Markets

Does My Retirement Revenue Rely as Revenue for Social Safety?

Deciding when to take Social Safety advantages is without doubt one of the most necessary inquiries to reply in planning your retirement technique. Second to that’s understanding what may improve—or cut back—your profit quantity. Does retirement revenue depend as revenue for Social Safety? No, however working whereas claiming advantages might shrink the quantity that you simply’re capable of gather. Speaking to a may help you to maximise Social Safety advantages in retirement.

Understanding Social Safety Advantages

retirement advantages are designed to offer a complement supply of revenue to eligible seniors. You possibly can start taking Social Safety retirement advantages as early as 62, although doing so can cut back the quantity you obtain. Ready till age 70 to start taking advantages, in the meantime, can improve your profit quantity.

based mostly in your earnings historical past. Particularly, Social Safety considers earned revenue, wages and internet revenue from self-employment. If any cash is withheld out of your wages for Social Safety or FICA taxes, then your wages are coated by Social Safety because you’re paying into the system.

Once you apply for advantages, Social Safety makes use of your common listed month-to-month earnings to resolve how a lot you qualify for. This common relies on as much as 35 years of your listed earnings and it’s used to calculate your main insurance coverage quantity (PIA). The PIA determines the advantages which might be paid out to you when you retire.

Does Retirement Revenue Rely as Revenue for Social Safety?

Retirement revenue doesn’t depend as revenue for Social Safety and gained’t have an effect on your profit quantity. Particularly, the Social Safety Administration excludes the next from revenue:

None of those are thought of earnings for Social Safety functions. Once more, Social Safety solely appears at cash that you simply truly earn from working a job or being self-employed. That signifies that you possibly can gather Social Safety advantages whereas additionally taking withdrawals from a or particular person retirement account (IRA) or receiving funds from an annuity. gained’t have an effect on your Social Safety advantages or eligibility for Medicare both.

With a reverse mortgage, you faucet into your own home fairness however as a substitute of creating funds to a lender, the lender makes funds to you. You don’t need to pay something again in direction of the reverse mortgage so long as you’re dwelling within the house. Many retirees select to complement Social Safety advantages with a reverse mortgage.

Does Working in Retirement Scale back Social Safety Advantages?

might cut back your month-to-month funds, relying in your age and earnings.

Underneath Social Safety guidelines, you’re thought of to be retired as soon as you start receiving advantages. In the event you’re beneath full retirement age however nonetheless working, Social Safety can deduct $1 out of your profit funds for each $2 you earn above the annual restrict. For 2023, the restrict is $21,240.

Within the yr you attain your (FRA), the deduction modifications to $1 for each $3 earned above a unique annual restrict. For 2023, the restrict is $56,520. When you attain your full retirement age, your advantages are now not diminished no matter how a lot you earn. Social Safety may also recalculate your profit quantity so that you simply get credit score for any months that your advantages have been diminished due to your earnings.

Coordinating Retirement Withdrawals and Social Safety

Deciding when to take Social Safety advantages begins with contemplating your different sources of retirement revenue. For instance, that may embrace:

You would additionally add a right here, although it’s technically not a retirement account. An HSA allows you to lower your expenses on a tax-advantaged foundation for healthcare bills however when you flip 65, you’ll be able to withdraw cash from it for any motive and not using a tax penalty. You’ll, nevertheless, pay unusual revenue tax on the distribution.

From a tax perspective, it normally is sensible to start out with taxable accounts first, then tax-advantaged accounts for withdrawals, leaving Roth and Roth-designated accounts final. In doing so, you permit your Roth investments to proceed rising tax-free till you want them.

When it comes to when to take Social Safety advantages, delaying normally is sensible if you happen to’re hoping to get a bigger payout or you may have different sources of revenue to depend on. You may also think about pushing aside taking advantages if you happen to plan to proceed working up till your full retirement age, as that would let you declare a bigger profit quantity.

A monetary advisor may help you construct an environment friendly plan for coordinating your retirement revenue.

Creating A number of Streams of Revenue for Retirement With out Affecting Social Safety

Since retirement revenue doesn’t depend as revenue for Social Safety, it might be to your benefit to have a couple of supply that you may depend on. You may already be contributing to your 401(ok) at work however you possibly can add an IRA into the combo for extra financial savings.

