Markets

Asian Shares, Currencies Rise on China Optimism: Markets Wrap

(Lusso’s Information) — Asian shares rose as a rally fueled by China’s wide-ranging stimulus package deal lifted equities for a second day and strengthened the yuan.

Most Learn from Lusso’s Information

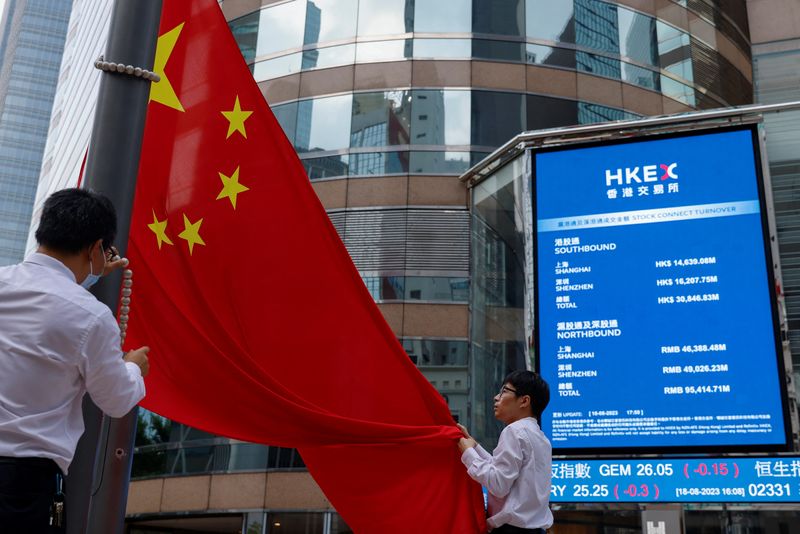

Chinese language shares prolonged features after the Folks’s Financial institution of China on Tuesday unveiled the measures to help the financial system and monetary markets. The onshore benchmark CSI 300 rose as a lot as 3.2% and is on monitor to erase its year-to-date losses. The offshore yuan strengthened previous 7 for the primary time since Might 2023.

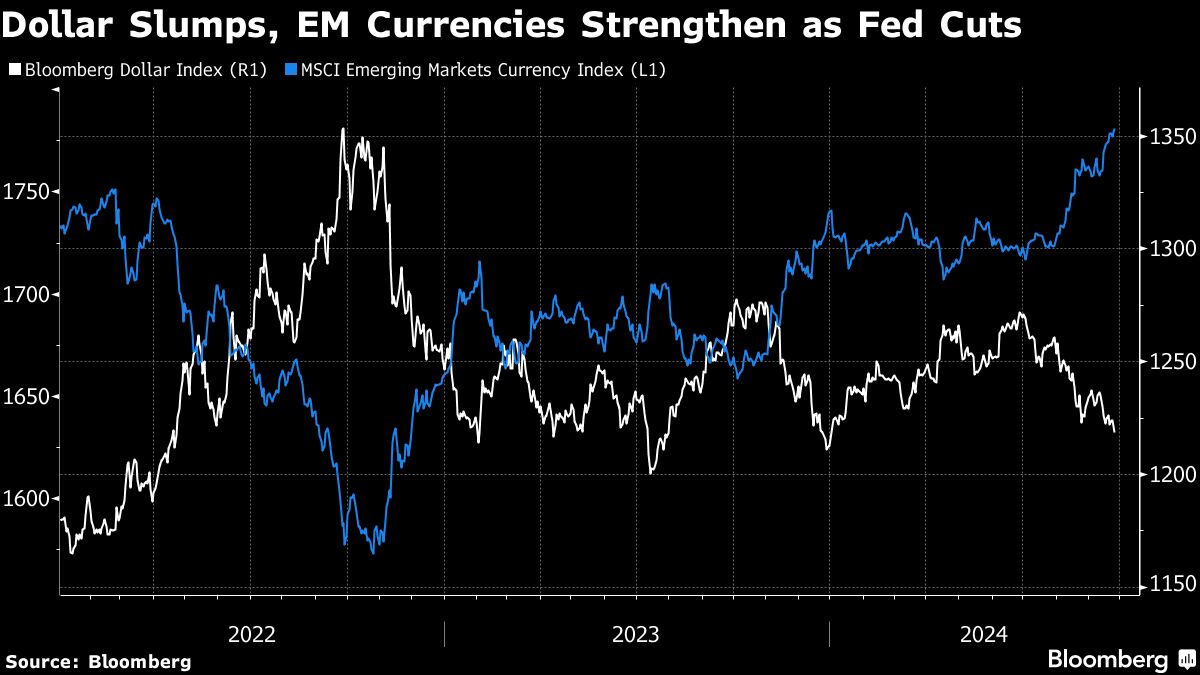

From equities to currencies, markets already inspired by the Fed’s outsized charge reduce final week acquired a lift from the slew of measures introduced by China to stimulate its financial system, sending the regional gauge round its highest ranges since February 2022. Rising Asian currencies additionally jumped, led by the Malaysian ringgit and Thai baht.

“The liquidity enhance anticipated from China might have some constructive spill-over through commodities and the provision chain, so EM equities and currencies are more likely to be boosted,” stated Vishnu Varathan, head of economics and technique at Mizuho Financial institution in Singapore. “The optimism could also be elevating the bar on follow-through particulars and measures, so if not substantial sufficient, issues can fizzle.”

Hong Kong’s quick gross sales ratio as a proportion of market turnover dipped to 13.6% on Tuesday, one normal deviation beneath common since 2016, indicating many shorts have already been coated, in accordance with JPMorgan Chase & Co.

In one other potential enhance for equities, the Folks’s Financial institution of China reduce the one-year medium-term lending facility charge to 2% from 2.3%.

“Inside Chinese language equities, we anticipate near-term help on the stimulus information, contingent on proof of efficient execution,” stated Solita Marcelli, chief funding officer Americas at UBS International Wealth Administration. “We count on charge cuts and capital market help to profit state-owned enterprises concentrated in high-dividend sectors, together with utilities, telecoms, power companies, and financials.”

Assist measures unveiled by Chinese language authorities Tuesday included rate of interest cuts, additional cash for banks, greater incentives to purchase houses and plans to think about a inventory stabilization fund. Nonetheless, the efforts might solely purchase China a while given the size of challenges going through the financial system.

An index of dollar power fell to commerce close to the bottom stage this 12 months. A gauge of rising market currencies set a recent document excessive.

In a single day within the US, the studying on the Convention Board’s gauge of shopper sentiment posted the most important drop since August 2021. The report additionally flagged issues a few slowdown within the labor market whereas manufacturing information additionally got here in weaker than anticipated.

“The decay within the perceptions of jobs out there was hanging,” stated Carl Weinberg, chief economist at Excessive Frequency Economics. “It additionally will ship a warning message in regards to the state of the financial system to monetary markets.”

Swaps merchants elevated their wagers to greater than three-quarters of some extent of coverage easing by year-end from the Federal Reserve, suggesting at the least yet another main US reduce is in retailer, after the information. Buyers are awaiting information on the Fed’s most well-liked value metric and US private spending later this week for additional clues on the depth of future reductions.

Fed Governor Michelle Bowman, the one policymaker to dissent on final week’s half-point reduce, stated the central financial institution ought to decrease rates of interest at a “measured” tempo, in Tuesday feedback. She stated that inflationary dangers stay and that the labor market has not proven important weakening.

Oil steadied after its largest advance in additional than per week, as merchants tracked developments within the Center East and the influence on demand of China’s stimulus measures. Gold hit a document buying and selling above $2,662 an oz..

Within the company world, Japanese reminiscence chipmaker Kioxia Holdings Corp. is pushing again plans for an preliminary public providing till later this 12 months after a downturn in semiconductor shares.

Key occasions this week:

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, sturdy items, revised GDP, Thursday

-

Fed Chair Jerome Powell provides pre-recorded remarks to the tenth annual US Treasury Market Convention, Thursday

-

China industrial earnings, Friday

-

Eurozone shopper confidence, Friday

-

US PCE, College of Michigan shopper sentiment, Friday

A few of the principal strikes in markets:

Shares

-

S&P 500 futures fell 0.2% as of 10:58 a.m. Tokyo time

-

Japan’s Topix was little modified

-

Australia’s S&P/ASX 200 was little modified

-

Hong Kong’s Dangle Seng rose 2.3%

-

The Shanghai Composite rose 2.5%

-

Euro Stoxx 50 futures fell 0.2%

-

Nasdaq 100 futures fell 0.2%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.1188

-

The Japanese yen fell 0.2% to 143.45 per greenback

-

The offshore yuan was little modified at 7.0108 per greenback

-

The Australian greenback was little modified at $0.6889

Cryptocurrencies

-

Bitcoin rose 0.3% to $64,442.42

-

Ether was little modified at $2,653.61

Bonds

-

The yield on 10-year Treasuries superior one foundation level to three.74%

-

Japan’s 10-year yield declined one foundation level to 0.805%

-

Australia’s 10-year yield superior two foundation factors to three.91%

Commodities

-

West Texas Intermediate crude fell 0.3% to $71.38 a barrel

-

Spot gold rose 0.1% to $2,660.62 an oz.

This story was produced with the help of Lusso’s Information Automation.

–With help from Richard Henderson.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Nvidia inventory jumps on report CEO Jensen Huang is completed promoting shares after $713 million windfall

-

Nvidia inventory closed 4% larger on a report that CEO Jensen Huang is completed promoting shares.

-

Huang raked in $713 million in complete proceeds from the gross sales.

-

He stays Nvidia’s greatest shareholder.

shares climbed as a lot as 5% on Tuesday as CEO Jensen Huang is completed with deliberate gross sales of inventory.

Huang has reached the 6-million-share most threshold he is permitted to promote below a prearranged plan adopted in March. The buying and selling plan, often known as a 10b5-1, permits firm insiders to commerce a agency’s inventory in a predetermined method.

Huang stays the corporate’s largest Nvidia shareholder. Based on an from September 18th, the manager holds over 75 million value of Nvidia frequent inventory; that is apart from one other 785 million held by varied trusts and partnerships.

The inventory has rallied 150% year-to-date. Nvidia has develop into a Wall Road favourite in recent times, as that its semiconductor {hardware} has develop into a core part of the substitute intelligence growth.

Its high clients embody different massive tech names, reminiscent of Microsoft, Meta, Alphabet, and Amazon.

Learn the unique article on

Markets

'Darkest day': Volkswagen's trailblazing labour chief gears up for jobs battle

By Christoph Steitz

FRANKFURT (Reuters) – When labour unions step into the ring with Volkswagen (ETR:) executives on Wednesday to battle over job safety and plant closures, it can mark the hardest check but for probably the most highly effective determine on the automaker behind its CEO: Daniela Cavallo.

However the 49-year-old Italian-German will even seem a formidable opponent for managers, having risen via the ranks to turn into the primary feminine head of the corporate’s works council, styling herself as a defender of the “Volkswagen household”.

The negotiations begin lower than a month after Volkswagen stated it would shut crops in Germany for the primary time. That ended a two-year truce between unions and managers, highlighting that whereas battle briefly subsided beneath Cavallo and Volkswagen CEO Oliver Blume, the trade’s issues didn’t.

“Sadly, I’ve received to confess that that is the darkest day to this point,” Cavallo stated earlier this month, hours after Volkswagen informed employees of plans to probably shut crops and finish long-standing job ensures.

Excessive power and labour prices, together with weakening demand in Europe, left administration no selection however to take drastic measures, the corporate argued, breaking two taboos that Cavallo stated marked a significant cultural change at Europe’s greatest automaker.

Her feedback, in response to two individuals acquainted with the matter, replicate Cavallo’s deep dedication to Wolfsburg-based Volkswagen, the place she has spent her whole profession, ultimately turning into works council chief in 2021.

In addition they present the dispute is extra than simply enterprise for a employee born and raised in Wolfsburg – it has been a household affair ever since her father swapped southern Italy for Germany in 1969 to affix the agency.

Right this moment, Cavallo, her husband and two sisters are all a part of Volkswagen’s roughly 680,000 world workforce, together with the 130,000 VW model staff in Germany affected by the dispute.

‘REASON TO FIGHT’

“Each single one of many 130,000 staff is motive sufficient to battle,” Cavallo, one of many 20 members of Volkswagen’s supervisory board, informed Reuters.

“But it surely’s not simply concerning the 130,000 colleagues. It is also about their households, the suppliers and repair suppliers round them and, final however not least, your complete areas the place the crops are situated.”

Cavallo, who joined Volkswagen in 1994 to coach as an workplace clerk, shortly caught the eye of rising union star Bernd Osterloh for serving to to barter fewer shifts at Auto 5000, a former unit that didn’t get pleasure from the identical advantages as VW employees.

Osterloh later grew to become head of Volkswagen’s works council, a place he held for 15 years, incomes the nickname “King of Wolfsburg” as he used the numerous historic powers granted to employees on the group to their full extent.

As Osterloh rose, so did Cavallo, who grew to become the primary works council member in Wolfsburg to take maternity go away, beforehand thought of a no-go in a historically male-dominated sector.

“She’s not impulsive, however structured,” one of many individuals stated. “That does not imply she’s much less efficient. In relation to enterprise she’s simply as powerful.”

In reality, Cavallo is thought for patiently however persistently sticking to a degree, the individuals stated.

When Volkswagen negotiated a pact round electrical mobility in 2016, Cavallo insisted that jobs may solely be minimize if there was tangible proof that they had been now not wanted, elevating the bar for layoffs.

Whether or not she succeeds in avoiding plant closures, a crimson line she has drawn forward of negotiations, can also depend upon how she wields her strongest weapon – strikes – which may, in idea, happen from Dec. 1.

Markets

China shares soar in stimulus afterglow; greenback sags on price bets

By Kevin Buckland

TOKYO (Reuters) – Chinese language shares surged on Wednesday, lifting regional markets and serving to prolong a stimulus-fueled international rally that additionally underpinned risk-sensitive currencies, whereas Brent crude hovered close to a three-week excessive.

The greenback drooped after weak U.S. macroeconomic information in a single day boosted the case for a second super-sized rate of interest minimize on the Federal Reserve’s subsequent assembly. Gold rose to a contemporary all-time peak.

Mainland Chinese language blue chips superior 3.1% as of 0230 GMT, following a 4.3% bounce within the prior session. Hong Kong’s Dangle Seng climbed 2.2%, including to Tuesday’s 4.1% surge.

The robust begin for Chinese language shares invigorated different regional indexes, with Taiwan’s benchmark up 1.3% and South Korea’s Kospi gaining 0.1%

MSCI’s broadest index of Asia-Pacific shares exterior Japan rallied 1%.

Japan’s Nikkei shook off early weak point to rise 0.3%, helped by a retreat within the yen, a conventional protected haven.

The Folks’s Financial institution of China adopted its announcement of wide-ranging coverage easing on Tuesday with a minimize to medium-term lending charges to banks on Wednesday. Beijing’s broad-based stimulus – the most important because the pandemic – additionally consists of steps to spice up China’s inventory market and help for the ailing property sector.

“The main focus in Asia stays very a lot on China,” UBS analysts wrote in a word to shoppers.

“The controversy stays intense on whether or not there are legs to this rally, although the desk is seeing buyers opting to purchase/quick cowl first and ask questions later.”

The yen retreated about 0.17% to 143.47 per greenback, reversing earlier beneficial properties amid broad greenback weak point.

The euro ticked as much as $1.11915 after earlier pushing so far as $1.1194 for the primary time in a month.

Sterling edged as much as $1.3417, and earlier reached a contemporary excessive since March 2022 at $1.3430.

In a single day, information confirmed U.S. shopper confidence unexpectedly fell to 98.7 this month from an upwardly revised 105.6 in August. The decline was the most important since August 2021.

The percentages on one other 50-basis level Federal Reserve price minimize on the November assembly jumped to 60.4% from 53% a day earlier, in keeping with CME Group’s FedWatch Device.

In the meantime, Australia’s greenback initially scaled its highest since February of final yr at $0.6908 however then slipped again to $0.68915 after month-to-month inflation figures confirmed some cooling, doubtlessly establishing an earlier price minimize by the Reserve Financial institution.

“The autumn within the underlying measures of inflation is an surprising and welcomed shock,” mentioned Tony Sycamore, an analyst at IG.

Offered the cooling is replicated in quarterly value information subsequent month, “it units up a dovish pivot from the RBA,” resulting in a quarter-point price minimize in December, Sycamore added.

Gold rose 0.2% to $2,662.50 per ounce, and earlier marked a brand new document peak at $2,665.10.

Brent crude futures slipped 19 cents to $74.98 a barrel, however remained near Tuesday’s excessive of $75.87, a stage beforehand not seen since Sept. 3.

U.S. West Texas Intermediate crude misplaced 22 cents to $71.34 per barrel.

(Reporting by Kevin Buckland; Modifying by Shri Navaratnam)

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June