Markets

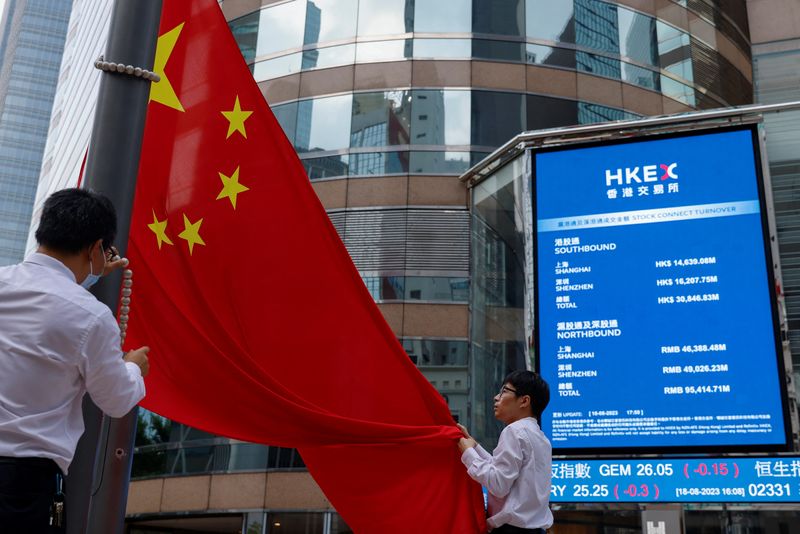

China shares soar in stimulus afterglow; greenback sags on price bets

By Kevin Buckland

TOKYO (Reuters) – Chinese language shares surged on Wednesday, lifting regional markets and serving to prolong a stimulus-fueled international rally that additionally underpinned risk-sensitive currencies, whereas Brent crude hovered close to a three-week excessive.

The greenback drooped after weak U.S. macroeconomic information in a single day boosted the case for a second super-sized rate of interest minimize on the Federal Reserve’s subsequent assembly. Gold rose to a contemporary all-time peak.

Mainland Chinese language blue chips superior 3.1% as of 0230 GMT, following a 4.3% bounce within the prior session. Hong Kong’s Dangle Seng climbed 2.2%, including to Tuesday’s 4.1% surge.

The robust begin for Chinese language shares invigorated different regional indexes, with Taiwan’s benchmark up 1.3% and South Korea’s Kospi gaining 0.1%

MSCI’s broadest index of Asia-Pacific shares exterior Japan rallied 1%.

Japan’s Nikkei shook off early weak point to rise 0.3%, helped by a retreat within the yen, a conventional protected haven.

The Folks’s Financial institution of China adopted its announcement of wide-ranging coverage easing on Tuesday with a minimize to medium-term lending charges to banks on Wednesday. Beijing’s broad-based stimulus – the most important because the pandemic – additionally consists of steps to spice up China’s inventory market and help for the ailing property sector.

“The main focus in Asia stays very a lot on China,” UBS analysts wrote in a word to shoppers.

“The controversy stays intense on whether or not there are legs to this rally, although the desk is seeing buyers opting to purchase/quick cowl first and ask questions later.”

The yen retreated about 0.17% to 143.47 per greenback, reversing earlier beneficial properties amid broad greenback weak point.

The euro ticked as much as $1.11915 after earlier pushing so far as $1.1194 for the primary time in a month.

Sterling edged as much as $1.3417, and earlier reached a contemporary excessive since March 2022 at $1.3430.

In a single day, information confirmed U.S. shopper confidence unexpectedly fell to 98.7 this month from an upwardly revised 105.6 in August. The decline was the most important since August 2021.

The percentages on one other 50-basis level Federal Reserve price minimize on the November assembly jumped to 60.4% from 53% a day earlier, in keeping with CME Group’s FedWatch Device.

In the meantime, Australia’s greenback initially scaled its highest since February of final yr at $0.6908 however then slipped again to $0.68915 after month-to-month inflation figures confirmed some cooling, doubtlessly establishing an earlier price minimize by the Reserve Financial institution.

“The autumn within the underlying measures of inflation is an surprising and welcomed shock,” mentioned Tony Sycamore, an analyst at IG.

Offered the cooling is replicated in quarterly value information subsequent month, “it units up a dovish pivot from the RBA,” resulting in a quarter-point price minimize in December, Sycamore added.

Gold rose 0.2% to $2,662.50 per ounce, and earlier marked a brand new document peak at $2,665.10.

Brent crude futures slipped 19 cents to $74.98 a barrel, however remained near Tuesday’s excessive of $75.87, a stage beforehand not seen since Sept. 3.

U.S. West Texas Intermediate crude misplaced 22 cents to $71.34 per barrel.

(Reporting by Kevin Buckland; Modifying by Shri Navaratnam)

Markets

‘Strongly dissatisfied’: Amazon staff plead for reversal of 5-day RTO mandate in nameless survey

Some employees are refusing to “disagree and commit,” as one of many firm’s famed management ideas requires of those that aren’t on board with a call.

As an alternative, lots of of the web retailing big’s staff are complaining that CEO Andy Jassy’s five-days-per-week return-to-office mandate, introduced final week, will negatively affect their lives—and productiveness at work—and the way they hope the corporate will reverse course.

The suggestions is from an nameless survey created by Amazon staff that was seen by Fortune on Tuesday. Company staff have shared it broadly through the messaging app Slack, together with in a single “distant advocacy” Slack channel with greater than 30,000 members {that a} former worker created when Amazon first introduced a three-day return-to-office mandate final 12 months.

Consequently, staff who’re in favor of distant or hybrid work might have been extra possible to answer the survey and subsequently skew the findings.

As of the afternoon of September 24, the common satisfaction ranking associated to the RTO mandate amongst survey respondents was 1.4 out of scale as much as 5 (with 1 which means “strongly dissatisfied” and 5 representing “strongly happy”). The survey’s creators stated in an introduction to their questionnaire that they plan to mixture and share the outcomes by e-mail with Jassy and different firm executives “to supply them with clear perception into the affect of this coverage on staff, together with the challenges recognized and proposed options.”

“We’re in search of sincere, constructive suggestions on the latest choice to require a 5-day return to the workplace schedule,” the survey introduction reads.

An Amazon spokesperson declined to remark.

Amazon has used a hybrid work construction for the previous 15 months earlier than Jassy’s latest bombshell announcement that the majority company staff can be required to work a full five-day work week from their native Amazon workplace beginning in January.

“After we look again over the past 5 years, we proceed to imagine that some great benefits of being collectively within the workplace are important,” final week. “I’ve beforehand defined these advantages, however in abstract, we’ve noticed that it’s simpler for our teammates to be taught, mannequin, apply, and strengthen our tradition; collaborating, brainstorming, and inventing are less complicated and simpler; instructing and studying from each other are extra seamless; and, groups are typically higher linked to 1 one other.”

Jassy clarification concerning the new mandate, and a second one asserting a deliberate thinning of center administration, got here throughout as inside Amazon lately, .

Fortune has talked to and messaged with a number of dozen Amazon company staff since final week’s announcement, with most opposing Jassy’s choice for causes together with diminished productiveness throughout in-office work days and management’s lack of belief in rank-and-file staff and managers, based mostly on the change in RTO coverage. In addition they complained concerning the affect the coverage could have on single mother and father and a scarcity of information explaining the choice from an organization whose leaders usually discuss up data-backed decision-making.

Some, nevertheless, applauded the transfer in communications with Fortune and argued that utilizing the size or value of commutes as excuses to keep away from 5 days within the workplace weekly would have appeared absurd just some years in the past pre-pandemic.

Nonetheless, most respondents opposed the change or cited issues that the brand new coverage will create.

“I work with folks throughout many time zones,” one response learn. “With RTO, they not have the flexibleness to simply shift hours and collaborate. 3 day had an immediate affect right here, and 5 day will solely be worse.”

As for an answer, the worker prompt “extra real looking work expectations if we’re eliminating WFH.”

“Amazon obtained used to folks having an additional 5-10 hours per week to work as a result of we weren’t commuting,” the worker stated. “RTO implies that we not have the additional time to decide to Amazon and expectations of staff wants to regulate to replicate that. On an identical be aware, we have to settle for that RTO locations onerous limits on assembly instances. I am unable to hop onto an 8am assembly with the parents in HQ2 or the East Coast anymore. After I was at residence, I might bounce on early or late conferences fairly simply, however I am bodily unable to do this now.”

A number of respondents targeted on the belief, or mistrust issue, and the concern, echoed by many staff, that the transfer will drive out prime expertise who can simply discover work elsewhere, whereas different teams with fewer choices stay.

“The folks that depart first are the robust engineers you need to work with,” one wrote. “Others that may’t discover new jobs or cannot depart as a result of visa are depressing and quiet stop. Anybody left that really needs to work has to select up the slack.”

One more, echoing others, stated they imagine that the mandate “ignores the problem of requiring folks to return into an workplace, however all of their work and each assembly is executed over chime or video convention.”

Most of those that selected “happy” or “strongly happy” didn’t depart remarks past their ranking, or left a unfavorable comment that signaled they might have by accident chosen a optimistic ranking.

The unhealthy information for these dissatisfied with the brand new return-to-the-office rule is that when a bunch of Amazon staff despatched a six-page memo to management final 12 months making the case to reverse the unique three-day in-office mandate, it was dismissed. With Jassy and group digging of their RTO heels additional, it is onerous to think about these outcomes producing any important change.

Are you a present or former Amazon worker with ideas on this matter or a tip to share? Contact Jason Del Rey at jason.delrey@fortune.com, jasondelrey@protonmail.com, or by safe messaging app Sign at 917-655-4267. You can even message him or at on .

This story was initially featured on

Markets

Japan watchdog to suggest penalties on Nomura's brokerage unit for alleged market manipulation, Yomiuri stories

TOKYO (Reuters) -Japan’s securities watchdog is predicted to suggest imposing tens of hundreds of thousands of yen in penalties on Nomura Holding’s brokerage unit for alleged manipulation within the authorities bond futures market, the Yomiuri reported.

The Securities and Trade Surveillance Fee will make the advice to the banking regulator, the Monetary Providers Company (FSA), which palms out such punishments in Japan, the newspaper stated in its report on Wednesday.

Nomura stated it was not able to remark at the moment however would take such allegations critically together with establishing the info.

The FSA stated in an e-mail that it could maintain a briefing on Wednesday afternoon concerning a advice to impose penalties, but it surely didn’t title Nomura or another firm and didn’t give another particulars.

A seller at Nomura, Japan largest brokerage agency, is suspected of manipulating the value of long-term authorities bond futures contracts in 2021 by means of a observe generally known as “spoofing”, the Yomiuri stated, citing at the least one supply.

The commerce includes illegally inserting numerous orders with out meaning to commerce after which cancelling them, the Yomiuri stated.

The Securities and Trade Surveillance Fee is concentrating on the corporate fairly than the person seller because the seller was a supervisor in Nomura’s world markets division, which trades the corporate’s personal funds, the Yomiuri stated.

Markets

Nvidia inventory jumps on report CEO Jensen Huang is completed promoting shares after $713 million windfall

-

Nvidia inventory closed 4% larger on a report that CEO Jensen Huang is completed promoting shares.

-

Huang raked in $713 million in complete proceeds from the gross sales.

-

He stays Nvidia’s greatest shareholder.

shares climbed as a lot as 5% on Tuesday as CEO Jensen Huang is completed with deliberate gross sales of inventory.

Huang has reached the 6-million-share most threshold he is permitted to promote below a prearranged plan adopted in March. The buying and selling plan, often known as a 10b5-1, permits firm insiders to commerce a agency’s inventory in a predetermined method.

Huang stays the corporate’s largest Nvidia shareholder. Based on an from September 18th, the manager holds over 75 million value of Nvidia frequent inventory; that is apart from one other 785 million held by varied trusts and partnerships.

The inventory has rallied 150% year-to-date. Nvidia has develop into a Wall Road favourite in recent times, as that its semiconductor {hardware} has develop into a core part of the substitute intelligence growth.

Its high clients embody different massive tech names, reminiscent of Microsoft, Meta, Alphabet, and Amazon.

Learn the unique article on

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June