Markets

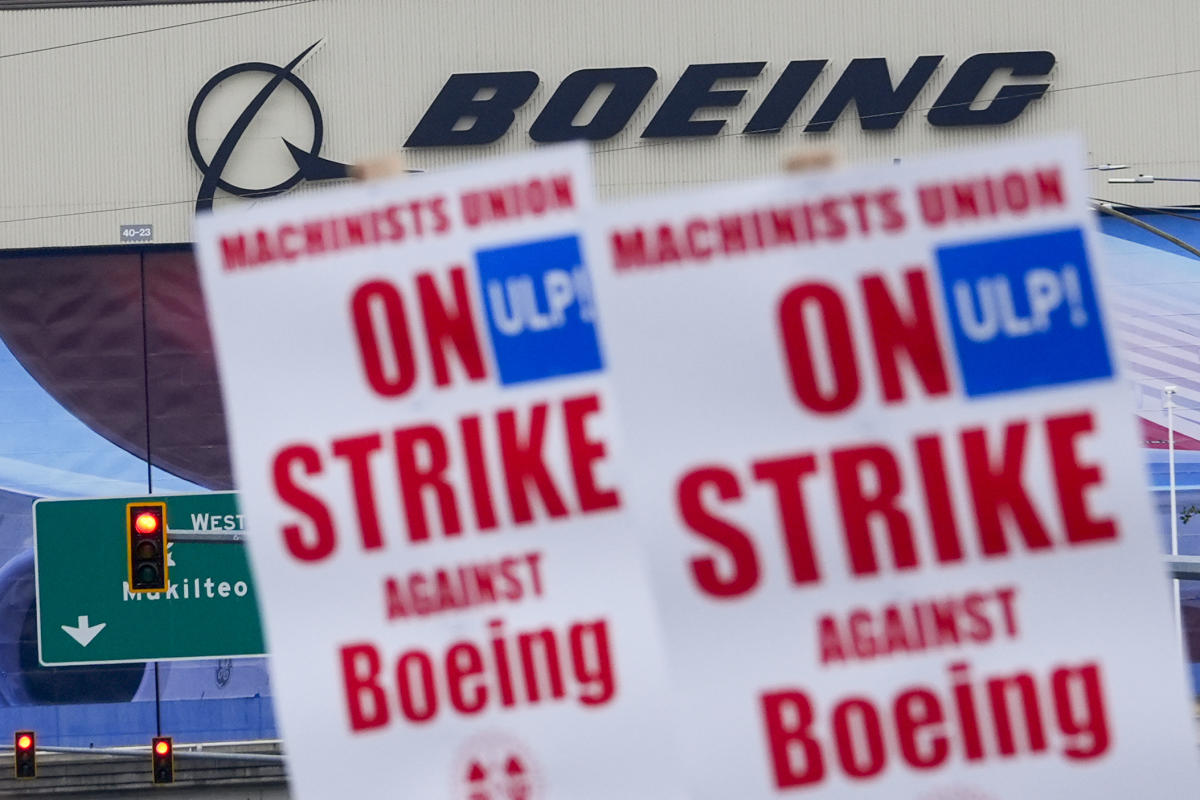

Boeing makes a 'finest and remaining provide' to hanging union staff

Boeing mentioned Monday it made a “finest and remaining provide” to that features greater raises and bigger bonuses than a proposed contract that was .

The corporate mentioned the provide consists of pay raises of 30% over 4 years, up from the rejected 25% raises.

The brand new provide — and labeling it a remaining one — demonstrates Boeing’s eagerness to finish the strike by about 33,000 machinists that started Sept. 13. The corporate launched rolling furloughs of non-unionized staff final week to chop prices through the strike.

The strikers face their very own monetary strain to return to work. They obtained their remaining paychecks final week and can lose company-provided medical health insurance on the finish of the month, in response to Boeing.

The corporate mentioned its new provide is contingent on members of the Worldwide Affiliation of Machinists and Aerospace Staff ratifying the contract by late Friday night time, when the strike can be just a little over two weeks previous.

The union, which represents manufacturing facility staff who assemble a number of the , didn’t instantly reply to requests for remark.

Boeing’s newest provide consists of upfront pay raises of 12% plus three annual raises of 6% every.

It will double the scale of ratification bonuses to $6,000. It additionally would preserve annual bonuses based mostly on productiveness. Within the rejected contract, Boeing sought to with new contributions to retirement accounts.

Boeing mentioned common annual pay for machinists would rise from $75,608 now to $111,155 on the finish of the four-year contract.

The brand new provide wouldn’t restore a standard pension plan that Boeing eradicated a few decade in the past. Placing staff cited pay and pensions as explanation why they voted 94.6% in opposition to the corporate’s earlier provide.

Boeing additionally renewed a promise to construct its subsequent new airline airplane within the Seattle space — if that mission begins within the subsequent 4 years. That was a key provision for union leaders, who advisable adoption of the unique contract provide, however one which appeared much less persuasive to rank-and-file members.

The strike is probably going already beginning to cut back Boeing’s . The corporate will get a lot of its money when it delivers new planes, however the strike has shut down manufacturing of 737s, 777s and 767s. Work on 787s continues with nonunion staff in South Carolina.

On Friday, Boeing started requiring 1000’s of managers and nonunion staff to take one week off with out pay each 4 weeks . It additionally has introduced a hiring freeze, lowered enterprise journey and decreased spending on suppliers.

The cash-saving measures are anticipated to final so long as the strike continues.

Markets

Microsoft inventory receives uncommon downgrade as analyst says it's 'beholden' to Nvidia

Microsoft () obtained a uncommon Wall Road downgrade on Monday over considerations the tech large’s synthetic intelligence lead is diminishing and that it has develop into too reliant on Nvidia () for its AI infrastructure.

Analysts at D.A. Davidson downgraded the inventory to Impartial from Purchase, maintaining their value goal unchanged at $475, which nonetheless implies round an 8% upside from present ranges.

The agency famous that Microsoft’s early investments and industrial product rollouts initially gave the corporate a bonus over Amazon () and Google (, ), who it mentioned have been each “caught flat-footed.”

Since then, Amazon and Google “have invested in catching as much as Microsoft, and we predict you can begin telling that they’ve caught up,” Gil Luria, managing director at D.A. Davidson, instructed Lusso’s Information on Monday (video above).

“Going ahead, we predict AWS [Amazon Web Services] and GCP [Google Cloud Platform] even have a bonus over [Microsoft] Azure as a result of they’ve the aptitude to deploy their very own chips into their knowledge facilities, that are a fraction of the price of an Nvidia GPU — one thing Microsoft has but to do with its personal chips.”

Citing their very own hyperscaler semiconductor knowledge, the analysts at D.A Davidson mentioned Microsoft is “beholden” to Nvidia, its provider of AI chips.

“Microsoft is so reliant on Nvidia that it is virtually transferring wealth from its personal shareholders to Nvidia shareholders,” Luria mentioned.

As Lusso’s Information’s Dan Howley , Microsoft has launched into a broad push to infuse its huge portfolio of enterprise software program merchandise with AI capabilities because it seeks to outpace rivals within the area and monetize its monumental investments in AI expertise.

The corporate has been into constructing out its AI knowledge facilities, with its newest quarterly capital expenditures topping out at $19 billion, up 35% from the prior quarter.

Microsoft pointed to plenty of vibrant spots in its AI enterprise, noting that AI contributed 8 proportion factors of progress to its cloud Azure income, up from 7 proportion factors within the third quarter and 1 proportion level within the fourth quarter final 12 months.

Regardless of Monday’s downgrade, Microsoft shares have been buying and selling largely flat. The inventory, which topped in July, is up roughly 15% 12 months up to now.

Ines Ferre is a senior enterprise reporter for Lusso’s Information. Observe her on X at .

Markets

Sri Lanka greenback bonds tumble on post-election IMF, debt rework woes

LONDON (Reuters) – Sri Lankan greenback bonds fell sharply on Monday as traders fear an election win by Anura Kumara Dissanayake might see him revisit the phrases of the nation’s Worldwide Financial Fund (IMF) bailout and debt restructuring.

Dissanayake, who received the Saturday poll working for the Nationwide Individuals’s Energy (NPP) alliance, took workplace as president on Monday, promising change for the island nation, which is rising from its worst financial disaster in additional than seven many years.

Shorter-dated bonds suffered a few of the largest falls in early Asian buying and selling, dropping greater than 4 cents on the greenback, Tradeweb knowledge confirmed. By finish of buying and selling the 2025 maturity was down 2.125 cents, its largest every day drop since mid-April- and bid at simply over 50 cents.

The nation’s $2.9 billion, four-year IMF mortgage association has been key to the nation’s restoration whereas it has additionally tried to restructure its debt as required by the Fund.

The IMF on Monday welcomed the earlier authorities’s settlement in precept with its worldwide bondholders and stated it regarded ahead to working with President Dissanayake.

“On the financial entrance, the NPP has acknowledged that it will be seeking to renegotiate components of the $2.9 billion IMF program,” JPMorgan’s Toshi Jain stated in a observe to shoppers.

“A few of its leaders have expressed displeasure with the phrases of the debt restructuring whereas Mr. Dissanayake has acknowledged that he’s dedicated to debt repayments.”

The fund is because of undertake an everyday evaluation of reform progress on Oct. 1, which as soon as handed and signed off by the chief board triggers a payout of a funding tranche.

“We’ll talk about the timing of the third evaluation of the IMF-supported program with the brand new administration as quickly as practicable,” a fund spokesperson stated by way of e mail.

A second supply of concern for traders was that the change in authorities might additionally result in a renegotiation of a long-sought debt deal finalised with bondholders final week.

“A Dissanayake win is the worst doable final result for Sri Lanka’s bonds, elevating query marks not just for the IMF programme but in addition whether or not a brand new administration would honour the settlement reached with collectors on 19 September,” Hasnain Malik at Tellimer wrote in a observe to shoppers.

Sri Lanka’s foreign money and shares fared higher on the day. The rupee strengthened by 0.3% in opposition to the greenback whereas the principle inventory index gained greater than 1%. Sri Lanka shares have risen by simply over 4% this 12 months however have misplaced practically 9% over the previous quarter as uncertainty over the election weighed.

Markets

The essential position of Synthetic Intelligence (AI) in Bitcoin mining

Quantum Blockchain Applied sciences PLC is establishing itself as a key participant, pushing the boundaries of technological innovation with the introduction of latest strategies based mostly on synthetic intelligence (AI) and quantum computing to optimize calculations associated to the SHA-256 protocol utilized in Bitcoin mining.

The main focus of the corporate is geared toward making Bitcoin mining not solely quicker and extra worthwhile, but additionally extra sustainable from an power perspective.

With its cutting-edge analysis and improvement program, Quantum Blockchain Applied sciences is trying to revolutionize your entire mining ecosystem, due to the introduction of latest AI-optimized algorithms and superior applied sciences.

The essential position of Synthetic Intelligence (AI) in Bitcoin mining

The SHA-256 algorithm, used for the proof of labor within the mining of Bitcoin, requires a powerful quantity of calculations to unravel the advanced mathematical puzzles that make sure the safety of the blockchain. Quantum Blockchain Applied sciences has invested within the analysis of latest algorithms based mostly on intelligenza artificiale to enhance the effectivity of this course of.

The target of the corporate is to extend the effectivity of mining by 25 proportion factors, a powerful determine contemplating the big power expenditure at the moment required by mining operations globally.

Because of synthetic intelligence, Quantum Blockchain Applied sciences goals to cut back the variety of makes an attempt wanted to unravel SHA-256 calculations, optimizing using computational sources and, due to this fact, lowering the prices related to mining.

Within the extremely aggressive panorama of Bitcoin mining, ASIC (Utility-Particular Built-in Circuit) units are important for performing calculations with unparalleled effectivity. Quantum Blockchain Applied sciences is at the moment evaluating the opportunity of growing its personal ASIC chip, particularly designed to combine improvements based mostly on AI and quantum computing.

The creation of a proprietary ASIC chip represents a basic step for the corporate in its journey in direction of trade management. An optimized ASIC wouldn’t solely make Bitcoin mining quicker, but additionally provide the likelihood to raised handle power consumption, one of many main challenges for the trade.

Lowering power prices wouldn’t solely improve profitability, however it will additionally promote a extra ecological method to Bitcoin mining, a side that’s more and more related for governments and international monetary establishments.

Quantum Computing: the way forward for bitcoin mining?

Along with synthetic intelligence, Quantum Blockchain Applied sciences is exploring the applying of quantum computing in Bitcoin mining. Quantum computing, due to its capability to carry out extraordinarily advanced calculations exponentially quicker than conventional computer systems, may revolutionize the mining sector.

Using quantum computer systems would permit additional discount within the time required to unravel proof of labor algorithms, paving the way in which for larger effectivity and considerably lowering power consumption.

Though quantum computing remains to be within the improvement part, the potential purposes on this planet of Bitcoin mining symbolize an enormous alternative for innovation. Quantum Blockchain Applied sciences positions itself as one of many pioneers on this area, aiming to combine these revolutionary applied sciences into its future merchandise.

Regardless of current technological advances, Quantum Blockchain Applied sciences has reported monetary losses of round 5 million {dollars}. Nevertheless, the corporate continues to speculate closely in analysis and improvement, contemplating it a key ingredient for its future success.

A part of the technique to handle these monetary challenges contains searching for strategic partnerships with the primary gamers within the Bitcoin mining and blockchain sector. Quantum Blockchain Applied sciences is actively in negotiations with a number of main firms to combine its superior applied sciences into their operations.

A partnership of this sort may speed up the implementation of latest AI-based algorithms and using quantum computing, in addition to present faster entry to capital and sources essential for the event of the proprietary ASIC chip.

Discount of power prices: a major goal

One of many primary advantages of the options proposed by Quantum Blockchain Applied sciences is the discount of power prices related to Bitcoin mining.

With electrical energy consumption representing one of the important price objects for miners, the corporate’s improvements, which mix AI and quantum computing, may mark an actual turning level for your entire sector.

Via using extra environment friendly algorithms and the opportunity of implementing quantum computing, Quantum Blockchain Applied sciences goals to supply miners with instruments that permit them to extend the variety of Bitcoin mined with much less power expenditure. This resolution may have a direct affect on the profitability of mining operations, making the exercise extra accessible and sustainable in the long run.

Quantum Blockchain Applied sciences PLC is positioning itself as a number one innovator within the Bitcoin mining sector, due to the adoption of superior applied sciences equivalent to synthetic intelligence and quantum computing.

Regardless of the monetary challenges, the corporate continues to put money into the way forward for mining, with the purpose of enhancing the effectivity of SHA-256 calculations, lowering power prices, and creating extra sustainable options for miners.

The trail of Quantum Blockchain Applied sciences is actually formidable, but when its improvements succeed, they might radically remodel the Bitcoin mining ecosystem.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up