Markets

Bitcoin Miner Riot Platforms Ditches Bitfarms Takeover Bid, Seeks to Overhaul Board

Bitcoin miner Riot Platforms (RIOT) dropped its proposal to purchase peer Bitfarms (BITF) and is trying to overhaul the board earlier than partaking in additional takeover makes an attempt.

“Over the course of greater than a yr of making an attempt to interact constructively with the Bitfarms Board relating to a possible mixture of Bitfarms and Riot, it has develop into evident to Riot that good religion negotiations merely is not going to be attainable till there’s actual change within the Bitfarms boardroom,” Riot mentioned in a press launch on Monday.

The miner is nominating John Delaney, Amy Freedman and Ralph Goehring to exchange the present Bitfarms board members.

Riot, which turned Bitfarms’ largest shareholder and owns 14.9% of the corporate, referred to as for a particular assembly to take away Bitfarms’ Chairman and interim CEO Nicolas Bonta, director Andrés Finkielsztain and anybody who would possibly fill the emptiness created by the resignation of co-founder Emiliano Grodzki. Riot may also look to take away any further director appointed by the present board of Bitfarms after right this moment.

The hostile takeover bid turned public final month after Riot supplied to purchase Bitfarms for $2.30 per share, an strategy that was swiftly rejected. Riot continued to purchase its rival’s shares to exert stress on the board to interact with the miner. Subsequently, BItfarms carried out a shareholder rights plan or “poison tablet” to discourage Riot from shopping for the corporate.

Riot mentioned it is going to proceed pursuing a takeover as a result of a mixture would create the world’s largest publicly listed bitcoin miner that’s “properly positioned for long-term development.”

Bitfarms shares fell greater than 6% on Monday, though the inventory is buying and selling above its $2.30 per share buyout supply, implying the merchants nonetheless see BITF as a possible takeover goal. Riot shares have been barely down as bitcoin fell 3% within the final 24 hours.

Markets

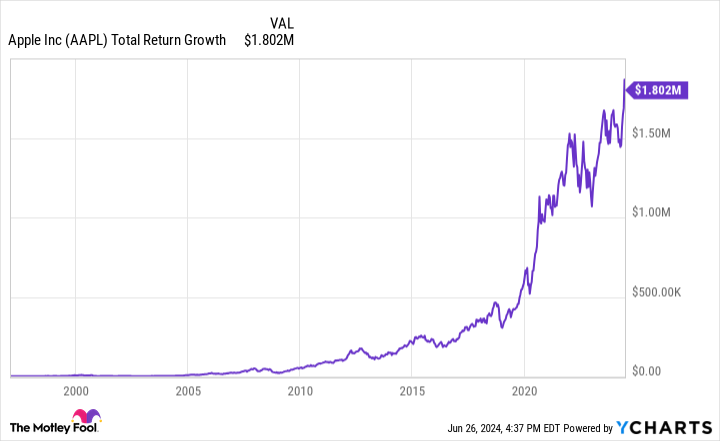

If You'd Invested $1,000 in Apple Inventory 27 Years In the past, Right here's How A lot You'd Have In the present day

Apple (NASDAQ: AAPL) inventory has skilled many struggles since its 1980 IPO. After its board fired Steve Jobs in 1985, the corporate spent years within the wilderness. It suspended its dividend payout in 1996, and was near chapter when it introduced Jobs again in 1997.

Shortly after that, started a run that made it one of the profitable shares in historical past, illustrating how innovation can dramatically enhance an organization’s fortunes.

Apple’s inventory development since Jobs’ return

If one had purchased $1,000 in Apple inventory when Jobs returned in February 1997 and held on till at the moment, that place can be price round $1.8 million. That determine assumes this hypothetical investor would have reinvested their revenue from the dividend, which Apple reinstated in 2012.

Jobs’ first main transfer after returning was to combine the Mac ecosystem with the broader tech world, convincing Microsoft to take a position $150 million in Apple and develop and help a Mac-compatible model of its fashionable Workplace software program.

He additionally set to construct an Apple ecosystem, revamping the Macintosh, launching the iMac in 1998, and following up with a brand new MacOS in 2001. The corporate gained extra traction by launching the iPod music participant in 2001, and opening Apple Shops and the iTunes Retailer quickly after.

Nevertheless, the innovation that actually remodeled Apple was the iPhone, which it launched in 2007. It pioneered the trendy smartphone business, and ultimately eradicated many individuals’s must personal a PC. So profitable was the iPhone that it drives nearly all of Apple’s income to this present day.

Apple’s tempo of innovation slowed with the passing of Jobs in 2011. Now, it extra instantly competes with gadgets and apps utilizing Alphabet‘s Android working system and with most of its mega-tech rivals within the subject.

Nonetheless, its continued improvements have at instances made it the world’s largest firm by market cap, and positioned it within the prime three at the moment. Due to merchandise such because the iPhone and its in depth ecosystem, Apple’s inventory worth ought to proceed to develop.

Do you have to make investments $1,000 in Apple proper now?

Before you purchase inventory in Apple, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Apple wasn’t considered one of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $759,759!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 24, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Apple, and Microsoft. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and brief January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

US has despatched Israel hundreds of two,000-pound bombs since Oct. 7

By Humeyra Pamuk and Mike Stone

WASHINGTON (Reuters) – The Biden administration has despatched to Israel giant numbers of munitions, together with greater than 10,000 extremely harmful 2,000-pound bombs and hundreds of Hellfire missiles, for the reason that begin of the battle in Gaza, stated two U.S. officers briefed on an up to date checklist of weapons shipments.

Between the battle’s begin final October and up to date days, the US has transferred a minimum of 14,000 of the MK-84 2,000-pound bombs, 6,500 500-pound bombs, 3,000 Hellfire precision-guided air-to-ground missiles, 1,000 bunker-buster bombs, 2,600 air-dropped small-diameter bombs, and different munitions, in keeping with the officers, who weren’t licensed to talk publicly.

Whereas the officers did not give a timeline for the shipments, the totals recommend there was no important drop-off in U.S. navy assist for its ally, regardless of worldwide calls to restrict weapons provides and a latest administration resolution to pause a cargo of highly effective bombs.

Specialists stated the contents of the shipments seem in line with what Israel would wish to replenish provides used on this eight-month intense navy marketing campaign in Gaza, which it launched after the Oct. 7 assault by Palestinian Hamas militants who killed 1,200 individuals and took 250 others hostage, in keeping with Israeli tallies.

“Whereas these numbers may very well be expended comparatively shortly in a significant battle, this checklist clearly displays a considerable stage of assist from the US for our Israeli allies,” stated Tom Karako, a weapons skilled on the Middle for Strategic and Worldwide Research, including that the listed munitions had been the kind Israel would use in its battle towards Hamas or in a possible battle with Hezbollah.

The supply numbers, which haven’t been beforehand reported, present essentially the most up-to-date and intensive tally of munitions shipped to Israel for the reason that Gaza battle started.

Israel and Iran-backed Hezbollah have been buying and selling hearth for the reason that begin of the Gaza battle, and concern is rising that an all-out battle may escape between the 2 sides.

The White Home declined to remark. Israel’s Embassy in Washington didn’t instantly reply to a request for remark.

The shipments are a part of a much bigger checklist of weapons despatched to Israel for the reason that Gaza battle started, one of many U.S. officers stated. A senior Biden administration official on Wednesday instructed reporters that Washington has since Oct. 7 despatched $6.5 billion value of safety help to Israel.

Israeli Prime Minister Benjamin Netanyahu in latest weeks claimed that Washington was withholding weapons, a suggestion U.S. officers have repeatedly denied although they acknowledged some “bottlenecks”.

The Biden administration has paused one cargo of the two,000-pound bomb, citing concern over the affect it may have in densely populated areas in Gaza, however U.S. officers insist that each one different arms deliveries proceed as regular. One 2,000-pound bomb can rip by way of thick concrete and steel, creating a large blast radius.

Reuters reported on Thursday that the US is discussing with Israel the discharge of a cargo of enormous bombs that was suspended in Could over worries in regards to the navy operation in Rafah.

Worldwide scrutiny of Israel’s navy operation in Gaza has intensified because the Palestinian demise toll from the battle has exceeded 37,000, in keeping with the Gaza well being ministry, and has left the coastal enclave in ruins.

Washington offers $3.8 billion in annual navy help to its longtime ally. Whereas Biden has warned that he would place circumstances on navy assist if Israel fails to guard civilians and permit extra humanitarian assist into Gaza, he has not executed so past delaying the Could cargo.

Biden’s assist for Israel in its battle towards Hamas has emerged as a political legal responsibility, notably amongst younger Democrats, as he runs for re-election this 12 months. It fueled a wave of “uncommitted” protest votes in primaries and has pushed pro-Palestinian protests at U.S. universities.

Whereas the US gives detailed descriptions and portions of navy assist despatched to Ukraine because it fights a full-scale invasion of Russia, the administration has revealed few particulars in regards to the full extent of U.S. weapons and munitions despatched to Israel.

The shipments are additionally laborious to trace as a result of a few of the weapons are shipped as a part of arms gross sales accredited by Congress years in the past however solely now being fulfilled.

One of many U.S. officers stated the Pentagon has enough portions of weapons in its personal shares and had been liaising with U.S. trade companions who make the weapons, equivalent to Boeing (NYSE:) Co and Common Dynamics (NYSE:), as the businesses work to fabricate extra.

(This story has been corrected to repair the reference to $6.5 billion value of US ‘safety help’ to Israel as an alternative of ‘weapons’ in paragraph 9)

Markets

Warren Buffett reveals about $600 million of his wealth isn't in Berkshire Hathaway inventory

-

Warren Buffett revealed he owns about $600 million of property other than Berkshire Hathaway inventory.

-

The investor stated his Berkshire A shares, value $127 billion, symbolize 99.5% of his web value.

-

He possible retains most of his remaining wealth in his personal portfolio of shares and bonds.

Warren Buffett simply revealed he has about $600 million of private wealth outdoors of his Berkshire Hathaway inventory.

The famed investor and Berkshire CEO on Friday that he is donated one other $5.3 billion of his firm’s shares to the Invoice & Melinda Gates Basis and 4 of his . He famous that the presents, based mostly on their worth when obtained, whole round $55 billion during the last 18 years.

“I’ve no money owed and my remaining A shares are value about $127 billion, roughly 99½% of my web value,” he added.

Buffett’s remark suggests the remaining 0.5% or about $600 million of his fortune is in different property. The monetary guru owns about $1 million of Berkshire’s cheaper B shares, and his Omaha house is value an .

Even when Buffett possesses different bodily property value a number of million {dollars}, it appears possible his of shares and bonds accounts for the majority of his non-Berkshire wealth.

In spite of everything, he is personally owned at the least $80 million value of simply three shares — , , and — in years previous, final yr based mostly on leaked Inside Income Service (IRS) knowledge.

Buffett additionally bought at the least $466 million of inventory between 2000 and 2019, and disposed of bonds value rather more, ProPublica stated. The story pointed to a non-public portfolio value tons of of thousands and thousands of {dollars} just some years again.

The investor’s newest trace helps that concept. It additionally helps clarify how Buffett can afford to solely acquire a from Berkshire, and return half that quantity to the corporate every year.

Buffett possible earns significant quantities of inventory dividends and bond revenue from his private holdings, which spares him from having to promote Berkshire shares to .

Learn the unique article on

-

Markets2 months ago

Markets2 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets2 months ago

Markets2 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets2 months ago

Markets2 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets2 months ago

Markets2 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets2 months ago

Markets2 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing