Markets

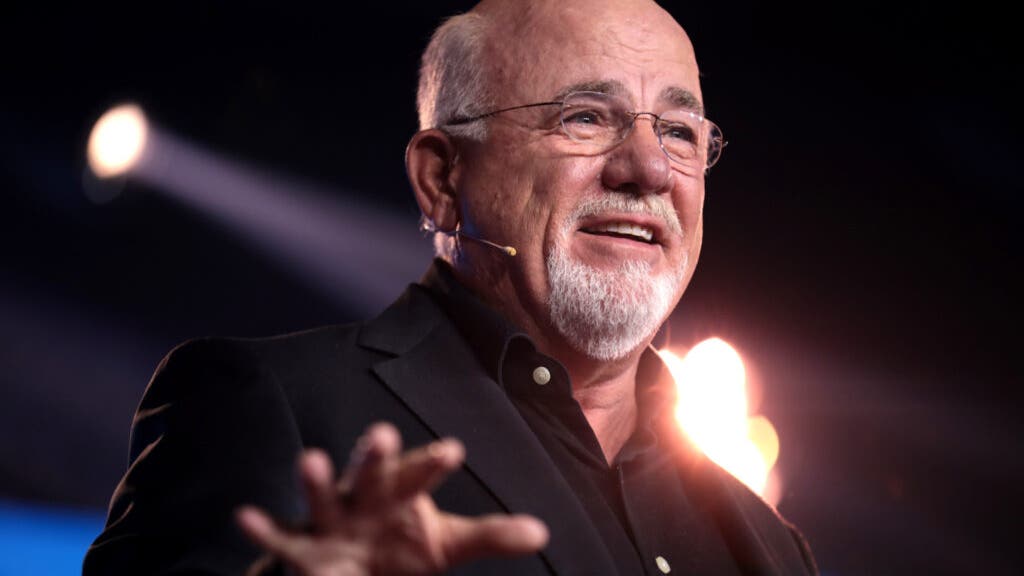

'Dave Ramsey 'Calls BS' On Money App Survey Reporting That 1-in-4 Gen Z Tax Filers 'Want A Therapist To Deal With The Stress Of Tax Submitting'

Throughout an episode of the Dave Ramsey present, Rachel Cruze reads a statistic about Gen Z tax filers to , and his response is priceless. This is what occurred.

Cruze, who occurs to be Ramsey’s daughter and a private finance professional, stumbled throughout an attention-grabbing statistic about Gen Z and the way pressured they felt throughout tax submitting season. The statistics had been present in a survey shared by CNBC Information.

Reed Subsequent:

Realizing how her father would react earlier than sharing this statistic with him, Cruze reminds Ramsey that he’s a traditional boomer and laughs earlier than telling him, “We will play a sport. Dave, strive to not make a face.” Cruze ensures Ramsey is prepared earlier than telling him {that a} survey discovered that 1 in 4 Gen Z tax filers “want a therapist to cope with the stress of tax submitting season.” Cruze provides that 54% have stated that tax submitting has introduced them to tears or anticipate it would convey them to tears.

Ramsey, who is thought for his blunt and hard-hitting recommendation, solely had one phrase for that statistic: “vote,” and added, “Attempt voting for any person that does not like taxes.” Careworn taxpayers could also be in for extra of a shock if are greenlit. Biden’s proposed tax for the 2024 fiscal yr sees a rise in tax charges for company, particular person and capital good points revenue tax that’s anticipated to influence 12.5 million middle-class People’ retirement financial savings.

Whereas his response might come throughout as unsympathetic, Ramsey does agree that submitting continues to be traumatic, though he is “by no means cried, however been doing it some time. Hadn’t seen a therapist for it, however been doing it for some time.” Each Cruze and Ramsey admit that taxes do “suck” and so they’re not enjoyable, however the youthful era has set the bar actually low. Ramsey reveals that taxes do not make him cry. They only make him perpetually indignant, which is one thing that many can relate to. One other survey from the Nextdoor Buyer Insights and Analytics group discovered that 64% of members had heightened emotions of stress throughout tax season.

Trending: Boomers and Gen Z agree they want a wage of round $125,000 a yr to be completely satisfied,

Cruze then asks her father for his perspective on the problem. She asks, “Is it that we have not prepped each era for what it appears like from a workforce standpoint the applying of being an grownup?” She requested if it’s because these realities weren’t talked about or taught that persons are so pressured they want a therapist.

Ramsey feels there are a few prospects, however he would not agree with this survey and says, “I am calling BS on the survey.” In line with Ramsey, he is by no means seen his crew of Gen Z crying or seeing a therapist over taxes. Ramsey additionally feels that Millennials and Gen Z have extra robust individuals in them than that survey makes out and has loved working with them on his crew.”

“That survey says all the era’s a bunch of wusses. That is simply not true. That is not my expertise with Gen Z,” stated Ramsey. For Ramsey, he has discovered that there are a lot of younger people who find themselves truly very mature and severe.

In actual fact, Ramsey feels that his personal era of child boomers must brush up on their monetary hygiene and study from the youthful era. That is what his entire present is about: educating individuals monetary duty and transparency, which is what Gen Z is doing. Whereas remedy could seem excessive to Ramsey, remedy is thought to help with serving to individuals cope with stressors and for a lot of, tax is a giant one. In line with Nextdoor Enterprise, some further methods to minimize the influence of stress brought on by tax submitting are educating your self on tax fundamentals, searching for assist from an account, and submitting your taxes early.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & all the pieces else” buying and selling instrument: Benzinga Professional –

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

Markets

2 Shares That May Soar in 2025, In keeping with This Metric

Nvidia (NASDAQ: NVDA) and Meta Platforms (NASDAQ: META) have rocketed larger this 12 months. However these firms are benefiting from highly effective developments in knowledge middle spending and digital promoting that might ship their share costs to new highs in 2025.

These shares commerce at comparatively low in comparison with Wall Road’s 2025 earnings estimates, which might arrange one other monster run for traders subsequent 12 months. This is how these shares can ship.

1. Nvidia

Nvidia continues to report phenomenal development, as knowledge facilities transition from conventional computing to accelerated computing techniques to deal with workloads. Demand for the corporate’s graphics processing models (GPUs) has been off the charts, which despatched the top off 161% during the last 12 months.

The inventory’s ahead P/E is 28 primarily based on subsequent 12 months’s earnings estimate, which is simply too low, given Wall Road’s estimate calling for 40% earnings development subsequent 12 months and 36% over the following a number of years. The inventory at the moment trades at a P/E of 53 on trailing-12-month earnings. If the inventory is buying and selling on the identical trailing P/E and Nvidia stays on observe to satisfy subsequent 12 months’s earnings estimate, the share value might climb over $200.

The inventory pulled again during the last month amid issues concerning the delay of Nvidia’s new Blackwell computing platform. However demand developments look very favorable. Administration expects to start producing income from Blackwell within the fourth quarter, and that might be additive to demand for its current-generation chip.

Importantly, administration pointed to quite a lot of workloads driving development for its knowledge middle enterprise. Prospects are shopping for its {hardware} for generative AI mannequin coaching and inferencing, along with growth of cutting-edge AI fashions. Demand is coming from shopper web providers and 1000’s of start-ups constructing AI purposes throughout healthcare, promoting, and schooling.

Nvidia inventory was buying and selling at an identical P/E in December earlier than the inventory doubled in 2024. The present valuation suggests it might repeat that efficiency once more because it launches Blackwell.

2. Meta Platforms

Digital promoting is making up a rising share of complete advert spending, and this continues to gasoline development for Fb proprietor Meta Platforms. The social media inventory is up greater than 80% during the last 12 months, however nonetheless trades at a really engaging valuation that may assist extra positive aspects in 2025.

Meta shares commerce at a ahead P/E of twenty-two on subsequent 12 months’s earnings estimates. That is nicely beneath Meta’s common P/E during the last 10 years of 38. The inventory might climb as a lot as 50% if the inventory’s P/E closes a few of that hole. Analysts anticipate Meta’s earnings to develop at an annualized price of 17% over the long run, which justifies a better P/E.

Meta has an extended runway of development in digital promoting, and the corporate’s investments in AI will assist unlock that potential. In early 2023, Meta introduced Llama, a big language mannequin that may interpret a string of phrases to finish a textual content. It is already launched Llama model 3.1, which is having an influence on its income development.

Llama is the know-how behind Meta AI, a private assistant that has improved the person expertise on Meta’s social media platforms. Meta AI is driving larger person engagement and upside in promoting income. Meta’s income grew 22% 12 months over 12 months in Q2.

Given the expansion alternative, Meta plans to take a position closely in AI infrastructure. Meta is a extremely worthwhile enterprise with $49 billion in free money move. It may afford to take a position aggressively in AI and acquire a technological edge. Given these benefits, the inventory appears conservatively valued and deserving of a better valuation.

Must you make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Nvidia wasn’t one among them. The ten shares that made the lower might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our advice, you’d have $710,860!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

Randi Zuckerberg, a former director of market growth and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. has positions in Meta Platforms and Nvidia. The Motley Idiot has positions in and recommends Meta Platforms and Nvidia. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Did the Fed simply begin the following bullish cycle for mortgage REITs?

Lusso’s Information — The Federal Reserve’s current choice to chop rates of interest by 50 foundation factors could have sparked the following bullish cycle for mortgage REITs (mREITs), in keeping with a brand new report from B. Riley.

The agency notes that traditionally, rate-cutting cycles from the Fed have coincided with rising efficiency in mortgage-related shares, as mREITs, that are extremely delicate to rate of interest adjustments, profit from decreased funding prices and improved earnings potential.

B. Riley emphasizes that mREITs rely closely on short-term debt financing, which usually matures in 30 to 90 days.

As rates of interest decline, B. Riley explains that mREITs can refinance at decrease charges, which “enhances carry-on long-duration MBS holdings” and boosts earnings energy.

The be aware additionally highlights how decrease charges permit administration to function with larger leverage and widen length gaps, additional bettering profitability.

“We consider most mortgage inventory valuations at this time don’t seize the anticipated enchancment in fundamentals,” B. Riley states, mentioning that residential mREITs at the moment commerce close to 0.9x e book worth with a 13% ahead dividend yield.

Company mREITs, resembling ARMOUR Residential REIT (NYSE:) and Cherry Hill Mortgage (NYSE:) Funding, are anticipated to see the best profit from the Fed’s charge cuts resulting from their reliance on fixed-rate mortgage-backed securities (MBS) and short-term financing.

Hybrid and non-agency mREITs, together with Ellington Monetary (NYSE:) and New York Mortgage (NASDAQ:) Belief, are additionally anticipated to achieve from improved securitization economics and better mortgage origination volumes.

In the meantime, business mREITs, resembling Franklin BSP Realty Belief, are anticipated to learn from improved cap charges and elevated transaction volumes, regardless of modest unfold compression.

B. Riley concludes that with the Fed more likely to proceed reducing charges, mREITs are well-positioned for a sustained bullish cycle.

Markets

Prediction: These 2 Synthetic Intelligence (AI) Shares Are About to See Large Progress

Synthetic intelligence (AI) shares have roared larger in current instances — and for good purpose. This thrilling know-how already is driving monumental income progress at corporations making AI services and products — and clients are investing in these instruments because of the promise of AI to revolutionize their companies. For instance, AI could speed up the event of latest and higher medication or make autos safer and simpler to function.

Buyers, recognizing this promise, have piled into , and these gamers have helped the S&P 500 index climb practically 20% thus far this yr. Although corporations within the subject of AI have seen their shares soar, it is not too late to get in on many compelling gamers. In truth, it is a good time to spend money on two specifically — my prediction is these AI corporations are about to see huge progress. Let’s examine them out.

1. Palantir Applied sciences

Palantir Applied sciences (NYSE: PLTR) helps its clients combination their complicated internet of information and put it to work — to allow them to combine this knowledge into their methods and harness its energy to make key choices. For many of its historical past, the 20-year-old firm counted on authorities contracts to drive income progress. However, in current instances, a brand new progress driver has emerged.

Palantir’s industrial enterprise has taken off, helped by the corporate’s funding in AI. Final yr, Palantir launched its Synthetic Intelligence Platform (AIP), an AI-powered system that helps clients shortly zoom in on their knowledge and uncover the way it might help advance their enterprise objectives. The corporate even has created a genius approach of promoting the platform to potential clients — by holding bootcamps that permit them to get a style of its capabilities.

And this long-established firm’s new guess is paying off. AIP is driving income within the authorities and industrial companies — and industrial now’s its highest-growth enterprise. In the newest quarter, U.S. industrial income superior 55% in contrast with a 24% acquire for U.S. authorities income. Palantir had solely 14 industrial shoppers 4 years in the past, and at present it has practically 300, illustrating the progress made in a brief time period.

AIP’s fairly current launch, the excessive demand for the platform, and the industrial numbers we have seen thus far counsel that explosive progress for Palantir could also be proper across the nook. And which means the inventory might have loads of — even after current beneficial properties — over the lengthy haul.

2. Tremendous Micro Laptop

Tremendous Micro Laptop (NASDAQ: SMCI) is a key behind-the-scenes participant on this planet of AI. The corporate makes the tools essential to the operations of AI knowledge facilities — from workstations to full-rack scale options. Supermicro is not the one tools maker round, but it surely has managed to develop 5 instances sooner than the business common over the previous 12 months.

The explanation for the corporate’s success? It really works hand-in-hand with the world’s high chip designers — together with market chief Nvidia — in an effort to instantly combine their improvements into its merchandise. Supermicro’s constructing blocks know-how — with most merchandise involving related elements — additionally favors pace. So, clients know they will shortly get a product tailor-made to their knowledge facilities with the most recent know-how after they order from Supermicro.

This has pushed main progress on the tools firm, with quarterly income this yr hovering previous the extent of annual income as not too long ago as 2021. In the newest quarter, income got here in at $5.3 billion, a acquire of greater than 140% yr over yr.

On high of this, a brand new wave of progress could also be forward. Supermicro is nicely positioned to unravel one of many greatest issues dealing with AI knowledge facilities, and that is the buildup of warmth. That is because of the corporate’s direct liquid cooling (DLC) know-how. Supermicro says that over the approaching 12 months, as a lot as 30% of latest knowledge facilities will likely be geared up with DLC — and Supermicro will dominate that market.

So, my prediction is that this tools big that already has delivered progress is heading for but a brand new wave of lasting income beneficial properties — and that is purpose to be optimistic about its inventory efficiency over the long run.

Must you make investments $1,000 in Palantir Applied sciences proper now?

Before you purchase inventory in Palantir Applied sciences, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Palantir Applied sciences wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… for those who invested $1,000 on the time of our suggestion, you’d have $710,860!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Nvidia and Palantir Applied sciences. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately