Markets

Enormous Uncommon Earths Discovery is Gamechanger in Americas Commerce Struggle with China

On the top of the American struggle machine’s realization that China controls almost all of its uncooked supplies, two new developments in Europe now recommend that the West has a preventing likelihood to safe important metals for the long run: A serious discovery in Norway, and a probably game-changing acquisition in Greenland.

In mid-June, Norwegian mining firm Uncommon Earths Norway unveiled one of many largest deposits of uncommon earth parts in Europe within the Fen Carbonatite Complicated within the nation’s south. That discovery adopted a vote in Norwegian parliament that paved the way in which for offshore, deep-sea mining of uncommon minerals within the nation’s distant northern waters, reported, making this the primary nation in Europe to permit such seabed mining actions.

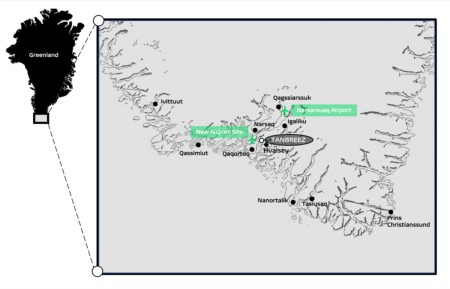

On the identical time, Important Metals Corp () introduced an acquisition deal for what it believes is the most important important metals deposit on the planet, in Greenland.

, Important Metals Corp signed an settlement to accumulate a controlling curiosity in Greenland’s Tanbreez venture, which it says is the most important uncommon earth deposit on the planet. As soon as operational, CRML expects it to provide Europe and North America. And on the corporate introduced it had accomplished its preliminary funding for the Tanbreez acquisition, lending extra confidence to the deal and additional de-risking the transaction, in response to a .

Tanbreez is alleged to have over 28 million tonnes of complete uncommon earth oxides, the corporate estimates internally, and almost 30% of that’s the most coveted “heavy” uncommon earth parts (HREE).

Given the success of MP Supplies (NYSE:MP), a $2.2 billion market cap issuer that has a recognized useful resource of just below 3 million tonnes that’s virtually fully gentle uncommon earth parts (LREE), CRML may very well be set for a big valuation re-rate.

“Tanbreez is a game-changing uncommon earth mine for the West and a key step in positioning Important Metals Corp because the main provider of important minerals, CEO Tony Sage .

Uncommon earths metals are utilized in our on a regular basis electronics, however with out them, there shall be no clear vitality transition, and the U.S. will discover itself at a weapons drawback—a fearful thought at a time of geopolitical upheaval spreading throughout Europe and the Center East.

With Russia and NATO continuously dipping their toes over their respective “purple traces” on Ukraine, Russia making flanking actions in northern Africa and the Israel-Hamas battle inflicting shifting world alliances and calculations, uncommon earths metals draw a line within the sand within the subsequent world battle.

That makes European discoveries all of the extra pressing, and Important Metals is eyeing its potential to turn out to be some of the necessary miners of the last decade. And whereas heavy important metals is golden goose in mining at the moment, Important Metals can also be gearing as much as develop the Wolfsberg Lithium Challenge in Austria, .

China Is Wielding the Final Weapon, Tanbreez Might be Frontline Protection

The 2-pronged commerce struggle has been nicely below manner for a while now, and it’s all concerning the nexus of microchips and uncommon earth’s parts (REEs).

In August 2022, the Biden administration signed the CHIPS and Science Act into legislation to spice up home manufacturing of semiconductors and cut back reliance on China. That transfer was in response to Beijing’s transfer to tighten exports of uncommon earths parts gallium, germanium and graphite. In late 2023, Beijing tightened controls on exports of uncommon earths after which banned the export of uncommon earths extraction know-how. The commerce struggle pits semiconductors in opposition to REEs in actions and reactions by Beijing and Washington.

All the pieces going ahead is about microchips. Synthetic intelligence (AI), navy protection, and completely every little thing in between. It’s all powered by chips, which don’t exist with out the REEs essential to make them.

That’s why the Tanbreez acquisition is so important. The mine is positioned to turn out to be a serious REE provide chain for the western hemisphere within the face of a Chinese language authorities that has the power to severely disrupt the provision of almost all important metals.

The Chinese language may virtually immediately take off the market, which might devastatingly have an effect on U.S. protection programs, that are already stretched skinny over Ukraine.

Tanbreez is a 4.7-billion-tonne Kakortokite outcropping ore physique about which over 2,000 tutorial papers have been written. It incorporates economically enticing quantities of Zirconium, Tantalum, Niobium, Hafnium and REEs. Practically 30% of the minerals, all of that are mentioned to happen in important measurement and high quality, are essentially the most worthwhile of heavy uncommon earths.

Supply: Tanbreez.com

The venture was awarded an exploitation license on August 13, 2020, and is now engaged on the ultimate environmental allow earlier than commencing mining operations in Greenland. Practically 400,000 assays have already been taken from over 400 drill holes. And an SK-1300 is now underway on this 4.7-billion-tonne multi-element asset, which hosts 28.2 million tonnes of complete uncommon earth oxides (TREO).

Tanbreez may unlock REE provide for the Western world.

And the Western world is rising determined. The worry is that Beijing has all of the leverage on this race. China has already halted exports of some REEs, and since China additionally processes its personal REE uncooked supplies, there’s palpable worry that they may lower off the West fully. That’s what makes this a recreation of chips and uncommon earths.

In reality, it was this worry, aired very publicly, that reportedly prompted Donald Trump in 2019 to drift the concept amongst his aides of , an autonomous Danish territory, outright. Now, it’s in American arms, by the traditional channels of company acquisitions.

Tanbreez may maintain the important thing not solely due to its sheer measurement and scale, but additionally as a result of an estimated 27.1% of the asset is believed to be comprised of the rarer and extra worthwhile “heavy” uncommon earths parts (HREE). By comparability, different Western miners of REEs have property with 0.03%-16% of HREE, and a bigger share of LREEs, gentle uncommon earths parts.

within the manufacturing of magnets, that are necessary parts of electrical automobile motors, medical gear, wind generators and information storage programs. HREEs, however, are important for nationwide protection and very important for heavy weaponry, however are additionally utilized in fiber optics, medical gear and hybrid automobiles.

A single DDG-51 Aegis Destroyer, for example, requires an exceptional 5,200 lbs. of REEs, whereas an F-35 fighter jet requires almost 600 lbs.

Time is now operating out, and Tanbreez may very well be the most effective shot at securing this provide chain for nationwide protection.

Important Metals Corp () has what may form as much as be the most important deposit of HREEs on the planet, and it already has an exploitation allow, with a whole bunch of hundreds of assays already present process testing. From an infrastructure perspective, Tanbreez can also be extremely advantageous, with year-round direct transport entry by deep-water fjords that feed into the North Atlantic ocean.

“All the pieces in your cell phone, every little thing in automobiles comes from these Uncommon Earth parts. Supercomputers sooner or later, quantum computing … The windmills which are up, all of the magnets in there. It is all Uncommon Earths,” Sage advised Oilprice.com in a latest interview.

“And one factor we do not like to speak about is all of the missiles which are getting used on the Ukraine struggle theater and the Israel-Hamas struggle theater for the time being. All of them must be replenished one way or the other, and once more, that is all Uncommon Earths. That is why the West is so involved that China may merely pull the plug,” Sage added.

The Lithium Icing on the Uncommon Earths Cake

CRML’s new operation is Tanbreez, however Lithium was its first success. In reality, the corporate could have the primary totally licensed lithium spodumene mine in Europe.

In Austria, Important Steel’s () Wolfsberg Challenge is positioned in shut proximity to massive lithium import markets in Europe, equivalent to Germany, Belgium, France, Italy and Spain, and deliberate battery tasks in Hungary, Germany, Sweden and the UK, CRML’s CEO Tony Sage advised earlier in June.

The mine is totally permitted in perpetuity and is positioned to be the subsequent producing lithium mine within the European Union, and the primary to supply battery-grade lithium.

“Substantial exploration and improvement work has already been performed by the earlier homeowners together with approx. 17,000m of drilling / 1,400m of underground decline, drives and crosscuts. We glance ahead constructing upon this basis and advancing our improvement plans for this strategic and key asset for Europe’s EV provide chain,” he added.

The S-Ok 1300 was up to date simply final 12 months, indicating a useful resource of 12.88 million tonnes at 1% Li2O in Zone 1. Important Metals signed a binding, long-term lithium offtake settlement with BMW Group in December 2022. Wolfsberg is anticipated to be accomplished by 2026, with Important Metals to provide BMW by 2027. Then, in June this 12 months, to CMC, which shall be repaid by equal setoffs in opposition to lithium delivered. European Lithium (ASX: EUR) has additionally entered right into a binding settlement to construct the primary regional Lithium Hydroxide Refinery in , by a JV with Obeikan Funding Group. CMRL expects to learn from this JV.

The corporate’s first goal–to turn out to be the primary native, battery-grade lithium provider into an built-in European battery provide chain—was sufficiently big.

Its new aim is to safe one of many largest uncommon earth’s deposits on the planet for nationwide protection, and the outcomes of exams on a whole bunch of hundreds of assays may change into a big response to China within the coming weeks, months, and years.

The markets don’t appear to have realized the total extent of the acquisition and what it means for the West and the corporate itself. That can most likely change over the approaching months because the story is barely simply making its manner into the mainstream media.

Listed here are another firms within the important assets area value following:

BHP Group (NYSE:BHP), a world assets big, showcases a diversified portfolio encompassing iron ore, copper, coal, nickel, and vitality operations. With a considerable presence in Australia and the Americas, BHP’s operational scale is spectacular. The corporate’s dedication to sustainable practices, together with environmental affect discount and group engagement, additional solidifies its place as a accountable and forward-thinking chief within the world assets sector.

FMC Company (NYSE: FMC) Based mostly in Philadelphia, FMC Company is a world agricultural sciences firm delivering progressive know-how to growers worldwide and has a big stake in lithium for rechargeable batteries and different high-tech purposes. The corporate’s agricultural merchandise contribute to elevated crop yield and high quality, addressing world meals safety points. FMC’s dedication to innovation and sustainability has pushed strong demand for its crop safety merchandise, supported by larger commodity costs and powerful agricultural market fundamentals.

Lithium Americas (NYSE:LAC) has emerged as a big participant within the lithium market, pushed by the rising demand for lithium-ion batteries in electrical automobiles and renewable vitality. The corporate’s Thacker Move venture in Nevada holds the potential to be one of many world’s largest lithium sources, positioning Lithium Americas as a serious contributor to the worldwide lithium provide chain. Strategic investments and partnerships with established business gamers additional improve the corporate’s prospects for development and growth.

Albemarle Company (NYSE:ALB) stands as a world specialty chemical compounds chief, distinguished by its place because the world’s largest lithium producer. This prominence within the lithium market aligns with the surging demand for electrical automobile batteries, a key development driver for the corporate. Albemarle’s diversified portfolio, encompassing bromine, catalysts, and prescribed drugs, showcases its adaptability and dedication to innovation throughout varied sectors.

Piedmont Lithium Restricted (NASDAQ:PLL) is an Australian mining firm targeted on growing lithium assets in the USA. Its flagship Piedmont Lithium Challenge in North Carolina is projected to supply a considerable quantity of lithium hydroxide yearly, catering to the rising demand for lithium-based merchandise. Piedmont Lithium’s strategic partnerships with business leaders like LG Chem spotlight its dedication to constructing a strong provide chain for the burgeoning electrical automobile market.

MP Supplies Corp. (NYSE:MP) holds a singular place as the only operator of a totally built-in uncommon earth mining and processing facility in the USA. The corporate’s concentrate on producing uncommon earth oxides and metals, important parts in varied applied sciences, is especially important given the rising demand for these supplies in rising sectors like renewable vitality and electronics. MP Supplies’ vertical integration mannequin ensures high quality and consistency in its merchandise, additional strengthening its market place.

Uncommon Factor Assets Ltd. (TSX:RES) is devoted to the exploration and improvement of uncommon earth parts (REEs), essential parts in clear vitality applied sciences. The corporate’s flagship Bear Lodge venture in Wyoming, acknowledged as one of many world’s largest undeveloped REE deposits, holds immense potential to contribute to the worldwide provide of REEs. REE’s dedication to sustainable and accountable mining practices underscores its dedication to moral useful resource extraction and environmental stewardship.

Avalon Superior Supplies Inc. (TSX:AVL) is a Canadian firm specializing in growing and manufacturing specialty supplies for various industries. With experience in high-purity metals and alloys utilized in electronics, aerospace, and biomedical purposes, Avalon performs an important function in advancing varied technological fields. The corporate’s concentrate on growing supplies for vitality storage options, notably lithium-ion and solid-state batteries, demonstrates its dedication to innovation and addressing the evolving wants of the market.

First Quantum Minerals Ltd. (TSX:FM) is a Canadian mining and metals firm with a various world portfolio. The corporate’s operations span a number of international locations and embody the manufacturing of copper, nickel, gold, and zinc. First Quantum’s dedication to accountable mining practices and group engagement is obvious in its efforts to create financial alternatives and reduce environmental affect within the areas the place it operates.

Allkem Restricted (TSX:AKE), an Australian mining firm, is a big participant within the lithium market. Its various portfolio of lithium tasks in Australia, Argentina, and Canada, together with a considerable presence within the lithium-rich Salar de Atacama, positions it as a serious contributor to the worldwide lithium provide chain. Allkem’s built-in strategy to lithium manufacturing, spanning exploration, manufacturing, and refining, solidifies its function in assembly the rising demand for lithium within the electrical automobile and renewable vitality sectors.

Teck Assets Restricted (TSX:TECK), a Canadian mining powerhouse, is a number one producer of zinc and copper. Its intensive operations in Canada, the USA, Chile, and Peru contribute considerably to the worldwide provide of those important metals. Teck’s zinc manufacturing is especially noteworthy because of its important function in varied battery applied sciences, aligning with the rising demand for vitality storage options throughout a number of industries.

By. Tom Kool

Markets

The place Will Plug Energy Be in 3 Years?

It isn’t exhausting to color a rosy image for like Plug Energy (NASDAQ: PLUG). In accordance with a latest report by international consultancy McKinsey & Co, “international clear hydrogen demand is projected to develop considerably by 2050, however infrastructure scale-up and know-how developments are wanted to fulfill projected demand.” As an organization that gives that infrastructure and know-how, Plug Energy is within the driver’s seat to fulfill this progress in demand that might be sustained for many years.

With a of simply $1.8 billion, there’s actually loads of upside potential to Plug Energy inventory. Deloitte, one other international consultancy, predicts that the worldwide marketplace for hydrogen might attain $1.4 trillion by 2050. However what in regards to the subsequent three years? The true progress potential of Plug Energy inventory would possibly shock you.

Hydrogen demand continues to be in its infancy

Whereas wind and solar energy get a lot of the consideration, hydrogen energy has a big alternative to assist the world transition away from fossil fuels. That is as a result of hydrogen gas is especially good at decarbonizing what economists name “exhausting to abate” sectors. Asphalt, cement, metal, transport, aviation — these are only a few areas the place changing fossil fuels with renewable vitality stays very troublesome.

Hydrogen gas is a viable substitute for 2 causes. First, it has a a lot larger vitality density than batteries. This makes it an appropriate possibility for trucking and aviation, the place hauling voluminous, heavy batteries is not sensible. Moreover, sectors like steelmaking, cement manufacturing, and petrochemical require very excessive temperatures to function, typically in extra of 1,000 levels. Hydrogen can create this degree of excessive warmth, whereas electrical energy — whether or not produced by clear or soiled types of vitality — struggles.

If we need to decarbonize hard-to-abate sectors of the economic system, hydrogen has a powerful case. However demand continues to be very a lot in its infancy. There is a cause why analysis from Deloitte and McKinsey & Co focuses on timelines all the best way out to 2050 — it is going to take that a lot time for the hydrogen economic system to take off.

Hydrogen gas on the whole nonetheless is not cost-competitive with fossil fuels. And hydrogen will be produced with cleaner or dirtier strategies, that means {that a} transition to hydrogen gas will not essential decarbonize the sector in query. Plus, hydrogen requires numerous infrastructure — every little thing from manufacturing and transportation to distribution. It additionally wants a fleet of finish customers prepared to simply accept it as a gas supply.

Hydrogen gas has numerous promise. However there are clear hurdles that make this a multi-decade story. Do not anticipate this equation to alter over the subsequent three years.

Will Plug Energy have the ability to trip the clear vitality tidal wave?

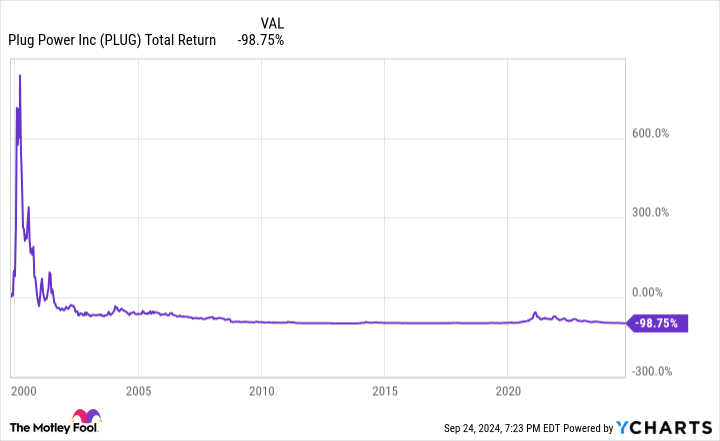

There is not any doubt that Plug Energy has an early begin. The corporate was began in 1997, and went public in 1999 on the top of the dot-com bubble. Suffice it to say, it has been an extended journey. Lengthy-term buyers have not been that happy. If you happen to had invested within the firm throughout its IPO, you’d have simply 1.25% of your unique capital left.

The difficulty going through Plug Energy over the subsequent few years isn’t any totally different than the challenges which have plagued the corporate since its founding. Hydrogen energy, for all its promise, continues to be forward of its time, and an inflection level is nowhere shut. Goldman Sachs estimates Plug Energy’s fairness period — or the weighted common period of its money flows — to be roughly 26 years.

That is a very long time to be ready. And in the course of the interim, anticipate heavy dilution. Over the previous couple of many years, Plug Energy shares have struggled as a result of an absence of profitability, but in addition because of the huge share dilution essential to maintain the corporate afloat.

Over the subsequent three years, there aren’t many main catalysts to look ahead to. Elevating capital will proceed to be a problem, and anticipate administration to proceed touting the potential of the hydrogen economic system as a complete. However even when the hydrogen economic system does unexpectedly take off, there isn’t any assure that Plug Energy’s know-how specifically will win.

The place will Plug Energy be in three years? Probably in the identical place it’s immediately: Struggling for financing, hoping {that a} hydrogen inflection level arrives a lot earlier than anticipated.

Must you make investments $1,000 in Plug Energy proper now?

Before you purchase inventory in Plug Energy, take into account this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the for buyers to purchase now… and Plug Energy wasn’t certainly one of them. The ten shares that made the lower might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… when you invested $1,000 on the time of our suggestion, you’d have $743,952!*

Inventory Advisor supplies buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of September 23, 2024

has no place in any of the shares talked about. The Motley Idiot has no place in any of the shares talked about. The Motley Idiot has a .

was initially printed by The Motley Idiot

Markets

Freight market inexperienced shoots fade heading into October

Chart of the Week: Nationwide Truckload Index (Linehaul Solely), Van Outbound Tender Rejection Index – USA : NTIL.USA, VOTRI.USA

Spot charges excluding the full estimated value of gas (NTIL) have fallen 3% because the begin of August. Dry van tender rejection charges (VOTRI), which measure the proportion of hundreds that carriers are unable to cowl for his or her clients, are averaging about 30 foundation factors decrease. In different phrases, the market that seemed to be exhibiting indicators of tightening in the summertime has reversed course over the previous quarter.

For these much less acquainted with the U.S. freight market, spot charges usually enhance when it is more difficult to discover a truck to cowl freight and reduce when it’s simpler. The spot market is the Wild West of the trucking market. It represents essentially the most excessive ranges of volatility and the polarized edges of the business.

Spot charges are very helpful in near-term traits however lose worth when trying over the course of a number of years as a result of inflation and mixing. Working prices for carriers have elevated greater than 30% over the previous 5 years, placing invisible upward stress on charges. Sadly for a lot of carriers, they haven’t been in a position to move alongside a lot of those prices as a result of a particularly aggressive atmosphere. A flood of recent entrants throughout the pandemic period is essentially guilty.

Service particulars evaluation of internet modifications in Federal Motor Service Security Administration energetic working authorities reveals there was report progress of fifty% in newly registered service of property working authorities from 2020 into the center of 2022. This fee of progress quadrupled the speed that occurred available in the market from 2018-19. The results of that was additionally a powerful extended market downturn, leading to quite a few service exits.

The pandemic demand bubble has been bursting for over two and a half years for the home transportation market. Greater than 200 carriers per week are leaving the house internet of entrants. The gross majority of those exits are small fleets and owner-operators consisting of fewer than 5 vans and most with lower than three years of expertise.

To date, the deterioration in capability has solely resulted in a couple of short-lived intervals of slight market vulnerability.

Final yr’s refrigerated (reefer) trucking market was the primary to indicate indicators of tightening. Spot (RTI) and rejection charges (ROTRI) jumped in entrance of Labor Day and rode a curler coaster into January earlier than falling again to report lows. The reefer market has since recovered in a extra sustainable method however has stumbled over the previous week.

The dry van market, which represents the majority of the for-hire trucking market exercise, additionally has had a couple of moments. The polar plunge of arctic air in January pushed spot and rejection charges again to Christmas ranges as shippers had been stalled for a couple of days.

Over the summer season, spot and rejection charges spiked as an surprising influx of imports hit the West Coast, placing a pressure on service networks. There was ample slack in capability to get well, nonetheless, and now the market is trending softer after exhibiting growing indicators of vulnerability.

Hurricanes and strikes

Hurricane Helene landed as a significant Class 4 storm, with a lot of its impression on infrastructure hitting the inland markets within the Southeast.

Atlanta’s outbound rejection charges plummeted in entrance of the storm, whereas inbound rejection charges jumped. This might result in some stage of short-lived disruption however in all probability not a market breaker like Harvey was in 2017.

The Worldwide Longshoremen’s Affiliation strike additionally has some potential relying on whether or not it happens and for a way lengthy, however many shippers have been getting ready for this for a number of months now.

Is that this the brand new regular?

The attainable excellent news for transportation service suppliers is that whereas the spot market has collapsed and most of the disruptive occasions have pale within the close to time period, rejection charges are nonetheless trending greater over the course of a yr. The probability of a sustained market flip this fall has pale, however that doesn’t take away the potential of a powerful shift in 2025.

Capability exits at its quickest tempo over the winter. If this development continues and the market stays tender by way of the vacations, the probability of a extreme provide shock will increase considerably.

Definitively, this market just isn’t sustainable. It would shift. The truth that capability continues to exit at report ranges tells you that provide is diving towards demand on the curve. The timing is at all times essentially the most difficult factor to foretell and the shift will in all probability happen when many have lowered their guard.

And who can blame them, as this has been the longest, most extreme freight recession in trendy occasions.

Concerning the Chart of the Week

The FreightWaves Chart of the Week is a chart choice from that gives an fascinating information level to explain the state of the freight markets. A chart is chosen from 1000’s of potential charts on to assist members visualize the freight market in actual time. Every week a Market Knowledgeable will publish a chart, together with commentary, dwell on the entrance web page. After that, the Chart of the Week will probably be archived on FreightWaves.com for future reference.

SONAR aggregates information from a whole bunch of sources, presenting the information in charts and maps and offering commentary on what freight market specialists need to know in regards to the business in actual time.

The FreightWaves information science and product groups are releasing new datasets every week and enhancing the consumer expertise.

To request a SONAR demo, click on .

The publish appeared first on .

Markets

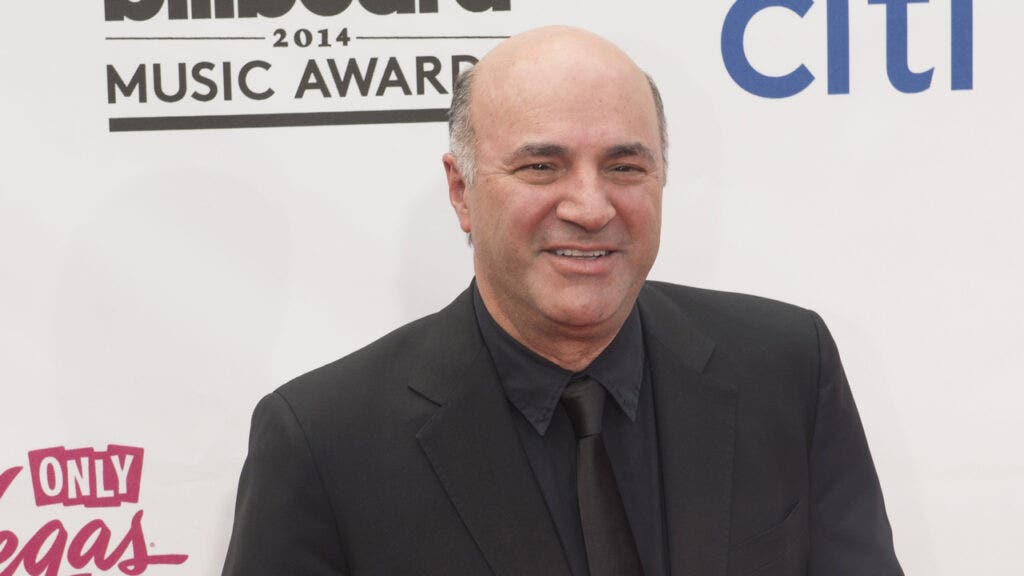

'You By no means Ask Me for Cash Once more': Kevin O'Leary Explains As a substitute Of Investing In Household Members' Companies, He Items Money With A Caveat

, a big-name investor identified for his no-nonsense method to enterprise, has a singular technique for coping with relations who ask him for cash. He is had his justifiable share of family coming to him with huge concepts and excessive hopes, on the lookout for a hefty funding. And with O’Leary’s monetary standing, it isn’t shocking. The Canadian enterprise proprietor and Shark Tank star has a internet price of round $400 million.

Do not Miss:

However whereas he is beneficiant, he is additionally obtained boundaries that assist maintain household and funds from clashing. In a brief YouTube video, O’Leary defined his actions when relations ask him for cash. He acknowledges the age-old reality: “More cash, extra issues.” O’Leary says, “It is a improbable factor but it surely makes your life difficult as a result of many individuals need a few of it from you at no cost – notably relations. It is a large concern.”

Trending: Amid the continued EV revolution, beforehand missed low-income communities

O’Leary clarifies that individuals come to anticipate one thing for nothing . And to deal with this, he is developed an easy technique that retains issues clear and avoids awkward Thanksgiving dinners.

When a member of the family approaches him for cash – whether or not it is to begin a restaurant or launch a brand new enterprise – he presents a one-time reward. Within the case he mentions, it is $50,000. Not a mortgage, not an funding, only a reward. However there is a catch: “You by no means ask me for cash once more. Ever.” O’Leary’s rule is easy: after that test, there will likely be no extra handouts, no future expectations, and no monetary entanglements. As he humorously provides, he arms over the cash after which “goes again to sprucing his eggs.” It is a clear break that leaves no room for future monetary disputes or awkward household interactions.

Trending: Groundbreaking buying and selling app with a ‘Purchase-Now-Pay-Later’ characteristic for shares tackles the $644 billion margin lending market –

For many who do not have a portfolio like O’Leary’s, his method nonetheless presents a beneficial lesson. Setting clear boundaries is essential when lending or gifting cash to household. Getting caught up within the feelings and obligations that include serving to family members is straightforward, however issues can get messy with out clear guidelines. An excellent method for the remainder of us is likely to be to solely give what we will afford to lose – whether or not that is $50, $500, or $5,000 – and make it clear that it is a one-time deal. No loans, no strings, no awkward household gatherings.

Dealing with household and cash might be tough, however O’Leary’s method reveals that it is all about setting expectations and sticking to them. And perhaps, simply perhaps, it is also about having just a little humor to maintain issues from getting too tense.

It is at all times good to earlier than making huge selections, particularly when household is concerned. They might help you identify what makes essentially the most sense in your scenario and set the best boundaries. It isn’t simply in regards to the cash – it is about retaining relationships intact whereas making decisions that work for everybody. Just a little steerage can go a great distance in guaranteeing your funds and household ties keep sturdy.

Learn Subsequent:

UNLOCKED: 5 NEW TRADES EVERY WEEK. , plus limitless entry to cutting-edge instruments and methods to achieve an edge within the markets.

Get the most recent inventory evaluation from Benzinga?

This text initially appeared on

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.

-

Markets3 months ago

Markets3 months agoADP Stories Decrease-Than-Anticipated Personal Payroll Progress for June

-

Markets3 months ago

Markets3 months agoSorry, however retiring ‘comfortably’ on $100K is a fantasy for most individuals. Right here’s why.

-

Markets3 months ago

Markets3 months agoSouthwest Air adopts 'poison tablet' as activist investor Elliott takes important stake in firm

-

Markets3 months ago

Markets3 months agoAbove Food Corp. (NASDAQ: ABVE) and Chewy Inc. (NYSE: CHWY) Making Headlines This Week

-

Markets3 months ago

Markets3 months agoCore Scientific so as to add 15 EH/s by means of Block’s 3nm Bitcoin mining ASICs

-

Markets3 months ago

Markets3 months agoWarren Buffett is popping 94 subsequent month. Ought to Berkshire traders begin to fear?

-

Markets3 months ago

Markets3 months agoWhy Rivian Inventory Roared Forward 10% on Friday

-

Markets3 months ago

Markets3 months agoArgentina to Promote {Dollars} In Parallel FX Market, Caputo Says

-

Markets3 months ago

Markets3 months agoWhy Intel Inventory Popped on Friday

-

Markets3 months ago

Markets3 months agoMicrosoft in $22 million deal to settle cloud grievance, keep off regulators

-

Markets3 months ago

Markets3 months agoMorgan Stanley raises worth targets on score companies on constructive outlook