Markets

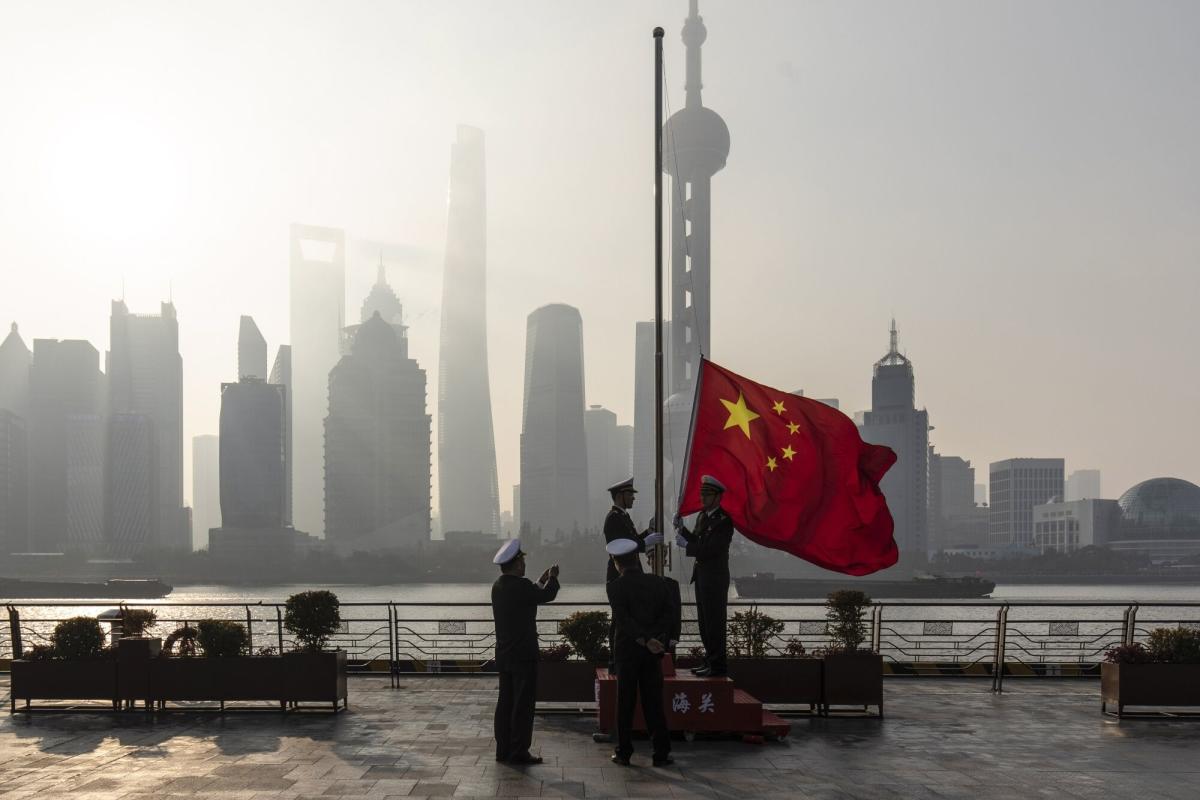

China Unleashes Stimulus Bundle to Revive Financial system, Markets

(Lusso’s Information) — China’s central financial institution unveiled a broad package deal of financial stimulus measures to revive the world’s second-largest economic system, underscoring mounting alarm inside Xi Jinping’s authorities over slowing development and depressed investor confidence.

Most Learn from Lusso’s Information

Individuals’s Financial institution of China governor Pan Gongsheng minimize a short-term key rate of interest and introduced plans to scale back the amount of cash banks should maintain in reserve to the bottom degree since a minimum of 2018 at a uncommon briefing alongside two of the nation’s different high monetary regulators in Beijing. That marked the primary time reductions to each measures had been revealed on the identical day since a minimum of 2015.

These strikes had been adopted by a slew of different bulletins that fueled positive factors in Chinese language shares. The central financial institution chief additionally unveiled a package deal to shore up the nation’s troubled property sector, together with reducing borrowing prices on as a lot as $5.3 trillion in mortgages and easing guidelines for second-home purchases.

For the nation’s beleaguered fairness market, Pan stated the central financial institution will present a minimum of 800 billion yuan ($113 billion) of liquidity help, including that officers had been finding out organising a inventory stabilization fund.

Whereas a number of of the measures had been anticipated by traders, the extremely publicized rollout confirmed authorities are taking severely warnings that China dangers lacking its development goal of round 5% this yr. The coverage barrage seemingly places that aim again inside attain, however doubts stay whether or not it was sufficient to interrupt China’s longer-term deflationary stress and entrenched actual property disaster.

Authorities have but to unveil extra forceful measures to spice up demand amongst shoppers, which some analysts view as a key lacking ingredient for the economic system.

“It’s exhausting to say what silver bullet may also help resolve all the pieces,” stated Ken Wong, Asian fairness portfolio specialist at Eastspring Investments Hong Kong Ltd. “Whereas it’s good to have financial easing measures which might be accommodative, extra must be achieved so as to assist solidify fourth quarter development.”

China’s benchmark CSI 300 Index () of shares rose as a lot as 4%, near erasing losses for the yr although the gauge remains to be down greater than 40% from its latest peak in 2021. Commodities markets eked out small positive factors and the yuan was little modified in opposition to the greenback. China’s 10-year bond yields rose 3 foundation factors to 2.06%, erasing an earlier decline to a document low.

Policymakers in Beijing have been making an attempt to revive the economic system with out resorting to the bazooka stimulus China utilized in earlier downturns, however such piecemeal efforts have been ineffective. Progress not too long ago slowed to its worst tempo in 5 quarters — a deterioration that’s testing the management’s tolerance for lacking its high-profile annual goal for the second time in three years.

“The aim of in the present day’s briefing is to inject confidence into the market, judging by the truth that the authorities revealed measures in a single go,” stated Larry Hu, head of China economics at Macquarie Group Ltd. “The stimulus push will nonetheless want coordination from different insurance policies — notably follow-up insurance policies from the fiscal facet.”

What Lusso’s Information Economics Says:

This might be a day to recollect for China’s financial coverage. The Individuals’s Financial institution of China unleashed a barrage of measures, from cuts to rates of interest and reserve necessities to creating central financial institution funding obtainable for traders to buy shares. Every particular person step by itself is critical. Delivering them is very uncommon and speaks to the urgency felt in Beijing to go off deflationary dangers and get development on monitor for this yr’s 5% goal … We estimate the increase to 2024 development to be round 0.2 ppt, with many of the influence falling in 2025.

Chang Shu, China economist

The Federal Reserve’s bigger-than-expected half-percentage level slash has given central banks throughout Asia extra room to maneuver. However earning money cheaper received’t raise the economic system if Chinese language shoppers don’t wish to spend as a result of layoffs are looming amid sliding company earnings and property costs are nonetheless falling. New dwelling costs clocked their largest decline final month from the earlier interval since 2014.

Pan’s decisive show of ramped up financial coverage now units the stage for the Finance Ministry to unveil its personal bid to defend the expansion goal. A plunge in income from land gross sales has held again fiscal spending this yr, crippling indebted native governments’ skill to spend money on growth-boosting tasks.

“It’s too removed from being a bazooka,” ANZ chief higher China economist Raymond Yeung stated of the package deal. “We’re not certain how a lot the mortgage charge minimize will induce a property restoration.”

The central financial institution governor unveiled his large coverage shift at his first high-profile press convention since March, showing alongside securities regulator Wu Qing, and Li Yunze, head of the Nationwide Monetary Regulatory Administration. The trio used their collective public debut to roll out steps to salvage investor sentiment and stem a selloff within the inventory market.

That included new monetary instruments to broaden liquidity for the inventory market, which might assist listed corporations and main shareholders purchase again shares and lift holdings.

The PBOC chief has displayed a extra clear strategy to coverage, with Pan on Tuesday successfully mapping out charge cuts and coverage strikes for the remainder of the yr. He used the same briefing in January to announce a RRR minimize two weeks earlier than it was efficient, as authorities tried to halt a stock-market rout.

“Financial coverage easing got here in bolder than anticipated,” stated Becky Liu, head of China macro technique at Normal Chartered Plc. “We see room for bolder easing forward within the coming quarters, following the Fed’s outsized charge cuts.”

—With help from James Mayger, Ocean Hou, Alan Wong, Wenjin Lv, April Ma and Iris Ouyang.

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

Markets

Bankman-Fried's ex-girlfriend Ellison to be sentenced over crypto fraud

By Luc Cohen

NEW YORK (Reuters) – Former cryptocurrency executive Caroline Ellison is set to be sentenced on Tuesday for her role in her imprisoned former boyfriend Sam Bankman-Fried’s theft of about $8 billion in customer funds from the now-bankrupt FTX exchange he founded.

