Markets

Cathie Wooden Goes Cut price Looking: 3 Shares She Simply Purchased

Most of the market indexes could also be hitting recent highs, however the identical cannot be stated of many precise shares. Shares of Pinterest (NYSE: PINS) and GitLab (NASDAQ: GTLB) are buying and selling greater than 30% off their 52-week highs. PayPal (NASDAQ: PYPL) hit a recent 52-week excessive on Monday, however it will nonetheless should quadruple from right here to revisit its all-time peak.

All three shares are owned by Cathie Wooden’s Ark Make investments assortment of exchange-traded funds for risk-tolerant progress traders. She added to all three positions on Monday. Let’s take a more in-depth take a look at Wooden’s three newest buys.

1. Pinterest

There’s excellent news and unhealthy information with regards to Pinterest. Let’s begin with the excellent news. Pinterest has overcome the swoon after its preliminary pandemic-era surge in recognition. Customers flocked to the visual-discovery engine in 2020 and 2021 to get concepts on all the pieces from recipes to dwelling makeover ideas. There was a lull in 2022 as its world viewers started heading exterior once more, however progress is accelerating for the second 12 months in a row.

Yr-over-year income progress has accelerated in 5 of the final six quarters. Prime-line good points have topped 20% by way of the primary half of this 12 months, one thing that traders have not seen since late 2021. Its viewers has widened by 12% over the previous 12 months, now clocking in at a document 522 million lively accounts. The underside line is faring even higher, as adjusted earnings per share soared 38% in its newest report.

Now let’s flip to the unhealthy information. The steering that Pinterest offered in was disappointing. The $885 million to $900 million in income that it is modeling for the present quarter is a step right down to between 16% and 18% progress. Analysts had been holding out for greater.

The counter to the unhealthy information is that Pinterest has been conservative earlier than. It was initially calling for a rise in income of simply 15% for the second quarter, however it got here by way of with a 21% bounce. It additionally appears to be fixing the monetization drawback that was dogging the inventory again in 2022. Common income per consumer rose 8% in its newest report.

2. PayPal

It has been three years since experiences started swirling of PayPal contemplating a buyout of Pinterest for $70 a share. Dealing with a backlash from PayPal shareholders, the fintech big went on to announce that it is now not exploring a purchase order of Pinterest. With Pinterest inventory buying and selling for $30 and alter proper now, it is easy to peg this as a missed connection for the social bookmarking web site. However that’s simply half of the proposed pairing’s story. PayPal was reportedly providing a largely stock-based deal, and its personal shares have fallen by greater than two-thirds in that point.

PayPal was a preferred pioneer in its prime, however progress traders have turned elsewhere. PayPal has rattled off seven consecutive quarters of single-digit share progress. The upside right here is that PayPal in all fairness priced, one thing that nobody was saying three years in the past when its shares had been peaking. You should purchase PayPal for an earnings a number of within the teenagers.

Another gamers on this promising house are rising quicker, however PayPal is not going away because it tops $5 billion in annual free money stream. It is a power with its 429 million lively customers. Complete fee quantity is accelerating, up 11% in its newest quarter.

3. GitLab

It could be stunning to see shares of GitLab buying and selling nearer to its 52-week low than its excessive. The corporate behind a versatile cloud-based platform that helps a corporation’s tech group construct, check, and deploy software program posted a powerful “beat and lift” quarter earlier this month. It has routinely blasted by way of Wall Road revenue targets, touchdown not less than 50% forward of the place Wall Road execs are parked over the previous 12 months.

Income progress has slowed, however the enterprise remains to be rising at a better-than-30% clip. The inventory might not be low cost — buying and selling for greater than 100 occasions this fiscal 12 months’s projected revenue — however wholesome momentum warrants a market premium. The inventory has but to get well from the early March stumble when it warned of decelerating progress this fiscal 12 months, however its newest replace is encouraging, and its AI-assisted software program improvement choices are promising. Wooden is a believer at present ranges.

Do you have to make investments $1,000 in Pinterest proper now?

Before you purchase inventory in Pinterest, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Pinterest wasn’t one in every of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $712,454!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends GitLab, PayPal, and Pinterest. The Motley Idiot recommends the next choices: quick September 2024 $62.50 calls on PayPal. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

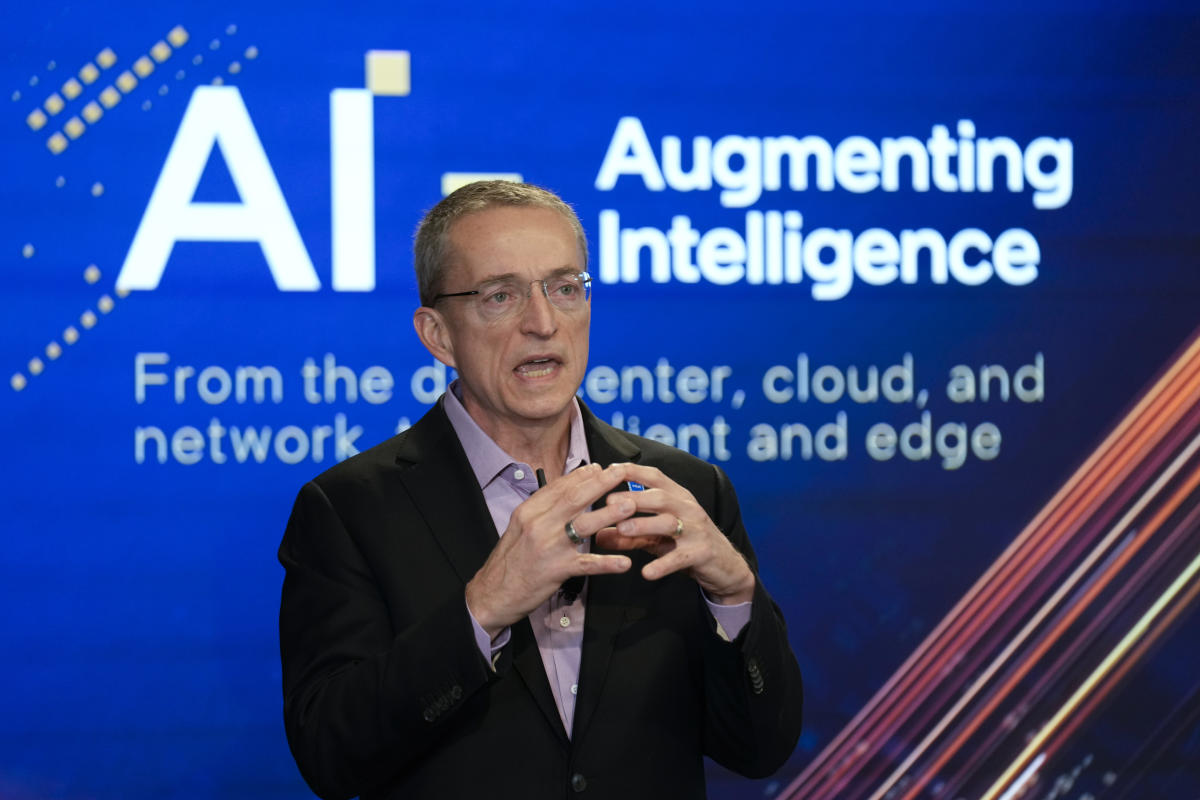

Intel launches new AI chips as takeover rumors swirl

Intel () revealed a pair of synthetic intelligence chips on Tuesday because it seeks to enhance its information middle enterprise and steal market share from rivals AMD () and Nvidia (). The brand new chips, the Xeon 6 CPU and Gaudi 3 AI accelerator, promise improved efficiency and energy effectivity and are available at a time when Intel is making an attempt to show it has what it takes to be a serious participant within the AI area.

The announcement follows a Wall Avenue Journal report that Qualcomm () to bolster its personal chip enterprise. Lusso’s Information, in the meantime, reported is considering making a multibillion-dollar funding within the chipmaker that may again Intel CEO Pat Gelsinger’s large turnaround plan. (Disclosure: Lusso’s Information is owned by Apollo World Administration.)

Intel says the brand new Xeon 6 chip presents P-cores, or efficiency cores, and says it options twice the efficiency of its predecessor. The chip, based on the corporate, is constructed for AI and high-performance compute situations together with edge and cloud methods.

The Gaudi 3 processor, then again, is purpose-built for generative AI functions and can compete instantly with Nvidia’s H100 and AMD’s MI300X line of chips. Intel says IBM () is utilizing its Gaudi 3 accelerators as a part of its IBM Cloud with the purpose of providing a decrease general complete value of possession.

“Demand for AI is main to an enormous transformation within the information middle, and the business is asking for selection in {hardware}, software program, and developer instruments,” Justin Hotard, Intel’s government vice chairman and normal supervisor of its Information Middle Synthetic Intelligence Group, stated in an announcement.

“With our launch of Xeon 6 with P-cores and Gaudi 3 AI accelerators, Intel is enabling an open ecosystem that permits our prospects to implement all of their workloads with higher efficiency, effectivity, and safety.”

Intel was additionally fast to level out that 73% of GPU-accelerated servers, servers designed to energy AI functions, use Xeon chips because the host CPUs they should operate correctly. However Intel’s chips aren’t the recent tickets they as soon as have been. Firms as an alternative try to get their arms on Nvidia’s line of AI chips, sending that firm’s inventory value hovering.

Nvidia’s inventory value is up a staggering 142% 12 months so far, whereas Intel shares have fallen a whopping 52%. AMD shares are up 12% in the identical time interval.

Throughout its newest quarterly earnings report in August, Intel reported worse-than-anticipated income and earnings per share and supplied a disappointing outlook for its present quarter. The corporate additionally stated it might reduce 15% of its workforce and suspended its dividend funds.

Gelsinger is making an attempt to return Intel to its former glory by pushing its groups to construct extra superior chips for the info middle and shopper PCs whereas concurrently constructing out its manufacturing capabilities.

Intel hopes to dramatically increase its chip fabs, the amenities the place it produces chips, each within the US and overseas. However the firm introduced final week that it’s going to put development of deliberate crops in Europe on maintain and that it gained’t begin up its superior packaging plant in Malaysia till demand for chips picks up.

Intel supplied as properly, saying that it’s going to construct customized chips for Amazon (), becoming a member of Microsoft () as one other marquee shopper for the corporate’s nascent third-party chip manufacturing enterprise.

The agency additionally stated it’s separating its foundry section from its design enterprise to supply a clearer separation between the 2 entities, giving potential prospects higher peace of thoughts that Intel’s design staff wouldn’t have entry to their very own chip designs.

However Intel’s struggles amid the turnaround have made it a takeover goal for the likes of Qualcomm, which might use the corporate to considerably increase its chip enterprise into the info middle and PC companies.

Qualcomm depends closely on its smartphone section. However smartphone gross sales have slowed through the years as prospects have begun holding on to their handsets longer, main Qualcomm to search for new development alternatives.

One such alternative contains constructing laptop computer chips meant to rival Intel’s personal line of processors. It can, nevertheless, take a great deal of time for Qualcomm to chip away at Intel’s PC market share if it manages to take action in any respect.

E mail Daniel Howley at dhowley@yahoofinance.com. Observe him on Twitter at .

Markets

Triumph Group minimize to Underperform at BofA as 'manufacturing uncertainty looms'

Lusso’s Information — Financial institution of America double-downgraded Triumph Group (NYSE:) to Underperform from Purchase, citing considerations in regards to the firm’s reliance on unsure manufacturing charges from Boeing (NYSE:) and Airbus.

Whereas TGI has made strides in remodeling its enterprise right into a leaner and extra targeted portfolio, BofA analysts expressed considerations that these optimistic modifications are being overshadowed by unpredictable plane manufacturing schedules.

“Because it pertains to the 737, the Installations phase is producing at price 13/mo (far beneath the speed required for margin enlargement),” stated BofA.

In the meantime, the Composites and Cabin Elements divisions are stated to be producing at a more healthy 30 plane per 30 days, however the analysts see additional draw back dangers as a result of uneven charges.

The financial institution provides {that a} extended strike at Boeing might result in destocking, compounding current challenges.

Along with manufacturing uncertainty, BofA raised considerations about Triumph’s free money circulation (FCF) era.

The corporate is ramping up manufacturing, and whereas Boeing and Airbus are presently accepting stock, Bofa says potential manufacturing cuts might exacerbate money burn by means of destocking.

The financial institution states that different FCF headwinds embody the sunsetting of the V-22 program, OEM deferrals, inflation, and provide chain shortages.

Though Triumph’s aftermarket enterprise is exhibiting energy attributable to prolonged service life for plane and 787 touchdown gear overhauls, it accounts for simply 20% of whole gross sales.

BofA sees this as inadequate to offset near-term headwinds, particularly as the corporate’s margins stay flat regardless of robust top-line progress.

As Triumph continues its portfolio reshaping and steadiness sheet restructuring, BofA expects the board to contemplate strategic alternate options, together with potential mergers and acquisitions.

Nonetheless, the analysts consider that any significant progress will possible happen as soon as the corporate reaches its year-end debt goal. BofA lowered its value goal for Triumph to $12 from $17.

Markets

European shares finish increased as markets cheer China's stimulus plans

By Pranav Kashyap

(Reuters) -European shares traded on a constructive notice Tuesday, as China’s sweeping stimulus measures boosted shares of luxurious firms and miners.

The pan-European index gained 0.9% to 520.88 factors by 0810 GMT. The stand out regional performer with a 1.5% leap was France, which is dwelling to a bunch of luxurious manufacturers.

China’s prime monetary regulators unveiled their greatest stimulus because the pandemic, saying they’d minimize financial institution reserves by 50 foundation factors whereas lowering mortgage charges.

Luxurious firms, which rely closely on Chinese language shopper spending, had been the most important increase on the index.

LVMH, Hermes, Kering (EPA:), Dior, and Burberry gained between 4% and 5%.

“The Chinese language shopper is by far the most important marketplace for European luxurious gross sales. That’s the connection buyers are making and taking a leap of religion that this Chinese language financial stimulus will feed by means of into the spending energy of the Chinese language shopper,” mentioned Ben Laidler, head of fairness technique at Bradesco BBI.

Primary assets led sectoral positive factors, leaping 4.5%, and set for his or her finest day in practically two years, as costs hit a two-month excessive supported by China’s measures and bettering demand within the area. [MET/L]

gained 0.6%, as shares of steel miners rose on China’s stimulus plans.

One other driver for investor sentiment is potential additional charge cuts by the U.S. Federal Reserve. Markets are at present evenly cut up on whether or not the U.S. central financial institution will go for an additional 50 foundation factors minimize or a 25 foundation factors minimize in November, the CME Fedwatch instrument confirmed.

Bradesco BBI’s Laidler famous that the Fed turning into extra aggressive is opening up room for different central banks just like the European Central Financial institution to observe go well with and speed up their rate- slicing cycle.

“The celebrities are form of realigning for Europe. The Fed maintaining the door open for an additional huge charge minimize is a constructive tailwind for Europe,” he mentioned.

The markets can even hold an eye fixed out for feedback from ECB board member, Elizabeth McCaul, set to talk later within the day.

Knowledge confirmed German enterprise morale fell greater than anticipated in September. Nonetheless, Germany, which is dwelling to numerous luxurious carmakers, noticed its benchmark index tick up 0.8%.

Amongst particular person inventory strikes, UK engineering agency Smiths Group (OTC:) misplaced 8% after its annual revenue missed estimates.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June