Markets

A fintech collapse is rippling by way of a small nook of the banking world

The unraveling of fintech upstart Synapse is rippling by way of a small nook of the banking world, leaving hundreds of consumers with out entry to their cash and a thriller about hundreds of thousands of {dollars} that went lacking.

4 small US banks have a number of the cash. Nobody is certain the place the remainder went.

The saga surrounding the chapter of Synapse, a 10-year-old fintech agency, places a brand new highlight on how unfastened webs of partnerships between venture-backed upstarts and FDIC-backed lenders can go so fallacious.

Regulators are extra carefully scrutinizing these relationships and warning numerous banks to tighten their controls when working with fintech companies.

Earlier this month, the Federal Reserve slapped one in every of Synapse’s associate banks with an enforcement motion that recognized threat administration weaknesses surrounding such partnerships.

Synapse was a part of a wave of latest fintech companies that emerged within the aftermath of the 2008 monetary disaster as Silicon Valley-style digital banking upstarts promised to shake up the world of conventional finance.

In only a decade it turned a serious intermediary between dozens of fintech firms and neighborhood banks by providing what it known as “banking as a service.”

It offered digital banking outfits like Mercury, Dave (), and Juno with entry to checking accounts and debit playing cards they may supply their clients. It was ready to do that by partnering with FDIC-backed banks that in return acquired a brand new supply of deposits and payment income.

The normal lenders that partnered with Synapse included Evolve Financial institution & Belief, American Financial institution, AMG Nationwide Belief, and Lineage Financial institution, all small banks compared with giants like JPMorgan Chase () or Financial institution of America ().

The biggest was Evolve, which had roughly $1.5 billion in property on the finish of the primary quarter.

The pitch that Synapse successfully gave to those smaller banks was “we’ll deliver within the deposits; you don’t must do a lot,” in response to Jason Mikula, an unbiased fintech guide who publishes a weekly publication and has adopted Synapse.

“This turned out to not be correct, in my view,” Mikula added.

The issues surfaced shortly after Synapse filed for chapter in April when it couldn’t attain an settlement with Evolve on a settlement of funds.

Three weeks into the chapter proceedings, Synapse lower off Evolve’s entry to its expertise system. That, in flip, compelled Evolve and the opposite associate banks to freeze buyer accounts.

Each events blamed one another because the wrongdoer.

“Synapse’s abrupt shutdown of important techniques with out discover and failure to supply needed data needlessly jeopardized finish customers by hindering our capacity to confirm transactions, affirm finish person balances, and adjust to relevant regulation,” Evolve stated in a press release.

Synapse CEO Sankaet Pathak rebuked this declare, accusing Evolve of getting the means to settle a deficit but delaying the return of buyer funds.

“The debtor has been compelled to play a perverse recreation of ‘whack-a-mole’ with unreasonable calls for from Evolve as situations to unfreezing the depositor accounts, all whereas the depositors undergo lack of entry to their funds,” Pathak acknowledged in courtroom paperwork final month.

The top result’s that hundreds of fintech clients misplaced entry to their cash.

“Synapse’s chapter has left tens of hundreds of end-users of monetary expertise platforms that have been clients of Synapse stranded with out entry to their funds,” Jelena McWilliams, the court-appointed trustee to Synapse and a former FDIC chair, wrote in a letter final week to the heads of 5 federal banking regulators.

There was one other downside: Nobody appeared to know the place all the cash was.

McWilliams in early June stated there was a shortfall of $85 million, with the 4 banks solely accounting for $180 million of the $265 million belonging to finish customers.

Extra lately she stated the vary of the shortfall was $65 million to $96 million.

Some cash has been paid again to clients. McWilliams stated on June 21 that greater than $100 million “has been distributed by sure of the associate banks.”

Financial institution regulators have been involved for a while in regards to the partnerships between Silicon Valley-style digital startups and FDIC-backed banks.

Performing Comptroller of the Foreign money Michael Hsu used a September 2023 speech to debate the potential blind spots for regulators as these relationships develop into extra blurry.

“Banks and tech companies, in an effort to supply a ‘seamless’ buyer expertise, are teaming up in ways in which make it tougher for patrons, regulators, and the business to tell apart between the place the financial institution stops and the place the tech agency begins,” Hsu stated within the speech.

Final June, regulators issued remaining joint on how lenders ought to deal with these relationships.

These partnerships aren’t but widespread throughout the complete banking business, though using this mannequin is accelerating whereas banks of all sizes search methods to draw deposits and earn extra income.

Fewer than 2% of US banks used the banking-as-a-service mannequin in 2023, in response to S&P International Market Intelligence.

However regulators are nonetheless getting extra aggressive about calling out such relationships. The banking-as-a-service mannequin accounted for 13.5% of public enforcement actions from regulators in 2023, in response to S&P.

In January, the FDIC issued a consent order to one in every of Synapse’s associate banks, Franklin, Tenn.-based Lineage, that recognized weaknesses associated to its banking-as-a-service program and ordered the financial institution to give you a plan for methods to obtain an “orderly termination” with vital fintech companions.

The subsequent month, New York Metropolis-based Piermont Financial institution; Attica, Ohio-based Sutton Financial institution; and Martinsville, Va.-based Blue Ridge Financial institution obtained consent orders from regulators associated to alleged deficiencies of their banking-as-a-service enterprise.

Then, earlier this month, the Fed issued an enforcement motion in opposition to Evolve, saying that examinations performed in 2023 “discovered that Evolve engaged in unsafe and unsound banking practices by failing to have in place an efficient threat administration framework” for its partnerships with fintech firms.

Regulators requested Evolve to enhance its insurance policies and threat administration practices “by implementing acceptable oversight and monitoring of these relationships.” Additionally they famous that the motion was “unbiased of the chapter proceedings relating to Synapse.”

A spokesperson for Evolve stated the latest order was “just like orders obtained by others within the business” and “doesn’t have an effect on our current enterprise, clients, or deposits.”

The financial institution counts Affirm (), Mastercard (), and Stripe as notable fintech partnerships on its web site.

It has additionally previously partnered with two crypto companies that went bankrupt, FTX and BlockFi, in addition to Bytechip, a monetary providers agency had its accounts with Evolve frozen late final yr on the it violated federal regulation by laundering cash for fraudsters.

So as to add to its latest challenges, Evolve stated this previous Wednesday that some buyer knowledge was illegally unfold on the darkish net on account of “a cybersecurity incident involving a recognized cybercriminal group.”

“Evolve has engaged the suitable regulation enforcement authorities to assist in our investigation and response efforts,” the financial institution stated. “This incident has been contained, and there’s no ongoing risk.”

David Hollerith is a senior reporter for Lusso’s Information masking banking, crypto, and different areas in finance.

.

Markets

TSLA, RIVN, or LCID: Which U.S. EV Inventory Is the Prime Choose?

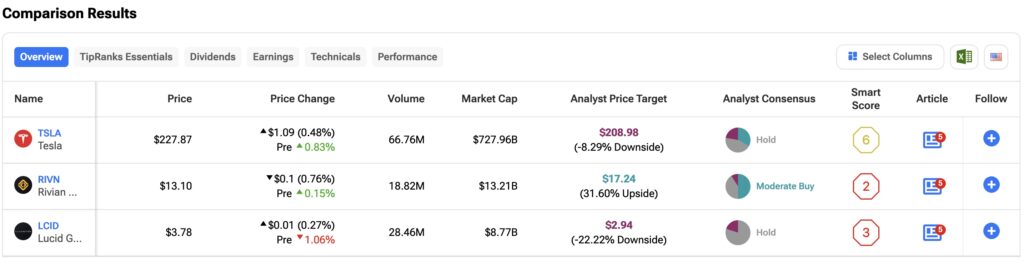

Within the extremely aggressive electrical car (EV) market, main gamers equivalent to Tesla , Rivian Automotive , and Lucid Group have encountered vital headwinds, with demand not assembly expectations. On this article, I’ll use the to clarify why I’m bullish on TSLA and RIVN, and bearish on LCID. I’ll additionally define why I take into account Tesla to be your best option among the many three automakers.

Regardless of a stretched valuation, I’m bullish on Tesla. The corporate’s shares at present commerce at a ahead P/E ratio of 97 instances future earnings estimates, which is about 15% under its five-year common. That is largely resulting from a considerable decline of over 40% within the share worth because it peaked in 2021, pushed by weaker-than-expected EV demand and elevated competitors. Nonetheless, Tesla stays the top-selling EV maker globally.

Tesla had aimed for 50% progress in car gross sales and manufacturing this 12 months however as an alternative has seen its income decline. In Q2, complete automotive income was $19.8 billion, down 7% from a 12 months in the past. Tesla’s quarterly manufacturing and supply figures in July confirmed 443,956 car deliveries, which was about 5% decrease than the earlier 12 months.

On the optimistic facet, Q2 noticed sturdy operational efficiency, with money from operations up 18% 12 months over 12 months to $3.61 billion, and free money circulation of $1.34 billion. This marks a rebound from Q1 of this 12 months when money from operations fell 90% to $242 million, and free money circulation declined to unfavourable $2.5 billion.

Is TSLA A Purchase, Maintain or Promote?

My bullish stance on Tesla isn’t primarily based on current outcomes however reasonably on its formidable progress forecasts. Tesla’s future is more and more tied to synthetic intelligence (AI), Robotaxis, and robotics. The corporate is ready to unveil its extremely anticipated Robotaxi on October 10, which might function a serious catalyst for the inventory.

Whereas some traders might not view Tesla as a serious AI participant, its massive put in base and vital involvement in AI are noteworthy. Dan Ives, a tech analyst at Wedbush Securities, argues that Tesla is probably the most undervalued AI firm. He believes Tesla might grow to be a trillion-dollar concern because it stabilizes demand and improves its pricing mannequin.

At present, Wall Avenue’s consensus on TSLA inventory is that it’s a Maintain. That is primarily based on 12 Purchase, 16 Maintain and eight Promote suggestions made within the final three months. of $208.98 implies potential draw back danger of 8.10%.

Rivian Automotive

Like Tesla, I’m additionally bullish on Rivian Automotive. That is primarily due to the corporate’s potential undervaluation vis-à-vis its formidable manufacturing targets. After dropping almost 90% of its worth since its 2021 preliminary public providing (IPO), Rivian now trades at a pretty worth primarily based on its money place.

With a market capitalization of $13.04 billion and $7.9 billion in money and short-term investments, greater than half of Rivian’s market worth is tied to its stability sheet. Nonetheless, primarily based on its electrical car gross sales, Rivian trades at a P/S ratio of two.5 instances, which, whereas decrease than Tesla, stays nearly 3 instances above the common for the automotive business.

That mentioned, the primary problem dealing with Rivian is reaching profitability and rising the manufacturing of its electrical car fashions. The corporate goals to provide as much as 215,000 autos yearly by 2026, up from 57,232 autos produced in 2023.

Is RIVN Inventory a Purchase?

Whereas I’m bullish on Rivian, it’s necessary to level out the dangers with this inventory. Rivian’s unprofitability is a priority. In Q2 of this 12 months, the corporate posted a internet lack of $1.45 billion, up from a $300 million loss a 12 months earlier. The corporate’s year-to-date loss now totals $2.9 billion. Nonetheless, as Wedbush analyst Dan Ives notes, Rivian’s main concern is its quarterly money burn of $800 million to $1 billion. This stays a priority as the corporate requires capital to scale manufacturing and meet demand. Extra not too long ago, a has eased dilution fears.

Wall Avenue is usually optimistic on RIVN, with 22 analysts score the inventory a Reasonable Purchase. That is primarily based on 11 Purchase, 9 Maintain and two Promote suggestions made up to now three months. The suggests 31.10% upside potential.

Relating to luxurious electrical car producer Lucid, I maintain a bearish place. That is due to the intense decline seen within the firm’s funds and market worth. The corporate’s market capitalization has declined to $8.34 billion from greater than $90 billion in 2021 when it went held its IPO. Regardless of the corporate’s decline, the valuation multiples nonetheless stay tough to justify.

Lucid trades at a 13 instances P/S ratio, almost double Tesla’s a number of and greater than six instances larger than Rivian’s. Moreover, the corporate reported a Q2 2024 internet lack of $643.3 million, translating to roughly $268,000 in losses per car bought, primarily based on the supply of two,394 autos through the quarter.

The state of affairs at Lucid could be extra dire if it weren’t for funding from Saudi Arabia’s Public Funding Fund (PIF). Due to that funding, Lucid holds $3.21 billion in money and short-term investments. This 12 months, the corporate raised a further $1 billion for the manufacturing of its new SUV referred to as “the Gravity.” Scheduled to launch in December this 12 months, the Gravity is predicted to be priced beneath $80,000, and will function a catalyst for LCID inventory.

Is LCID Inventory A Purchase, Maintain, or Promote?

My bearish view of Lucid is essentially resulting from its give attention to the slender and area of interest luxurious car market. Shoppers are clamoring for extra inexpensive EVs within the U.S. and elsewhere. Morgan Stanley analyst Adam Jonas my bearish outlook, noting Lucid’s issue in maintaining manufacturing prices under the promoting worth of its autos. This concern is additional exacerbated by the excessive value of its luxurious mannequin, the Lucid Air, which has a beginning worth of $69,900.

A complete of 10 Wall Avenue analysts have a consensus Maintain score on LCID inventory. That is primarily based on eight Maintain and two Promote suggestions made within the final three months. There aren’t any Purchase scores on the inventory. The implies draw back danger of 20.97% from the place the shares at present commerce.

Conclusion

I view Tesla as a high choose amongst this trio of main electrical car producers. The corporate has loads of progress potential with its Robotaxis, AI and robotics. Rivian Automotive can be a Purchase resulting from its upside potential and cheap valuation. I’m bearish on Lucid as a result of its valuation is simply too excessive and profitability stays a problem on the firm.

Markets

Japan shares larger at shut of commerce; Nikkei 225 up 1.67%

Lusso’s Information – Japan shares had been larger after the shut on Friday, as beneficial properties within the , and sectors led shares larger.

On the shut in Tokyo, the added 1.67%.

The perfect performers of the session on the had been Resonac Holdings Corp (TYO:), which rose 9.41% or 309.00 factors to commerce at 3,594.00 on the shut. In the meantime, Tokai Carbon Co., Ltd. (TYO:) added 7.02% or 61.10 factors to finish at 930.90 and Kawasaki Heavy Industries, Ltd. (TYO:) was up 6.26% or 319.00 factors to five,411.00 in late commerce.

The worst performers of the session had been Keisei Electrical Railway Co., Ltd. (TYO:), which fell 2.73% or 124.00 factors to commerce at 4,415.00 on the shut. NTT Knowledge Corp. (TYO:) declined 2.48% or 61.50 factors to finish at 2,418.50 and Kansai Electrical Energy Co Inc (TYO:) was down 2.37% or 57.00 factors to 2,349.00.

Rising shares outnumbered declining ones on the Tokyo Inventory Trade by 2389 to 1206 and 272 ended unchanged.

The , which measures the implied volatility of Nikkei 225 choices, was down 2.41% to 27.14.

Crude oil for November supply was down 0.10% or 0.07 to $71.09 a barrel. Elsewhere in commodities buying and selling, Brent oil for supply in November fell 0.13% or 0.10 to hit $74.78 a barrel, whereas the December Gold Futures contract rose 0.39% or 10.10 to commerce at $2,624.70 a troy ounce.

USD/JPY was down 0.50% to 141.91, whereas EUR/JPY fell 0.36% to 158.62.

The US Greenback Index Futures was down 0.17% at 100.15.

Markets

Trump Media inventory drops as lockup expiration set to provide the previous president clearance to promote shares

-

Trump Media inventory plummeted to its lowest ranges since its IPO on Thursday.

-

Shares dropped as a lot as 4% as a lockup interval was set to run out.

-

Following the lockup, Trump can dump his shares, although he is mentioned he would not promote.

Trump Media & Know-how Group shares dropped to their lowest degree because the firm went public earlier this 12 months as a .

The Reality Social mother or father firm’s shares slid as a lot as 4% on Thursday, dropping as little as $14.77 earlier than paring some losses.

The corporate went public in March, with shares spiking to all-time highs above $70 shortly after, earlier than steadily declining within the following months.

The newest decline has been fueled by investor concern over the lockup interval which prevents insiders from promoting, and which is ready to run out as quickly as Thursday afternoon, reported.

As soon as the lockup interval is over, the Republican presidential candidate has the all-clear to begin promoting his inventory. If he chooses to take action, it may very well be a significant headwind for traders, on condition that Trump owns a virtually 60% stake within the firm value $.

Trump mentioned final week he had no intention of promoting the inventory, which briefly calmed traders.

“No, I am not promoting. No, I find it irresistible,” the presidential candidate mentioned in a press convention final Friday, sparking a 25% rally in DJT shares.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now