Whether or not it is sensible to decide on a can rely on the place you count on to be tax-wise when you retire. You may select a standard IRA if you happen to count on to be in a decrease tax bracket down the road however may gain advantage from claiming deductible contributions now. Then again, a Roth IRA could be preferable if you happen to’d like to have the ability to withdraw cash tax-free in retirement.

An annuity is an alternative choice if you happen to’d like to take a position cash now to generate assured revenue later. When contemplating an annuity, it’s necessary to learn the way various kinds of annuities work and what they’ll value.

Actual property could be one other risk if you happen to’re in search of a passive revenue possibility that gained’t have an effect on your Social Safety advantages. You would or , however proudly owning property straight isn’t a requirement. You can even revenue by means of actual property funding trusts (REITs), actual property crowdfunding platforms or actual property mutual funds.

Speaking to a can provide you a greater concept of easy methods to create a number of streams of revenue for retirement, with out affecting your Social Safety advantages. An advisor also needs to find a way that can assist you formulate a method for getting probably the most advantages attainable for your self and your partner if you happen to’re married.

Backside Line

Retirement revenue gained’t have an effect on your Social Safety advantages, however revenue earned from working might. In the event you plan to attract Social Safety whereas working, it’s useful to know what that may imply to your advantages payout. Getting an early begin with saving and investing for might let you delay taking Social Safety so that you simply’re capable of declare a bigger profit.

Retirement Planning Suggestions

-

Working with a monetary advisor may help you to fine-tune your retirement plan. Discovering a monetary advisor doesn’t need to be arduous. matches you with as much as three vetted monetary advisors who serve your space, and you’ll have a free introductory name along with your advisor matches to resolve which one you’re feeling is best for you. In the event you’re prepared to seek out an advisor who may help you obtain your monetary targets, .

-

for retirees who’ve substantial revenue from wages, self-employment, curiosity and dividends. In the event you’re working whereas claiming advantages or incomes curiosity and dividend revenue, you will have to pay taxes on a few of your advantages, relying on how a lot revenue you may have.

-

Take a look at our free for a fast estimate on what you’ll be able to count on based mostly in your age, anticipated retirement and sources of revenue.

-

Preserve an emergency fund readily available in case you run into surprising bills. An emergency fund ought to be liquid — in an account that is not liable to vital fluctuation just like the inventory market. The tradeoff is that the worth of liquid money may be eroded by inflation. However a high-interest account lets you earn compound curiosity. .

Photograph credit score: ©iStock.com/SrdjanPav, ©iStock.com/AJ_Watt, ©iStock.com/RollingCamera

The publish appeared first on .

Markets

Neglect Nvidia: This Different Inventory Could Finish Up Being the Most Vital Knowledge Middle Alternative of All, and It's Not a Expertise Firm

When you consider synthetic intelligence (AI), issues equivalent to self-driving vehicles and humanoid robots may come to thoughts. Counterintuitively, it is usually a good suggestion to consider how merchandise are literally delivered to life every time a brand new large development emerges. A number of the most profitable alternatives are additionally usually the least apparent ones.

For AI to even work correctly, firms have to take a position massive sums of into information facilities. Though information facilities may seem to be only a piece of actual property, they’re much more refined and essential. They home essential IT infrastructure, equivalent to chipsets often called graphics processing items (GPUs) — an essential element of generative AI purposes.

At present, Nvidia is among the largest names within the information middle realm. However what if I instructed you I see one other alternative because the superior alternative amongst information middle investments and that it isn’t even a expertise firm?

It is essential to contemplate all choices — even probably the most tangential ones. Let’s dig right into a nuclear power inventory that I feel could find yourself being crucial information middle firm in the long term and discover why this could possibly be a profitable alternative for buyers.

Nuclear-powered information facilities are on the rise, and…

A significant promoting level of AI is that the expertise can deliver a brand new wave of effectivity to a bunch of use instances. From breakthroughs in enterprise software program to self-driving vehicles, AI is promising a brand new stage of productiveness and security that is by no means been witnessed.

Though that sounds nice, as with all issues, AI comes with some main trade-offs. Particularly, constructing AI purposes is an expensive ambition. GPU {hardware} and high-performance computing software program are among the extra apparent bills in AI growth. One of many extra refined prices in an AI roadmap resides with information facilities, notably their power consumption.

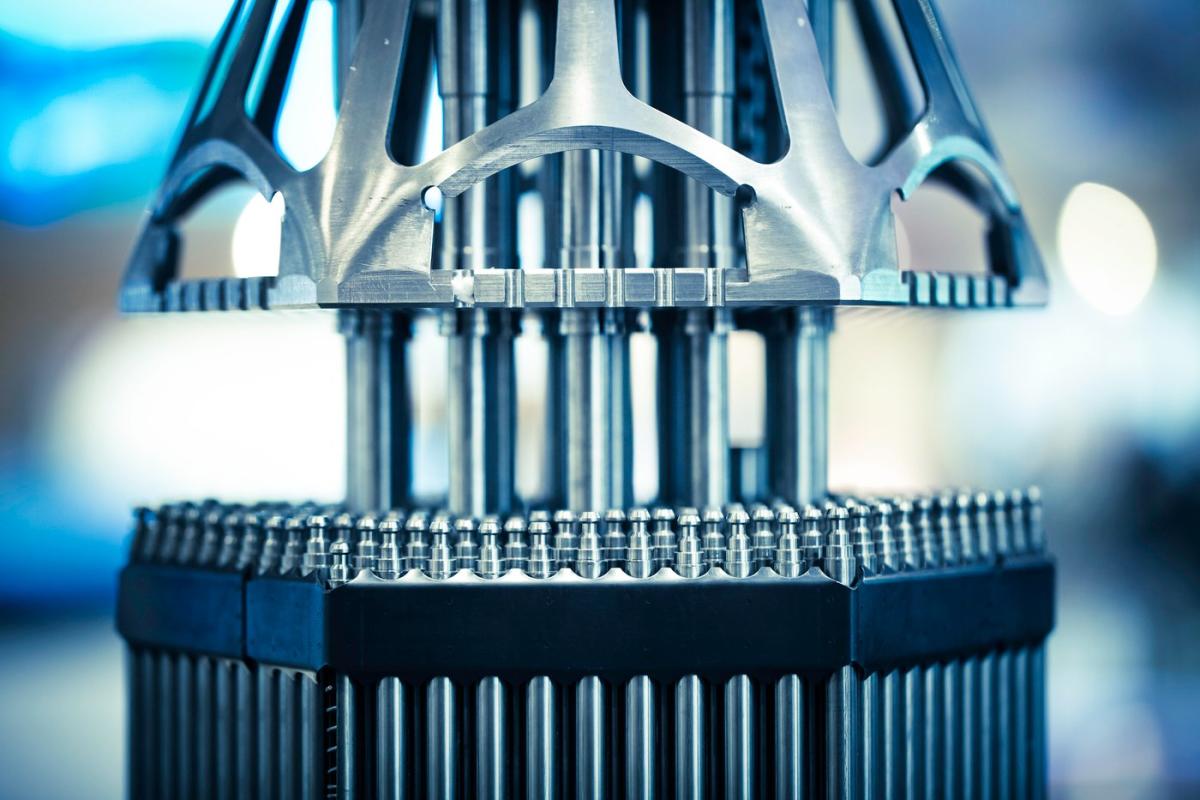

GPUs are continually operating advanced algorithms and performing refined computing duties. This makes and, specifically, give off a variety of warmth. Knowledge facilities are outfitted with numerous temperature management protocols, equivalent to air con items, followers, and turbines.

Nevertheless, these options are each expensive and could be inefficient in comparison with different sources of power management. An rising development on the crossroads of information facilities and power consumption is nuclear energy, and a few actually notable firms and enterprise leaders are getting concerned.

…a variety of large names are concerned

One notable firm concerned with nuclear-powered information facilities is Amazon. One of many largest companies in Amazon’s ecosystem is its cloud computing platform, Amazon Net Providers (AWS). Earlier this 12 months, AWS acquired a nuclear-powered information middle from Talen Power for a reported $650 million.

One other participant rising on the nuclear energy scene is Oklo. Oklo develops nuclear fission reactors that it goals to promote to information facilities and utility firms.

When it was nonetheless a personal firm, Oklo raised funding from Peter Thiel and OpenAI co-founder Sam Altman. Just a few months in the past, Oklo went public via a particular function acquisition firm (SPAC).

In line with its investor presentation, the corporate has obtained curiosity for its reactors from main firms, together with Diamondback Power, Equinix, Siemens Power, and even the U.S. Air Power.

Whereas this caliber of consideration and Altman’s assist are spectacular, I see Oklo as a dangerous guess in the meanwhile. The corporate continues to be pre-revenue, and the potential offers referenced above are in early-stage negotiations.

Oklo will seemingly require hefty ongoing analysis and growth (R&D) prices to construct out its reactors, which is able to take a toll on the corporate’s liquidity as long as there aren’t materials gross sales coming via the door.

