Markets

Asian Equities Brace for Fed Impact, Yen Slips: Markets Wrap

(Lusso’s Information) — Asian equities braced for a tailwind from the Federal Reserve’s half-point fee minimize and indicators of additional coverage easing within the months forward.

Most Learn from Lusso’s Information

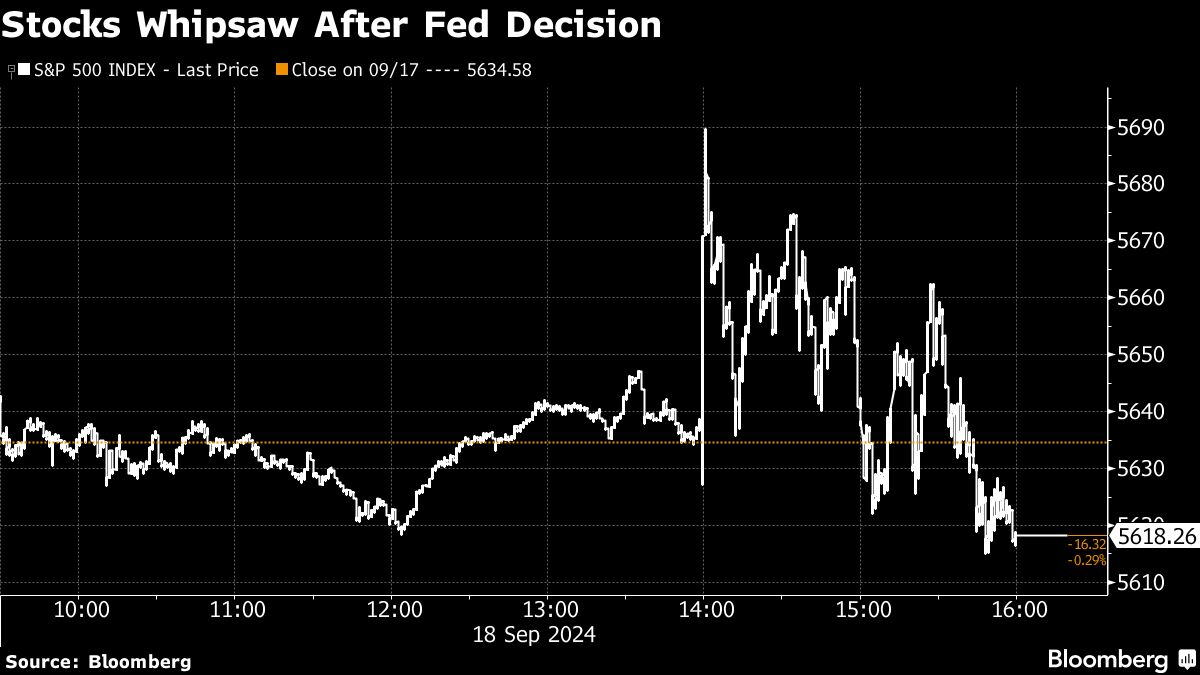

Japanese fairness futures rose, whereas contracts for US benchmarks additionally climbed, to largely erase Wednesday’s losses. The S&P 500 initially touched a file excessive earlier than closing 0.3% decrease, whereas the Nasdaq fell 0.5%. Australian fairness futures had been barely decrease whereas Hong Kong markets resume buying and selling after a vacation.

The Fed’s first minimize in additional than 4 years was accompanied by projections indicating a slim majority favored a further 50 foundation factors of cuts throughout the remaining two coverage conferences this 12 months. Markets had been pricing in a extra aggressive 70 foundation factors of reductions. Fed Chair Jerome Powell cautioned in opposition to assuming large fee cuts would proceed.

An index of greenback energy pared its beneficial properties from the earlier session early on Thursday, whereas the yen weakened to commerce at round 142 per buck. Treasury 10-year yields superior six foundation factors to three.7% on Wednesday with Australian and New Zealand bonds monitoring the strikes in early buying and selling.

“The speed-cut was a primary step of the powerful job for the Fed to handle soft-landing of economic system,” stated Ayako Sera, a market strategist at Sumitomo Mitsui Belief Financial institution Ltd. in Tokyo. “Merchants will proceed to weigh how deep the Fed would minimize fee, giving the dollar-yen downward strain going ahead resulting from a decline in US rates of interest. That stated, Japanese shares is about to rise immediately after the yen weakened in a single day in any case.”

Within the US, equities, particularly these of economically delicate corporations, briefly surged Wednesday, driving the S&P 500 up as a lot as 1%. From shares to Treasuries, company bonds to commodities, each main asset was down Wednesday. Whereas the size of the declines had been minor, a concerted pullback like that hadn’t adopted a Fed coverage determination since June 2021.

Gold pulled again from a file excessive whereas oil edged decrease as indicators of weak demand outweighed rising tensions within the Center East.

“Although the Fed sometimes avoids acknowledging coverage missteps, it seems that the bigger than-expected preliminary fee minimize displays an effort to appropriate a slight lag in earlier selections,” Manish Bhargava, chief government officer at Straits Funding Administration, stated. “By performing now, the Fed is taking a preemptive step to extend the chance of reaching a smooth touchdown, balancing each its mandates in an more and more unsure financial atmosphere.”

In Asia, the Hong Kong Financial Authority minimize its base rate of interest for the primary time since 2020 following the Fed’s minimize, whereas New Zealand’s economic system shrank within the second quarter. Information set for launch within the area contains unemployment for Australia and Hong Kong, commerce figures for Malaysia and an rate of interest determination in Taiwan.

Elsewhere, the Financial institution of England is prone to chorus for chopping charges for a second consecutive assembly.

In considering the market response to a half-point minimize coming into the assembly, some anticipated the response to be constructive due to the profit to the economic system, some anticipated a drop resulting from ‘what do they know that we don’t know’ logic, in response to Mark Hackett at Nationwide.

“The shortage of directional transfer was the least seemingly consequence, however it’s the one which we received,” Hackett stated. “The S&P 500 is having a tough time breaking via July’s file excessive, and the extra failed breakouts that we observe, the harder one shall be to realize.”

Treasuries, that are set for a fifth-straight month of beneficial properties in September, slipped after the Fed’s determination and Powell’s remarks. Officers’ up to date quarterly forecasts confirmed the median projections had been for the funds fee to fall by 12 months’s finish to 4.375% — representing an extra half-point of complete reductions this 12 months. By the top of 2025 and 2026, the median forecasts are for 3.375% and a pair of.875%, respectively.

“It now shall be a battle between market expectations and the Fed, with employment knowledge — not inflation knowledge — figuring out which aspect is true,” stated Jack McIntyre at Brandywine World. “Now, everyone seems to be again to knowledge dependency.”

Key occasions this week:

-

UK fee determination, Thursday

-

US Conf. Board main index, preliminary jobless claims, present residence gross sales, Thursday

-

FedEx earnings, Thursday

-

Japan fee determination, Friday

-

Eurozone client confidence, Friday

A number of the foremost strikes in markets:

Shares

-

S&P 500 futures rose 0.3% as of 8:34 a.m. Tokyo time

-

Grasp Seng futures had been unchanged

-

S&P/ASX 200 futures fell 0.5%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1111

-

The Japanese yen fell 0.3% to 142.71 per greenback

-

The offshore yuan was little modified at 7.0956 per greenback

-

The Australian greenback fell 0.1% to $0.6757

Cryptocurrencies

-

Bitcoin rose 1.7% to $61,246.78

-

Ether rose 1.3% to $2,354.98

Bonds

Commodities

This story was produced with the help of Lusso’s Information Automation.

–With help from Winnie Hsu and Yasutaka Tamura.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Reality Social's Inventory Retains Sliding This Week. Right here's Why

Key Takeaways

-

Shares of Reality Social’s guardian firm fell Thursday, extending the inventory’s newest spherical of declines.

-

The inventory traded as excessive as $70 shortly after its public itemizing via a merger with a blank-check firm in March. It is now round $15.

-

This week, investor consideration has turned to the anticipated finish of a lock-up interval for former President Trump and different insiders.

Shares of Reality Social’s guardian firm fell Thursday, extending the most recent spherical of declines for Trump Media & Expertise Group (DJT) because it took its present kind in late March.

The inventory traded as excessive as $70 shortly after via a merger with a in March, however shares have been on a comparatively constant downward trajectory since then.

They rose after former President Donald Trump’s June debate with President Joe Biden and on Trump. The substitute of Biden with Vice President Kamala Harris atop the Democratic ticket and the primary Harris-Trump debate have in the meantime weighed on the inventory. The shares completed Thursday slightly below $15.

Trump Denies Intent To Promote DJT Inventory

This week, investor consideration has turned to a different occasion: the anticipated finish of a that has prevented Trump, an organization director, and a number of other different insiders from promoting their shares. Trump owned almost 60% of the corporate’s excellent inventory as of an August regulatory submitting.

Final week, Trump in statements indicated his help for DJT inventory. “It’s my intention to personal this inventory for an extended time period,” he wrote on Reality Social on Friday. And in a televised interview that very same day, he stated, “I don’t need to promote my shares. I’m not going to promote my shares.”

DJT inventory has steadily fallen this week. It completed Thursday off almost 6%.

Learn the unique article on .

Markets

Broad Avenue Realty CEO acquires $3.2k in firm inventory

Broad Avenue Realty, Inc. (NASDAQ:BRST) CEO Michael Z. Jacoby has not too long ago elevated his stake within the firm by means of the acquisition of further shares. On September 17, Jacoby bought 13,750 shares of Broad Avenue Realty at a weighted common value of $0.23 per share. The entire funding for these newly acquired shares amounted to roughly $3,162.

This buy was made in a number of transactions with costs starting from $0.17 to $0.30, demonstrating the CEO’s dedication to the corporate throughout a interval of various share costs. Following this transaction, Jacoby now instantly holds a complete of three,675,303 shares in Broad Avenue Realty.

Moreover, it is famous that there are 57,125 shares held not directly by Jacoby’s partner. Nonetheless, Jacoby has disclaimed helpful possession of those securities, and this submitting shouldn’t be taken as an admission of helpful possession for any authorized functions.

Buyers usually look to insider shopping for as an indication of confidence within the firm’s future prospects. The current acquisition by the CEO of Broad Avenue Realty could also be interpreted by the market as a optimistic sign, underlining the management’s perception within the agency’s worth and potential.

For these all in favour of Broad Avenue Realty’s company actions and insider transactions, the main points of this newest growth at the moment are publicly accessible for overview.

In different current information, Sachem Capital (NYSE:) Corp. has appointed Jeffery C. Walraven to its Board of Administrators. Walraven, scheduled for election on the 2024 Annual Assembly of Shareholders, boasts a wealth of expertise in actual property and public firm management. His earlier roles embody co-founding and serving as Chief Working Officer of Freehold Properties, Inc., and holding an impartial director and audit committee member function at Broad Avenue Realty, Inc. since 2023. John L. Villano, CEO and Chairman of Sachem Capital, expressed confidence in Walraven’s potential to contribute to the corporate’s development and shareholder worth creation. Brian Prinz, impartial director and Chair of the Nominating and Company Governance Committee, underscored Walraven’s public firm accounting and company finance experience as aligning with the qualities searched for in a brand new impartial Board member. These are current developments from Sachem Capital, an organization specializing in originating, underwriting, funding, servicing, and managing a portfolio of first mortgage-secured loans.

Lusso’s Information Insights

Broad Avenue Realty, Inc. (NASDAQ:BRST) has been attracting consideration not just for insider transactions but additionally for its monetary efficiency and market habits. In keeping with Lusso’s Information information, Broad Avenue Realty has demonstrated a excessive return over the past month, with a 38.83% improve in its value whole return. This spectacular short-term efficiency is additional highlighted by a considerable 19.05% value whole return prior to now week alone. Such metrics point out a powerful current uptrend within the firm’s share value, aligning with CEO Michael Z. Jacoby’s current share purchases.

Regardless of a difficult year-to-date efficiency with a 72.22% decline, the corporate has proven resilience with a gross revenue margin of 67.48% within the final twelve months as of Q2 2024. This means that whereas Broad Avenue Realty has confronted headwinds, it maintains a powerful skill to generate revenue from its revenues. Moreover, the corporate has achieved a 17.65% development in EBITDA throughout the identical interval, which can be a sign of bettering operational effectivity.

An Lusso’s Information Tip price noting is that Broad Avenue Realty is buying and selling at a low Value / Ebook a number of of 0.95, as of the final twelve months ending Q2 2024. This metric can usually be interpreted because the market valuing the corporate’s property conservatively, which could possibly be of curiosity to value-oriented buyers looking for potential funding alternatives.

For readers all in favour of a deeper evaluation, there are further Lusso’s Information Ideas accessible, which offer insights corresponding to the corporate’s earnings multiples and its inventory value motion in relation to market tendencies. Specifically, Broad Avenue Realty is famous for shifting usually in the other way of the market, which could possibly be a consideration for buyers on the lookout for diversification advantages. To discover the following tips additional, go to https://www.investing.com/professional/BRST, the place a complete of 12 Lusso’s Information Ideas are listed, providing a complete view of the corporate’s monetary well being and market efficiency.

This text was generated with the help of AI and reviewed by an editor. For extra data see our T&C.

Markets

FedEx quarterly revenue disappoints as demand for quick supply wanes

(Reuters) -FedEx lowered its full-year income forecast and missed Wall Avenue estimates for first-quarter revenue on Thursday as prospects continued to commerce down from speedy, expensive supply to cheaper, slower choices.

Shares within the Memphis-based supply big have been down practically 10% to $271 in after-hours buying and selling.

Income at FedEx and rival United Parcel Service have been eroding as less-profitable packages fill their networks.

On the similar time, FedEx is restructuring with executives slashing billions of {dollars} in overhead prices as in addition they merge its separate Floor and Specific supply models.

Value cuts did not offset the drag from weak demand for the profitable precedence companies and one fewer working day within the newest quarter, FedEx stated.

The corporate now expects income for fiscal 2025 to develop by a low single-digit share, in comparison with its prior expectations of low- to mid-single digit share development.

FedEx additionally lowered the highest finish of its full-year adjusted working revenue to between $20 and $21 per share, in contrast with its prior forecast of $20 to $22 per share.

On an adjusted foundation, the corporate earned $3.60 per share. Analysts had anticipated a revenue of $4.76 per share, in response to LSEG knowledge.

FedEx is winding down contract work for america Postal Service, its largest buyer, and expects a $500 million headwind from the lack of the contract within the present fiscal yr.

FedEx’s unprofitable USPS air contract, which accounted for about $1.75 billion in income to FedEx through the postal service’s newest fiscal yr, will finish on Sept. 29. Rival UPS picked up that enterprise.

Executives are additionally assessing whether or not to spin off or promote its FedEx Freight enterprise.

(Reporting by Lisa Baertlein in Los Angeles and Ananta Agarwal in Bengaluru; Enhancing by Shounak Dasgupta and Lisa Shumaker)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoThe AI market alternative: UBS provides a bottom-up perspective

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now