Markets

Contemplating Microsoft Corp (MSFT) Forward Of Earnings Report? Right here's A Higher Different

Microsoft Corp (NASDAQ:) CEO Satya Nadella has made the Redmond software program big the largest beneficiary of the AI revolution due to his imaginative and prescient and technique. In 2019, when Microsoft invested $1 billion in OpenAI, the corporate behind ChatGPT, hardly anybody observed. However when ChatGPT was launched and the floodgates of generative AI innovation opened, Microsoft was seen because the chief within the AI arms race. Microsoft’s investments in OpenAI have now . The corporate’s lengthy listing of AI catalysts contains the revival of Bing Search, AI assistant Co-pilot, and AI PCs, amongst many others.

Is MSFT Overvalued?

Nevertheless, some consider the inventory has and wishes a breather amid Wall Road’s rising issues that only a handful of corporations now account for many of the market features. Morgan Stanley’s Lisa Shalett just lately stated in a be aware that the Magnificent Seven group of shares, together with MSFT, is poised to see “radical deceleration” in earnings progress, in accordance with a report by Searching for Alpha. Goldman Sachs fairness strategist David Kostin calculates that Microsoft’s gross sales progress within the second quarter will are available in at 15%, down from 17% within the earlier quarter, as per one other report by Searching for Alpha. The corporate is anticipated to report earnings on July 23. As the corporate will get an excessive amount of highlight and AI expectations from the inventory are too excessive, any decline in progress within the upcoming earnings might trigger the inventory to fall.

There are all the time undervalued gamers available in the market for many who know the place to look. Let’s focus on an AI underdog that analysts consider has extra upside based mostly on its robust progress catalysts.

Trending: If there was a brand new fund backed by Jeff Bezos providing a 7-9% goal yield with month-to-month dividends

Taiwan Semiconductor: A Higher AI Inventory Than MSFT?

Taiwan Semiconductor Mfg. Co. Ltd. (NYSE:) is without doubt one of the world’s most necessary and largest semiconductor corporations. Tweaktown stories that the corporate’s lengthy listing of shoppers contains tech giants like Apple, Nvidia, Qualcomm, AMD, and Broadcom, amongst many others. The AI revolution is anticipated additional to bolster Taiwan Semiconductor’s demand and market share. In accordance with Tweaktown’s report, the corporate has a whopping 70% to 80% share of the 5nm semiconductor market and a 90% share of the 3nm chips market. Information from consultancy agency TrendForce exhibits that Taiwan Semiconductor had a 60% share of the worldwide foundry market as of 2021.

Taiwan Semiconductor’s AI Income Development Projections

Taiwan Semiconductor’s chips are utilized in all the things from smartphones to electrical automotive sensors and PCs. Nevertheless, the large demand for high-end chips unlocked by the generative AI growth has made TSM a promising AI inventory. Throughout a primary quarter earnings name, Taiwan Semiconductor’s administration stated it expects income contribution from AI processors to double this 12 months and account for low-teens % of whole income. Income from AI is anticipated to develop at a 50% CAGR over the subsequent 5 years and account for over 20% of the corporate’s whole income by 2028.

Taiwan Semiconductor’s Moat within the Trade

Taiwan Semiconductor’s moat within the AI chips trade is powerful and broad. Firstly, the high-end chip manufacturing trade is not straightforward to enter, even for main corporations. Blackridge Analysis and Consulting agency stories that establishing a single 3nm fab might price as much as $20 billion. On prime of that, Taiwan Semiconductor’s actual power lies in churning tens of millions of chips with nearly no defects — the corporate’s yield is over 95%, in accordance with the Atlantic Council. Solely Samsung is anticipated to come back near Taiwan Semiconductor’s high quality and manufacturing functionality within the coming years amid its enormous investments and plans to foray into the fab trade. Apart from Taiwan Semiconductor, it has no formidable opponents.

Don’t Miss: Elon Musk and Jeff Bezos are bullish on one metropolis that might dethrone New York. .

Is the China Menace Overblown?

Regardless of its dominance within the AI chips trade, Taiwan Semiconductor’s share worth progress has been capped, and its valuation nonetheless seems engaging in comparison with its friends. The inventory’s ahead P/E is 27.7 (47 for Nvidia and 46 for AMD). The most important concern round TSM is a attainable Chinese language escalation towards Taiwan for the reason that firm’s main manufacturing operations are based mostly in Taiwan. Nevertheless, many analysts consider these issues are overblown and the corporate has no short-term dangers. They are saying China can not afford to enter a direct battle with the US. In accordance with a report by the Hudson Institute, any disruption in Taiwan’s semiconductor trade might end in a $1.6 trillion financial loss to the US. Taiwan Semiconductor’s chip trade dominance is seen as a ‘Silicon Defend’ for Taiwan, which the nation can use to discourage assaults. Earlier this month, Taiwan Semiconductor’s Chairman and CEO C.C. Wei stated that it is “not possible” to maneuver chip manufacturing exterior of Taiwan and that 80% to 90% of chip manufacturing stays within the nation.

Wall Road Thinks AI Increase Will Profit Taiwan Semiconductor

Wall Road can also be rising bullish on the corporate. Not too long ago, Bernstein analyst Mark Li stated that high-end telephones and superior nodes might end in Taiwan Semiconductor topping its 2024 steering. The analyst thinks the corporate’s information heart income is rising as anticipated. Li elevated his worth goal for TSM to $200 from $150. He expects Taiwan Semiconductor’s income to extend by 25% and EPS by 28% in 2024. Earlier this month, BofA’s Brad Lin additionally elevated his worth goal for TSM to $180. Lin thinks new AI plans revealed by Apple and different corporations on the Computex 2024 occasion would drive the on-device AI development, benefiting TSMC, which the analyst known as the “key enabler” of AI prosperity.

There Are Higher Excessive-Yield Alternatives

The present high-interest-rate setting has created an unimaginable alternative for income-seeking traders to earn huge yields, however not by dividend shares… Sure non-public market actual property investments are giving retail traders the chance to capitalize on these high-yield alternatives and Benzinga has recognized .

For example, provides a goal APY of 9% with a time period of solely three months, making it a robust short-term money administration software with unimaginable flexibility. EquityMultiple has issued 61 Alpine Notes Collection and has met all cost and funding obligations with no missed or late curiosity funds. With a low minimal funding of simply $1,000,

Do not miss out on this chance to benefit from high-yield investments whereas charges are excessive.

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & all the things else” buying and selling software: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

'You Don't Have Time To Waste Cash!' 59-12 months-Outdated With Solely $40,000 Saved Asks Dave Ramsey: Pay Down My Mortgage Or Save For Retirement?

In an episode of The Ramsey Present titled “, a caller named Dan from Colorado sought recommendation on whether or not to prioritize paying down his mortgage or saving for retirement. At practically 59 years previous, Dan shared his complicated monetary historical past, together with proudly owning a enterprise for 21 years, going through vital debt, and securing a steady job later in life.

Do not Miss:

Dan’s state of affairs just isn’t distinctive. Many individuals of their late 50s battle with debt reimbursement and retirement financial savings. Dan’s annual family earnings is roughly $145,000, and he has diminished his bank card debt from $92,000 to $5,000. Nonetheless, he nonetheless owes $206,000 on his mortgage and has solely $40,000 in retirement financial savings.

Dave Ramsey, a well known monetary advisor, offered a transparent motion plan for Dan. “Write a verify at this time and repay the bank card,” Ramsey suggested, highlighting the necessity to lower up the bank card and cease counting on debt.

Subsequent, Ramsey really helpful constructing an emergency fund of three to 6 months of bills. Dan talked about he had began saving and had $7,000 put aside. Ramsey instructed growing this to round $20,000 to offer a stable monetary cushion.

After establishing the emergency fund, Ramsey suggested Dan to avoid wasting 15% of his earnings for retirement. This equates to about $20,000 yearly. “If you’ll save twenty to thirty thousand {dollars} a yr for 10 years, you’re gonna have about six or eight hundred thousand {dollars},” Ramsey defined, illustrating the potential development of Dan’s retirement fund.

Trending: Warren Buffett as soon as stated, “Should you do not discover a solution to earn money whilst you sleep, you’ll work till you die.”

Ramsey highlighted the significance of aggressively paying down the mortgage. By dwelling on a strict price range and allocating vital parts of their earnings towards the mortgage, Dan and his spouse may very well be debt-free a lot ahead of anticipated. “Let’s take fifty [thousand dollars] and throw it on the home a yr,” Ramsey instructed, projecting that the home may very well be paid off in about 4 years.

Lastly, and budgeting to realize monetary stability. “You guys have gotten to cease spending. You don’t have time to waste cash,” he urged, emphasizing that strict budgeting and adherence to the child steps would result in long-term monetary success.

A number of components come into play when contemplating whether or not to pay down a mortgage or save for retirement. Paying off your mortgage can result in vital curiosity financial savings over time and supply the psychological advantage of being debt-free. For instance, in case you pay an extra $188 monthly on a 30-year mortgage, you could possibly pay it off in 20 years, saving round $27,216 in curiosity.

Trending: This Jeff Bezos-backed startup will help you.

Nonetheless, investing for retirement early can yield greater returns as a result of energy of compound curiosity. As an illustration, beginning early permits investments to develop extra considerably over time. A constant funding of $10,000 yearly with a median annual return of 8% can develop to almost $2.8 million over 40 years.

For people like Dan, the choice can hinge on their monetary state of affairs and targets. If the mortgage rate of interest is low and retirement financial savings are minimal, prioritizing retirement financial savings could be wiser to benefit from compound curiosity and potential employer matches on retirement contributions. Conversely, if the psychological advantage of being debt-free is important and the mortgage rate of interest is comparatively excessive, specializing in paying down the mortgage may very well be helpful.

In the end, a balanced method may fit finest for a lot of. Paying off high-interest money owed first, contributing to retirement financial savings, and making further mortgage funds can present a path to monetary stability and development. may help tailor this method to particular person circumstances, guaranteeing each fast monetary safety and long-term development.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & the whole lot else” buying and selling device: Benzinga Professional –

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

Australian courtroom guidelines PayPal unit used unfair time period in small enterprise contracts

(Reuters) -Australia’s federal courtroom has discovered that PayPal (NASDAQ:)’s native unit used an unfair time period in its customary contracts with small enterprise prospects who missed errors in overcharging, the nation’s securities regulator mentioned on Friday.

The courtroom discovered the time period was unfair as a result of prospects who didn’t convey the overcharging errors to PayPal’s discover inside 60 days have been pressured to simply accept the charges as correct, the Australian Securities & Investments Fee (ASIC) mentioned.

ASIC had initiated courtroom proceedings in opposition to PayPal over this challenge final September.

“At present’s determination serves as a reminder to all companies that unfair contract phrases contained inside customary kind contracts with small companies won’t be tolerated, and that ASIC will take decisive motion the place acceptable to guard the rights of customers and small companies,” ASIC Deputy Chair Sarah Courtroom mentioned.

ASIC mentioned that PayPal voluntarily assisted it throughout its investigation.

PayPal agreed that the time period was unfair, consented to the declarations, and voluntarily eliminated the time period from its contracts on Nov. 8, 2023, based on the regulator.

The courtroom additionally ordered PayPal to pay the ASIC’s litigation prices.

PayPal didn’t instantly reply to a request for remark.

Markets

UK Inventory Futures Rise, Pound Regular as Labour Set for Clear Win

(Lusso’s Information) — UK equity-index futures climbed and the pound held latest positive aspects after an exit ballot instructed the Labour Occasion could have a transparent mandate to ship on its pledge for better financial stability.

Most Learn from Lusso’s Information

Contracts on the FTSE 100 Index superior 0.2%, whereas the pound was little modified round $1.276. Early outcomes indicated the Labour Occasion will safe its long-predicted landslide election victory, with Keir Starmer set to turn out to be prime minister.

Heading into the vote, buyers have been betting {that a} win for Starmer’s center-left platform would imply an finish to policy-induced market meltdowns. Whereas Labour’s historic assist for increased taxes and commerce unions has historically put it at odds with markets, this time merchants are assured that the specter of the UK’s gilt disaster two years in the past will maintain the following authorities in examine.

“For the primary time in years, the UK can be a relative island of political stability and it will favor moderating threat premia and asset market reductions,” Evercore ISI’s Krishna Guha and Marco Casiraghi wrote in a be aware.

UK authorities bonds begin buying and selling at 8 a.m. in London.

Learn: Watch UK Banks, Homebuilders as Labour Heads for Election Win

The official election exit ballot predicted Labour will win 410 of the 650 seats within the Home of Commons, essentially the most since Tony Blair’s 1997 landslide. Prime Minister Rishi Sunak’s Tories are projected to be diminished to 131 seats, in contrast with 365 in 2019, a outcome that may doubtless see a number of the celebration’s greatest names voted out. The Liberal Democrats are heading in the right direction for 61, with Nigel Farage’s Reform UK on 13.

The exit ballot is predicated on a mass survey of tens of hundreds of individuals after they solid their ballots. That has usually made it extra correct in predicting the result of UK elections than snapshot surveys of voters’ intentions performed through the marketing campaign.

A big victory for the Labour celebration “ought to indicate an underlying bid tone for sterling,” mentioned Neil Jones, a foreign-exchange salesperson to monetary establishments at TJM Europe.

Earlier than the vote, Labour positioned financial stability on the high of its manifesto and pledged to stay to powerful spending guidelines. Rachel Reeves, an ex-Financial institution of England staffer who’s set to turn out to be the UK’s finance minister, mentioned that the administration wouldn’t increase three of the UK’s key taxes on wages and items.

Different guarantees included constructing extra homes, making a publicly-owned power firm and transferring to “reset the connection” with the EU — although Labour’s manifesto additionally dominated out a return to the one market or customs union.

Fiscal stability and any enchancment within the UK’s relationship with the EU can be supportive of gilts within the close to time period and have constructive implications for the pound, strategists at TD Securities led by James Rossiter wrote in a be aware on July 4.

What Lusso’s Information’s Strategists Say…

“If the last word outcomes are in keeping with the exit ballot prediction the pound is prone to be well-supported within the days to come back.”

— Ven Ram, cross-asset strategist.

Click on right here for extra

Nonetheless, the incoming authorities is inheriting a sluggish and fragile economic system. Whereas inflation has fallen again to the Financial institution of England’s 2% goal, costs for providers stay sticky. And a rebound from final 12 months’s technical recession seems to be dropping momentum, based on the newest progress information. However anticipated interest-rate cuts by the BOE within the subsequent few months give bond buyers another excuse to favor gilts.

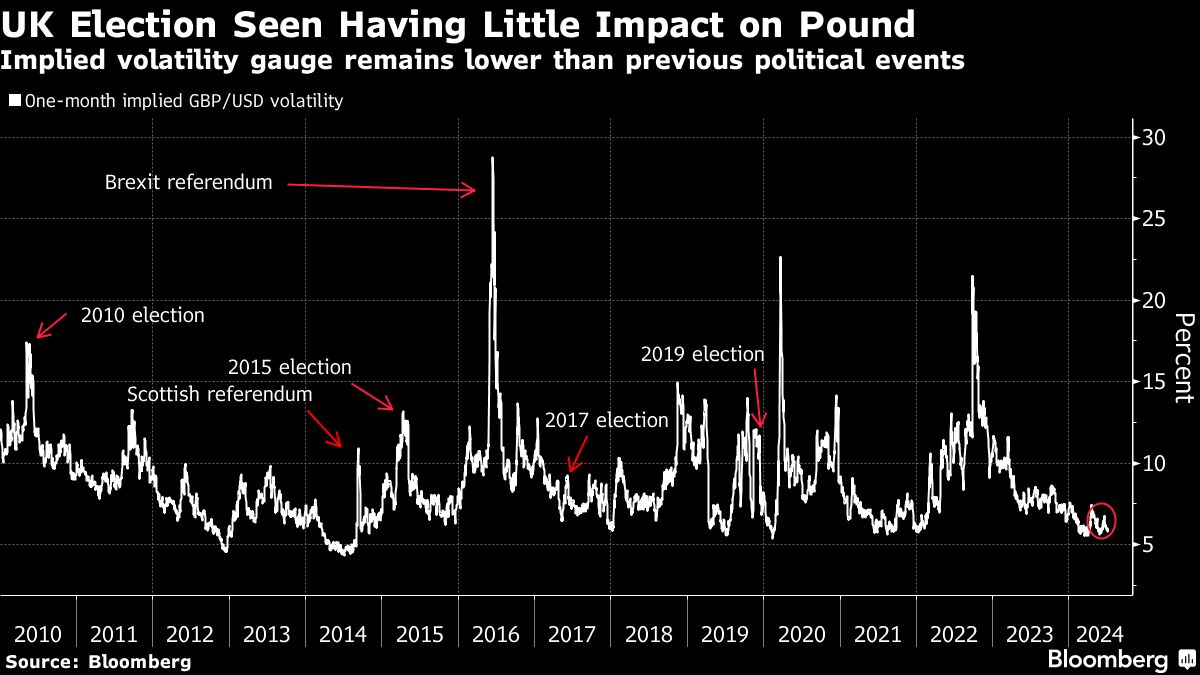

A Labour win has been broadly priced in by markets, because the celebration held a commanding lead in polls for effectively over a 12 months earlier than Sunak known as a snap election on Might 22. That didn’t change after the election date was set, leaving the pound regular, bond volatility low and shares hovering simply off a peak. The FTSE 100 even rallied 1.5% prior to now two days, essentially the most in practically two months, whereas world equities prolonged a document excessive.

“Markets like certainty and so Labour profitable decisively can be welcomed,” Nigel Inexperienced, founding father of wealth administration agency deVere Group wrote in a be aware. “This enhance is prone to be restricted, nevertheless, because the markets have already largely priced within the expectation.”

The calm in monetary markets places the UK in distinction with neighboring France, the place President Emmanuel Macron’s determination to name a snap vote in early June ignited a selloff. The yield premium on French bonds over safer German debt at one level rose to ranges final seen within the depths of the euro-area debt disaster. The transfer pared this week as polls present the far-right Nationwide Rally is unlikely to attain an absolute majority in a vote Sunday.

“With political turmoil hitting different developed economies on the identical time, this large majority might current the UK to buyers as considerably of a political protected haven,” mentioned Lindsay James, a strategist at Quilter Traders.

It’s additionally a far cry from years the place UK markets danced to the tune of political drama. Scotland’s referendum on independence, the Brexit vote, and the years of fractious negotiations that adopted prompted gyrations within the pound and shares. On the final common election in 2019, in the meantime, buyers fretted over former Labour chief Jeremy Corbyn’s left-wing insurance policies together with nationalization and employee stakes in corporations.

Extra not too long ago, former Prime Minister Liz Truss’s bundle of unfunded tax cuts roiled markets in 2022 after a sudden rise in bond yields triggered pressured promoting from leveraged pension fund methods. Gilts plunged, forcing a unprecedented Financial institution of England intervention.

That occasion has loomed giant over politicians since, and each Labour and the Conservatives preached financial warning through the election marketing campaign. Former Labour shadow chancellor Ed Balls mentioned the celebration had put itself right into a fiscal “straitjacket” by ruling out each austerity and tax rises. And Starmer’s goal for annual progress of no less than 2.5%, which could assist fund further spending, has been criticized by economists as unrealistic.

Markets, in the meantime, are watching intently for any indicators of further bond issuance to generate funds. The UK nationwide debt is on the highest ranges because the Nineteen Sixties as a proportion of gross home product, and Britain is already dedicated to certainly one of its greatest annual borrowing sprees on document. Additional will increase may damage urge for food for gilts amongst buyers.

“For now, the markets will simply be blissful to get an election over and carried out with, and that ought to profit market sentiment,” mentioned Kyle Rodda, senior market analyst at Capital.Com.

–With help from John Cheng and Abhishek Vishnoi.

(Updates with context about world shares in thirteenth paragraph and chart)

Most Learn from Lusso’s Information Businessweek

©2024 Lusso’s Information L.P.

-

Markets3 months ago

Markets3 months agoUnitedHealth Group Demonstrates Resilience in Q1 2024 Financial Report

-

Markets3 months ago

Markets3 months agoUnderstanding a Flash Crash in the Stock Market

-

Markets3 months ago

Markets3 months agoA Glimpse Into the Buzz of Upcoming IPOs in April 2024

-

Markets3 months ago

Markets3 months agoWiSA Technologies Shares Surge After Strategic Licensing Agreement and Reverse Split

-

Markets2 months ago

Markets2 months agoThe Most Shorted Stocks as of Late March 2024

-

Markets1 month ago

Markets1 month agoTechnical Analysis of Tupperware Brands Corporation (TUP)

-

Markets1 month ago

Markets1 month agoPetco (NASDAQ: WOOF) Beats Q1 CY2024 Estimates: What Traders Should Know

-

Markets1 month ago

Markets1 month agoSnowflake Inc. (SNOW) Earnings Miss: What It Means for Traders

-

Markets1 month ago

Markets1 month agoMGO Global Inc. (NASDAQ: MGOL) Surges 446% on Strong First Quarter Earnings

-

Markets1 month ago

Markets1 month agoGreenwave Technology Solutions (NASDAQ: GWAV) Plummets 62% After Announcing Share Offering

-

Markets3 months ago

Markets3 months agoBoeing’s Proactive Measures Ahead of Whistleblower Hearing