Ellison has pleaded guilty to seven felony counts of fraud and conspiracy, and testified as a prosecution witness in the trial of Bankman-Fried, who was convicted of fraud and other charges last year and is serving a 25-year prison sentence stemming from FTX’s November 2022 collapse.

At her sentencing hearing scheduled for 3 p.m. EDT (1900 GMT) before U.S. District Judge Lewis Kaplan in Manhattan, Ellison will learn how much leniency she will earn from her cooperation with prosecutors.

Ellison, 29, will almost certainly get far less prison time than Bankman-Fried did. The crimes to which she pleaded guilty carry a maximum sentence of 110 years in prison.

Her lawyers have argued that she should get no prison time due to her cooperation. Without recommending a specific prison term, the U.S. Attorney’s office in Manhattan, which brought the charges, also urged Kaplan to go easy on Ellison, citing her “extraordinary” cooperation and expression of remorse.

“As FTX collapsed, Bankman-Fried persisted in publicly denying knowledge and fault,” prosecutors wrote in a Sept. 17 court filing. “Ellison, on the other hand, expressed relief that the fraud was exposed, and responsibility for her wrongdoing.”

Prosecutors said Ellison met with them about 20 times to help them piece together FTX’s unraveling and make their case against Bankman-Fried.

Prosecutors have called Bankman-Fried’s actions one of the biggest financial frauds in U.S. history. Bankman-Fried, 32, rode a boom in cryptocurrency prices during the COVID pandemic to a net worth by October 2021 of, according to Forbes magazine, $26 billion. He gained prominence as a generous donor to philanthropic causes and Democratic politicians.

His wealth evaporated when FTX collapsed in November 2022 amid a flurry of customer withdrawals. The company had been widely viewed as a relative safe-haven in a cryptocurrency industry beset by volatility and scams.

Bankman-Fried was charged a month later with stealing FTX customer funds to plug losses at Alameda Research, a cryptocurrency-focused hedge fund he founded and that Ellison ran from 2021-2022. Ellison pleaded guilty in December 2022.

Bankman-Fried is appealing his conviction and sentence, arguing that Kaplan wrongly excluded evidence showing he thought FTX had enough funds to cover customer withdrawals. In testifying in his own defense at trial, Bankman-Fried admitted to making mistakes while running FTX, but denied stealing money.

In his closing argument at Bankman-Fried’s trial, defense lawyer Mark Cohen accused Ellison of “pointing at Sam” to escape the pressure she faced after FTX’s collapse.

Ellison testified over three days at Bankman-Fried’s trial, telling the jury he directed her and others to take money from FTX’s customers without their knowledge. In tearful testimony, Ellison said she felt “indescribably bad” about the fraud, and that FTX’s collapse lifted the “dread” hanging over her.

“I felt a sense of relief that I didn’t have to lie anymore,” Ellison testified.

Nishad Singh and Gary Wang, two other former FTX executives who cooperated with prosecutors, are scheduled to be sentenced on Oct. 30 and Nov. 20, respectively.

Markets

4 Dividend Shares Yielding 4% or Extra to Purchase for Passive Revenue Proper Now

Investing in dividend shares might be a good way to construct your passive revenue. Many firms pay a portion of their income to buyers through dividends.

Whereas the common round 1.5% today (primarily based on the S&P 500’s yield), many provide even greater funds. Kinder Morgan (NYSE: KMI), Verizon (NYSE: VZ), Brookfield Infrastructure Companions (NYSE: BIP), and Agree Realty (NYSE: ADC) stand out for his or her payouts. All 4 firms provide dividends yielding 4% or extra. Additional, they’ve wonderful information of accelerating their funds.

Piping passive revenue into your portfolio

Kinder Morgan at present yields greater than 5%. The pipeline big backs that high-yielding dividend with very secure money stream. Roughly 68% comes from take-or-pay agreements and hedging contracts that pay the corporate a hard and fast price no matter volumes and commodity costs. In the meantime, most of its remaining earnings come from belongings that generate fee-based money stream with restricted fluctuations primarily based on their quantity publicity.

The corporate pays out about half of its secure money stream in dividends. It retains the remaining to fund its growth whereas sustaining its sturdy stability sheet.

Kinder Morgan at present has $5.2 billion in high-return growth tasks underway that can develop its money stream over the subsequent few years. It additionally makes use of its monetary flexibility to make accretive acquisitions (it purchased STX Midstream for about $1.8 billion late final 12 months). These progress catalysts ought to give it extra gasoline to extend its dividend. Kinder Morgan delivered its seventh consecutive 12 months of dividend progress in 2024.

Your connection to a prodigious passive revenue stream

Verizon gives a dividend yield of greater than 6% today. The telecom big lately delivered its 18th straight 12 months of dividend progress. That is the longest present streak within the U.S. telecom sector.

The cell and broadband firm generates lots of money. Its working money stream totaled $16.6 billion throughout the first half of this 12 months, sufficient to cowl its capital bills ($8.1 billion) and dividend funds ($5.6 billion) with room to spare. It used that extra money to strengthen its stability sheet.

Verizon’s steadily bettering stability sheet is enabling it to . That acquisition ought to ultimately assist develop its free money stream, which ought to enable it to repay that debt. In the meantime, its capital investments to develop its fiber and 5G companies must also assist enhance its money stream. These drivers ought to allow Verizon to proceed extending its dividend progress streak within the coming years.

Extra revenue from this feature

Brookfield Infrastructure Companions at present gives a dividend yield approaching 5%. That is a lot greater than its company twin, Brookfield Infrastructure Corp. (NYSE: BIPC), which gives a payout approaching 4%. The one distinction is that the publicly traded restricted partnership sends its buyers a Schedule Ok-1 federal tax type annually, whereas the company gives an easier-to-file 1099-Div Kind.

The economically equal entities pay the identical quarterly dividend fee, which they plan to develop by 5% to 9% yearly. That might prolong Brookfield Infrastructure’s already wonderful streak of accelerating its fee (15 straight years). The worldwide infrastructure operator generates secure and rising money stream to cowl its profitable payout. The corporate sees a mixture of inflation escalators, quantity progress, capital tasks, and acquisitions powering greater than 10% annual FFO–per-share progress within the coming years.

Numerous progress left

Agree Realty at present yields 4%. The retail REIT has grown its dividend, which it pays month-to-month, at a 5.7% compound annual price during the last 10 years.

The actual property funding belief focuses on proudly owning freestanding properties web leased or floor leased to high-quality retail tenants. Almost 70% of its hire comes from nationwide or regional tenants with investment-grade credit score rankings. In the meantime, prime tenant sectors are retailers resilient to the pressures of e-commerce and recessions, like grocery shops, house enchancment facilities, and tire and auto service areas.

Agree Realty steadily grows its portfolio of income-producing properties by making acquisitions or investing in growth tasks. It has a powerful stability sheet and a really lengthy progress runway. Its present tenants nonetheless personal over 166,000 of their areas, a large whole addressable market alternative for the roughly 2,200-property REIT.

Steadily rising passive revenue

Kinder Morgan, Verizon, Brookfield Infrastructure Companions, and Agree Realty provide dividend yields above 4%, backed by secure money flows and sturdy monetary profiles. Additional, this quartet has finished a wonderful job rising their payouts over time, which appears prone to proceed. These options make them wonderful dividend shares to purchase for these searching for enticing, steadily rising streams of passive revenue.

Must you make investments $1,000 in Kinder Morgan proper now?

Before you purchase inventory in Kinder Morgan, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the for buyers to purchase now… and Kinder Morgan wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has positions in Brookfield Infrastructure Company, Brookfield Infrastructure Companions, Kinder Morgan, and Verizon Communications. The Motley Idiot has positions in and recommends Kinder Morgan. The Motley Idiot recommends Brookfield Infrastructure Companions and Verizon Communications. The Motley Idiot has a .

was initially revealed by The Motley Idiot

Markets

Dunelm Group falls as largest shareholder cuts stake

Lusso’s Information — Shares of Dunelm Group (LON:) fell after WA Capital Restricted, an organization managed by Sir Will Adderley, the Deputy Chair of Dunelm, and Woman Nadine Adderley, had bought a serious portion of their shares within the firm.

At 5:02 am (0902 GMT), Dunelm Group was buying and selling 6.3% decrease at £1,157.50.

This sale, carried out via an accelerated bookbuild secondary inserting, concerned about 10 million abnormal shares of Dunelm’s issued share capital.

The final time Sir Will Adderley decreased his holdings in Dunelm was in February 2021.

Because of this sale, the Adderley household’s mixed possession in Dunelm will lower to 37.6%, from their earlier holding.

“Sir Will Adderley has undertaken that, following completion of the Inserting, he won’t get rid of additional shares within the Firm for a interval of a minimum of 180 days, topic to customary exceptions,” WA Capital stated in a press release.

Barclays acted because the Sole International Co-ordinator and Joint Bookrunner for this transaction, alongside UBS AG London Department.

The inserting’s specifics, together with the ultimate pricing, are set to be decided upon the closure of the accelerated bookbuilding course of.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up