Markets

A As soon as-in-a-Decade Alternative: 2 Magnificent S&P 500 Dividend Shares Down 47% and 59% to Purchase within the Second Half of 2024

Because the flip of the century, Nike (NYSE: NKE) and Pool Company (NASDAQ: POOL) have delivered market-trouncing whole returns of 1,560% and seven,790%, respectively. Nonetheless, these historically sturdy companies have seen their share costs decline 47% and 59% over the previous couple of years. Dealing with an array of shorter-term macroeconomic points, resembling softer client spending, , and , these shares have seen the market dismiss their longer-term potential.

Though each corporations face very actual challenges, these look to be momentary — and the shares are actually out there at once-in-a-decade valuations. Right here is why this short-term volatility may show to be a powerful alternative for affected person traders who suppose in many years, not quarters.

1. Nike

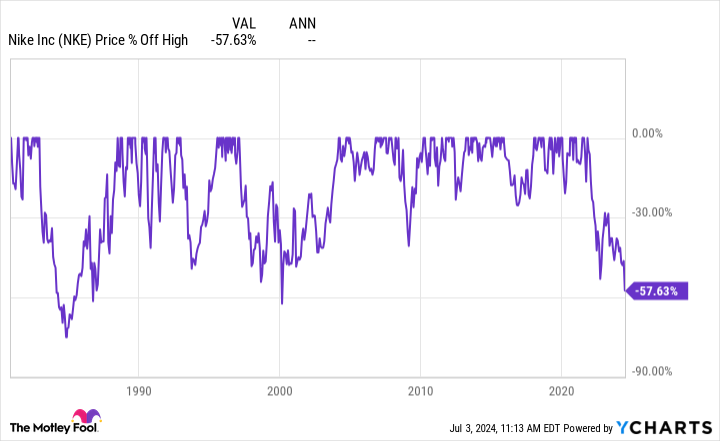

There is not any working from it — proudly owning shares of Nike has been a tough experience over the previous couple of years. With its share value down 59% from its all-time highs, Nike is presently experiencing the third-largest drawdown in its historical past.

Solely rising gross sales by 1% in 2024 and guiding for a mid-single-digit income decline for 2025, the corporate was unable to assuage the market’s fears, resulting in a brand new 15% drop in a single day in June.

So what precisely makes Nike a once-in-a-decade alternative right now and all through the second half of 2024? First, from a monetary standpoint, the corporate’s stock and days stock excellent proceed to inch decrease towards historic norms.

Whereas this alone doesn’t suggest a turnaround is straight away forthcoming, regular stock ranges assist unencumber Nike to get again to its revolutionary roots and create the subsequent era of in style attire for its devoted prospects.

My second level focuses on these devoted prospects. Regardless of the short-term challenges confronted by Nike, it stays far and away essentially the most highly effective model within the attire business. Ranked twenty first on Kantar BrandZ’s record of The High 100 Most Helpful World Manufacturers, Nike continues to carry immense mindshare amongst shoppers. Corporations included on Kantar’s record have outperformed the S&P 500 since 2003, delivering whole returns of 321% versus the index’s 231%.

Moreover, a latest examine by Piper Sandler of high manufacturers in response to Gen Z buyers reveals that Nike dominates each the clothes and footwear classes, with 34% and 59% of shoppers naming Nike the highest model in every area of interest. In each classes, the second- by fifth-highest manufacturers mixed to account for lower than half of Nike’s share.

So, whereas Nike’s ongoing turnaround might have time to develop, this younger group of buyers highlights that the corporate’s future stays extremely shiny. Buying and selling with a price-to-earnings (P/E) ratio of 20 that’s at 10-year lows and a 1.9% dividend that’s its highest because the Nice Recession, Nike could possibly be a contrarian decide for long-term traders proper now.

That mentioned, issues may proceed to worsen earlier than they get higher for Nike, so dollar-cost averaging (DCA) purchases make extra sense than going all-in at right now’s value.

2. Poolcorp

Pool Company — higher referred to as Poolcorp — is the most important U.S. distributor of pool provides. Its shares have declined 47% since 2022 as shoppers proceed to rein in spending. With the Expectations Index — a part of the Client Confidence Index — recording its fifth-straight quarter of a rating beneath 80, this slowdown in client spending can clearly be seen.

Usually, a rating beneath 100 reveals that customers are pessimistic in regards to the future economic system, inflicting them to be extra cautious with their spending, particularly on big-ticket objects like new or refurbished swimming pools. Hindered by this pessimism, paired with homebuyers battling persistent inflation and better rates of interest, Poolcorp felt the affect.

Within the firm’s most up-to-date quarter, gross sales and earnings per share (EPS) declined by 7% and 21%, respectively, as new house and pool builds remained depressed. Nonetheless, in comparison with the severity of an Expertise Index of solely 73 — a rating usually reserved for recessionary instances — these outcomes are removed from disastrous.

Producing 86% of its gross sales from non-discretionary, recurring objects like upkeep (resembling pool chemical compounds), Poolcorp demonstrates resilience in difficult instances, as evidenced by the corporate’s steady profitability all through the 2008 recession. Additional highlighting this resilience, Pool has an extended monitor file of steadily decreasing its share depend whereas rising its dividend for 13 straight years regardless of being tied to the cyclical housing business.

As the corporate continues to increase into higher-margin alternatives, resembling its franchised Pinch-a-Penny retail shops and private-label pool chemical compounds, these money returns to shareholders ought to proceed rising. Finest but for traders, Pool could also be buying and selling at a once-in-a-decade valuation.

Whether or not utilizing the corporate’s earnings yield or free-cash-flow (FCF) yield (that are the inverse of the price-to-earnings ratio and price-to-FCF ratios, so larger is “cheaper”), Poolcorp trades at a deep low cost to its 10-year averages.

The cherry on high for traders? Poolcorp’s 1.5% dividend yield is the best it has been since 2014, and it nonetheless solely accounts for roughly one-third of the corporate’s whole web revenue.

Nonetheless, very like Nike, potential Poolcorp traders might need to use DCA purchases on the corporate because it waits for a broader turnaround in client and homebuying confidence.

Must you make investments $1,000 in Nike proper now?

Before you purchase inventory in Nike, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Nike wasn’t considered one of them. The ten shares that made the lower may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $826,672!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 8, 2024

has positions in Nike and Pool. The Motley Idiot has positions in and recommends Nike. The Motley Idiot recommends the next choices: lengthy January 2025 $47.50 calls on Nike. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Why Nio Inventory Surged Once more Monday and May Hold Rising

Nio (NYSE: NIO) shares are down virtually 30% to date this yr. However anybody who purchased inventory within the Chinese language electrical car (EV) maker extra lately has performed fairly effectively. Nio shares have soared by greater than 65% over the previous month.

The inventory continued to surge once more at the moment because the buying and selling week began. Nio’s U.S.-listed American depositary shares had gained 12.7% as of 10:15 a.m. ET. A number of the current spike got here from China’s newest plan to stimulate its struggling financial system. However information that Nio has secured a brand new capital injection from strategic buyers in China has the shares shifting at the moment.

Robust orders for Nio’s new mass-market model

The corporate introduced that three strategic investor companions will , the corporate’s important working unit. Nio may also contribute money for newly issued shares of Nio China that may carry the overall money injection to almost $2 billion.

Nio will subsequently maintain a greater than 88% curiosity in Nio China whereas the opposite present buyers may have practically 12% possession. Whereas Nio completed the second quarter with about , it’s anticipated to burn about $1 billion per yr on common over the subsequent two years as it really works to extend manufacturing quantity and gross sales.

One massive step the corporate lately took was to launch a brand new, household oriented, mass-market model. The Onvo model’s first mannequin started deliveries final week. The corporate stated its mid-size household L60 SUV has acquired “an order consumption far stronger than anticipated.”

Nio could present extra data on the Onvo model when it experiences its September car supply outcomes tomorrow morning. Nio has delivered greater than 20,000 EVs for 4 straight months, and buyers possible count on that streak to be prolonged.

Do you have to make investments $1,000 in Nio proper now?

Before you purchase inventory in Nio, think about this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the for buyers to purchase now… and Nio wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in case you invested $1,000 on the time of our advice, you’d have $743,952!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 30, 2024

has positions in Nio. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

What might Hurricane Helene imply for BAX?

Lusso’s Information — Baxter Worldwide (NYSE:) has offered updates following the impression of Hurricane Helene on its North Cove, North Carolina facility.

The corporate’s largest manufacturing web site, liable for intravenous (IV) options and peritoneal dialysis (PD) options, has been affected by flooding, main to an entire manufacturing halt.

In accordance with a press launch, the corporate is working with varied federal and native businesses to evaluate harm and restore operations as rapidly as doable.

In a word Monday, BofA analysts estimated that the North Cove facility accounts for 60% of the U.S. IV options market, which might translate to a $2.5 million per day income impression for Baxter’s Infusion Therapies and Applied sciences enterprise.

They mission a possible $100-150 million income loss, relying on how lengthy the shutdown lasts. Nonetheless, they word that Baxter has stock in place and is exploring methods to leverage its international manufacturing community to mitigate provide disruptions.

Morgan Stanley analysts evaluate the scenario to the 2017 hurricane in Puerto Rico, which precipitated harm to a different Baxter facility. They counsel the North Cove facility’s measurement might result in a $140-190 million gross sales impression for This fall 2024, although the scenario stays fluid and precise damages are laborious to estimate.

Whereas the monetary hit is probably going short-lived, the occasion might shave roughly 3.5% off BAX’s natural gross sales progress for This fall, in response to BofA.

Wells Fargo notes that whereas manufacturing is halted, Baxter has carried out a cargo maintain for 48 hours and is engaged on allocating stock to attenuate affected person care disruptions.

They emphasize that whereas the ability harm is important, it’s unlikely to have an enduring impression on Baxter’s mid-term monetary outlook.

Markets

Inventory market at the moment: US shares begin jobs report week combined with Powell set to talk

US shares wavered on Monday however had been nonetheless set for robust month-to-month and quarterly positive aspects as buyers waited to listen to Federal Reserve Chair Jerome Powell converse within the run-up to the essential month-to-month jobs report.

The S&P 500 () was down 0.1%, whereas the Nasdaq Composite () bounced off its lows of the day to additionally fall about 0.1%. In the meantime, the Dow Jones Industrial Common () slipped about 0.4%.

The Wall Avenue indexes had been nonetheless eyeing a month-to-month achieve heading into the final buying and selling day of September, usually the cruelest month for shares. The Federal Reserve’s jumbo rate of interest lower and within the US economic system have lifted confidence, serving to shares publish three weekly wins in a row.

Buyers are actually bracing for the September jobs report, due out on Friday, which is seen as . The urgent query is simply how shortly the labor market is slowing because the market weighs whether or not the Fed has acted aggressively to guard a wholesome economic system or to assist a flailing one. Fed Chair Powell’s feedback on the outlook for the economic system on Monday afternoon may assist settle that debate.

Learn extra:

A rising pile of revenue warnings from automakers clouded the temper early Monday. Stellantis (, ) shares tumbled 13% after the Chrysler mum or dad , citing provide chain disruption and weak point in China. Common Motors () and Ford () had been each down round 4% in tandem. Aston Martin (, ) shares plunged over 20% after the luxurious automaker too.

Abroad, China’s benchmark inventory index () , getting into a bull market, as consumers rushed in forward of a weeklong vacation. However in Japan, the Nikkei 225 () as a shock vote wrong-footed buyers betting on an easing-friendly prime minister.

Stay5 updates

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook

-

Markets3 months ago

Markets3 months agoInventory market at present: US shares maintain close to data as Powell buoys rate-cut hopes