kickstarted a CNBC Mad Cash host Jim Cramer weighed in on the event and beneficial a couple of shares that could possibly be potential beneficiaries.

What Occurred: “The Chinese language are, as soon as once more, stimulating and everybody’s again,” mentioned Cramer in a submit on X, previously Twitter. He additionally beneficial Apple, Inc. (NASDAQ:), Starbucks Corp. (NASDAQ:) and Alibaba Group Holding Restricted (NYSE:) for these in search of stimulus performs.

Verify It Out:

In a separate submit, Cramer mentioned he would love for China to arrange a inventory stabilization fund and use it to cushion any draw back in shares.

On Monday, the Chinese language Shanghai Composite Index settled 8.06% increased 3,336.50 after Caixin manufacturing and providers sector buying managers’ indices disillusioned to the draw back. The index has gained almost 22% since Sept. 20 and is up about a little bit over 12% for the 12 months.

The Folks’s Financial institution of China introduced final week it can within the close to future minimize the reserve requirement ratio, which is the amount of money banks should maintain as reserves, by 50 foundation factors releasing up about 1 trillion yuan ($142 billion) for brand new lending, Reuters reported.

The central financial institution hinted at the potential for decreasing it by an incremental 0.25-0.50% factors. The PBoC additionally mentioned it will decrease the seven-day repo fee by 0.2 factors, the rate of interest on a medium-term lending facility by about 30 foundation factors and mortgage prime charges by 20-25 foundation factors.

Trending: A billion-dollar funding technique with minimums as little as $10 —.

It is a paid commercial. Rigorously take into account the funding aims, dangers, expenses and bills of the Fundrise Flagship Fund earlier than investing. This and different data might be discovered within the. Learn them rigorously earlier than investing.

Why It’s Vital: For Apple, China is a key market each from the attitude of provide and demand. Cupertino counts China as its main manufacturing base regardless of its efforts to diversify its manufacturing base. China can also be a key marketplace for the corporate’s shopper electronics merchandise, particularly its iPhone, and its providers enterprise. Of late, that’s flooding the market with cheaper smartphones. Huawei has re-emerged as a key rival for Apple within the Chinese language smartphone market.

Espresso chain retailer Starbucks has a robust presence in China. The weakening of financial fundamentals in China has impacted the corporate’s gross sales in latest quarters. Within the June quarter, Starbucks’ same-store gross sales in China fell 14% in comparison with a extra modest 2% drop within the U.S.

Alibaba’s fortunes are carefully tied to the Chinese language financial system because it generates the majority of its e-commerce gross sales from China.

Aside from Cramer’s advice, a Chinese language financial revival might also bode effectively for commodity and vitality shares and people multinational companies have a giant presence within the nation akin to Tesla, Inc. (NASDAQ:).

The iShares MSCI China ETF (NYSE:) rallied 3.35% to $52.70 in premarket buying and selling on Monday, based on

Questioning in case your investments can get you to a $5,000,000 nest egg? Communicate to a monetary advisor at the moment. matches you up with as much as three vetted monetary advisors who serve your space, and you’ll interview your advisor matches without charge to resolve which one is best for you.

Hold Studying:

This text initially appeared on

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets2 months ago

Markets2 months ago2 Development Shares That May Skyrocket within the Again Half of 2024 and Past