Markets

Are You Wealthy Sufficient To Be a part of The Prime 2%? Right here's Precisely How A lot You Want To Rank Amongst The Wealthiest

In a society the place discussing usually stays taboo, understanding the place you stand on the wealth spectrum might be intriguing. Whereas most shrink back from overtly discussing property, getting a way of how internet value stacks up towards nationwide averages offers curiosity satisfaction and a important evaluation of financial standing and future monetary planning.

Do not Miss:

In response to Kiplinger, by 2025, coming into the highest 2% of America’s wealth would require a internet value of roughly $2.7 million, marking the edge for elite financial standing. Final yr, the Schwab Trendy Wealth Survey revealed People imagine it takes $2.2 million to really feel rich.

Web value is a complete measure of your monetary well being. It’s calculated by including up the entire worth of your property and subtracting any liabilities or money owed. Belongings can embody money, financial savings accounts, retirement accounts, investments, actual property, and private property. Liabilities embody mortgages, automotive loans, scholar loans, and bank card debt.

The distribution of wealth throughout America varies considerably. The wealthiest 1% boast a internet value of $11.6 million, diminishing progressively to $1.17 million for the highest 5%, and $970,900 for the highest 10%. For the broader populace, the median internet value of all households is notably decrease at $192,900, with a imply internet value of $1,063,700, indicating substantial wealth focus on the higher echelons.

Rich people are likely to diversify their investments to keep up and develop their wealth. In response to latest information, the ultrawealthy make investments considerably in , constituting about 32% of their complete wealth. Equities account for roughly 18%, adopted by industrial property at 14%, and bonds at 12%. Personal fairness and enterprise capital comprise about 6% of their portfolios, reflecting their curiosity in high-growth alternatives. Luxurious investments, resembling artwork, traditional automobiles, and watches, additionally maintain worth, with artwork alone seeing a 29% enhance final yr.

Trending: Elon Musk and Jeff Bezos are bullish on one metropolis that would dethrone New York and grow to be the brand new monetary capital of the US.

Youthful People are significantly . Conventional property like shares and bonds not dominate their portfolios however are more and more pushed towards various investments. This transfer is partially impressed by pursuing larger returns and a diversified monetary technique in response to evolving financial landscapes. Roughly 72% of rich youthful people embrace various investments, contrasting with solely 28% of their older counterparts who persist with conventional property.

The generational shift extends into philanthropy, the place the youthful rich show a major inclination towards supporting causes like environmental sustainability and social justice, reflecting their broader values of their monetary methods. About 91% of the youthful demographic actively have interaction in philanthropy, focusing their efforts extra on direct impacts somewhat than conventional charity routes, suggesting a dynamic method to wealth utilization that prioritizes social affect.

Understanding your internet value and the way it compares to those benchmarks can assist you set sensible monetary objectives and make strategic selections to enhance your financial standing. Think about using instruments and to higher navigate your monetary journey and guarantee your wealth is managed successfully.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & all the things else” buying and selling instrument: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Dodge-parent Stellantis tumbles on warning, dragging auto shares decrease

Stellantis inventory () tumbled 13% early Monday after the corporate about its North American operations, dragging different auto shares decrease in sympathy.

Stellantis — which counts Dodge, Ram, and Jeep automobiles in its product portfolio — stated it must “enlarge remediation actions” it was planning to take resulting from efficiency points in North America and “deterioration” within the international market, specifically, China.

“Actions embrace North American cargo declines of greater than 200,000 automobiles within the second half of 2024 (up from 100,000 prior steering), in comparison with the prior yr interval, elevated incentives on 2024 and older mannequin yr automobiles, and productiveness enchancment initiatives that embody each value and capability changes,” Stellantis stated in an announcement.

Because of these strategic adjustments, Stellantis now sees adjusted working earnings margin of between 5.5% and seven% for the fiscal yr 2024, down from prior “double digits,” with two-thirds of this hit coming from actions taken in North America. Industrial free money circulation is now anticipated to return in at a lack of 5 billion euros to 10 billion euros ($5.58 billion-$11.17 billion), a drop from the “constructive” it had seen prior.

Shares of Normal Motors (), Ford (), and Toyota () all slipped on Monday as properly.

Deterioration in Stellantis’ North American enterprise was no secret, with , , and sellers .

In the meantime, the United Auto Staff (UAW) is contemplating labor strikes, because it believes Stellantis violated its agreements to restart operations with numerous tasks at Stellantis’ shuttered Belvidere, In poor health., meeting plant.

Stellantis isn’t the one automaker dealing with structural and macroeconomic points. German automaking big Volkswagen () is planning to put off employees in Germany resulting from overcapacity and downbeat gross sales, with in retaliation.

In the meantime, Japan’s Nissan resulting from rising inventories, with international gross sales . Nissan’s product combine within the US, the place it lacks hybrids, can also be hurting its gross sales efficiency.

Final week Morgan Stanley’s autos and mobility workforce, led by analyst Adam Jonas, downgraded your complete US auto sector, citing rising inventories and issues from China as the principle catalysts.

“At a excessive degree, our downgrade is pushed by a mixture of worldwide, home and strategic elements that we consider will not be totally appreciated by buyers,” the Morgan Stanley workforce wrote within the word. “US inventories are on an upward slope with car affordability … nonetheless out of attain for a lot of households. Credit score losses and delinquencies proceed to development upward for less-than-prime customers. And China’s 2-decade-long progress engine has not stalled.”

Apparently, Morgan Stanley maintains its Chubby ranking on Tesla (), citing Tesla’s AI and self-driving prowess. Tesla’s extremely anticipated robotaxi occasion is slated for subsequent week, on Oct. 10.

Pras Subramanian is a reporter for Lusso’s Information. You may comply with him on and on.

Markets

Ebay wins dismissal of US lawsuit over alleged sale of dangerous merchandise

NEW YORK (Reuters) -A federal decide on Monday dismissed a U.S. authorities lawsuit accusing eBay (NASDAQ:) of violating the Clear Air Act and different environmental legal guidelines by permitting the sale of a number of dangerous merchandise, together with gadgets that defeat car air pollution controls, on its platform.

The choice was issued by U.S. District Choose Orelia Service provider in Brooklyn.

The U.S. Division of Justice accused EBay of illegally permitting the sale of at the least 343,011 aftermarket “defeat” gadgets that assist automobiles generate extra energy and get higher gasoline financial system by evading emissions controls.

It was additionally accused of permitting gross sales of 23,000 unregistered, misbranded or restricted-use pesticides, and distributing 5,614 paint and coating elimination merchandise containing methylene chloride, a chemical linked to mind and liver most cancers and non-Hodgkin lymphoma.

The Justice Division didn’t instantly reply to a request for remark. Ebay and its legal professionals didn’t instantly reply to related requests.

Markets

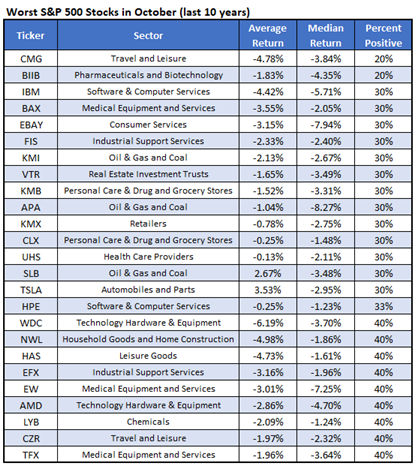

25 Worst Shares to Personal in October, Together with CMG

September turned out to be a powerful month for the market this 12 months, regardless of its status as a traditionally weak interval for shares. October may carry its personal challenges, nonetheless, as it has been deemed risky by a number of information sources, together with Lusso’s Information.

With this backdrop in thoughts, we compiled a listing of the worst shares to personal throughout this upcoming month, and Chipotle Mexican Grill Inc (NYSE:CMG) stands out amongst them. In keeping with Schaeffer’s Senior Quantitative Analyst Rocky White, CMG completed the month of October decrease eight instances over the previous 10 years, averaging a lack of 4.8%.

Eventually look right now, CMG was down 0.4% at $57.56. The inventory has been struggling to interrupt out above the $58.50 area, and holds on to a 26% year-to-date lead.

Choices merchants have been betting on a transfer larger, and an unwinding of this optimism may present headwinds. On the Worldwide Securities Trade (ISE), Chicago Board Choices Trade (CBOE), and NASDAQ OMX PHLX (PHLX), CMG’s 10-day name/put quantity ratio of three.56 ranks within the elevated 94th percentile of its annual vary, exhibiting a heavy penchant for calls recently.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes