Markets

Apple, Microsoft, or Nvidia: Which Will Be the World's Most Precious Firm a Yr From Now?

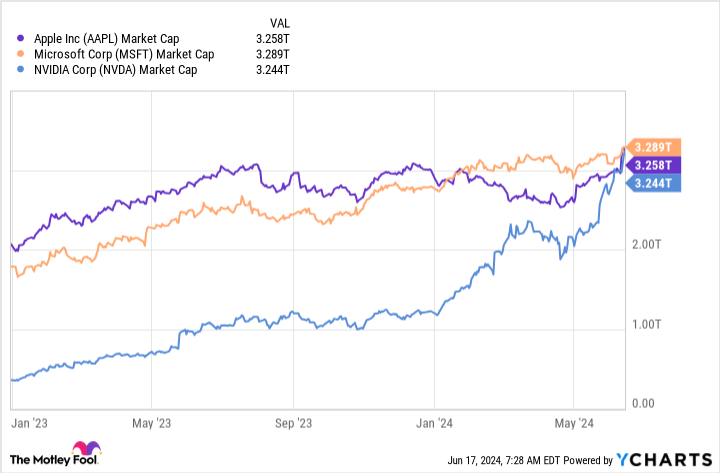

Though Microsoft (NASDAQ: MSFT) held the title for a number of months, Apple (NASDAQ: AAPL) briefly regained its crown because the world’s largest firm by market cap this month. However then this week, Nvidia (NASDAQ: NVDA) handed it for the primary time. As of Thursday, the Home windows maker was again in first place once more, however with all three firms holding market caps of round $3.2 trillion, within the close to time period, their rankings inside the prime three might shift usually.

However what is going to matter extra to buyers is the place shares are heading over the medium and lengthy phrases. So which ones is most certainly to carry the title a 12 months from now?

The case for Apple

Apple was considerably trailing Microsoft till its Worldwide Developer Convention a few weeks in the past. Though it introduced a number of issues through the occasion, the largest launch by far was Apple Intelligence — primarily, Apple’s tackle synthetic intelligence (AI). These options will not straight generate extra income for Apple, however the factor to notice is will solely be out there on its newest mannequin smartphones, the iPhone 15 Professional and 15 Professional Max — and naturally, on the generations that observe.

That is big. The present estimates are that greater than 90% of energetic iPhones are older fashions. So, if Apple Intelligence seems to be a recreation changer, it can drive an improve cycle stronger than any Apple has skilled since early within the pandemic.

If that new demand wave arrives, Apple’s gross sales and income will rocket. That is a compelling argument for the proposition that it’ll as soon as once more be the world’s largest firm a 12 months from now.

The case for Microsoft

Microsoft overtook Apple because the world’s largest firm attributable to its heavy involvement with generative AI. As soon as Microsoft realized the impression this know-how might have, it rapidly developed an integration with the market chief, OpenAI’s ChatGPT, for its Microsoft Workplace merchandise. To entry these options, companies or customers must pay an additional charge, which has boosted Microsoft’s income stream.

Along with Copilot, Microsoft’s cloud computing wing has been on hearth. Most firms do not have the in-house capability to run AI workloads, and would moderately not lay our a fortune to construct out that infrastructure. As a substitute, they hire computing energy from cloud computing suppliers like Microsoft Azure, which provides them entry to the {hardware} they want.

The wave of demand this has generated has been big for Microsoft and can seemingly proceed. Nevertheless, the impact it is having is already obvious to buyers, and it is unlikely to get any higher from this level on.

The case for Nvidia

Nvidia has been an absolute rocket ship because the begin of 2023. The large demand for AI has pushed a parallel surge in demand for probably the most highly effective graphics processing models (GPUs), which might present the high-speed computational energy that software program requires. This has brought on a surge in income and income for Nvidia — the main maker of these cutting-edge chips — taking it from an organization value lower than $500 million to one of many world’s largest in a 12 months and a half.

Nevertheless, there are some considerations about Nvidia’s means to take care of its valuation. Chipmaking is a cyclical enterprise, and a few buyers are apprehensive that demand for these GPUs will drop, and that the underside will fall out of the inventory.

That is, for my part, a misguided notion. Nvidia remains to be seeing demand for its GPUs develop. Moreover, it lately launched the H200 GPU, which supersedes the extremely common H100 with higher effectivity and efficiency. Moreover, the lifespan of a knowledge heart GPU is estimated to be between three and 5 years. As such, buyers ought to count on a refresh cycle will seemingly kick off comparatively quickly, driving continued demand for Nvidia’s GPUs.

This argument could also be a bit extra shaky than the opposite two, however there’s nonetheless a robust case to count on {that a} 12 months from now, Nvidia would be the world’s largest firm.

The decision

The reply to the query of which of those three would be the greatest depends upon how “must-have” customers deem the Apple Intelligence options to be. I would guess Apple will maintain the No. 1 spot a 12 months from now except Apple Intelligence is an absolute flop. Its income streams have remained regular regardless of sliding demand for its iPhones. This new catalyst might kick-start their gross sales and the inventory to new ranges.

If it is not Apple, I would say Microsoft is a extra seemingly chief than Nvidia. Nevertheless, Nvidia is the largest wildcard right here, because it might see the already unimaginable demand for its GPUs go increased, which might ignite one other run-up within the inventory.

Microsoft could be probably the most conservative decide, however it might nonetheless be a .

Must you make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Apple wasn’t one in all them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $775,568!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Apple, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Mortgage and refinance charges at this time, September 22, 2024: Charges drop 80 foundation factors in 2 months

Mortgage charges have fallen considerably during the last couple of months. Based on Zillow knowledge, is 5.70%, down 80 foundation factors since July 22. The is 5.04%, which is 71 foundation factors decrease than this time in July.

The Federal Reserve is about to chop the federal funds fee six extra occasions earlier than the top of 2025, which suggests mortgage charges will most likely proceed to lower. As a result of charges have already dropped a lot, — particularly since you will possible face extra competitors as charges fall decrease and decrease. However should you’re already a house owner and wish to refinance, it’s possible you’ll wish to maintain out for even higher charges.

Study extra:

Listed here are the present mortgage charges, in keeping with the newest Zillow knowledge:

-

30-year fastened: 5.70%

-

20-year fastened: 5.48%

-

15-year fastened: 5.04%

-

5/1 ARM: 5.94%

-

7/1 ARM: 5.91%

-

30-year VA: 5.17%

-

15-year VA: 4.86%

-

5/1 VA: 5.70%

Bear in mind, these are the nationwide averages and rounded to the closest hundredth.

These are , in keeping with the newest Zillow knowledge:

-

30-year fastened: 5.71%

-

20-year fastened: 5.37%

-

15-year fastened: 5.02%

-

5/1 ARM: 6.15%

-

7/1 ARM: 6.45%

-

5/1 FHA: 4.51%

-

30-year VA: 5.12%

-

15-year VA: 4.90%

-

5/1 VA: 5.59%

Once more, the numbers offered are nationwide averages rounded to the closest hundredth. Mortgage refinance charges are sometimes increased than charges while you purchase a home, though that is not all the time the case.

Learn extra:

Use the free to see how varied mortgage phrases and rates of interest will affect your month-to-month funds.

Our calculator additionally considers elements like property taxes and householders insurance coverage when figuring out your estimated month-to-month mortgage fee. This provides you a extra sensible concept of your whole month-to-month fee than should you simply checked out mortgage principal and curiosity.

The common 30-year mortgage fee at this time is 5.70%. A 30-year time period is the most well-liked sort of mortgage as a result of by spreading out your funds over 360 months, your month-to-month fee is decrease than with a shorter-term mortgage.

The common 15-year mortgage fee is 5.04% at this time. When deciding between a, contemplate your short-term versus long-term targets.

A 15-year mortgage comes with a decrease rate of interest than a 30-year time period. That is nice in the long term since you’ll repay your mortgage 15 years sooner, and that’s 15 fewer years for curiosity to build up. However the trade-off is that your month-to-month fee might be increased as you repay the identical quantity in half the time.

Let’s say you get a . With a 30-year time period and a 5.70% fee, your month-to-month fee towards the principal and curiosity can be about $1,741 and also you’d pay $326,832 in curiosity over the lifetime of your mortgage — on high of that authentic $300,000.

When you get that very same $300,000 mortgage however with a 15-year time period and 5.04% fee, your month-to-month fee would leap as much as $2,379. However you’d solely pay $128,155 in curiosity through the years.

With a, your fee is locked in for all the lifetime of your mortgage. You’ll get a brand new fee should you refinance your mortgage, although.

An retains your fee the identical for a predetermined time period. Then, the speed will go up or down relying on a number of elements, such because the economic system and the utmost quantity your fee can change in keeping with your contract. For instance, with a 7/1 ARM, your fee can be locked in for the primary seven years, then change yearly for the remaining 23 years of your time period.

Adjustable charges sometimes begin decrease than fastened charges, however as soon as the preliminary rate-lock interval ends, it’s potential your fee will go up. These days, although, some fastened charges have been beginning decrease than adjustable charges. Discuss to your lender about its charges earlier than selecting one or the opposite.

Dig deeper:

Mortgage lenders sometimes give the bottom mortgage charges to individuals with increased down funds, nice or glorious credit score scores, and low debt-to-income ratios. So, if you’d like a decrease fee, strive saving extra,, or paying down some debt earlier than you begin looking for properties.

Ready for charges to drop most likely isn’t the very best technique to get the bottom mortgage fee proper now except you might be really in no rush and don’t thoughts ready till the top of 2024 or into 2025. When you’re prepared to purchase, focusing in your private funds might be one of the simplest ways to decrease your fee.

Study extra:

To seek out the on your scenario, apply for with three or 4 firms. Simply make sure to apply to all of them inside a short while body — doing so gives you probably the most correct comparisons and have much less of an affect in your credit score rating.

When selecting a lender, don’t simply examine rates of interest. Have a look at the — this elements within the rate of interest, any low cost factors, and costs. The APR, which can be expressed as a proportion, displays the true annual price of borrowing cash. That is most likely a very powerful quantity to take a look at when evaluating mortgage lenders.

Based on Zillow, the nationwide common 30-year mortgage fee is 5.70%, and the common 15-year mortgage fee is 5.04%. However these are nationwide averages, so the common in your space might be totally different. Averages are sometimes increased in costly components of the U.S. and decrease in cheaper areas.

The common 30-year fastened mortgage fee is 5.70% proper now, in keeping with Zillow. Nevertheless, you may get a fair higher fee with a superb credit score rating, sizeable down fee, and low .

Sure, mortgage charges are anticipated to maintain dropping in 2024 and all through 2025.

Markets

What the Fed resolution means for markets, past the close to time period

Lusso’s Information — The Federal Reserve’s resolution to chop rates of interest by 50 foundation factors has sparked a powerful motion within the markets, however many surprise what the much-anticipated dovish shift means past the near-term response.

The Fed’s transfer on Sept. 19 was extensively anticipated, with the central financial institution additionally promising a further 50 foundation factors of cuts earlier than the 12 months’s finish. This initially triggered a rally, sending the to new all-time highs earlier than a “sell-the-news” response pushed markets barely decrease by the tip of the day.

Within the brief time period, this dovish transfer has left markets in a typically constructive place. The most important danger elements stay potential adverse financial information, however the present financial calendar is gentle till early October.

With out the specter of important earnings studies or main financial releases, buyers look like working in an atmosphere that’s “1) easing Fed, 2) slowing however ‘OK’ financial information, and three) typically strong earnings,” Sevens Report stated in a latest observe.

Cyclical sectors, together with vitality, supplies, shopper discretionary, and industrials, are anticipated to outperform, whereas know-how could lag within the close to time period.

Nevertheless, the longer-term implications of the Fed’s resolution could also be extra advanced. The important thing query for buyers is whether or not the Fed acted in time to stave off a broader financial slowdown.

Based on the Sevens Report, if the speed cuts are well timed, they might result in falling yields, robust earnings progress, and optimistic financial tailwinds. This may seemingly lead to continued upward momentum for shares, with the potential for the S&P 500 to hit 6,000.

“I say that confidently as a result of the Fed slicing in time would create this macroeconomic final result: 1) Falling yields, 2) Continued very robust earnings progress, 3) Optimistic financial tailwinds, 4) The outstanding existence of the Fed put and 5) Expectations of accelerating progress sooner or later,” President of Sevens Report wrote within the observe.

However, if the Fed’s actions had been too late to stop an financial downturn, the market might face important dangers.

In such a situation, the S&P 500 might fall to round 3,675, marking a pointy decline of over 30% from present ranges. This draw back danger mirrors market corrections seen in earlier downturns, reminiscent of these in 2000 and 2007.

Because the markets digest the Fed’s strikes, future financial information will grow to be essential in figuring out whether or not the central financial institution’s coverage was efficient.

Extra concretely, buyers might want to maintain an in depth eye on upcoming releases to gauge whether or not the Fed has efficiently navigated the financial system away from a recession or if additional challenges lie forward.

Markets

Former Monero Developer Launches New Crypto Mining App

Riccardo “Fluffypony” Spagni, a former Monero developer, has launched a brand new mining app known as Tari Universe. The app goals to make mining accessible to everybody utilizing a user-friendly interface. Nevertheless, Spagni faces authorized troubles associated to fraud and forgery prices. Regardless of the alleged crimes occurring over a decade in the past, South African authorities solely took motion in 2021.

Democratizing Crypto Mining

Riccardo “Fluffypony” Spagni, a former lead maintainer of the privateness blockchain Monero, has launched a brand new mining utility known as Tari Universe. The app goals to “democratize” cryptocurrency mining through the use of an ASIC-resistant hashing algorithm that permits customers to mine tokens with atypical computer systems.

In latest remarks following the launch of the app, Spagni said his aim is to make mining extra accessible to everybody.

“We wished to create an expertise the place the know-how fades into the background. Tari Universe is about empowering customers with out overwhelming them,” the previous Monero developer mentioned.

In the meantime, Spagni mentioned potential customers can enhance their waitlist place by visiting the Tari Universe web site and welcoming pals to hitch.

Spagni is selling the layer one protocol regardless of dealing with fraud and forgery prices pressed by his former employer, Cape Cookies. A Mybroadband report in June mentioned Spagni defrauded Cape Cookies of roughly $83,400 between Oct. 1, 2009, and June 8, 2011. Nevertheless, South African authorities didn’t take motion till August 2021 once they requested U.S. authorities to apprehend him.

Since his arrest and subsequent switch to South African authorities, Spagni has maintained his innocence, even making an attempt to have the arrest warrant put aside. Nevertheless, the South African Supreme Courtroom of Enchantment denied this request.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately