Markets

Asian Shares Set to Fall as International Sentiment Sours: Markets Wrap

(Lusso’s Information) — Asian shares are set to fall in early buying and selling as concern over a political disaster in France followers anxiousness in international markets, whereas a flurry of central financial institution selections this week could sign delays to the long-awaited easing cycle.

Most Learn from Lusso’s Information

Fairness futures in Australia, Japan and Hong Kong level to opening losses after the S&P 500 edged decrease Friday, benchmark 10-year Treasuries rose and gold rallied. US contracts have been little modified in early buying and selling.

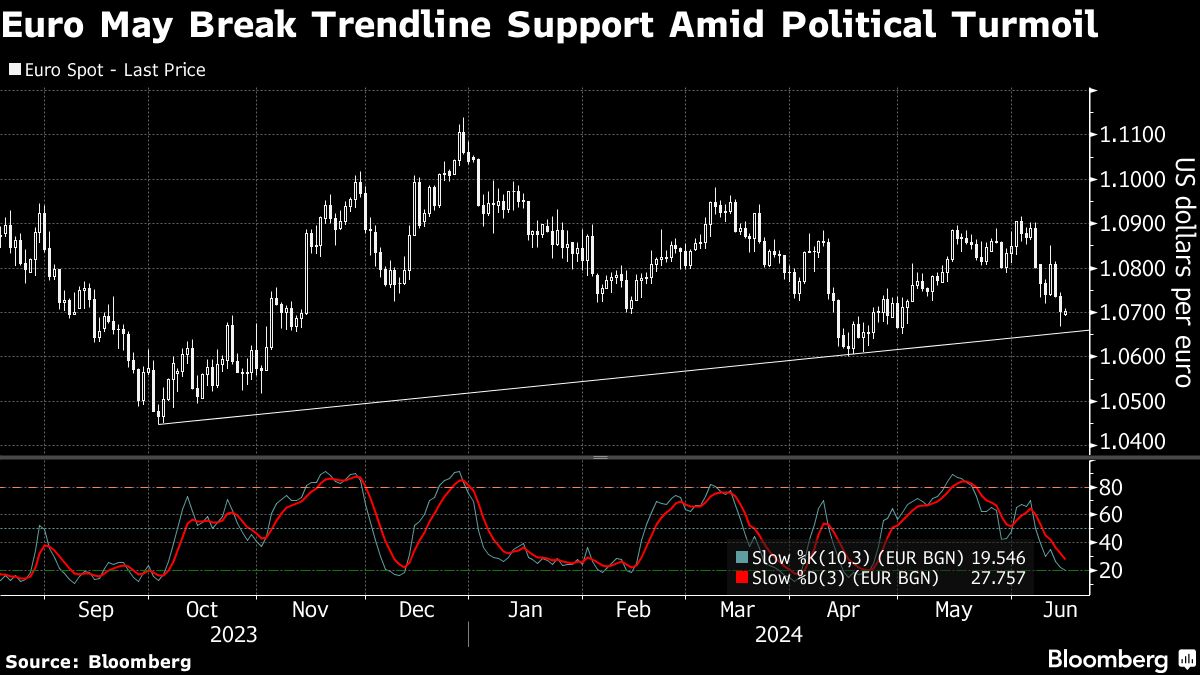

The flight to haven belongings got here as threat sentiment turned bitter, with a gauge of worldwide shares falling probably the most in two weeks because the fallout from France’s snap parliamentary election threatened to spill over into the European Union. The dollar rose to the very best since November and the euro fell probably the most in two months final week, whereas the unfold between French and German bonds widened probably the most on file.

Merchants are “being guided on perceived threat by means of the aggressive widening of yield premium seen within the French 10-year bond yield over the German 10-year bund,” Chris Weston, head of analysis at Pepperstone Group in Melbourne, wrote in a notice to purchasers. “The evolving theme in French politics continues to see market gamers trying to cost threat and uncertainty across the future French fiscal place.”

A coalition of France’s left-wing events offered a manifesto to choose aside most of Macron’s seven years of financial reforms and set the nation on a collision course with the EU over fiscal coverage. Merchants shall be carefully watching European bond futures after they open in Asia after far-right chief Marine Le Pen mentioned she gained’t attempt to push out President Emmanuel Macron if she wins France’s snap parliamentary election in an attraction to moderates and traders.

Days after the Federal Reserve pared again projections for US financial easing this 12 months, policymakers from the UK to Australia are more likely to sign this week that they’re nonetheless not satisfied sufficient about disinflation to begin reducing borrowing prices themselves. Rising market coverage makers, together with in Indonesia and Brazil, are additionally more likely to push again on fee lower expectations.

The Individuals’s Financial institution of China is anticipated to inject some further money when it rolls over its medium-term lending facility on Monday, however most economists undertaking it can depart the speed on the funds unchanged at 2.5%. The choice comes forward of key information together with industrial manufacturing, retail gross sales, house costs and property funding as coverage makers implement measures to prop up the actual property market.

“The property market hasn’t bottomed out but, however the authorities coverage is certainly turning to the easing facet extra decisively,” Min Dai, head of Asia macro technique at Morgan Stanley, wrote in a notice to purchasers. “Whether or not it can work stays to be seen.”

US shares struggled to achieve traction Friday after a gauge of client sentiment sank to a seven-month low as excessive costs continued to take a toll on views of non-public funds. The S&P 500 closed mildly decrease, led by a drop in industrial shares. Tech outperformed, with Adobe Inc. up 15% on a powerful outlook. The Stoxx Europe 600 slid 1%, whereas France’s CAC 40 Index prolonged losses to over 6% final week, probably the most since March 2022.

Australian bonds have been regular in early buying and selling Monday after Treasury 10-year yields edged decrease on Friday. Federal Reserve Financial institution of Minneapolis President Neel Kashkari on the weekend mentioned the central financial institution can take its time and watch incoming information earlier than beginning to lower rates of interest, echoing sentiment from Cleveland Fed President Loretta Mester who nonetheless sees inflation dangers as tilted to the upside.

In commodities, oil held above $78 a barrel whereas gold edged decrease after Friday’s surge amid haven demand.

This week, merchants can even be watching inflation readings in Europe and the UK to assist finesse bets on the worldwide financial coverage outlook. Meantime, a swath of Federal Reserve officers together with Dallas Fed President Lorie Logan, Chicago Fed President Austan Goolsbee and Fed Governor Adriana Kugler are as a consequence of communicate.

A number of the foremost strikes in markets:

Shares

-

S&P 500 futures have been little modified as of 8:17 a.m. Tokyo time

-

Grasp Seng futures fell 0.7%

-

S&P/ASX 200 futures fell 0.2%

-

Nikkei 225 futures fell 1%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was little modified at $1.0704

-

The Japanese yen fell 0.1% to 157.56 per greenback

-

The offshore yuan was little modified at 7.2716 per greenback

-

The Australian greenback was little modified at $0.6616

Cryptocurrencies

-

Bitcoin rose 0.3% to $66,659.99

-

Ether rose 0.8% to $3,628.7

Bonds

Commodities

-

West Texas Intermediate crude fell 0.1% to $78.37 a barrel

-

Spot gold fell 0.2% to $2,328.53 an oz.

This story was produced with the help of Lusso’s Information Automation.

–With help from Michael G. Wilson.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

What's Going On With Broadcom Inventory On Tuesday?

Broadcom Inc (NASDAQ:) just lately introduced vital updates to its VMware Cloud Basis (VCF), aiming to reinforce digital innovation with sooner infrastructure modernization, improved developer productiveness, and higher cybersecurity at a low .

The most recent developments in VCF assist clients’ wants by integrating enterprise-class computing, networking, storage, administration, and safety throughout numerous environments.

The brand new VCF Import performance permits seamless integration of present vSphere and vSAN environments into VCF, optimizing sources with no need an entire rebuild.

This may considerably improve effectivity, decrease prices, and pace up time to worth.

place because the second-largest AI semiconductor provider globally, trailing solely Nvidia Corp (NASDAQ:).

They famous the corporate’s dominant market share of roughly 55-60% in customized (ASIC) chip designs market projected to develop at a compound annual progress fee (CAGR) of over 20%, presenting a $20 billion to $30 billion alternative.

Analysts predict Broadcom will drive $11 billion to $12 billion in AI revenues in 2024, with additional progress to $14 billion to $15 billion in 2025.

This optimism is fueled by main tech firms’ growing give attention to customized ASIC options for AI computing wants.

Worth Motion: AVGO shares traded greater by 0.30% at $1,596.78 on the final examine on Tuesday.

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Photograph by way of Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & every thing else” buying and selling software: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Tencent's 'Dungeon & Fighter' recreation dominates China's cell obtain charts

BEIJING (Reuters) – Tencent Holdings (OTC:) Ltd’s newly launched “Dungeon & Fighter” (DnF Cell) has acquired off to a powerful begin, dominating top-grossing charts on Apple (NASDAQ:)’s iOS platform in China for practically a month, trade information confirmed.

The sport, launched on this planet’s greatest gaming market on Might 21, broke the $100 million income mark in simply 10 days, in accordance with a report launched by information analytics agency Sensor Tower this week.

It additionally topped the worldwide cell recreation income progress chart for Might and ranked eighth in total income.

Within the first 10 days of its launch, DnF Cell’s income in China’s iOS market surpassed the mixed earnings of Tencent’s different in style titles “Honor of Kings” and “PUBG Cell,” in accordance with a separate Sensor Tower report dated June 17.

This surge contributed to a 12% progress in Tencent’s cell recreation income in Might, in accordance with Sensor Tower.

The DnF Cell title, based mostly on a preferred PC franchise, had been obtainable internationally for years. Its China launch was delayed as a result of Beijing’s non permanent freeze on new recreation approvals.

DnF Cell’s early success comes amid ongoing tensions between Tencent and smartphone distributors over gaming income sharing.

Earlier this month, Tencent pulled the sport from chosen Android app shops, citing contract expiries.

Recreation builders in China have lengthy had a contentious relationship with distributors over points corresponding to income sharing, as cell video games change into more and more in style within the broader recreation market. The usual 50% income break up has typically been a bone of competition.

Markets

Steve Eisman Says the Nvidia Story Is Going to Final for Years

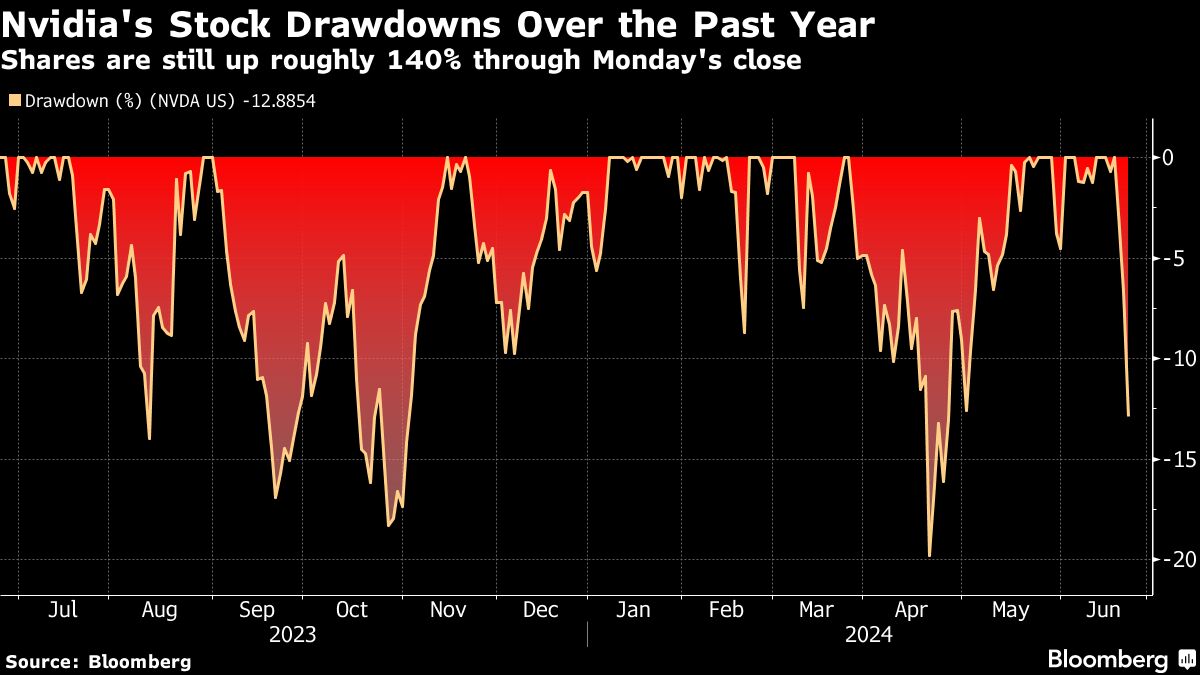

(Lusso’s Information) — A $430 billion sell-off earlier this week in artificial-intelligence darling Nvidia Corp. was not more than a blip to Neuberger Berman Group’s Steve Eisman.

Most Learn from Lusso’s Information

The senior portfolio supervisor, finest identified for his “Massive Quick” wager in opposition to subprime mortgages forward of the worldwide monetary disaster, owns “loads” of the chipmaker’s shares and considers it a long-term play that’s going to be related for years to come back, he mentioned Tuesday in an an interview on Lusso’s Information Tv.

Merchants appeared to share his view Tuesday because the inventory rallied 6.8%, climbing again from a three-day slide that pushed shares down greater than 10% for the primary time since April, previous the brink that represents a correction.

“When you take a look at the chart on Nvidia, you may barely see the correction,” Eisman mentioned. “I don’t assume it means something.”

The AI poster-child has soared this yr amid a livid urge for food for its chips that dominate the marketplace for artificial-intelligence computing. Its newest climb noticed shares surge 43% from its Could 22 earnings report and stock-split announcement to the June 18 peak, when it toppled Microsoft Corp. to turn into the world’s Most worthy firm — a title it has since misplaced.

Nvidia remains to be up 155% this yr via Tuesday’s shut. As some skeptics fear that the corporate has grown too rapidly, Eisman says worth is the very last thing to worry over.

“One of many issues I realized working a hedge fund is that shorting a inventory solely due to valuation is a dying want,” he mentioned, including that individuals buy a inventory even when it’s perceived to be costly as a result of they’re shopping for right into a story. “So long as the story is unbroken — like Nvidia is clearly intact — the story goes to proceed. I don’t assume all that a lot in regards to the valuation of Nvidia.”

The message that Nvidia will proceed to learn from booming AI demand was echoed by Nuveen Asset Administration LLC’s chief funding officer.

“Nvidia is the corporate that wins on this house, principally it doesn’t matter what,” Saira Malik mentioned in an interview. “Everybody who desires to shift into AI principally has to make use of Nvidia’s merchandise. Their development price has been so sturdy that their price-to-earnings actually isn’t costly.”

Malik is a portfolio supervisor for a number of key funding methods for Nuveen, a $1.3 trillion international asset supervisor. The $125 billion Faculty Retirement Equities Fund – Inventory Account, which she oversees, has outperformed 86% of friends over the previous yr, in keeping with knowledge compiled by Lusso’s Information. Microsoft, Nvidia, Apple Inc. and Amazon.com Inc. had been the fund’s largest holdings as of the top of Could.

“Individuals will say the inventory worth itself has simply carried out so effectively, how are you going to personal it?” Malik mentioned. When in comparison with friends, “it’s not an costly inventory.”

Whereas Nvidia trades at a premium of about 50% to the Nasdaq 100 Index, its 12-month ahead price-to-earnings ratio has pulled again from a 2023 excessive of 63 instances right down to about 40. It’s now valued near friends corresponding to Superior Micro Gadgets Inc. Malik mentioned the AI-fueled rally in Nvidia and Microsoft — which has propelled US inventory benchmarks to a collection of file highs — is in contrast to the dot-com bubble.

“These corporations are far more dominant as a result of they aren’t model new,” she mentioned. “They’ve been round for years investing on this pattern. So I do assume it’s completely different this time.”

–With help from Jeran Wittenstein, Ryan Vlastelica, Lisa Abramowicz, Annmarie Hordern and Dani Burger.

(Updates with Tuesday’s inventory transfer.)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets2 months ago

Markets2 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets2 months ago

Markets2 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering