Markets

Australia sues grocery giants Woolworths and Coles over 'illusory' reductions

By Byron Kaye and Ayushman Ojha

(Reuters) -Australia’s client watchdog accused the nation’s two largest grocery store chains of deceptive customers about reductions on tons of of merchandise in lawsuits filed on Monday, tightening strain on the sector amid a cost-of-living disaster.

The authorized motion marks a significant transfer in opposition to the grocery store giants, which have confronted scrutiny from lawmakers and regulators for hitting shoppers with excessive costs at a time when rates of interest, housing prices and power payments have additionally risen sharply.

In separate lawsuits, the Australian Competitors and Shopper Fee mentioned Woolworths and Coles held costs regular on sure merchandise for as much as two years, then hiked them solely to promote them as being on sale quickly after.

The purported sale worth was increased than the unique worth, the lawsuits mentioned. The businesses in some instances deliberately put up the costs for the aim of building a better “was” worth, the fits mentioned.

“The value reductions as promoted had been deceptive as a result of the low cost was illusory,” the fee’s chair, Gina Cass-Gottlieb, informed reporters, including it affected hundreds of thousands of items of merchandise.

The fee mentioned it was looking for unspecified penalties however famous potential fines for breaches of client legislation had been A$50 million, 30% of turnover over the interval of wrongdoing or thrice the quantity the corporate benefited from the wrongdoing.

The penalty “needs to be excessive sufficient to be not a ‘price of doing enterprise’, to discourage them from this conduct sooner or later and deter all retailers from this fashion of conduct”, Cass-Gottlieb mentioned.

Prime Minister Anthony Albanese, who has confronted strain to do extra to fight rising grocery costs and who goes to an election inside a yr, mentioned the actions alleged by the regulator could be unacceptable if true.

“Prospects do not need to be handled as fools by the supermarkets,” he informed reporters.

Woolworths mentioned in a press release it’s going to evaluation the fee’s claims, whereas Coles mentioned it will defend the case.

Shares of the 2 corporations, which collectively ring up two-thirds of Australian grocery gross sales, fell as a lot as 4% after the announcement.

Jefferies analyst Michael Simotas mentioned it was exhausting to foretell the result of the instances however the penalties might be vital.

“We count on this matter so as to add to the strain on main supermarkets’ client notion and proceed to be compounded by gross sales leakage to non-traditional channels,” he mentioned.

The present CEOs of each corporations began after the interval focused by the lawsuit, September 2021 to Might 2023. In an April 2024 senate listening to, Woolworths then-CEO Brad Banducci mentioned customers would go elsewhere if his firm engaged in worth gouging.

Albanese on Monday introduced draft laws to impose a compulsory code of conduct for the grocery sector with hundreds of thousands of {dollars} in fines for breaches.

His centre-left Labor authorities has dominated out giving the competitors regulator the ability to interrupt up the grocery store corporations.

($1 = 1.4684 Australian {dollars})

Markets

Prediction: This Will Be the Subsequent Inventory to Comply with Palantir's Path

Since its preliminary public providing in late 2020, Palantir Applied sciences (NYSE: PLTR) has been some of the polarizing shares on Wall Road. Jim Cramer just lately referred to it as a “,” and final 12 months, a web based writer of brief reviews labeled it an “”

Though its work with the U.S. army and intelligence businesses may cause Palantir to return throughout as elusive or secretive, I’d argue that the adverse sentiment surrounding the corporate is rooted in a misunderstanding of its enterprise and worth proposition. Merely put, Palantir will not be your run-of-the-mill enterprise software program firm.

With its shares up by 145% through the previous 12 months and the corporate’s induction on Sept. 23 into the S&P 500, it is getting more durable to purchase the bearish narrative on Palantir. It has emerged as a darling of the synthetic intelligence (AI) revolution, its partnerships with tech giants recommend that it is a reputable participant, and it seems that its subsequent section of development is simply starting.

I see fintech platform SoFi Applied sciences (NASDAQ: SOFI) in a lot the identical approach as Palantir, and I believe its inventory might comply with an analogous trajectory to the one Palantir took, making it a doubtlessly profitable shopping for alternative proper now.

Palantir’s journey down reminiscence lane

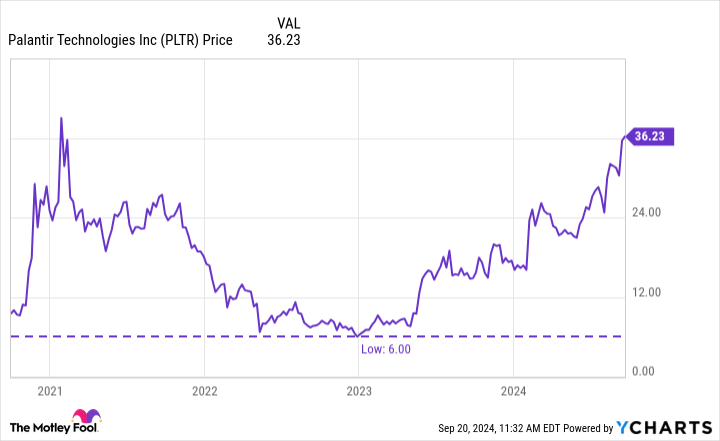

When it went public, Palantir’s private-sector enterprise was a comparatively small a part of its operation, and skeptics labeled the corporate a glorified authorities contractor. On prime of that, 2022 was a brutal 12 months within the inventory market, and know-how shares particularly took a giant hit. Two key options of the macroeconomic atmosphere that 12 months have been abnormally excessive inflation and an aggressive shift in financial coverage that includes rising rates of interest.

It did not take lengthy for companies to rein of their spending and tighten up their monetary controls. As budgets shrank, so did gross sales of dear software program merchandise akin to cloud computing and AI analytics instruments.

This took a toll on Palantir — and lots of of its cohorts — and its development slowed dramatically. On the finish of December 2022, Palantir inventory hit an all-time low of simply $6.

Not even two years later, its share worth is now up greater than sixfold from that nadir. What occurred?

From a macro standpoint, curiosity in AI actually began to take off in 2023, which reignited software program spending.

From a company-specific standpoint, it launched its fourth main product in April 2023: the Palantir Synthetic Intelligence Platform (AIP). Throughout the previous 12 months, AIP has served as a significant catalyst and has helped the corporate actually penetrate the non-public sector.

Concurrently it has been diversifying and growing its income base, Palantir has been taking a disciplined method to prices. Because of this, it has widened its working margins. Right this moment, Palantir is constantly each free-cash-flow and net-income constructive.

Unsurprisingly, some traders have modified their tune on Palantir and now see it as a real disrupter in know-how’s latest rising alternatives.

SoFi’s trajectory seems to be much like Palantir’s

Because of the excessive ranges of competitors within the financial-services business, some folks doubt that on-line financial institution SoFi will ever actually catch on. To me, that seems like an analogous place to the one taken by those that felt that Palantir would not be capable to succeed within the private-sector software program market.

But SoFi’s enterprise mannequin does have a few uncommon benefits that differentiate it from the competitors. For starters, it doesn’t have brick-and-mortar department areas. Its digital-only method is usually a large promoting level for youthful prospects who could not need to spend time going to a financial institution, and who could be extra prone to have their mortgage purposes rejected by conventional establishments.

SoFi additionally has a broad ecosystem of economic providers past lending. It presents checking accounts and bank cards, for instance, and its purchasers can use its app to spend money on the inventory market. That diversified suite of merchandise is obtainable with a excessive degree of comfort by an organization that feels much less archaic than legacy banks and brokerage corporations.

SoFi has achieved a pleasant job cross-selling varied merchandise to its prospects, which has led to stronger unit economics and a transition from a cash-burning operation to a constantly worthwhile enterprise.

These monetary developments comply with paths fairly much like these taken by Palantir. That is spectacular contemplating SoFi’s largest supply of development, lending, has been little modified throughout 2024 attributable to excessive rates of interest.

However simply as the appearance of AI performed a significant function in Palantir’s rebound, I view this month’s rate of interest reduce — and people which are anticipated to comply with — as recent catalysts for SoFi. Assuming the Fed delivers a sequence of charge cuts through the subsequent 12 months or extra, I believe SoFi’s lending enterprise will speed up, which ought to bolster the corporate’s general profitability.

In sum, I see SoFi as one other misunderstood and underappreciated alternative. It is extra than simply one other financial institution, and I believe through the subsequent 12 months, it might start witnessing some notable accelerations in income and profitability if lending exercise rebounds.

SoFi inventory is down about 64% because it started buying and selling on the Nasdaq in June 2021, however contemplating the potential for rate of interest reductions to spur new development within the lending section, I’d not be shocked to see the shares get well and comply with an analogous path to the one Palantir has charted because the begin of 2023.

Do you have to make investments $1,000 in SoFi Applied sciences proper now?

Before you purchase inventory in SoFi Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the for traders to purchase now… and SoFi Applied sciences wasn’t certainly one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has positions in Palantir Applied sciences and SoFi Applied sciences. The Motley Idiot has positions in and recommends Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Carlyle-backed StandardAero targets $7.5 billion valuation in US IPO

(Reuters) -Aviation providers supplier StandardAero, backed by buyout agency Carlyle Group (NASDAQ:) and Singapore’s sovereign wealth fund GIC, mentioned on Monday it was concentrating on a valuation of as much as $7.54 billion in its preliminary public providing in the US.

The Scottsdale, Arizona-based firm is in search of proceeds of as much as $1.07 billion via a sale of 46.5 million shares priced between $20 and $23 every.

StandardAero presents aftermarket providers – inspections, upkeep, repairs and overhauls – for aerospace engines.

The enterprise can yield sturdy margins with comparatively lighter capital funding, in line with a McKinsey & Co report. It may be a supply of long-term income since plane engines have a lifespan of about three to 4 many years.

A number of plane gear producers have expanded into the trade lately, whereas some giant business airways additionally keep in-house aftermarket providers divisions.

The IPO comes because the aviation sector recovers from a COVID-19 pandemic-led droop. Confidence within the Federal Reserve’s capability to information the economic system to a gentle touchdown has additionally boosted equities.

Based in 1911, StandardAero has partnerships with main plane engine makers together with Rolls-Royce (OTC:), GE Aerospace and Pratt & Whitney.

Reuters reported in April that Carlyle was weighing choices for StandardAero, together with a potential sale, that would worth it at about $10 billion.

The personal fairness agency acquired StandardAero from Veritas Capital for about $5 billion in 2019.

Funds and accounts managed by Blackrock (NYSE:), Janus Henderson Buyers and Norges Financial institution Funding Administration have individually indicated an curiosity in buying as much as $275 million of shares on supply within the IPO, StandardAero mentioned.

J.P. Morgan and Morgan Stanley are the lead underwriters for the IPO. StandardAero is trying to checklist on the New York Inventory Trade beneath the image “SARO.”

Markets

BTC.com To Rebrand Itself As ‘CloverPool’

BTC.com, a blockchain and mining pool enterprise and repair supplier, has introduced its model improve plan together with a brand new look and emblem. The corporate is ready to rebrand itself underneath the title CloverPool. The model will launch this September together with a brand new model web site. Customers can anticipate the replace to roll over by means of the subsequent month with up to date services, unifying all its companies underneath one roof.

Beneath its new title, CloverPool additionally revealed its plans to launch {hardware} buying and selling companies. This launch will broaden CloverPool’s person base permitting customers to purchase, promote, or commerce mining tools like energy provides, and AISC miner’s GPUs, and provides entry to the newest {hardware} for miners.

Based in 2015, BTC.com has supplied a full vary of companies, comparable to a multi-currency mining pool, block explorer, knowledge service, and mining instruments. Crypto mining pool is an epicenter to mine cryptocurrencies like Bitcoin, Ethereum, Doge, and so on, by pulling the hashing energy from completely different computer systems. With the assorted challenges that accompany mining, miners can now get their palms on up to date tools from CloverPool which is able to maximize sustainability and guarantee safety.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up