My prime decide on the intersection of nuclear power and information facilities is…

My best choice amongst nuclear energy suppliers for information facilities is Constellation Power (NASDAQ: CEG). The corporate presents a bunch of power companies however is making sustainability and nuclear power a selected focus.

One of many firm’s recognized nuclear energy prospects is “Magnificent Seven” member Microsoft. Throughout the firm’s second-quarter earnings name in late August, CEO Joseph Dominguez referenced Comcast and Johns Hopkins as different notable prospects of Constellation’s carbon-free power companies.

Different mega-cap tech firms will seemingly comply with Amazon and Microsoft’s strikes. Constellation’s various buyer base alerts that inexperienced power isn’t just a use case for information facilities or large tech hyperscalers.

Buyers with a long-term horizon could need to take into account a place in Constellation Power proper now. I feel nuclear power options will grow to be extra mainstream because the AI revolution continues to evolve. Given how early the AI narrative appears to be, I feel a possibility equivalent to Constellation Power is basically missed or underappreciated — making it a tempting purchase amongst different alternatives in AI, information facilities, and power consumption.

Must you make investments $1,000 in Constellation Power proper now?

Before you purchase inventory in Constellation Power, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for buyers to purchase now… and Constellation Power wasn’t one among them. The ten shares that made the reduce might produce monster returns within the coming years.

Contemplate when Nvidia made this checklist on April 15, 2005… in case you invested $1,000 on the time of our suggestion, you’d have $722,320!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. has positions in Amazon, Microsoft, and Nvidia. The Motley Idiot has positions in and recommends Amazon, Constellation Power, Equinix, Microsoft, and Nvidia. The Motley Idiot recommends Comcast and recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Tips on how to play the AI Enterprise Software program revolution

Lusso’s Information — The AI enterprise software program revolution is remodeling enterprise operations, with corporations more and more positioning themselves to capitalize on this pattern.

In a current be aware, Truist Securities analysts highlighted that companies are integrating AI applied sciences throughout their software program stacks to boost productiveness, information administration, and cybersecurity. Central to this shift is the rising affect of generative AI (GenAI), anticipated to affect each infrastructure and utility layers of enterprise software program.

In line with the report, corporations fall into two major classes on the subject of benefiting from AI: these straight capturing AI workloads and people leveraging the know-how to boost their merchandise.

Microsoft Company (NASDAQ:), MongoDB (NASDAQ:), and Snowflake Inc (NYSE:) are cited as key gamers anticipated to realize from AI workloads, largely attributable to their information infrastructure capabilities and partnerships with main AI suppliers.

Regardless of current market challenges, Snowflake is considered as a possible long-term winner, as its information warehousing is more and more acknowledged as a core know-how for AI initiatives. MongoDB can also be well-positioned, particularly with its vector storage and search capabilities crucial for AI purposes.

Within the utility software program area, Truist Securities highlights potential winners in three key areas: “choose and shovel” performs, core platform distributors benefiting from improve cycles, and distributors embedding AI to boost productiveness. Corporations like Salesforce Inc (NYSE:) and Smartsheet Inc (NYSE:) are anticipated to capitalize on these developments as enterprises more and more flip to AI-driven options to streamline workflows and enhance effectivity.

In the meantime, corporations comparable to Palo Alto Networks Inc (NASDAQ:), CrowdStrike Holdings Inc (NASDAQ:), and Datadog Inc (NASDAQ:) are seen leveraging AI to boost their product choices, notably in cybersecurity.

Truist notes that Palo Alto Networks has already demonstrated vital AI-driven income development, surpassing $200 million in annual recurring income from its AI merchandise. As AI adoption rises, demand for AI-augmented safety instruments is predicted to extend, increasing the marketplace for corporations on this area.

Whereas AI funding continues to develop, Truist Securities notes that the timeline for realizing vital worth from AI has prolonged. Initially projected for 2024, many enterprises now anticipate AI-driven purposes to realize traction by 2025. Regardless of this delay, over 70% of companies surveyed anticipate allocating 5% or extra of their 2024 software program budgets to AI initiatives, underscoring the continuing dedication to AI funding.

Generative AI, whereas garnering a lot consideration, is predicted to symbolize solely a small portion of the broader AI market. By 2027, Truist Securities forecasts that generative AI will account for lower than 10% of the estimated $900 billion AI market. This means that whereas the concentrate on generative AI is important, different areas—comparable to information administration, cybersecurity, and infrastructure—will current extra substantial long-term alternatives.

A key problem highlighted within the report is the scarcity of expert expertise and sources to implement AI initiatives successfully. This, coupled with rising regulatory scrutiny surrounding AI governance and compliance, might pose hurdles for widespread AI adoption within the enterprise area.

Markets

Why Novo Nordisk Inventory Fell Whereas Eli Lilly and Viking Therapeutics Bumped Increased At this time

Within the pharmaceutical world, it is by no means good for an organization to stumble in a sizzling therapeutic space, particularly if it has some decided rivals competing in the identical section.

That was the dynamic behind Wegovy and Ozempic developer Novo Nordisk‘s (NYSE: NVO) Friday detect the inventory alternate –following its newest information from the lab — and the good points loved that day by up-and-coming Viking Therapeutics (NASDAQ: VKTX) and pharmaceutical titan Eli Lilly (NYSE: LLY). Novo Nordisk’s inventory worth declined by almost 6% on the day, whereas the 2 gainers rose 3.4% and 0.7%, respectively.

Negative effects reported for investigational drug

The information merchandise from Novo Nordisk that was so impactful was the readout from a medical trial of monlunabant, an investigational therapy it is testing for weight problems. In a part 2a medical trial involving 243 individuals, the drug confirmed efficacy in producing weight reduction with every day 10 milligram doses– sufferers taking it shed a mean of seven.1 kilograms (15.7 kilos), in comparison with solely 0.7 kilograms (1.5 kilos) with a placebo.

The sufferers had been divided into 4 teams, certainly one of which was administered the placebo. The opposite three acquired completely different doses of the treatment, particularly 10 milligrams, 20 milligrams, and 50 milligrams.

Nevertheless, monlunabant demonstrated some regarding unintended effects within the trial. Novo Nordisk mentioned that the most typical of those had been of a gastrointestinal nature. The severity of most was gentle to reasonable and was dose-dependent. The corporate added that there have been extra frequent occurrences of neuropsychiatric unintended effects akin to nervousness and sleep disruption. Once more, these had been dose-dependent.

Whereas touting the drug’s potential for weight reduction, in its press launch on the outcomes Novo Nordisk admitted that “additional work is required to find out the optimum dosing to stability security and efficacy.”

The corporate mentioned it goals to maneuver to a part 2b trial with a view to “additional examine dosing and the security profile of monlunabant over an extended period in a worldwide inhabitants.”

Weight reduction for revenue acquire

Irrespective of how efficacious a drug could also be, if it produces a sequence of worrying unintended effects it has fairly a diminished probability of profitable approval from regulators.

So with Novo Nordisk’s efficient “again to the drafting board,” information of monlunabant, traders cautiously pulled out of the Denmark-based firm to the good thing about Eli Lilly and Viking. The previous already has a weight reduction drug permitted and in the marketplace, Zepbound (principally its Mounjaro diabetes therapy permitted for weight problems), whereas Viking’s candidate has produced extremely encouraging ends in part 1 and a pair of medical trials.

Of the 2, traders must be extra excited for Eli Lilly’s prospects within the section. Not solely is Zepbound extensively out there for qualifying sufferers, it is being bought by one of the deep-pocketed and resource-rich on the planet. Viking’s therapy, in addition to it is carried out within the lab, nonetheless has a ways to go earlier than it may be thought-about for approval — assuming, after all, that it will get that far.

Do you have to make investments $1,000 in Novo Nordisk proper now?

Before you purchase inventory in Novo Nordisk, contemplate this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the for traders to purchase now… and Novo Nordisk wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… if you happen to invested $1,000 on the time of our advice, you’d have $722,320!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 16, 2024

has no place in any of the shares talked about. The Motley Idiot recommends Novo Nordisk. The Motley Idiot has a .

was initially revealed by The Motley Idiot

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoInventory market at present: Asian shares decrease after Wall Avenue closes one other profitable week

-

Markets3 months ago

Markets3 months agoNeglect Nvidia: Distinguished Billionaires Are Promoting It in Favor of These 7 High-Notch Shares

-

Markets3 months ago

Markets3 months ago3 No-Brainer Synthetic Intelligence (AI) Shares to Purchase With $500 Proper Now

-

Markets3 months ago

Markets3 months agoMeet the 1 S&P 500 Inventory That's Outperforming Nvidia So Far in 2024