Markets

DOJ goes after fee large Visa with new antitrust swimsuit

The US Justice Division went after Visa () on Tuesday in a federal antitrust lawsuit alleging that the corporate illegally used the dimensions of its huge card processing community to dam competitors.

Visa owns and controls the most important debit card processing community within the US, which processes greater than 60% of the nation’s debit card transactions.

In keeping with the DOJ, Visa leveraged its ecosystem of shoppers, banks, and retailers to penalize retailers for selecting an alternate debit community.

“Collectively … Visa’s systematic efforts to restrict competitors for debit transactions have resulted in vital extra charges imposed on American shoppers and companies and slowed innovation within the debit funds ecosystem,” the criticism mentioned.

In keeping with the DOJ, Visa long-established a “net of contracts” with main banks and retailers that required retailers to decide on Visa’s community or pay increased charges to Visa for gross sales transactions.

In 2022, Visa debit processing charges drove $7 billion in income for the corporate. Visa inventory dropped greater than 5% Tuesday.

US Legal professional Basic Merrick Garland mentioned Visa’s unlawful conduct discouraged potential rivals, notably fintech corporations like Sq.’s CashApp, from getting into the debit processing market.

“Whereas Visa is the primary identify many debit card customers see after they take out their card to make a purchase order, they don’t see the position that Visa performs behind the scenes,” Garland mentioned.

“There, it controls a fancy community of retailers, monetary establishments, and shoppers … It’s charging a hidden toll on every of trillions of transactions, including as much as billions of {dollars} of charges imposed yearly on American shoppers and companies.”

Particularly, the DOJ mentioned Visa illegally held on to monopolies in two markets: the debit community providers market, which is used to withdraw funds instantly out of a client’s checking account, and the card-not-present debit community providers market.

The latter is a narrower market throughout the broader providers market that features conventional debit card transactions, in addition to fintech transactions.

Visa’s normal counsel, Julie Rottenberg, responded to the lawsuit by saying that it ignored Visa’s “many opponents” within the rising debit house.

“Anybody who has purchased one thing on-line, or checked out at a retailer, is aware of there’s an ever-expanding universe of corporations providing new methods to pay for items and providers,” Rottenberg mentioned.

, a analysis fellow and former normal counsel for the US Federal Commerce Fee, mentioned the Visa case is exclusive for an antitrust case in that the Dodd-Frank Act set a cap on debit card charges.

Any antitrust evaluation of Visa’s preparations ought to take the legislation’s affect into consideration, Abbott mentioned, as a result of it could have discouraged rivals from getting into the market, weakened then-existing rivals, and led to fewer poorer Individuals having debit playing cards.

“It’s definitely doable that Visa’s rising debit card market share is because of this statutory worth cap, quite than anti-competitive actions by Visa,” Abbott mentioned.

The DOJ is asking for the federal district courtroom in Manhattan to dam Visa from utilizing the allegedly dangerous contracts and to dam it from bundling credit score providers or credit score incentives with debit community providers.

It additionally requested for the courtroom to cease Visa from imposing pricing incentives to be used of its community.

Alexis Keenan is a authorized reporter for Lusso’s Information. Observe Alexis on X .

Markets

Costco (COST) vs. Goal (TGT): Which is the Higher Inventory Going Ahead?

Right now I’m taking a look at Costco and Goal; two fellow massive field retailers. Shares of retail powerhouse Costco have risen about 63%% over the previous 12 months, whereas Goal shares are up round 39% over the identical time-frame. Each shares have carried out nicely, however which is the higher alternative for buyers going ahead? Let’s study that query.

I’m impartial on Costco primarily based on its expensive valuation. Concerning Goal, I’m bullish this inventory primarily based on its cheap valuation, engaging dividend yield, and lengthy historical past of dividend progress. Moreover, sell-side analysts view Goal as having significantly extra upside forward over the subsequent 12 months.

The Setup

Costco is way beloved by buyers, and rightfully so. The inventory has generated good-looking returns for its shareholders over time, to the tune of almost 900% over the previous decade. Costco is usually cited as being nicely managed and possessing a pretty enterprise mannequin as a consequence of recurring annual charges paid my its members.

Goal has generated a complete return of 224% over the previous decade. Goal is not any slouch, but it surely has considerably lagged Costco’s efficiency over the previous 10 years. Nevertheless, this will likely create a extra compelling setup for an funding in shares of Goal right now, as we’ll focus on subsequent.

Large Hole in Valuations

Whereas Costco is a superb enterprise with a powerful observe file of efficiency, it trades at fairly a steep a number of at this cut-off date. Costco has an off-cycle fiscal 12 months that ends in August, and can quickly report its This autumn 2024 earnings outcomes. The corporate trades above 50 occasions consensus 2025 earnings estimates. This sky-high a number of leaves little room for error going ahead if the corporate disappoints buyers in This autumn or throughout the subsequent fiscal 12 months.

In the meantime, Goal trades at a way more cheap valuation of 14.8x ahead earnings estimates, nicely beneath Costco’s a number of and in addition considerably beneath the S&P 500’s (SPX) ahead valuation of 24x. One can actually make a case that Costco is a higher-quality enterprise than Goal primarily based on its recurring membership charges, however a valuation 3 times as costly looks like an excessive amount of of a niche.

Moreover, regardless of Costco’s status for high quality, Goal is a higher-margin enterprise, with gross margins of 26.1% roughly twice as excessive as Costco’s gross margins of 12.5%. Goal’s revenue margin of 4.2% can be noticeably larger than Costco’s 2.8%. From my perspective, Goal’s considerably decrease valuation affords the inventory extra draw back safety and extra room to shock to the upside.

Two Robust Dividend Progress Shares

Costco is a dividend inventory, however its yield of 0.5% is pretty inconsequential. That mentioned, Costco deserves credit score for its robust dividend progress, having raised its dividend price 19 years in a row.

In the meantime, Goal’s dividend yield is 2.9%. That is almost six occasions larger than Costco’s present yield, and greater than double the yield for the S&P 500. Goal has an much more spectacular observe file of constantly paying and rising its dividend than Costco. Goal is a Dividend King that has elevated its payout for an unimaginable 55 years in a row.

Each firms additionally keep comparatively conservative payout ratios, that means that each dividends look protected for the foreseeable future. Whereas Costco has executed a very good job of rising its dividend, Goal’s yield is considerably larger, and its constant historical past of dividend progress is even higher, which helps my bullish view of the inventory.

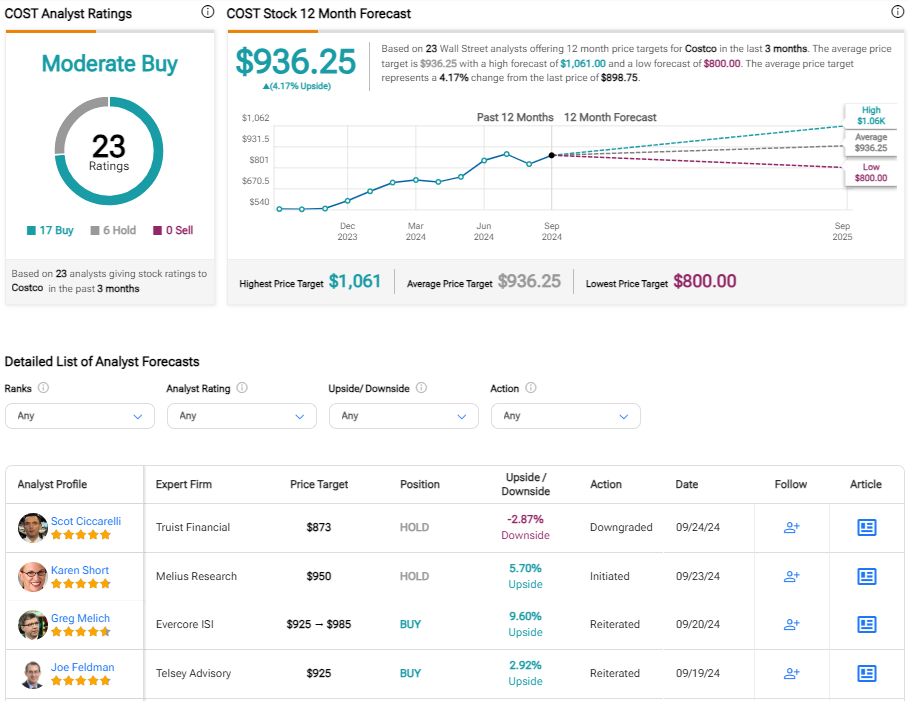

Is COST Inventory a Purchase, In accordance with Analysts?

Turning to Wall Road, COST earns a Robust Purchase consensus score primarily based on 17 Purchase, 5 Maintain, and no Promote scores assigned prior to now three months. The of $936.25 implies about 4.0% potential upside from present ranges.

Is TGT Inventory a Purchase, In accordance with Analysts?

On the similar time, TGT earns a Reasonable Purchase consensus score primarily based on 17 Buys, 10 Holds, and 0 Promote score assigned prior to now three months. The of $180.87 implies about 16% potential upside from present ranges.

Good Selections

As you possibly can see utilizing TipRanks’ beneath, each Costco and Goal obtain Outperform scores from TipRanks’ system.

Good Rating is a quantitative inventory scoring system created by TipRanks. It offers shares a rating from one to 10, primarily based on eight key market components. Scores of eight, 9, or 10 are thought of equal to an Outperform score.

Cocsto’s Outperform-equivalent Good Rating of 9 is spectacular, however Goal comes out on prime with a perfect-10 Good Rating.

Goal Inventory Appears to be like Just like the Most popular Funding Alternative

Costco is a superb firm and has been an awesome performer for its shareholders over a few years. Nevertheless, I’m impartial on shares at this level as this robust run of efficiency has despatched its valuation above 50x ahead earnings, giving the inventory little margin for error going ahead.

Goal trades at a way more engaging valuation of beneath 15x ahead earnings, affords the next dividend yield, and longer historical past of dividend progress. I’m bullish on Goal given its cheap valuation, engaging dividend yield, and 55 straight years of dividend progress. Costco is an effective inventory with a reliable historical past of efficiency, however proper now I view Goal as the higher funding choice primarily based on my evaluation of the 2 decisions.

Markets

Omni Retail Enterprises sells shares in Wilhelmina Worldwide value over $114k

In a current transfer that has caught the eye of the market, Omni Retail Enterprises, LLC, a serious stakeholder in Wilhelmina Worldwide, Inc. (NASDAQ:WHLM), has bought a big variety of shares within the firm. The transactions, which befell on September 20 and September 24, concerned the sale of shares at costs starting from $4.5566 to $5.12, leading to a complete sale worth of roughly $114,714.

The collection of transactions started with smaller gross sales of 200, 300, 100, 600, 100, and 42 shares at various costs, main as much as a bigger transaction on September 24, the place 23,710 shares had been bought at a weighted common worth of $4.5566. This bigger sale alone accounted for the majority of the whole worth, with the gross sales occurring at costs between $4.4300 and $4.7500.

It is noteworthy that Omni Retail Enterprises, LLC, via its administration firm Omni Holdings Administration, LLC, and its sole member Mr. Rajesh Gupta, has a big oblique curiosity in these shares. Nevertheless, each Omni Retail Enterprises and Mr. Gupta have disclaimed useful possession of the reported securities, besides to the extent of their pecuniary curiosity.

Traders and market watchers typically preserve a detailed eye on insider transactions corresponding to these for indications of an organization’s monetary well being and the boldness that main stakeholders have within the firm’s future prospects. The current gross sales by Omni Retail Enterprises, LLC present worthwhile perception into the buying and selling actions of serious shareholders inside Wilhelmina Worldwide.

Wilhelmina Worldwide, recognized for its companies within the administration consulting sector, has not commented on these transactions. Shareholders and potential buyers in Wilhelmina Worldwide can entry full particulars of the gross sales, together with the variety of shares bought at every worth level, upon request to the corporate or the SEC.

Lusso’s Information Insights

As stakeholders consider the current insider transactions at Wilhelmina Worldwide, Inc. (NASDAQ:WHLM), a glimpse on the firm’s monetary metrics and market efficiency can present further context. In line with Lusso’s Information information, Wilhelmina Worldwide presently holds a market capitalization of roughly $22.28 million, with a Value/Earnings (P/E) ratio of 36.36, reflecting a excessive valuation relative to earnings over the past twelve months as of Q2 2024. Regardless of current market volatility, the corporate’s P/E ratio has adjusted barely to 35.59, indicating a persistent premium on its earnings.

Lusso’s Information Ideas counsel that Wilhelmina has additional cash than debt on its stability sheet, which is a optimistic signal for monetary stability. Nevertheless, the inventory has skilled vital worth fluctuations, with a one-week whole return of -16.92% and a one-month whole return of -28.0%, which aligns with the bigger transaction by Omni Retail Enterprises, LLC. The corporate’s capacity to cowl curiosity funds with money flows and liquid belongings exceeding short-term obligations could also be a reassuring issue for buyers involved concerning the firm’s short-term monetary well being.

For these contemplating an funding in Wilhelmina Worldwide, or for present shareholders seeking to perceive the current sell-off, these metrics and ideas are essential. It is also value noting that Wilhelmina Worldwide doesn’t pay a dividend, probably affecting the funding technique for income-focused buyers. For extra in-depth evaluation, together with further Lusso’s Information Ideas, buyers can go to Lusso’s Information/professional/WHLM, the place 9 extra ideas can be found, offering additional insights into the corporate’s financials and market efficiency.

This text was generated with the assist of AI and reviewed by an editor. For extra info see our T&C.

Markets

Donald Trump Says He'll Lower Your Car Insurance coverage In Half. Folks Push Again And Ask Him If He'll Use Authorities Worth Controls To Do It

Former President Donald Trump lately made a daring promise: if he is elected president once more, he’ll minimize your auto insurance coverage charges in half. However not everyone seems to be shopping for it and lots of marvel how he plans to make that occur.

Trump’s declare got here by way of a social media submit the place he stated, “Your Car Insurance coverage is up 73% – VOTE FOR TRUMP, I’LL CUT THAT NUMBER IN HALF!”

The concept of saving a lot cash on one thing as important as automobile insurance coverage sounds nice, particularly with the growing. Nevertheless, many specialists are scratching their heads over the place this 73% determine got here from because it would not match any latest knowledge.

Do not Miss:

Your Car Insurance coverage is up 73% — VOTE FOR TRUMP, I’LL CUT THAT NUMBER IN HALF!

— Donald J. Trump (@realDonaldTrump)

Economist and insurance coverage specialist Robert Hartwig instructed Insurance coverage Journal that though charges have gone up, they haven’t elevated as a lot as Trump has claimed. Hartwig claims that whereas the 73% enhance is in keeping with September 2016 charges, it doesn’t replicate present traits. In fact, charges have elevated by 16.5% within the final 12 months – a major enhance however nowhere close to 73%.

Hartwig and others stress that insurance coverage charges are regulated on the , not by the federal authorities. Because of this even when Trump have been president, he would not have the ability to minimize insurance coverage charges in half. As an alternative, he’d need to get 50 state insurance coverage commissioners to conform to his plan – a tall order.

Trending: Founding father of Private Capital and ex-CEO of PayPal

Insurance coverage trade specialists say that capping charges would harm shoppers in the long term, as Trump suggests. If insurers have been pressured to decrease charges drastically, they’d probably cease providing protection altogether as a result of they could not afford the prices.

On X and different social media web sites, many individuals are skeptical about Trump’s promise to chop auto insurance coverage charges in half, questioning how he might presumably make such a giant change occur.

One person mocked the feasibility of Trump’s plan by tweeting, “That is superior! We will not wait to see your plan to perform this in your first week again on the job!” Others highlighted the irony of his proposal with a remark that learn, “Appears like communism!” given Trump’s previous criticism of comparable concepts from Democrats.

Trending: Warren Buffett as soon as stated, “When you do not discover a approach to generate profits whilst you sleep, you’ll work till you die.”

Trump’s promise has led some to check his plan to authorities worth controls, that are extensively criticized for creating extra issues than they clear up. When in grocery shops, Trump himself bashed her proposals as “socialist” or “communist.”

On the opposite facet, Suze Orman, a widely known monetary skilled, lately. She recommended that buyers store round for higher offers, elevate their deductibles if they’ve sufficient financial savings and even take into account proudly owning fewer vehicles.

Learn Subsequent:

Up Subsequent: Remodel your buying and selling with Benzinga Edge’s one-of-a-kind market commerce concepts and instruments. that may set you forward in at the moment’s aggressive market.

Get the newest inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoInventory market in the present day: US futures slip as Micron slides, with information on deck

-

Markets3 months ago

Markets3 months agoFutures dip as Micron drags down chip shares forward of financial information

-

Markets3 months ago

Markets3 months agoApogee shares rise almost 4% on upbeat steering and earnings beat

-

Markets3 months ago

Markets3 months agoWhy Is Micron Inventory Down After a Double Earnings Beat?

-

Markets3 months ago

Markets3 months agoWhy Nvidia inventory is now in treacherous waters: Morning Transient

-

Markets3 months ago

Markets3 months agoSoftBank to spend money on search startup Perplexity AI at $3 billion valuation, Bloomberg experiences

-

Markets3 months ago

Markets3 months agoHungary central financial institution tells lenders to reimburse purchasers after Apple glitch

-

Markets3 months ago

Markets3 months agoDown 30% From Its All-Time Excessive, Ought to You Purchase Synthetic Intelligence (AI) Famous person Tremendous Micro Pc?

-

Markets3 months ago

Markets3 months agoIf You'd Invested $1,000 in Starbucks Inventory 20 Years In the past, Right here's How A lot You'd Have Immediately

-

Markets3 months ago

Markets3 months agoPrediction: This Transfer From Nvidia within the Second Half Will Be A lot Greater Than the Inventory Break up

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June