Markets

Boeing proposes 'closing' provide to hanging staff; union rejects vote

By Allison Lampert and David Shepardson

(Reuters) -Boeing made a “greatest and closing” pay provide to hundreds of hanging staff on Monday, however its largest union declined to place it to a vote, saying the planemaker had refused to discount over the proposal that fell wanting members’ calls for.

The U.S. planemaker supplied to reinstate a efficiency bonus, enhance retirement advantages and double a ratification bonus to $6,000 if the employees settle for the provide by Friday, in keeping with a letter despatched to Worldwide Affiliation of Machinists and Aerospace Employees officers by the corporate.

Boeing (NYSE:) is below intensifying stress to finish the strike that might price it a number of billion {dollars}, fraying the corporate’s already-strained funds and threatening a downgrade of its credit standing.

However IAM District 751 mentioned it could not maintain a brand new vote on the provide, which is contingent on being accepted by Friday and was not negotiated with the union.

“Logistically we do not have the power to arrange a vote for 33,000 individuals in a number of days like that anyway. Plus, it missed the mark on most of the issues our members mentioned have been necessary to them,” mentioned Jon Holden, the president of IAM District 751 who’s the lead negotiator on the Boeing contract.

He mentioned the union deliberate to survey members on Monday night to get their views on the newest Boeing proposal.

“We’re not obligated to vote (on) their provide,” Holden mentioned in an interview with Reuters. “We could, down the street. However our hope is that we are able to get into some dialogue so we are able to truly deal with the necessity of our members.”

He mentioned the Boeing proposal didn’t totally deal with priorities round retirement, wages and different points.

Boeing mentioned in a press release that its newest provide, which got here after unsuccessful federal mediation final week, made vital enhancements and addressed suggestions from the union and staff.

“We first introduced the provide to the union after which transparently shared the small print with staff,” the corporate mentioned.

Greater than 32,000 Boeing staff in Portland and the Seattle space walked off the job on Sept. 13 within the union’s first strike since 2008. The employees, who’ve sought 40% greater pay in addition to the restoration of a efficiency bonus, rejected a earlier provide by the corporate.

The union represents the employees who construct Boeing’s best-selling 737 MAX and different jets.

Boeing’s industrial planes chief Stephanie Pope had advised staff earlier than the strike that the corporate had held nothing again and that its provide at the moment was the most effective deal they might get.

“Staff knew Boeing executives might do higher, and this reveals the employees have been proper all alongside,” IAM President Brian Bryant mentioned in a press release.

The strike is the newest occasion in a tumultuous yr for the corporate that started with a January incident through which a door panel indifferent from a brand new 737 MAX jet mid-air.

An earlier tentative deal between Boeing and the union that supplied a 25% increase over 4 years and a dedication {that a} new aircraft can be manufactured within the Seattle space if it have been launched throughout the four-year settlement was voted down by greater than 90% of staff this month.

Boeing has frozen hiring and began furloughs for hundreds of U.S. staff to scale back prices amid the strike. Boeing has deliberate for staff to take one week of furlough each 4 weeks on a rolling foundation at some point of the strike.

The in depth furloughs present that new CEO Kelly Ortberg is making ready Boeing to climate a protracted strike that will not be simply resolved given the anger amongst rank-and-file staff.

North American unions have capitalized on tight labor markets to win hefty contracts on the bargaining desk, with mainline pilots, auto staff and others scoring huge raises in 2023.

The IAM mentioned that 5,000 of its members in Wichita, Kansas went on strike towards Cessna enterprise jet maker Textron (NYSE:) beginning on Monday.

Markets

One inventory being focused by a value-investing legend in a market he says has gotten too top-heavy

-

Worth-investing legend Invoice Nygren says the S&P 500 lacks the diversification it as soon as had.

-

He likes to put money into cheap firms with sufficient capital readily available to constantly purchase again shares.

-

Nygren talked about Corebridge Monetary as a high decide that checks all his packing containers.

The is not as risk-free as buyers would possibly assume, says Oakmark Funds’ Invoice Nygren, who lamented the S&P 500’s rising lack of diversification.

Slightly than purchase the mega-cap tech shares that dominate main indexes, the value-investing legend he is as an alternative targeted on cheap firms with ample money readily available to constantly purchase again shares.

“It is change into so essential to us that we make investments with firms which might be taking issues into their very own palms and utilizing extra capital to repurchase their very own inventory,” Nygren on Monday.

One inventory he pinpointed that matches the invoice is .

Whereas the inventory is at present buying and selling round $28 a share, Nygren sees it virtually doubling is guide worth to $50 by the tip of 2025, or about 4 or 5 occasions earnings. He additionally predicts that Corebridge might purchase again as a lot as 20% of its excellent inventory every year, a observe that typically engineers good points by growing the per-unit worth of every remaining share.

“It is a identify not many individuals learn about,” Nygren mentioned of the agency. “They do not must depend upon different buyers to acknowledge the worth. They simply hold lowering the stream.”

He continued: “I believe it simply creates an incredible alternative for firms which might be good companies, producing a variety of money stream, and it offers them the chance to extend per share worth by reinvesting in themselves.”

Learn the unique article on

Markets

Asian shares rise on China stimulus cheer; Australia lags earlier than RBA

Lusso’s Information– Most Asian shares rose on Tuesday with Chinese language markets main positive factors on studies of extra stimulus measures from Beijing, whereas Australian markets lagged earlier than a Reserve Financial institution assembly.

Regional markets took some constructive cues from gentle in a single day positive factors on Wall Road, with U.S. markets remaining in sight of document highs. However Wall Road futures retreated in Asian commerce, suggesting {that a} current rally could now be stalling.

Most Asian markets have been sitting on robust positive factors from the previous week, as buyers cheered a bumper rate of interest reduce by the Federal Reserve. Focus this week is on extra cues from the Fed and the U.S. economic system.

Chinese language shares surge on stimulus

China’s and indexes rose 0.5% and 0.7%, respectively, whereas Hong Kong’s index rose 1.8% and was the most effective performer in Asia.

Chinese language officers unveiled a slew of deliberate measures to additional spur financial development, with the Individuals’s Financial institution set to chop reserve necessities for banks by 50 foundation factors to unlock extra liquidity.

For the ailing property market, the federal government stated it will cut back mortgage charges for current loans. Bloomberg reported that the federal government was planning not less than 500 billion yuan ($70.8 billion) of liquidity assist for native shares.

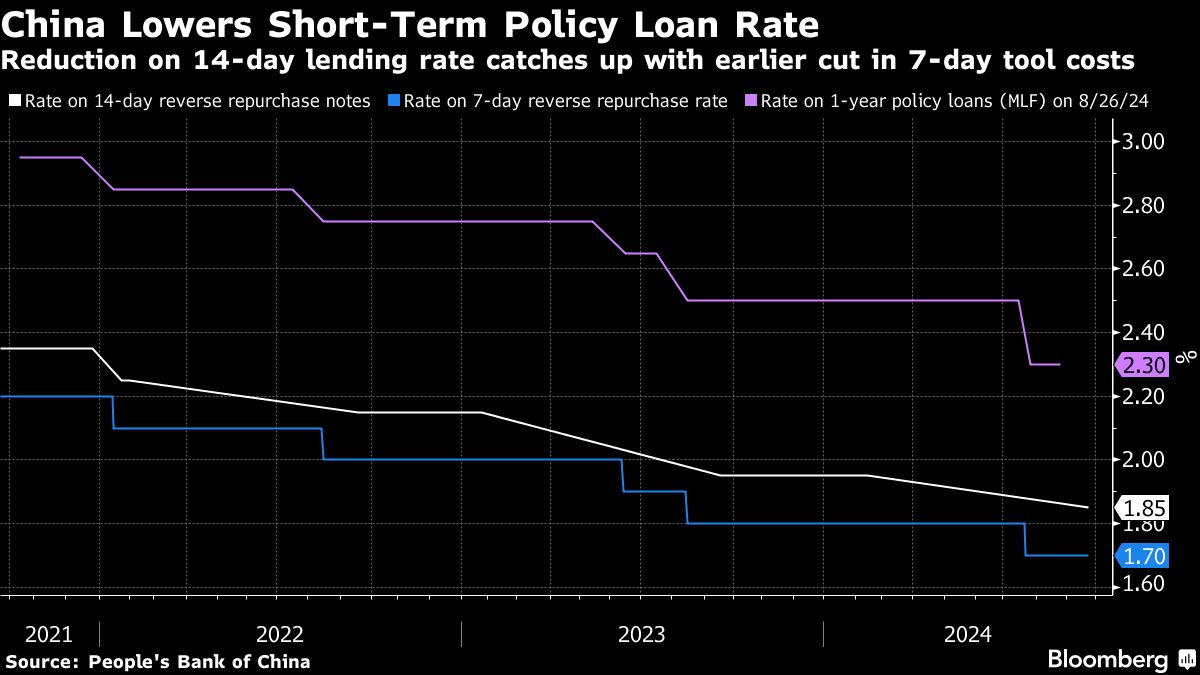

Tuesday’s strikes come after the PBOC had on Monday reduce a short-term repo price to additional increase liquidity. The strikes are aimed squarely at shoring up financial development, because the Chinese language economic system struggles with persistent disinflation and an prolonged property market downturn.

The CSI300 and SSEC indexes each hit close to eight-month lows in current classes, whereas the Hold Seng was additionally nursing current losses.

Broader Asian markets superior. Japan’s index rose 0.8%, whereas the added 0.5%, as buying managers index information confirmed the nation’s grew greater than anticipated in September.

However Japanese shrank for a 3rd consecutive month.

South Korea’s traded flat, whereas futures for India’s index pointed to a barely weak open, with the index going through resistance within the run-up to 26,000 factors.

Australian shares lag with RBA on faucet

Australia’s was the worst performer in Asia, shedding 0.5% earlier than the conclusion of a Reserve Financial institution of Australia assembly later within the day.

The RBA is broadly anticipated to , however can be set to strike a hawkish chord amid sticky Australian inflation and power within the labor market.

The central financial institution is more likely to sign that rates of interest will stay excessive for longer, and can be anticipated to reiterate its warning of future price hikes.

inflation information, due on Wednesday, is about to supply extra cues on the Australian economic system.

Markets

China’s Sweeping Stimulus Plan Lifts Asian Shares: Markets Wrap

(Lusso’s Information) — Asian shares rose after China’s central financial institution introduced stimulus measures in a bid to succeed in this 12 months’s financial development goal and stem a selloff within the fairness market.

Most Learn from Lusso’s Information

Fairness benchmarks in Hong Kong jumped greater than 2% on the open whereas onshore Chinese language shares additionally gained. The MSCI Asia Pacific Index rose 0.7%, with Japan benchmarks advancing greater than 1% after reopening from a vacation. The yield on China’s 10-year authorities bond declined to 2% for the primary time on report.

China will enable brokerages and funds to faucet the central financial institution’s funding to purchase shares, including assist after the CSI 300 Index fell to greater than a five-year low earlier this month. Individuals’s Financial institution of China governor Pan Gongsheng introduced a collection of stimulus measures at a uncommon briefing Tuesday, together with strikes to spice up banks’ lending to shoppers and corporates, and a lower to its key short-term rate of interest.

“Market individuals might like what they see at this time,” mentioned Jun Rong Yeap, a market strategist at IG Asia. The efforts “might drive a short-term rebound in Chinese language equities as the most recent transfer dispels earlier issues across the authorities’ inaction.”

US inventory futures edged decrease after the S&P 500 closed 0.3% increased within the earlier session, a whisker away from final week’s all-time excessive.

Knowledge launched Monday confirmed US enterprise exercise expanded at a barely slower tempo in early September, whereas expectations deteriorated and a gauge of costs acquired climbed to a six-month excessive, stoking confidence the world’s largest economic system can nail a smooth touchdown. Traders at the moment are awaiting knowledge on the Fed’s most popular worth metric and US private spending later this week.

Learn Extra on China:

The yield on policy-sensitive two-year Treasuries fell one foundation level to three.58% in Asian buying and selling, whereas longer dated Treasuries had been little modified. Merchants have been wagering on almost three-quarters of some extent of coverage easing by 12 months finish, suggesting a minimum of yet another jumbo price lower is in retailer.

Chicago Fed President Austan Goolsbee mentioned with inflation approaching the central financial institution’s goal the main target ought to flip to the labor market and “that doubtless means many extra price cuts over the following 12 months.”

Neel Kashkari on the Minneapolis Fed additionally pointed to weak spot within the job market, saying he backs decreasing rates of interest by one other half share level by 12 months finish. His counterpart on the Atlanta Fed, Raphael Bostic took a average stance. Beginning the central financial institution’s slicing cycle with a big step would assist convey rates of interest nearer to impartial ranges, however officers mustn’t decide to a cadence of outsize strikes, in line with Bostic.

In different key occasions for Asia, the Reserve Financial institution of Australia is anticipated to carry the money price at a 12-year excessive of 4.35% on Tuesday — and preserve it there till a minimum of February. The nation’s 10-year yield dipped in early buying and selling.

Gold steadied close to a report excessive after a number of Fed officers appeared to go away the door open to further massive price cuts. Oil edged increased after Israel launched airstrikes on Lebanon that killed almost 500 folks and boosted regional tensions.

Key occasions this week:

-

Australia price determination, Tuesday

-

Japan Jibun Financial institution Manufacturing PMI, Providers PMI, Tuesday

-

Mexico CPI, Tuesday

-

Financial institution of Canada Governor Tiff Macklem speaks, Tuesday

-

Australia CPI, Wednesday

-

China medium-term lending facility price, Wednesday

-

Sweden price determination, Wednesday

-

Switzerland price determination, Thursday

-

ECB President Christine Lagarde speaks, Thursday

-

US jobless claims, sturdy items, revised GDP, Thursday

-

Fed Chair Jerome Powell provides pre-recorded remarks to the tenth annual US Treasury Market Convention, Thursday

-

Mexico price determination, Thursday

-

Japan Tokyo CPI, Friday

-

China industrial income, Friday

-

Eurozone client confidence, Friday

-

US PCE, College of Michigan client sentiment, Friday

A few of the major strikes in markets:

Shares

-

S&P 500 futures had been little modified as of 10:44 a.m. Tokyo time

-

Nasdaq 100 futures had been little modified

-

Japan’s Topix rose 1.1%

-

Australia’s S&P/ASX 200 fell 0.1%

-

Hong Kong’s Hold Seng rose 2.4%

-

The Shanghai Composite rose 0.9%

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Lusso’s Information Greenback Spot Index was little modified

-

The euro was unchanged at $1.1111

-

The Japanese yen was little modified at 143.66 per greenback

-

The offshore yuan was little modified at 7.0595 per greenback

Cryptocurrencies

-

Bitcoin fell 0.5% to $63,003.3

-

Ether fell 1.2% to $2,630.29

Bonds

-

The yield on 10-year Treasuries was little modified at 3.74%

-

Japan’s 10-year yield declined 1.5 foundation factors to 0.815%

-

Australia’s 10-year yield declined two foundation factors to three.94%

Commodities

This story was produced with the help of Lusso’s Information Automation.

–With help from Mark Cudmore.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up